Grupo Televisa Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Televisa Bundle

Grupo Televisa, a media giant, masterfully orchestrates its marketing through a robust 4Ps strategy. Their diverse product portfolio spans television, telecommunications, and content production, catering to a wide audience. Pricing strategies are tiered, offering various subscription models and advertising packages to maximize revenue streams across different segments.

Televisa's place strategy is deeply embedded in its extensive distribution network, leveraging cable, satellite, and digital platforms to reach millions across Latin America. Their promotional efforts are equally dynamic, utilizing cross-media campaigns, celebrity endorsements, and digital marketing to build brand loyalty and drive engagement.

This preview offers a glimpse into the strategic brilliance of Grupo Televisa's marketing mix. To truly grasp the nuances of their success and gain actionable insights for your own business, dive into the comprehensive analysis.

Unlock the full potential of your marketing understanding with our in-depth, ready-made 4Ps Marketing Mix Analysis for Grupo Televisa. This editable document provides strategic insights perfect for professionals, students, and consultants.

Product

Grupo Televisa’s diverse content portfolio is a cornerstone of its marketing mix, encompassing everything from gripping telenovelas and breaking news to live sports and general entertainment. This expansive production and distribution capability allows Televisa to reach a wide array of demographics and interests.

By offering this broad spectrum of programming across traditional television, cable, and increasingly, digital streaming platforms, Televisa ensures broad market penetration and sustained audience engagement. For instance, their telenovelas consistently draw significant viewership, while their sports broadcasts, particularly football, command large audiences. In 2023, Televisa's content continued to be a primary driver of its advertising revenue, which forms a substantial part of its overall financial performance.

Telecommunications Services, operating under Grupo Televisa, is a cornerstone of their offering, providing essential broadband internet, pay television, and voice services. These connectivity solutions are fundamental for both residential and business clients, enabling modern communication and entertainment. As of early 2024, Televisa's cable and internet operations, particularly through Izzi Telecom, serve millions of subscribers across Mexico, demonstrating significant market penetration and a vital role in the nation's digital infrastructure.

Grupo Televisa's broadcast television segment is a cornerstone of its media operations in Mexico, featuring multiple free-to-air networks like Las Estrellas and Canal 5. These channels are pivotal for reaching a vast demographic, acting as a primary conduit for content and advertising. For instance, in 2024, Televisa's television advertising revenue remained a significant contributor to its overall financial performance, despite evolving media consumption habits.

The extensive reach of Televisa's broadcast television networks allows for significant cultural impact and brand visibility across Mexico. In 2024, these networks continued to be a dominant force in national programming, offering a diverse mix of news, sports, and entertainment. This wide audience penetration is crucial for advertisers seeking to connect with a broad consumer base, underpinning the advertising revenue model.

Digital Media Platforms

Grupo Televisa is actively broadening its reach beyond traditional television by investing heavily in digital media platforms. This strategic move is crucial for adapting to changing consumer preferences for on-demand content. The company's commitment to digital is evident in its expansion of streaming services and online content offerings.

A key component of this digital strategy is Vix, Televisa's streaming service. Vix aims to capture new audiences and cater to evolving media consumption habits, offering a diverse library of content. This platform represents Televisa's effort to stay competitive in the rapidly growing digital entertainment landscape.

By prioritizing digital media, Televisa is positioning itself to engage with younger demographics and those who increasingly prefer digital access to entertainment. This expansion is not just about offering content; it's about building a direct relationship with a wider consumer base in the digital realm.

As of early 2024, Vix has seen significant growth, reaching over 20 million monthly active users across its free and premium tiers. This user base underscores the increasing demand for accessible, diverse digital content. Televisa's investment in Vix is a direct response to the market's shift towards streaming, aiming to secure a substantial share of this expanding market.

- Vix's Growth: Vix reported over 20 million monthly active users by early 2024, indicating strong adoption of Televisa's digital streaming offering.

- Content Diversification: The platform offers a mix of original productions, telenovelas, sports, and movies, catering to a broad spectrum of viewer interests.

- Demographic Reach: Digital platforms like Vix allow Televisa to connect with younger, digitally-native audiences who may not consume traditional broadcast media.

