Grupo Televisa Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grupo Televisa Bundle

Unlock the full strategic blueprint behind Grupo Televisa's diverse business model. This in-depth Business Model Canvas reveals how the media giant leverages its extensive content creation, broadcasting, and telecommunications segments to capture significant market share. Ideal for entrepreneurs, consultants, and investors seeking actionable insights into a media powerhouse's operations.

Dive deeper into Grupo Televisa’s real-world strategy with the complete Business Model Canvas. From its vast customer segments in entertainment and connectivity to its crucial key partnerships, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its future opportunities lie.

Partnerships

Grupo Televisa holds a substantial 45% equity stake in TelevisaUnivision, a pivotal collaboration that positions them as the foremost Spanish-language media and content entity worldwide. This partnership is instrumental in distributing Televisa's rich content library, particularly within the burgeoning United States Hispanic demographic, by utilizing Univision's established broadcast networks and the rapidly growing ViX streaming service.

The strategic alliance with TelevisaUnivision allows Televisa to effectively monetize its vast content catalog, extending its reach and revenue streams to a broader international audience. This synergy is a cornerstone of Televisa's business model, enabling it to capitalize on the significant demand for Spanish-language content across various platforms and geographies.

Grupo Televisa actively partners with independent content production studios and individual creators to broaden its programming slate. This strategy is crucial for injecting new and engaging content into its ecosystem, moving beyond its internal production capabilities. For instance, in 2024, TelevisaUnivision continued to invest in third-party content acquisition and co-production deals to bolster its offerings across its various platforms.

These collaborations are vital for staying competitive and catering to diverse audience preferences. By working with external talent, Televisa gains access to a wider array of genres and innovative storytelling formats that might not emerge from solely in-house operations. This partnership model also allows for risk-sharing, particularly on larger projects, making ambitious productions more financially feasible.

In 2024, the company's commitment to diverse content was evident in its deals with various production houses, aiming to secure a steady stream of fresh series and films. This approach not only enriches its content library but also fosters a dynamic production environment. The strategic alliances ensure that Televisa remains a go-to source for compelling entertainment in a rapidly evolving media landscape.

Grupo Televisa, through its Sky Mexico and integrated Cable operations, secures crucial broadcasting partnerships with major international sports leagues like LaLiga, Premier League, and Bundesliga. These alliances are fundamental to their business model, acting as a primary draw for pay-TV subscribers in a competitive landscape. The acquisition of LaLiga rights through the 2031-32 season underscores the long-term strategic value placed on exclusive sports content.

Technology and Platform Providers

Grupo Televisa collaborates with technology and platform providers to elevate its digital offerings. Partnerships with firms like ThinkAnalytics are central to this strategy, focusing on enhancing personalization and viewer engagement across its streaming and telecommunications services.

These collaborations are vital for integrating sophisticated features such as advanced search functionality, intuitive content discovery, and personalized recommendations. Such capabilities are instrumental in fostering deeper customer engagement and building loyalty within the highly competitive digital media market. For instance, ThinkAnalytics reported a significant increase in content discovery rates for clients employing its AI-driven solutions, directly impacting user retention.

- Enhanced User Experience: Partnerships ensure advanced features like seamless search and tailored recommendations.

- Increased Engagement: These technologies are crucial for boosting customer interaction and loyalty.

- Competitive Edge: Staying ahead in the streaming and telecom sectors relies on cutting-edge platform capabilities.

- Data-Driven Insights: Collaborations often involve leveraging data analytics to refine user engagement strategies.

Advertising Agencies and Marketing Firms

Grupo Televisa collaborates with premier advertising agencies and marketing firms to optimize its advertising revenue. These partnerships are crucial for creating impactful campaigns and attracting significant advertising investments from key brands. For instance, in 2024, the Mexican advertising market saw substantial growth, with digital advertising alone projected to reach over $7 billion USD, highlighting the critical role these agencies play in monetizing Televisa's extensive audience reach.

- Maximizing Ad Revenue: Agencies help Televisa craft tailored advertising solutions that resonate with specific demographics across its television, radio, and digital platforms.

- Audience Monetization: These collaborations are essential for effectively selling ad inventory to a wide range of national and international advertisers.

- Campaign Effectiveness: Partnering with marketing experts ensures that advertising campaigns placed on Televisa's properties achieve high engagement and return on investment for clients.

- Market Insights: Agencies provide valuable data and insights into consumer behavior, allowing Televisa to better position its advertising offerings.

Grupo Televisa's strategic stake in TelevisaUnivision is a cornerstone, leveraging Univision's reach for content distribution, particularly to the US Hispanic market via networks and the ViX streaming service. This partnership is key to monetizing Televisa's extensive content library, expanding its global audience and revenue streams. TelevisaUnivision reported robust growth in its streaming segment in 2024, with ViX accumulating over 30 million monthly active users by year-end.

Televisa secures vital broadcasting rights for premium international sports leagues, including LaLiga and Premier League, through its Sky Mexico and Cable operations. These agreements are essential for subscriber acquisition and retention in a competitive pay-TV market. The acquisition of LaLiga broadcast rights through the 2031-32 season highlights the long-term strategic importance of exclusive sports content, a significant draw for viewers.

Collaborations with technology providers like ThinkAnalytics enhance Televisa's digital platforms, focusing on personalized content discovery and user engagement. These partnerships are crucial for maintaining a competitive edge in the digital media landscape by improving user experience and fostering loyalty. ThinkAnalytics solutions have been shown to boost content discovery rates by over 20% for their clients, directly impacting user retention.

Partnerships with leading advertising agencies are critical for optimizing ad revenue and attracting significant brand investments. In 2024, the Mexican digital advertising market was estimated to exceed $7 billion USD, underscoring the importance of these alliances for monetizing Televisa's vast audience reach across its platforms.

What is included in the product

Grupo Televisa's business model focuses on leveraging its extensive media and telecommunications infrastructure to serve diverse customer segments through multiple channels, offering integrated entertainment and connectivity solutions.

This model is designed to capture value through advertising, content licensing, cable subscriptions, and mobile services, reflecting a strategy of content creation and distribution across a broad ecosystem.

Grupo Televisa's Business Model Canvas acts as a pain point reliver by providing a high-level, one-page snapshot of their multifaceted media and telecommunications operations, allowing for quick identification of core components and strategic alignment.

