Tenet Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

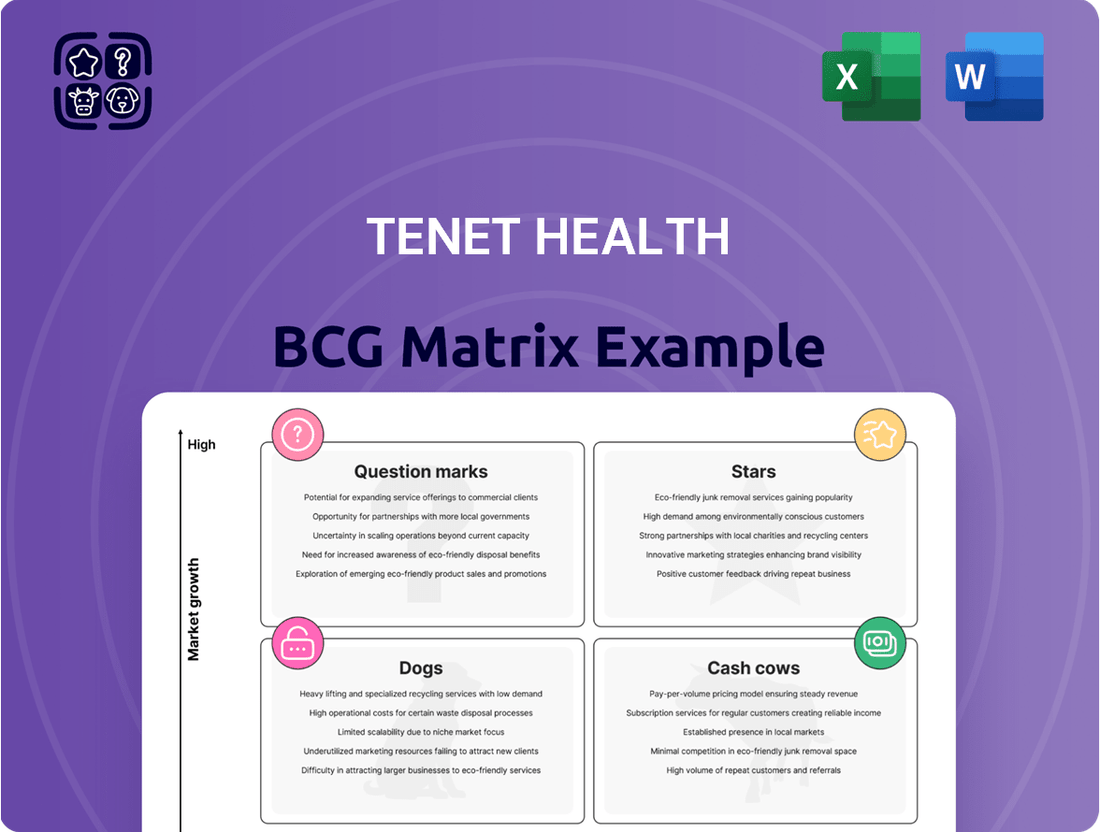

Understand how Tenet Health strategically manages its diverse portfolio of healthcare services and facilities. Our BCG Matrix analysis categorizes these offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a crucial snapshot of their market growth and share. This preview offers a glimpse into which services are driving significant revenue and which may require re-evaluation.

Don't miss out on the detailed insights that can transform your understanding of Tenet Health's strategic positioning. Purchase the full BCG Matrix report to unlock a comprehensive breakdown of each quadrant, data-driven recommendations for resource allocation, and a clear roadmap for future growth and investment decisions.

Stars

Tenet's Ambulatory Care segment, primarily driven by United Surgical Partners International (USPI), is a powerful growth driver, increasingly focusing on more complex procedures such as joint replacements and cardiovascular services. This strategic shift towards higher-acuity offerings is fueling consistent revenue and EBITDA expansion, a trend bolstered by both acquisitions and the development of new facilities.

