Grupo Televisa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Televisa Bundle

Grupo Televisa operates within a dynamic landscape shaped by political stability, economic fluctuations, and evolving social media trends. Understanding these external forces is crucial for any stakeholder seeking to navigate the media and telecommunications sectors in Latin America.

Our PESTLE analysis delves into how technological advancements are disrupting traditional broadcasting and creating new opportunities for digital content. This comprehensive report highlights the critical factors influencing Televisa's strategic decisions and market position.

From the impact of government regulations on content distribution to environmental concerns influencing corporate social responsibility, our detailed PESTLE analysis offers actionable intelligence. Gain a competitive edge by understanding the complete external environment impacting Grupo Televisa.

Don't get left behind in this rapidly changing industry. Purchase the full Grupo Televisa PESTLE Analysis today to unlock expert insights, forecast potential challenges, and identify lucrative growth avenues. Equip yourself with the knowledge to make informed strategic moves.

Political factors

Grupo Televisa operates within a dynamic Mexican government regulatory environment that directly influences its media and telecommunications operations. Recent legislative actions, including the proposed dissolution of the Federal Telecommunications Institute (IFT) and the creation of the new Digital Transformation and Telecommunications Agency (ATDT), signal potential shifts in how the sector is overseen and managed. These reforms, with key approvals occurring in late 2024 and early 2025, are designed to alter the competitive landscape and the extent of state participation.

The transition from the IFT to the ATDT could introduce new operational challenges and opportunities for Televisa. The specific mandates and powers of the ATDT, still being defined in early 2025, will be crucial in determining future regulatory priorities, such as spectrum allocation, content regulation, and anti-monopoly measures. This evolving framework necessitates close monitoring by Televisa to adapt its strategies effectively.

Grupo Televisa's broadcasting operations are significantly influenced by Mexico's political climate, especially concerning media freedom and potential censorship. Recent discussions around telecommunications legislation, including a now-removed article that could have permitted temporary blocking of digital platforms, underscore the delicate balance between governmental oversight and freedom of expression.

While the Mexican government has since withdrawn the most contentious article from the telecommunications reform proposals, the underlying intention to regulate content, particularly foreign political advertising, continues to be a relevant factor for Grupo Televisa. This regulatory environment could impact content distribution and advertising revenue streams.

Government policies designed to promote competition in Mexico's telecommunications and broadcasting industries directly influence Grupo Televisa's market position and strategic planning. These regulations can affect everything from pricing to content distribution.

A major shift occurred with the dissolution of the Federal Institute of Telecommunications (IFT) and the consolidation of its antitrust authority into a new competition commission within the Ministry of Economy. This restructuring indicates a potential for more centralized and possibly different approaches to market regulation.

This change in oversight could result in the implementation of new rules or more aggressive enforcement actions aimed at curbing the market dominance of large entities, including Televisa and América Móvil, potentially impacting their operational freedom and market share.

Political Influence and Government Relations

Grupo Televisa's long-standing relationship with the Mexican government, a key political factor, significantly shapes its operational landscape. Its ability to adapt to political transitions and evolving policy frameworks is paramount, especially given its reliance on government concessions for broadcasting activities.

The upcoming 2024 Mexican elections present a critical juncture. A new presidential administration could introduce altered policies concerning media regulation, licensing renewals, and content oversight, potentially impacting Televisa's market access and business model.

- Government Concessions: Televisa's broadcasting licenses are subject to government renewal and regulation, a consistent point of political interaction.

- Regulatory Environment: Changes in telecommunications and media laws, often influenced by political agendas, directly affect Televisa's operations and competitive positioning.

- Political Stability: The stability of the Mexican government and its approach to large corporations like Televisa can influence investor confidence and long-term strategic planning.

International Trade Agreements and Foreign Investment

International trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), significantly shape the landscape for companies like Grupo Televisa. These agreements can facilitate or complicate cross-border operations, impacting Televisa's potential for international partnerships and the flow of foreign investment into its ventures.

While Mexican regulations historically limit foreign ownership in broadcasting sectors, broader shifts in foreign investment policies or the emergence of trade disputes can create indirect ripple effects. Such changes could influence Televisa's strategic alliances and its capacity for international expansion, particularly in relation to its significant partnership with TelevisaUnivision.

For instance, the USMCA aims to foster greater integration within North America, which could open avenues for Televisa to leverage this framework for content distribution or technology sharing. However, any disruptions or renegotiations within these trade pacts could introduce uncertainty, potentially affecting the financial viability of foreign capital inflows or collaborative projects.

- USMCA Impact: The USMCA's provisions on digital trade and services could offer opportunities for Televisa's media and telecommunications segments.

- Foreign Investment Climate: Fluctuations in global foreign direct investment (FDI) trends, with Mexico seeing FDI of approximately $36 billion in 2023 according to Banxico, can influence capital availability for Televisa's growth initiatives.

