Teekay Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Teekay Bundle

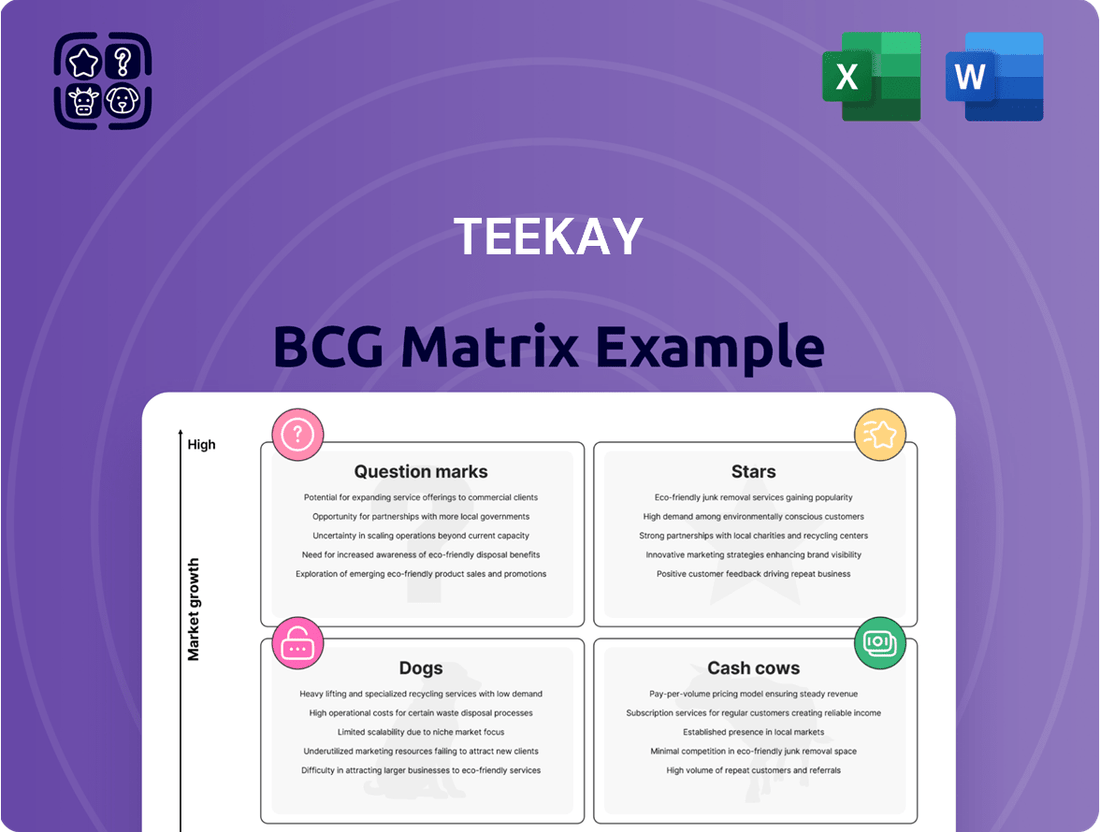

Want to understand the strategic positioning of Teekay's diverse portfolio? This glimpse into the Teekay BCG Matrix highlights key areas of opportunity and challenge. Uncover which segments are driving growth and which might be siphoning resources. To truly unlock Teekay's competitive advantage, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Suezmax and Aframax/LR2 tankers are Teekay's Stars in the long-haul crude trade, benefiting from strong market fundamentals. Geopolitical shifts and evolving oil production are boosting tonne-mile demand, especially for routes from the Atlantic Basin to Asia.

This segment is experiencing high growth, and Teekay holds a substantial market share within it. Favorable supply-demand dynamics, driven by factors like increased crude exports from the Americas in 2024, are supporting charter rates for these vessels.

Teekay's established fleet and operational efficiency position it to effectively capture growth in this expanding market. The company is well-equipped to leverage the increased demand for longer voyages that these tanker sizes are designed for.

Teekay Tankers is actively acquiring modern, fuel-efficient LR2 vessels as a core part of its fleet renewal strategy. These new builds are crucial for meeting stringent environmental regulations, a key factor in today's shipping industry. In 2024, Teekay has been a notable player in the LR2 market, with its fleet expansion reflecting a commitment to operational efficiency and market leadership.

