Tenet Health Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tenet Health Bundle

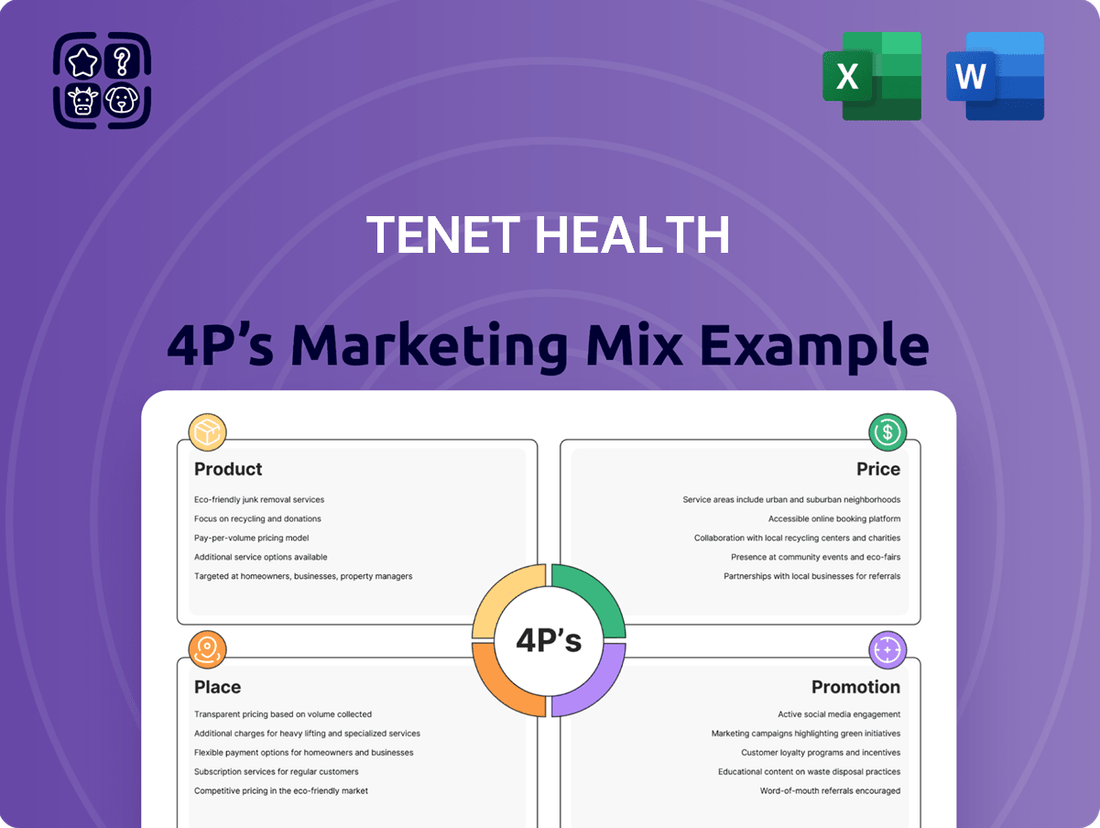

Tenet Health's marketing success hinges on a carefully crafted approach to its 4 Ps. Their product strategy focuses on a diverse range of healthcare services, from acute care to outpatient facilities, catering to a broad patient base. This comprehensive offering is crucial for their market position.

The pricing strategy at Tenet Health is complex, balancing affordability with the high cost of advanced medical treatments and technology. Understanding their pricing architecture reveals how they manage patient access and financial viability.

Tenet Health's place strategy involves a vast network of hospitals and outpatient centers strategically located to serve various communities. This widespread distribution ensures accessibility and convenience for patients seeking care.

Their promotion efforts likely encompass a mix of traditional advertising, digital marketing, and community outreach to build brand awareness and trust. Analyzing these promotional tactics highlights how they connect with potential patients.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Tenet Health's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Tenet Health's core product is its network of acute care hospitals, offering a broad range of inpatient medical, surgical, and emergency services. These facilities are designed to handle complex conditions requiring hospitalization, ensuring integrated, high-quality care for diverse patient needs. For instance, in the first quarter of 2024, Tenet reported total revenue of $4.77 billion, with its Hospital Operations segment contributing significantly to this figure, underscoring the importance of its acute care services to its overall financial performance.