This structured approach helps alleviate the pain of understanding a complex conglomerate by condensing its strategy into a digestible format, ideal for brainstorming and internal use.

Activities

Grupo Televisa's central pillar is the production and ongoing enhancement of a wide spectrum of Spanish-language programming. This encompasses popular telenovelas, crucial news broadcasts, engaging sports coverage, and a variety of entertainment programs.

This commitment to content creation fuels extensive studio operations and relies on large creative teams. In 2024, Televisa continued its robust production schedule, developing a significant volume of original content to meet the demands of its diverse distribution channels.

The company's ability to produce approximately 100,000 hours of original content each year is a testament to its integrated production capabilities. This sheer volume ensures a consistent and appealing pipeline of programming for its broadcast networks, cable channels, and burgeoning streaming services.

This continuous output of fresh content is vital for maintaining audience engagement across Televisa's various platforms. By consistently developing new and relevant shows, the company solidifies its position as a leading content provider in the Spanish-speaking world.

Grupo Televisa's core operations revolve around broadcasting and distributing content across multiple platforms. This includes managing its free-to-air television networks and leveraging channels like cable, satellite (Sky Mexico), and streaming services such as Blim TV and ViX, a joint venture with Univision. These activities are crucial for reaching audiences throughout Mexico, Latin America, and the significant U.S. Hispanic market.

The company's distribution strategy is multifaceted, encompassing the operation of broadcast infrastructure, the strategic licensing of its extensive content library to other media entities, and ensuring broad market penetration. This wide reach is fundamental to its business model, allowing for diverse revenue streams from advertising, subscription fees, and content sales.

Televisa's recent strategic move to integrate Sky into its Cable segment highlights a commitment to streamlining and optimizing its distribution capabilities. This consolidation is designed to create a more cohesive and efficient delivery system for its content, further solidifying its market presence.

In 2024, TelevisaUnivision, the entity encompassing Televisa's content and media assets, continued to invest heavily in its streaming platform, ViX. This platform is a key battleground for audience attention in the burgeoning digital media landscape, aiming to capture a larger share of the Spanish-language streaming market.

Grupo Televisa's telecommunications service provision, primarily through its Izzi and Sky brands, is a cornerstone of its business. These operations deliver a comprehensive suite of services, encompassing video entertainment, robust high-speed broadband, voice communication, and mobile connectivity to both homes and businesses.

Managing vast fiber-to-the-home (FTTH) networks is a critical activity, ensuring reliable and high-quality service delivery. This infrastructure investment is essential for staying competitive in the rapidly evolving telecommunications landscape. Customer support is also paramount, aiming for high subscriber satisfaction.

In 2024, the telecommunications sector, including broadband and pay-TV, continued to see strong demand. For instance, Izzi reported substantial subscriber growth, reflecting the ongoing need for integrated digital services. Sky, while facing evolving market dynamics, remained a significant player in the pay-TV segment.

Advertising Sales and Management

A core activity for Grupo Televisa is the sale and intricate management of advertising inventory across its diverse media ecosystem. This encompasses television networks, radio frequencies, expansive digital properties, and traditional print publications. The company actively courts advertisers and advertising agencies, crafting bespoke campaigns that capitalize on Televisa's substantial audience reach and detailed demographic understanding.

Advertising revenue forms a critical pillar of Televisa's overall financial health and operational strategy.

- Advertising Sales: Active engagement with clients to sell ad space across Televisa's vast media portfolio.

- Campaign Management: Developing and executing advertising campaigns tailored to specific client needs and audience segments.

- Audience Leverage: Utilizing deep audience data and reach to offer compelling advertising solutions.

- Revenue Generation: A primary driver of the company's financial performance through advertising income.

Strategic Investments and Portfolio Management

Grupo Televisa's strategic investments and portfolio management are core to its business model, focusing on optimizing its asset base and enhancing shareholder value. A significant move was the formation of TelevisaUnivision, in which Televisa holds a 45% stake, a venture aimed at consolidating the Spanish-language media market. This strategic partnership highlights Televisa's commitment to adapting to evolving media consumption trends and expanding its reach.

The company also fully acquired Sky Mexico, a key move to strengthen its pay-TV operations and integrate its content and distribution strategies. Beyond these major initiatives, Televisa actively manages a diverse portfolio that includes legacy media assets such as publishing and radio, as well as interests in professional sports. This diversification allows Televisa to tap into various revenue streams and mitigate risks across different market segments.

- Strategic Investments: Holding a 45% stake in TelevisaUnivision, a significant player in the Spanish-language media landscape.

- Portfolio Consolidation: Full acquisition of Sky Mexico, enhancing its integrated media and telecommunications offerings.

- Asset Optimization: Continuously evaluating and managing its diverse portfolio, including publishing, radio, and sports ventures.

- Value Creation: Aiming to unlock shareholder value by adapting to market shifts and maintaining a competitive edge.

Grupo Televisa's key activities revolve around creating and distributing compelling Spanish-language content across various platforms. This includes producing telenovelas, news, and sports, alongside managing broadcast networks, cable, and streaming services like ViX. In 2024, the company continued to invest in its content pipeline and digital platforms to reach a broad audience in Mexico, Latin America, and the U.S. Hispanic market.

