Tenet Health SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

Tenet Health's SWOT analysis reveals a company navigating a dynamic healthcare landscape, leveraging its extensive network of facilities while facing intense competition and evolving regulatory pressures. Understanding these core elements is crucial for anyone invested in the healthcare sector.

Discover the complete picture behind Tenet Health's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Tenet Healthcare's diversified healthcare service portfolio is a significant strength, encompassing general acute care hospitals, ambulatory surgery centers (ASCs), and a variety of outpatient facilities. This broad operational base allows Tenet to cater to a wide spectrum of patient needs, thereby diversifying its revenue streams and reducing dependence on any single service line. For instance, in the first quarter of 2024, Tenet's Hospital Operations segment reported net operating revenues of $4.4 billion, while its Ambulatory Care segment contributed $1.4 billion, showcasing the balanced revenue generation from its diverse offerings.

Tenet's United Surgical Partners International (USPI) is a powerhouse, driving significant growth for the company. In 2024, USPI saw robust performance with rising revenues and Adjusted EBITDA, and this positive trend is expected to continue into 2025.

This ambulatory care division is expanding its reach, with Tenet strategically investing in more Ambulatory Surgery Centers (ASCs). They are actively acquiring existing facilities and developing new ones, recognizing the industry's move towards outpatient procedures.

The focus is on higher-acuity procedures, such as joint replacements, which are increasingly being performed in lower-cost outpatient settings. This strategic positioning allows USPI to capitalize on a major market shift.

Tenet Healthcare significantly improved its financial standing in 2024 by divesting non-core hospital assets. This strategic move allowed for substantial deleveraging, resulting in a lower leverage ratio by the end of the year.

The company’s robust free cash flow generation in 2024 provides enhanced flexibility for capital allocation. This improved financial position empowers Tenet to pursue future growth opportunities and deliver greater shareholder returns.

Focus on High-Acuity Services and Operational Efficiency

Tenet Health's strategic pivot to high-acuity services, including cardiovascular and neurosciences in its hospitals, and total joint replacements in its Ambulatory Surgery Centers (ASCs), is a significant strength. This focus on more complex and profitable procedures enhances revenue potential. For instance, by Q1 2025, Tenet reported a substantial increase in volumes for these specialized service lines.

This emphasis on higher-acuity care is complemented by rigorous operational efficiency and cost management. Disciplined cost controls, particularly a reduction in reliance on expensive contract labor, have directly boosted profitability. This strategic approach resulted in strong Adjusted EBITDA margins, with the company achieving a notable 16.5% margin in the first quarter of 2025, demonstrating effective execution.

- High-Acuity Service Focus: Strategic shift towards cardiovascular, neurosciences, and total joint replacements in hospitals and ASCs.

- Operational Efficiency: Disciplined cost management, including significant reduction in contract labor expenses.

- Improved Profitability: Strong Adjusted EBITDA margins, reaching 16.5% in Q1 2025, reflecting effective cost controls.

- Enhanced Revenue Potential: Focus on higher-reimbursement procedures drives top-line growth and margin expansion.

Strategic Capital Deployment and Physician Engagement

Tenet Health is strategically investing capital to bolster its high-acuity hospital services and grow its physician network. This involves actively bringing new physicians into its United Surgical Partners International (USPI) segment and employed groups, fostering crucial partnerships. Such capital deployment directly supports the expansion of high-quality, high-acuity care delivery, reinforcing Tenet's competitive standing.

For example, as of the first quarter of 2024, Tenet reported that its USPI segment continued to see strong performance, with ambulatory surgery centers (ASCs) showing robust patient volumes. The company's commitment to physician engagement is a cornerstone of this strategy, aiming to align incentives and drive clinical excellence across its growing network.

- Strategic Capital Allocation: Tenet prioritizes investments in high-acuity services and physician network expansion.

- Physician Network Growth: Actively onboarding new physicians into USPI and employed physician groups.

- High-Acuity Focus: Investment directly supports the development of specialized, complex care services.

- Market Position Enhancement: Strengthens Tenet's ability to attract and retain both patients and physicians for advanced care.

