Teekay Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Teekay Bundle

Teekay's industry is shaped by powerful forces, from the intense rivalry among existing players to the bargaining power of their customers. Understanding these dynamics is crucial for any stakeholder.

The threat of new entrants and the availability of substitute services present unique challenges that Teekay must navigate strategically. These forces can significantly impact profitability and market share.

Supplier power also plays a critical role, influencing the cost of operations and the availability of essential resources for Teekay's fleet. Managing these relationships is key.

This brief overview only scratches the surface of Teekay's competitive landscape. Unlock the full Porter's Five Forces Analysis to explore Teekay’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Teekay's reliance on a concentrated group of global shipyards for constructing new vessels and performing significant maintenance, especially for specialized ships like LNG carriers and FPSOs, highlights a key supplier power dynamic. These shipyards, primarily located in South Korea and China, possess considerable leverage.

This leverage stems from the substantial capital investments required for new builds and the lengthy timelines involved, making switching suppliers costly and time-consuming for Teekay. In 2024, the global shipbuilding market continued to see strong demand, particularly for specialized vessels, further solidifying the bargaining power of these dominant players.

Suppliers of highly specialized marine equipment, such as advanced propulsion systems and sophisticated navigation technology, hold significant bargaining power over Teekay. The critical nature and unique specifications of these components mean that Teekay's fleet relies heavily on these particular inputs for safe and efficient operations.

The limited availability of viable alternatives for these specialized systems further amplifies supplier power. Developing or integrating substitute technologies can be prohibitively expensive and time-consuming for Teekay, reinforcing the suppliers' leverage in price negotiations and contract terms.

For instance, the global market for LNG carriers, a key segment for Teekay, often features proprietary engine technologies or complex cargo handling systems. Suppliers of these niche technologies can command higher prices as Teekay has few other options to fulfill its operational requirements, impacting Teekay's cost structure.

Teekay faces significant switching costs when changing suppliers for critical services like dry-docking and major engine overhauls. These costs aren't just the direct fees; they also encompass potential operational downtime, project delays, and the expense of retraining crews on new equipment or procedures. For example, a dry-docking can take weeks and cost millions, and switching providers mid-project or for routine maintenance can lead to significant financial and logistical disruptions, strengthening the bargaining power of existing, trusted suppliers.

Labor and Crew Specialization

The bargaining power of suppliers in the maritime industry is significantly shaped by the availability of specialized labor. For companies like Teekay, which operate complex vessels such as LNG, LPG, and FPSOs, finding highly skilled and certified officers and technical crew is paramount. A limited pool of these professionals, coupled with strong maritime unions, can give these specialized labor groups considerable leverage.

This leverage translates into demands for higher wages, better benefits, and improved working conditions, directly impacting Teekay's operational expenditures. In 2024, the global shortage of experienced maritime personnel, particularly for advanced gas and offshore production vessels, has intensified this dynamic. For instance, the International Maritime Organization (IMO) has highlighted ongoing challenges in crewing, especially for technologically advanced ships.

- Limited Availability of Skilled Crew: The scarcity of certified officers and specialized technicians for LNG, LPG, and FPSO operations strengthens supplier power.

- Union Influence: Strong maritime unions representing these specialized workers can negotiate for higher compensation and favorable terms, increasing Teekay's labor costs.

- Impact on Operational Costs: Increased wages and benefits demanded by specialized labor directly affect Teekay's profitability and overall financial performance.

- Global Talent Shortage: A worldwide deficit in experienced maritime professionals, a trend observed in 2024, further empowers specialized labor suppliers.

Fuel Price Volatility

Fuel price volatility significantly impacts Teekay's operating costs, as bunker fuel represents a substantial expense for its shipping fleet. Global oil prices, influenced by geopolitical tensions and fluctuating supply and demand, directly affect these costs. For instance, in early 2024, oil prices experienced notable swings, impacting shipping margins.

This reliance on fuel suppliers grants them inherent bargaining power. While Teekay employs hedging strategies to mitigate some of this risk, the fundamental need for fuel means suppliers can exert influence over Teekay's operational expenditures. This dynamic is a key consideration in managing profitability.

- Bunker fuel costs are a primary operating expense for Teekay's fleet.