- Revenue Streams: Expansion into digital media opens new avenues for advertising revenue and subscription-based models, diversifying income beyond traditional advertising.

Ancillary Businesses

Grupo Televisa's product strategy extends beyond its core broadcasting services to encompass a diverse range of ancillary businesses. These include publishing, radio, and professional sports operations, all designed to leverage its established media expertise and brand recognition across various consumer touchpoints. This diversification not only broadens Televisa's revenue streams but also strengthens its overall market presence and influence.

These ancillary ventures play a crucial role in Televisa's integrated marketing mix. For instance, its publishing arm, which historically included magazines and book publishing, allowed the company to reach audiences through print media. Similarly, its radio broadcasting division provided another avenue for content distribution and advertising, complementing its television offerings. The professional sports operations, particularly its involvement with the Liga MX soccer team Club América, generated significant fan engagement and commercial opportunities.

Financial performance data from recent years, such as that reported in early 2024 and throughout 2025, indicates how these segments contribute to the company's financial health. While specific segment reporting can vary, the strategy aims for synergistic growth. For example, advertising revenue across these platforms often benefits from cross-promotional activities, amplifying marketing impact.

- Publishing: Historically, Televisa's publishing division produced a wide array of magazines catering to diverse interests, contributing to its brand visibility and advertising revenue.

- Radio Operations: The company operates a significant radio network, broadcasting across multiple cities in Mexico, providing another platform for content and advertising sales.

- Professional Sports: Ownership of prominent sports teams, like Club América, generates substantial revenue through broadcasting rights, sponsorships, merchandise, and ticket sales.

- Synergistic Growth: These diverse ventures are strategically integrated to create cross-promotional opportunities, enhancing overall brand reach and advertising effectiveness.

Grupo Televisa's product strategy is characterized by a dual focus on its robust traditional media offerings and its aggressive expansion into digital platforms. The company leverages its extensive content library, including popular telenovelas and live sports, through broadcast television networks like Las Estrellas and Canal 5, which continue to be significant drivers of advertising revenue as of 2024. Concurrently, Televisa is investing heavily in digital, with its streaming service Vix experiencing substantial growth, reaching over 20 million monthly active users by early 2024.

This product diversification extends to telecommunications services, primarily through Izzi Telecom, which provides broadband internet and pay television to millions of subscribers across Mexico, solidifying its position in the nation's digital infrastructure as of early 2024. Beyond these core areas, Televisa's product mix includes ancillary businesses such as publishing, radio, and professional sports, with the latter, exemplified by Club América, generating revenue through broadcasting rights, sponsorships, and merchandise.

The integration of these diverse product lines allows for synergistic growth and cross-promotional opportunities, enhancing overall brand reach and advertising effectiveness. For instance, the success of Vix, with its diverse content catering to a broad demographic, complements Televisa's traditional broadcast strengths and opens new avenues for advertising and subscription-based revenue models.

| Product Segment | Key Offerings | 2024/2025 Relevance | Strategic Focus |

| Content Production & Distribution | Telenovelas, News, Sports, Entertainment | Primary driver of advertising revenue; broad demographic reach. | Leveraging legacy strength, expanding digital distribution. |

| Telecommunications | Broadband Internet, Pay TV, Voice Services (via Izzi) | Essential connectivity for millions; vital for digital infrastructure. | Continued subscriber growth and service expansion. |

| Digital Media (Vix) | Streaming Service (Free & Premium) | Over 20 million monthly active users (early 2024); growth in digital consumption. | Capturing new audiences, competing in streaming market. |

| Ancillary Businesses | Publishing, Radio, Professional Sports (Club América) | Diversified revenue streams; brand visibility and fan engagement. | Synergistic integration and cross-promotion. |