Tenet's diversified healthcare services, including hospitals and ambulatory surgery centers (ASCs), provide a stable revenue base. The company's strategic focus on high-acuity procedures, such as cardiovascular and joint replacements, within both its hospital and ASC segments, is a key strength, driving improved reimbursement and profitability. This focus is supported by disciplined cost management, notably a reduction in contract labor, which bolstered Adjusted EBITDA margins to 16.5% in Q1 2025.

| Segment | Q1 2024 Net Operating Revenues (Billions USD) | Q1 2025 Adjusted EBITDA Margin |

|---|---|---|

| Hospital Operations | $4.4 | N/A |

| Ambulatory Care (USPI) | $1.4 | N/A |

| Overall Company | N/A | 16.5% |

What is included in the product

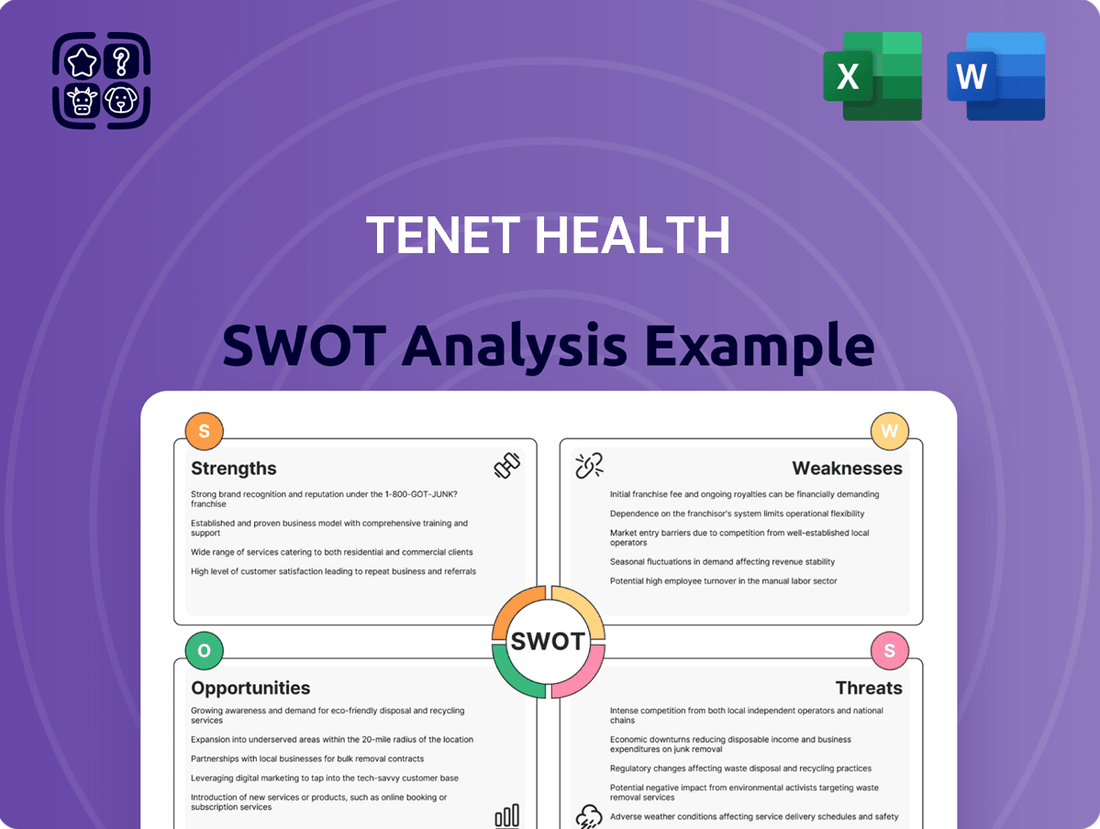

Delivers a strategic overview of Tenet Health’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of Tenet Health's internal and external factors for focused strategic problem-solving.

Weaknesses

While Tenet Health has focused on reducing its debt, it still carries a considerable financial obligation. As of December 31, 2024, the company's long-term debt stood at approximately $9.931 billion. This substantial debt load, even with ongoing deleveraging efforts, can constrain financial maneuverability.

This significant leverage means Tenet remains susceptible to shifts in the economic landscape. Higher interest payments could divert resources from growth initiatives or operational improvements, impacting profitability. Furthermore, a substantial debt burden can make it more challenging to secure additional financing if needed, especially during periods of economic uncertainty.