- Global geopolitical events and supply-demand imbalances create significant price volatility for bunker fuel.

- Teekay utilizes hedging to manage fuel price risk, but remains dependent on fuel suppliers.

- The inherent dependence on fuel suppliers gives these entities considerable bargaining power over Teekay's operating costs.

Teekay's bargaining power with suppliers is limited due to the specialized nature of its fleet and the high costs associated with switching. The company relies on a few global shipyards for new builds and major repairs, particularly for LNG carriers and FPSOs, where these yards possess significant leverage.

Suppliers of critical, proprietary marine equipment also hold substantial power, as Teekay has few viable alternatives, leading to higher costs. Furthermore, a global shortage of skilled maritime labor, a trend noted in 2024, empowers maritime unions and specialized crew providers, increasing Teekay's labor expenses.

The significant portion of Teekay's operating costs attributed to bunker fuel also grants suppliers considerable bargaining power, despite hedging strategies.

| Supplier Category | Key Leverage Factors | Impact on Teekay | 2024 Context |

|---|---|---|---|

| Shipyards (LNG/FPSO) | Concentrated market, high capital investment, long lead times | Limited choice, higher construction/maintenance costs | Strong demand for specialized vessels |

| Specialized Equipment Providers | Proprietary technology, few alternatives, critical components | Higher prices, dependence on specific suppliers | Continued innovation in marine tech |

| Skilled Maritime Labor | Global shortage, specialized skills, union influence | Increased wage/benefit demands, higher operational costs | Persistent crewing challenges |

| Fuel Suppliers | Essential commodity, price volatility, geopolitical influence | Significant operating expense, price risk | Fluctuating oil prices impacting margins |

What is included in the product

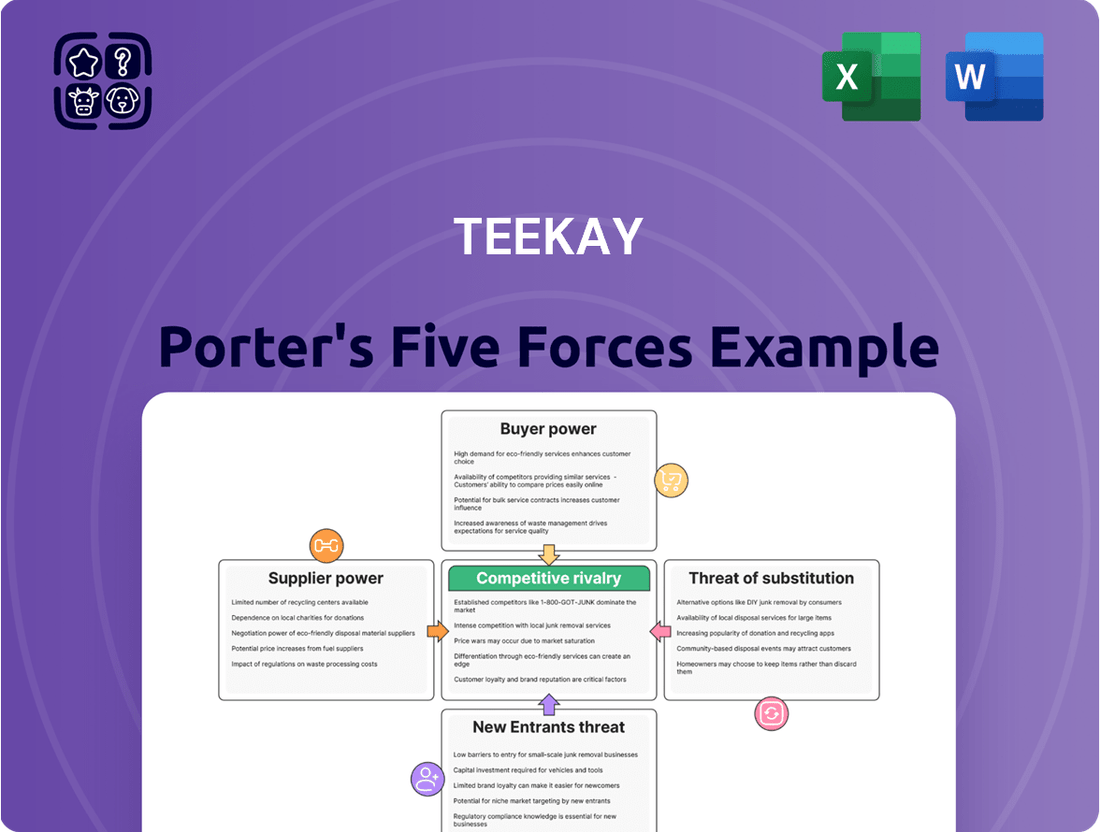

This analysis examines the five competitive forces impacting Teekay, including the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and the intensity of rivalry within the industry.

