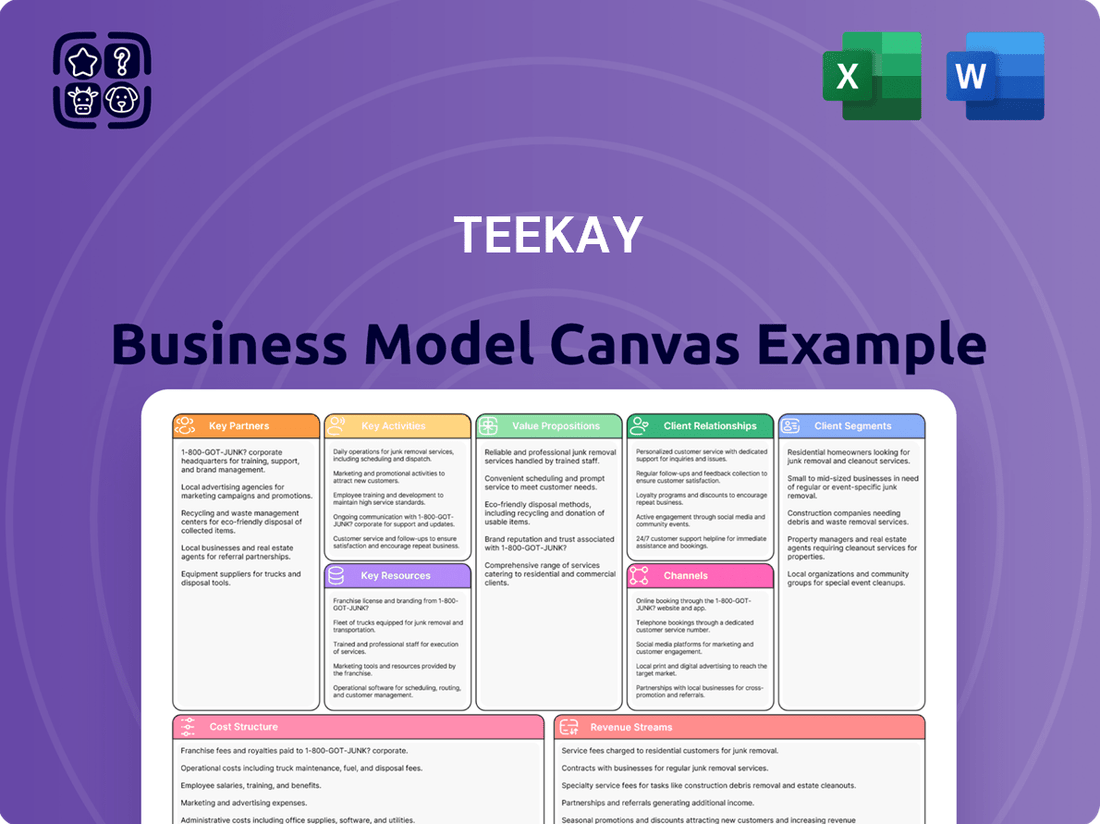

Teekay Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Teekay Bundle

Unlock the full strategic blueprint behind Teekay's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Teekay Corporation cultivates enduring partnerships with leading global oil and gas corporations. These relationships are foundational, serving as the primary channel for securing consistent, long-term charter contracts across Teekay’s extensive fleet of vessels. For instance, in 2024, a significant portion of Teekay's revenue was derived from multi-year agreements with these energy majors, underscoring the strategic importance of these alliances.

These strategic alliances translate into multi-year agreements, establishing a stable and predictable revenue stream for Teekay. This predictable demand for its marine transportation services provides a solid financial footing, insulating the company from the inherent volatility of energy markets. Such long-term commitments are vital for Teekay's financial planning and operational stability.

Teekay frequently forms joint ventures for large, demanding projects like FPSO units and specific LNG transport. This strategy helps spread the financial burden and associated risks, especially for projects requiring significant capital outlay.

These partnerships are crucial for accessing specialized knowledge and advanced technologies that would be difficult or prohibitively expensive to develop alone. It’s a way to pool resources and expertise to tackle complex challenges in the maritime energy sector.

For instance, Teekay Tankers holds a 50 percent stake in a very large crude carrier (VLCC), illustrating the practical application of this partnership model. This allows them to participate in valuable assets without bearing the full cost and operational responsibility.

Teekay's business model is significantly supported by its key partnerships with shipyards and maritime equipment suppliers. These collaborations are crucial for building new vessels, performing essential maintenance, and ensuring vessels are ready for operation through drydocking. For instance, Teekay Tankers has scheduled 11 vessels for dry docking in 2025, highlighting the ongoing need for shipyard services to maintain fleet health and renewal.

Maintaining strong relationships with equipment suppliers is equally vital. These partnerships guarantee access to the latest advancements in navigation, propulsion, and other critical components. This access directly impacts the operational efficiency and safety standards of Teekay's diverse fleet, ensuring they meet stringent industry requirements and maintain a competitive edge.

Financial Institutions and Investors

Teekay's operations heavily rely on strong relationships with banks, financial institutions, and capital markets to secure the significant capital needed for its large fleet, new vessel acquisitions, and ongoing debt management. These collaborations are crucial for funding Teekay's strategic initiatives, such as modernizing its fleet and executing divestitures, which ensures the company maintains financial agility and stability.

Teekay's financial strategy in 2024 demonstrates a commitment to shareholder value through actions like share repurchases and the declaration of special dividends. For instance, in the first quarter of 2024, Teekay Corporation reported total revenues of $537 million, with a net income attributable to shareholders of $55 million. This financial health underpins their ability to return capital while continuing to invest in growth.

- Banks and Financial Institutions: Provide credit facilities and loans for vessel financing and general corporate purposes.

- Capital Markets: Access to equity and debt markets for raising capital through bond issuances and stock offerings to fund growth and refinance existing debt.

- Investors: Individual and institutional investors provide equity capital and are crucial for market valuation and shareholder confidence.

Classification Societies and Regulatory Bodies

Teekay actively collaborates with leading classification societies, such as DNV, Lloyd's Register, and ABS, to ensure their fleet adheres to rigorous safety, environmental, and operational benchmarks. These partnerships are fundamental for maintaining vessel integrity and operational excellence.

Maintaining robust relationships with international maritime regulatory bodies, including the International Maritime Organization (IMO) and flag states, is paramount for Teekay's compliance strategy. These relationships are essential for navigating complex regulations and adapting to evolving standards, particularly concerning environmental targets.