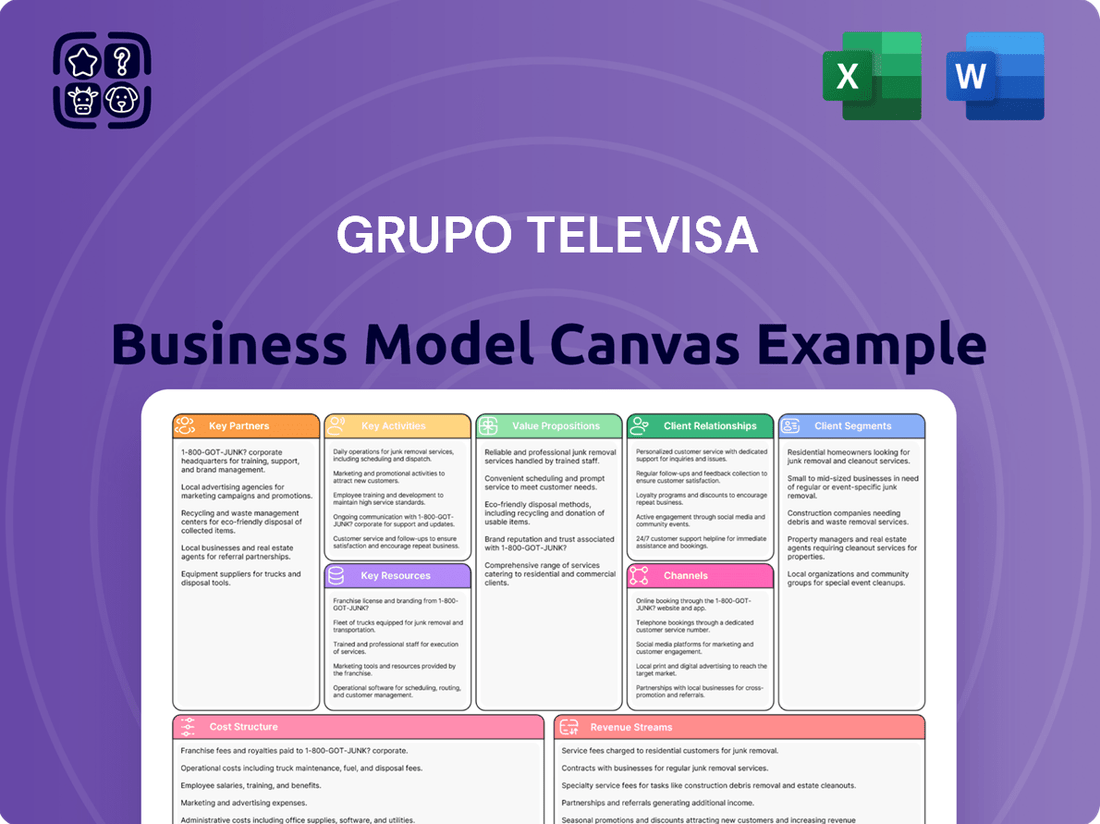

Preview Before You Purchase

Business Model Canvas

The Grupo Televisa Business Model Canvas you are previewing is the complete, unedited document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, offering full insight into Televisa's strategic framework. You'll gain immediate access to this comprehensive analysis, ready for your immediate use and application.

Resources

Grupo Televisa's extensive content library, boasting over 300,000 hours of programming, is a critical resource. This vast collection includes a significant number of original telenovela titles, a genre where Televisa holds considerable influence, alongside rights to popular international formats.

This robust intellectual property forms the bedrock of Televisa's business model, facilitating the distribution of content across a diverse array of platforms. The ability to leverage this content across various channels is a key driver of revenue generation, particularly through licensing agreements.

In 2024, the strategic utilization of this library continued to be paramount. The sheer volume and variety of content allow Televisa to cater to evolving consumer preferences and capitalize on new distribution avenues, solidifying its standing as a premier producer of Spanish-language content.

Grupo Televisa leverages its critical broadcast licenses for national and regional television networks. These licenses are foundational to its media operations, allowing it to reach a vast audience across Mexico.

The company's telecommunications infrastructure is a significant asset. By 2024, Televisa had passed 19.9 million homes with its network, encompassing extensive fiber optic capabilities. This robust infrastructure is vital for delivering a range of services.

These physical and intangible assets are the backbone of Televisa's service delivery model. They enable the company to provide television, high-speed internet, and telephony services, connecting millions of households and businesses throughout Mexico.

Grupo Televisa leverages its deeply ingrained brand reputation, a significant asset cultivated over many years of consistent media presence. This strong recognition is particularly potent within Mexico and across Spanish-speaking regions.

The company's extensive audience reach, covering an impressive 93% of Mexican television households and extending to millions more in Latin America and the United States, is a critical resource. This vast viewership directly translates into attracting a large base of viewers, paying subscribers, and valuable advertising partners.

In 2024, Televisa's ability to command attention across these markets is a key differentiator. For instance, its broadcast networks continue to be primary sources of news and entertainment for a substantial portion of the Mexican population, solidifying its role as a cultural touchstone.

Production Studios and Technical Facilities

Grupo Televisa leverages its extensive production infrastructure, including approximately 300,000 square meters of studio and technical facilities primarily located in Mexico City. These assets are fundamental to its content creation capabilities, enabling the efficient production of a wide range of programming.

These state-of-the-art facilities are not just spaces; they are core operational assets that allow Televisa to maintain high production values and a competitive edge in the media landscape. The scale and sophistication of these studios directly support the company's ability to generate diverse content for its various platforms.

- Extensive Studio Space: Approximately 300,000 square meters of production facilities in Mexico City.

- Content Creation Hub: Dedicated facilities for the end-to-end creation of media content.

- Quality and Efficiency: State-of-the-art equipment and infrastructure ensure high-quality, efficient production.

- Competitive Advantage: These facilities are key to maintaining Televisa's position in the media industry.

Skilled Talent and Human Capital

Grupo Televisa's business model heavily relies on its considerable workforce, a key resource encompassing content creators, journalists, technical experts, sales professionals, and customer service staff. This human capital is fundamental to generating its wide array of programming, operating its sophisticated telecommunications infrastructure, and fostering customer relationships.

The company's success in delivering engaging content and reliable services is directly tied to the expertise of its employees. For instance, in 2024, Televisa continued to invest in training and development programs aimed at enhancing the skills of its content production teams, ensuring they remain at the forefront of media innovation.

- Content Creation Expertise: Skilled writers, directors, and producers are essential for developing compelling television shows, news programs, and digital content.

- Technical Proficiency: Engineers and technicians manage and maintain Televisa's extensive broadcast and telecommunications networks.

- Sales and Marketing Acumen: Dedicated teams drive revenue through advertising sales and the promotion of its various services.

- Customer Engagement: Frontline staff are critical for customer satisfaction and retention across its cable and media operations.

Grupo Televisa's extensive content library, featuring over 300,000 hours of programming, is a cornerstone. This vast collection, rich with original telenovelas and international formats, empowers content distribution across multiple platforms. In 2024, the strategic use of this intellectual property remained vital for revenue generation through licensing and catering to diverse consumer tastes.