Effortlessly identify and quantify competitive pressures, transforming complex market dynamics into actionable insights for strategic pain relief.

Customers Bargaining Power

Teekay's customer base is heavily concentrated, featuring major global oil and gas corporations, energy traders, and governmental bodies. These significant players wield considerable bargaining power, largely due to their substantial purchasing volumes and the limited availability of specialized marine transportation services. For instance, a single major client could represent a significant portion of Teekay's revenue, making it challenging to push for less favorable terms.

The bargaining power of customers in the marine transportation sector, particularly for Teekay, is significantly influenced by the importance of their service to the customer. For large energy companies, marine transportation is a vital link in their global supply chains.

These major clients often possess substantial purchasing power, capable of influencing pricing and contract conditions. Their capacity to switch between providers or negotiate favorable terms stems from their scale and the essential nature of the service.

For example, in 2024, the global shipping industry saw fluctuating demand, which can empower larger customers to negotiate better rates. The ability of a customer to easily find alternative suppliers or to integrate shipping services internally can further amplify their bargaining leverage.

Teekay's customers, especially major oil and gas corporations, frequently have dedicated shipping departments and established relationships with multiple carriers. This reduces their reliance on any single shipping company, giving them considerable sway over freight rates and contract specifics.

The availability of alternative carriers significantly influences customer bargaining power in the shipping industry. In segments like conventional crude and product tankers, a crowded market with many operators provides customers with ample choice, thereby increasing their leverage. For instance, in 2024, the global tanker fleet saw continued growth, with new vessels entering the market, further intensifying competition among carriers.

However, this dynamic shifts for specialized services. For niche sectors such as Liquefied Natural Gas (LNG) shipping or Floating Production, Storage, and Offloading (FPSO) units, the number of qualified and experienced providers is considerably smaller. This limited supply of specialized vessels and expertise reduces the number of viable alternatives for customers, thereby tempering their bargaining power.

Backward Integration Potential of Customers

Large oil and gas majors, with their substantial financial resources, can exert significant bargaining power. They possess the capacity to integrate backward into marine transportation, effectively bringing shipping services in-house. This strategic option serves as a credible threat, allowing them to negotiate more favorable terms with third-party carriers such as Teekay.

Consider the scale of these players. For instance, in 2024, major integrated oil companies continued to report robust earnings, providing ample capital for such strategic moves. This financial muscle means they can absorb the costs associated with owning or chartering their own fleets, thereby reducing their reliance on external providers and increasing their leverage in price discussions.

- Financial Capacity: Major oil and gas companies often have multi-billion dollar capital expenditure budgets, enabling them to fund fleet acquisition or long-term chartering.

- Strategic Incentive: Controlling transportation can ensure supply chain reliability and potentially reduce overall logistics costs, directly impacting their profitability.

- Threat of Self-Sufficiency: The credible threat of operating their own vessels forces third-party carriers to offer competitive pricing to retain business.

- Market Influence: A significant portion of global oil and gas production volume is controlled by these majors, giving their sourcing decisions considerable weight in the market.

Market Conditions and Freight Rates

Customer bargaining power in the shipping industry is heavily shaped by market conditions. When there are too many ships for the available cargo, or when demand for shipping is low, freight rates fall. This oversupply means customers can negotiate harder for lower prices, as shipping companies compete fiercely for business.

Conversely, when the market is tight, meaning there's more cargo than available vessels, customer leverage diminishes. In such scenarios, shipping companies are in a stronger position to dictate terms and maintain higher freight rates. For instance, during periods of heightened global trade activity, like the surge seen in 2021, freight rates for container shipping experienced unprecedented increases, significantly reducing the bargaining power of customers.

