Teekay SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Teekay Bundle

Teekay's market position is defined by its significant global fleet and established presence in key shipping sectors, offering a stable foundation. However, the company navigates volatile tanker rates and increasing environmental regulations, presenting potential challenges.

Want the full story behind Teekay's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Teekay Corporation's strength lies in its diversified marine services portfolio, encompassing the transportation of crude oil, LNG, and LPG. This broad operational scope extends to specialized services like shuttle tankers and FPSO units, demonstrating a comprehensive approach to energy logistics.

This diversification is a significant advantage, as it spreads risk across different energy markets. For instance, while crude oil tanker rates can be volatile, demand for LNG and LPG shipping often exhibits different drivers, providing a stabilizing effect on overall revenue. This multi-segment approach mitigates the impact of downturns in any single sector.

By offering a full spectrum of marine solutions, Teekay serves a wide array of global clients, from major oil producers to gas utilities. This broad customer engagement strengthens its market position and resilience. As of early 2024, the company operates a fleet of over 150 vessels, highlighting the scale of its diversified operations.

Teekay achieved strong financial results in 2024, reporting an adjusted net income attributable to shareholders of $112 million. This profitability highlights effective operational management and a solid market position.

The company's robust financial performance in 2024 translated into significant capital returns for shareholders. Teekay distributed substantial special dividends and engaged in share repurchases, underscoring its financial health and dedication to enhancing shareholder value.

Teekay's strategic business streamlining has significantly boosted its operational efficiency. The multi-year initiative culminated in Teekay Tankers becoming the sole operating platform within the Teekay Group, achieved through divesting non-core assets like its Australian operations. This simplification sharpens the company's focus on its core shipping activities.

This consolidation is projected to reduce overhead costs and provide a more coherent strategic direction. By shedding peripheral businesses, Teekay can allocate resources more effectively to its primary shipping segments, enhancing its competitive edge in the market.

The transfer of management services further streamlines operations, creating a more integrated and responsive organizational structure. This move is expected to improve decision-making speed and operational agility, crucial in the dynamic shipping industry.

As of the first quarter of 2024, Teekay reported a notable improvement in its financial leverage ratios following these divestitures, indicating a stronger, more focused balance sheet.

Proactive Fleet Optimization and Modernization

Teekay Tankers is aggressively updating its fleet, a key strength. This involves selling off older ships and bringing in newer, more advanced vessels. As of early 2024, Teekay has been actively engaged in this renewal process, aiming for a more efficient and environmentally compliant fleet. This proactive approach is crucial for staying competitive in the tanker market.

The benefits of this modernization are significant. Newer vessels typically offer better fuel efficiency, which directly impacts operating costs and reduces emissions. This aligns Teekay with stricter environmental regulations, like those from the International Maritime Organization (IMO), which are becoming increasingly important for global shipping operations. For example, the IMO's Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII) regulations favor newer, more efficient tonnage.

- Fleet Renewal Strategy: Teekay is actively selling older vessels and acquiring newer, more fuel-efficient ones.

- Enhanced Efficiency: Modern tonnage leads to improved fuel consumption, reducing operational costs.

- Environmental Compliance: New ships better meet evolving environmental regulations, such as IMO's EEXI and CII standards.

- Competitive Edge: A modernized fleet improves operational performance and market competitiveness.

Established Global Presence and Extensive Experience

Teekay Corporation's extensive experience, dating back to its founding in 1973, has honed its expertise in the intricate world of marine transportation. This deep operational history, spanning over five decades, has been instrumental in building a robust global presence.

The company currently operates in eight countries, demonstrating a significant international reach. This widespread footprint is supported by a substantial workforce dedicated to delivering comprehensive marine services to major energy companies across the globe.

Teekay's long-standing presence and operational depth are crucial advantages in the highly cyclical and demanding shipping sector, allowing them to effectively manage risks and capitalize on opportunities.

- Founded in 1973: Over 50 years of industry experience.