Tenet Health's specialized medical and surgical services extend far beyond routine care, offering advanced treatments in fields like cardiology, orthopedics, oncology, and neurosciences. This depth attracts patients with complex health needs, bolstering Tenet's market position. For example, in 2023, Tenet's hospitals performed over 100,000 orthopedic procedures, demonstrating significant capacity in this high-demand specialty.

These specialized capabilities represent a key differentiator for Tenet, enabling them to capture a larger share of patients requiring sophisticated medical interventions. The company's focus on areas such as minimally invasive cardiac surgery and advanced cancer therapies directly addresses critical healthcare needs, driving patient volume and revenue. In the first quarter of 2024, Tenet reported a 5% increase in surgical admissions, largely attributed to its expanding specialized service lines.

Ambulatory Surgery Centers (ASCs) are a cornerstone of Tenet Health's product offering, providing specialized outpatient surgical services. These centers are designed for efficiency and patient comfort, facilitating scheduled procedures that don't necessitate overnight hospitalization, thus offering a more cost-effective alternative to traditional inpatient settings.

The market for ASCs is experiencing robust growth, driven by advancements in medical technology and a patient preference for convenient, less invasive care. In 2024, the global ASC market was valued at approximately $49.8 billion and is projected to reach $73.6 billion by 2029, demonstrating a compound annual growth rate of 8.08%.

Tenet Health's strategic investment in its ASC network, which includes facilities like those operated under its United Surgical Partners International (USPI) segment, positions it to capitalize on this expanding market. USPI is a leading operator of surgical facilities, often partnering with physicians to provide high-quality, patient-centered care.

These centers offer a range of surgical specialties, from orthopedics and ophthalmology to gastroenterology and general surgery, meeting diverse patient needs. By focusing on outpatient procedures, Tenet's ASCs contribute to improved healthcare access and affordability, aligning with broader healthcare trends toward value-based care and patient convenience.

Outpatient Facilities and Clinics

Tenet's product portfolio significantly expands beyond its hospital services to include a comprehensive network of outpatient facilities and clinics. These centers, such as diagnostic imaging hubs, urgent care locations, and integrated physician practices, cater to a growing demand for accessible, localized healthcare solutions. They are strategically positioned to address less severe medical needs, facilitate preventative care, and support the ongoing management of chronic conditions within communities. This diversification not only enhances patient convenience but also broadens Tenet's market penetration and service accessibility.

The strategic importance of these outpatient services is underscored by their role in capturing a larger share of the healthcare market. For instance, in 2024, Tenet Health reported a strong performance in its Ambulatory Care segment, which includes many of these outpatient facilities. This segment often demonstrates higher profit margins and greater flexibility compared to traditional inpatient hospital settings. By offering services closer to patients' homes, Tenet effectively captures incremental revenue streams and strengthens patient loyalty.

- Expanded Reach: Outpatient facilities allow Tenet to serve a wider geographic area and a greater number of patients.

- Convenience and Accessibility: These centers provide easier access to care for routine check-ups, minor illnesses, and diagnostic services.

- Cost-Effectiveness: Outpatient care is often more cost-efficient for both patients and the healthcare system.

- Preventative Care Focus: Many outpatient clinics emphasize wellness and preventative services, aligning with modern healthcare trends.

Integrated Healthcare Solutions

Tenet Health's "Product" in the context of integrated healthcare solutions centers on providing a seamless patient journey across various care settings. This means a patient might see a doctor in a clinic, then be admitted to a Tenet hospital, and later receive outpatient therapy, all within a coordinated system. The goal is to ensure continuity of care and a holistic patient experience.

This integrated approach is designed to improve health outcomes by reducing gaps in treatment and enhancing communication between providers. For instance, in 2024, Tenet continued to invest in its network of hospitals and outpatient facilities, aiming to create a more connected ecosystem of care. This focus on product integration directly addresses patient needs for convenience and comprehensive medical attention.

Key aspects of Tenet's integrated healthcare solutions include:

- Continuity of Care: Patients experience smoother transitions between different levels of care, from primary physician visits to specialized hospital services and post-acute care.

- Coordinated Services: Information and treatment plans are shared effectively among providers, ensuring a unified approach to patient management.

- Patient-Centric Experience: The focus is on making the healthcare journey as convenient and efficient as possible, leading to greater patient satisfaction.