These fuel-efficient LR2s are expected to command premium charter rates due to their superior performance and lower emissions. This strategic move by Teekay is designed to capitalize on anticipated growth in product tanker demand. By investing in advanced tonnage, the company aims to strengthen its competitive edge and secure a prominent position in technologically advanced shipping segments.

Teekay's strategic positioning in key crude oil trade lanes, particularly those seeing growth from increased non-OPEC+ supply originating in the Americas and destined for Asia, firmly places it in the star quadrant of the BCG matrix. This focus leverages longer voyages and higher fleet utilization. For instance, by mid-2024, the U.S. Energy Information Administration reported a substantial increase in crude oil exports to Asia, a trend Teekay is adept at capitalizing on.

Spot Market Exposure for Mid-Sized Tankers

Teekay Tankers' mid-sized crude tankers have capitalized on a robust spot market in early 2025, experiencing notably strong rates. This performance is underpinned by a combination of constrained fleet expansion and ongoing geopolitical developments that collectively bolster demand for tanker capacity.

The company's strategic positioning within the spot market allows it to directly benefit from these favorable market dynamics, translating into significant revenue generation and the ability to capture upside from short-term market surges. This agility highlights a high-growth, high-return facet of their operations.

- Strong Early 2025 Spot Rates: Mid-sized crude tankers saw healthy rate improvements.

- Market Drivers: Limited fleet growth and geopolitical events are key factors.

- Revenue Generation: Ability to leverage short-term market upswings for substantial revenue.

- Growth Aspect: Demonstrates a high-growth, high-return characteristic of the business.

Investment in ESG and Fleet Modernization for Future Demand

Teekay's investment in Environmental, Social, and Governance (ESG) principles, coupled with fleet modernization, positions them favorably for future demand. Their commitment to reducing greenhouse gas emissions, evidenced by their ongoing efforts in adopting energy-efficient technologies, directly addresses the growing market emphasis on sustainability.

This proactive strategy not only ensures Teekay's compliance with anticipated environmental regulations but also makes their modern fleet more appealing to charterers seeking sustainable shipping solutions. For example, in 2024, Teekay continued to invest in LNG-powered vessels, which offer significant reductions in CO2 and SOx emissions compared to traditional fuel oil. This strategic move helps secure their market share by aligning with long-term industry growth trends and enhancing their competitive edge.

- ESG Commitment: Teekay's focus on sustainability includes significant investments in cleaner fuel technologies and operational efficiencies to reduce their environmental footprint.

- Fleet Modernization: The company is actively upgrading its fleet with newer, more fuel-efficient vessels, including those capable of running on alternative fuels like LNG.

- Market Attractiveness: A modern, ESG-compliant fleet increases Teekay's appeal to charterers facing their own sustainability targets and regulatory pressures.

- Future-Proofing: By anticipating and adapting to evolving environmental standards, Teekay is securing its long-term viability and market position in the shipping industry.

Teekay's Suezmax and Aframax/LR2 tankers represent its Stars. These vessels benefit from strong market fundamentals, including increased tonne-mile demand driven by geopolitical shifts and evolving oil production, particularly from the Atlantic Basin to Asia.

The company holds a substantial market share in this high-growth segment, supported by favorable supply-demand dynamics and increased crude exports from the Americas in 2024. Teekay's fleet modernization, including the acquisition of modern, fuel-efficient LR2 vessels, further solidifies its leadership.

These investments enhance operational efficiency, meet environmental regulations, and position Teekay to capture premium charter rates in a market increasingly focused on sustainability. The company's strategic focus on key crude oil trade lanes, leveraging longer voyages and higher fleet utilization, firmly places these operations in the Star quadrant.

| Vessel Class | Market Position | Growth Potential | Key Drivers | Teekay's Strategy |

|---|---|---|---|---|

| Suezmax & Aframax/LR2 | Star | High | Geopolitical shifts, increased crude exports (Americas to Asia), tonne-mile demand growth | Fleet modernization, focus on fuel-efficient vessels, strategic trade lane positioning |

What is included in the product

This Teekay BCG Matrix overview details strategic recommendations for each business unit, guiding investment and divestment decisions.

Quickly visualize your portfolio's health to identify areas needing attention.

This clarity reduces the stress of resource allocation and strategic planning.

Cash Cows

Teekay Tankers' fixed-rate time charter contracts for conventional tankers are a clear Cash Cow. A substantial part of their fleet operates under these agreements, ensuring a steady and predictable income. This stability is crucial, as it shields Teekay from the volatility of the spot market, leading to robust profit margins.