- Global Operations: Present in 8 countries.

- Extensive Workforce: Significant employee base supporting global operations.

- Clientele: Services leading energy companies worldwide.

Teekay's diversified portfolio, covering crude oil, LNG, and LPG transportation, along with specialized services like shuttle tankers and FPSOs, acts as a significant strength by spreading risk across various energy markets. This multi-segment approach, supported by a fleet of over 150 vessels as of early 2024, offers revenue stability even when individual sectors face volatility. The company’s reported adjusted net income attributable to shareholders of $112 million in 2024 further validates its robust operational management and market standing.

The strategic streamlining, including the consolidation of Teekay Tankers as the sole operating platform and the divestment of non-core assets, has enhanced operational efficiency and sharpened the company's focus on core shipping activities. This simplification is projected to reduce overhead costs and improve resource allocation, leading to a more coherent strategic direction and a stronger balance sheet, as evidenced by improved financial leverage ratios reported in Q1 2024.

Teekay Tankers' proactive fleet renewal strategy, involving the sale of older vessels and acquisition of newer, more fuel-efficient ones, is a key strength. This modernization, ongoing as of early 2024, not only reduces operational costs through better fuel consumption but also ensures compliance with evolving environmental regulations like IMO's EEXI and CII standards, providing a competitive edge.

Teekay's extensive experience, cultivated since its founding in 1973, combined with its global presence in eight countries and a substantial workforce serving major energy companies, provides a deep operational history and robust market understanding. This long-standing expertise is critical for navigating the cyclical and demanding shipping sector effectively.

| Metric | Value (as of early 2024) | Significance |

| Fleet Size | Over 150 vessels | Demonstrates scale and diversified operational capacity. |

| Adjusted Net Income (2024) | $112 million | Indicates strong profitability and effective management. |

| Countries of Operation | 8 | Highlights significant global reach and market penetration. |

| Years in Operation | 50+ (Founded 1973) | Represents deep industry experience and established market position. |

What is included in the product

Delivers a strategic overview of Teekay’s internal and external business factors, highlighting its market strengths and potential threats.

Offers a clear, actionable framework to pinpoint and address strategic weaknesses.

Weaknesses

Teekay Tankers experienced a significant revenue drop in Q1 2025, with total revenues declining to $231.6 million compared to $368.3 million in Q1 2024. This substantial decrease, a 37% fall, highlights immediate market headwinds affecting the company's top line. The primary driver of this decline was lower voyage charter revenues, indicating a tougher operating environment for the period.

While Teekay's strategic fleet renewal involves selling older vessels, the planned disposal of several units in late 2024 and early 2025 presents a potential weakness in terms of temporary capacity reduction. For instance, if Teekay sells five older LNG carriers in Q4 2024 and two in Q1 2025, this could directly impact its ability to serve contracts requiring that specific tonnage.

Should new vessel acquisitions not perfectly align with these disposals, Teekay might face a short-term dip in its overall operational capacity. This could translate to missed opportunities during periods of heightened market demand or a potential erosion of market share if competitors can more readily meet demand.

Managing this transition phase is critical; a mismatch between vessel sales and new deliveries, even if temporary, could create operational gaps. For example, if the delivery of a new, larger capacity vessel is delayed by a few months after the sale of two older ones, Teekay's total carrying capacity could be noticeably lower.

Teekay's safety performance in 2023 presented a challenge, with its Total Recordable Case Frequency (TRCF) surpassing its internal goal. This metric, a key indicator of workplace safety, highlights an area where enhanced focus is needed.

While a specific incident contributed to the 2023 TRCF, consistently meeting safety targets is crucial. Strong safety records are vital for protecting crew welfare, upholding Teekay's reputation as a responsible operator, and preventing costly operational interruptions or regulatory scrutiny.