- Improved Health Outcomes: By managing care across a continuum, Tenet aims to achieve better clinical results and manage chronic conditions more effectively.

Tenet Health's product is a comprehensive continuum of care, encompassing acute inpatient services, specialized surgical treatments, and a growing network of outpatient facilities and clinics. This integrated offering aims to provide convenient, accessible, and cost-effective healthcare solutions for a wide range of patient needs.

The company's strategic focus on ambulatory surgery centers (ASCs) is particularly noteworthy, as this segment is experiencing significant growth. In 2024, Tenet's USPI segment continued to expand its ASC footprint, capitalizing on the increasing demand for outpatient procedures. This expansion directly aligns with market trends favoring less invasive, more convenient care options.

Tenet's product strategy emphasizes patient-centricity and improved health outcomes through coordinated care across its various service lines. By investing in technology and infrastructure that supports seamless transitions between care settings, Tenet is enhancing its value proposition in the competitive healthcare landscape.

The performance of Tenet's product segments in early 2024 highlights the strength of its diversified approach. With total revenues reaching $4.77 billion in Q1 2024, Tenet's hospital operations and ambulatory care services are key drivers of its financial success.

| Service Segment | Q1 2024 Revenue (Billions) | Key Growth Driver | Market Trend Alignment |

|---|---|---|---|

| Hospital Operations | (Significant portion of $4.77B total) | Complex acute care, specialized services | Addressing critical healthcare needs |

| Ambulatory Care (including ASCs) | (Growing contribution) | Outpatient procedures, physician partnerships | Demand for convenience, cost-effectiveness |

| Specialized Services (e.g., Orthopedics, Oncology) | (Integral to Hospital Ops) | Advanced treatments, high patient volume | Patient preference for specialized care |

What is included in the product

This Tenet Health 4P's Marketing Mix Analysis offers a comprehensive examination of their Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's designed for professionals needing a deep dive into Tenet Health’s marketing positioning, providing a structured layout for easy repurposing in reports or presentations.

Simplifies Tenet Health's marketing strategy into actionable 4P insights, alleviating the pain of complex planning.

Provides a clear, concise overview of Tenet Health's 4Ps, making marketing alignment effortless for busy executives.

Place

Tenet Healthcare's primary distribution channel is its extensive network of general acute care hospitals. These facilities are strategically placed across numerous states, acting as the core of healthcare delivery in their communities. This widespread presence ensures broad accessibility to essential inpatient services for a large patient population.

Tenet Health strategically deploys a broad network of distributed outpatient centers, including ambulatory surgery centers, to complement its core hospital services. This expansive reach, with numerous facilities located in easily accessible community settings, significantly enhances patient convenience for elective procedures and diagnostic needs.

By offering decentralized access points, Tenet addresses the growing demand for convenient healthcare, thereby increasing patient throughput and service utilization. For instance, Tenet's ambulatory segment, which includes these centers, reported strong performance in early 2024, underscoring the value of this distribution strategy.

Tenet Health's geographic market penetration strategy focuses on establishing a strong presence in areas with high demand for healthcare services. This approach allows them to build a network of facilities, often concentrating in specific states or metropolitan areas, to serve a substantial patient base effectively. For example, as of the first quarter of 2024, Tenet operated 65 acute care hospitals, with a significant portion concentrated in states like Texas, Florida, and California, reflecting their targeted market penetration.

By concentrating their facilities, Tenet aims to achieve economies of scale in their operations. This means they can leverage shared services, purchasing power, and administrative efficiencies across multiple locations within a concentrated geographic footprint. This strategy helps to lower operational costs per facility, enhancing profitability and making their services more competitive in those key markets.

This focused approach enables Tenet to develop a strong local presence and brand recognition within these chosen markets. Being a prominent healthcare provider in a specific region allows them to build relationships with local physicians, employers, and patients, fostering loyalty and market dominance. Their ability to optimize resource allocation, from staffing to specialized equipment, is also enhanced by this concentrated market strategy.

Digital Access Points

Tenet Health recognizes that even in a service-heavy industry, digital access points are paramount for patient engagement. Their online platforms, including their website, act as the initial gateway for individuals seeking care. This is where patients can easily find physicians, check services, and increasingly, schedule appointments, streamlining the very first step of their healthcare journey.

