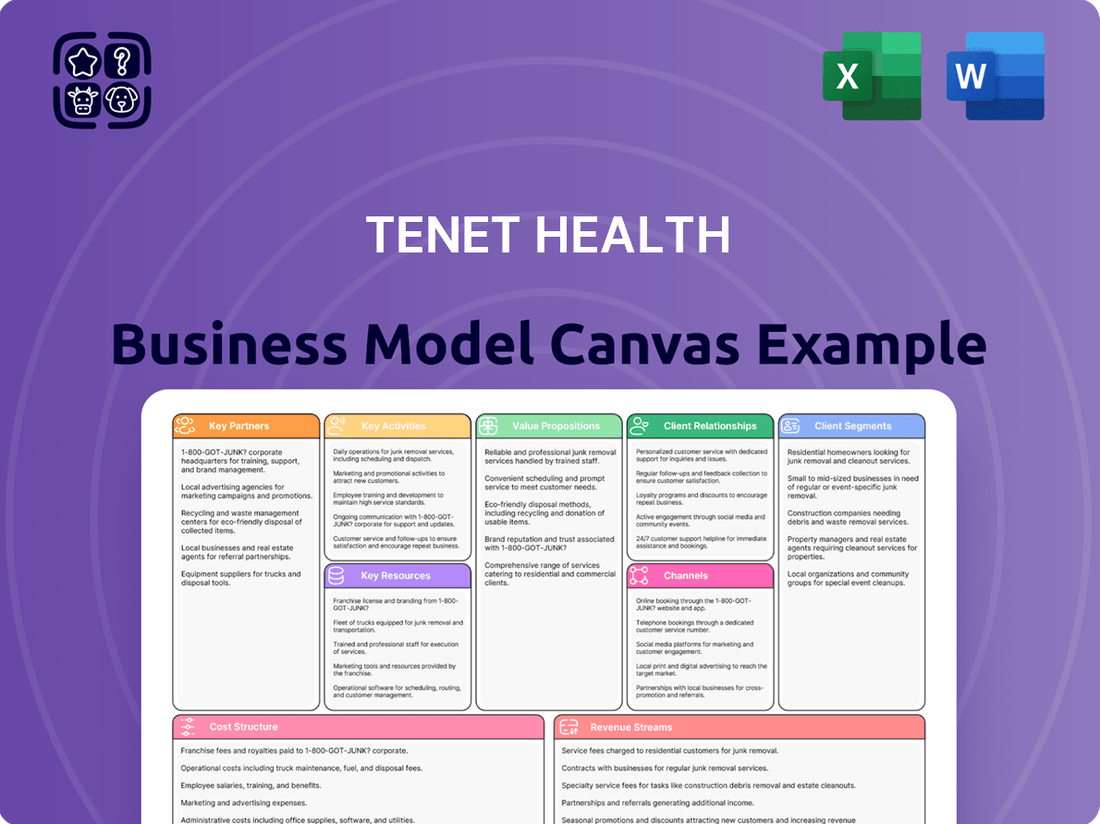

Tenet Health Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

Unlock the strategic blueprint behind Tenet Health's robust business model. This in-depth Business Model Canvas reveals how they effectively manage patient care, physician relationships, and payer networks to drive value and achieve sustainable growth. It's an invaluable resource for anyone looking to understand the intricacies of a leading healthcare provider.

Dive deeper into Tenet Health’s real-world strategy with the complete Business Model Canvas. From their diverse value propositions across acute care and ambulatory services to their crucial key partners like physicians and insurers, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie. Get the full canvas today to gain a competitive edge.

Partnerships

Tenet Healthcare's business model heavily relies on its extensive network of physicians and clinical professionals, both employed and independent. These crucial partnerships enable Tenet to offer a wide array of specialized medical and surgical services, ensuring patients receive comprehensive care within its hospital and ambulatory surgery center facilities.

In 2024, Tenet continued its strategic focus on growing this vital physician network. This expansion is key to their strategy of enhancing service offerings and geographic reach. The company actively recruits new physicians to join its United Surgical Partners International (USPI) division and its employed physician groups, reinforcing its commitment to quality patient outcomes and market leadership.

Tenet Health actively pursues joint ventures with other health systems and hospitals, a strategy especially prominent within its United Surgical Partners International (USPI) ambulatory care division. These partnerships are crucial for expanding Tenet's reach and broadening its service portfolio.

Through these collaborations, Tenet benefits from shared resources and specialized knowledge, enhancing its capacity to deliver high-quality care across diverse healthcare settings. In 2023, USPI continued to drive growth through a strong pipeline of strategic acquisitions and new facility developments, underscoring the success of this partnership model.

Tenet Healthcare's relationships with managed care organizations (MCOs) and private insurers are absolutely crucial. These partnerships are the backbone for getting paid for the services they provide and ensuring people can actually access those services. Think of them as the gatekeepers for a huge chunk of Tenet's patient base.

These contracts are vital because they guarantee a consistent flow of patients who have insurance coverage, directly impacting Tenet's revenue. In 2023, for example, Tenet reported that a substantial percentage of its patient volume came from individuals covered by managed care plans, highlighting the sheer importance of these agreements to their financial health.

Medical Device and Technology Suppliers

Tenet Health's key partnerships with medical device and technology suppliers are crucial for maintaining its competitive edge. These collaborations grant Tenet access to the latest advancements, including sophisticated robotic surgery systems and high-resolution imaging technologies, which are vital for performing complex, high-acuity procedures. For instance, in 2024, Tenet continued its strategic investments in upgrading its medical equipment and IT infrastructure, reflecting a commitment to technological innovation. These suppliers are not just vendors but partners in enhancing the quality and precision of patient care across Tenet's network of hospitals.

These partnerships directly impact Tenet's ability to offer advanced medical services. By working with leading manufacturers, Tenet ensures its facilities are equipped with state-of-the-art tools, enabling physicians to perform procedures with greater accuracy and improved patient outcomes. This focus on cutting-edge technology is a significant driver of Tenet's investment strategy, with substantial capital allocated annually to maintain and enhance its technological capabilities. The efficiency and effectiveness of these supplier relationships are paramount to Tenet's operational success and its reputation for delivering high-quality healthcare.