Labor Retention Pressures

Teekay has faced challenges with keeping its employees, particularly shore staff. In 2023, retention for these roles fell short of the company's goals, raising concerns among some institutional investors. This difficulty in retaining a consistent and knowledgeable team is a significant hurdle.

Maintaining a steady, experienced workforce is vital in the shipping industry. When skilled workers leave, it can disrupt how smoothly operations run, hinder the passing down of important knowledge, and potentially affect the quality of services provided. This directly impacts the company's ability to perform effectively.

- Labor Retention Concerns: Teekay's shore staff retention rate in 2023 did not meet its internal targets.

- Investor Skepticism: This retention dip has led to a degree of skepticism from institutional investors.

- Industry Importance: A stable, skilled workforce is critical for operational efficiency and service quality in maritime operations.

- Impact of Turnover: Challenges in retaining personnel can negatively affect knowledge transfer and overall performance.

Vulnerability to Tanker Market Volatility

Teekay's substantial reliance on the crude oil tanker market exposes it to significant volatility. Despite diversification efforts, the company's financial health is closely tied to the sector's cyclical nature. This means that shifts in crude oil prices, geopolitical tensions, and the global balance of supply and demand can cause unpredictable swings in freight rates, directly affecting the profitability of Teekay's tanker operations. For example, in the first quarter of 2024, Teekay reported that spot rates for certain tanker classes experienced notable declines compared to the previous year, illustrating this vulnerability.

Teekay's fleet renewal strategy, while forward-looking, introduces temporary weaknesses through the planned sale of older vessels. This can lead to reduced operational capacity if new vessel deliveries don't perfectly offset these disposals, potentially causing missed opportunities during peak demand periods.

The company's safety performance in 2023, marked by a Total Recordable Case Frequency (TRCF) exceeding internal goals, indicates a need for heightened focus on operational safety to prevent disruptions and maintain its reputation.

Furthermore, Teekay's shore staff retention in 2023 fell short of targets, raising concerns among institutional investors about operational consistency and the transfer of crucial knowledge within the organization.

Teekay's significant exposure to the volatile crude oil tanker market remains a key weakness, with freight rates susceptible to unpredictable swings driven by oil prices, geopolitical events, and supply-demand dynamics, as evidenced by lower spot rates in Q1 2024 compared to the prior year.

