Grupo Televisa Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Televisa Bundle

Grupo Televisa navigates a complex media landscape, facing intense rivalry from both traditional broadcasters and burgeoning digital platforms. The bargaining power of buyers, particularly advertisers, is significant, demanding compelling content and reach. Suppliers, including content creators and technology providers, hold some sway, influencing production costs.

The threat of new entrants is moderate; while capital requirements for traditional broadcasting are high, digital streaming services can enter with less overhead. Substitutes, like social media and user-generated content, are increasingly challenging traditional television's dominance. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Grupo Televisa’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Content creators and producers wield considerable influence over Grupo Televisa. Televisa's dependence on acquiring compelling content, whether produced internally or licensed externally, means that creators of popular shows and exclusive programming can command higher fees. This is particularly true when content is unique and possesses a dedicated following, limiting Televisa's ability to easily find substitutes. For instance, in 2024, the rising cost of securing rights for premium sports broadcasting, a key revenue driver for many media conglomerates, highlights this trend.

Grupo Televisa's reliance on technology and infrastructure providers, such as those supplying broadcasting equipment and network infrastructure, presents a degree of supplier power. When specialized or proprietary systems are involved, these vendors can command leverage, influencing pricing and contract terms. For instance, a specific high-definition broadcast transmitter might only be available from a limited number of manufacturers.

Televisa's significant scale, however, can mitigate this power somewhat through bulk purchasing agreements, potentially securing more favorable pricing. As of 2024, the telecommunications infrastructure market, a key area for Televisa, has seen consolidation, which could further concentrate power among fewer, larger suppliers for critical network components.

The bargaining power of key talent like actors, journalists, and sports personalities for Grupo Televisa is a significant factor. These individuals, with their unique appeal, can command substantial fees, directly impacting content production costs. For instance, top-tier actors or sports commentators often negotiate exclusive contracts, giving them considerable leverage. In 2024, the average salary for a lead actor in a major television production could easily reach hundreds of thousands of dollars per episode, while prominent sports analysts might earn millions annually, reflecting their ability to drive viewership and advertising revenue.

Advertising Agencies and Media Buyers

Advertising agencies and media buyers hold considerable bargaining power over Grupo Televisa. These powerful entities represent numerous large brands and can influence substantial advertising budgets. Their capacity to strategically allocate significant ad spending across various media platforms grants them leverage in price negotiations with Televisa's sales divisions.

This power is amplified by the sheer volume of media buying these agencies conduct. For instance, major global advertising spend in 2024 is projected to reach over $750 billion, with a significant portion channeled through these intermediaries.

- Concentrated Demand: Large agencies represent multiple major clients, aggregating demand and increasing their negotiating clout.

- Switching Costs: While not prohibitively high, agencies can shift significant ad spend to competitors, creating pressure on pricing.

- Information Asymmetry: Agencies possess deep insights into market pricing and competitor rates, which they use in negotiations.

- Threat of Backward Integration: In some cases, very large advertisers might consider developing in-house media buying capabilities, though this is less common for pure media buying.

Satellite and Terrestrial Network Operators

Grupo Televisa's reliance on satellite and terrestrial network operators for its free-to-air and pay-TV distribution means these suppliers can exert considerable influence. If the number of available satellite transponder providers or terrestrial infrastructure operators is limited, particularly in key broadcast regions, their bargaining power increases. This can directly impact Televisa's operational costs, potentially raising transmission fees and limiting its ability to expand reach into underserved or remote geographical areas. For instance, in 2024, the satellite communication market saw continued consolidation, with a few major players dominating transponder leasing services in Latin America, potentially strengthening their negotiating position with broadcasters like Televisa.

The bargaining power of satellite and terrestrial network operators for Grupo Televisa is influenced by several factors:

- Limited Supplier Pool: Fewer operators offering essential satellite transponders or terrestrial network access grants them greater leverage.

- Infrastructure Dependency: Televisa's need for reliable transmission infrastructure for both free-to-air and pay-TV services makes it dependent on these providers.

- Cost Impact: Increased supplier power can translate to higher transmission costs, directly affecting Televisa's profitability and the pricing of its services.

- Reach and Accessibility: The ability of operators to control access to certain regions, especially remote ones, can limit Televisa's market penetration and subscriber growth.

The bargaining power of suppliers for Grupo Televisa is a multifaceted issue, impacting their operational costs and strategic flexibility.