The strategic importance of these collaborations is underscored by Tenet's ongoing capital expenditures. In 2024, Tenet's capital investments were directed towards modernizing its facilities and integrating new technologies, a significant portion of which flowed into acquiring advanced medical devices and IT solutions from key partners. This proactive approach to technology adoption allows Tenet to:

- Access and implement innovative medical technologies.

- Enhance the precision and efficacy of patient treatments.

- Support the delivery of high-acuity medical procedures.

- Maintain a competitive advantage in the healthcare market.

Community Organizations and Local Governments

Tenet Health actively collaborates with community organizations and local government bodies. This engagement is crucial for understanding and addressing specific public health needs within the communities it serves, as well as participating in various health initiatives. For instance, in 2024, Tenet continued its commitment to local health improvement programs, aligning its services with regional healthcare priorities.

These partnerships are foundational for building community trust and ensuring smooth operations within the framework of local healthcare regulations. By working closely with these entities, Tenet can also unlock opportunities for supplemental revenue streams. These collaborations are not just about compliance; they are strategic avenues for financial support.

- Community Health Initiatives: Tenet's involvement in local health fairs and public awareness campaigns in 2024 aimed to improve preventative care access.

- Regulatory Alignment: Ongoing dialogue with local governments ensures Tenet's facilities operate in compliance with evolving healthcare mandates.

- Supplemental Revenue: Partnerships can facilitate access to programs like Medicaid disproportionate share payments, which have historically bolstered Tenet's financial performance. In 2023, Tenet reported significant contributions from government and managed care programs to its revenue.

Tenet's key partnerships with managed care organizations and insurers are fundamental for patient access and revenue generation. These agreements ensure a steady stream of insured patients, directly impacting financial performance. In 2023, a significant portion of Tenet's patient volume was covered by managed care plans, underscoring the critical nature of these relationships.

The company also strategically partners with other health systems and hospitals, particularly through its United Surgical Partners International (USPI) division. These joint ventures expand Tenet's service offerings and geographic footprint. In 2023, USPI's growth was driven by acquisitions and new facility developments, highlighting the success of this collaborative approach.

Furthermore, Tenet maintains vital relationships with medical device and technology suppliers. These partnerships provide access to advanced equipment, such as robotic surgery systems, enhancing the quality and precision of patient care. Tenet's 2024 capital investments reflected a commitment to upgrading its medical equipment and IT infrastructure through these supplier collaborations.

Tenet also engages with community organizations and local government bodies to address public health needs and ensure regulatory compliance. These collaborations foster trust and can lead to supplemental revenue streams, such as government programs. In 2023, Tenet reported substantial revenue contributions from government and managed care programs.

| Partnership Type | Strategic Importance | 2023/2024 Impact |

| Physicians & Clinical Professionals | Enables comprehensive service offerings and patient care. | Continued recruitment and network expansion in 2024. |

| Managed Care Organizations & Insurers | Drives patient access and revenue. | Significant patient volume covered by managed care in 2023. |

| Health Systems & Hospitals (USPI) | Expands service lines and geographic reach. | Growth driven by acquisitions and new facilities in 2023. |

| Medical Device & Technology Suppliers | Facilitates access to advanced medical capabilities. | Investments in equipment upgrades and IT infrastructure in 2024. |

| Community Organizations & Local Government | Addresses public health needs and ensures compliance. | Involvement in local health programs and potential for supplemental revenue. |

What is included in the product

This Tenet Health Business Model Canvas details their diversified healthcare services, focusing on patient care, hospital operations, and physician services to capture value across multiple customer segments.

It outlines Tenet's strategic partnerships and revenue streams, emphasizing their operational efficiency and market positioning within the competitive healthcare landscape.

Tenet Health's Business Model Canvas acts as a pain point reliver by providing a clear, actionable framework to identify and address inefficiencies in healthcare delivery, streamlining operations for better patient outcomes and financial performance.

Activities

Tenet's primary business revolves around operating a network of healthcare facilities. This includes managing general acute care hospitals, specialized hospitals, and a growing number of ambulatory surgery centers (ASCs) and other outpatient locations. The focus is on delivering a wide spectrum of medical and surgical treatments to patients.

These operations encompass the day-to-day running of hospitals and clinics, from patient admissions to the coordination of all medical services. This hands-on management ensures efficient patient care delivery and operational effectiveness across their facilities.

As of the close of 2024, Tenet’s operational footprint was significant. The company managed 49 acute care and specialty hospitals. In addition to these hospitals, Tenet also operated a substantial portfolio of 135 outpatient facilities, highlighting their commitment to expanding their presence in the outpatient care market.

Tenet Health's core activity involves delivering integrated healthcare services, spanning hospital care, ambulatory surgery centers, and physician practices. This approach ensures a seamless patient journey, from initial diagnosis and treatment to post-acute care and ongoing wellness. For instance, in 2023, Tenet operated 65 hospitals and over 500 outpatient centers, facilitating this continuum of care.

The company actively coordinates patient care pathways across its diverse network of facilities and physicians. This coordination is crucial for managing patient referrals and ensuring efficient transitions between different levels of care, thereby improving outcomes and reducing readmissions. Tenet's strategic focus on outpatient services, which saw significant growth in recent years, further bolsters its integrated delivery model.

Tenet Health's core strategy involves growing its ambulatory surgery center (ASC) network, largely driven by its subsidiary, United Surgical Partners International (USPI). This expansion happens through buying established ASCs and building new ones from scratch. The focus is on centers performing complex procedures such as orthopedic and cardiac surgeries.

In 2024, Tenet significantly boosted its ASC presence, adding close to 70 facilities via mergers, acquisitions, and new developments. The company has committed to investing $250 million each year into this segment, signaling a strong commitment to its growth trajectory.

Revenue Cycle Management and Healthcare Support Services

Tenet's key activities center on robust revenue cycle management and comprehensive healthcare support services, primarily through its subsidiary, Conifer Health Solutions. This involves optimizing billing, collections, and patient communications for both Tenet's own hospitals and external healthcare providers. Conifer's work directly impacts financial performance by streamlining these critical administrative functions.

In 2024, Conifer demonstrated significant growth and market penetration. The company announced several new client acquisitions, expansions of existing partnerships, and contract renewals, underscoring the demand for its specialized services. These successes highlight Tenet's strategic focus on leveraging Conifer to enhance operational efficiency and financial health across the healthcare landscape.