Televisa's broadcast licenses are fundamental, enabling national and regional network reach across Mexico. Coupled with its robust telecommunications infrastructure, which by 2024 passed 19.9 million homes with significant fiber optic capabilities, these assets form the backbone for delivering television, internet, and telephony services.

The company's brand reputation, deeply ingrained in Mexico and Spanish-speaking regions, is a significant intangible asset. This, alongside its vast audience reach—covering 93% of Mexican TV households and millions more in Latin America and the US—allows for strong advertising partnerships and subscriber acquisition, as evidenced by its continued cultural relevance in 2024.

Grupo Televisa's approximately 300,000 square meters of studio and technical facilities in Mexico City are critical for content creation. These state-of-the-art assets ensure high production values and a competitive edge, facilitating the efficient generation of diverse media content in 2024.

The company's workforce, comprising content creators, technical experts, and sales professionals, is a vital resource. In 2024, Televisa continued investing in employee development, particularly for its content production teams, to maintain innovation in the media landscape.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Content Library | Over 300,000 hours of programming, including original telenovelas. | Key for licensing revenue and catering to evolving consumer preferences. |

| Broadcast Licenses | National and regional television network licenses. | Foundation for reaching a vast audience across Mexico. |

| Telecommunications Infrastructure | Extensive fiber optic network. | Passed 19.9 million homes by 2024, enabling service delivery. |

| Brand Reputation & Audience Reach | Strong recognition in Spanish-speaking markets; 93% of Mexican TV households reached. | Drives advertising revenue and subscriber growth. |

| Production Infrastructure | Approx. 300,000 sq. meters of studio facilities. | Ensures high-quality, efficient content creation. |

| Human Capital | Skilled workforce in content creation, technical operations, and sales. | Essential for content generation and service delivery; ongoing investment in training. |

Value Propositions

Grupo Televisa's comprehensive Spanish-language entertainment provides a significant value proposition by offering a vast library of content, from beloved telenovelas to modern series and films. This extensive selection caters directly to the cultural preferences and entertainment needs of Spanish-speaking audiences globally. For instance, in 2024, TelevisaUnivision reported that its Spanish-language content reached over 60 million people in the U.S. alone, underscoring the broad appeal and demand for such programming.

This rich offering ensures cultural relevance and deep relatability, a key driver for audience engagement. By consistently producing and distributing popular genres, Televisa fulfills a critical market need for authentic and captivating Spanish-language stories. Their commitment to quality and cultural resonance is a cornerstone of their business model, directly contributing to viewer loyalty and market penetration.

Grupo Televisa's Cable and Sky segments are central to its value proposition, offering dependable, high-speed internet, television, and voice services. These integrated packages are designed to fulfill the diverse connectivity requirements of both homes and businesses in today's digital landscape.

The company's strategic emphasis on expanding its network infrastructure, notably through investments in fiber-to-the-home technology, highlights a dedication to ensuring robust and uninterrupted service delivery. This focus on network enhancement directly translates to a more reliable and superior customer experience.

As of early 2024, Televisa's broadband subscriber base continued to show growth, reflecting the market's demand for its integrated telecommunications offerings. For instance, its cable operations consistently reported strong performance in broadband penetration, a key indicator of the value proposition's success.

Grupo Televisa's business model heavily relies on its exclusive rights to broadcast major sports leagues and events, including popular football competitions like LaLiga and the Premier League, alongside significant Mexican sports. This exclusive content acts as a powerful draw for sports fans, differentiating their pay-TV and streaming services in a competitive market.

For instance, in 2024, Televisa's commitment to sports broadcasting continues to be a cornerstone of its strategy, attracting a dedicated subscriber base seeking premium live entertainment. This deep catalog of sporting events is a key factor in customer retention and acquisition, directly contributing to revenue streams from subscriptions and advertising.

Mass Market Advertising Reach and Targeted Solutions

Grupo Televisa provides advertisers with extensive access to a massive Spanish-speaking demographic across various media channels, facilitating broad market penetration for their campaigns. This extensive reach is a cornerstone of its value proposition for businesses aiming for widespread brand recognition.

Beyond sheer volume, Televisa's evolving digital infrastructure and data analytics capabilities are increasingly enabling highly specific audience segmentation. This allows for the delivery of precisely targeted advertising messages, thereby enhancing campaign efficiency and driving better returns for advertisers.

For instance, in 2024, Televisa's consolidated advertising and telecommunications revenues reached approximately $1.7 billion, underscoring the significant commercial opportunities available through its platforms.

- Unmatched Mass Market Access: Reaching millions of Spanish-speaking consumers across Mexico and beyond.

- Data-Driven Targeting: Leveraging analytics to deliver personalized ad experiences.

- Enhanced ROI for Advertisers: Maximizing campaign effectiveness through precise audience engagement.

- Integrated Media Solutions: Offering a mix of traditional and digital channels for comprehensive campaigns.

Information and News Authority

Grupo Televisa’s Information and News Authority value proposition is central to its media operations. Through its extensive broadcast networks and growing digital presence, Televisa delivers crucial news and information to millions, establishing itself as a go-to source for current events.

This dedication to reliable news reporting not only fosters deep trust with its audience but also fulfills a significant public service role. By consistently providing timely and accurate updates, Televisa strengthens its reputation as a comprehensive and dependable media entity.

In 2023, Televisa's news division continued to be a significant driver of audience engagement across its platforms. Its commitment to journalistic integrity helps maintain its standing in a competitive media landscape.

- Trusted Source: Televisa’s news operations are a cornerstone of its credibility.

- Extensive Reach: Millions rely on Televisa for daily news updates.

- Public Service: Providing vital information serves a critical societal function.

- Brand Solidification: News authority reinforces Televisa's overall media brand.

Grupo Televisa's expansive content library, featuring popular telenovelas, series, and films, offers a significant value proposition by catering to the cultural nuances of Spanish-speaking audiences. This deep well of content ensures strong audience connection and loyalty.

The company's integrated telecommunications services, including high-speed internet and television via its Cable and Sky segments, provide a reliable connectivity solution for consumers and businesses. Investments in fiber optics underscore a commitment to service quality.

Televisa's exclusive broadcasting rights for major sports leagues, such as LaLiga and the Premier League, serve as a powerful differentiator, attracting and retaining subscribers seeking premium live sports content.