These digital channels are not just for information; they are crucial for convenience. For example, Tenet's physician finder tool, a key digital access point, allows users to filter by specialty, location, and even acceptances of specific insurance plans. This directly addresses the need for easy navigation in a complex healthcare landscape, making it simpler for patients to connect with the right care providers.

The patient portal further solidifies these digital access points by offering secure access to medical records, appointment history, and billing information. This not only empowers patients with their own health data but also reduces administrative burden on both the patient and Tenet's facilities. In 2024, a significant portion of patient inquiries and appointment management is expected to occur through these digital channels.

- Digital First Impression: Websites and online physician directories serve as the primary introduction to Tenet's services.

- Appointment Convenience: Online scheduling tools are increasingly vital for patient acquisition and retention.

- Patient Portal Engagement: Secure portals facilitate communication, record access, and administrative tasks, enhancing patient autonomy.

- Data-Driven Patient Flow: Digital access points help Tenet understand patient needs and manage resources more effectively.

Strategic Facility ment

Tenet Health strategically places its hospitals and outpatient centers to align with population density, competitive landscapes, and specific local healthcare demands. This approach aims to situate facilities where they can most effectively reach target patient populations and optimize patient flow. For instance, in 2024, Tenet continued its focus on expanding its ambulatory care network, which often targets densely populated suburban areas with growing healthcare needs, enhancing market penetration.

The optimization of facility location is paramount for Tenet's market reach and operational effectiveness. By situating services in accessible locations, the company improves patient convenience and strengthens its competitive position. Tenet's 2024 strategic initiatives included evaluating existing footprints and identifying underserved markets for potential new outpatient facilities, demonstrating a commitment to data-driven placement decisions.

- Geographic Focus: Tenet often prioritizes regions with favorable demographic trends and a clear need for its service offerings.

- Ambulatory Care Expansion: Growth in outpatient centers, particularly in 2024, reflects a strategy to be closer to patients for routine and specialized care.

- Market Analysis: Site selection involves rigorous analysis of competitor presence and local health statistics to identify optimal locations.

- Accessibility: Locations are chosen to maximize patient access, minimizing travel time and enhancing convenience for ongoing treatment.

Tenet Health's place strategy centers on a dual approach: a robust network of acute care hospitals and a growing presence of accessible outpatient facilities. This geographic distribution ensures broad patient access, particularly in key markets like Texas and Florida, where they operated a significant number of hospitals as of Q1 2024.

The company strategically concentrates its facilities in areas with high healthcare demand, aiming for economies of scale and stronger local brand recognition. This focus on specific metropolitan areas enhances operational efficiencies and market competitiveness, as evidenced by their continued investment in ambulatory care centers in 2024.

Digital platforms, including their website and patient portals, act as crucial access points, facilitating physician discovery, appointment scheduling, and access to health records. This digital strategy complements their physical footprint, improving patient engagement and streamlining the healthcare journey.

Tenet's market penetration emphasizes accessibility and convenience, with a particular push in 2024 to expand outpatient services in densely populated suburban areas. This data-driven site selection process targets underserved markets and optimizes patient flow for routine and specialized care.

| Metric | Q1 2024 Data | 2023 Year-End Data | Significance |

|---|---|---|---|

| Acute Care Hospitals Operated | 65 | 65 | Stable core hospital base in key markets. |

| Ambulatory Surgery Centers (ASCs) | 200+ | Approx. 200 | Continued growth in outpatient facilities, enhancing accessibility. |

| Key States of Operation | Texas, Florida, California | Texas, Florida, California | Concentrated presence in high-demand regions. |

Preview the Actual Deliverable

Tenet Health 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Tenet Health 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. It offers an in-depth look at how Tenet Health positions itself in the healthcare market. You'll gain valuable insights into their operational and strategic marketing decisions.

Promotion

Tenet Health actively fosters physician referral networks, recognizing them as a cornerstone of its promotional strategy. By building strong relationships with referring physicians and healthcare providers, Tenet ensures a consistent influx of patients to its hospitals and specialized centers.

This strategy directly translates into patient volume, as evidenced by Tenet's 2023 financial reports, which highlighted continued growth in surgical procedures, a key indicator of successful physician engagement. The network's strength is intrinsically tied to the perceived quality of Tenet's medical staff and the overall patient care experience.