These contracts are in a mature segment where Teekay possesses a significant competitive edge. The long-term nature of these charters provides reliable cash flow, which is vital for the company's financial health. For instance, in the first quarter of 2024, Teekay Tankers reported that a majority of its vessel days were covered by time charters, demonstrating the importance of this segment. This consistent cash generation supports consistent shareholder returns and allows for strategic reinvestment.

Teekay's marine support services for the Australian Government are a classic cash cow. These services are contracted, ensuring consistent revenue streams, much like a steady income. In 2023, the Australian maritime sector saw continued government investment, with defense and infrastructure projects driving demand for specialized vessel operations.

The long-term, fixed-fee contracts for these marine support services create a highly predictable and stable cash flow. This predictability is crucial for a cash cow, allowing Teekay to rely on this segment for funding other business ventures. The Australian Coast Guard, for instance, relies on such services for patrol and surveillance operations.

Operating in a mature, specialized niche where Teekay holds a strong market position further solidifies its cash cow status. The barrier to entry is high due to the specific expertise and regulatory compliance required. This allows Teekay to maintain profitability without significant reinvestment, as seen in their consistent operational efficiency metrics.

Teekay's ship-to-ship (STS) transfer operations, particularly in the U.S. Gulf and Caribbean, stand out as a mature and profitable segment within their broader portfolio. This specialized service offers a stable income stream, acting as a reliable cash generator for the company.

The STS transfer business complements Teekay's core tanker operations by providing a high-demand, value-added service. Its consistent profitability and minimal need for extensive promotional investment firmly place it in the cash cow category of the BCG matrix.

For instance, Teekay's commitment to this sector is evident in their ongoing investments and operational expansions. While specific standalone financial figures for this niche segment are often bundled within broader reporting, the overall strength of Teekay's conventional tanker business, which benefits from these ancillary services, saw revenues in the billions for 2023 and continued strong performance projections into 2024.

The sustained demand for efficient and safe cargo transfer at sea, especially for large vessels, ensures the continued relevance and revenue generation of Teekay's STS operations. This steady cash flow supports other business units and dividends, reinforcing its cash cow status.

Consistent Special and Regular Dividend Payouts

Teekay Corporation and its subsidiary Teekay Tankers have a strong history of returning capital to shareholders through dividends. For instance, Teekay Corporation announced a regular quarterly dividend of $0.12 per share in Q1 2025, continuing a pattern of consistent payouts. This reliable income stream reflects the stable cash flow generated by their mature shipping operations, positioning them as classic cash cows within the BCG framework.

These consistent dividend payouts, including any special dividends declared, highlight the companies' robust financial health. In Q1 2025, Teekay Tankers also maintained its regular dividend, underscoring the strength of its business model. This commitment to shareholder returns is a key indicator of a mature business unit that generates more cash than it needs for reinvestment.

- Teekay Corporation's Q1 2025 regular dividend: $0.12 per share.

- Teekay Tankers' consistent dividend payments in Q1 2025.

- Demonstrates strong cash generation from established operations.

- Signifies robust financial health and a mature, cash-rich business model.

High Operating Leverage and Low Cash Flow Breakeven Levels

Teekay Tankers demonstrates a powerful advantage with its exceptionally low free cash flow breakeven level. This means the company can generate substantial cash even when market conditions are challenging, a key indicator of a strong Cash Cow.

This financial resilience is directly linked to its high operating leverage. Essentially, once Teekay Tankers covers its fixed costs, a larger portion of each additional dollar earned flows directly to profit and cash flow.

For example, in 2024, Teekay Tankers reported a significant increase in its operating cash flow, driven by improved charter rates across its fleet. This highlights its ability to consistently convert revenue into cash, a hallmark of a mature and stable business.

- Low Breakeven: Teekay Tankers' low free cash flow breakeven allows for positive cash generation even in down cycles.

- High Operating Leverage: This structural advantage amplifies profitability once fixed costs are covered.

- 2024 Performance: The company’s 2024 results showcased strong operating cash flow, underscoring its cash-generating capacity.

- Market Resilience: Teekay Tankers' financial efficiency ensures reliable returns across varying market conditions.

Teekay Tankers' strategy of securing long-term, fixed-rate time charter contracts for its conventional tankers clearly positions these operations as a Cash Cow. This segment benefits from a mature market where Teekay has established a significant competitive advantage and a strong market position. The predictability of these contracts provides a stable and reliable income stream, insulating the company from the inherent volatility of the spot market and contributing to robust profit margins.