For advertisers, Televisa offers unparalleled access to a vast Spanish-speaking demographic, amplified by data-driven targeting capabilities that enhance campaign effectiveness and deliver superior ROI.

Televisa's news operations solidify its role as a trusted information provider, reinforcing its brand and fostering audience engagement through reliable, timely reporting.

| Value Proposition | Description | Key Metric/Example |

| Content Library | Extensive Spanish-language entertainment including telenovelas, series, and films. | TelevisaUnivision reached over 60 million in the U.S. in 2024. |

| Telecommunications Services | Reliable high-speed internet, TV, and voice services via Cable and Sky. | Growth in broadband subscriber base as of early 2024. |

| Sports Broadcasting Rights | Exclusive rights to major sports leagues like LaLiga and Premier League. | Key factor in customer retention and acquisition for premium live entertainment. |

| Advertising Reach & Targeting | Access to a massive Spanish-speaking demographic with data-driven segmentation. | Consolidated advertising revenues reached approx. $1.7 billion in 2024. |

| News & Information Authority | Trusted source for news and current events. | News division drives significant audience engagement across platforms. |

Customer Relationships

Grupo Televisa’s free-to-air television networks are designed for mass market engagement, reaching millions through broad appeal content. This strategy prioritizes widespread viewership over direct customer interaction, acting as a broadcasting channel for entertainment and news.

The relationship is primarily a one-way street, with Televisa delivering content and leveraging its extensive reach for advertising revenue. In 2024, the company continued to rely on this model to capture a significant portion of the Mexican advertising market, which remains heavily influenced by traditional media's broad reach.

Grupo Televisa's cable and satellite operations, primarily through Izzi and Sky, cultivate customer relationships via a subscription model. This entails consistent billing cycles, comprehensive technical support, and dedicated customer service for essential telecommunications and entertainment services. The company’s approach hinges on maintaining high customer satisfaction and effectively resolving issues to combat churn in a highly competitive telecom landscape.

In 2024, the telecom industry continues to emphasize customer loyalty. For Grupo Televisa, this translates into a strategic focus on retention programs and service quality improvements. For instance, proactive customer outreach and bundled service offerings are key strategies employed to enhance the perceived value and reduce the likelihood of customers switching providers, a critical factor given the increasing availability of alternative options.

Grupo Televisa's customer relationships are increasingly shaped by digital platform personalization, especially with services like Blim TV and ViX. This means moving beyond traditional broadcasting to offer highly tailored experiences, aiming to deepen connections with viewers.

Leveraging data analytics is key to this personalization. By understanding viewing habits and preferences, Televisa can deliver specific content recommendations, making the digital platforms more engaging and relevant to each user. This data-driven approach is vital for building loyalty in the competitive streaming market.

Interactive features are also a significant component, fostering a more dynamic relationship. This could include anything from live Q&A sessions with talent to personalized content hubs, all designed to keep audiences actively involved and invested in the platforms.

The success of this strategy is evident in the growth of streaming. For instance, TelevisaUnivision reported that ViX reached 30 million monthly active users by the end of 2023, demonstrating the effectiveness of personalized digital engagement in attracting and retaining a large audience.

Direct Sales and Account Management for Businesses

For advertising clients and enterprise telecommunications services, Grupo Televisa leverages direct sales teams and dedicated account managers. These professionals work closely with businesses to understand their specific needs, from advertising reach to robust connectivity solutions. This personalized approach is key to building lasting partnerships and ensuring client retention.

The focus is on understanding client objectives and delivering tailored solutions. This often involves intricate negotiations for contracts and service packages, aiming to provide maximum value and foster long-term, recurring revenue streams. For instance, in 2024, many enterprise clients sought integrated media and connectivity packages, a trend Grupo Televisa actively addressed through its account management.

- Dedicated Account Management: Personalized service ensures client needs are met, fostering loyalty.

- Customized Solutions: Tailoring advertising and telecommunications packages for specific business requirements.

- Contract Negotiation: Building strong client relationships through fair and beneficial agreements.

- Recurring Revenue Focus: Strategies aimed at securing long-term client partnerships and predictable income.

Community and Public Relations

Grupo Televisa actively cultivates its relationship with the public through various channels, extending beyond its core media offerings. Its commitment to corporate social responsibility (CSR) plays a vital role, fostering goodwill and a positive brand perception. For instance, in 2024, Televisa continued its support for educational programs and environmental initiatives, demonstrating a dedication to societal well-being.

Public service announcements (PSAs) are another key element, allowing Televisa to leverage its platform for important social causes, further embedding itself within the community fabric. This proactive engagement helps build a sense of trust and shared purpose with its audience. Community engagement programs, such as local event sponsorships and partnerships with non-profit organizations, directly connect Televisa with the people it serves, reinforcing brand loyalty.

The impact of these efforts is seen in sustained audience engagement and a generally favorable public image, which are crucial for long-term brand health and resilience in the competitive media landscape. These initiatives go beyond transactional relationships, building a deeper connection with stakeholders.

- Corporate Social Responsibility: Continued investment in educational and environmental programs in 2024.

- Public Service Announcements: Utilized its media platforms to promote key social awareness campaigns throughout the year.

- Community Engagement: Supported local events and partnered with community organizations to foster direct connections.

- Brand Perception: These activities contribute to a positive public image and enhanced brand loyalty.

Grupo Televisa manages diverse customer relationships, from mass-market broadcasting with a one-way communication model to subscription-based services like Izzi and Sky that emphasize customer support and retention. Digital platforms such as ViX are transforming these relationships through personalization and interactive features, aiming for deeper engagement.

For business clients, direct sales and dedicated account managers facilitate tailored solutions for advertising and telecommunications needs, focusing on long-term partnerships and recurring revenue. The company also cultivates public goodwill through corporate social responsibility initiatives and public service announcements, reinforcing brand loyalty and a positive image.

| Relationship Type | Key Engagement Strategy | 2024 Focus/Data Point |

| Mass Market (Broadcasting) | Broad appeal content, advertising revenue | Continued reliance on broad reach for advertising market share. |

| Subscription (Cable/Satellite) | Subscription model, technical support, customer service | Emphasis on retention programs and service quality improvements. |

| Digital Platforms (Streaming) | Personalization, data analytics, interactive features | ViX reached 30 million monthly active users by end of 2023, indicating strong digital engagement. |

| Business Clients | Dedicated account management, customized solutions | Addressing demand for integrated media and connectivity packages. |

| Public/Community | CSR, PSAs, community engagement | Continued support for educational and environmental programs; utilized platforms for social awareness campaigns. |

Channels

Grupo Televisa leverages its four prominent national free-to-air television networks—Las Estrellas, Canal 5, Nu9ve, and Foro—along with a network of regional stations, as its core conduits for content dissemination. This extensive infrastructure ensures broad audience penetration throughout Mexico, functioning as the bedrock for delivering news, diverse entertainment, and live sporting events.