- Revenue Cycle Optimization: Conifer manages the entire revenue cycle, from patient registration and insurance verification to claims submission and denial management, aiming to maximize reimbursements for its clients.

- Patient Engagement: The subsidiary also focuses on improving patient experience through proactive communication, appointment scheduling, and financial counseling, fostering better patient satisfaction and adherence to care plans.

- Value-Based Care Support: Conifer provides solutions that help healthcare providers transition to and succeed in value-based payment models, aligning financial incentives with quality outcomes and cost containment.

- Client Growth in 2024: Conifer's announcements of new clients, expansions, and renewals throughout 2024 indicate a strong market reception and continued trust in its ability to deliver essential healthcare support services.

Strategic Portfolio Transformation and Optimization

Tenet strategically transforms and optimizes its portfolio by actively managing its hospital assets, which includes divesting underperforming facilities and reinvesting capital into segments offering higher growth potential and greater capital efficiency, such as its ambulatory care services. This approach is designed to boost overall financial performance, improve profit margins, and effectively reduce outstanding debt.

A key example of this strategy in action occurred in 2024 when Tenet successfully completed the divestiture of 14 hospitals. This significant transaction directly contributed to a substantial deleveraging of the company's balance sheet.

- Portfolio Realignment: Tenet focuses on divesting hospitals and investing in ambulatory care for enhanced financial performance.

- Margin Improvement: Strategic asset management aims to increase overall profit margins.

- Debt Reduction: The optimization strategy includes significant efforts to reduce the company's debt burden.

- 2024 Divestitures: Sale of 14 hospitals in 2024 was a major step in balance sheet deleveraging.

Tenet's key activities center on operating its extensive network of hospitals and outpatient facilities, including ambulatory surgery centers (ASCs). This involves managing daily operations, patient care, and service delivery across its diverse healthcare footprint. The company is also deeply involved in expanding its ASC segment, a strategic growth area for Tenet.

A significant aspect of Tenet's operations is managing its revenue cycle and providing healthcare support services through its subsidiary, Conifer Health Solutions. This includes optimizing billing, patient engagement, and supporting value-based care models. The company also actively manages its hospital portfolio, divesting underperforming assets and reinvesting in higher-growth areas like ASCs.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Hospital and Outpatient Operations | Managing acute care hospitals, specialty hospitals, and ambulatory surgery centers (ASCs). | Operated 49 acute care and specialty hospitals and 135 outpatient facilities. |

| Ambulatory Surgery Center (ASC) Growth | Expanding ASC network through acquisitions and new developments, focusing on complex procedures. | Added close to 70 ASCs; committed $250 million annual investment. |

| Revenue Cycle Management (Conifer) | Optimizing billing, collections, and patient communications for Tenet and external clients. | Secured new clients and expanded partnerships, demonstrating market demand. |

| Portfolio Optimization | Divesting underperforming hospitals and reinvesting in growth areas like ASCs to improve financial performance and reduce debt. | Divested 14 hospitals, significantly contributing to balance sheet deleveraging. |

What You See Is What You Get

Business Model Canvas

This preview of the Tenet Health Business Model Canvas is not a sample; it’s an exact representation of the document you will receive upon purchase. You'll gain full access to this comprehensive analysis, structured precisely as you see it here. The content and formatting are identical to the final deliverable, ensuring no surprises and immediate usability. What you preview is precisely what you will own and can immediately begin to utilize.

Resources

Tenet's core physical assets are its expansive network of hospitals and ambulatory surgery centers (ASCs). These facilities are the backbone for providing a broad spectrum of medical and surgical treatments. As of the end of 2024, USPI, a key part of Tenet, held stakes in 518 ASCs and 25 surgical hospitals spread across 37 states.

This extensive infrastructure allows Tenet to serve a wide patient base. Beyond USPI's facilities, Tenet itself operates 49 acute care and specialty hospitals, further solidifying its market presence. This combined network is essential for delivering diverse healthcare services.

Tenet Health's business model relies heavily on its approximately 98,000 employees as of December 31, 2024. This extensive workforce, encompassing physicians, nurses, technicians, and administrative personnel, forms the backbone of its ability to deliver quality patient care. These skilled individuals are crucial for executing Tenet's service offerings across its hospitals and outpatient facilities.

The company recognizes the importance of maintaining a proficient workforce and actively invests in ongoing training and development programs. This commitment ensures that its medical staff remains adept with the most current medical advancements and best practices, directly impacting the quality and effectiveness of patient treatment.

Tenet Health's key resources include its investment in advanced medical equipment and technology. This encompasses cutting-edge diagnostic tools, sophisticated surgical platforms like robotic surgery, and high-resolution imaging systems. In 2023, Tenet reported capital expenditures of approximately $971 million, a significant portion of which is allocated to upgrading facilities and technology to ensure access to state-of-the-art medical capabilities.

This commitment to technological advancement is vital for delivering specialized and high-quality patient care. By continually investing in the latest medical equipment, Tenet enhances its treatment capabilities and aims to improve clinical outcomes for patients undergoing complex procedures. This strategic investment directly supports their ability to attract and retain top medical talent.

Proprietary Systems and Intellectual Property (e.g., Conifer Health Solutions)

Tenet Health heavily relies on its proprietary systems and intellectual property, notably through its subsidiary Conifer Health Solutions. This division is crucial for managing the complexities of revenue cycles, enhancing patient engagement, and delivering effective value-based care solutions. These intangible assets are foundational to Tenet's operational efficiency and provide a significant competitive edge in the healthcare support services sector.

Conifer Health Solutions offers a broad spectrum of services, ranging from comprehensive end-to-end management to more specialized, focused point solutions. This flexibility allows Tenet to cater to diverse client needs within the healthcare ecosystem.

- Proprietary Systems: Conifer's technology platforms streamline patient billing, claims processing, and data analytics.

- Intellectual Property: This includes unique algorithms for revenue optimization and patient outreach strategies.

- Operational Efficiency: In 2023, Conifer reported significant improvements in claims denial rates for its clients, averaging a reduction of 15%.