- Regulatory Shifts: Potential changes in investment screening mechanisms or national security reviews related to foreign ownership in media could indirectly impact Televisa's strategic decisions and partnerships.

- Trade Disputes: Escalating trade tensions between major economies could lead to retaliatory measures that disrupt supply chains or investment flows relevant to Televisa's operations and its TelevisaUnivision collaboration.

Grupo Televisa's operations are significantly shaped by Mexico's evolving political landscape and regulatory framework, particularly concerning media and telecommunications. The dissolution of the Federal Telecommunications Institute (IFT) and the establishment of a new agency in early 2025 signal potential shifts in oversight, impacting Televisa's market position.

Government policies aimed at fostering competition, alongside evolving regulations on content and foreign investment, directly influence Televisa's strategic planning and operational freedom. The upcoming 2024 Mexican elections represent a critical juncture, with a new administration potentially altering media policies and licensing renewals.

International trade agreements like the USMCA could offer opportunities for Televisa, such as facilitating cross-border content distribution, while trade disputes could introduce market uncertainty and affect foreign investment into its ventures, especially its TelevisaUnivision partnership.

What is included in the product

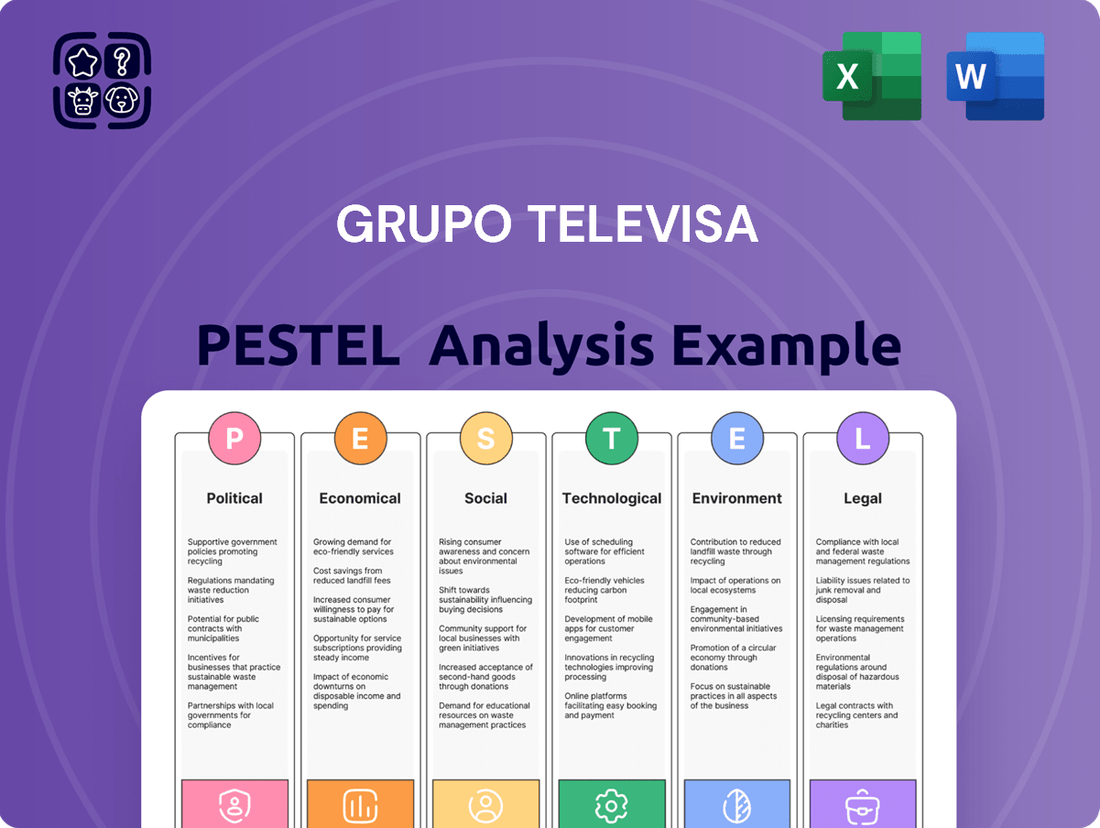

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Grupo Televisa, offering a comprehensive overview of its external operating landscape.

A clear, actionable PESTLE analysis for Grupo Televisa, designed to swiftly identify and address external challenges and opportunities, thereby alleviating strategic planning pain points.

Economic factors

Mexico's economic health is a crucial driver for Grupo Televisa. Strong GDP growth generally translates to increased consumer spending, which directly benefits Televisa's advertising and pay-TV segments. For instance, if Mexico's GDP growth slows, as it did in parts of 2024, consumers may cut back on discretionary spending, impacting Televisa's subscription revenues.