What is included in the product

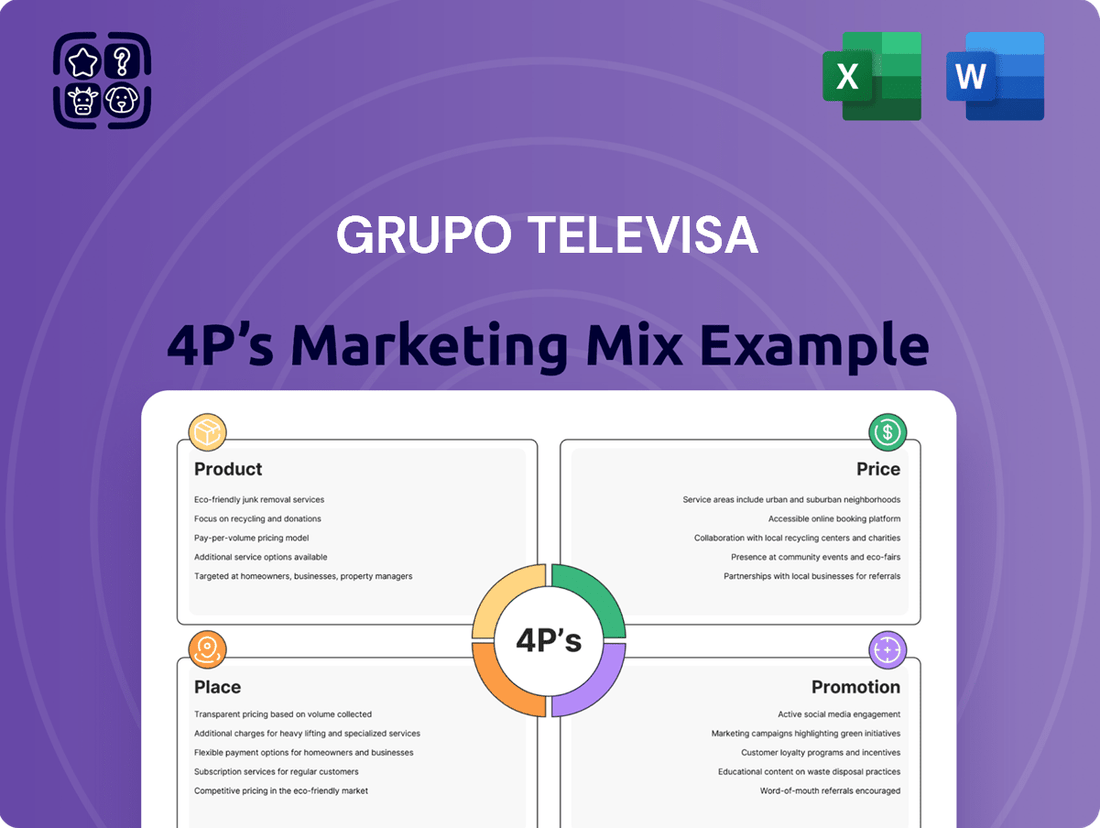

This analysis provides a comprehensive breakdown of Grupo Televisa's Product, Price, Place, and Promotion strategies, offering insights into their market positioning and operational practices.

It's designed for professionals needing a grounded understanding of Televisa's marketing approach, suitable for reports, benchmarking, or strategic planning.

Streamlines the understanding of Televisa's marketing strategy by highlighting how each of the 4Ps addresses consumer pain points, simplifying complex analysis for quick decision-making.

Simplifies the identification of opportunities and challenges within Televisa's marketing approach, offering a clear framework to address market pain points effectively.

Place

Grupo Televisa leverages its robust free-to-air broadcasting infrastructure, reaching an estimated 90% of Mexican households as of early 2024. This extensive network serves as a cornerstone of its product strategy, providing a platform for its diverse entertainment and news content. The accessibility of these channels ensures a broad audience engagement, a key element in Televisa's market penetration strategy.

Televisa's cable and telecommunications operations, including its pay-TV and internet services, directly reach consumers. This direct-to-home distribution is key to offering bundled packages and securing consistent revenue. In 2024, Televisa's cable segment, primarily through its Izzi subsidiary, served over 4.7 million video subscribers, demonstrating the reach of this direct model.