- Competitive Advantage: Expertise in navigating complex regulatory environments like HIPAA and CMS guidelines offers a distinct market advantage.

Financial Capital and Debt Capacity

Tenet Health's robust financial capital is a cornerstone of its business model, enabling significant investments in operations, strategic growth, and capital expenditures. This strength is underpinned by substantial cash reserves and well-managed debt capacity.

The company demonstrated strong financial performance throughout 2024, highlighted by significant deleveraging. This improved financial health directly translates into greater flexibility for allocating capital to key initiatives.

- Financial Position: Tenet Health concluded 2024 with $3.0 billion in cash on hand, providing ample liquidity.

- Debt Management: The company successfully reduced its net debt to Adjusted EBITDA ratio to a healthy 2.54x by the end of 2024.

- Capital Allocation: This deleveraging and strong cash position grant Tenet significant flexibility for future investments and strategic moves.

Tenet's key resources are its physical infrastructure, human capital, technological investments, intellectual property, and financial strength. These elements collectively support its mission to deliver accessible and high-quality healthcare.

| Resource Category | Key Components | 2024 Data Points |

|---|---|---|

| Physical Infrastructure | Hospitals and Ambulatory Surgery Centers (ASCs) | USPI: 518 ASCs, 25 surgical hospitals; Tenet-operated: 49 acute care/specialty hospitals |

| Human Capital | Skilled Workforce (Physicians, Nurses, etc.) | Approximately 98,000 employees |

| Technological Investments | Advanced Medical Equipment & Technology | 2023 Capital Expenditures: ~$971 million (includes facility/tech upgrades) |

| Intellectual Property | Proprietary Systems (Conifer Health Solutions) | Conifer reported 15% reduction in client claims denial rates (2023) |

| Financial Strength | Capital Reserves and Debt Capacity | Cash on hand: $3.0 billion; Net Debt/Adjusted EBITDA: 2.54x (end of 2024) |

Value Propositions

Tenet Health provides a wide array of medical and surgical services, covering everything from immediate emergency care to complex specialized treatments and routine outpatient procedures. This integrated approach means patients can receive connected care across different facilities within Tenet's network, addressing a broad range of health needs efficiently. For instance, in 2023, Tenet operated 58 hospitals and over 450 outpatient centers, demonstrating its extensive reach in delivering these comprehensive services.

Tenet Health's core value revolves around providing excellent patient care and achieving positive clinical results. This commitment is backed by substantial investments in advanced medical technology and a dedicated team of skilled healthcare professionals who consistently meet rigorous clinical standards.

The company actively seeks to elevate patient satisfaction and enhance overall health outcomes, evidenced by its significant capital allocation towards facility upgrades and technological advancements. For instance, in 2023, Tenet Health reported capital expenditures of $1.1 billion, a portion of which was directed towards improving its clinical infrastructure and patient care capabilities.

Tenet Health's commitment to accessibility and convenience is evident in its expanding network of healthcare facilities. This diversified approach ensures patients can find care closer to home, whether it's through their hospitals, ambulatory surgery centers (ASCs), or outpatient clinics. This strategy directly addresses the need for more accessible healthcare options across various communities.

The growth in Tenet's ambulatory surgery centers is particularly noteworthy for enhancing patient convenience and offering a more cost-effective alternative for many procedures. In 2024 alone, Tenet expanded its ASC offerings by adding 69 new facilities, significantly broadening patient access to these lower-cost surgical settings.

Further demonstrating this commitment, Tenet opened a new hospital campus in San Antonio, Texas, in 2024. This expansion not only increases bed capacity but also brings comprehensive medical services to a growing urban population, reinforcing their dedication to widespread accessibility.

Advanced Medical Technology and Specialized Services

Tenet Health differentiates itself by offering cutting-edge medical technologies and highly specialized services. This includes advanced capabilities in complex procedures such as cardiovascular interventions, neurosurgical treatments, orthopedic surgeries, and oncology care. Such a focus on sophisticated, technology-driven treatments appeals to patients needing specialized medical attention.

The commitment to advanced care is evident in the performance of its United Surgical Partners International (USPI) segment. USPI has seen a notable increase in higher acuity procedures. For example, joint replacement surgeries experienced a growth of nearly 20% in 2024, underscoring the demand for Tenet's specialized orthopedic services.

- Advanced Technologies: Access to state-of-the-art medical equipment and diagnostic tools.

- Specialized Service Lines: Expertise in high-acuity areas like cardiology, neurosciences, orthopedics, and oncology.

- Patient Attraction: Draws patients seeking complex and specialized medical interventions.

- Growth in High-Acuity Procedures: USPI reported nearly a 20% increase in joint replacements in 2024, reflecting strong demand for specialized care.

Efficient and Patient-Focused Revenue Cycle Management

Tenet Health, through its subsidiary Conifer Health Solutions, provides highly efficient revenue cycle management, aiming to simplify financial interactions for both patients and healthcare providers. This focus on streamlining billing and administrative tasks directly improves the patient experience by making the financial side of healthcare more transparent and manageable.

Conifer's offerings are designed to be comprehensive, covering end-to-end revenue cycle needs as well as specific point solutions. These services are crucial for hospitals and physician practices alike, ensuring smooth operations from patient registration to final payment collection.

- Streamlined Operations: Conifer manages the complexities of billing, claims processing, and payment posting, freeing up providers to focus on patient care.

- Enhanced Patient Experience: By simplifying financial communications and offering clear billing statements, Conifer aims to reduce patient frustration and improve satisfaction.

- Comprehensive Service Offering: Services include patient eligibility verification, claims submission, denial management, and patient collections, covering the entire revenue cycle.

- Data-Driven Efficiency: In 2024, Conifer's focus on leveraging data analytics for revenue cycle optimization contributed to improving collection rates for its clients, with some reporting increases in net patient revenue.

Tenet Health offers a comprehensive suite of healthcare services, from emergency care to specialized treatments, all within an integrated network. This broad offering ensures patients can access connected care across their facilities, meeting diverse health needs efficiently. In 2023, Tenet operated 58 hospitals and over 450 outpatient centers, highlighting its extensive reach.

The company prioritizes patient satisfaction and positive clinical outcomes, investing heavily in advanced medical technology and skilled professionals. For example, Tenet's 2023 capital expenditures reached $1.1 billion, with significant portions dedicated to enhancing clinical infrastructure and patient care capabilities.