These free-to-air channels are instrumental in Televisa’s strategy to reach a vast demographic, offering a platform for both original productions and acquired content. In 2024, free-to-air television continued to be a significant advertising revenue driver, with Televisa's networks capturing a substantial portion of this market share, reflecting their enduring appeal to a wide range of viewers.

Izzi, Grupo Televisa's cable television operation, and Sky Mexico, its direct-to-home satellite pay television system, are crucial channels for delivering bundled services. These platforms offer a comprehensive package of video, broadband internet, and telephony to a vast subscriber base.

These channels are instrumental in reaching millions of customers across Mexico, Central America, and the Dominican Republic. They provide a premium and diversified content and connectivity experience that is central to Televisa's business model.

In 2024, Izzi continued to be a significant player in the Mexican pay-TV market. While specific subscriber numbers fluctuate, the company consistently aims to expand its broadband and pay-TV offerings, competing effectively in a dynamic telecommunications landscape.

Sky Mexico, as of late 2023 and projections for 2024, remained a key provider of satellite television, particularly in areas where cable infrastructure is less developed. Its extensive reach ensures access to entertainment for a broad demographic.

Blim TV, operated by Grupo Televisa, and ViX, part of TelevisaUnivision, serve as critical digital channels for content distribution. These platforms are essential for delivering on-demand and premium entertainment, reaching a growing digital-first demographic.

ViX, in particular, has shown significant growth, reaching over 30 million monthly active users by early 2024. This expansion into digital streaming allows TelevisaUnivision to tap into new revenue streams and offer flexible viewing experiences across multiple devices, from smartphones to smart TVs.

These streaming services are key to TelevisaUnivision's strategy of monetizing its extensive content library in an evolving media landscape. By offering a mix of free and subscription-based content, they cater to a broad audience, enhancing user engagement and broadening market reach beyond traditional broadcast.

Mobile Services

Grupo Televisa's mobile services operate as a crucial channel within its Business Model Canvas, primarily through its relaunched mobile virtual network operator (MVNO) offering. This allows Televisa to bundle mobile connectivity with its existing pay-TV, broadband, and landline services, creating a more compelling and integrated value proposition for its customers.

By leveraging its established infrastructure and customer base, Televisa aims to increase subscriber loyalty and average revenue per user (ARPU). This strategy directly addresses the growing demand for converged telecommunications solutions in the Mexican market.

The MVNO model enables Televisa to offer competitive mobile plans without the significant capital expenditure of building its own cellular network. This agility is key to its market positioning.

Key aspects of this channel include:

- Bundled Offerings: Integrating mobile services into existing telecom packages to enhance customer retention and attract new subscribers seeking a single provider for all their communication needs.

- MVNO Strategy: Utilizing a virtual network model to provide mobile services, reducing infrastructure costs and increasing operational flexibility.

- Market Penetration: Aiming to capture a larger share of the Mexican mobile market by offering differentiated and value-added services.

- Revenue Diversification: Expanding revenue streams beyond traditional pay-TV and broadband by tapping into the lucrative mobile sector.

Print Media and Radio

Despite the evolving media landscape, Grupo Televisa's print media and radio segments remain relevant channels. These operations continue to serve as conduits for news, entertainment, and crucially, advertising, reaching distinct audience segments and reinforcing Televisa's broad media footprint.

In 2024, the company's commitment to these traditional platforms underscores their enduring value. While digital consumption dominates, print and radio still capture significant reach, particularly among certain demographics, contributing to Televisa's diversified revenue streams.

- Print Media Reach: Televisa's print publications, though facing industry-wide challenges, still maintain a readership base that advertisers value for targeted campaigns.

- Radio's Local Impact: The radio division offers localized content and advertising opportunities, connecting with communities across Mexico and bolstering brand visibility.

- Advertising Revenue Contribution: These channels, while not the largest segment, provide a consistent and valuable source of advertising revenue, complementing Televisa's digital and broadcast offerings.

- Demographic Engagement: Print and radio effectively engage specific demographic groups that may be less accessible through purely digital platforms, maintaining Televisa's comprehensive market penetration.

Grupo Televisa's Channels segment is multifaceted, encompassing traditional broadcast, pay-TV, digital streaming, and even mobile services. These channels collectively form the backbone of content delivery and customer engagement, driving both advertising and subscription revenues. The strategic integration of these diverse platforms allows Televisa to cater to a wide array of consumer preferences and market needs, solidifying its position across the media landscape.

Customer Segments

This segment encompasses the vast majority of the population in Mexico and Latin America, relying on free-to-air television, radio, and increasingly, digital platforms for entertainment and information. Grupo Televisa's strategy focuses on broad reach, aiming to connect with the majority of Mexican households through diverse content offerings that appeal to a wide spectrum of ages and interests.

In 2024, Televisa's free-to-air television channels, such as Las Estrellas and Canal 5, continued to be a primary source of news and entertainment for millions. These channels historically command significant audience share, with prime-time programming often reaching over 50% of available viewers in key demographics.

The company's digital expansion efforts in 2024 aimed to capture this mass market audience online, offering streaming services and digital content that complements its traditional broadcast offerings. This pivot reflects the growing internet penetration across Latin America, with mobile data usage steadily increasing.

Grupo Televisa's radio stations also play a crucial role in reaching this mass market, providing news, music, and talk shows that resonate with local tastes and preferences. Radio advertising remains a significant revenue stream for reaching broad audiences, especially in areas where digital access might be limited.

Residential households, primarily served by Izzi and Sky, represent a core customer segment for Grupo Televisa. These subscribers are looking for bundled services, including cable television, high-speed internet, and sometimes voice services, all delivered reliably to their homes. In 2024, Izzi continued to be a significant player in the Mexican broadband market, aiming to capture a larger share of this household demand.

