Grupo Televisa Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Televisa Bundle

Curious about Grupo Televisa's market performance? Our preview offers a glimpse into how their diverse portfolio stacks up, identifying potential Stars, Cash Cows, Dogs, and Question Marks. Understand the strategic implications of these placements and how they influence Televisa's future. This is just the tip of the iceberg, offering a foundational understanding of their competitive landscape.

To truly grasp Grupo Televisa's strategic positioning and unlock actionable insights, you need the full BCG Matrix. This comprehensive report provides a detailed breakdown of each business unit's placement, complete with data-driven analysis and expert commentary. Don't miss out on the opportunity to gain a complete picture of their market share and growth potential.

Invest in a deeper understanding of Grupo Televisa's strategic assets by purchasing the full BCG Matrix. This essential tool will empower you to make informed decisions about resource allocation and future investments. Gain a competitive edge by understanding where Televisa excels and where they may need to pivot.

Get the full BCG Matrix and discover exactly which of Grupo Televisa's offerings are driving growth and which might be holding them back. This detailed analysis will equip you with the knowledge to strategize effectively and capitalize on emerging opportunities. Purchase now for immediate access to this critical business intelligence.

Stars

ViX, TelevisaUnivision's streaming service, is positioned as a significant growth driver within the company's BCG matrix. It's projected to be the fastest-growing major Spanish-language streaming service in the Americas by 2025, with an expected 18% subscriber increase. This rapid expansion, fueled by a freemium model and strategic alliances, has propelled ViX into profitability, achieving this milestone in the latter half of 2024 and sustaining it into Q1 2025.

Izzi's fixed broadband services are a significant component of Grupo Televisa's business, operating within a dynamic Mexican market. The Mexican fixed broadband market is set for substantial growth, with an estimated CAGR of 9.5% anticipated between 2024 and 2030. As of 2024, Izzi held a strong position with 5.6 million broadband subscribers. This solid subscriber base, coupled with the market's upward trajectory, suggests Izzi's fixed broadband is a star performer, capable of significant future investment and revenue expansion.

TelevisaUnivision is heavily investing in original Spanish-language content for its ViX streaming service, a key driver for subscriber acquisition and retention. By focusing on culturally resonant dramas, comedies, and live soccer, the company is capitalizing on its deep production expertise. This strategy aims to carve out a distinct niche in the rapidly expanding Spanish-speaking streaming landscape. In 2024, ViX continued to expand its original content library, aiming to capture a larger share of the estimated $40 billion global Spanish-language media market.

Fiber-to-the-Home (FTTH) Network Expansion

Grupo Televisa's Fiber-to-the-Home (FTTH) network expansion positions it strongly within the BCG Matrix. The company actively extended its FTTH reach, passing 365,000 new homes in 2024, contributing to a total of over 19.9 million homes passed. This aggressive deployment highlights substantial investment in a high-growth segment, aiming for an additional 1 million new locations by 2025. These efforts are crucial for bolstering broadband service growth and solidifying its market standing.

- Network Reach: Over 19.9 million homes passed with FTTH as of 2024.

- 2024 FTTH Expansion: Passed 365,000 homes with FTTH technology.

- 2025 Growth Target: Plans to expand network to 1 million new locations.

- Strategic Importance: Supports broadband service growth and competitive advantage.

TelevisaUnivision's Digital Sports Content Rights

TelevisaUnivision's digital sports content rights are a clear star in its business portfolio. The company announced a record-breaking year for sports in 2024, demonstrating robust engagement and revenue generation from these high-demand assets.

Exclusive broadcasts, like the Paris 2024 Olympics, captured the attention of 47 million viewers across both traditional television and digital streaming, underscoring the immense reach and monetization opportunities inherent in live sports content.

- High Viewer Engagement: 47 million viewers tuned in for the Paris 2024 Olympics across TelevisaUnivision's platforms.

- Digital Growth Driver: Exclusive sports rights are crucial for acquiring and retaining audiences on streaming and digital services.

- Monetization Potential: The strong performance in sports indicates significant revenue generation capabilities from these valuable content assets.

- Future Growth: Leveraging these digital sports rights positions the segment for continued expansion and audience acquisition in the competitive media landscape.