Tenet Health, like all healthcare providers, is susceptible to shifts in government regulations and reimbursement policies. For instance, potential cuts to Medicaid funding or the implementation of site-neutral payment policies could directly affect Tenet's revenue streams, particularly within its hospital segment. While Tenet's strategic focus on Ambulatory Surgical Centers (ASCs) might offer some buffer, these policy changes necessitate constant vigilance and adaptation to maintain financial stability.

Tenet Health, like many in the healthcare industry, grapples with persistent labor shortages, especially for highly skilled medical staff. This ongoing challenge can strain operational capacity and necessitate higher spending on recruitment and competitive compensation packages. For instance, the U.S. Bureau of Labor Statistics projected a 13% growth in healthcare occupations between 2022 and 2032, faster than the average for all occupations, highlighting intense demand.

The need to rely on contract labor to fill staffing gaps further exacerbates cost pressures. These temporary arrangements often come with significantly higher hourly rates compared to permanent staff, directly impacting Tenet's operating margins. This reliance can also lead to inconsistencies in care delivery and team cohesion.

Impact of Hospital Divestitures on Revenue

Tenet Health's strategic divestiture of 14 hospitals in 2024, a move intended to streamline its portfolio, had a direct impact on its hospital segment's revenue. This reduction in its physical footprint resulted in a noticeable decline in net operating revenues for this specific segment when compared to 2023 figures.

While other business segments like Ambulatory Care and USPI showed growth, the smaller hospital base now presents a more constrained foundation for future revenue expansion within that particular division. This strategic shift, though aimed at long-term efficiency, means fewer hospital facilities contributing to overall top-line performance in the immediate term.

- Divestiture Impact: 14 hospitals sold in 2024.

- Revenue Decline: Net operating revenues for the hospital segment decreased year-over-year.

- Portfolio Transformation: Part of a broader strategy to optimize Tenet's asset base.

- Future Growth Constraint: Smaller hospital footprint limits immediate revenue generation potential in this segment.

Competitive Market Pressures

Tenet Health navigates a healthcare landscape fraught with intense competition. This includes rivalry from other major hospital networks, specialized outpatient clinics, and increasingly, innovative non-traditional healthcare providers. These competitive pressures can indeed impact pricing strategies, patient volume, and the crucial effort to attract and keep skilled medical professionals. For instance, in 2024, the healthcare sector saw continued consolidation, with larger systems leveraging economies of scale, putting smaller or less diversified players like Tenet under pressure to adapt.

The need for continuous innovation and clear differentiation is paramount to maintaining market share in this environment. Tenet must actively invest in new service lines, patient experience improvements, and technological advancements to stand out. Reports from late 2024 indicated that patient preference is increasingly shifting towards outpatient settings and telehealth, presenting a challenge for traditional hospital-centric models if they don't evolve.

Specifically, the competitive market pressures can manifest in several ways:

- Price Sensitivity: Increased competition often leads to greater price scrutiny from both patients and insurers, potentially limiting revenue growth.

- Patient Acquisition Costs: Marketing and outreach efforts to attract new patients become more significant and costly in a crowded market.

- Talent Wars: Hospitals compete fiercely for top medical talent, driving up labor costs and impacting operational efficiency.

- Service Line Competition: Competitors may offer specialized services at lower costs or with greater convenience, drawing patients away from Tenet's facilities.

Tenet Health's substantial debt load, approximately $9.931 billion as of December 31, 2024, limits its financial flexibility and makes it vulnerable to economic downturns. This leverage can divert funds from growth initiatives and hinder access to future financing.

The company faces significant regulatory risks, including potential cuts to government reimbursement programs like Medicaid. Changes in policies, such as site-neutral payments, could directly impact Tenet's revenue, particularly within its hospital segment, requiring constant adaptation.

Persistent labor shortages, especially for skilled medical professionals, strain Tenet's operations and increase costs due to reliance on higher-paid contract labor. The projected 13% growth in healthcare occupations through 2032 underscores this competitive labor market.

Tenet's divestiture of 14 hospitals in 2024, while strategic, reduced its hospital segment's revenue base. This smaller footprint limits immediate revenue growth potential within that division, even as other segments like Ambulatory Care expand.