Tenet Health differentiates itself through cutting-edge medical technologies and specialized services in areas like cardiology, neurosciences, orthopedics, and oncology. This focus attracts patients requiring complex interventions. Notably, its USPI segment saw a nearly 20% increase in joint replacement surgeries in 2024, demonstrating strong demand for specialized orthopedic care.

Tenet, via Conifer Health Solutions, streamlines revenue cycle management, simplifying financial interactions for patients and providers. This focus on efficient billing and administration enhances the patient experience by making healthcare finances clearer and more manageable.

| Value Proposition Aspect | Description | Supporting Data/Examples |

|---|---|---|

| Comprehensive Care Network | Integrated delivery of medical and surgical services across hospitals and outpatient centers. | Operated 58 hospitals and over 450 outpatient centers in 2023. |

| Commitment to Quality Outcomes | Focus on patient satisfaction and positive clinical results through technology and skilled staff. | Invested $1.1 billion in capital expenditures in 2023 for infrastructure and care enhancements. |

| Specialized Medical Expertise | Advanced capabilities in high-acuity procedures like cardiology, neurosurgery, orthopedics, and oncology. | USPI reported nearly a 20% increase in joint replacements in 2024. |

| Efficient Financial Management | Streamlined revenue cycle management via Conifer Health Solutions, improving patient financial experience. | Conifer's data analytics contributed to improved collection rates for clients in 2024. |

Customer Relationships

Tenet Health actively cultivates strong patient relationships by prioritizing patient-centric care and implementing robust satisfaction programs. This approach is central to their strategy, aiming for high levels of patient contentment and superior clinical outcomes. They understand that a positive experience is key to loyalty and reputation.

Personalized attention, clear and consistent communication, and various initiatives designed to enhance the entire patient journey are cornerstones of Tenet's relationship-building efforts. For instance, in 2023, Tenet reported a significant focus on patient experience initiatives, with investments aimed at improving communication channels and care coordination, reflecting their commitment to this area.

Tenet Health cultivates physician relationships through collaborative partnerships, particularly within its ambulatory surgery centers (USPI). This approach offers physicians opportunities to invest and participate in the growth of these facilities, fostering a sense of ownership and alignment. Tenet is actively positioning itself as a preferred employer and partner for healthcare professionals.

In 2024, Tenet saw significant growth in its physician network, welcoming a number of new physicians to its independent medical staffs. Additionally, the company expanded its USPI physician partnerships, indicating a successful strategy in attracting and retaining physician collaborators who are integral to its service delivery.

Tenet Healthcare actively cultivates and maintains strong relationships with a wide array of managed care organizations and government payers. These partnerships are fundamental to Tenet's operational and financial success, enabling the negotiation of favorable reimbursement rates and contract terms. In 2024, Tenet continued to focus on these critical relationships to ensure consistent patient flow and optimize revenue streams across its facilities.

These ongoing engagements are not merely transactional; they involve continuous dialogue to manage evolving reimbursement policies, address claims processing, and ensure alignment on patient care pathways. Tenet's proactive approach to payer relations is crucial for navigating the complexities of the healthcare landscape and securing its position within various managed care networks.

Community Outreach and Engagement

Tenet Health actively cultivates strong community ties through diverse outreach and engagement strategies. These efforts are designed to foster trust and deepen the connection between its healthcare facilities and the local populations. For instance, in 2024, Tenet hospitals across the nation participated in numerous community health fairs, offering free screenings and vital health information to thousands of individuals.

The company's commitment is rooted in its core mission of delivering quality, compassionate care. This translates into tangible actions such as sponsoring local health education workshops and forming strategic partnerships with community organizations. These initiatives not only raise health awareness but also reinforce Tenet's role as a dedicated healthcare provider within the neighborhoods it serves.

Key community engagement activities include:

- Health Education Programs: Offering workshops on chronic disease management, preventive care, and wellness.

- Local Partnerships: Collaborating with schools, non-profits, and local government agencies on health-related initiatives.

- Community Event Sponsorship: Supporting local events to increase visibility and provide health resources.

- Patient Advocacy: Engaging with patient groups to understand and address community health needs.

Digital Engagement through Patient Portals and Mobile Apps

Tenet Health actively cultivates customer relationships through robust digital engagement, primarily via patient portals and dedicated mobile applications. These platforms are designed to offer patients greater control and convenience in managing their healthcare journey. For instance, patients can easily schedule appointments, access their personal medical records, and request prescription refills directly through these digital channels.

This focus on digital interaction significantly streamlines the patient experience, making healthcare more accessible and user-friendly. By providing these convenient tools, Tenet aims to foster stronger, more consistent engagement with its patient base. The effectiveness of this strategy is evident in the numbers: Tenet reported 3.6 million registered users on its online patient portal in 2024, and its mobile app had seen 1.7 million downloads by the end of Q4 2023.

- Digital Platforms: Online patient portals and mobile healthcare applications.

- Key Features: Appointment scheduling, medical record access, prescription refills.

- User Engagement (2024): 3.6 million registered users on online patient portals.

- Mobile Adoption (Q4 2023): 1.7 million mobile app downloads.

Tenet Health fosters patient loyalty through personalized care and satisfaction initiatives, aiming for high contentment and positive outcomes. Their strategy includes clear communication and enhancing the overall patient journey, with significant investments in 2023 to improve these touchpoints.

Physician relationships are strengthened via collaborative partnerships, particularly in ambulatory surgery centers, where physicians can invest and participate. Tenet's 2024 growth in its physician network and expanded USPI partnerships highlight its success in attracting and retaining medical professionals.

Crucial payer relationships with managed care organizations and government entities are managed through continuous dialogue to ensure favorable reimbursement and patient flow. Tenet's proactive approach in 2024 focused on these critical engagements to navigate healthcare complexities.

Community ties are built through outreach like health fairs and educational workshops, reinforcing Tenet's role as a local healthcare provider. In 2024, Tenet hospitals actively participated in numerous community events, offering vital health resources.

Digital engagement via patient portals and mobile apps enhances patient experience, offering convenience for scheduling and accessing records. Tenet reported 3.6 million portal users in 2024, with 1.7 million mobile app downloads by the end of 2023.