TelevisaUnivision's digital sports content rights are a clear star in its business portfolio, demonstrating robust engagement and revenue generation from these high-demand assets. Exclusive broadcasts, like the Paris 2024 Olympics, captured the attention of 47 million viewers across both traditional television and digital streaming, underscoring the immense reach and monetization opportunities inherent in live sports content.

Izzi's fixed broadband services are another star performer. With 5.6 million broadband subscribers as of 2024 and operating in a Mexican fixed broadband market projected for substantial growth (9.5% CAGR from 2024-2030), Izzi is well-positioned for continued expansion and revenue generation.

Grupo Televisa's Fiber-to-the-Home (FTTH) network expansion, passing over 19.9 million homes by 2024 with a target of 1 million new locations by 2025, solidifies its broadband infrastructure as a star asset, essential for future growth.

| Business Unit | BCG Category | Key Metrics & Performance |

|---|---|---|

| ViX (Streaming) | Star | Projected 18% subscriber increase by 2025; achieved profitability in late 2024. |

| Izzi (Fixed Broadband) | Star | 5.6 million subscribers (2024); market CAGR of 9.5% (2024-2030). |

| FTTH Network Expansion | Star | 19.9 million homes passed (2024); target 1 million new locations by 2025. |

| Digital Sports Rights | Star | 47 million viewers for Paris 2024 Olympics; strong revenue generation. |

What is included in the product

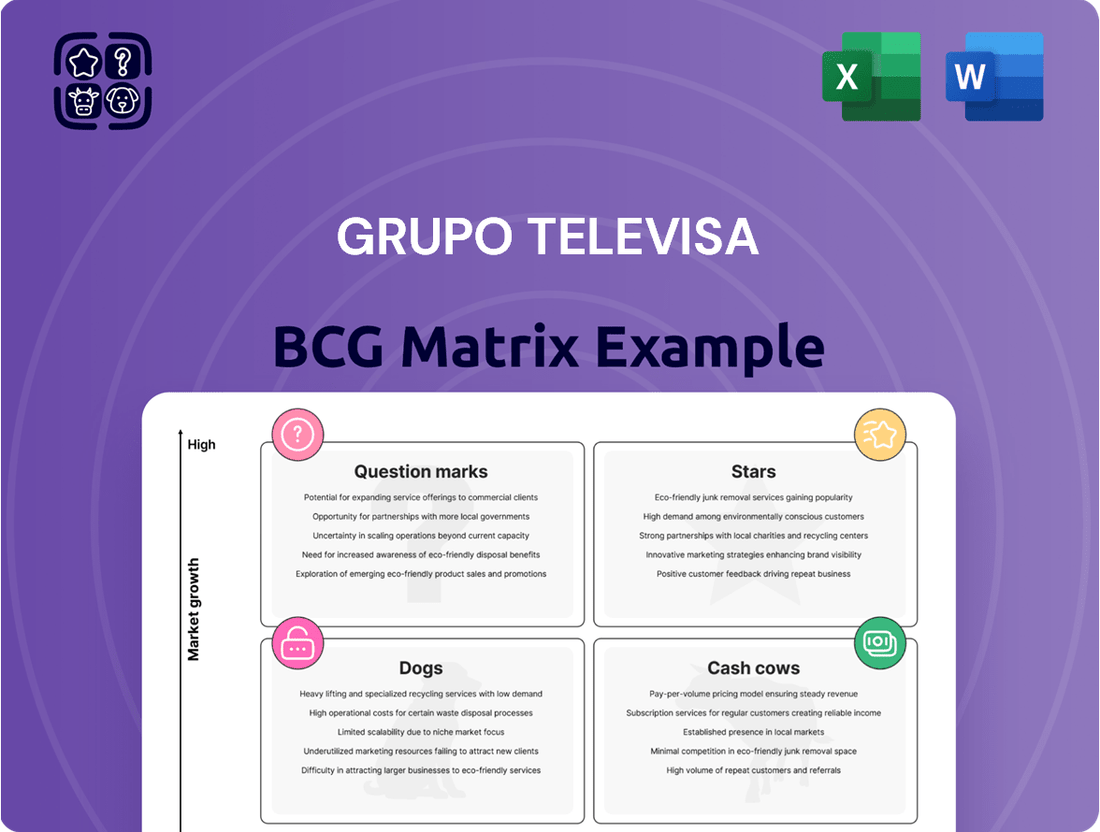

Grupo Televisa's BCG Matrix offers a tailored analysis of its diverse media and telecommunications portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

Grupo Televisa's BCG Matrix offers a one-page overview placing each business unit in a quadrant, simplifying complex portfolio analysis.