The company's commitment to this sector is substantial, with plans to allocate around $250 million annually to mergers and acquisitions within the ambulatory space. Furthermore, Tenet anticipates launching 10 to 12 new de novo centers in 2025, underscoring the robust growth potential of this market and Tenet's dominant standing within it.

Tenet Health is strategically growing its high-acuity service lines, like orthopedics and cardiology, in outpatient and ambulatory surgery centers. This move facilitates more efficient, cost-effective care delivery and meets the rising demand for specialized procedures outside traditional hospitals. In 2024, Tenet saw continued growth in these areas, with cardiology and orthopedic services representing a significant portion of their ambulatory revenue. For instance, the company's USPI (United Surgical Partners International) segment, a key driver of its ambulatory strategy, has consistently shown strong performance in orthopedic and spine procedures.

Tenet Health is actively investing in digital health and AI, aiming to boost efficiency and patient outcomes. This includes expanding telehealth services and implementing AI for diagnostics, which are seen as key growth drivers. For instance, by mid-2024, Tenet reported a 20% increase in telehealth appointments compared to the previous year, demonstrating significant adoption.

These digital advancements are strategically positioned to capture a larger share of the growing digital healthcare market, projected to reach over $600 billion globally by 2026. By enhancing patient access and streamlining operations, Tenet expects to see a reduction in administrative costs by up to 15% in these digital segments by the end of 2024.

The integration of AI in areas like medical imaging analysis is expected to improve diagnostic accuracy and speed, directly impacting patient care quality. Tenet's focus on these high-growth, technology-driven areas strengthens its competitive edge in a rapidly evolving healthcare sector.

Integrated Healthcare Service Lines

Tenet's integrated healthcare service lines are designed to capture market share by offering a continuum of care. This strategy is particularly effective in regions where Tenet has a significant presence, allowing for better management of patient flows and resource allocation. For example, in 2024, Tenet continued to focus on expanding its ambulatory surgery center network, aiming to capture more outpatient procedures which often have higher margins than inpatient stays.

This integrated model allows Tenet to build stronger relationships with managed care payers by offering a more complete service offering. By providing services from acute care hospitals to physician clinics and ambulatory surgery centers, Tenet can manage a larger portion of a patient's healthcare journey. This comprehensive approach supports efficient resource utilization and can lead to improved patient outcomes and cost efficiencies.

The focus on integrated service lines positions Tenet to capitalize on growing market trends, such as the increasing demand for outpatient procedures and value-based care arrangements. In 2024, Tenet's Ambulatory Care division, which includes its surgery centers and other outpatient facilities, remained a key driver of growth and profitability, reflecting the success of this integrated strategy.

- Ambulatory Surgery Centers: Tenet's continued investment in ASCs aims to capture a larger share of outpatient procedures.

- Network Expansion: Strengthening payer networks through integrated service offerings is a core strategic pillar.

- Resource Utilization: An integrated model facilitates efficient deployment of staff and facilities across different care settings.

- Market Share Growth: By covering multiple points in the patient care pathway, Tenet seeks to increase its overall market penetration.

Conifer Health Solutions (Revenue Cycle Management)

Conifer Health Solutions, a key subsidiary of Tenet Health, is firmly positioned as a growing Star in the BCG matrix, primarily due to its robust revenue cycle management and value-based care services. This segment not only bolsters Tenet's internal financial efficiency but also serves a burgeoning external client base, tapping into a high-demand market driven by healthcare systems’ need to optimize financial performance and navigate intricate payment models.

Conifer's strategic importance is underscored by its consistent market penetration, evidenced by recent announcements of new client acquisitions, service expansions, and contract renewals. These achievements highlight its increasing relevance and competitive edge in the healthcare revenue cycle management sector. For instance, in early 2024, Conifer secured significant new partnerships, further solidifying its growth trajectory.