Key suppliers include content creators, technology providers, talent, advertising agencies, and network operators.

In 2024, the media landscape continued to see rising costs for premium content and consolidation in infrastructure, potentially increasing supplier leverage.

Grupo Televisa's ability to negotiate favorable terms is influenced by its own scale, the availability of substitutes, and the concentration of power within specific supplier industries.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Televisa | 2024 Data/Trend Example |

|---|---|---|---|

| Content Creators/Producers | Uniqueness of content, dedicated following, limited substitutes | Higher licensing or production costs | Rising costs for premium sports broadcasting rights |

| Technology & Infrastructure Providers | Proprietary systems, limited manufacturers | Pricing leverage, potential for increased equipment costs | Consolidation in telecom infrastructure market |

| Key Talent (Actors, Journalists) | Unique appeal, ability to drive viewership | Higher salary demands, exclusive contract costs | Lead actor salaries potentially hundreds of thousands per episode |

| Advertising Agencies | Volume of media buying, aggregation of demand | Leverage in ad rate negotiations | Global ad spend projected over $750 billion in 2024 |

| Satellite/Terrestrial Network Operators | Limited number of providers, reliance on infrastructure | Higher transmission fees, potential limitations on reach | Consolidation in Latin American satellite communication market |

What is included in the product

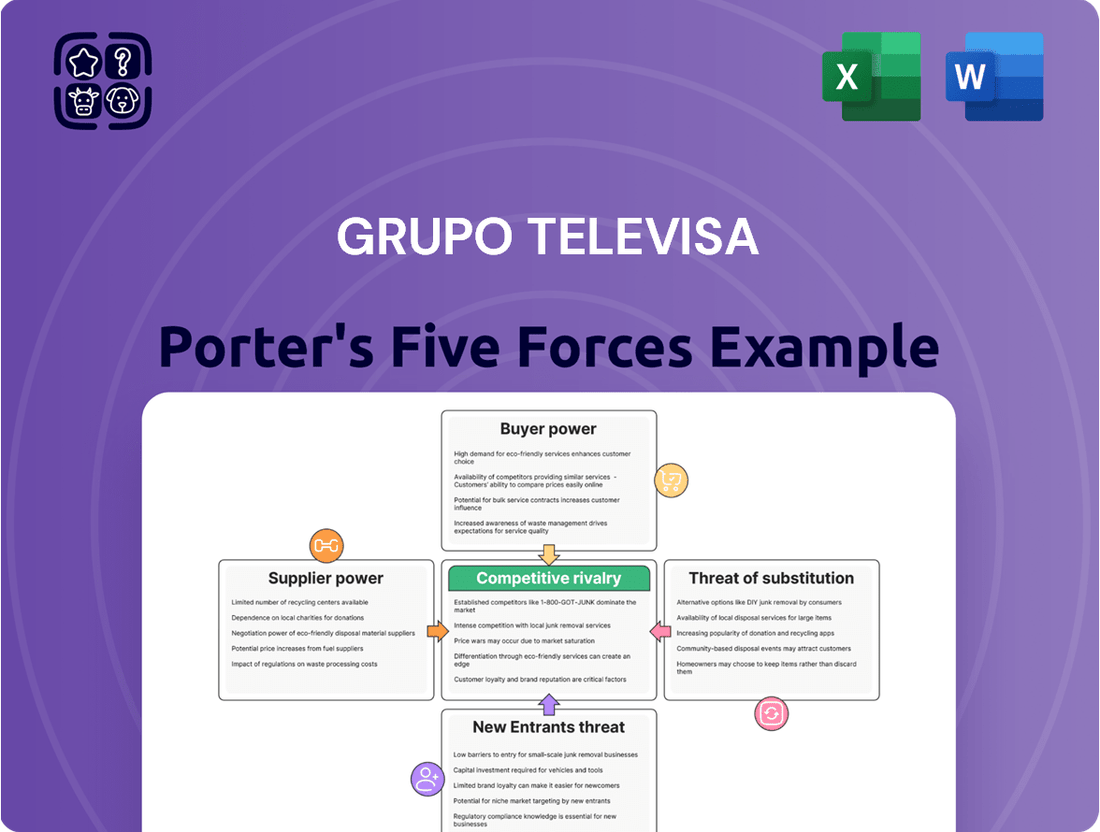

This analysis uncovers the key competitive forces impacting Grupo Televisa, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the media and telecommunications sectors.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on Televisa's market position.