Cash Cows

Televisa's free-to-air television networks, such as Las Estrellas, represent a significant Cash Cow for Grupo Televisa. These networks continue to hold a commanding presence in the Mexican market, reaching an impressive 93% of all television households.

While the audience share has seen a gradual decrease from 66.8% in early 2014 to 56% by the close of 2023, these traditional broadcast channels are still a powerhouse for advertising revenue. This enduring appeal, despite the growing influence of digital media, solidifies their status as a mature segment providing consistent and substantial cash flow for the company.

Izzi's traditional cable TV services are a quintessential cash cow for Grupo Televisa, holding a dominant position in Mexico's pay-TV market. Following regulatory approval, its combined market share with Sky reached an impressive 58%.

Despite a modest 3.1% revenue dip in Q1 2025 and a slight customer base contraction, this segment remains a powerhouse for stable, predictable cash generation. The extensive existing infrastructure and loyal subscriber base continue to fuel consistent revenue streams, even as the market matures.

TelevisaUnivision's content licensing and syndication, excluding ViX, demonstrated robust performance with a 12% year-over-year revenue increase in the first quarter of 2025. This upward trend highlights the enduring appeal and commercial viability of their vast content portfolio. The company's substantial library and original productions continue to attract significant licensing interest from diverse third-party platforms globally, fueling this growth.

This segment operates as a prime example of a cash cow within TelevisaUnivision's business model. It generates substantial revenue with comparatively minimal incremental investment, effectively monetizing existing intellectual property. The high-margin nature of this business allows for consistent and predictable cash flow generation, reinforcing its status as a core contributor to the company's financial strength.

Advertising Sales on Traditional Media

Advertising sales on traditional media, particularly television, represent a significant cash cow for Grupo Televisa. In 2024, this segment generated an impressive $1.43 billion in advertising revenue, with a dominant 68% derived from its traditional television operations. This indicates a continued reliance on and success within established broadcasting channels, even as the media landscape evolves.

While the broader advertising market in Mexico experienced a softening, with an 18% decline in Mexican ad revenue in Q1 2025, Televisa's traditional media segment remains a robust income generator. Its established market share in traditional broadcasting solidifies its position as a primary cash cow.

- 2024 Advertising Revenue: $1.43 billion

- Traditional TV Contribution: 68% of total ad revenue

- Q1 2025 Market Trend: 18% decline in Mexican ad revenue

- Strategic Position: High market share in traditional broadcasting

Grupo Televisa's Core Telecommunications Infrastructure

Grupo Televisa's core telecommunications infrastructure, encompassing its extensive cable and direct-to-home (DTH) networks, functions as a significant cash cow. This established infrastructure generates a reliable and consistent revenue stream from its substantial existing customer base. In 2023, Televisa's total revenue reached approximately $8.1 billion, with its consolidated telecommunications segment playing a pivotal role in this performance.

The infrastructure, having undergone significant build-out, now requires comparatively less large-scale capital expenditure to maintain and operate, especially when contrasted with its robust cash flow generation capabilities. This allows for a steady return on investment and a predictable income source for the company. For instance, Televisa's operational efficiencies within its telecommunications division consistently contribute to strong operating cash flow, underpinning its 'cash cow' status.

- Established Network: Utilizes a vast and largely depreciated network of fiber optic and coaxial cables.

- Stable Customer Base: Benefits from a loyal subscriber base for its internet, pay-TV, and voice services.

- Operational Efficiency: Achieves strong margins due to optimized network management and service delivery.

- Predictable Revenue: Generates consistent recurring revenue from bundled service packages.

Televisa's traditional free-to-air television networks, like Las Estrellas, are strong cash cows, reaching 93% of Mexican TV households. Despite a slight audience share dip from 66.8% in 2014 to 56% in 2023, these channels remain vital for advertising revenue, providing consistent cash flow.

Izzi's cable TV services represent a core cash cow, holding a 58% market share with Sky. Even with a small revenue dip in Q1 2025, its established infrastructure and subscriber base ensure steady, predictable cash generation.