Full Version Awaits

Tenet Health SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Tenet Health's Strengths, Weaknesses, Opportunities, and Threats. This analysis is designed to provide actionable insights for strategic decision-making. The full, detailed report is unlocked and available immediately after purchase.

Opportunities

The healthcare industry is steadily moving towards outpatient care, particularly in ambulatory surgery centers, which is a major growth avenue for Tenet. This shift allows for more cost-effective and convenient patient treatment.

Tenet is actively capitalizing on this by planning to invest around $250 million each year into acquiring businesses in the ambulatory sector. This strategic investment aims to expand their footprint and service offerings.

Furthermore, Tenet expects to establish 10 to 12 new ambulatory surgery centers from scratch in 2025. This expansion will be powered by their robust USPI platform, which is already a leader in the industry.

Tenet Health can significantly boost its performance by embracing cutting-edge technologies. This includes expanding telehealth services, which saw a substantial surge in adoption, with reports indicating a more than 60-fold increase in virtual visits in early 2024 compared to pre-pandemic levels. Investing in AI for diagnostics can lead to earlier and more accurate disease detection, improving patient outcomes and potentially reducing long-term treatment costs.

Furthermore, AI-enabled tools offer a clear path to optimizing clinical care coordination and streamlining the complex revenue cycle management. By automating administrative tasks and improving data analysis, Tenet can reduce operational overhead and enhance financial predictability. For instance, AI in revenue cycle management has shown the potential to improve claim denial rates by as much as 15-20% for some healthcare systems.

This strategic digital transformation positions Tenet to attract a growing segment of patients who prefer modern, accessible healthcare solutions. The focus on digital health not only streamlines internal processes but also enhances the patient experience, making Tenet a more competitive and attractive provider in the evolving healthcare landscape.

Tenet Health is actively pursuing strategic acquisitions and de novo development, particularly within its United Surgical Partners International (USPI) segment. This proactive approach extends to identifying key hospital growth opportunities across the nation. For instance, in 2023, Tenet completed 12 acquisitions, adding 15 facilities to its ambulatory surgery center (ASC) network, a significant expansion of its USPI footprint.

Collaborations are a cornerstone of Tenet's growth strategy. By partnering with physician groups, other health systems, and various healthcare entities, Tenet can significantly broaden its network reach. These partnerships are designed to enhance its existing service offerings and deepen market penetration, ultimately fueling further growth and creating substantial value. For example, its ongoing joint ventures with leading physician groups demonstrate this commitment to shared growth and operational excellence.

Capitalizing on Demand for High-Acuity Procedures

Tenet Health is well-positioned to capitalize on the ongoing demand for high-acuity procedures. These complex services, including joint replacements and cardiovascular interventions, are experiencing sustained patient interest and represent a significant opportunity for revenue growth. Tenet's strategic focus on these higher-margin services, through investments in advanced technology and strong physician collaborations, is crucial for enhancing profitability.

The company's dual approach, offering these procedures in both its Ambulatory Surgery Centers (ASCs) and full-service hospitals, allows it to capture a broader patient base. For example, in 2024, Tenet reported that its ASCs continued to see strong performance, with a focus on outpatient surgical cases, many of which are high-acuity. This strategy directly supports driving revenue per case higher and improving overall financial performance.

- Sustained Demand: Growing patient preference for complex procedures like orthopedic and cardiac surgeries.

- Higher Margins: High-acuity cases typically offer better profitability per procedure.

- Strategic Investment: Tenet's commitment to advanced technology and physician partnerships supports this focus.

- ASC Growth: Continued expansion and utilization of ASCs for efficient delivery of these procedures.

Addressing the Needs of an Aging Population

The demographic shift towards an older population presents a significant opportunity for Tenet Health. By 2030, it's projected that over 20% of the U.S. population will be 65 or older, a group that typically requires more extensive healthcare services. This growing segment, coupled with the increasing incidence of chronic conditions like diabetes and heart disease, directly fuels demand for hospital care and specialized treatments. Tenet is well-positioned to capitalize on this trend by aligning its service offerings and developing targeted programs for geriatric patients, thereby securing a consistent and expanding patient base.