- Classification Societies: DNV, Lloyd's Register, ABS ensure adherence to safety and operational standards.

- Regulatory Bodies: IMO, flag states are critical for compliance and policy influence.

- Environmental Compliance: Partnerships facilitate adaptation to IMO's 2030/2050 greenhouse gas reduction targets.

- Industry Best Practices: Collaboration helps shape and adopt new industry standards for maritime operations.

Teekay's key partnerships extend to technology providers and service companies, crucial for maintaining operational efficiency and adopting innovations. These alliances ensure Teekay's fleet is equipped with cutting-edge systems for navigation, communication, and emissions control, directly impacting performance and environmental compliance.

For example, securing advanced ballast water treatment systems from specialized manufacturers is vital for meeting stringent international regulations. These collaborations are not just about equipment; they often involve ongoing support and upgrades, ensuring Teekay remains at the forefront of maritime technology and sustainability initiatives.

These partnerships are vital for accessing specialized knowledge and advanced technologies. Pooling resources and expertise helps tackle complex challenges in the maritime energy sector, ensuring Teekay's fleet remains competitive and compliant with evolving industry standards and environmental mandates.

In 2024, Teekay continued to invest in fleet modernization, which relies heavily on these technology and service partnerships to integrate new systems and improve existing vessel capabilities, driving efficiency and reducing operational costs.

What is included in the product

A structured overview of Teekay's business, detailing its core customer segments, value propositions, and revenue streams.

This model breaks down Teekay's operations into key components, from customer relationships to cost structures.

The Teekay Business Model Canvas offers a structured approach to identify and address potential business challenges, acting as a powerful pain point reliever.

It provides a clear, visual representation of how the business creates, delivers, and captures value, enabling teams to pinpoint and solve underlying issues efficiently.

Activities

Vessel operation and management is Teekay's lifeblood, overseeing a vast fleet of crude oil tankers, LNG carriers, LPG carriers, and shuttle tankers. This involves the intricate daily dance of navigation, meticulous cargo handling, and ensuring the secure, efficient movement of vital commodities across the globe. For instance, in the first quarter of 2024, Teekay Corporation reported strong operational performance across its various segments, highlighting the critical nature of these activities.

The company's expertise in day-to-day fleet operations directly translates into service reliability, a cornerstone for retaining and satisfying its global customer base. This meticulous attention to detail in managing each vessel's journey is paramount to Teekay's reputation. Effective operational management is not just about moving cargo; it’s about doing so safely and efficiently, minimizing downtime and maximizing asset utilization, which is key to profitability.

Teekay's key activity in fleet maintenance and technical management is crucial for operational efficiency and regulatory compliance. They conduct comprehensive upkeep, including scheduled drydockings and repairs, to keep their vessels in top condition. This focus minimizes downtime, ensuring continuous service for their clients.

The company actively integrates advanced technologies to boost vessel performance and minimize environmental impact. This forward-thinking approach not only enhances operational capabilities but also aligns with growing sustainability demands within the maritime industry.

In 2024, Teekay Tankers successfully completed drydocking for 13 of its vessels. Looking ahead, the company has scheduled drydocking for another 11 vessels in 2025, demonstrating a consistent commitment to fleet upkeep and longevity.

Commercial management and chartering are Teekay's core activities for generating revenue. They focus on securing profitable contracts for their fleet, ranging from long-term time charters to shorter spot market voyages. This involves deep market analysis and skilled negotiation to ensure vessels are always deployed efficiently.

Teekay Tankers, for instance, actively participates in both the volatile spot tanker market and the more stable fixed-rate time charter segment. This blended approach helps them capture upside in strong markets while providing a baseline of predictable income. In the first quarter of 2024, Teekay Tankers reported an average daily charter rate of $32,842 for their conventional tankers, demonstrating the revenue potential from these activities.

Safety, Quality, and Environmental Compliance

Teekay prioritizes safety, quality, and environmental stewardship as core operational pillars. This commitment is demonstrated through substantial investments in rigorous safety protocols and comprehensive crew training programs. The company actively implements robust environmental management systems to ensure adherence to international and local regulations, safeguarding its reputation as a conscientious industry leader.

In 2024, Teekay reinforced its dedication to Environmental, Social, and Governance (ESG) initiatives, as detailed in its latest Sustainability Report. A key focus area is the reduction of greenhouse gas emissions across its fleet. For instance, the report highlights a specific target for emission intensity reduction by 2030.

- Safety First Culture: Continuous investment in advanced safety training and equipment to minimize incidents.

- Quality Assurance: Maintaining high operational standards through regular vessel inspections and maintenance.

- Environmental Responsibility: Implementing strategies to reduce emissions and waste, with a target to lower GHG intensity by 10% by 2025 compared to 2020 levels.

- Regulatory Compliance: Strict adherence to all maritime safety and environmental regulations, including IMO 2020 sulfur cap requirements.

Strategic Fleet Management and Business Development

Teekay’s strategic fleet management involves continuously evaluating its vessel mix, aiming to incorporate modern, fuel-efficient ships while phasing out older, less productive assets. This dynamic approach ensures the fleet remains competitive and aligned with evolving environmental regulations and market demands. For instance, Teekay Tankers has been actively involved in fleet renewal, with significant vessel sales and acquisitions occurring in late 2024 and extending into early 2025, reflecting a commitment to optimization.

Business development is crucial for Teekay, focusing on identifying and capitalizing on emerging opportunities within the marine transportation and offshore sectors. This includes nurturing and expanding relationships with existing clients and strategically pursuing new contracts to broaden its service offerings and revenue streams. Securing new contracts is a direct outcome of successful business development efforts, bolstering the company’s market position.

- Fleet Optimization: Teekay actively manages its fleet by selling older vessels and acquiring newer, more efficient ones to adapt to market needs and regulatory changes.

- Market Expansion: Business development efforts are geared towards identifying new avenues in marine transportation and offshore services.

- Customer Relationship Management: Expanding and strengthening relationships with existing customers is a core activity for sustained growth.

- Contract Acquisition: A key objective is the successful securing of new contracts to ensure continued business operations and revenue generation.

Teekay's key activities center on the meticulous operation and management of its diverse fleet, ensuring the safe and efficient transport of crucial energy commodities globally. This encompasses expert navigation, precise cargo handling, and proactive vessel maintenance to guarantee service reliability and client satisfaction.