The bargaining power of customers is also influenced by the availability of alternatives and the cost of switching providers. In a fragmented market with many shipping companies, customers have more choices, which increases their power. However, if switching involves significant costs or logistical complexities, customers may have less ability to push for lower prices.

- Market Oversupply: Periods of vessel oversupply lead to lower freight rates, increasing customer bargaining power.

- Subdued Demand: Weak economic activity or reduced trade volume empowers customers to demand lower prices.

- Tight Markets: High demand relative to vessel availability reduces customer leverage and strengthens shipping companies' pricing power.

- Customer Choice: The number of available shipping providers and the ease of switching influence the extent of customer bargaining power.

Teekay's customers, particularly major oil and gas companies, possess significant bargaining power due to their large order volumes and the essential nature of marine transportation for their operations. This leverage is amplified by the availability of alternative carriers in certain segments, allowing them to negotiate favorable pricing and contract terms. For instance, the global tanker market's capacity in 2024, with a substantial number of vessels available, provided customers with ample choice and thus increased their negotiation strength.

The capacity of large customers to potentially bring shipping services in-house, backed by their considerable financial resources, acts as a credible threat that further enhances their bargaining power. This threat compels carriers like Teekay to offer competitive rates to retain their business. For example, major energy firms often have multi-billion dollar capital budgets, enabling fleet expansion or long-term charters, which can reduce their dependence on third-party providers.

| Factor | Impact on Customer Bargaining Power | 2024 Market Context Example |

|---|---|---|

| Customer Concentration & Volume | High leverage for large clients due to significant purchasing power. | Major oil producers can account for a substantial percentage of a tanker company's annual revenue. |

| Availability of Alternatives | Increases power in fragmented markets; decreases in specialized segments. | In 2024, a growing global tanker fleet offered more choices for crude transport, strengthening customer negotiation. |

| Threat of Self-Sufficiency | Credible threat to integrate shipping internally reduces reliance on external carriers. | Large energy companies with robust 2024 earnings could fund their own fleets, enhancing their negotiation leverage. |

| Market Conditions (Supply/Demand) | Oversupply empowers customers; undersupply strengthens carriers. | Periods of high vessel availability in 2024 generally led to lower freight rates, boosting customer bargaining power. |

Preview Before You Purchase

Teekay Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Teekay Porter's Five Forces Analysis provides an in-depth examination of the competitive landscape within the maritime industry, specifically focusing on Teekay's strategic positioning. You’ll gain valuable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. The detailed breakdown presented here is precisely what you will receive, ensuring full transparency and immediate applicability to your business strategy.

Rivalry Among Competitors

The marine transportation industry, particularly for crude oil and LNG tankers, is characterized by a blend of large, established companies and a considerable number of smaller operators. Teekay faces robust competition from other major shipping firms, creating a highly competitive environment for securing contracts and expanding market share. For instance, in 2024, the global tanker market saw significant activity, with companies like Euronav and Frontline continuing to be major players alongside Teekay, vying for lucrative shipping routes and long-term agreements.

The marine transportation industry, while seeing growth in niche areas like Liquefied Natural Gas (LNG) and Floating Production Storage and Offloading (FPSO) vessels, generally operates in mature markets. This maturity means companies often compete fiercely for a limited pool of existing business, rather than expanding into new territory, which naturally fuels intense rivalry. For instance, in 2024, while the demand for specialized offshore units remained robust, the broader tanker market experienced fluctuating rates, pushing established players to vie more aggressively for contracts.

The maritime shipping industry, including companies like Teekay, is characterized by extremely high fixed costs due to the immense capital required for vessels and infrastructure. For instance, a modern LNG carrier can cost upwards of $200 million. These substantial fixed costs create a powerful incentive for companies to maintain high utilization rates, even if it means accepting lower freight rates.

This pressure to cover substantial fixed expenses can lead to intense competition and aggressive pricing, especially when there's overcapacity in the market. During periods of economic slowdown, such as the global economic shifts anticipated in late 2024 and into 2025, this dynamic is exacerbated. Companies may engage in price wars to secure contracts, impacting profitability across the sector.