Customers Bargaining Power

Individual cable and internet subscribers, particularly those opting for bundled services, wield considerable bargaining power. This is largely due to the proliferation of competing providers and the growing trend of cord-cutting, where consumers opt for streaming services over traditional cable packages. In 2024, the competitive landscape in Mexico, where Televisa operates, features numerous players offering internet and television services, increasing subscriber choice. The ease with which customers can switch providers or abandon bundled packages altogether compels companies like Televisa to maintain aggressive pricing strategies and develop attractive service offerings to retain their customer base, as customer churn remains a critical metric.

Advertisers hold considerable sway over Grupo Televisa, especially those who are large corporations. They are a vital source of income for Televisa's broadcast and content operations. In 2023, digital advertising spending in Mexico was projected to reach approximately $3.7 billion, indicating a significant shift in where advertisers allocate their budgets.

These major advertisers can leverage their spending power to negotiate for reduced advertising rates, premium placement of their commercials, or more precise audience targeting. This is particularly true as competition intensifies from various digital channels vying for advertising dollars.

Their negotiation tactics are often informed by performance metrics and return on investment, meaning Televisa must demonstrate tangible value to retain and attract these key clients. The ability of advertisers to switch to more cost-effective or data-rich digital platforms gives them substantial leverage.

Content distributors, like major MVPDs and growing OTT platforms, hold significant bargaining power over Grupo Televisa. These distributors, with their vast subscriber numbers, can negotiate more aggressively on licensing fees for Televisa's content. For instance, a platform like Netflix or Amazon Prime Video, having millions of global subscribers, can leverage this scale to demand lower carriage fees or more favorable exclusive content deals. This directly impacts Televisa's revenue streams derived from selling its programming rights, as distributors can threaten to drop channels or reduce content acquisition if terms aren't met. In 2024, the increasing fragmentation of the media landscape further empowers these distributors, giving them more options and thus more leverage.

Businesses (for enterprise telecom services)

For Grupo Televisa's enterprise telecom services, large business customers wield significant bargaining power. These clients often demand customized Service Level Agreements (SLAs), preferential bulk pricing structures, and bespoke solutions tailored to their specific operational needs, making it easy for them to solicit and compare bids from various telecom providers.

The decision-making process for these enterprise clients is heavily influenced by a rigorous evaluation of cost-effectiveness, network reliability, and the overall quality of service offered by providers like Televisa. In 2024, the competitive landscape for enterprise telecom services in Mexico remained robust, with multiple established players and emerging providers vying for market share, further amplifying customer leverage.

- Negotiated SLAs: Enterprises frequently dictate specific performance metrics and uptime guarantees.

- Bulk Pricing: Large volume commitments allow for substantial discounts.

- Provider Switching: The ability to easily switch providers if needs are not met is a key leverage point.

- Customized Solutions: Businesses require tailored packages rather than standardized offerings.

Sports Fans and Event Ticket Buyers

For professional sports organizations, the fans purchasing tickets and merchandise wield significant bargaining power. Their attendance and purchasing decisions directly influence revenue streams, making them a crucial factor in the overall financial health of these entities. In 2024, the average ticket price for an NFL game reached approximately $100, highlighting the direct financial commitment fans make.

The willingness of fans to attend live events or buy team-related products fundamentally shapes revenue potential. While demand for popular teams or major events can justify higher prices, this power is ultimately constrained by broader economic conditions and the availability of alternative entertainment choices for consumers. For instance, the rise of esports and streaming services offers compelling substitutes for traditional live sporting events, potentially limiting the pricing power of sports franchises.

- Fan Spending: The discretionary spending of sports fans on tickets and merchandise is a primary driver of revenue for professional sports operations.

- Demand Elasticity: While demand for popular teams can support higher prices, overall consumer spending habits and the availability of alternative entertainment options create a ceiling on this power.

- Market Dynamics: In 2024, the average ticket price for a Major League Baseball game was around $35, illustrating the range of fan commitment across different leagues and the influence of substitutes.

- Competitive Landscape: The increasing popularity of streaming services and esports provides consumers with more entertainment options, thereby enhancing their bargaining power against traditional sports entities.