The value proposition for these households centers on convenience and a comprehensive entertainment and connectivity solution. They often prefer a single provider for multiple essential services, simplifying billing and management. Grupo Televisa's strategy involves offering competitive pricing and service packages to attract and retain these residential subscribers.

Advertisers and businesses, both national and international, alongside advertising agencies, represent a crucial customer segment for Grupo Televisa. These entities are actively seeking to connect with the significant Spanish-speaking consumer base that Televisa reaches across Mexico and other markets.

They leverage Televisa's extensive network of media platforms, including television, digital, and radio, to execute impactful marketing campaigns and enhance their brand visibility. In 2023, the advertising revenue for TelevisaUnivision, the combined entity, reached approximately $3.0 billion, highlighting the substantial investment made by these businesses in Televisa's advertising solutions.

Sports Enthusiasts

Sports enthusiasts represent a core customer segment for Grupo Televisa, particularly through its Sky Mexico pay-TV services. This group shows a strong preference for exclusive access to live sports, encompassing major international football leagues and prominent local sporting events. In 2024, the continued demand for these rights fuels subscription growth and retention within this demographic.

This segment's behavior directly influences revenue streams, with a significant portion of Sky Mexico's subscriber base attributed to their desire for comprehensive sports coverage. Furthermore, Grupo Televisa is increasingly leveraging digital platforms to cater to these enthusiasts, offering sports-focused streaming content that complements traditional pay-TV offerings, adapting to evolving consumption habits.

- Exclusive Live Sports Content: This segment prioritizes access to premium football leagues and local sports.

- Pay-TV Subscriptions: Sky Mexico benefits significantly from this demographic's demand for live broadcasts.

- Streaming Services: Growth in sports-focused streaming content appeals to younger, digitally-savvy sports fans.

- Revenue Driver: Sports content is a key factor in retaining and attracting subscribers for Televisa's media offerings.

Digital-First Consumers

Digital-first consumers represent a rapidly expanding demographic that prioritizes streaming services and mobile devices for their content consumption. They value the convenience of on-demand access and seek tailored viewing experiences. Grupo Televisa's strategic investments in platforms like Blim TV and its more recent, significant expansion with ViX directly cater to this tech-savvy audience, aiming to capture a larger share of their media consumption. By 2024, the Latin American streaming market is projected to see substantial growth, with a significant portion of this driven by users aged 18-35 who are digital natives.

- Growing Preference: Consumers increasingly favor digital platforms over traditional broadcasting.

- On-Demand Expectation: Immediate access to content is a key driver for this segment.

- Personalization Demand: Tailored recommendations and user interfaces are highly valued.

- Platform Investment: Televisa's commitment to ViX and Blim TV targets this digitally inclined user base.

Grupo Televisa serves a diverse range of customer segments, from the mass market consuming free-to-air content to sophisticated digital-first users and dedicated sports fans. Advertisers and businesses are also crucial, leveraging Televisa's reach for their marketing efforts.

In 2024, the company continued to cater to residential households through its Izzi and Sky services, offering bundled internet, TV, and phone options. This segment values convenience and a single provider for multiple essential services.

Advertisers and businesses, including agencies, are key customers seeking to reach a large Spanish-speaking audience. In 2023, TelevisaUnivision's advertising revenue demonstrated the significant value placed on this reach, amounting to approximately $3.0 billion.

Sports enthusiasts remain a vital demographic, primarily through Sky Mexico's pay-TV subscriptions, with a strong demand for live football and local sports events, which drives retention and growth.

Cost Structure

Grupo Televisa's content production and acquisition is a significant expense. This includes the substantial costs of creating original programming like telenovelas, news broadcasts, and various entertainment shows. In 2024, the company continued to invest heavily in these areas to maintain its market position.

Acquiring licensing rights for third-party content, particularly for popular sports broadcasts and international series, represents another major cost. These rights are often expensive and competitive, especially for premium live events that draw large audiences.

The sheer volume of content Televisa produces and licenses annually drives these costs higher. For instance, the production of numerous telenovelas and the ongoing acquisition of sports rights are continuous, substantial financial commitments for the company.

Grupo Televisa faces substantial costs in developing and upkeep of its vast telecommunications network. This includes significant capital outlays for expanding its fiber optic and satellite infrastructure, essential for delivering cable and broadcasting services.

Ongoing operational expenses for maintaining this complex infrastructure are also considerable. These costs cover routine repairs, software updates, and the general upkeep required to ensure seamless service delivery to millions of subscribers across Mexico.

For instance, in 2023, Televisa's capital expenditures, which heavily include network infrastructure, were reported to be around MXN 15.9 billion, highlighting the ongoing investment in its physical assets.

Personnel and operational expenses are a significant component of Grupo Televisa's cost structure, encompassing employee salaries, benefits, and general administrative costs. These expenses are spread across its varied business segments, including broadcasting, telecommunications, and publishing, reflecting the breadth of its operations.

To manage these costs, Televisa has actively pursued efficiency initiatives. In 2023, the company continued to implement measures aimed at optimizing operational expenditures, which have included strategic headcount reductions across various divisions to streamline operations and improve profitability.

Marketing and Sales Costs

Grupo Televisa invests heavily in marketing and sales to draw in viewers and advertisers. These costs cover everything from broad advertising campaigns across television, radio, and digital platforms to the salaries and commissions of their sales teams who secure advertising contracts.

The company's promotional efforts are crucial for maintaining its market share in a competitive landscape. For example, in 2023, Televisa's consolidated revenue was MXN 83,773 million, with a significant portion allocated to these customer acquisition and retention activities. These expenditures are vital for promoting their content and services, including their cable offerings and broadcast channels.

- Marketing Campaigns: Expenses for television commercials, digital ads, and social media promotions to reach a wide audience.

- Sales Force Compensation: Salaries, bonuses, and commissions for the teams responsible for selling advertising slots and cable subscriptions.

- Promotional Activities: Costs associated with events, partnerships, and content tie-ins designed to boost viewership and subscriber numbers.

- Market Research: Investments in understanding consumer preferences and market trends to refine marketing strategies.