Product Differentiation

Competitive rivalry in marine transportation is intensified by the difficulty in truly differentiating services. Companies like Teekay often focus on aspects such as fleet age and technological sophistication, reliability metrics, and robust safety histories to stand out. Specialized capabilities, like operating ice-class vessels or deploying advanced floating production, storage, and offloading (FPSO) units, also serve as key differentiators.

Teekay actively works to differentiate itself through a commitment to operational excellence across its diverse service segments, which include conventional tankers, LNG carriers, and offshore production assets. This focus on seamless execution and customer service aims to build loyalty in a market where price can often be a primary consideration.

- Fleet Modernity: Teekay's fleet modernization efforts are crucial for differentiation, with investments in newer, more fuel-efficient vessels. For example, as of late 2023, Teekay LNG Partners, a significant part of the Teekay group, operated a fleet of 48 LNG carriers and 11 conventional tankers, with ongoing newbuild programs.

- Reliability and Safety: A strong track record in operational reliability and safety is a critical differentiator, reducing downtime and risk for charterers.

- Specialized Capabilities: Teekay's involvement in the offshore sector, operating FPSOs and other production facilities, highlights its specialized technical expertise, setting it apart from pure shipping companies.

- Operational Excellence: Consistent delivery of services, efficient voyage management, and proactive maintenance contribute to Teekay's reputation for operational excellence, a key factor in securing long-term contracts.

Exit Barriers

Teekay's competitive rivalry is significantly influenced by high exit barriers within the shipping industry. The substantial capital investment required for vessels, coupled with considerable long-term debt obligations, makes it exceedingly difficult for companies to simply cease operations when market conditions turn unfavorable.

These entrenched commitments mean that even during periods of low profitability, companies like Teekay often continue to operate their fleets. This persistence contributes to persistent overcapacity in the market. When too many ships are chasing too little cargo, rates are driven down, intensifying the competitive pressure among all players.

For instance, as of the first quarter of 2024, the global shipping industry faced ongoing challenges with vessel utilization rates fluctuating significantly across different segments. Companies with substantial fixed costs, such as those operating LNG carriers or shuttle tankers as Teekay does, find it particularly hard to idle assets without incurring substantial losses, thus prolonging their presence in a weak market.

- High Capital Investment: The cost of acquiring and maintaining a modern tanker or gas carrier can range from tens of millions to hundreds of millions of dollars, creating a significant barrier to entry and exit.

- Long-Term Debt: Many shipping companies finance their vessel purchases through extensive debt, with repayment schedules extending over many years. This debt remains a liability even if the company wishes to exit the market.

- Specialized Assets: Certain vessel types, like shuttle tankers used in offshore oil production, are highly specialized and have limited alternative uses, making them difficult to sell or repurpose if a company decides to exit that specific market.

- Operational Scale: Maintaining a competitive fleet often requires a certain scale of operations. Smaller players or those struggling financially may find it difficult to divest their assets efficiently without incurring substantial write-downs.

Teekay operates in a fiercely competitive landscape, challenged by both large, established global players and smaller niche operators. The industry's high fixed costs, often exceeding $200 million for a single LNG carrier, compel companies to maintain high utilization, leading to aggressive pricing, especially during market downturns. In 2024, the tanker market, for instance, saw continued competition among major firms like Euronav and Frontline, vying for contracts amidst fluctuating freight rates.

Differentiation is challenging, but Teekay focuses on fleet modernity, reliability, safety, specialized capabilities like FPSO operations, and overall operational excellence. For example, as of late 2023, Teekay LNG Partners managed a substantial fleet, underscoring its commitment to advanced assets. These factors are crucial for securing long-term agreements in a market where price is often paramount.