- Revenue Cycle Management Growth: Conifer's focus on optimizing patient billing, claims processing, and accounts receivable management addresses a critical pain point for healthcare providers.

- Value-Based Care Support: The company's expertise in value-based care services aligns with the industry's shift towards outcomes-based reimbursement, a rapidly expanding market segment.

- Market Penetration Success: Conifer’s ongoing success in attracting and retaining clients, including major health systems, demonstrates its strong market position and service efficacy.

- Financial Optimization for Tenet: Internally, Conifer contributes significantly to Tenet Health's overall financial health by streamlining operations and improving cash flow.

Conifer Health Solutions is a significant growth driver for Tenet, operating as a Star in the BCG matrix due to its strong performance in revenue cycle management and value-based care services. This segment is experiencing robust demand from external healthcare providers seeking to optimize their financial operations and adapt to evolving reimbursement models.

Conifer's success is evident in its consistent market penetration and acquisition of new clients, underscoring its competitive strength. The company's ability to support value-based care initiatives aligns perfectly with industry trends, positioning it for sustained growth.

Conifer's contribution to Tenet's financial health is substantial, enhancing internal efficiency and cash flow. Its expanding client base and service offerings solidify its status as a key strategic asset for Tenet Health.

| Segment | BCG Category | Key Drivers | 2024 Performance Indicator |

|---|---|---|---|

| Conifer Health Solutions | Star | Revenue Cycle Management, Value-Based Care Services | Secured significant new partnerships in early 2024, expanding client base. |

What is included in the product

This BCG Matrix overview highlights Tenet Health's strategic positioning of its services as Stars, Cash Cows, Question Marks, and Dogs.

It guides investment, holding, or divestment decisions for each business unit to optimize the portfolio.

A clear Tenet Health BCG Matrix overview pinpoints underperforming units, alleviating the pain of resource misallocation.

Cash Cows

Tenet's established acute care hospitals in stable markets function as its cash cows. These facilities, even with ongoing portfolio adjustments via divestitures, are the bedrock of the company's operations, consistently generating significant cash flow. They provide vital medical and surgical services, encompassing everything from complex surgeries to diagnostic imaging.

Despite strategic divestitures, these mature hospital operations continue to demonstrate resilience. For instance, in 2023, Tenet reported that its Hospitals segment generated $5.7 billion in revenue. The segment also maintained stable admissions, underscoring their strong footing in their respective communities and their ability to deliver reliable financial performance.

General inpatient medical and surgical services are Tenet Health's established cash cows, providing a steady stream of revenue. These core services, encompassing everything from routine medical care to common surgeries, meet consistent demand across the population. In 2023, Tenet reported that its hospital segment generated $18.3 billion in revenue, with a significant portion attributable to these essential inpatient offerings.

The mature and relatively low-growth market for general hospital services allows Tenet to leverage its existing infrastructure and operational efficiencies, leading to strong profit margins. This stability is crucial for funding investments in other areas of the business. For instance, Tenet's focus on optimizing these services contributed to an adjusted EBITDA of $3.1 billion in 2023, demonstrating their robust cash-generating capability.

Tenet Health's traditional diagnostic imaging centers are solid Cash Cows within its portfolio. These facilities provide essential radiology services, benefiting from a stable patient flow and established referral networks. This consistent demand translates into reliable revenue streams with minimal need for significant capital injections to maintain or expand their operations.

In 2024, diagnostic imaging services remain a critical component of healthcare delivery, with Centers for Medicare & Medicaid Services (CMS) reimbursement rates for many common procedures showing stable or slightly increasing trends, supporting the revenue generation of these centers. Their strong market position in a well-understood and mature market segment means they consistently contribute significant cash to Tenet Health.