Technology and Digital Platform Development Costs

Grupo Televisa's investment in digital infrastructure and streaming technology development is a significant cost. This includes ongoing expenses for platform maintenance and upgrades to services like Blim TV and ViX, essential for remaining competitive. These expenditures are critical for enhancing user experience and adapting to the rapidly changing digital media environment.

For instance, in 2024, companies in the media sector often allocate substantial budgets to cloud computing, content delivery networks (CDNs), and the development of proprietary streaming software. While specific figures for Televisa's 2024 digital platform development aren't publicly detailed here, these investments are directly tied to revenue generation through subscriptions and advertising on their digital offerings.

- Digital Infrastructure Investment: Costs associated with servers, cloud services, and network capacity.

- Streaming Technology Development: Expenses for building and improving video-on-demand and live streaming capabilities.

- Platform Maintenance and Operations: Ongoing costs for software updates, security, and technical support for platforms like ViX.

- Content Management Systems: Investment in systems to efficiently manage and deliver digital content.

Grupo Televisa's cost structure is heavily influenced by its extensive content creation and acquisition activities. These are fundamental to its broadcasting and media operations. The company also faces significant capital and operational expenditures for maintaining and expanding its telecommunications infrastructure, which is vital for its cable and internet services.

| Cost Category | Description | 2023 Data (Approximate or Indicative) |

| Content Production & Acquisition | Creating original shows, licensing sports rights, acquiring third-party content. | Significant portion of operating expenses. |

| Telecommunications Infrastructure | Capital expenditures for fiber optics, satellite, network maintenance. | Capital expenditures around MXN 15.9 billion in 2023. |

| Personnel & Operations | Salaries, benefits, administrative costs across all segments. | Streamlined through efficiency initiatives in 2023. |

| Marketing & Sales | Advertising campaigns, sales force compensation, promotions. | A key allocation of revenue, supporting MXN 83,773 million in consolidated revenue (2023). |

| Digital Infrastructure & Streaming | Platform development, cloud services, content delivery networks. | Substantial budgets allocated in 2024 for competitive digital offerings. |

Revenue Streams

Advertising sales across its free-to-air television networks, radio stations, and digital platforms form a core revenue engine for Grupo Televisa. This income is derived from selling commercial spots, securing sponsorships, and executing integrated marketing campaigns that capitalize on the company's extensive audience reach.

In 2024, TelevisaUnivision, a significant part of Grupo Televisa's operations, reported advertising revenue exceeding $3 billion. This substantial figure underscores the critical role of advertising in the company's financial performance and its ability to monetize its vast media properties.

Grupo Televisa's subscription fees from its cable and satellite television operations, primarily through Izzi and Sky Mexico, represent a cornerstone of its revenue model. These recurring payments for bundled services like television, broadband internet, and phone lines provide a stable and predictable income stream. In 2024, this segment continued to be a vital contributor, reflecting ongoing demand for these essential telecommunications services across Mexico.

Grupo Televisa monetizes its extensive content library by licensing and syndicating it to a wide array of partners. This includes deals with other television broadcasters, popular streaming services like Netflix and Disney+, and international markets, generating significant revenue. In 2024, TelevisaUnivision reported continued strength in its content licensing segment, contributing to its overall financial performance by extending the global reach and profitability of its produced shows and telenovelas.

Digital and Streaming Platform Subscriptions

Grupo Televisa generates significant revenue through its digital and streaming platforms. This includes direct subscriptions to its own service, Blim TV, as well as its substantial investment in ViX, operated by TelevisaUnivision. These digital offerings are key components of Televisa's evolving business model.

The performance of these platforms is directly reflected in their financial contributions. As of 2024, Blim TV reported an active subscriber base of 2.3 million users. Concurrently, ViX demonstrated its market strength by generating a substantial $1 billion in revenue during the same year.

- Digital Subscriptions: Revenue is derived from users subscribing to Blim TV.

- Streaming Platform Stake: Income is generated from Televisa's share in ViX, a major streaming service.

- 2024 Performance: Blim TV had 2.3 million active subscribers, and ViX achieved $1 billion in revenue.

Other Business Operations

Grupo Televisa taps into a varied revenue stream beyond its core media operations. This includes income from its publishing arm, which encompasses magazine sales, and its radio broadcasting network. Professional sports, notably the popular Club America, and live entertainment events also contribute significantly to its top line.

In 2024, a strategic move saw the spin-off of certain sports and gaming assets into a separate entity, Ollamani. However, Televisa continues to hold stakes in these ventures, ensuring that these operations still feed into its consolidated revenue picture.

Televisa's diversified business model allows it to capture revenue from multiple avenues:

- Publishing: Revenue generated from the sale of magazines and other printed content.

- Radio Broadcasting: Income derived from advertising and other services offered across its radio stations.

- Professional Sports: Earnings from team operations, broadcasting rights, and merchandise, particularly through entities like Club America.

- Live Entertainment: Revenue from organizing and promoting concerts, shows, and other live events.

Grupo Televisa's revenue streams are diverse, encompassing advertising, subscription services, content licensing, and digital platforms.

In 2024, TelevisaUnivision's advertising revenue surpassed $3 billion, highlighting the strength of its media properties. Cable and satellite operations, like Izzi and Sky Mexico, provide stable income through subscriptions.

Content licensing remains robust, with deals extending Televisa's reach globally. Digital platforms, including Blim TV and ViX, are increasingly important, with Blim TV serving 2.3 million users and ViX generating $1 billion in 2024.

| Revenue Stream | Description | 2024 Data Point |

|---|---|---|

| Advertising | Sales across TV, radio, and digital platforms | TelevisaUnivision advertising revenue > $3 billion |

| Subscriptions | Cable and satellite services (Izzi, Sky Mexico) | Continued vital contribution |

| Content Licensing | Licensing content to broadcasters and streaming services | Continued strength reported |

| Digital/Streaming | Blim TV subscriptions and ViX stake | Blim TV: 2.3 million subscribers; ViX: $1 billion revenue |

Business Model Canvas Data Sources

The Grupo Televisa Business Model Canvas is built using a comprehensive mix of internal financial reports, market research from reputable industry analysts, and strategic insights derived from competitor analysis. These diverse data sources ensure each component of the canvas is grounded in factual information and reflects the company's operational realities.