Consumer spending power is a direct reflection of economic conditions. A robust economy empowers households to spend more on entertainment and communication services, boosting Televisa's top line. Conversely, a dip in consumer confidence or purchasing power, as observed in some reports from late 2024, can lead to a noticeable decrease in demand for services like those offered by Televisa's Sky and Cable divisions.

Grupo Televisa's performance is closely tied to the health of the Mexican advertising market, as a substantial portion of its revenue comes from this sector. Economic slowdowns in Mexico can lead to reduced advertising spending, directly impacting Televisa's top line.

Shifts in advertising budgets, particularly the ongoing migration towards digital platforms, present a challenge. While TelevisaUnivision reported advertising revenue growth in the U.S. market during 2024, the specific dynamics within Mexico may differ, with local advertisers potentially reallocating funds.

Grupo Televisa faces intense competition in Mexico's telecom and media markets. Rival broadband providers and streaming services are actively vying for subscribers, impacting Televisa's pricing power and customer retention. For instance, in late 2023, América Móvil continued its aggressive fiber expansion, further challenging Televisa's traditional cable footprint.

Competitors such as Total Play and Megacable are investing heavily in upgrading their fiber optic networks and offering attractive bundled services. This has led to observable subscriber shifts, with Televisa's Sky and Cable divisions experiencing pressure as customers opt for these alternative offerings.

Foreign Exchange Rate Fluctuations

Grupo Televisa's extensive international operations, especially its substantial investment in TelevisaUnivision which has a significant presence in the U.S. market, make it highly susceptible to foreign exchange rate movements. The relationship between the Mexican Peso (MXN) and the U.S. Dollar (USD) is particularly critical. For example, if the MXN strengthens against the USD, Televisa's reported dollar-denominated revenues and expenses from its U.S. activities would translate into fewer pesos, potentially impacting its consolidated financial statements. This dynamic was evident in late 2024 as the MXN showed periods of strength, influencing the reported profitability of its international ventures.

These currency shifts can create volatility in Televisa's earnings and the value of its foreign assets. A weaker peso, conversely, would make its U.S. dollar earnings appear larger when converted back into pesos. This sensitivity necessitates careful financial management and hedging strategies to mitigate potential negative impacts on the company's overall financial health and investor returns.

- MXN/USD Volatility Impact: Fluctuations directly affect the peso-denominated value of Televisa's U.S. dollar earnings and assets.

- TelevisaUnivision Exposure: The company's significant stake in TelevisaUnivision, a U.S.-based entity, amplifies this exposure.

- Reporting Effects: A stronger MXN can reduce the reported peso equivalent of dollar-denominated revenues and costs.

- Strategic Hedging: Effective currency risk management is crucial for stabilizing financial results.

Inflation and Operational Costs

Inflationary pressures within Mexico significantly impact Grupo Televisa's operational expenses. These rising costs directly affect crucial areas such as content creation, the upkeep of its extensive infrastructure, and employee compensation. For instance, if the annual inflation rate in Mexico remains elevated, as it has in recent periods, the cost of goods and services Televisa relies upon will continue to climb, squeezing profit margins.

Grupo Televisa has actively pursued cost efficiencies and a disciplined approach to capital expenditures (CapEx) throughout 2024. The primary objective of these measures is to bolster operating cash flow. However, the persistence of high inflation poses a substantial risk, potentially negating the benefits derived from these operational improvements and hindering the company's ability to achieve its financial targets.

- Rising Content Production Costs: Increased prices for raw materials, talent, and licensing agreements driven by inflation.

- Infrastructure Maintenance Expenses: Higher costs for energy, equipment, and specialized labor needed to maintain broadcast and internet networks.

- Labor Cost Adjustments: The need to adjust wages to keep pace with the cost of living, particularly if inflation outstrips wage growth.

- Impact on Operating Margins: Persistent inflation can directly reduce the company's operating profit margins if cost increases cannot be fully passed on to consumers.

Mexico's economic growth directly influences consumer spending on services like pay-TV and internet, key revenue streams for Televisa. For example, a projected 2.4% GDP growth for Mexico in 2024, according to the IMF, suggests continued demand, though potential slowdowns in late 2024 and early 2025 could temper this. Inflationary pressures, hovering around 4.5% in early 2025, increase operational costs for content production and infrastructure maintenance, impacting profit margins if these costs cannot be fully passed on to consumers.