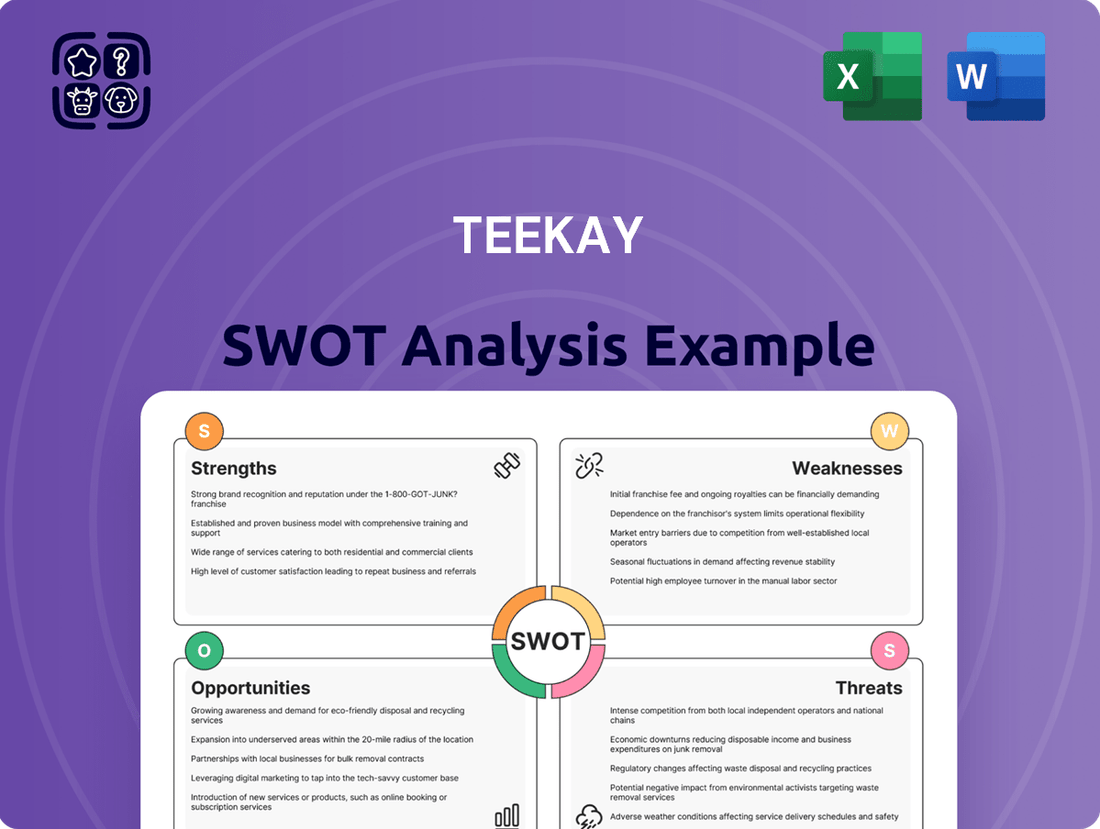

Preview Before You Purchase

Teekay SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

Opportunities

The global FPSO market is on a strong upward trajectory, expected to grow from $22.8 billion in 2024 to $36.6 billion by 2033, representing a significant growth opportunity. This expansion is fueled by heightened offshore exploration and production activities, especially in deeper waters. This trend directly benefits Teekay's FPSO business, offering avenues for increased operational capacity and market penetration.

Global oil consumption is projected to climb further in 2025, a trend that bodes well for companies like Teekay. This growing demand for energy transportation creates a favorable environment for Teekay's crude oil and product tanker operations.

Analysts anticipate this sustained demand will translate into higher charter rates and improved utilization for Teekay's fleet. For instance, the International Energy Agency (IEA) forecast in their 2024 outlook that global oil demand would reach approximately 106.4 million barrels per day in 2025, representing a solid increase.

Teekay's strategic fleet modernization initiative is a significant opportunity. By acquiring newer vessels, the company is integrating advanced technologies that promise improved fuel efficiency. For instance, the company has been actively taking delivery of new LNG carriers and Aframax tankers designed with cutting-edge propulsion systems.

This investment in modern, energy-efficient tonnage directly translates into lower operating expenses. We anticipate these efficiencies will not only bolster Teekay's bottom line but also solidify its commitment to environmental stewardship. As of early 2024, the maritime industry is increasingly prioritizing vessels with lower emissions profiles, making Teekay's updated fleet highly competitive.

The enhanced fleet is better equipped to meet stringent environmental regulations and the growing demand from charterers for greener shipping solutions. This proactive approach positions Teekay to capture more favorable contracts and maintain a strong market presence in a rapidly evolving regulatory landscape.

Strategic Investments and Joint Ventures

Teekay's strategic investments, like its 50% stake in a VLCC joint venture, are key opportunities. This allows them to grow their fleet and market presence without shouldering the entire financial burden. These collaborations also mean shared risks, opening doors to new geographic markets and diversifying how they earn revenue. For instance, in early 2024, Teekay Offshore Partners, a subsidiary, continued to leverage its joint ventures to secure new contracts, enhancing its operational capacity.

- Expansion of Market Reach: Joint ventures allow Teekay to access regions or customer segments it might not be able to penetrate alone.

- Shared Capital Expenditure: Partnering reduces the upfront capital required for new assets, freeing up resources for other strategic initiatives.

- Risk Mitigation: Spreading the financial and operational risks across multiple partners makes large-scale projects more manageable.

- Diversified Revenue Streams: Entering into joint ventures can create new revenue channels and reduce reliance on existing business lines.