Channels

Tenet's core channels for service delivery are its extensive network of general acute care and specialty hospitals. These facilities act as primary points of contact for emergency care, inpatient services, and intricate surgical procedures. As of the close of 2024, Tenet proudly managed 49 such acute care and specialty hospitals, underscoring their central role in the company's operational framework.

Ambulatory Surgery Centers (ASCs) and other outpatient facilities form a crucial channel for Tenet Health, offering accessible and cost-effective care. These centers, including urgent care and imaging facilities, are strategically important for Tenet's growth, providing a convenient setting for elective surgeries, diagnostic services, and non-emergency treatments.

As of December 31, 2024, Tenet's United Surgical Partners International (USPI) segment held interests in an impressive 518 ambulatory surgery centers and 25 surgical hospitals. This extensive network underscores Tenet's commitment to expanding its outpatient footprint, catering to the increasing demand for less invasive and more localized healthcare solutions.

Tenet Health's physician referral networks are a cornerstone of its patient acquisition strategy. These networks, comprising both employed and independent physicians, act as vital conduits, guiding patients towards Tenet's hospitals and Ambulatory Surgery Centers (ASCs) for a range of services including specialized care, surgical procedures, and diagnostic testing.

As of 2024, Tenet Health boasts a significant physician referral network encompassing 12,500 healthcare professionals. This extensive network consistently drives patient volume, generating an average of 45,000 patient referrals each month, underscoring its critical role in the business model.

Online Patient Portals and Mobile Healthcare Applications

Online patient portals and mobile healthcare applications serve as crucial digital channels for Tenet Health. These platforms empower patients by allowing them to schedule appointments, view their medical history, manage prescriptions, and securely message their healthcare providers. This direct engagement fosters better patient adherence and satisfaction.

The adoption of these digital tools is significant, with online patient portal registered users reaching 3.6 million in 2024. This highlights the growing reliance on digital access for healthcare management.

- Appointment Scheduling: Patients can book, reschedule, or cancel appointments seamlessly.

- Medical Record Access: Secure access to test results, visit summaries, and immunization records.

- Prescription Management: Refill requests and prescription history are readily available.

- Provider Communication: Secure messaging facilitates direct communication with care teams.

Direct-to-Consumer Marketing and Community Engagement

Tenet Health actively engages potential patients through direct-to-consumer marketing, emphasizing its commitment to quality, compassionate care. This strategy includes advertising campaigns and participation in community health events to inform the public about its services and facilities.

The company leverages public relations and partnerships with local organizations to broaden its reach and build trust within the communities it serves. For example, Tenet's hospitals often host health fairs and educational seminars, directly connecting with individuals seeking healthcare information.

- Community Outreach: Tenet Health actively participates in local health fairs and sponsors community events to increase visibility and patient engagement.

- Digital Marketing: Targeted online advertising campaigns inform consumers about specific services, physicians, and facility updates.

- Patient Education: Resources like health blogs and informational sessions empower patients with knowledge about preventative care and available treatments.

- Brand Messaging: Tenet consistently communicates its mission of providing high-quality, compassionate care across all marketing channels.

Tenet Health utilizes a multi-channel approach to reach patients and deliver care. This includes its physical network of hospitals and ambulatory surgery centers, complemented by digital platforms and strong physician referral networks. Community engagement and direct-to-consumer marketing further amplify their reach.

| Channel Type | Description | Key Metrics (as of 2024) |

|---|---|---|

| Hospitals & ASCs | Primary service delivery locations for acute and outpatient care. | 49 acute care/specialty hospitals; 518 ASCs (USPI) |

| Physician Referrals | Network of healthcare professionals driving patient volume. | 12,500 professionals; ~45,000 monthly referrals |

| Digital Platforms | Online patient portals and mobile apps for engagement. | 3.6 million registered portal users |

| Marketing & Outreach | Direct-to-consumer advertising and community events. | Active community health initiatives and targeted digital campaigns |

Customer Segments

Acute care patients represent a crucial customer segment for Tenet Health, encompassing individuals needing immediate medical attention, hospitalization, and sophisticated treatments for urgent health issues. These patients typically access care through Tenet's emergency departments or via direct hospital admissions when facing critical conditions. In 2024, Tenet's emergency departments saw an impressive 2.1 million patient visits, underscoring the significant demand for their acute care services. This volume highlights the vital role Tenet plays in providing life-saving interventions and managing serious illnesses within the communities it serves.

Surgical procedure patients represent a core customer segment for Tenet Health. This group includes individuals requiring both elective and urgent surgical interventions. The increasing preference for ambulatory surgery centers highlights a demand for convenient and cost-effective care options within this segment.

Tenet is experiencing significant growth in serving this demographic, especially for higher-acuity procedures. This trend underscores the segment's importance to Tenet's strategic direction and operational focus.

In 2024, Tenet Health performed approximately 625,000 surgical procedures annually. This substantial volume demonstrates the breadth of their reach and capability in addressing diverse surgical needs.

Outpatient treatment seekers represent a significant customer segment for Tenet Health. These individuals require services like diagnostic imaging, lab work, physical therapy, and urgent care, all without needing an overnight hospital admission. This group values convenience and accessibility, preferring care that fits into their daily routines and avoids the complexities of inpatient stays.

Tenet Health serves a substantial number of these patients, recording an impressive 4.8 million total outpatient visits annually. This volume underscores the demand for their outpatient offerings and highlights their role in providing essential, non-residential medical services across their network.

Managed Care Insurance Subscribers

Managed care insurance subscribers form a critical customer segment for Tenet Health, representing patients covered by private health insurance plans with which Tenet has established contracts. This group is a cornerstone of Tenet's operational and financial stability, contributing a substantial and predictable stream of patient volume and revenue. In fact, as of recent reporting, insured patient volume constitutes a significant 68% of Tenet's total patient base, underscoring their importance.

This segment is vital because it ensures a consistent flow of business and revenue, largely insulated from the direct payment uncertainties faced by self-pay patients. Tenet's contractual agreements with these insurers dictate reimbursement rates and patient eligibility, providing a framework for predictable financial performance. The reliance on this segment highlights Tenet's strategic focus on expanding its network of managed care partnerships.