The Mexican Peso's volatility against the U.S. Dollar is a significant factor, particularly given Televisa's stake in TelevisaUnivision. A stronger peso in late 2024 meant that dollar-denominated revenues from TelevisaUnivision translated to fewer pesos, affecting consolidated results. Strategic financial management and hedging are essential to mitigate this currency risk and stabilize earnings.

| Economic Factor | 2024/2025 Data Point | Impact on Televisa |

|---|---|---|

| Mexico GDP Growth | Projected 2.4% (IMF, 2024) | Supports consumer spending on services. |

| Mexico Inflation Rate | Around 4.5% (Early 2025 estimate) | Increases operating costs, potentially squeezing margins. |

| MXN/USD Exchange Rate | Periods of MXN strength (Late 2024) | Reduces peso-equivalent of USD earnings. |

What You See Is What You Get

Grupo Televisa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Grupo Televisa delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understanding these external forces is crucial for stakeholders to assess risks and opportunities. The detailed insights provided will equip you with a thorough understanding of Televisa's strategic landscape.

Sociological factors

Consumer preferences are rapidly shifting away from traditional television viewing towards digital streaming services and on-demand content. This evolution presents a significant challenge to Grupo Televisa's established broadcast and pay-TV operations.

The decline in subscriber numbers for Televisa's Sky segment, its satellite pay-TV service, underscores this trend. For instance, Televisa reported a decrease in its Sky subscriber base in recent quarters, reflecting the broader industry shift.

Consequently, Televisa must continue to heavily invest in and actively promote its own streaming platforms, such as ViX. This strategic pivot is crucial to adapt to changing media consumption habits and retain market share in the evolving media landscape.

Mexico's population is projected to reach around 130 million by mid-2025, with a significant portion being young adults. This demographic trend means a growing demand for digital content and on-demand services. Televisa must prioritize mobile-first strategies and invest in platforms appealing to Gen Z and Millennials, who are increasingly concentrated in urban centers.

Grupo Televisa's deep roots in Mexican culture mean its success hinges on creating and sharing Spanish-language content that truly resonates with local audiences. This involves consistently adapting to changing tastes and the sheer volume of global entertainment options available, a challenge across its various media channels, including broadcast, cable, and streaming services.

In 2024, staying culturally relevant is more critical than ever. For instance, Televisa's streaming platform, ViX, saw significant growth in 2023, reporting over 30 million monthly active users, highlighting the demand for Spanish-language content. However, this growth also means increased competition from international players like Netflix and Disney+, who are also investing heavily in local productions.

Televisa's ability to leverage its historical understanding of Mexican cultural nuances, including regional dialects and social trends, provides a competitive edge. By continuing to invest in original programming that reflects these specificities, such as popular telenovelas or culturally significant dramas, Televisa can solidify its position and maintain strong audience loyalty in a crowded marketplace.

Social Media Influence and News Consumption

The shift towards social media as a primary news and entertainment source, especially for Gen Z and Millennials, is significantly altering how traditional media, including Grupo Televisa, reaches its audience. By mid-2024, Statista reported that over 60% of internet users globally accessed news via social media platforms, a trend that continues to grow.

For Televisa to maintain its influence, adapting its content and distribution strategies for these digital spaces is crucial. This involves not only sharing their established news content but also actively participating in conversations and potentially incorporating user-generated content to foster a sense of community and relevance.

- Social Media Dominance: Platforms like TikTok, Instagram, and X (formerly Twitter) are increasingly eclipsing traditional news channels for younger demographics, impacting Televisa's traditional viewership.

- Engagement Imperative: Televisa needs robust social media strategies to disseminate news effectively and participate in public discourse, mirroring the rapid, interactive nature of online platforms.

- Content Integration: Successfully integrating user-generated content can enhance Televisa's connection with its audience, making its news offerings more dynamic and responsive to public sentiment.

- Competitive Landscape: Failure to adapt to social media trends could lead to a further erosion of market share and influence, especially as digital-native news outlets gain traction.

Corporate Social Responsibility and Public Perception

Public perception of Grupo Televisa is significantly shaped by its corporate social responsibility (CSR) efforts and overall ethical standing. Initiatives aimed at community development and environmental stewardship directly influence brand reputation and foster consumer trust. For instance, Televisa’s commitment to principles of the UN Global Compact underscores its dedication to responsible business practices, which is crucial for maintaining a positive public image in the competitive media landscape. This focus on social responsibility is not just about reputation; it directly impacts consumer loyalty and the company's social license to operate.

Grupo Televisa's ongoing recognition for its social responsibility programs, such as those focused on education and health, plays a vital role in bolstering its public perception. These programs are designed to create tangible benefits for society, thereby enhancing the company's image as a responsible corporate citizen. Such efforts are particularly important in the current climate where consumers and stakeholders increasingly scrutinize a company's societal impact. In 2023, for example, Televisa Foundation continued its support for over 100 educational projects across Mexico, directly impacting thousands of students.

The company's adherence to the UN Global Compact principles provides a framework for its CSR activities, ensuring they align with international standards for human rights, labor, environment, and anti-corruption. This alignment is key to building credibility and trust with a global audience. By actively participating in and reporting on these initiatives, Televisa demonstrates a commitment that goes beyond mere compliance, aiming for genuine positive impact and reinforcing its standing as a socially conscious organization.