For instance, Tenet can enhance its offerings in areas such as cardiology, orthopedics, and post-acute care, which are critical for managing age-related health issues. The company’s existing network of acute care hospitals and outpatient facilities provides a strong foundation to build upon. By adapting services to meet the unique needs of seniors, such as increasing access to telehealth for chronic disease management and expanding rehabilitation services, Tenet can solidify its market position.

- Growing Demand: The U.S. population aged 65 and over is expected to reach 73 million by 2030, a 50% increase from 2010.

- Chronic Disease Prevalence: Approximately 6 in 10 adults in the U.S. have a chronic disease, with older adults experiencing multiple chronic conditions at higher rates.

- Service Expansion: Tenet can focus on expanding services like geriatric primary care, memory care units, and chronic care management programs.

- Patient Base Stability: Catering to the needs of an aging population ensures a stable and growing patient base, driving consistent revenue.

Tenet is strategically expanding its ambulatory surgery center (ASC) network, with plans to add 10-12 new centers in 2025, leveraging its strong USPI platform. This aligns with the healthcare industry's shift towards outpatient care, offering cost-effective and convenient patient treatment. The company is also investing approximately $250 million annually in acquisitions within the ambulatory sector to bolster its market presence.

Threats

Tenet Health is contending with a significant threat from escalating operating costs. In 2024, the cost of essential medical supplies saw a notable increase, mirroring broader inflationary trends impacting the healthcare sector. This rise in input costs directly challenges Tenet's ability to maintain profitability.

Compounding these internal cost pressures is the relentless external pressure from payers. Commercial insurance companies are engaging in increasingly stringent reimbursement negotiations. For instance, data from industry reports in early 2024 indicated that average reimbursement rates from major commercial payers saw minimal growth, often failing to keep pace with inflation.

Government reimbursement programs, such as Medicare and Medicaid, also continue to exert downward pressure on rates. These programs, crucial for a significant portion of Tenet's patient base, often implement rate adjustments that do not fully account for rising service delivery costs. This creates a squeeze on profit margins, even as Tenet implements cost-saving measures.

The healthcare sector faces considerable and shifting regulatory oversight. Potential new policies and reforms from Washington, like site-neutral payment adjustments and modifications to Medicaid funding, represent significant threats. For instance, proposed legislation in 2024 aimed to expand site-neutral payments, which could impact reimbursement rates for outpatient services provided in physician-owned facilities, a segment Tenet operates in.

This evolving landscape creates substantial compliance burdens and necessitates costly operational adjustments. Tenet Health must remain vigilant, continuously monitoring legislative developments and adapting its strategies to mitigate potential financial impacts. The uncertainty surrounding these policy shifts demands flexibility and proactive risk management to navigate the complexities of healthcare regulation.

As a major healthcare provider, Tenet Health manages extensive sensitive patient information, making it a significant target for cybercriminals. The healthcare sector experienced a 100% increase in reported breaches in 2023 compared to 2022, affecting over 133 million individuals, according to IBM's X-Force Threat Intelligence Index. This highlights the increasing vulnerability of organizations like Tenet.

A successful cyberattack leading to a data breach could expose Tenet to substantial financial penalties, with HIPAA fines potentially reaching $1.5 million per violation per year. Beyond fines, the company faces significant legal liabilities and severe reputational harm, potentially leading to a loss of patient trust and disruption of core operations. For instance, the average cost of a healthcare data breach in 2023 was $10.93 million, a 42.3% increase over three years, as reported by IBM.

Competition from Emerging Healthcare Models

Emerging healthcare models present a significant threat to Tenet Health. Non-traditional providers like specialized clinics, urgent care centers, and virtual health platforms are increasingly capturing market share by offering more convenient and cost-effective solutions. For instance, the telehealth market, valued at approximately $198.3 billion in 2023, is projected to grow substantially, potentially siphoning off patients seeking primary care or routine consultations that Tenet's hospitals traditionally manage.

These agile competitors can often bypass the overhead associated with large hospital systems, enabling them to offer services at lower price points. This creates intense price pressure and challenges Tenet's ability to maintain patient volumes in its core service lines. The convenience factor, especially with virtual care accessible from home, directly competes with the traditional in-person hospital visit, demanding Tenet to adapt its service delivery.