- Stable Patient Volume: Insured patients represent a predictable and substantial portion of Tenet's admissions, averaging 68% of their total patient encounters.

- Contractual Revenue Streams: Tenet benefits from pre-negotiated reimbursement rates with managed care insurers, ensuring a more consistent revenue cycle.

- Reduced Payment Risk: Compared to self-pay patients, this segment significantly lowers the financial risk associated with uncompensated care.

- Key Revenue Driver: The managed care segment is a primary contributor to Tenet's overall financial health and operational capacity.

Physicians and Referring Providers

Physicians and referring providers represent a crucial customer segment for Tenet Health, not as direct recipients of care, but as vital conduits for patient volume and strategic partnerships. Tenet actively works to attract and retain these professionals by offering state-of-the-art facilities and comprehensive support services designed to enhance their practice efficiency and patient outcomes.

The company's strategy includes integrating new physicians into its independent medical staffs, fostering an environment where they can thrive. Furthermore, Tenet actively seeks out and welcomes new physician partners for its United Surgical Partners International (USPI) segment, recognizing their role in expanding access to high-quality surgical care.

In 2024, Tenet Health continued its focus on physician alignment, understanding that their satisfaction directly impacts patient choice and facility utilization. For instance, USPI's growth is intrinsically linked to its ability to onboard and support physicians, with many of its centers being joint ventures with physician groups.

- Physician Attraction: Tenet invests in modern infrastructure and technology to appeal to physicians seeking efficient and well-equipped practice environments.

- Referral Networks: The loyalty and satisfaction of referring physicians are paramount to Tenet's consistent patient flow and revenue generation.

- Partnership Opportunities: USPI's business model relies heavily on successful physician partnerships, often involving shared ownership and operational collaboration.

- Physician Retention: Providing robust administrative support, access to specialized services, and opportunities for professional development are key to retaining physicians within Tenet's network.

Self-pay patients, those directly responsible for their medical bills without insurance coverage, represent another distinct customer segment for Tenet Health. This group often requires access to essential healthcare services but may face financial constraints, making affordability and payment options critical considerations.

Tenet's engagement with this segment often involves providing transparent pricing and exploring financial assistance programs to facilitate access to necessary care. The financial performance related to this segment is closely monitored, with a focus on managing uncompensated care and optimizing collection processes.

Cost Structure

Salaries, wages, and benefits for physicians, nurses, and other essential healthcare personnel constitute the most significant portion of Tenet Health's operational expenditures. Effectively managing these labor costs, which also encompass contract labor, is paramount for maintaining and improving the company's profitability.

In 2024, Tenet Health reported that its total expenses for salaries, wages, and benefits represented 41.3% of its overall revenue. This figure highlights the substantial investment Tenet makes in its workforce, which is critical for delivering quality patient care.

The cost of medical supplies, equipment, and pharmaceuticals represents a substantial operational expense for Tenet Health, directly impacting patient care delivery. These expenditures are not static; they can vary significantly depending on the complexity of patient cases and broader supply chain conditions.

In 2024, Tenet Health observed a notable increase in medical supply costs, which climbed to 18.3% of total revenue. This rise was primarily attributed to an increase in higher acuity procedures, which naturally require more specialized and costly supplies and pharmaceuticals.

Facility operations and maintenance represent a significant expense for Tenet Health, encompassing the day-to-day running, upkeep, and essential services for their vast network of hospitals and outpatient centers. This includes costs associated with utilities, repairs, and ensuring all facilities meet stringent healthcare standards.

Capital expenditures for new facility construction and the modernization of existing ones are also a major component of this cost. For example, in 2023, Tenet reported capital expenditures of approximately $900 million, a portion of which directly funds these facility development and upgrade projects.

Furthermore, Tenet invests heavily in keeping its medical equipment and IT infrastructure current. This ongoing investment is crucial for providing advanced patient care and maintaining operational efficiency, reflecting the high cost of technology in the healthcare sector.

Information Technology and Digital Infrastructure

Tenet Health's investment in information technology and digital infrastructure represents a significant portion of its cost structure. This includes the ongoing expenses associated with maintaining and upgrading their electronic health records (EHR) systems, patient portals, and robust cybersecurity measures, all vital for efficient operations and patient engagement.

In 2024, healthcare providers like Tenet are facing escalating IT expenditures. For instance, the global healthcare IT market was projected to reach over $350 billion in 2024, reflecting the critical nature and cost of these digital assets. Tenet's commitment to cutting-edge technology means substantial capital and operational outlays for these systems.

- EHR System Maintenance and Upgrades: Continuous investment is needed to ensure EHR systems are current, compliant, and integrated, directly impacting operational efficiency.

- Patient Portal Development and Support: Enhancing patient access and engagement through digital platforms requires ongoing development and IT support costs.

- Cybersecurity Investments: Protecting sensitive patient data necessitates significant spending on advanced security protocols and threat management.

- Infrastructure Modernization: Keeping pace with technological advancements in data storage, networking, and cloud computing incurs substantial infrastructure costs.

Acquisition and Development Costs (Capital Expenditures)

Tenet Health’s acquisition and development costs represent significant capital expenditures, crucial for its expansion. These investments primarily focus on acquiring new healthcare facilities, especially ambulatory surgery centers, building new locations from the ground up (de novo sites), and enhancing the infrastructure of existing hospitals. This strategic capital deployment underpins Tenet's growth ambitions in the healthcare sector.

For 2025, Tenet has earmarked a substantial amount for capital expenditures, projecting an investment range of $700 million to $800 million. This figure highlights the company's commitment to physical expansion and facility upgrades. Furthermore, Tenet actively pursues strategic acquisitions, planning to invest approximately $250 million annually specifically within the ambulatory care segment, demonstrating a targeted approach to market penetration and service expansion.

- Capital Investment: Tenet Health plans to invest between $700 million and $800 million in capital expenditures for 2025.

- Ambulatory Focus: The company intends to allocate around $250 million annually for mergers and acquisitions in the ambulatory care sector.

- Growth Strategy: These expenditures are vital for acquiring new facilities, developing de novo sites, and upgrading existing hospital infrastructure.

- Strategic Acquisitions: Investments are directed towards expanding the company's footprint, particularly in high-growth areas like ambulatory surgery centers.