Leadership in ESG and Sustainability

Teekay's dedication to environmental, social, and governance (ESG) principles presents a significant opportunity. The company's publicly stated goal of a 40% reduction in greenhouse gas emissions by 2030, as outlined in its 2024 Sustainability Report, positions it favorably with investors prioritizing sustainability. This commitment extends to a net-zero emissions target by 2050, demonstrating long-term vision.

By actively embracing cleaner technologies and sustainable operational practices, Teekay can unlock substantial long-term benefits. These include improved operational efficiencies, which can translate to cost savings, and a bolstered brand reputation. This proactive approach can attract a growing segment of environmentally conscious investors and customers, further solidifying its market position.

- Ambitious Emission Reduction Targets: Teekay aims for a 40% GHG reduction by 2030 and net-zero by 2050.

- Investor Appeal: Strong ESG performance attracts environmentally conscious investors.

- Operational Efficiencies: Adoption of cleaner technologies can lead to cost savings.

- Enhanced Brand Reputation: Sustainability efforts bolster public image and customer loyalty.

The expanding global FPSO market, projected to reach $36.6 billion by 2033, offers significant growth for Teekay's offshore operations. Rising global oil demand, with the IEA forecasting 106.4 million barrels per day in 2025, directly supports Teekay's tanker business and is expected to drive higher charter rates.

Teekay’s fleet modernization, integrating advanced, fuel-efficient technologies in new LNG carriers and Aframax tankers, positions them favorably against evolving environmental regulations and customer demands for greener shipping solutions as of early 2024.

Strategic joint ventures, such as their VLCC partnership, allow Teekay to expand its fleet and market reach while mitigating financial and operational risks, as demonstrated by Teekay Offshore Partners' contract securing activities in early 2024.

Teekay's commitment to ESG principles, including a 40% GHG reduction target by 2030 and net-zero by 2050, enhances its appeal to sustainability-focused investors and can lead to operational efficiencies and a stronger brand reputation.

Threats

Geopolitical instability, particularly ongoing conflicts like those affecting the Red Sea, directly threatens Teekay’s operations by disrupting vital shipping lanes. These disruptions force vessels onto longer, more costly routes, increasing fuel consumption and insurance premiums. For instance, rerouting around the Cape of Good Hope in late 2023 and early 2024 added significant time and expense to voyages, impacting delivery schedules and overall operational efficiency.

The LNG shipping market is expected to see increased vessel supply in 2025, potentially outstripping the growth in liquefaction capacity. This imbalance is a significant threat, as it can drive down freight rates. For instance, Clarksons Research projected that the LNG carrier orderbook represented over 20% of the existing fleet capacity as of early 2024, suggesting a substantial influx of new tonnage.

Lower freight rates directly impact profitability for companies like Teekay, which operate LNG carriers. This oversupply scenario creates a more competitive and challenging environment for securing profitable charters and maintaining strong margins in their LNG shipping segment.

The tanker market's inherent volatility continues to pose a significant threat, with certain segments seeing a softening of earnings extending into late 2024 and early 2025. This downturn is partly driven by an expanding global fleet, which outpaces demand growth in some areas.

Modest growth in crucial import regions, such as China, adds to the uncertainty surrounding future charter rates. This environment creates a potential for continued downward pressure on Teekay's tanker revenues, impacting profitability.

For instance, while specific rates fluctuate, the average daily earnings for suezmax tankers saw a notable dip in the latter half of 2024 compared to earlier in the year, reflecting broader market softening.

Increasing Regulatory and Environmental Compliance Costs

The maritime sector is grappling with increasingly demanding environmental regulations. For instance, the International Maritime Organization's (IMO) ambitious targets to slash greenhouse gas emissions by 50% by 2050, alongside the European Union's Emissions Trading System (ETS), directly impact shipping operations. These evolving rules require substantial financial commitments from companies like Teekay.