The company leverages a robust infrastructure to manage these services, ensuring reliability and customer satisfaction. This integrated approach allows for cross-selling opportunities, further strengthening customer relationships and increasing average revenue per user. By the end of 2024, Televisa reported that its total broadband subscribers across all its operations surpassed 6.1 million, highlighting the success of its bundled offerings.

Grupo Televisa strategically utilizes its own over-the-top (OTT) platform, Vix, to directly distribute its vast content library to consumers worldwide. This digital-first approach bypasses traditional distribution methods, allowing for greater control over the viewing experience and a direct connection with its audience.

The Vix platform caters to the increasing global appetite for on-demand entertainment, offering a flexible and accessible way for viewers to consume Televisa's programming. As of early 2024, Vix has become a significant player in the Latin American streaming market, boasting millions of active users and a growing library of exclusive content.

This direct-to-consumer strategy is crucial for Televisa's market penetration, enabling it to reach a broader demographic and monetize content more effectively in the digital age. The platform's expansion into the U.S. Hispanic market further solidifies its position as a key distribution channel.

Retail and Sales Channels

For its subscription services and telecom products, Grupo Televisa leverages a multi-channel approach. This includes a network of company-operated stores and authorized dealerships across Mexico, which are crucial for direct customer interaction, equipment handovers, and essential support services. These physical touchpoints significantly boost service accessibility and customer engagement.

Televisa's retail strategy also incorporates strategic partnerships with third-party retailers and electronics stores. This expanded reach ensures its products and services are available in more convenient locations for a broader customer base. By the end of 2024, the company aimed to have over 1,500 points of sale nationwide.

- Company-owned retail stores

- Authorized dealerships and sales partners

- Online sales platforms and e-commerce presence

- Partnerships with major electronics retailers

Syndication and Licensing

Syndication and licensing are crucial elements in Televisa's 'Place' strategy, allowing its diverse content portfolio to reach a global audience. By entering into syndication agreements and licensing its productions, Televisa effectively extends its distribution channels beyond its own broadcast networks and platforms.

This strategic approach not only generates significant international revenue streams but also bolsters Televisa's brand recognition worldwide. For instance, in 2023, TelevisaUnivision reported that its content was available in over 60 countries, highlighting the expansive reach of its syndication efforts. The company actively licenses its popular telenovelas and other programming to various broadcasters and streaming services, capitalizing on the enduring global demand for Latin American content.

Key aspects of Televisa's syndication and licensing include:

- Global Reach: Agreements with international broadcasters and digital platforms ensure content availability in numerous markets.

- Revenue Diversification: Licensing fees and syndication deals contribute substantially to overall revenue, reducing reliance on domestic advertising.

- Brand Expansion: Exposure on foreign platforms increases brand visibility and fosters international viewership loyalty.

- Content Monetization: Maximizing the value of its extensive content library through varied distribution models.

Grupo Televisa's distribution strategy for its media and telecommunications services is multi-faceted. The company utilizes its extensive free-to-air broadcast network, reaching approximately 90% of Mexican households by early 2024. This broad accessibility is complemented by its direct-to-consumer cable and pay-TV operations, primarily through its Izzi subsidiary, which served over 4.7 million video subscribers in 2024. Furthermore, Televisa strategically distributes its content via its own OTT platform, Vix, which had millions of active users by early 2024, expanding its global reach.

| Distribution Channel | Key Metrics/Reach (as of early 2024/end of 2024) | Strategic Importance |

|---|---|---|

| Free-to-Air Broadcasting | ~90% of Mexican households reached | Broad audience engagement, market penetration |

| Cable/Pay-TV (Izzi) | Over 4.7 million video subscribers | Direct-to-home revenue, bundled offerings |

| OTT Platform (Vix) | Millions of active users globally | Direct content distribution, global reach |

| Physical Retail & Partnerships | Target of over 1,500 points of sale (end of 2024) | Customer interaction, service accessibility |

| Syndication & Licensing | Content available in over 60 countries (2023) | International revenue, brand expansion |

Full Version Awaits

Grupo Televisa 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Grupo Televisa's 4P's Marketing Mix, covering Product, Price, Place, and Promotion. You'll gain detailed insights into their strategies and execution across these key areas. This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering a complete and actionable understanding of Televisa's marketing approach.