Content licensing and syndication, separate from ViX, saw a 12% revenue increase in Q1 2025, highlighting the value of TelevisaUnivision's extensive library. This segment monetizes existing intellectual property with minimal investment, delivering high-margin, stable cash flow.

Advertising sales on traditional media, especially TV, are a key cash cow. In 2024, this segment brought in $1.43 billion, with 68% from traditional TV, demonstrating its continued strength despite an 18% drop in overall Mexican ad revenue in Q1 2025.

| Segment | 2024 Revenue (Approximate) | Key Metric | Cash Cow Status Rationale |

|---|---|---|---|

| Traditional TV Advertising | $1.43 billion | 68% of ad revenue from traditional TV | Dominant market share, consistent ad sales |

| Izzi Cable TV | (Not specified, but significant) | 58% combined market share (with Sky) | Stable subscriber base, established infrastructure |

| Content Licensing | (Not specified, but growing) | 12% YoY revenue growth (Q1 2025) | Monetizes existing IP, high margins |

Preview = Final Product

Grupo Televisa BCG Matrix

The Grupo Televisa BCG Matrix you see here is the precise, fully formatted document you will receive immediately after completing your purchase. This preview offers an uncompromised look at the strategic analysis, with no watermarks or demo content, ensuring you get exactly what you need for your business planning.

Rest assured, the Grupo Televisa BCG Matrix previewed on this page is the exact final version you'll download upon purchase. This professionally crafted report, designed for strategic clarity, will be delivered to you directly, ready for immediate application in your business decisions.

Dogs

Sky Mexico's Direct-to-Home (DTH) satellite pay-TV operations are firmly in the Dogs quadrant of the BCG Matrix. This segment has experienced a significant revenue drop of 13.2% in the first quarter of 2025, following a 12.8% decline for the full year 2024. The core issue is a substantial 17.2% reduction in Revenue Generating Units (RGUs), signaling a rapid loss of subscribers in a contracting market.

Despite aggressive cost-cutting measures, including reductions in operating expenses and capital expenditure, the DTH business continues to be a cash trap. The ongoing subscriber exodus means that any capital invested is unlikely to generate sufficient returns, further solidifying its position as a low-growth, low-market-share business.

Grupo Televisa's print publishing division, though not a spotlighted segment in recent financial disclosures, likely occupies a position as a 'Dog' within the BCG Matrix. The global print media industry, including Mexico, has been in a long-term decline, with digital platforms dominating content consumption.

This segment probably contends with a low market share and limited growth potential, facing significant challenges in adapting to evolving media habits and the pervasive shift towards online information sources. For instance, by 2024, digital advertising spending in Mexico was projected to surpass print advertising, underscoring the competitive landscape.

Grupo Televisa's radio operations likely face similar challenges to print publishing, grappling with declining listenership and advertising revenue as audiences migrate to digital audio platforms and streaming services. This trend suggests a low market share within a market experiencing slow or negative growth.

Given these market dynamics and without specific recent financial disclosures for the radio segment, it's reasonable to categorize it as a 'Dog' within Grupo Televisa's BCG Matrix. This classification implies that the segment generates low profits and may require significant investment to maintain its current position or divestment to reallocate resources.

Legacy Satellite TV Packages

Within Sky Mexico, legacy satellite TV packages are firmly positioned as Dogs in the BCG Matrix. These older offerings are facing significant challenges as consumers increasingly opt for high-speed internet and over-the-top streaming services. This trend is leading to accelerated subscriber churn, making these packages less profitable and a shrinking part of Grupo Televisa's overall business.

The diminishing returns from these legacy products are a clear indicator of their Dog status. Customers are actively migrating away from traditional satellite, and the cost to maintain these services often outweighs the revenue generated. This situation requires careful management to minimize losses and potentially divest or phase out these offerings.

- Subscriber Churn: Legacy satellite packages are experiencing higher-than-average subscriber churn rates as customers switch to broadband and streaming.

- Market Share Decline: The market share for these older TV packages is shrinking as newer, more attractive alternatives gain traction.

- Profitability Erosion: Profitability for these legacy offerings is declining due to increased competition and reduced customer demand.

- Strategic Focus Shift: Grupo Televisa is likely shifting its strategic focus and investment away from these declining products towards more growth-oriented services.