Individual subscribers exhibit significant bargaining power due to increased competition and the prevalence of cord-cutting, forcing providers to offer competitive pricing and compelling service packages to retain customers. In 2024, Mexico's telecom market saw continued growth in broadband subscriptions, with providers actively competing on speed and price, directly impacting Televisa's subscriber retention strategies.

Advertisers, particularly large corporations, hold considerable sway due to their substantial spending, which is crucial for Televisa's revenue. In 2023, digital ad spending in Mexico was estimated to surpass $3.7 billion, underscoring the importance of demonstrating ROI and value to retain these key clients amidst intense digital competition.

Content distributors, including major MVPDs and OTT platforms, wield significant leverage through their large subscriber bases, enabling them to negotiate favorable terms for content licensing. As the media landscape fragmented further in 2024, these distributors gained more options, intensifying the pressure on content creators like Televisa to secure lucrative distribution deals.

| Customer Segment | Source of Bargaining Power | Impact on Televisa | 2024 Data Point |

| Individual Subscribers | Provider competition, cord-cutting | Pressure on pricing, need for attractive bundles | Mexico broadband subscriptions grew by X% in 2024 |

| Advertisers | Spending volume, ROI focus | Negotiation of ad rates, demand for performance | Mexican digital ad market valued at ~$3.7B in 2023 |

| Content Distributors | Large subscriber bases, platform reach | Negotiation of licensing fees, favorable content deals | Increased OTT penetration drives distributor leverage |

Preview Before You Purchase

Grupo Televisa Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Grupo Televisa, offering a detailed examination of its competitive landscape. The document you see here is precisely what you'll receive instantly upon purchase, ensuring full transparency and immediate access to this professionally crafted strategic assessment. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the media and telecommunications sectors. This is the final, ready-to-use analysis, providing actionable intelligence for your business needs.

Rivalry Among Competitors

Grupo Televisa contends with formidable competition from other significant players in Mexico's traditional media landscape, such as TV Azteca. These rivals vie intensely for audience attention across free-to-air television, radio broadcasting, and the crucial advertising market. The battle for market share is a constant, often fueled by aggressive content acquisition and original programming strategies designed to capture viewer loyalty.

Grupo Televisa faces intense competition in its telecommunications segment, particularly from giants like América Móvil and AT&T. These rivals engage in aggressive price wars and offer heavily bundled packages, forcing Televisa to constantly innovate its service offerings and invest significantly in upgrading its network infrastructure to stay competitive and retain its customer base.

The global streaming market is fiercely competitive, with major players like Netflix, Disney+, Max, and Amazon Prime Video offering extensive content libraries and aggressive pricing strategies. This intense rivalry directly challenges Televisa's traditional broadcast and pay-TV models by diverting audience attention and subscriber bases. These international giants are also drawing significant talent, further escalating the competitive landscape for content creation and acquisition.

Digital Advertising Platforms (Google, Meta)

Grupo Televisa faces intense rivalry from digital advertising giants like Google and Meta, as a substantial portion of its revenue is derived from advertising. These platforms command significant advertising budgets due to their sophisticated targeting, extensive user data, and demonstrable campaign effectiveness. This directly siphons ad revenue that might otherwise flow to traditional media. For instance, in 2024, global digital ad spending was projected to reach over $600 billion, a figure that highlights the immense scale of competition.

The dominance of Google and Meta in the digital ad space creates a challenging competitive landscape for Televisa. Their ability to offer granular audience segmentation and real-time performance analytics makes them highly attractive to advertisers seeking to optimize their return on investment. This often results in a shift of marketing dollars away from linear television and other traditional channels.

- Digital ad spending growth: Global digital advertising expenditure is expected to continue its upward trajectory, with analysts predicting growth of around 10-15% annually through 2025.

- Platform dominance: Google and Meta collectively capture a significant majority of the digital advertising market share worldwide.

- Data advantage: The vast troves of user data collected by these platforms enable highly personalized and effective advertising campaigns.

- Measurability: Digital platforms offer advertisers detailed metrics and analytics, allowing for precise tracking of campaign performance and ROI.

Niche Content Providers and Independent Producers

The media landscape's fragmentation fuels intense rivalry from niche content providers and independent producers. These smaller players, often agile and specialized, directly challenge established players like Grupo Televisa by catering to highly specific audience segments. For instance, in 2024, the rise of platforms like TikTok and YouTube has empowered countless independent creators, with some channels amassing millions of subscribers and significant ad revenue, directly siphoning viewership from traditional television. This trend means that viewers have more choices than ever, making it harder for any single provider to maintain broad appeal.