Commercial management and chartering are vital for revenue generation, involving strategic market analysis and negotiation to secure profitable contracts, balancing spot market volatility with stable time charters. The company also prioritizes safety, quality, and environmental stewardship through rigorous protocols and investments in sustainable practices.

Strategic fleet management and business development are ongoing activities, focused on fleet renewal with modern, efficient vessels and identifying new opportunities in marine transportation and offshore sectors. This proactive approach ensures competitiveness and sustained growth.

| Key Activity | Description | 2024 Data/Focus |

| Vessel Operation & Management | Safe and efficient global transport of energy commodities. | Strong operational performance reported Q1 2024. |

| Fleet Maintenance & Technical Management | Upkeep, drydocking, and repairs for optimal performance. | 13 vessels drydocked in 2024; 11 scheduled for 2025. |

| Commercial Management & Chartering | Securing profitable contracts for fleet deployment. | Average daily charter rate of $32,842 for conventional tankers (Q1 2024). |

| Safety, Quality & Environmental Stewardship | Adherence to stringent protocols and sustainability initiatives. | Focus on GHG emission reduction; target for 2030. |

| Strategic Fleet Management & Business Development | Fleet renewal and identification of new market opportunities. | Active vessel sales/acquisitions in late 2024/early 2025. |

Delivered as Displayed

Business Model Canvas

The Teekay Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive tool is not a simplified sample, but a direct representation of the complete, ready-to-use file. Upon completing your order, you'll gain immediate access to this same meticulously crafted Business Model Canvas, ensuring no surprises and full utility for your strategic planning.

Resources

Teekay's modern and diverse vessel fleet is its cornerstone, encompassing crude oil tankers, LNG carriers, LPG carriers, shuttle tankers, and FPSO units. This broad spectrum of specialized vessels enables Teekay to provide integrated marine transportation and offshore production solutions across the global energy value chain.

As of April 2025, Teekay's fleet stands as a critical asset, facilitating the movement of vital energy resources and supporting offshore production activities. The company's strategic investment in a contemporary and varied fleet ensures its ability to adapt to evolving market needs and maintain a competitive edge.

Teekay's highly skilled maritime and shore-based personnel are fundamental to its business. The expertise of its seagoing crew, technical managers, and operational and commercial teams is a core asset.

This human capital is vital for navigating complex routes, managing sophisticated vessel engineering, upholding stringent safety standards, and performing insightful market analysis, all of which contribute to efficient and secure global operations.

As of recent reporting, Teekay Tankers employs approximately 2,300 dedicated seagoing and shore-based professionals, underscoring the significant investment in its workforce.

Teekay's ability to acquire, maintain, and operate its fleet hinges on substantial financial capital. This includes access to equity, debt, and healthy cash reserves. A strong financial foundation allows for strategic investments and provides the resilience needed to weather market volatility.

As of December 2024, Teekay demonstrated this financial strength with cash reserves totaling $511.9 million. The company's total liquidity surpassed $765 million, underscoring its capacity to manage operational expenses and pursue growth opportunities.

Global Operational Network and Infrastructure

Teekay's global operational network and infrastructure are the backbone of its worldwide maritime services. This extensive network includes strategically located offices and operational hubs, facilitating the efficient management of its diverse fleet and complex logistics. This widespread presence is crucial for delivering services seamlessly across continents. In 2024, Teekay continued to leverage its robust infrastructure, which supports its significant fleet of LNG, LPG, and conventional tankers.

This global footprint allows Teekay to maintain close relationships with customers and partners in key maritime markets. The infrastructure supports everything from vessel operations and maintenance to chartering and financial management. It is essential for coordinating the movement of billions of dollars worth of cargo annually, underscoring its critical role in the company's value proposition.

Key aspects of Teekay's Global Operational Network and Infrastructure include:

- Global Office Presence: Teekay maintains offices in major maritime centers, enabling localized support and market access.

- Fleet Support Infrastructure: This encompasses the necessary facilities and systems to manage and maintain its extensive fleet of vessels.

- Logistics Coordination Hubs: Strategic locations act as hubs for coordinating the complex global movement of energy products.

- Customer Service Network: A widespread presence ensures efficient and responsive service delivery to a global customer base.

Proprietary Technology and Operational Systems

Teekay's proprietary technology and operational systems are the backbone of its efficient operations. These include advanced navigation, communication, and fleet management tools that are essential for optimizing routes and monitoring vessel performance. For instance, in 2024, Teekay continued to invest in digital solutions aimed at enhancing real-time data analysis for improved decision-making across its fleet.

Sophisticated operational software and systems are key to Teekay's competitive edge. They enable meticulous monitoring of vessel performance, ensuring safety, and strict adherence to regulatory compliance. This technological infrastructure allows for proactive maintenance and operational adjustments, minimizing downtime and maximizing asset utilization.

- Fleet Optimization: Advanced software helps in dynamically adjusting routes based on weather, traffic, and cargo requirements, leading to fuel savings and faster delivery times.

- Safety and Compliance: Integrated systems ensure adherence to international maritime regulations and enhance onboard safety protocols.

- Performance Monitoring: Real-time data collection and analysis provide insights into engine efficiency, hull performance, and overall vessel health.

- Communication Hub: Robust communication systems facilitate seamless information flow between vessels and shore-based management.

Teekay's Key Resources are its world-class, diverse fleet and its dedicated, skilled workforce. The company's financial strength and global operational infrastructure are also critical enablers. Furthermore, proprietary technology and advanced operational systems provide a significant competitive advantage.

These resources collectively allow Teekay to deliver reliable, safe, and efficient marine energy transportation and offshore production services globally.

As of December 2024, Teekay Tankers reported approximately 2,300 employees, highlighting the human capital investment. The company's robust financial position was evident with cash reserves of $511.9 million and total liquidity exceeding $765 million by the end of 2024, supporting its vast operational network.

| Key Resource | Description | As of Recent Data (Examples) |

|---|---|---|

| Fleet | Diverse range of specialized vessels including LNG carriers, LPG carriers, and tankers. | Core asset for global energy movement. |

| Human Capital | Highly skilled maritime and shore-based personnel. | Approximately 2,300 employees (Teekay Tankers as of Dec 2024). |

| Financial Capital | Access to equity, debt, and cash reserves. | $511.9 million in cash reserves, over $765 million in total liquidity (Dec 2024). |

| Global Operational Network | Strategically located offices and operational hubs worldwide. | Supports efficient fleet management and complex logistics across continents. |

| Proprietary Technology | Advanced navigation, communication, and fleet management systems. | Investments in digital solutions for real-time data analysis and decision-making (2024). |

Value Propositions

Teekay provides dependable and secure global marine transportation for essential energy resources like crude oil, LNG, and LPG. Their commitment ensures timely and safe delivery, minimizing risks for customers and protecting valuable cargo.