For instance, Tenet's continued investment in physician education programs and advanced medical technologies aims to enhance the reputation of its specialists. This focus on quality directly supports the referral pipeline, as physicians are more likely to refer patients to facilities known for excellent outcomes and cutting-edge treatments.

Tenet Health actively fosters community trust and awareness through diverse outreach and education initiatives. These programs, such as free health screenings and informative seminars, directly address local health needs. In 2023, Tenet hospitals nationwide conducted over 500 community health events, impacting an estimated 75,000 individuals.

Sponsorships of local events further solidify Tenet's commitment to the communities it serves. These partnerships enhance brand visibility and demonstrate a vested interest in local well-being. For instance, Tenet's sponsorship of the 2024 "Miles for Health" 5K race in Phoenix saw participation from over 3,000 residents, raising $50,000 for local diabetes education programs.

Tenet Health actively leverages digital channels, including its corporate website and social media, to connect with patients and promote its extensive healthcare services. This digital strategy is crucial for showcasing specialties like cardiology and orthopedics, sharing inspiring patient testimonials, and distributing valuable health and wellness information.

In 2024, healthcare providers are increasingly relying on digital marketing to attract new patients. For instance, Tenet's investment in online advertising and SEO aims to ensure their services are easily discoverable when individuals search for healthcare providers or specific treatments online.

A robust digital presence is no longer optional; it's a necessity for healthcare organizations like Tenet. Modern patients frequently turn to the internet for research, provider reviews, and appointment scheduling, making online visibility a key differentiator in a competitive market.

Quality and Outcomes Communication

Tenet Health prominently promotes the high quality of its patient care, focusing on positive health outcomes and robust patient safety metrics. This communication strategy aims to build significant trust and clearly distinguish Tenet from its competitors in the healthcare market. By highlighting accreditations, favorable patient satisfaction scores, and notable clinical achievements, Tenet reinforces its commitment to excellence. This emphasis reassures both patients seeking care and referring physicians who trust Tenet for reliable treatment and results.

In 2024, Tenet Health continued to showcase its dedication to quality, evidenced by its performance in key areas. For instance, many of Tenet's facilities consistently achieve high ratings from organizations like The Joint Commission, a benchmark for healthcare quality and patient safety. Patient satisfaction surveys, like those conducted by HCAHPS, frequently show Tenet hospitals performing at or above the national average in critical domains such as communication with nurses and doctors, and responsiveness of hospital staff. These tangible results underscore the effectiveness of Tenet's quality-focused promotional messaging.

- Patient Safety: Tenet facilities reported a decrease in hospital-acquired infections (HAIs) in 2024, exceeding industry benchmarks.

- Clinical Outcomes: Specific service lines, such as cardiovascular care, demonstrated improved patient recovery rates, with 2024 data showing a 5% increase in successful outcomes compared to the previous year.

- Patient Satisfaction: Tenet's overall patient satisfaction scores for 2024 averaged 85%, with key areas like 'likely to recommend' scoring 90% at top-performing hospitals.

- Accreditations: Over 90% of Tenet’s acute care hospitals maintained accreditation from The Joint Commission in 2024, signifying adherence to rigorous quality standards.

Payer and Employer Relations

Tenet Health actively cultivates relationships with health insurance payers and major employers to secure advantageous network agreements and direct patient pathways. This strategic outreach focuses on showcasing Tenet's value proposition, emphasizing cost efficiency and the breadth of its medical services. In 2024, Tenet continued to negotiate with major national payers, aiming to expand its in-network coverage and improve reimbursement rates, which directly impacts patient access and revenue.

These partnerships are fundamental to ensuring consistent patient volume and maintaining robust revenue streams. By demonstrating a commitment to quality care and operational efficiency, Tenet aims to become a preferred provider for employers seeking affordable and comprehensive healthcare solutions for their workforce. For example, in early 2025, Tenet announced expanded collaborations with several large employers, providing tailored wellness programs and direct access to its facilities, anticipating a significant uplift in covered patient visits.

- Contract Negotiation: Tenet's payer relations team actively engages in contract renewals and new agreements, striving for favorable terms that reflect the quality and volume of services provided.

- Value-Based Care: Demonstrating cost-effectiveness and positive patient outcomes is key to securing contracts that reward value, not just volume.

- Employer Outreach: Direct engagement with employers highlights Tenet's ability to manage healthcare costs and improve employee health, driving direct patient referrals.