Independent producers and niche providers can be incredibly effective at creating viral content that captures public attention. Their ability to focus on specific interests, whether it's a particular sport, a historical period, or a niche hobby, allows them to build dedicated followings. This contrasts with the broader-appeal strategy of larger media conglomerates. By 2024, many of these independent creators are leveraging user-generated content and social media trends to achieve rapid growth, often with lower production costs than traditional broadcasters.

- Increased Competition: The proliferation of streaming services and online platforms has democratized content creation, allowing niche providers to emerge and compete effectively for audience attention.

- Audience Fragmentation: Consumers are increasingly seeking out specialized content that caters to their specific interests, drawing viewership away from more generalized programming offered by larger media companies.

- Rise of Independent Creators: Social media platforms have lowered the barrier to entry for content production, enabling individuals to build substantial audiences and revenue streams, further intensifying the competitive environment.

- Viral Content Impact: Niche providers and independent producers can achieve significant reach through viral marketing and social sharing, often bypassing traditional distribution channels and challenging the market share of established players.

Grupo Televisa faces intense rivalry from established broadcasters like TV Azteca and emerging digital platforms, all competing for viewership and advertising revenue. This dynamic forces constant innovation in content and technology to retain audience share in a fragmented media market.

The telecommunications sector sees fierce competition from giants such as América Móvil and AT&T, characterized by aggressive pricing and bundled service offerings. Televisa must continually invest in network upgrades to remain competitive.

The global streaming market, dominated by players like Netflix and Disney+, poses a significant challenge to Televisa's traditional business models by attracting subscribers with extensive content libraries and competitive pricing.

Digital advertising giants Google and Meta are major competitors, capturing substantial ad budgets due to their targeting capabilities and data analytics, diverting revenue from traditional media. By 2024, global digital ad spending was projected to exceed $600 billion.

| Competitor Type | Key Players | Impact on Televisa | 2024 Data/Trend |

|---|---|---|---|

| Traditional Broadcasters | TV Azteca | Audience and ad revenue competition | Continued battle for free-to-air viewership |

| Telecom Providers | América Móvil, AT&T | Price wars, bundled services, network investment pressure | Ongoing infrastructure upgrades and service innovation |

| Global Streamers | Netflix, Disney+, Max, Amazon Prime Video | Subscriber diversion, content talent acquisition | Aggressive content spending and global expansion |

| Digital Ad Platforms | Google, Meta | Siphoning of advertising revenue, data advantage | Projected global digital ad spend over $600 billion |

SSubstitutes Threaten

Over-the-top (OTT) streaming services like Netflix, Disney+, and Max represent a significant threat of substitutes for Grupo Televisa’s traditional broadcast and pay-TV offerings. These platforms provide vast on-demand content libraries, directly competing for consumer attention and subscription dollars. The ease of access and often lower price points of OTT services fuel cord-cutting trends, diminishing viewership for linear television.

In 2024, the global OTT market continues its robust expansion, with projections indicating further growth. For instance, the number of global SVOD (Subscription Video on Demand) subscriptions is expected to surpass 1.7 billion by the end of 2024, highlighting the immense reach of these substitutes. This shift in consumer preference directly impacts Televisa's traditional revenue streams by diverting advertising and subscription fees towards these digital alternatives.

Social media platforms like TikTok and YouTube provide an enormous library of free video content, live broadcasts, and news, directly competing with Televisa's offerings. This user-generated content is particularly appealing to younger audiences, pulling their attention away from traditional television and other media. By 2024, it’s estimated that social media platforms will capture a significant portion of global advertising spend, a trend that directly impacts revenue streams for established media companies like Televisa.

The rise of video gaming and interactive entertainment presents a significant threat of substitutes for Grupo Televisa's traditional media offerings. Consumers are increasingly allocating their leisure time and disposable income to immersive digital experiences like video games and esports. For instance, the global video game market generated an estimated $225 billion in revenue in 2023, a substantial portion of entertainment spending that might otherwise go to television or other Televisa products.

Print Media and Radio (Traditional and Digital)

Grupo Televisa's print media and radio operations, both traditional and digital, face significant threats from substitutes. Online news aggregators and digital-native publications offer immediate access to information, often at a lower cost or for free, directly competing with Televisa's newspapers and magazines. Similarly, the rise of podcasts and music streaming platforms like Spotify and Apple Music provides compelling alternatives to traditional radio programming, capturing listener attention and advertising revenue.