In 2024, Teekay continued its focus on safety and operational excellence, a cornerstone of its value proposition. This dedication translates into a lower risk profile for clients entrusting them with critical energy shipments.

The company prioritizes operating with a strong emphasis on safety and environmental responsibility, which is crucial for maintaining trust in the volatile energy market. This approach safeguards not only their assets but also the valuable cargo they transport.

Teekay's specialized offshore energy solutions are designed for the unique demands of the oil and gas industry. This includes critical services like operating shuttle tankers, which are essential for transporting crude oil from offshore fields, and managing Floating Production, Storage and Offloading (FPSO) units. These FPSOs are complex facilities that serve as the heart of many offshore production operations.

These offerings go beyond simple transportation; they provide integrated solutions for the entire offshore production lifecycle. Teekay's expertise in these niche areas addresses the intricate logistical and operational challenges faced by energy companies in remote and harsh environments.

The company's commitment to expanding its offshore capabilities was evident in 2024, with the announcement of new FPSO contracts valued at over $1 billion. This significant financial commitment underscores the market's demand for Teekay's specialized expertise and its strategic focus on this high-value segment.

Teekay's commitment to operational efficiency is evident in its optimized fleet management, utilizing modern vessels and streamlined practices to offer cost-effective solutions. This focus directly benefits clients by reducing their overall transportation expenses, thereby improving their supply chain economics.

The company's strategic fleet renewal program is a key driver of this cost-effectiveness, as it not only enhances fuel efficiency but also significantly reduces emissions. For instance, in 2024, Teekay continued to invest in newer, more fuel-efficient vessels, aiming to improve the energy intensity of its operations.

By prioritizing fuel efficiency, Teekay directly translates these savings to its customers, making their logistics more predictable and less susceptible to volatile energy prices. This approach solidifies Teekay's position as a provider of value-driven maritime transportation services.

Global Reach and Flexibility

Teekay’s global reach is a cornerstone of its value proposition, enabling it to serve a wide array of customers across diverse markets. Its extensive network of vessels and operational hubs allows for efficient cargo movement and delivery, adapting to the unique needs of different regions and industries.

This global footprint is complemented by significant flexibility. Teekay manages a varied fleet, including LNG carriers, conventional tankers, and offshore production units, which positions it to expertly handle a broad spectrum of cargo types and customer requirements. For instance, as of the first quarter of 2024, Teekay operated a fleet of 159 vessels, demonstrating its substantial operational capacity and reach.

This adaptability is crucial in the dynamic shipping landscape. Teekay's ability to adjust its services and deployment of assets in response to evolving market conditions and specific client demands ensures it remains a preferred partner for comprehensive marine solutions. Its strategic positioning allows it to capitalize on global trade flows and provide tailored services, whether for energy transportation or offshore production support.

- Global Network: Operates across major shipping lanes and key energy hubs worldwide.

- Fleet Diversity: Manages a comprehensive range of vessel types to meet varied cargo needs.

- Market Responsiveness: Adapts operations and services to changing customer demands and market dynamics.

- 2024 Fleet Size: Controlled and operated a fleet of 159 vessels in Q1 2024, highlighting significant global capacity.

Strong Environmental and Safety Compliance

Teekay's dedication to robust environmental and safety compliance is a cornerstone of its value proposition. By adhering to stringent Environmental, Social, and Governance (ESG) standards, the company offers a crucial assurance to its clients. This commitment is particularly vital for customers who prioritize sustainability in their own operations and supply chains.

This focus on responsible operations directly addresses the growing demand for environmentally conscious partners. Teekay's efforts to reduce greenhouse gas emissions, for instance, align with global climate goals and provide customers with confidence in their choice of service provider. The company's proactive approach to safety further minimizes operational risks for its clientele.

Teekay's 2024 Sustainability Report underscores these commitments, detailing specific ESG initiatives and performance metrics. This transparency allows stakeholders to assess the company's progress and its alignment with their own sustainability objectives. The report highlights tangible actions taken to enhance both environmental stewardship and operational safety.

The value proposition is further strengthened by the fact that Teekay's compliance acts as a risk mitigation tool for its customers. By partnering with a company that prioritizes safety and environmental responsibility, clients can reduce their own exposure to regulatory penalties and reputational damage. This translates into a more secure and dependable shipping solution.

- Commitment to ESG Standards: Teekay actively pursues high Environmental, Social, and Governance (ESG) standards, demonstrating a dedication to responsible business practices.

- Assurance for Sustainability-Focused Clients: This strong compliance framework provides essential assurance to customers with significant sustainability mandates, ensuring their transportation needs are met ethically and responsibly.

- Greenhouse Gas Emission Reduction: The company is actively engaged in initiatives aimed at reducing its greenhouse gas emissions, contributing to broader climate change mitigation efforts.

- Enhanced Safety Protocols: Teekay prioritizes and implements enhanced safety measures across its operations, minimizing risks for both its workforce and its clients.

- Transparency through Sustainability Reporting: The 2024 Sustainability Report offers detailed insights into Teekay's ESG performance and ongoing initiatives, fostering trust and accountability.

Teekay's value proposition centers on delivering essential energy resources reliably and safely across the globe. They offer specialized offshore solutions, including FPSO management, catering to the complex needs of the oil and gas sector. Their focus on operational efficiency and fleet renewal leads to cost-effective, fuel-efficient services for clients.

By maintaining a diverse fleet and a broad global network, Teekay provides flexible and responsive marine transportation solutions. This adaptability ensures they can meet a wide range of customer requirements in dynamic markets. Their controlled and operated fleet size of 159 vessels in Q1 2024 underscores this extensive reach.