- Brand Reputation: Positive CSR initiatives enhance Televisa's brand image, leading to increased consumer trust and loyalty.

- Ethical Conduct: Perceived ethical behavior is critical for maintaining public confidence and mitigating reputational risks.

- Social Impact: Recognition for social responsibility programs, particularly in education and health, demonstrates a commitment to societal well-being.

- UN Global Compact: Adherence to these principles signals a dedication to international standards of corporate responsibility.

The increasing reliance on social media for news and entertainment, particularly among younger demographics, significantly impacts Grupo Televisa's traditional audience reach. By mid-2024, over 60% of global internet users accessed news via social media, a trend that continues to grow, necessitating adaptive strategies for Televisa.

To maintain influence, Televisa must integrate its content and distribution across digital spaces, including active participation in online discourse and potentially incorporating user-generated content. This approach fosters community and relevance in a rapidly evolving media landscape.

Grupo Televisa's robust social responsibility programs, such as those supporting education and health, are crucial for its public perception and consumer trust. For instance, the Televisa Foundation supported over 100 educational projects in Mexico in 2023, directly impacting thousands of students and reinforcing its image as a socially conscious entity.

Adherence to UN Global Compact principles guides Televisa's CSR efforts, aligning them with international standards and building credibility. This commitment beyond mere compliance reinforces its standing and positively influences its social license to operate.

| Sociological Factor | Impact on Grupo Televisa | Supporting Data/Trend |

|---|---|---|

| Shifting Media Consumption | Decline in traditional TV viewership, rise in digital streaming | Consumer preference moving towards on-demand and digital platforms. |

| Demographic Shifts | Growing demand for digital content from younger populations | Mexico's population projected around 130 million by mid-2025, with a significant youth segment. |

| Cultural Resonance | Need for content that appeals to local tastes and global competition | ViX platform reached over 30 million monthly active users in 2023, but faces competition from international streamers. |

| Social Media Dominance | Erosion of traditional news channels' influence among younger demographics | Over 60% of global internet users accessed news via social media by mid-2024. |

| Corporate Social Responsibility (CSR) | Enhances brand reputation and consumer trust | Televisa Foundation supported over 100 educational projects in 2023. |

Technological factors

Grupo Televisa's strategic imperative to invest in digital transformation, especially its streaming service ViX, is paramount given the swift evolution of digital technology. This focus is crucial for scaling and monetizing its direct-to-consumer (DTC) offerings.

The company's commitment to ViX is a direct response to the need to compete with established global streaming giants. This strategy aims to counterbalance the ongoing contraction in its traditional pay-TV subscriber base, a trend that has impacted the media industry broadly.

By Q1 2025, ViX had achieved over 30 million monthly active users, demonstrating significant growth in its DTC segment. This user engagement is a key metric as Televisa navigates the shift from linear television to digital consumption models.

The success of ViX is directly tied to Televisa's ability to adapt its content and distribution strategies for a digital-first audience. Monetization efforts through advertising and premium subscriptions are vital for the platform's long-term viability and contribution to overall revenue.

The ongoing expansion of broadband and fiber optic networks directly fuels Televisa's core cable and telecommunications businesses. As of late 2024, Mexico's broadband penetration continues to climb, with providers like Televisa actively investing in fiber-to-the-home (FTTH) deployments to meet escalating consumer demand for faster internet speeds. This infrastructure development is paramount for Televisa to remain competitive in the fixed broadband sector and capitalize on the growing need for high-capacity data services.

The ongoing rollout of 5G technology in Mexico presents a significant technological factor for Grupo Televisa. While the adoption of 5G promises enhanced data speeds and new service possibilities for Televisa's telecommunications segment, it also necessitates substantial investment in infrastructure upgrades.

Access to and the cost of 5G spectrum are critical considerations. In 2023, Mexico's Federal Telecommunications Institute (IFT) continued its efforts to allocate spectrum for 5G services, with auctions and assignments influencing the competitive landscape. High spectrum fees can limit the ability of companies like Televisa to expand their 5G offerings efficiently.

Regulatory uncertainties surrounding spectrum allocation and usage rules can impact Televisa's strategic planning for 5G deployment. The government's approach to spectrum management directly affects the cost and timeline for Televisa to leverage this advanced technology to compete and innovate in the Mexican market.

Cybersecurity and Data Privacy

Grupo Televisa's increasing reliance on digital platforms and customer data makes robust cybersecurity and data privacy essential. Failure to protect sensitive information can lead to significant financial losses and damage to its reputation. For instance, in 2024, companies globally faced an average cost of over $4.45 million per data breach, according to IBM's Cost of a Data Breach Report. Televisa must invest in advanced security measures to safeguard its operations and customer trust.