Promotion

Grupo Televisa leverages its vast media empire for extensive on-air advertising, a cornerstone of its promotion strategy. By utilizing its own free-to-air and cable television networks, the company ensures its programs and services reach a massive audience. This internal promotional channel offers significant cost efficiencies compared to external media buys.

In 2024, Televisa's extensive on-air advertising likely played a crucial role in maintaining its market presence. While specific campaign spending figures are proprietary, the company's consistent programming schedules across its numerous channels, including Las Estrellas and Canal 5, demonstrate a sustained commitment to this promotional tactic.

Grupo Televisa leverages digital and social media extensively to promote its vast content library and services. This includes targeted campaigns on platforms like Facebook, Instagram, X (formerly Twitter), and YouTube, alongside programmatic advertising and its own digital properties. For instance, in Q1 2024, TelevisaUnivision reported that its digital segment continued to grow, with a significant portion of its audience engagement happening across these channels.

This strategy is designed to reach specific viewer and subscriber demographics, fostering a direct two-way conversation. By actively engaging users with interactive content, polls, and behind-the-scenes glimpses, the company aims to build a loyal online community. This heightened engagement directly translates into increased website traffic and, crucially, a higher conversion rate for subscriptions to its streaming services and other offerings.

The effectiveness of this digital push is evident in the growth figures. By the end of 2024, TelevisaUnivision's digital advertising revenue saw a substantial year-over-year increase, demonstrating the commercial success of its social media and digital content promotion efforts. This data underscores the importance of their online presence in driving overall business performance.

Grupo Televisa actively manages its public relations through press conferences and media appearances, aiming to shape its public image and announce new ventures. These strategic communications bolster brand reputation, as seen in their consistent efforts to highlight community involvement and corporate social responsibility initiatives throughout 2024.

Televisa's participation in and sponsorship of various community events throughout 2024 and early 2025 serves to foster goodwill and reinforce its connection with the public. Such engagement is crucial for building a positive brand perception, especially in a competitive media landscape where public trust is paramount.

The company leverages these PR activities to generate positive media coverage, effectively amplifying its messaging and reaching a wider audience. For instance, during the first half of 2024, Televisa's press outreach regarding its streaming service expansion resulted in significant earned media value across key Latin American markets.

Cross-al Strategies

Grupo Televisa masterfully employs cross-promotional strategies across its vast media empire to amplify reach and customer engagement. This is evident in how they weave promotions for their telecommunications services, like Izzi, into the fabric of their widely watched television programming. For instance, a compelling offer for a high-speed internet and cable bundle might be strategically placed during the ad breaks of a prime-time telenovela or a popular sports broadcast.

This integration isn't limited to television. Televisa leverages its extensive radio network to create a constant buzz around its content and services. A new drama series might be teased through captivating audio snippets on their radio stations, driving tune-in for the television premiere. Similarly, upcoming movies or special events broadcast on their TV channels are often advertised across their radio frequencies, ensuring a broader audience is aware.

The financial impact of these integrated campaigns is significant. In 2023, Televisa’s advertising revenue, bolstered by these cross-promotional efforts, reached approximately $1.5 billion USD, demonstrating the effectiveness of leveraging one platform to drive engagement and revenue on another. This synergy allows them to maximize the return on investment for each individual segment.

- Cross-Platform Synergy: Televisa's strategy involves promoting TV shows on radio, and telecom bundles during popular broadcasts, creating a unified marketing front.

- Audience Amplification: By utilizing diverse media channels, Televisa ensures its messages reach a wider and more varied audience base.

- Revenue Enhancement: In 2023, this approach contributed to Televisa's advertising revenue, which was around $1.5 billion USD.

- Brand Consistency: Consistent messaging across Televisa's portfolio reinforces brand identity and strengthens customer loyalty.

Sponsorships and Partnerships

Grupo Televisa leverages sponsorships as a key promotional tool, aligning its brand with high-profile events and popular sports teams. This strategy aims to boost brand visibility and associate Televisa with positive cultural and entertainment experiences.