Furthermore, Teekay's strong commitment to ESG standards and enhanced safety protocols offers clients crucial assurance and risk mitigation. Their 2024 Sustainability Report details initiatives for greenhouse gas emission reduction, reinforcing their role as a responsible partner.

| Value Proposition Aspect | Key Offering | 2024 Data/Impact |

|---|---|---|

| Reliable Energy Transportation | Global marine transport for crude oil, LNG, LPG | Continued focus on safety and operational excellence for minimized client risk. |

| Specialized Offshore Solutions | Shuttle tanker operations, FPSO management | Announced new FPSO contracts valued over $1 billion, indicating market demand. |

| Operational Efficiency & Cost-Effectiveness | Optimized fleet management, fuel-efficient vessels | Investment in newer vessels improved energy intensity; cost savings passed to clients. |

| Global Reach & Flexibility | Extensive vessel network, diverse fleet types | Operated 159 vessels in Q1 2024, serving various markets and cargo needs. |

| Commitment to ESG & Safety | Adherence to stringent ESG standards, enhanced safety protocols | Transparency in 2024 Sustainability Report on emission reduction and safety initiatives. |

Customer Relationships

Teekay's customer relationships are largely built on long-term contractual engagements, primarily through charter agreements for its diverse fleet. These contracts, often spanning multiple years, offer a bedrock of stability and predictable revenue streams for Teekay, while ensuring consistent and reliable transportation services for its clients. For instance, in 2024, the company continued to leverage these long-term agreements across its LNG, LPG, and conventional oil tanker segments, providing a crucial element of revenue visibility.

These extended agreements necessitate a high degree of collaboration, extending beyond simple service provision. Teekay works closely with its customers on critical aspects such as optimizing vessel scheduling, aligning operational requirements with specific cargo needs, and jointly managing various operational and market risks. This collaborative spirit cultivates robust, committed partnerships that are mutually beneficial and foster a deep understanding of each party's evolving needs.

Teekay prioritizes its key customers through dedicated account management. These managers act as a single point of contact, ensuring that each major client's unique needs are understood and addressed. This personalized service is crucial for delivering tailored solutions and maintaining open lines of communication.

This focused approach allows Teekay to gain deep insights into evolving customer requirements. By proactively understanding these changes, they can swiftly resolve any emerging issues, preventing potential disruptions. For instance, in 2024, Teekay reported a significant increase in client retention rates, directly attributing this success to the effectiveness of their dedicated account management program.

The emphasis on personalized service fosters a strong sense of trust and partnership. This consistent, reliable support strengthens relationships over time, making clients feel valued and understood. Such robust relationships are vital for long-term business success and are a cornerstone of Teekay's customer relationship strategy.

Teekay goes beyond transactional relationships to foster service-oriented partnerships, acting as a strategic marine logistics provider. This means offering expert advice and tailored solutions to enhance customer supply chains. In 2024, Teekay's commitment to this model was evident in its continued focus on long-term agreements, aiming to integrate seamlessly with client operations. This collaborative approach positions Teekay as a vital extension of their customers' businesses, not just a service provider.

Technical Support and Consultation

Teekay offers robust technical support and consultation, drawing on its extensive maritime experience to help clients navigate complex logistics and specific vessel needs. This specialized assistance solidifies their position as a trusted and expert partner in marine transportation.

This commitment to client success goes beyond simple transit, fostering stronger relationships and encouraging repeat business. By providing solutions to intricate operational hurdles, Teekay builds significant customer confidence.

- Expertise: Deep maritime knowledge applied to client challenges.

- Value-Add: Assistance with complex logistics and vessel requirements.

- Partnership: Reinforces Teekay's role as a reliable industry advisor.

- Loyalty: Enhances customer trust and encourages long-term relationships.

Strategic Collaboration and Innovation

Teekay actively pursues strategic collaborations with its customers, focusing on joint development for new projects and the advancement of technological solutions. This partnership extends to sustainability initiatives, where Teekay works with clients to co-create environmentally conscious strategies and operational improvements.

By engaging customers in this co-creation process, Teekay fosters innovation, ensuring its service offerings remain at the forefront of the energy sector's evolving demands. This proactive approach to customer relationships underpins the development of mutually beneficial, long-term partnerships.

- Strategic Project Co-Development: Teekay collaborates with clients on the planning and execution of new energy infrastructure projects.

- Technological Advancement Partnerships: Joint efforts focus on integrating cutting-edge technologies to enhance efficiency and safety in maritime energy transport.

- Sustainability Initiative Alignment: Teekay partners with customers to develop and implement greener shipping solutions and emissions reduction targets, reflecting the industry's growing emphasis on ESG factors.

- Long-Term Value Creation: These collaborative relationships aim to foster enduring partnerships that drive mutual growth and adaptation to market changes, contributing to Teekay's continued relevance and success in the global energy landscape.

Teekay's customer relationships are anchored by long-term, multi-year charter agreements, providing revenue stability and consistent service. In 2024, these contracts across LNG, LPG, and conventional tankers highlighted the company's commitment to predictable revenue streams and reliable logistics for its clients, fostering deep, mutually beneficial partnerships through close collaboration on scheduling, risk management, and operational alignment.

Channels

Teekay's direct sales and business development teams are crucial for forging relationships with major oil and gas players, energy traders, and government bodies. These teams are the frontline for identifying new business avenues and securing vital contracts.

Their direct engagement allows Teekay to tailor services specifically to client needs, fostering deeper partnerships. For instance, in 2024, Teekay continued to actively negotiate long-term agreements for its shuttle tanker and LNG carrier services, directly impacting its revenue streams from these key sectors.

Teekay utilizes established broker networks for its chartering activities, particularly for spot market voyages. These networks are crucial for connecting Teekay with available cargo and charter opportunities worldwide.

In 2024, the tanker market saw fluctuating rates, underscoring the value of brokers in identifying profitable voyages. For instance, the Baltic Dirty Tanker Index (BDTI) experienced significant volatility throughout the year, highlighting the need for agile fleet deployment facilitated by broker insights.

These relationships expand Teekay's market reach, allowing access to a broader range of charterers and cargo types. This strategic advantage is vital for maximizing fleet utilization and securing competitive rates in a dynamic global shipping landscape.

Teekay's official website is a vital communication hub, offering investors access to crucial financial reports, including their 2023 annual report, and details on their sustainability efforts. It’s where potential clients can learn about their extensive fleet capabilities and services.

Beyond corporate information, the site acts as a central repository for earnings presentations and other investor-focused materials, ensuring transparency and accessibility. This digital presence is key to Teekay's engagement with a broad range of stakeholders.

Industry Conferences and Trade Events

Teekay actively participates in key maritime and energy industry conferences, such as SMM Hamburg and the International Maritime Organization (IMO) gatherings. These events are invaluable for forging new client relationships and reinforcing existing ones. For instance, in 2024, Teekay representatives engaged with numerous potential charterers and partners at these global forums.