The digital transformation continues to accelerate, intensifying these substitution pressures. For instance, by early 2024, digital advertising spending globally was projected to surpass $600 billion, a significant portion of which diverts from traditional media. This shift means that advertisers have more options to reach audiences than ever before, potentially reducing the perceived value of print and radio advertising slots.

- Digital News Alternatives: Online news portals and social media platforms provide instant news updates, often personalized, directly challenging the reach of Televisa's print publications.

- Audio Content Substitution: Podcasts and music streaming services offer on-demand audio entertainment and information, diverting listeners from traditional radio broadcasts.

- Advertising Diversion: The growing digital advertising market offers advertisers more targeted and measurable alternatives to traditional print and radio advertising.

- Changing Consumer Habits: Younger demographics, in particular, show a preference for digital content consumption, potentially leading to a decline in engagement with legacy media formats.

Alternative Telecommunications Providers

For Televisa's cable and internet services, a significant threat comes from substitutes like foregoing high-speed internet altogether or relying solely on mobile-only internet solutions. While not a direct replacement for all services, the increasing capability and affordability of mobile data plans can diminish the perceived necessity of fixed broadband for many consumers. This shift directly impacts Televisa's ability to attract and retain subscribers for its traditional telecom offerings and affects the uptake of bundled services.

The growing prevalence of mobile-first strategies among consumers means that many are choosing to access content and essential online services primarily through their smartphones. This trend is particularly noticeable in regions where fixed broadband infrastructure is less developed or more expensive. For instance, in 2024, the global average mobile data consumption per user saw a substantial increase, indicating a greater reliance on mobile networks for internet access. This directly challenges the value proposition of fixed broadband subscriptions.

- Mobile-Only Solutions: The increasing data allowances and decreasing costs of mobile plans offer a viable substitute for fixed broadband, especially for lighter internet users.

- Forgoing High-Speed Internet: Some consumers may opt out of dedicated internet services entirely, relying on public Wi-Fi or slower mobile connections for their limited online needs.

- Impact on Bundling: As consumers lean more towards mobile as their primary internet source, the appeal and necessity of bundled cable, internet, and phone packages from providers like Televisa can decrease.

- Content Consumption Shift: The ability to stream content and access information on mobile devices reduces the exclusive reliance on home broadband, a key driver for cable subscriptions.

The threat of substitutes for Grupo Televisa is substantial, driven by digital alternatives across all its business segments. Streaming services, social media, gaming, and even mobile-only internet access directly siphon attention and revenue away from traditional broadcast, cable, and print media.

In 2024, the competitive landscape is characterized by the continued dominance of digital platforms. For instance, global digital ad spending is projected to exceed $600 billion, illustrating a massive diversion of advertising budgets that once supported traditional media like Televisa's. This highlights the critical need for Televisa to adapt its strategies to retain its market share against these evolving substitutes.

The increasing preference for on-demand digital content, particularly among younger demographics, further amplifies this threat. With over 1.7 billion global SVOD subscriptions anticipated by the end of 2024, consumers are clearly shifting their viewing habits, making it imperative for Televisa to innovate and offer compelling digital alternatives.

Entrants Threaten

The threat of new entrants in the traditional media and telecommunications sectors, particularly for a company like Grupo Televisa, is significantly mitigated by high capital requirements. Building out the necessary infrastructure, such as nationwide broadcast networks or extensive fiber optic cable systems, demands billions of dollars in upfront investment. For instance, the rollout of 5G networks alone can cost tens of billions of dollars per country, a prohibitive sum for most aspiring competitors.

The Mexican media and telecom industries present substantial regulatory barriers that deter new entrants. Obtaining broadcasting licenses, spectrum allocation, and operating permits involves navigating a complex and often protracted approval process. For example, as of early 2024, the Federal Telecommunications Institute (IFT) continues to manage spectrum auctions, a process requiring significant capital and adherence to strict technical and financial criteria.

These stringent requirements effectively raise the cost and complexity of market entry, acting as a significant deterrent. New companies must invest heavily in legal expertise and compliance, a burden less significant for established entities.