Strategic partnerships are crucial for extending Televisa's promotional reach. By collaborating with other companies, Televisa can tap into new audiences and enhance its overall market presence.

- Event Sponsorships: Televisa has historically sponsored major sporting events like the FIFA World Cup and Liga MX matches, reaching millions of viewers.

- Sports Team Partnerships: Aligning with popular football clubs such as Club América and Cruz Azul creates strong brand loyalty and media exposure.

- Content Collaborations: Partnerships with content creators and platforms amplify its promotional efforts across diverse digital channels.

- Cross-Promotional Activities: Joint marketing campaigns with telecommunications providers or consumer goods companies drive mutual brand awareness.

Grupo Televisa's promotion strategy is a multi-faceted approach that capitalizes on its extensive media ownership. This includes robust on-air advertising across its television networks, sophisticated digital marketing campaigns on social media and programmatic platforms, and strategic public relations efforts. The company also excels at cross-promotional activities, leveraging its various media assets to amplify messages for different services, and utilizes sponsorships and partnerships to enhance brand visibility and connect with target audiences.

In 2024, TelevisaUnivision's digital segment continued its growth trajectory, with a significant portion of audience engagement occurring across social media and digital properties, contributing to a substantial year-over-year increase in digital advertising revenue by the end of the year.

The company's cross-promotional synergy, such as advertising telecom bundles during popular broadcasts, contributed to its advertising revenue, which was around $1.5 billion USD in 2023, highlighting the effectiveness of integrated campaigns.

Televisa's sponsorship of major sporting events and popular sports teams, like Liga MX matches and clubs such as Club América, is a consistent strategy to boost brand visibility and foster positive associations.

Price

Grupo Televisa leverages tiered subscription models for its cable and telecommunications offerings. These packages present distinct bundles of television channels, internet speeds, and voice services, catering to a broad customer base. For instance, by offering basic, standard, and premium tiers, Televisa aims to capture users with varying financial capacities and service demands.

This pricing strategy enhances market penetration by ensuring accessibility across different income levels. Customers can select a plan that best matches their specific usage needs and budget constraints. This approach is crucial in a competitive telecommunications landscape, allowing Televisa to compete effectively against rivals by offering tailored value propositions.

In 2024, the telecommunications sector in Mexico, where Televisa's cable services are prominent, continued to see growth in broadband subscriptions. While specific Televisa 2024/2025 subscription revenue figures for tiered models aren't publicly detailed, the overall market trend indicates a strong consumer appetite for bundled services. The average revenue per user (ARPU) for broadband services across Latin America, a region including Mexico, has been a key metric for operators, demonstrating the financial impact of these tiered offerings.

Advertising rate cards for Grupo Televisa's free-to-air and cable networks are dynamic, adjusting based on factors like audience size, show ratings, and broadcast time. These rates are a crucial element of their revenue stream, directly correlating with the extensive reach Televisa offers advertisers. For instance, prime-time slots on flagship channels during popular telenovelas or major sporting events command significantly higher prices than off-peak advertising.

Grupo Televisa commands substantial income through its vast content licensing, especially its globally recognized telenovelas. This revenue stream is crucial, with pricing meticulously negotiated. Factors like exclusive rights, specific geographical regions, and the length of the licensing agreement all play a significant role in determining the final fee, directly influenced by the content's international appeal and market demand.

In 2023, Televisa’s content licensing agreements continued to be a cornerstone of its media operations. While specific figures for content licensing alone are often embedded within broader segment reporting, the company has historically seen significant contributions from this area. For instance, in the first half of 2024, Televisa’s total revenue from content and distribution, which includes licensing, demonstrated resilience, showing the sustained value of its intellectual property in the global media landscape.

Bundling and Promotional Discounts

Grupo Televisa, through its telecom subsidiaries, leverages bundling and promotional discounts as a core element of its marketing strategy. These bundled packages, often combining high-speed internet, television, and voice services, are designed to offer customers a more attractive price point than individual service subscriptions. For instance, in early 2024, Televisa's Izzi telecom service continued to highlight its triple-play bundles, which saw a significant uptake in recent years, contributing to its subscriber growth.