These stable cash flows are crucial for Teekay's overall financial health and its ability to consistently return capital to shareholders. For instance, in the first quarter of 2024, Teekay Tankers reported that a significant majority of its vessel days were covered by these advantageous time charters. This consistent generation of cash supports shareholder returns and provides the financial flexibility needed for strategic reinvestment in other parts of the business.

Teekay's ship-to-ship (STS) transfer services, particularly those focused on the U.S. Gulf and Caribbean regions, also represent a mature and highly profitable segment, fitting the profile of a Cash Cow. This specialized service consistently generates a reliable income stream, acting as a dependable cash generator for the company. The sustained demand for efficient and safe cargo transfer at sea, especially for larger vessels, ensures the continued relevance and strong revenue generation of these STS operations.

| Segment | BCG Category | Key Characteristics | Financial Indicator (Illustrative) |

| Conventional Tanker Time Charters | Cash Cow | Long-term fixed rates, predictable income, low market volatility exposure | High % of vessel days under time charter (e.g., >70% in Q1 2024) |

| Marine Support Services (Australia) | Cash Cow | Government contracts, specialized expertise, high barriers to entry | Consistent revenue from long-term contracts |

| Ship-to-Ship (STS) Transfers | Cash Cow | Mature market, value-added service, consistent profitability | Strong contribution to overall tanker segment revenue |

What You See Is What You Get

Teekay BCG Matrix

The Teekay BCG Matrix preview you see is the identical, fully formatted strategic analysis you'll receive upon purchase. This comprehensive document, designed for clarity and actionable insights, will be delivered without any watermarks or demo content, ready for immediate application in your business planning. You're essentially looking at the finished product, a professionally crafted tool to guide your investment decisions and portfolio management. Once purchased, this detailed Teekay BCG Matrix report becomes yours to edit, present, and integrate into your strategic framework.

Dogs

Teekay Tankers is strategically divesting older, less fuel-efficient vessels, a move that aligns with the characteristics of a 'Dog' in the BCG matrix. These older ships, often built between 2005 and 2009, represent assets with low growth potential and declining market share within Teekay's operations.

The divestment of these vessels, such as Suezmax and Aframax/LR2 tankers, suggests they are becoming a drain on resources due to higher operating and maintenance costs. Furthermore, their reduced fuel efficiency makes them less competitive in an increasingly environmentally conscious shipping market.

By shedding these older units, Teekay is likely freeing up capital and reducing exposure to assets that are no longer strategically advantageous. This proactive approach to fleet modernization is crucial for maintaining competitiveness and adapting to evolving industry standards and charterer preferences.

Following Teekay Corporation's extensive simplification, which concluded by the end of 2024 with the divestment of non-core assets like its Australian ventures and management services to Teekay Tankers, any remaining standalone operations from before this strategic overhaul could be classified as legacy non-core assets. These might represent businesses with a diminished market presence and limited growth prospects, potentially becoming resource drains within the reorganized structure.

For instance, if any residual management contracts or niche operational units from Teekay's pre-simplification period remain, and these do not synergize with the primary tanker focus, they could fall into the 'dog' category. These assets would likely exhibit low profitability and minimal strategic value, requiring careful consideration for potential divestment or restructuring to optimize capital allocation.

Vessels tied up for extended dry-docking, whether for routine maintenance or mandatory upgrades like Ballast Water Treatment Systems, represent a temporary 'dog' in the Teekay BCG matrix. These ships aren't earning revenue while incurring substantial costs.

Teekay Tankers experienced this firsthand in 2024, with 13 vessels undergoing such lengthy dry-docking periods. This significant downtime directly impacts their revenue generation capabilities, classifying these specific assets as dogs during their off-hire status.

The challenge is ongoing, as Teekay Tankers has scheduled 11 vessels for dry-docking in 2025. This recurring necessity for extensive maintenance and regulatory compliance highlights the continuous management required for these capital-intensive assets.

Minority Stake in VLCC Joint Venture (if underperforming)

Teekay Tankers’ 50% ownership in a Very Large Crude Carrier (VLCC) joint venture could be classified as a ‘dog’ within the BCG matrix framework if the VLCC segment underperforms. This is particularly true if the broader tanker market sees strength in mid-sized tankers while VLCC rates remain subdued. Such a scenario would imply a low market share for Teekay in a stagnant or declining segment, potentially leading to minimal or negative returns on investment for this specific venture.