Standard Outpatient Facility Services

Standard outpatient facilities, distinct from the high-growth ambulatory surgery centers (ASCs), represent a crucial component of Tenet Health's operations. These include a variety of urgent care centers and general outpatient clinics that handle routine medical needs. Their consistent, high-volume service delivery with stable demand makes them reliable generators of cash for the company.

These established facilities benefit from efficient operational models. This allows them to consistently generate revenue without the need for substantial new investments in marketing or market penetration. Tenet Health's management of these diverse outpatient services underscores their role as cash cows within the broader portfolio.

- Stable Demand: These facilities cater to everyday healthcare needs, ensuring a consistent patient flow.

- High Volume: Routine services are performed frequently, contributing to steady revenue streams.

- Low Investment Needs: Established infrastructure and processes minimize the requirement for significant new capital outlays.

- Consistent Cash Generation: Their predictable performance makes them reliable contributors to Tenet's overall financial health.

Existing Physician Networks and Employed Groups

Tenet's existing physician networks and employed groups are its established cash cows. These mature physician practices and independent medical staffs, integrated across Tenet's hospitals and outpatient centers, consistently generate patient referrals and ensure service delivery. This stability means they contribute reliably to revenue without demanding significant new investment for growth.

These physician networks provide a bedrock of consistent revenue. In 2023, Tenet Health reported that its employed physician services segment played a crucial role in its financial performance, contributing to the company's overall revenue stream. The steady demand for primary and specialty care from these established groups ensures a predictable income.

- Stable Revenue Generation: Provides consistent patient flow and service utilization.

- Lower Growth Investment: Requires less capital expenditure compared to expanding into new markets or service lines.

- Referral Engine: Acts as a primary source for patient admissions and procedures within Tenet facilities.

- Operational Efficiency: Leverages existing infrastructure and established patient relationships for cost-effective care delivery.

Tenet Health's established acute care hospitals in stable markets, alongside its diagnostic imaging centers and physician networks, function as its cash cows. These mature operations, despite ongoing portfolio adjustments, consistently generate significant cash flow by providing essential medical and surgical services, routine imaging, and primary/specialty care. Their resilience is evident in Tenet's 2023 financial performance, where the Hospitals segment alone generated $18.3 billion in revenue, underscoring the stable demand and operational efficiencies that define these core assets.

| Segment | 2023 Revenue (Billions) | Key Characteristic | Cash Cow Status |

| Hospitals | $18.3 | Stable inpatient medical/surgical services, consistent admissions | High |

| Diagnostic Imaging | Not separately reported, but integral to Hospital & ASC revenue | Essential radiology services, stable patient flow, established referrals | High |

| Physician Networks | Integral to overall revenue | Consistent patient referrals, service delivery, predictable income | High |

Full Transparency, Always

Tenet Health BCG Matrix

The Tenet Health BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report offers a strategic overview of Tenet Health's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs, based on market growth and relative market share. Rest assured, there are no watermarks or demo content; you are seeing the final, analysis-ready file ready for your business planning needs.

Dogs

Tenet Health's divestiture of 14 acute care hospitals in 2024 across California, South Carolina, and Alabama highlights a strategic move to shed underperforming assets. These hospitals likely struggled with low market share and limited growth potential, making them prime candidates for divestment.

These divested facilities can be categorized as Question Marks or Dogs within the BCG framework, indicating they required significant investment to improve their market position or were unlikely to generate substantial returns. For instance, in 2023, Tenet reported a net loss of $53 million from discontinued operations, largely attributable to divested hospital segments.

By shedding these underperforming hospitals, Tenet aims to free up capital and management focus for its more promising business units, such as its ambulatory surgery centers and its USPI physician services segment. This aligns with a broader industry trend of healthcare providers streamlining operations and concentrating on core competencies.

The decision to divest suggests these hospitals were likely cash traps, draining resources without generating sufficient returns. This strategic pruning is essential for improving overall portfolio performance and ensuring a healthier financial future for the company.