High exit barriers, including significant capital investment in vessels and substantial long-term debt, mean companies often persist even in low-profitability periods. This perpetuates overcapacity, driving down rates and intensifying rivalry. As of Q1 2024, persistent overcapacity remained a concern across segments, forcing companies like Teekay to keep assets operational to avoid greater losses.

| Competitor | Fleet Size (Approx. LNG Carriers) | Fleet Size (Approx. Tankers) | Key Differentiators |

|---|---|---|---|

| Teekay | 48 (as of late 2023) | 11 (as of late 2023) | Operational excellence, specialized offshore assets, fleet modernization |

| Euronav | N/A | ~40 (VLCCs/Suezmax) | Large tanker fleet, focus on crude oil transportation |

| Frontline | N/A | ~40 (VLCCs/Suezmax) | Modern fleet, strong market presence in crude oil |

SSubstitutes Threaten

Pipelines present a significant threat of substitution for Teekay's marine transportation services, especially for crude oil and natural gas moving within continents or regions. For example, the expansion of pipeline networks in North America, like the Keystone XL project (though facing delays and cancellations in various forms), aims to move oil more directly, potentially reducing reliance on tankers for some routes. This can bypass the need for sea-borne vessels altogether for these specific flows.

However, for intercontinental trade, marine transport remains the dominant and most cost-effective solution. The sheer volume and distance involved in global oil and gas shipments make pipelines impractical and prohibitively expensive for these long-haul movements. In 2024, the vast majority of global crude oil and LNG trade continued to rely on tanker shipping, underscoring the limitations of pipeline substitution on a global scale.

Global energy consumption is undergoing a significant transformation, presenting a long-term threat to companies like Teekay. The accelerating shift towards renewable energy sources, such as solar and wind power, directly challenges the demand for fossil fuels. This transition could substantially reduce the need for transporting crude oil, LNG, and LPG, services that form the core of Teekay's business. For instance, by 2024, renewable energy sources are projected to account for a larger share of global electricity generation, impacting the volume of traditional energy commodities requiring shipment.

The rise of onshore oil and gas production in key importing nations presents a significant threat. For instance, the United States' increased shale oil output has reduced its reliance on imported crude, impacting global shipping routes. This trend directly challenges the demand for Teekay’s long-haul transportation services, as more product stays within regional supply chains.

Furthermore, advancements in local refining and processing capabilities can diminish the need for transporting intermediate or refined products over long distances. Countries investing heavily in domestic petrochemical infrastructure, like those in the Middle East, aim to process more of their crude oil locally. This shift could mean fewer opportunities for Teekay to transport refined fuels, directly affecting its tanker segment.

In 2024, many nations continued to prioritize energy independence, leading to investments in domestic energy infrastructure. This strategic focus on onshore capabilities and local processing means that the volume of oil and gas requiring international marine transport could see a structural decline in certain regions, posing a direct threat to Teekay’s market share and revenue streams.

Technological Advancements in Storage

Innovations in energy storage, while nascent for the oil and gas sector, present a future threat. Advanced battery technologies or other large-scale storage solutions could theoretically lessen the need for traditional floating storage units like Teekay's FPSOs (Floating Production, Storage, and Offloading vessels) or long-term crude oil storage in tankers. This would impact a niche but significant area of Teekay's operations, particularly for managing supply chain imbalances or storing excess production.

The global energy storage market, which includes various technologies, is projected for substantial growth. For instance, the energy storage market was valued at approximately $300 billion in 2023 and is expected to reach over $700 billion by 2030, driven by renewable energy integration and grid modernization efforts. While direct substitution for FPSOs in offshore oil production is complex, advancements in storing and distributing energy could indirectly influence the demand for traditional hydrocarbon storage infrastructure.

- Technological Shift: Innovations in energy storage, particularly in battery and hydrogen technologies, could reduce reliance on physical storage of fossil fuels.

- Market Growth: The global energy storage market is expanding rapidly, projected to grow significantly in the coming years, indicating a broader trend away from traditional storage solutions.

- Indirect Impact: While FPSOs are specialized, the overall shift towards more efficient and distributed energy storage could lessen the long-term demand for extensive crude oil storage.

- Future Consideration: Teekay must monitor developments in energy storage to assess potential long-term impacts on its FPSO and tanker storage services.

Decentralized Energy Generation

The increasing adoption of decentralized energy generation, such as rooftop solar and microgrids, presents a long-term threat of substitution for traditional, large-scale energy transportation. As more communities and businesses generate their own power locally, the reliance on transporting fossil fuels over long distances, a core business for Teekay, could gradually decrease. For instance, by the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts, a significant jump from previous years, indicating a growing trend towards localized power sources.