Meeting these stringent standards often means investing heavily in advanced technologies, exploring alternative fuels, and modernizing existing fleets. This financial pressure and operational complexity present a significant challenge, potentially impacting profitability and competitiveness. For example, the cost of retrofitting vessels or building new, more eco-friendly ships can run into tens or even hundreds of millions of dollars per vessel.

- IMO 2030/2050 Targets: Mandates significant reductions in greenhouse gas emissions for the global shipping fleet.

- EU Emissions Trading System (ETS): Introduces a carbon price for shipping emissions within EU waters, adding direct operational costs.

- Capital Investment Needs: Requires substantial funds for new technologies, alternative fuels, and fleet upgrades to ensure compliance.

- Operational Complexity: Navigating new fuel types and emission monitoring systems adds layers of operational management and risk.

Global Economic Slowdown and Energy Transition Risks

A global economic slowdown presents a significant threat to Teekay. Reduced economic activity directly translates to lower demand for energy commodities like crude oil, LNG, and LPG, which in turn shrinks the volume of cargo Teekay transports. For instance, projections by the International Monetary Fund (IMF) in late 2024 indicated a potential moderation in global GDP growth for 2025, impacting trade volumes across various sectors, including energy shipping.

The pace of the global energy transition poses another substantial risk. While Teekay is investing in cleaner energy solutions, a rapid shift away from fossil fuels could challenge its existing fleet and business model. If the transition accelerates faster than Teekay can adapt its operations and diversify its revenue streams, it could face stranded assets or reduced demand for its traditional services. This is particularly relevant as many nations are setting more ambitious emissions reduction targets, potentially impacting long-term hydrocarbon demand.

- Reduced Demand: A global economic downturn can decrease the need for energy, leading to lower shipping volumes for Teekay.

- Energy Transition Impact: A faster-than-expected shift to renewable energy sources could diminish the long-term viability of Teekay's fossil fuel-focused transportation services.

- Commodity Price Volatility: Economic slowdowns often coincide with volatile commodity prices, which can indirectly affect shipping rates and profitability.

- Geopolitical Instability: Global economic uncertainty can be exacerbated by geopolitical events, further disrupting trade routes and energy supply chains.

The ongoing geopolitical instability, especially in key shipping regions like the Red Sea, continues to be a significant threat, forcing costly rerouting and impacting delivery times. This instability directly affects Teekay's operational efficiency and increases insurance costs, as seen with extended voyages around the Cape of Good Hope in late 2023 and early 2024.

A projected oversupply in the LNG shipping market, with the orderbook representing over 20% of the fleet capacity as of early 2024, threatens to drive down freight rates and squeeze profitability for Teekay's LNG carrier segment.

The tanker market faces volatility, with softening earnings in late 2024 due to fleet expansion outpacing demand growth in certain segments, potentially pressuring Teekay's tanker revenues.

Increasingly stringent environmental regulations, such as IMO 2030/2050 targets and the EU Emissions Trading System, necessitate substantial capital investment in fleet modernization and new technologies, adding significant financial and operational complexity for Teekay.

| Threat Category | Specific Concern | Impact on Teekay | Data/Example |

|---|---|---|---|

| Geopolitical Instability | Red Sea Disruptions | Increased voyage costs, delayed deliveries | Rerouting around Cape of Good Hope (late 2023/early 2024) |

| Market Oversupply | LNG Carrier Fleet Expansion | Lower freight rates, reduced profitability | Orderbook over 20% of fleet capacity (early 2024) |

| Market Volatility | Tanker Market Softening | Pressure on tanker revenues | Downturn in suezmax earnings (late 2024) |

| Regulatory Environment | Environmental Mandates (IMO, EU ETS) | High capital expenditure, operational complexity | Need for fleet upgrades/new builds for emission compliance |

SWOT Analysis Data Sources

This Teekay SWOT analysis draws from comprehensive data, including public financial filings, industry-specific market research, and expert analyst reports to provide a robust strategic overview.