Underperforming Niche Media Assets

Grupo Televisa might possess several niche media assets that aren't central to its digital transformation or telecom expansion. These could be smaller, specialized content channels or regional publications that, while potentially holding loyal audiences, don't contribute significantly to overall growth or profitability. Such assets often represent a drain on resources without substantial returns, making them prime candidates for strategic review.

These underperforming assets typically operate in markets with limited growth potential or face intense competition, resulting in low market share. Consequently, they require ongoing investment for maintenance rather than expansion, yielding minimal returns. For instance, if Televisa has a niche sports channel with a declining viewership, or a local news outlet in a shrinking market, these would fit the description of a Dog in the BCG matrix.

- Low Market Share: These assets likely command a small fraction of their respective niche markets, limiting their ability to scale.

- Low Growth Potential: The sectors these assets operate in may be stagnant or declining, offering little opportunity for significant revenue increases.

- Minimal Investment: Due to their status, these assets receive little to no new capital investment, hindering their ability to innovate or compete.

- Divestiture Consideration: Their limited contribution and ongoing costs often make divestiture or a complete shutdown a more financially sound decision.

Grupo Televisa's legacy satellite TV operations, particularly older package offerings from Sky Mexico, are firmly entrenched in the Dogs quadrant of the BCG Matrix. These segments are characterized by low market share within a contracting industry and offer minimal growth prospects. The primary driver for this classification is the significant and ongoing subscriber churn as customers migrate to digital alternatives.

The financial performance of these legacy DTH services reflects their Dog status, with substantial revenue declines. For instance, Sky Mexico's DTH business saw a 13.2% revenue drop in Q1 2025, following a 12.8% decline in 2024, largely due to a 17.2% reduction in Revenue Generating Units (RGUs). Despite cost-saving efforts, these operations remain cash traps, requiring careful management to mitigate losses.

Grupo Televisa's print publishing and radio operations also fall into the Dog category. The global trend of declining print media consumption and the shift of audiences to digital audio platforms directly impacts these segments. Limited growth potential and low market share in these traditional media sectors necessitate strategic decisions regarding their future, potentially including divestiture.

Other niche media assets within Grupo Televisa, such as specialized content channels or regional publications with loyal but small audiences, likely also reside in the Dog quadrant. These assets often operate in stagnant or declining markets, demanding investment for maintenance rather than growth, and their limited contribution to overall profitability makes them candidates for divestment or closure.

| Segment | BCG Quadrant | Key Metrics & Rationale | Financial Performance (2024/Q1 2025) |

|---|---|---|---|

| Sky Mexico DTH (Legacy Packages) | Dogs | Low market share, contracting market, high subscriber churn (17.2% RGU decline), minimal growth prospects. | Revenue decline of 12.8% (2024) and 13.2% (Q1 2025). |

| Print Publishing | Dogs | Declining global industry, shift to digital media, low growth potential, likely low market share. | Print advertising spending projected to be surpassed by digital advertising in Mexico by 2024. |

| Radio Operations | Dogs | Audience migration to digital audio and streaming, declining listenership, slow or negative market growth. | No specific recent figures, but market trends indicate low profitability and potential need for divestment. |

| Niche Media Assets | Dogs | Limited growth markets, intense competition, low market share, minimal returns, resource drain. | Require maintenance investment rather than expansion; potential for divestiture. |

Question Marks

Sky, primarily known for its direct-to-home satellite television, is also venturing into fixed wireless broadband (FWBB). By the close of 2024, Sky reported approximately 350,000 broadband revenue generating units (RGUs).

While the broader broadband market is expanding, Sky's FWBB holds a modest position in this highly competitive arena.

This offering taps into a segment with considerable growth potential, even as Sky's overall business faces challenges.

However, securing a more robust competitive standing and boosting its market share in FWBB will necessitate substantial investment.

Grupo Televisa's foray into mobile virtual network operator (MVNO) services with Izzi Móvil represents a developing segment within the company's broader media and telecommunications portfolio. By the close of 2024, Izzi Móvil had secured 334,000 subscribers, a notable achievement signaling early traction in a competitive landscape.