Tenet Health's BCG Matrix analysis highlights specialty programs that are becoming less relevant. These are services experiencing declining patient numbers, often because newer technologies or a shift to outpatient care have made them less competitive. For example, certain niche surgical procedures that require extensive inpatient stays might now be performed more efficiently and cost-effectively in ambulatory surgery centers, leading to a drop in demand for Tenet's hospital-based services in those areas.

These underperforming programs can become financial drains. Hospitals might continue to invest in outdated equipment or specialized staff for services that generate little revenue. In 2023, reports indicated that some hospitals were struggling with the profitability of specialized, low-volume departments, with operating margins sometimes dipping into negative territory. This situation forces difficult decisions about resource allocation, as funds could be better utilized in more robust or growing service lines.

The challenge lies in identifying these "dogs" early. A program that once had a strong market share might now have low growth and a shrinking patient base. For instance, a hospital's dedicated inpatient rehabilitation unit for a specific neurological condition might see fewer referrals if community-based outpatient therapy programs are now more accessible and preferred by patients and referring physicians. This results in low market share and minimal potential for future growth.

Non-strategic, geographically isolated facilities in Tenet's portfolio often represent hospitals or outpatient centers situated in intensely competitive or shrinking local markets. In these areas, Tenet typically holds a minimal market share and sees limited prospects for expansion.

These isolated assets can face challenges in drawing enough patients to operate efficiently, hindering their ability to achieve economies of scale. Consequently, they often yield low profits and offer little strategic advantage to Tenet as a whole.

For instance, in 2023, Tenet reported divesting several of its freestanding emergency departments and other non-core assets, a move that aligns with its strategy to shed such underperforming, isolated facilities.

Legacy IT Systems and Data Centers

Tenet Health's legacy IT systems and data centers represent potential cash cows or dogs within its business portfolio, depending on their current state and strategic disposition.

These older technological infrastructures often require substantial upkeep, leading to high maintenance costs and operational inefficiencies. For instance, in 2024, many healthcare organizations continued to grapple with the financial burden of maintaining aging hardware and software, with some reporting that up to 70% of their IT budget was allocated to legacy system support.

Tenet's strategic moves to decommission legacy data centers and consolidate systems indicate a recognition that these assets were likely consuming valuable resources without fostering significant growth or providing a competitive edge. This aligns with industry trends where organizations are actively migrating to cloud-based solutions to reduce capital expenditures and improve agility.

- High Maintenance Costs: Legacy systems often incur significant ongoing expenses for support, upgrades, and repairs.

- Operational Inefficiency: Outdated technology can lead to slower processing times and hinder workflow optimization.

- Resource Drain: Maintaining these systems diverts financial and human capital from more strategic growth initiatives.

- Decommissioning Efforts: Tenet's focus on closing legacy data centers suggests these were viewed as underperforming assets.

Highly Commoditized Inpatient Services in Oversaturated Markets

These highly commoditized inpatient services, prevalent in oversaturated markets, represent a significant challenge for Tenet Health. In areas where the supply of hospital beds far outstrips demand, or where competition is fierce from numerous providers, Tenet’s market share for these basic services is likely to be low. This oversupply erodes pricing power, meaning Tenet cannot command premium rates for services that are essentially interchangeable between providers.

Consequently, these essential but often low-margin services offer limited avenues for growth. They become prime candidates for strategic de-emphasis as Tenet looks to optimize its portfolio. For instance, in 2024, hospitals in highly competitive urban markets often saw average inpatient occupancy rates dipping below 60%, a clear indicator of oversupply and its impact on pricing and profitability for standard procedures.

- Low Market Share: In oversaturated markets, Tenet's basic inpatient services might struggle to capture significant market share due to intense competition.

- Reduced Pricing Power: Oversupply of beds and services diminishes Tenet's ability to set higher prices for commoditized offerings.

- Minimal Profit Margins: High competition and low pricing power often result in razor-thin profit margins for these essential services.