This shift impacts Teekay by potentially reducing the volume of crude oil and liquefied natural gas (LNG) requiring long-haul shipping. While Teekay’s current fleet is crucial for global energy distribution, the evolving energy landscape necessitates consideration of these evolving substitution patterns. The International Energy Agency (IEA) reported in early 2024 that solar PV alone accounted for nearly two-thirds of all renewable capacity additions in 2023, highlighting its rapid expansion as a decentralized solution.

- Impact on Long-Haul Movements: Decentralized generation reduces the necessity for transporting bulk energy commodities across vast distances.

- Growth in Renewables: Record renewable energy capacity additions globally, particularly solar, signal a shift away from centralized fossil fuel reliance.

- Volume Reduction: A sustained increase in localized energy production could lead to lower demand for Teekay’s core transportation services.

- Future Strategy: Teekay may need to adapt its business model to account for this long-term substitution threat from distributed energy resources.

Pipelines offer a direct substitute for Teekay's services, particularly for intra-continental energy movements. However, their effectiveness is limited for the vast intercontinental trade that defines global energy flows. Despite ongoing infrastructure projects, the sheer scale and distance of global oil and gas shipments in 2024 still overwhelmingly favor marine transport, making pipeline substitution impractical for most international routes.

The growing shift towards renewable energy sources and decentralized power generation represents a significant long-term substitution threat. As nations and regions increase their reliance on local solar, wind, and other renewables, the demand for transporting fossil fuels like crude oil and LNG diminishes. This trend, evidenced by record renewable capacity additions in 2023, directly impacts the volume of business for companies like Teekay.

Advancements in energy storage technologies, while still developing for large-scale hydrocarbon management, could indirectly affect Teekay's FPSO and storage operations. The global energy storage market's substantial growth, projected to exceed $700 billion by 2030, signals a broader move towards alternative energy solutions that may reduce the need for traditional fossil fuel storage infrastructure.

Entrants Threaten

Entering the marine transportation sector, particularly for sophisticated vessels like LNG carriers or floating production storage and offloading (FPSO) units, requires substantial capital. For instance, a new LNG carrier can cost upwards of $200 million. This immense financial outlay for acquiring or constructing such specialized assets acts as a significant deterrent for potential new players, thereby limiting the threat of new entrants.

The maritime shipping industry faces significant regulatory burdens that act as a strong barrier to new entrants. Compliance with international mandates, such as those set by the International Maritime Organization (IMO), requires substantial investment. For example, the IMO 2020 sulfur cap on fuel oil necessitated costly scrubber installations or the use of more expensive low-sulfur fuels, impacting operational expenditures for all players.

Achieving and maintaining compliance with evolving environmental standards, including upcoming decarbonization targets, presents ongoing financial and technical challenges. New companies must navigate complex permitting processes and invest in advanced, compliant technologies. These upfront and continuous compliance costs can deter potential new entrants, especially smaller firms lacking the capital reserves of established operators.

Established players like Teekay benefit from significant economies of scale in fleet management, procurement, and crew training, leading to lower per-unit operating costs. For instance, Teekay's extensive fleet allows for bulk purchasing of fuel and supplies, and optimized route planning, which smaller competitors cannot easily replicate. New entrants face the daunting task of achieving similar cost efficiencies without the accumulated operational experience and the sheer size of an incumbent fleet.

Access to Distribution Channels and Customer Relationships

New entrants face significant hurdles in accessing established distribution channels and cultivating strong customer relationships, particularly within the energy sector. Teekay, like many established players, relies on long-standing partnerships with major oil and gas companies and energy traders. These relationships are vital for securing the kind of lucrative, long-term contracts that provide consistent revenue streams and operational stability. In 2024, the dominance of these established networks means newcomers struggle to gain the necessary trust and market access to compete effectively for these critical agreements.

The difficulty in bypassing these entrenched networks is a substantial barrier. New entrants often lack the proven track record and the deep-seated trust that major clients demand when committing to multi-year, high-value transportation and logistics contracts. This makes it challenging for them to secure the volume of business needed to achieve economies of scale and profitability.

- Established Relationships: Teekay's deep ties with major oil and gas firms provide preferential access to contracts.