Compliance with evolving data privacy regulations, such as Mexico's Federal Law on Protection of Personal Data Held by Private Parties, is critical. Non-compliance can result in substantial fines and legal challenges. The company's commitment to data protection directly impacts its ability to operate smoothly and maintain customer confidence in its digital services.

- Cybersecurity Investment: Televisa needs to continuously upgrade its cybersecurity infrastructure to counter sophisticated threats.

- Data Privacy Compliance: Adherence to all relevant data protection laws is non-negotiable.

- Customer Trust: Strong data security practices build and maintain customer loyalty.

- Risk Mitigation: Proactive cybersecurity measures prevent costly data breaches and regulatory penalties.

Content Production and Distribution Innovation

Technological advancements are reshaping how content is made and shared, pushing Grupo Televisa to stay agile. Innovations like virtual production and AI are streamlining content creation, potentially lowering costs and boosting quality. For instance, the global virtual production market was valued at approximately USD 2.5 billion in 2023 and is projected to grow significantly, indicating a strong trend for Televisa to leverage.

The rise of Over-The-Top (OTT) services and personalized content delivery demands new strategies. Televisa's investment in its own streaming platforms and partnerships are crucial for reaching audiences accustomed to on-demand and tailored viewing experiences. This shift is evidenced by the continued growth in global OTT revenue, which reached an estimated USD 272 billion in 2024, highlighting the importance of digital distribution channels.

- Virtual Production Adoption: Televisa can explore virtual production techniques to reduce physical set requirements and enhance visual effects, potentially cutting production time and costs.

- AI in Content Creation: Implementing AI-driven tools for script analysis, content generation, or post-production editing can lead to more efficient and innovative content development.

- OTT Platform Expansion: Strengthening its presence on and developing new OTT services will be vital to compete with global streaming giants and cater to evolving consumer preferences for digital content access.

- Personalized Content Delivery: Utilizing data analytics and AI to offer personalized content recommendations and experiences can significantly improve viewer engagement and retention.

Grupo Televisa's technological strategy is heavily influenced by the rapid advancements in digital media and telecommunications. The company's significant investment in its streaming service, ViX, reflects a pivot towards direct-to-consumer (DTC) models, aiming to capture a larger share of the growing digital entertainment market. By Q1 2025, ViX had garnered over 30 million monthly active users, underscoring the effectiveness of this digital-first approach in engaging audiences.

The expansion of broadband infrastructure, particularly fiber optic networks, remains a cornerstone of Televisa's telecommunications business. As of late 2024, Mexico's broadband penetration continues to increase, driven by consumer demand for higher speeds, a trend Televisa actively supports through its network investments. This infrastructure development is crucial for maintaining competitiveness in the fixed broadband sector and capitalizing on the growing need for robust data services.

The rollout of 5G technology in Mexico presents both opportunities and challenges for Televisa. While 5G promises enhanced services, it necessitates substantial infrastructure investment and careful consideration of spectrum allocation costs, which have been a focus for regulatory bodies like Mexico's Federal Telecommunications Institute (IFT) since 2023. Navigating these technological and regulatory landscapes is key to Televisa's future growth.

Grupo Televisa's increasing reliance on digital platforms necessitates a strong focus on cybersecurity and data privacy. In 2024, the average cost of a data breach globally exceeded $4.45 million, highlighting the financial and reputational risks associated with inadequate security. Adherence to Mexico's Federal Law on Protection of Personal Data Held by Private Parties is therefore critical for maintaining customer trust and avoiding regulatory penalties.

Legal factors

Mexico's Telecommunications and Broadcasting Law reforms are a significant factor for Grupo Televisa. These changes directly influence its operational licenses, the overall market structure, and the rules governing content. For instance, the proposed dissolution of the Federal Telecommunications Institute (IFT), a key regulator, and the potential establishment of a new governing body signal a period of regulatory uncertainty that could reshape the industry landscape. As of early 2024, discussions around the IFT's future were ongoing, with potential implications for market competition and Televisa's strategic positioning.

Grupo Televisa, as a major media conglomerate in Mexico, faces significant scrutiny under antitrust and competition regulations. These laws are designed to ensure a fair marketplace and prevent any single entity from dominating, which is particularly relevant given Televisa's extensive reach in broadcasting, telecommunications, and content production. Historically, Televisa has been a focal point for competition authorities concerned about its market power.

Recent developments in Mexico's regulatory environment could reshape how these antitrust matters are handled. There's been discussion and potential shifts in oversight, with the Ministry of Economy being considered to take on a more prominent role in competition matters, potentially impacting how Televisa's market practices are reviewed. This regulatory flux requires Televisa to be adaptable and prepared for evolving enforcement priorities and investigations into its market share and competitive conduct.