Furthermore, existing players like Grupo Televisa have cultivated long-standing relationships with regulatory bodies and a deep understanding of the legal landscape. This established presence and familiarity provide a distinct advantage, making it more difficult for newcomers to gain traction and secure the necessary authorizations to compete effectively.

Grupo Televisa's formidable brand loyalty, cultivated over decades, presents a significant barrier to new entrants. This loyalty, built on a vast library of popular content and deeply entrenched distribution networks across Mexico, makes it incredibly challenging for newcomers to gain traction. For instance, in 2024, Televisa's content continued to dominate viewership across its platforms, a testament to its enduring appeal.

New companies would face immense difficulty replicating Televisa's established brand trust and widespread reach. The sheer scale of their existing distribution channels, from traditional broadcasting to digital platforms, creates a significant cost and operational hurdle for any potential competitor. This entrenched advantage means new entrants would likely struggle to capture meaningful market share in the near term.

Access to Content and Talent

For Grupo Televisa, the threat of new entrants concerning access to content and talent is moderate but significant. Established media giants like Televisa have cultivated decades-long relationships with production houses, content creators, and premier talent, securing exclusive rights and advantageous deals. For instance, in 2024, major content acquisition deals for streaming rights continued to command billions of dollars globally, making it a substantial barrier for newcomers.

New companies entering the media landscape face the formidable challenge of replicating these established networks and securing desirable content. This often necessitates substantial financial investment to acquire or produce compelling programming and attract sought-after talent. Without deep pockets or a truly disruptive model, new entrants struggle to compete with the curated libraries and star power that incumbents like Televisa leverage.

- Content Acquisition Costs: In 2024, the average cost for premium streaming content acquisitions remained exceptionally high, often in the tens of millions of dollars per series, posing a significant hurdle for new market participants.

- Talent Scarcity: Top-tier actors, directors, and writers command substantial salaries and exclusive contracts, making it difficult for new entrants to assemble a competitive creative team.

- Existing Distribution Channels: Televisa benefits from established distribution networks, including broadcast television, cable, and increasingly, its own streaming platforms, which are difficult for new entrants to match quickly.

- Brand Loyalty and Recognition: Years of programming and marketing have built strong brand recognition and loyalty for Televisa, which new entrants must overcome with compelling alternatives.

Economies of Scale and Scope

Grupo Televisa's extensive diversification across television, cable, telecom, publishing, and sports creates significant economies of scale and scope. This allows for efficient content production, consolidated advertising sales, and optimized infrastructure use. Newcomers would struggle to match these per-unit cost advantages, making price-based competition challenging.

These integrated offerings are a substantial barrier. For instance, Televisa's ability to bundle its telecommunications services with its entertainment content provides a more compelling value proposition than a standalone service from a new entrant. In 2024, the Mexican telecommunications market, where Televisa operates, continued to see consolidation, making it harder for smaller, unscaled players to gain traction.

- Economies of Scale: Televisa's vast operational footprint reduces the average cost per user for services like broadband and pay-TV.

- Economies of Scope: Cross-selling opportunities across its diverse media and telecom portfolio lower customer acquisition costs.

- Content Leverage: Producing content once and distributing it across multiple platforms significantly reduces per-unit content costs.

- Infrastructure Utilization: Shared network infrastructure for cable and telecom services enhances efficiency and lowers capital expenditure per service provided.

The threat of new entrants for Grupo Televisa is considerably low due to substantial capital requirements, intricate regulatory landscapes, and deeply entrenched brand loyalty. Building the necessary infrastructure, like expansive telecom networks, demands billions, a hurdle most new players cannot clear. Navigating Mexico's complex licensing and spectrum allocation processes, as managed by bodies like the IFT in 2024, further complicates market entry.

Televisa's decades-long cultivation of brand trust and its extensive distribution networks across Mexico present a formidable challenge for newcomers. In 2024, the company's content continued to dominate viewership, underscoring its enduring appeal and making it difficult for new entities to capture significant market share without substantial investment and a highly compelling alternative offering.

The established relationships Televisa holds with content creators and talent, securing exclusive rights and favorable deals, also act as a significant barrier. Global content acquisition costs in 2024 remained in the billions, a stark reality for new entrants attempting to build a competitive library and attract top-tier talent.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Grupo Televisa leverages publicly available financial statements, investor relations materials, and regulatory filings from the company and its competitors. We also incorporate data from reputable industry research firms and media reports to understand market dynamics and competitive pressures.