The Mexican telecom market continues its upward trajectory, particularly in mobile data consumption, presenting a fertile ground for growth. However, MVNOs like Izzi Móvil typically operate with a considerably smaller market share when juxtaposed against established Mobile Network Operators (MNOs). This dynamic positions Izzi Móvil as a potential 'Question Mark' in the BCG matrix, requiring strategic evaluation.

Sustained and significant investment in customer acquisition strategies and the enhancement of underlying network capabilities will be paramount for Izzi Móvil's evolution. Such investments are critical for Izzi Móvil to not only retain its current subscriber base but also to aggressively capture a more substantial portion of the market, thereby transitioning from a 'Question Mark' towards becoming a 'Star' performer for Grupo Televisa.

TelevisaUnivision's N+ initiative represents a strategic move to consolidate its news operations, aiming to capture a larger share of the digital news market. This reorganization is a direct response to the evolving media consumption habits, particularly among younger demographics who increasingly rely on digital platforms for information. The goal is to create a unified, cross-platform news experience.

The challenge for N+ lies in the highly competitive digital news environment. In 2024, digital advertising revenue for news publishers is projected to reach $84.3 billion globally, indicating significant spending but also intense competition for eyeballs and ad dollars. N+ needs substantial and ongoing investment in high-quality content and effective distribution channels to stand out against established digital-native players.

Specialized Niche Streaming Content or Channels

Grupo Televisa's strategy likely involves developing specialized niche streaming content or channels beyond its main ViX platform. These new ventures would aim to capture specific, high-growth audience segments within the streaming landscape, though they would begin with a minimal market presence. Significant investment in content production and promotional activities would be necessary to gauge their potential success and future growth trajectory.

These niche offerings would likely be categorized as 'Stars' or 'Question Marks' in the BCG matrix due to their nascent market share and substantial investment requirements. For instance, if Televisa were to launch a channel dedicated to Mexican regional sports or historical documentaries, it would require substantial upfront capital for content acquisition and marketing. By 2024, the global video streaming market reached an estimated $100 billion, highlighting the potential for specialized content to find a dedicated audience.

- Targeted Audience Capture: Niche channels can attract highly engaged viewers, fostering stronger brand loyalty and potentially higher subscription conversion rates.

- Content Investment: Significant capital is needed for producing or licensing unique content that appeals to these specific demographics, impacting initial profitability.

- Market Penetration: These ventures start with very low market share, requiring aggressive marketing and content strategies to gain traction against established players.

- Growth Potential: While initially small, successful niche channels can become significant revenue generators if they effectively tap into underserved markets.

Professional Sports Ventures (Non-Broadcasting)

Grupo Televisa's foray into professional sports ventures, distinct from broadcasting rights, positions these operations as potential "Question Marks" within its BCG Matrix. While the sports sector is experiencing robust growth in content consumption, Televisa's direct involvement might currently represent a nascent area with a relatively low market share. For example, in 2024, the global sports market was valued at over $1.5 trillion, but Televisa's direct ownership or promotion of teams may only capture a small fraction of this.

These non-broadcasting sports ventures would necessitate substantial capital investment and a meticulously crafted strategic approach to climb the market ladder and achieve significant profitability. Consider the costs associated with acquiring and maintaining professional sports teams, which can run into hundreds of millions of dollars annually, alongside marketing and operational expenses.

- Market Growth: The global sports industry continues its upward trajectory, driven by increasing fan engagement and digital content consumption.

- Televisa's Position: Direct sports ventures are likely in an early stage for Televisa, potentially holding a low market share compared to established players or its own broadcasting segment.

- Capital Intensity: Success in team ownership or event promotion demands significant financial resources for acquisition, operations, and talent management.

- Strategic Importance: Achieving market leadership in these ventures requires a clear strategy to build brand value and secure a competitive advantage.

Izzi Móvil, Grupo Televisa's mobile virtual network operator, is a prime example of a 'Question Mark' in the BCG matrix. Despite securing 334,000 subscribers by the end of 2024, its market share in the competitive Mexican telecom landscape remains relatively small compared to major Mobile Network Operators.

To transition from this nascent stage, Izzi Móvil requires significant and sustained investment in customer acquisition and network infrastructure. This strategic allocation of resources is crucial for increasing market penetration and solidifying its position against established competitors.

BCG Matrix Data Sources

Our Grupo Televisa BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on media and telecommunications, and official regulatory filings to ensure reliable insights.