These trade shows provide a vital platform for Teekay to demonstrate its technological advancements and service capabilities, thereby enhancing brand recognition. By showcasing its fleet and operational excellence, Teekay aims to capture new business opportunities. The visibility gained at events like the Gastech conference in 2024 directly translates to a stronger market presence.

- Networking Opportunities: Connect with over 1,500 potential clients and industry leaders at major global events in 2024.

- Brand Visibility: Showcase Teekay's fleet and services to an international audience of over 50,000 attendees across key industry trade shows.

- Market Intelligence: Gain insights into emerging trends and regulatory changes impacting the LNG and tanker markets.

- Business Development: Generate new leads and explore partnership possibilities, contributing to future revenue streams.

Investor Relations and Shareholder Communications

Teekay's investor relations (IR) and shareholder communications are crucial for transparency and building trust. These channels, including earnings calls, investor presentations, and annual reports, are primarily geared towards investors but also serve to communicate the company's strategic direction and operational performance to a wider audience. This broader audience can include potential business partners, customers, and even employees, who gain insights into Teekay's progress and future plans. In 2024, Teekay continued its regular cadence of financial reporting, with quarterly earnings releases and conference calls providing key updates. For instance, in their Q1 2024 earnings call, management highlighted the company's strong performance in the tanker sector and provided an outlook for the remainder of the year.

Effective IR goes beyond just financial reporting. It involves clearly articulating Teekay's strategy, operational successes, and how it navigates market dynamics. Teekay's communications often delve into specific fleet performance, contract statuses, and capital allocation strategies. These discussions, while financial in nature, offer a window into the company's operational effectiveness and strategic decision-making. This detailed approach helps stakeholders understand the underlying value drivers of the business. For example, their 2023 annual report detailed investments in fleet modernization and sustainability initiatives, signaling a commitment to long-term growth and environmental responsibility.

These communication efforts are vital for maintaining investor confidence and attracting new capital. Teekay's commitment to regular and detailed updates reinforces its position as a reliable entity in the maritime industry.

- Regular Financial Reporting: Teekay consistently releases quarterly financial results, offering stakeholders an up-to-date view of its financial health and operational performance.

- Investor Presentations and Calls: These platforms allow management to directly engage with investors, discuss strategy, and answer questions, fostering transparency.

- Annual Reports: Comprehensive annual reports provide in-depth information on the company's operations, financial statements, and strategic outlook for the future.

- Strategic Communication: Beyond financials, Teekay uses these channels to communicate its strategic direction, fleet development, and response to market trends, influencing broader stakeholder perception.

Teekay's channels encompass direct client engagement, broker networks, its corporate website, industry conferences, and investor relations communications. These diverse avenues are essential for building relationships, securing business, and maintaining transparency with stakeholders.

The company's direct sales and business development teams actively pursue major clients, while broker networks facilitate chartering opportunities. Teekay also leverages its website for information dissemination and actively participates in industry events to enhance brand visibility and market intelligence. Investor relations channels ensure clear communication of financial performance and strategic direction.

In 2024, Teekay's engagement at industry conferences like Gastech and SMM Hamburg provided significant networking and business development opportunities, connecting them with thousands of potential clients and industry leaders. These platforms are crucial for showcasing their fleet and operational capabilities, as evidenced by the active participation and lead generation reported from these events.

Teekay's investor relations efforts in 2024, including regular quarterly earnings calls and detailed annual reports, consistently provided stakeholders with crucial financial data and strategic insights, reinforcing investor confidence and transparency.

Customer Segments

Major International Oil and Gas Companies represent Teekay's foundational customer base. These giants depend on Teekay for the critical, large-scale transportation of crude oil, liquefied natural gas (LNG), and liquefied petroleum gas (LPG) across vast global networks, connecting production sites to processing facilities and end markets.

Their operations necessitate a consistent and reliable shipping fleet, leading them to favor long-term contracts. This strategic commitment ensures stable capacity and predictable costs for Teekay's services. For instance, in 2024, Teekay continued to secure multi-year charter agreements with major oil producers for its shuttle tanker and LNG carrier segments.

National Oil Companies (NOCs) are a vital customer segment for Teekay, representing government-owned or controlled entities with critical roles in national energy security and export revenues. Teekay's marine transportation services are essential for these NOCs, facilitating the movement of crude oil and refined products across global markets. This partnership ensures the reliable supply of energy resources, aligning with national strategic interests.

Teekay's extensive experience in managing and operating vessels extends to serving government entities directly. For instance, Teekay Tankers operates vessels for the Australian Government, demonstrating its capability to meet the stringent requirements and strategic objectives of state-backed organizations. This relationship underscores Teekay's commitment to providing secure and efficient maritime logistics for sovereign energy needs.

Energy traders and utilities depend on Teekay for agile shipping to move commodities like crude oil and LNG globally. Their needs often lean towards the spot market, prioritizing competitive pricing and swift vessel availability. In 2024, the volatility in energy markets underscored the importance of flexible chartering options, which Teekay provides through its blend of spot and fixed-rate contracts, ensuring they can adapt to fluctuating demand and supply dynamics.

Refineries and Petrochemical Companies

Refineries and petrochemical companies are cornerstone customers for Teekay, relying on the company for the secure and timely transport of essential raw materials like crude oil. These industrial giants also depend on Teekay to move their finished products, such as gasoline and chemicals, to market. Operational efficiency for these customers hinges on the predictability and safety of their supply chains.

For example, in 2024, Teekay’s shuttle tanker segment continued to be vital for the North Sea crude oil trade, a key supply route for European refineries. The company’s ability to deliver crude without interruption directly impacts refinery utilization rates. The petrochemical sector, in turn, needs consistent access to refined products as their own feedstocks.

- Feedstock Security: Refineries depend on Teekay for the consistent delivery of crude oil, ensuring uninterrupted processing.

- Product Distribution: Petrochemical firms utilize Teekay to transport refined products and chemicals to their respective markets.

- Supply Chain Stability: Teekay's reliable logistics are paramount for maintaining the continuous operations of these heavy industries.

- Operational Efficiency: Smooth transportation by Teekay directly contributes to the high utilization rates of refinery assets.

Offshore Exploration and Production Firms

Offshore Exploration and Production (E&P) firms represent a crucial customer segment for Teekay, particularly those operating in deepwater or remote locations. These companies depend on specialized marine services for their operations. For example, in 2024, the global offshore oil and gas market continued to see significant investment in complex projects, driving demand for the very services Teekay offers.