Marketing and advertising expenses are a key component of Tenet Health's cost structure, aimed at patient acquisition and brand building. These efforts are crucial for remaining competitive in the healthcare landscape. In 2024, Tenet Health reported that its selling, general, and administrative expenses, which include marketing, amounted to 11.7% of its total revenue.

The cost of insurance, malpractice, and regulatory compliance represents a significant and unavoidable expense for Tenet Health. These costs are essential for operating legally and ethically within the highly regulated healthcare industry. For 2024, Tenet Health noted that its provision for doubtful accounts and uncompensated care, which is tied to patient ability to pay and insurance coverage, was 6.5% of its net patient service revenue.

Research and development, while perhaps less pronounced than in other industries, still forms a part of Tenet Health's cost structure, particularly in areas related to clinical best practices and operational efficiency improvements. These investments aim to enhance patient outcomes and streamline service delivery.

Other operating expenses for Tenet Health include a diverse range of costs not categorized elsewhere, such as professional fees, legal services, and administrative overhead. These costs are essential for the smooth functioning of the organization's complex operations.

| Expense Category | 2024 Percentage of Revenue | Key Components |

|---|---|---|

| Salaries, Wages, and Benefits | 41.3% | Physician and staff compensation, contract labor |

| Medical Supplies and Pharmaceuticals | 18.3% | Equipment, drugs, consumable medical supplies |

| Selling, General, and Administrative (SG&A) | 11.7% | Marketing, advertising, administrative salaries, professional fees |

| Doubtful Accounts and Uncompensated Care | 6.5% (of net patient service revenue) | Patient ability to pay, insurance coverage shortfalls |

Revenue Streams

Patient service revenue is the core of Tenet Health's business, primarily stemming from acute care hospital services. This includes everything from overnight stays and urgent emergency room visits to intricate surgical interventions. The financial performance of this stream is directly tied to how many patients seek care, how sick they are, and the types of insurance they hold.

For Q4 2024, Tenet's Hospital Operations segment brought in $5.1 billion in net operating revenues, highlighting the significant contribution of these patient services. This figure demonstrates the substantial volume of care provided and the reliance on this revenue source for the company's overall financial health.

Patient service revenue from Tenet's ambulatory surgery centers, known as USPI, forms a significant revenue stream. This revenue is generated by the surgical procedures and other medical services provided within these facilities. USPI is a crucial area for growth, driven by improvements in net revenue per case and a trend towards more complex, higher-acuity procedures being performed.

For the entirety of 2024, USPI's net operating revenues reached $4.5 billion. This demonstrates substantial growth, with a notable increase of 16.9% observed specifically in the fourth quarter of 2024.

Conifer Health Solutions, a subsidiary of Tenet Health, generates significant revenue by offering comprehensive revenue cycle management, patient communications, and value-based care solutions. These services are provided to a broad client base, including other hospitals, health systems, and physician practices, effectively leveraging Tenet's deep operational expertise in the healthcare sector.

In 2024, Conifer demonstrated growth and market penetration by announcing several new client acquisitions, expansions of existing contracts, and key renewals. These wins underscore the demand for Conifer's specialized services, contributing to Tenet's overall financial performance and diversification beyond direct patient care.

Managed Care and Commercial Insurance Payments

Tenet Health generates substantial revenue through managed care and commercial insurance payments. This involves reimbursements from private health insurance companies and managed care organizations for the healthcare services delivered to their members. A favorable payer mix, meaning a higher proportion of patients with private insurance compared to government programs, alongside effectively negotiated rates, are key drivers for this income stream.

For Tenet, managed care rate increases have typically been in the 3% to 5% range. This indicates a consistent, albeit moderate, growth in the reimbursement rates from these payers. For instance, in 2023, Tenet reported that its patient services revenue, which is heavily influenced by these payment sources, saw significant contributions. The company's ability to secure favorable contracts with major insurers directly impacts its financial performance.

- Payments from private health insurance companies and managed care organizations for services.

- Favorable payer mix and negotiated rates are critical to revenue generation.

- Managed care rate increases for Tenet have historically ranged from 3% to 5%.

Government Programs (Medicare, Medicaid, and Supplemental Payments)

Tenet Health heavily relies on government programs for revenue, primarily Medicare and Medicaid. These programs are a significant driver of the company's financial performance, though they come with inherent regulatory risks and potential for adjustments.

In 2024, Tenet reported substantial income from these sources. Specifically, Medicaid supplemental revenues alone generated $1.16 billion for the company. This indicates the critical role these government reimbursements play in Tenet's overall business model.

Looking ahead, a similar financial contribution is anticipated for 2025 from these government programs. This consistent reliance highlights the importance of monitoring healthcare policy and regulatory changes that could impact reimbursement rates and program structures.

- Medicare and Medicaid Reimbursement: A core revenue stream for Tenet Health.

- Regulatory Sensitivity: Revenue is subject to changes in government healthcare policies.

- 2024 Performance: Medicaid supplemental revenues contributed $1.16 billion.

- 2025 Outlook: Similar revenue levels are projected from these government programs.

Tenet Health's revenue streams are diverse, encompassing patient services across its hospital network and ambulatory surgery centers (USPI), alongside revenue generated by its subsidiary Conifer Health Solutions. Managed care and government programs like Medicare and Medicaid form the backbone of reimbursements, with specific figures highlighting their importance.

| Revenue Stream | 2024 Contribution (USD) | Key Driver |

|---|---|---|

| Hospital Operations (Patient Services) | $5.1 Billion (Q4 2024) | Patient volume, acuity, payer mix |

| USPI (Ambulatory Surgery Centers) | $4.5 Billion (Full Year 2024) | Procedure volume, complexity, net revenue per case |

| Conifer Health Solutions | Announced new clients and contract expansions in 2024 | Revenue cycle management, patient communication, value-based care services |

| Government Programs (Medicaid Supplemental) | $1.16 Billion (2024) | Reimbursement rates, policy, patient eligibility |

Business Model Canvas Data Sources

The Tenet Health Business Model Canvas is built using a combination of internal financial data, patient demographic analysis, and competitive landscape research. These diverse data sources ensure each component of the canvas accurately reflects Tenet's operational realities and strategic objectives.