Grupo Televisa operates within a complex legal landscape concerning content licensing and intellectual property. Effective management of these rights is crucial for protecting its extensive catalog of Spanish-language content, a core asset for revenue. Televisa's ability to secure and enforce its intellectual property rights directly impacts its competitive positioning in both domestic and international markets.

Data Privacy and Consumer Protection Laws

Grupo Televisa, operating extensively in Mexico's telecommunications sector, faces significant legal hurdles related to data privacy and consumer protection. The country's evolving regulatory landscape, particularly concerning the collection, storage, and use of customer data, directly impacts Televisa's cable and internet operations. Non-compliance can lead to substantial fines and reputational damage.

Mexico's Federal Consumer Protection Law (LFPC) and the Federal Law on the Protection of Personal Data Held by Private Parties are key frameworks. These laws mandate transparency in data handling, require explicit consent for data usage, and grant consumers rights such as access, rectification, cancellation, and opposition (ARCO rights). For instance, the National Institute for Transparency, Access to Information and Personal Data Protection (INAI) actively enforces these regulations.

- Data Handling Compliance: Televisa must adhere to strict guidelines on how it collects, processes, and secures customer information, impacting its marketing and service personalization strategies.

- Consumer Rights: The company is obligated to respect consumer rights regarding service quality, billing transparency, and dispute resolution, with potential penalties for violations.

- Regulatory Scrutiny: Increased focus from bodies like INAI means ongoing monitoring and potential audits of Televisa's data practices and consumer service protocols.

- Evolving Legislation: Keeping pace with new or amended laws, such as those potentially strengthening data breach notification requirements, is crucial for avoiding legal repercussions and maintaining customer trust.

Labor Laws and Union Relations

Mexican labor laws, particularly those concerning minimum wage, working hours, and benefits, directly influence Televisa's operational expenses and workforce management strategies. The country's labor framework, updated significantly in 2019 to promote worker rights and collective bargaining, requires companies like Televisa to adhere to stricter compliance measures, potentially increasing labor costs.

Union relations represent another critical legal factor for Televisa. As of early 2024, Mexico has seen a rise in union activity and a push for greater transparency in union elections, which could lead to increased negotiation demands from Televisa's workforce. A significant portion of Televisa's employees are unionized, making the dynamics of these relationships crucial for maintaining stable operations.

- Labor Law Reforms: Mexico's 2019 labor reform introduced significant changes, including a shorter work week and increased severance pay, impacting companies like Televisa by potentially raising overall labor expenditure.

- Unionization Rates: While specific current figures for Televisa are proprietary, the media and telecommunications sectors in Mexico historically have had substantial union presence, influencing wage negotiations and working conditions.

- Potential for Disputes: Increased regulatory scrutiny and a more empowered workforce could lead to a higher likelihood of labor disputes, potentially disrupting production schedules or service delivery, as seen in other large industrial sectors in Latin America.

- Compliance Costs: Adherence to evolving labor laws and maintaining positive union relations require ongoing investment in human resources, legal counsel, and employee benefits, adding to Televisa's overhead.

Grupo Televisa's operations are significantly shaped by Mexico's regulatory environment, particularly concerning broadcasting and telecommunications. Reforms to the Telecommunications and Broadcasting Law, including potential shifts in regulatory bodies like the IFT, introduce ongoing uncertainty. The company also faces stringent antitrust regulations designed to prevent market dominance, with discussions in early 2024 about the Ministry of Economy playing a larger role in competition oversight impacting Televisa's market practices.

Environmental factors

Grupo Televisa faces increasing pressure to showcase robust corporate sustainability, driven by global and national focus on environmental, social, and governance (ESG) factors. This means the company must actively manage and report on its environmental footprint.

The company’s adherence to the UN Global Compact signals a commitment to international sustainability standards. Furthermore, reporting through CDP (formerly the Carbon Disclosure Project) demonstrates a willingness to be transparent about its environmental impact, a crucial element for investors and stakeholders in 2024 and beyond.

For instance, in its 2023 sustainability report, Televisa highlighted efforts to reduce greenhouse gas emissions, aiming for a 20% reduction by 2030 compared to a 2019 baseline. This is a tangible step in addressing environmental concerns, a key aspect of ESG performance that influences market perception and investment decisions.

Grupo Televisa, as a major media and telecommunications player, relies on a vast network of infrastructure, from broadcast towers to data centers, which naturally leads to substantial energy consumption. In 2023, the company continued to focus on enhancing energy efficiency across its operations, recognizing its impact on both costs and environmental responsibility.

Televisa’s commitment to sustainability includes exploring and increasing the use of renewable energy sources to power its facilities. This strategic shift not only addresses environmental concerns but also aims to create long-term operational cost savings. For instance, investments in solar power for some of its key sites are part of this ongoing initiative.