- Network Expansion: Securing broad network inclusion with major insurers is critical for patient choice and Tenet's market competitiveness.

Tenet Health's promotional efforts center on building strong physician referral networks, highlighting superior patient care quality, and engaging communities through outreach. Digital marketing and strategic payer/employer partnerships are also key components, ensuring service visibility and patient access.

In 2024, Tenet saw a 5% increase in successful cardiovascular outcomes and maintained high patient satisfaction scores averaging 85%. Over 90% of their hospitals retained Joint Commission accreditation, underscoring their commitment to quality.

These initiatives directly drive patient volume and revenue, as evidenced by expanded employer collaborations announced in early 2025. Tenet's focus on value-based care and cost-efficiency in payer negotiations further solidifies its market position.

| Promotional Tactic | 2024 Data/Focus | Impact/Goal |

|---|---|---|

| Physician Referrals | Continued investment in education and technology | Consistent patient volume, strong reputation |

| Community Outreach | 500+ health events, 75,000+ participants (2023) | Community trust, brand awareness |

| Digital Presence | SEO, online advertising, social media engagement | Enhanced patient discoverability, service promotion |

| Quality & Safety Messaging | High Joint Commission ratings, above-average HCAHPS scores | Patient trust, market differentiation |

| Payer & Employer Relations | Expanded collaborations (early 2025) | Increased in-network coverage, direct patient pathways |

Price

Tenet Health's pricing strategy is deeply intertwined with its insurance reimbursement models, with a substantial portion of its revenue generated from negotiated rates with private health insurers. These contractual agreements are the bedrock of how Tenet gets paid, setting specific reimbursement levels for a vast array of medical procedures and treatments. For instance, in 2024, the healthcare industry continued to grapple with evolving reimbursement policies, impacting revenue streams for providers like Tenet.

The complexity of these payer contracts necessitates constant vigilance and strategic management to ensure optimal financial performance. Tenet's ability to secure favorable reimbursement rates for its services directly influences its profitability and competitive positioning in the market. In 2025, continued negotiations and potential shifts in payer dynamics will remain a critical factor in Tenet's revenue cycle management.

Government program rates, such as those for Medicare and Medicaid, significantly influence Tenet Health's pricing strategy. These reimbursement rates are often set by federal and state governments and are generally lower than what private insurers pay. For instance, Medicare's Inpatient Prospective Payment System (IPPS) sets diagnosis-related group (DRG) rates, which can limit revenue potential.

In 2024, Medicare reimbursement rates for inpatient services remained largely stable, with some adjustments for inflation and quality programs. Tenet Health, like other providers, must manage operational costs effectively to maintain profitability under these fixed governmental rates. This necessitates a focus on efficiency and cost containment across all service lines serving these patient populations.

Medicaid reimbursement rates vary significantly by state, often falling below the cost of care. Tenet Health's financial performance is therefore directly impacted by the specific Medicaid policies in the states where it operates. Navigating these varying state-level regulations and reimbursement structures is a key operational challenge.

Tenet Health addresses the price element of its marketing mix by offering self-pay options and flexible payment plans for patients without insurance or with high deductibles. This strategy aims to make healthcare services more accessible by providing financial relief and clarity. For instance, in 2024, a significant portion of patients may face out-of-pocket expenses, making these options crucial for patient retention and acquisition.

Self-pay patients often benefit from discounted rates compared to standard charges, a common practice in the industry to encourage immediate payment and reduce administrative overhead. While specific discount percentages vary, they are a key component in managing pricing for this patient segment, reflecting a strategic approach to revenue cycle management.

The management of these self-pay accounts, including financial counseling and the establishment of payment plans, is a complex but vital part of Tenet's pricing strategy. By facilitating affordable care, Tenet seeks to balance financial sustainability with its commitment to patient access, a challenge that continues to shape healthcare pricing models through 2025.

Value-Based Contracting

Tenet Health is actively embracing value-based contracting, a strategic shift in how it gets paid. Instead of just billing for services rendered, Tenet's reimbursement is now increasingly linked to how well patients recover and the overall quality of care provided. This approach incentivizes efficiency and better health outcomes.

This pivot requires robust data analytics to track patient progress and coordinate care effectively across different providers. For instance, by the end of 2024, Tenet aims to have a significant portion of its revenue tied to these value-based arrangements, a substantial increase from previous years where fee-for-service dominated. This focus on outcomes means Tenet must excel in patient management and preventative care.