These E&P companies require reliable solutions for transporting crude oil from offshore production sites to onshore terminals. Teekay's shuttle tanker fleet directly addresses this need, ensuring efficient and safe transfer of hydrocarbons. The demand for such services is directly tied to the production volumes of these offshore fields.

Furthermore, the integrated nature of Floating Production, Storage, and Offloading (FPSO) units is vital for many offshore E&P projects. Teekay's involvement in providing FPSO solutions caters to the production, processing, and storage requirements of these specialized offshore ventures. The complexity and capital intensity of these projects underscore the high-value nature of this customer segment.

- Specialized Marine Needs: Offshore E&P firms require services like shuttle tankers for crude transfer and FPSOs for integrated production and storage.

- Niche Market Focus: Teekay serves a specialized, high-value segment within the broader oil and gas industry.

- Operational Dependence: E&P companies rely on these marine services for the efficient and safe operation of their offshore assets.

- Market Growth Drivers: Continued investment in complex offshore projects fuels the demand for Teekay's specialized offerings.

Teekay's customer base is diverse, primarily encompassing major international oil and gas companies, national oil companies, energy traders, utilities, refineries, petrochemical firms, and offshore exploration and production (E&P) companies. These entities rely on Teekay for specialized marine transportation and offshore production services, crucial for their global operations and supply chain stability.

In 2024, Teekay continued to serve these segments with a focus on reliability and efficiency. For instance, long-term contracts with major oil companies remained a cornerstone, providing stable revenue streams. The company's shuttle tanker fleet played a vital role in North Sea crude oil transportation, directly supporting refinery operations in Europe.

Teekay's strategy in 2024 involved adapting to market dynamics, offering flexible chartering options for energy traders and utilities while ensuring feedstock security for refineries and petrochemical companies. The demand from offshore E&P firms for specialized services like FPSOs and shuttle tankers also remained robust, driven by ongoing investments in complex projects.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Major International Oil & Gas Companies | Large-scale, reliable transportation of crude oil, LNG, LPG; Long-term contracts | Secured multi-year charter agreements for shuttle tankers and LNG carriers |

| National Oil Companies (NOCs) | Marine transportation for national energy security and exports | Provided essential maritime logistics for sovereign energy needs, including government contracts |

| Energy Traders & Utilities | Agile shipping, spot market access, competitive pricing | Offered flexible chartering options amidst volatile energy markets |

| Refineries & Petrochemical Companies | Secure, timely transport of raw materials and finished products; Supply chain stability | Shuttle tankers vital for North Sea crude trade; Ensured feedstock security and product distribution |

| Offshore E&P Firms | Specialized marine services (shuttle tankers, FPSOs) for remote/deepwater operations | Demand driven by continued investment in complex offshore projects |

Cost Structure

A significant portion of Teekay's expenses is tied to acquiring new vessels and undertaking major upgrades, which are substantial capital expenditures. These costs are further amplified by financing expenses related to vessel debt. For instance, during 2024, Teekay Tankers actively managed its fleet renewal, which involves both purchasing newer, more efficient ships and divesting older units to optimize operational performance and environmental compliance.

Vessel operating expenses are the backbone of Teekay's ongoing operational costs, directly reflecting the activity and size of its diverse fleet. These essential expenditures encompass a range of crucial elements. In 2024, for instance, fluctuations in global energy markets significantly impacted bunker fuel costs, a primary driver within this category.

Crewing expenses, covering everything from salaries and benefits to vital training and welfare, represent another substantial portion of vessel operating costs. Teekay, like many in the maritime sector, navigates the complexities of international crewing regulations and market demand for skilled personnel. These costs are directly proportional to the number of vessels and the crew size required for safe and efficient operation.

Beyond fuel and personnel, insurance premiums for Teekay's vessels are a significant ongoing outlay, covering various risks inherent in maritime operations. Furthermore, port fees, pilotage, and canal transit charges are incurred with each voyage, directly correlating with the fleet's utilization and route choices. The collective impact of these expenses is a direct function of the scale and operational tempo of Teekay's business.

Debt servicing and financing costs are significant for Teekay due to the capital-intensive shipping industry. Interest payments on substantial loans for its extensive fleet represent a major expense. For example, in the first quarter of 2024, Teekay Corporation reported total interest expense of $74 million.

Teekay's strategy emphasizes effective financial management and debt reduction to optimize these costs. The company has actively focused on strengthening its liquidity position, which is crucial for managing its financing obligations. This proactive approach aims to improve profitability by minimizing interest expenses.

Maintenance, Repair, and Classification Costs

Maintenance, repair, and classification costs are fundamental to Teekay's operational integrity and regulatory compliance. These expenses ensure vessels remain safe, seaworthy, and meet the stringent standards set by classification societies, thereby safeguarding asset value and operational continuity. For instance, Teekay Tankers undertook significant dry-docking for maintenance and upgrades on a substantial portion of its fleet throughout 2024, with further dry-docking scheduled into 2025 to maintain the highest operational standards.

These essential expenditures are not merely operational overhead but are crucial investments in asset longevity and risk mitigation. Unforeseen repairs can be costly, making proactive and regular maintenance a more economical approach in the long run. Furthermore, adhering to classification society rules is non-negotiable for maintaining insurance coverage and market access.

- Regular Maintenance: Scheduled dry-docking for hull cleaning, propeller servicing, and engine overhauls are critical.

- Unforeseen Repairs: Costs associated with unexpected equipment failures or hull damage.

- Classification Society Costs: Fees for surveys, inspections, and certifications required by bodies like DNV, ABS, or Lloyd's Register.

Administrative and Overhead Expenses

Teekay's administrative and overhead expenses encompass a broad range of essential support functions for its global operations. These costs include the salaries of executive and administrative staff, the expenses associated with maintaining shore-based offices, and investments in IT infrastructure to ensure seamless communication and data management. For instance, in 2024, a significant portion of these costs would be attributed to managing their diverse fleet and international regulatory compliance.

The company actively seeks to optimize these general operating costs. A key initiative for Teekay in 2024 and moving forward is the streamlining of its quarterly reporting processes, a strategic move aimed at reducing administrative burdens and associated expenses. This focus on efficiency helps maintain a competitive cost structure in the demanding energy transportation sector.