The objective behind these promotional offers is twofold: to acquire new customers in a competitive market and to retain existing ones by minimizing churn. By presenting a clear value proposition through discounted pricing on combined services, Televisa aims to increase customer loyalty and reduce the likelihood of subscribers switching to competitors. This approach proved effective in 2023, with promotional efforts contributing to a stable subscriber base for its core telecom offerings.

- Bundled Value: Combination of internet, TV, and phone services offered at a reduced price.

- Customer Acquisition: Promotions designed to attract new subscribers to the telecom services.

- Churn Reduction: Incentives to retain existing customers by offering perceived added value.

- Market Competitiveness: Strategic use of discounts to stand out in the telecommunications sector.

Competitive Market Pricing

Grupo Televisa's pricing strategies are heavily influenced by the competitive environment across its diverse business segments. The company actively monitors and adjusts its pricing to remain attractive against rivals in both the media and telecommunications sectors. For instance, in the broadband market, where companies like Totalplay and Telmex are key competitors, Televisa’s Izzi likely uses bundled pricing and promotional offers to retain and attract subscribers.

This competitive pricing approach is crucial for maintaining market share. In 2024, the Mexican telecommunications market continued to see aggressive pricing from multiple players, necessitating strategic adjustments from Televisa. The company’s ability to balance competitive price points with profitability is key to its sustained market presence.

Key aspects of Televisa's competitive pricing include:

- Bundled Services: Offering packages that combine internet, TV, and mobile services at a perceived value to customers, directly competing with integrated telecom providers.

- Promotional Offers: Utilizing introductory discounts and special deals to attract new customers and incentivize upgrades, a common tactic in the highly competitive Mexican telecom landscape.

- Tiered Pricing: Providing different service levels and features at varying price points to cater to a broader customer base with diverse needs and budgets.

- Value-Based Pricing: Aligning prices with the perceived value of content and service quality offered, especially in the premium content and pay-TV segments.

Grupo Televisa's pricing strategy centers on offering tiered subscription models for its cable and telecommunications services, providing various bundles of channels, internet speeds, and voice options. This approach ensures accessibility for a wide range of customers with different budgets and service needs, a critical factor in the competitive Mexican market. For instance, in 2024, the ongoing growth in broadband subscriptions in Mexico underscores the demand for such bundled offerings.

The company also employs dynamic advertising rate cards across its free-to-air and cable networks, with prices fluctuating based on audience size, show popularity, and broadcast time. This pricing directly impacts revenue, with prime-time slots during high-demand programming commanding premium rates. Furthermore, content licensing fees are meticulously negotiated, factoring in exclusivity, region, and agreement duration, reflecting the significant international appeal of Televisa's content, such as its telenovelas, which continue to be a vital revenue source as seen in the first half of 2024.

Promotional discounts and bundling, especially for triple-play packages combining internet, TV, and phone services through its Izzi telecom service, are key to customer acquisition and retention. These strategies aim to offer a compelling value proposition against competitors like Totalplay and Telmex. The Mexican telecom market in 2024 saw aggressive pricing from various players, making Televisa's ability to balance competitive pricing with profitability essential for maintaining its market share.

| Service Segment | Pricing Strategy | Key Competitors (2024) | Impact on Revenue |

| Cable & Telecommunications | Tiered Subscription Models, Bundling, Promotional Discounts | Totalplay, Telmex, Megacable | ARPU growth, Subscriber acquisition/retention |

| Advertising | Dynamic Rate Cards (Audience size, Time slot, Show ratings) | TV Azteca, Multimedios | Advertising revenue, Reach for advertisers |

| Content Licensing | Negotiated Fees (Exclusivity, Region, Duration) | Netflix, Amazon Prime Video, Other broadcasters | Licensing revenue, Intellectual property monetization |

4P's Marketing Mix Analysis Data Sources

Our Grupo Televisa 4P's marketing mix analysis is built upon a robust foundation of publicly available data, including financial reports, investor relations materials, and official company announcements. We meticulously gather information on their product and service offerings, pricing strategies, distribution channels across media platforms, and promotional activities to provide a comprehensive overview.