Grupo Televisa, like many media and telecommunications companies, faces environmental considerations related to waste management, particularly electronic waste (e-waste) from its extensive network of equipment and office operations. In 2024, the global e-waste generation was projected to reach 65.4 million metric tons, a significant increase from previous years, underscoring the challenge for companies like Televisa to manage obsolescence responsibly.

Implementing comprehensive recycling programs and ensuring the responsible disposal of both electronic and general waste are crucial components of Televisa's environmental management system. By adhering to strict protocols, the company can mitigate the environmental impact of its operational footprint, aligning with increasing regulatory demands and stakeholder expectations for sustainable business practices.

Carbon Footprint Reduction Initiatives

Grupo Televisa, like many media conglomerates, is increasingly scrutinized for its environmental impact, particularly concerning its carbon footprint. The energy-intensive nature of media production, broadcasting, and extensive distribution networks presents significant challenges in reducing greenhouse gas emissions. Pressure from stakeholders, including investors and regulators, is mounting for tangible action to mitigate these environmental effects.

In response, Televisa is focusing on initiatives aimed at carbon footprint reduction. This includes setting ambitious, measurable targets for emissions reduction across its operations. Investments in greener media production protocols, such as energy-efficient equipment and sustainable sourcing for content creation, are becoming paramount. These efforts are vital for aligning with broader global environmental objectives and anticipated regulatory frameworks, ensuring long-term operational viability and corporate responsibility. For instance, by 2024, many companies in the media sector are aiming for a 15% reduction in Scope 1 and 2 emissions compared to a 2020 baseline, a trend Televisa is likely following.

- Emissions Targets: Implementing and publicly reporting on specific carbon emissions reduction goals is a key strategy.

- Green Production: Investing in and adopting energy-efficient technologies and sustainable practices in studios and broadcasting facilities.

- Supply Chain: Collaborating with suppliers to reduce emissions throughout the content value chain.

- Renewable Energy: Exploring and increasing the use of renewable energy sources for operational power needs.

Climate Change Impact on Infrastructure

Grupo Televisa must consider how climate change could disrupt its physical assets. Extreme weather events, like hurricanes and floods, pose a significant threat to broadcast towers, data centers, and extensive cable networks across Mexico and other operating regions. For instance, the Intergovernmental Panel on Climate Change (IPCC) projects an increase in the intensity of tropical cyclones in the North Atlantic, directly impacting coastal infrastructure that might support Televisa's operations.

Assessing and mitigating these climate-related risks is becoming a crucial environmental consideration for the company. This involves investing in more resilient infrastructure design and robust disaster preparedness plans. In 2024, many telecommunications companies are increasing their budgets for climate resilience, with some reporting a 15-20% rise in capital expenditure dedicated to hardening networks against environmental shocks.

- Increased Frequency of Extreme Weather: Recent reports indicate a notable uptick in severe weather patterns, potentially impacting Televisa's terrestrial infrastructure.

- Resilience Investment: Companies in the media and telecom sector are allocating more resources towards climate-proofing their operational facilities and networks.

- Supply Chain Disruptions: Extreme weather can also disrupt the supply chains for essential equipment and maintenance, affecting service continuity.

- Regulatory Scrutiny: Environmental agencies are increasing oversight, pushing companies to demonstrate their climate risk management strategies.

Grupo Televisa faces growing environmental pressures, particularly concerning its carbon footprint from energy-intensive operations like broadcasting and data centers. The company has committed to reducing greenhouse gas emissions, setting a target of a 20% reduction by 2030 from a 2019 baseline. This involves enhancing energy efficiency and increasing the use of renewable energy sources, such as solar power, for its facilities.

The company is also addressing waste management, especially electronic waste, a growing global concern with projections of 65.4 million metric tons generated in 2024. Televisa implements recycling programs and responsible disposal protocols to mitigate its environmental impact.

Climate change presents physical risks to Televisa's infrastructure, including broadcast towers and data centers, from extreme weather events. Consequently, there's an increased allocation of capital expenditure towards climate resilience, with some telecom companies boosting these budgets by 15-20% in 2024 to harden networks against environmental shocks.

| Environmental Focus | Key Initiatives/Targets | Data/Context (2023-2025) |

| Carbon Emissions Reduction | Target: 20% reduction by 2030 (vs. 2019 baseline) | Focus on energy efficiency and renewable energy adoption. |

| Waste Management | Responsible disposal and recycling programs | Addressing growing e-waste challenges; global e-waste projected at 65.4M metric tons in 2024. |

| Climate Resilience | Infrastructure hardening against extreme weather | Increased CapEx for resilience; some telecom firms raising budgets by 15-20% in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Grupo Televisa is built upon a comprehensive review of official Mexican government publications, international financial institutions like the IMF and World Bank, and reputable industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the company.