Specific areas of concern include:

- Increased competition in outpatient services: Specialized clinics and ambulatory surgery centers can attract patients for procedures that might otherwise be performed in a hospital.

- Patient migration to virtual care: Telehealth platforms offer convenient access for consultations and follow-ups, potentially reducing the need for in-person visits to Tenet facilities.

- Price sensitivity: Lower overhead for new entrants allows for more competitive pricing, impacting Tenet's revenue streams.

- Focus on specific service lines: Niche providers can excel in particular areas, drawing patient volume away from diversified hospital offerings.

Economic Downturns and Public Health Crises

Broader economic downturns represent a significant threat to Tenet Health. During such periods, patient volumes often decrease, and the rate of uninsured individuals can rise, directly impacting revenue streams. Furthermore, the affordability of elective procedures, a key revenue driver, tends to decline, squeezing profitability. For instance, during periods of economic contraction, healthcare providers often see a shift towards more urgent care needs, potentially delaying or foregoing non-essential treatments that contribute significantly to financial performance.

Unforeseen public health crises, such as a pandemic, also pose substantial threats. These events can severely strain healthcare resources, leading to operational disruptions and unpredictable shifts in demand for services. The financial implications can be profound, requiring significant investment in new protocols and equipment while potentially impacting the ability to perform non-emergency procedures. The COVID-19 pandemic, for example, demonstrated how public health emergencies can lead to both surges in demand for certain services and cancellations of others, creating significant financial volatility for hospital systems like Tenet.

- Economic Downturn Impact: Reduced patient volumes and lower affordability of elective procedures directly affect Tenet's revenue.

- Uninsured Rates: Economic contractions often correlate with an increase in uninsured patients, impacting payment collection.

- Public Health Crisis Strain: Pandemics can overload resources and disrupt normal, revenue-generating operations.

- Demand Volatility: Health crises create unpredictable shifts in service demand, posing financial and operational challenges.

Tenet Health faces intensifying competition from agile, non-traditional healthcare providers like specialized clinics and telehealth platforms. These entities often operate with lower overhead, enabling more competitive pricing and capturing market share for convenient, focused services. This trend, exemplified by the telehealth market's projected growth, pressures Tenet's traditional hospital-centric model.

The healthcare regulatory environment remains a significant threat, with potential policy shifts like expanded site-neutral payments impacting reimbursement for outpatient services. Compliance burdens and the need for costly operational adaptations add to financial pressures. Staying abreast of legislative developments and managing regulatory risks are paramount for Tenet.

Cybersecurity threats are a constant danger, with the healthcare sector experiencing a sharp rise in data breaches. A successful attack could result in substantial fines, legal liabilities, and severe reputational damage, impacting patient trust and operational continuity. The average cost of a healthcare data breach in 2023 was $10.93 million, underscoring the financial exposure.

Broader economic instability and potential public health crises also pose threats, impacting patient volumes, increasing the uninsured rate, and disrupting revenue streams through volatile demand shifts. Economic downturns reduce elective procedure affordability, while crises can strain resources and operational capacity.

| Threat Category | Specific Concern | 2023-2025 Impact Data/Trend | Potential Financial Ramification |

|---|---|---|---|

| Competition | Telehealth & Specialized Clinics | Telehealth market valued at ~$198.3B in 2023, with significant projected growth. | Loss of patient volume for routine consultations and outpatient procedures. |

| Regulatory | Site-Neutral Payments | Proposed legislation in 2024 could affect outpatient service reimbursement. | Reduced revenue from specific service lines if adopted. |

| Cybersecurity | Data Breaches | Healthcare breaches increased 100% in 2023; average breach cost ~$10.93M in 2023. | HIPAA fines (up to $1.5M/year/violation), legal costs, reputational damage. |

| Economic/Public Health | Economic Downturns & Pandemics | Increased uninsured rates, reduced elective procedure demand during contractions; resource strain during health crises. | Decreased revenue, increased uncompensated care, operational disruption. |

SWOT Analysis Data Sources

This analysis draws from Tenet Health's official financial filings, comprehensive market research reports, and expert industry analysis to provide a robust and data-driven understanding of its strategic position.