- Limited Growth Potential: The lack of differentiation and market saturation restricts opportunities for substantial growth in these service lines.

Dogs in Tenet Health's portfolio represent business units with low market share and low growth prospects. These are often the segments requiring significant investment without the promise of substantial returns, or those that have become financially burdensome. Tenet's divestiture of 14 hospitals in 2024, for example, points to assets that likely fit the 'Dog' profile due to underperformance.

These underperforming entities can include legacy IT systems or highly commoditized inpatient services in oversaturated markets. For instance, in 2024, many healthcare IT budgets were heavily allocated to maintaining aging infrastructure, a characteristic of 'Dog' assets that drain resources. Similarly, hospitals in competitive urban markets in 2024 saw occupancy rates below 60%, indicating low demand and market share for basic services.

The strategic decision to divest or de-emphasize these 'Dogs' aims to reallocate capital and management attention to more promising areas, such as ambulatory surgery centers. This pruning is crucial for improving overall portfolio health and profitability, aligning with a broader industry trend of streamlining operations.

Identifying these 'Dogs' early is key. A once-strong specialty program can become a 'Dog' if patient numbers decline due to technological shifts or changes in care delivery, as seen with inpatient services shifting to outpatient settings. These units often represent a drain on resources, with some low-volume departments reporting negative operating margins in 2023.

| Category | Characteristics | Examples within Tenet Health | Strategic Implications |

| Dogs | Low Market Share, Low Growth Potential | Divested hospitals (e.g., 14 in 2024), legacy IT systems, commoditized inpatient services in saturated markets | Divestment, de-emphasis, or significant restructuring to improve performance or reduce resource drain. |

Question Marks

Emerging high-acuity surgical specialties in new Ambulatory Surgery Centers (ASCs) represent potential Stars in Tenet Health's portfolio, as these centers focus on complex procedures like advanced cardiovascular interventions and spine surgeries. While these areas show high growth potential, Tenet may not yet hold dominant market share in every specific new location or niche procedure. Significant investment is necessary to build market leadership and transition these ASCs into Stars.

Tenet Health's strategic development of new hospital campuses in markets like San Antonio, Texas, and Port St. Lucie, Florida, places these ventures squarely in the question mark category of the BCG matrix. These are essentially new or significantly expanded geographic territories for Tenet. In 2024, Tenet was actively involved in expanding its presence, with significant capital allocated to new facilities and acquisitions in growing regions.

While these emerging markets offer substantial growth potential, Tenet's initial market share in these specific locations will naturally be low. This necessitates considerable capital outlay for construction, equipment, and staffing, alongside robust marketing campaigns to build brand recognition and patient volume. For instance, in 2023, Tenet reported capital expenditures of $1.4 billion, a portion of which would support such greenfield developments and market entries.

Tenet Health's strategic investments in advanced AI-driven diagnostic tools and telehealth services position them squarely in potential "question mark" territory within the BCG matrix. These are undeniably high-growth sectors within healthcare, with the telehealth market projected to reach $500 billion by 2028.

While Tenet is actively allocating capital to these burgeoning technologies, their current market penetration and established revenue streams in these areas may still be relatively nascent compared to their more mature service lines. This means they are investing heavily in areas with uncertain, but potentially significant, future returns.

The development and scaling of AI diagnostics and telehealth platforms require substantial and ongoing capital expenditure. For instance, companies in this space often see R&D as a significant portion of their operating costs, reflecting the need for continuous innovation and adaptation to evolving technological landscapes and regulatory frameworks.

The success of these initiatives hinges on Tenet’s ability to effectively integrate these advanced tools, capture market share in a competitive and rapidly evolving landscape, and demonstrate clear value propositions to both patients and providers, ultimately driving them towards "star" status if successful.