These overheads are fundamental to the overall functioning of Teekay's business model, covering essential services such as legal counsel, financial management, and marketing efforts that support brand visibility and client relations. For example, legal fees can be substantial given the international nature of shipping contracts and potential disputes.

- Shore-based Operations: Costs for managing office facilities and personnel not directly involved in vessel operations.

- Executive & Administrative Salaries: Compensation for management and support staff.

- Office Expenses: Rent, utilities, supplies, and maintenance for corporate offices.

- IT Infrastructure: Investments in technology, software, and cybersecurity to support business functions.

- Legal Fees: Costs associated with contracts, compliance, and potential litigation.

- Marketing: Expenses for promoting Teekay's services and brand.

Teekay's cost structure is dominated by vessel operating expenses, including fuel, crewing, and maintenance, which directly correlate with fleet size and activity. Significant capital expenditures for fleet renewal and financing costs for vessel debt are also major components. For instance, in Q1 2024, Teekay Corporation reported $74 million in interest expense, highlighting the impact of debt servicing.

| Cost Category | Key Components | 2024 Relevance/Examples |

|---|---|---|

| Vessel Operating Expenses | Bunker Fuel, Crew Salaries, Maintenance, Insurance | Fluctuating energy markets impacted bunker fuel costs; fleet renewal involved significant dry-docking. |

| Capital Expenditures | New Vessel Acquisitions, Major Upgrades | Active fleet renewal programs throughout 2024. |

| Financing Costs | Interest Expense on Debt | Q1 2024 interest expense was $74 million for Teekay Corporation. |

| Administrative & Overhead | Shore-based Staff, IT, Legal, Marketing | Streamlining reporting processes to reduce administrative burdens. |

Revenue Streams

Time charter revenues represent a core income source for Teekay, where the company leases its vessels to clients for a predetermined duration at a fixed daily rate. Under this arrangement, Teekay manages the vessel's operations and crew, ensuring a stable and predictable revenue stream. In 2024, Teekay Tankers actively utilized a blend of spot market trading and fixed-rate time charter contracts to optimize its earnings.

Under bareboat charters, Teekay leases out its vessels for a set duration, with the client taking on all operational duties, crewing, and maintenance. This structure typically generates revenue that is lower in amount but exceptionally stable, as Teekay incurs fewer direct operating expenses.

For instance, in the first quarter of 2024, Teekay reported that its bareboat charter revenue contributed to its overall financial performance, reflecting the steady income generated from these long-term agreements where the charterer manages the day-to-day operations and associated costs.

Teekay Tankers leverages the spot market for a portion of its fleet, engaging in individual voyages driven by immediate demand. This strategy allows the company to capitalize on peak market conditions, achieving higher freight rates when demand surges. In 2023, Teekay Tankers reported that its spot fleet, which comprised a significant part of its operations, benefited from periods of strong tanker charter rates, contributing positively to overall revenue. This flexibility enables Teekay to actively seek out and secure profitable voyage opportunities as they arise.

Floating Production, Storage and Offloading (FPSO) Lease and Operations Fees

Teekay generates revenue through long-term contracts for leasing and operating Floating Production, Storage, and Offloading (FPSO) units. These specialized vessels are crucial for offshore oil and gas extraction, processing, and storage. The fees charged cover both the provision of the FPSO unit itself and the ongoing operational services required to maintain production.

Teekay's commitment to expanding its offshore capabilities is evident through its successful acquisition of new contracts for FPSO units. This strategic growth directly contributes to its revenue streams, reinforcing its position in the offshore energy sector. For instance, in late 2023, Teekay secured a contract for the Johan Castberg FPSO, a significant project expected to contribute substantial revenue over its lifespan.

- FPSO Lease Fees: These are the core earnings from providing the physical FPSO vessel for a set contract duration, typically spanning many years.

- Operations and Maintenance Fees: Revenue generated from the daily management, upkeep, and technical operation of the FPSO units.

- New Contract Wins: Teekay's ability to secure new FPSO projects, like the Johan Castberg FPSO, directly enhances its revenue pipeline.

- Long-Term Contract Value: The substantial, multi-year nature of FPSO contracts provides predictable and significant revenue streams for Teekay.

Specialized Marine Service Fees

Teekay generates income from specialized marine services critical to the energy sector. These include shuttle tanker operations, which are essential for transporting crude oil from offshore production facilities to onshore terminals, and towage services, vital for vessel maneuvering and safety in ports and offshore environments. The company also earns revenue from ship-to-ship transfer operations, facilitating the transfer of cargo between vessels at sea, a crucial service for optimizing logistics and managing different vessel sizes.

These specialized services provide Teekay with diversified revenue streams, reducing reliance on any single operational segment. The demand for these services is closely tied to global oil and gas production levels and the operational requirements of major energy companies. For example, Teekay Tankers actively operates a ship-to-ship transfer business, contributing directly to this specialized fee revenue.

- Shuttle Tanker Operations: Fees for transporting crude oil from offshore to onshore locations.

- Towage Services: Revenue from assisting vessels in ports and offshore operations.

- Ship-to-Ship Transfer Operations: Income generated from facilitating cargo transfers between vessels at sea.

Teekay's revenue streams are diverse, encompassing time charters, bareboat charters, FPSO operations, and specialized marine services. Time charters offer predictable income from leasing vessels with Teekay managing operations, while bareboat charters provide stable, lower-cost revenue where the client handles all operational aspects. FPSO contracts generate substantial, long-term fees for both vessel provision and ongoing operational support. Specialized services like shuttle tanker operations and ship-to-ship transfers add further revenue diversification, directly linked to energy sector activity.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Time Charters | Vessel leasing for a fixed duration with Teekay managing operations. | Teekay Tankers utilized time charters alongside spot market trading in 2024. |

| Bareboat Charters | Vessel leasing where the charterer assumes all operational responsibilities. | Q1 2024 results indicated steady income from bareboat charters. |

| FPSO Operations | Leasing and operating Floating Production, Storage, and Offloading units. | The Johan Castberg FPSO contract, secured in late 2023, represents significant future revenue. |

| Specialized Marine Services | Includes shuttle tanker, towage, and ship-to-ship transfer operations. | Teekay Tankers actively engages in ship-to-ship transfers, contributing to this segment. |

Business Model Canvas Data Sources

The Teekay Business Model Canvas is informed by a comprehensive review of internal financial reports, industry-specific market research, and analysis of competitor strategies. This data-driven approach ensures that each component, from value propositions to cost structures, is grounded in actionable intelligence.