- Trust and Credibility: Newcomers must overcome a significant trust deficit to be considered for long-term deals.

- Market Access Barriers: Existing networks act as gatekeepers, limiting opportunities for new participants.

- Contractual Dependencies: The energy sector's reliance on long-term contracts entrenches incumbent advantages.

Limited Shipyard Capacity and Long Lead Times

The threat of new entrants in the maritime sector, specifically for Teekay's tanker and LNG carrier operations, is significantly tempered by limited global shipyard capacity and extended construction timelines. This concentration means that even if a new player had the capital, securing a build slot for new vessels, particularly specialized ones, can take years. As of early 2024, the order books for many major shipyards were already filled through 2027 and beyond, creating substantial barriers to rapid fleet expansion for potential competitors.

This scarcity of available shipyard slots directly translates into long lead times for new vessel construction. New entrants face the challenge of not only financing the substantial cost of building a fleet but also waiting an extended period before their assets can even enter the market. This delay diminishes the immediate impact a new competitor could have, allowing established players like Teekay to maintain market share and operational continuity.

- Concentrated Shipbuilding Capacity: Global shipbuilding capacity, especially for sophisticated vessels like LNG carriers, is highly concentrated among a few key nations and shipyards.

- Extended Lead Times: Order books for major shipyards were frequently extending into 2027-2028 in early 2024, making it difficult for new entrants to acquire vessels quickly.

- High Capital Investment: The cost of building even a single modern tanker or LNG carrier can run into hundreds of millions of dollars, requiring significant upfront capital.

- Technological Complexity: Modern vessels incorporate advanced technologies, requiring specialized engineering and construction expertise not readily available to all potential entrants.

The threat of new entrants in the maritime transportation sector, particularly for specialized vessels like LNG carriers and FPSOs, is significantly constrained by the immense capital requirements. Acquiring or constructing a new LNG carrier alone can exceed $200 million, a substantial financial barrier for any aspiring competitor. This high cost of entry limits the pool of potential new players, thereby reducing the overall threat.

Regulatory compliance, including adherence to stringent international maritime standards and evolving environmental regulations, presents another formidable hurdle. Navigating complex permitting and investing in the latest compliant technologies requires significant financial and technical resources, which new entrants may struggle to muster compared to established operators like Teekay.

Established players benefit from substantial economies of scale, allowing for lower per-unit operating costs through bulk purchasing and optimized fleet management. Newcomers face the challenge of matching these cost efficiencies without the accumulated experience and the sheer size of an incumbent fleet, making it difficult to compete on price.

Securing long-term contracts with major energy firms is crucial for stability, but new entrants often lack the established relationships, trust, and proven track record that clients demand. In 2024, these entrenched networks continue to act as gatekeepers, limiting market access for newcomers and reinforcing the advantages of incumbents.

Limited global shipyard capacity and extended construction timelines further stifle the threat of new entrants. As of early 2024, shipyard order books were often filled through 2027-2028, meaning even well-capitalized new players face considerable delays in acquiring new vessels, providing incumbents with a significant buffer.

| Barrier | Description | Impact on New Entrants | Example Data (Early 2024) |

|---|---|---|---|

| Capital Requirements | High cost of acquiring specialized vessels (e.g., LNG carriers). | Deters potential entrants due to immense upfront investment. | New LNG carrier cost: >$200 million. |

| Regulatory Compliance | Meeting international and environmental standards. | Requires significant investment in technology and processes. | IMO 2020 fuel standards necessitated costly upgrades. |

| Economies of Scale | Cost advantages from large-scale operations. | New entrants struggle to match cost efficiencies of established players. | Bulk purchasing power of large fleets reduces per-unit costs. |

| Customer Relationships & Trust | Long-standing partnerships in the energy sector. | New entrants face difficulty securing lucrative long-term contracts. | Dominance of established networks limits new market access. |

| Shipyard Capacity & Lead Times | Limited availability and long wait times for new vessel construction. | Delays acquisition of new assets, reducing immediate competitive impact. | Shipyard order books extending into 2027-2028. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Teekay leverages data from Teekay's annual reports, investor presentations, and SEC filings. We also incorporate industry analysis from reputable sources like Clarkson Research and industry-specific trade publications to assess competitive dynamics.