Value-Based Care Models and Risk-Based Contracts

The healthcare industry is increasingly moving towards value-based care and risk-based contracts, a trend that signifies substantial growth potential alongside considerable complexity. Tenet Health, through its subsidiary Conifer Health Solutions, is actively involved in offering solutions designed for this evolving landscape.

However, Tenet's overall market penetration and demonstrated profitability in successfully navigating these sophisticated models across its entire business spectrum are still in a formative stage. Successfully managing these contracts demands substantial strategic adjustments and significant investment in advanced data analytics capabilities.

The shift to value-based care requires providers to be accountable for patient outcomes and costs, moving away from traditional fee-for-service. This transition is driven by payers seeking to control escalating healthcare expenditures.

- Market Growth: The global value-based healthcare market was projected to grow significantly, with estimates suggesting it could reach over $30 billion by 2027, indicating strong underlying demand.

- Conifer's Role: Conifer Health Solutions provides services like revenue cycle management and population health management, crucial for providers engaging in risk-based contracts.

- Data Analytics Investment: Effective participation in risk-based contracts necessitates robust data analytics to track patient populations, predict outcomes, and manage costs, representing a key investment area.

- Strategic Adaptation: Tenet's ability to integrate value-based care principles across its diverse operations, from hospital services to physician groups, is critical for long-term success in this domain.

Niche or Experimental Service Lines in Pilot Programs

Tenet Health might be testing niche or experimental service lines through pilot programs in certain hospitals. These could be cutting-edge treatments or specialized care areas that show promise for future growth. For instance, a pilot program focusing on advanced robotic surgery or a new telehealth platform for chronic disease management could fall into this category.

These initiatives typically have a very small current market share because they are new and unproven. Tenet would need to invest significantly in research and development, as well as gather data to validate their effectiveness and market demand. Think of it like a startup within a larger company, where the potential upside is substantial, but the risk of failure is also high.

For example, Tenet’s subsidiary, USPI (United Surgical Partners International), has historically been involved in acquiring and developing ambulatory surgery centers (ASCs), which was a niche area that grew significantly. While specific 2024 pilot program data for Tenet is not publicly detailed, the strategy aligns with exploring areas like specialized oncology treatments or advanced diagnostics. In 2023, Tenet reported that its ambulatory surgery centers generated approximately $4.6 billion in revenue, demonstrating the success of prior strategic expansions into specialized care.

- Exploration of Advanced Treatment Modalities: Piloting new, high-tech medical services with uncertain market adoption.

- Low Current Market Share: These services begin with minimal patient volume and recognition.

- High R&D and Validation Needs: Significant investment is required to prove efficacy and demand.

- Risk vs. Reward Profile: Potential for substantial future returns if successful, but also a high chance of discontinuation.

Tenet Health's ventures into new geographic markets and its development of nascent service lines, such as advanced AI diagnostics and telehealth, represent classic question marks in the BCG matrix. These areas demand significant capital for market entry and growth, with success hinging on Tenet's ability to capture market share and establish strong revenue streams in competitive, high-growth sectors. For example, Tenet's capital expenditures in 2023 were $1.4 billion, a portion of which undoubtedly supported these emerging opportunities with uncertain but potentially high returns.

| Category | Description | Market Growth Potential | Current Market Share | Investment Required | Example |

|---|---|---|---|---|---|

| Question Marks | New ventures or services with high growth potential but low current market share. | High | Low | High | New hospital campuses, AI diagnostics, telehealth, value-based care initiatives |

| Strategic Focus | Requires significant investment to determine if they can become Stars or if they should be divested. | N/A | N/A | N/A | N/A |

| 2024 Outlook | Continued allocation of capital to these areas, with a focus on building market leadership and validating business models. | Projected to grow significantly (e.g., telehealth market by 2028). | Nascent to low. | Ongoing, significant capital expenditure and R&D. | San Antonio hospital expansion, AI diagnostic platform integration. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial statements, competitor performance data, and market growth projections to accurately assess Tenet Health's portfolio.