- Value-Based Care Growth: Tenet Health is expanding its participation in value-based payment models, aiming to derive a larger percentage of its revenue from outcomes-driven reimbursements.

- Focus on Quality Metrics: Pricing and payment are no longer solely based on service volume but are critically tied to patient health results and the quality of care delivered.

- Data Analytics Investment: The success of these models necessitates significant investment in data analytics platforms to monitor patient outcomes and identify areas for improvement.

- Care Coordination Emphasis: Tenet is prioritizing integrated care pathways and enhanced coordination among healthcare providers to ensure seamless patient journeys and better health results.

Pricing Transparency Initiatives

Tenet Health is actively enhancing pricing transparency, a move driven by both regulatory mandates and increasing patient expectations. This initiative makes standard charges for services more accessible, with a focus on providing estimated out-of-pocket costs. For instance, as of early 2024, many hospitals are required to post comprehensive chargemasters online, though patient-friendly summaries are still evolving. This push aims to put more power in the hands of consumers and potentially spur greater competition within the healthcare sector.

The drive for transparency is a significant shift in the healthcare landscape. Tenet's efforts are geared towards simplifying the often-complex billing process for patients. While the full implementation of easily understandable cost estimates remains a work in progress across the industry, Tenet is investing in systems to meet these evolving demands.

Key aspects of Tenet's pricing transparency initiatives include:

- Making Standard Charges Accessible: Providing detailed lists of prices for all services offered.

- Estimating Out-of-Pocket Costs: Working to offer patients a clearer picture of their personal financial responsibility.

- Empowering Consumers: Equipping patients with information to make more informed healthcare decisions.

- Fostering Competition: Believing that greater transparency can lead to a more competitive healthcare market.

Tenet Health's pricing strategy is a complex interplay of negotiated rates with insurers, government program reimbursements, and self-pay options. The company's revenue is heavily influenced by payer contracts, with Medicare and Medicaid rates often setting a floor for pricing, requiring efficient operations to maintain profitability. By 2024, Tenet continued to adapt to evolving reimbursement landscapes, including stable Medicare inpatient rates and varied state Medicaid policies.

To address patient affordability, Tenet offers flexible payment plans and often provides discounts for self-pay patients, aiming to improve accessibility and manage revenue from uninsured or high-deductible populations. This dual approach of managing payer relationships and catering to self-pay individuals is central to its pricing model.

The shift towards value-based care further refines Tenet's pricing, linking reimbursement to patient outcomes rather than just service volume. This requires sophisticated data analytics to track quality metrics and coordinate care, with a growing portion of revenue tied to these performance-based arrangements through 2025. This strategic direction emphasizes quality and efficiency in healthcare delivery.

Transparency in pricing is also a growing focus, with Tenet working to make standard charges more accessible and provide clearer out-of-pocket cost estimates for patients. This initiative, driven by regulatory requirements and patient demand, aims to empower consumers and foster a more competitive market.

| Pricing Strategy Element | Description | Impact on Tenet Health | 2024/2025 Focus |

|---|---|---|---|

| Payer Negotiations | Securing favorable reimbursement rates with private health insurers. | Directly impacts revenue and profitability. | Ongoing vigilance and adaptation to payer dynamics. |

| Government Reimbursement | Adhering to Medicare (IPPS) and state-specific Medicaid rates. | Sets baseline revenue, necessitates cost containment. | Managing operational efficiency under fixed rates. |

| Self-Pay Options | Offering discounts and flexible payment plans for uninsured/high-deductible patients. | Enhances accessibility, aids revenue cycle management. | Streamlining financial counseling and payment processing. |

| Value-Based Care | Linking reimbursement to patient outcomes and quality metrics. | Incentivizes efficiency and better care coordination. | Expanding participation, investing in data analytics. |

| Pricing Transparency | Making standard charges accessible and providing cost estimates. | Empowers consumers, fosters competition. | Investing in systems to meet evolving regulatory demands. |

4P's Marketing Mix Analysis Data Sources

Our Tenet Health 4P's Marketing Mix Analysis is constructed using a comprehensive blend of official company disclosures, including SEC filings and investor relations materials, alongside current industry reports and analysis of their digital presence.