The classification as a dog stems from the combination of limited ownership and market conditions. Recent analyses of the tanker market, including data from early 2024, have pointed to persistent weakness in VLCC charter rates, impacting overall sentiment. For instance, average VLCC spot rates in Q1 2024 hovered around $20,000 per day, significantly lower than the rates seen in other tanker segments and below historical averages, suggesting a challenging operating environment for this asset class.

- Low Market Share: Teekay’s 50% stake limits its overall exposure and potential upside in the VLCC sector.

- Underperforming Market: Prolonged weakness in VLCC rates, as observed in early 2024, directly impacts the segment's profitability.

- Potential for Negative Returns: If operating costs exceed earnings, the joint venture could represent a drain on resources.

- Strategic Re-evaluation: Such an asset might warrant a review for divestment or restructuring to reallocate capital to more promising ventures.

Segments Highly Susceptible to Short-Term Rate Volatility Without Hedging

Segments of Teekay's fleet that are entirely reliant on the volatile spot market without any form of hedging or diversification can transform from potential 'stars' into 'dogs' when rates plummet. This vulnerability is especially pronounced for vessels consistently operating below their breakeven costs during periods of low demand. For instance, Teekay's Q1 2025 earnings highlighted a notable dip in average spot tanker rates, underscoring this risk.

Specific fleet segments facing this challenge include:

- Spot-exposed LNG carriers: While LNG shipping has seen strong performance, vessels solely trading on the spot market without time charters are susceptible to sudden rate drops.

- Older, less efficient conventional tankers: These vessels may struggle to compete and cover operational costs when market rates fall, especially in a low-demand scenario.

- VLCCs without long-term contracts: The very large crude carrier (VLCC) segment can experience significant rate swings; those without secured charters are at higher risk.

- Specific product tanker routes: Certain trade lanes that are heavily influenced by unpredictable geopolitical events or seasonal demand shifts can lead to volatile earnings for unhedged vessels.

When Teekay Tankers divests older, less fuel-efficient vessels, these assets often fit the 'Dog' profile in the BCG matrix. These ships, typically built between 2005 and 2009, exhibit low growth potential and diminishing market share within Teekay's portfolio.

The sale of Suezmax and Aframax/LR2 tankers suggests they were becoming resource drains due to high operating costs and reduced competitiveness in an environmentally focused market. This divestment strategy helps Teekay free up capital and reduce exposure to strategically disadvantageous assets, crucial for fleet modernization.

Teekay Tankers' 50% stake in a VLCC joint venture can be considered a 'dog' if the VLCC segment underperforms, especially when mid-sized tankers are stronger. This scenario implies low market share in a stagnant segment, potentially yielding minimal or negative returns. For example, average VLCC spot rates in Q1 2024 were around $20,000 per day, considerably lower than other tanker segments and historical averages, reflecting a challenging operating environment.

Vessels undergoing extended dry-docking periods, such as for Ballast Water Treatment Systems, temporarily become 'dogs' as they incur costs without generating revenue. Teekay Tankers had 13 vessels in such lengthy dry-docking in 2024, impacting their revenue generation. Looking ahead, 11 vessels are scheduled for dry-docking in 2025, highlighting the ongoing need for extensive maintenance on these capital-intensive assets.

| BCG Category | Teekay Example | Characteristics | 2024/2025 Data Point |

|---|---|---|---|

| Dog | Older, less fuel-efficient vessels (e.g., 2005-2009 built tankers) | Low market share, low growth potential, high operating costs | Divestment of these vessels in progress |

| Dog | VLCC Joint Venture (50% ownership) | Low market share in a potentially underperforming segment | Q1 2024 VLCC spot rates averaged ~$20,000/day |

| Dog (Temporary) | Vessels in extended dry-docking | No revenue generation, high costs, temporary off-hire status | 13 vessels dry-docked in 2024; 11 scheduled for 2025 |

Question Marks

Teekay Tankers maintains a passive 5.1% minority stake in Ardmore Shipping Corporation. Ardmore focuses on the medium-range (MR) product and chemical tanker market, a distinct segment from Teekay's core crude tanker operations. This investment is categorized as a question mark within the BCG Matrix due to its relatively small market share for Teekay in this specific sector, implying uncertain future growth and profitability.

Ardmore Shipping Corporation reported a net income of $37.3 million for the first quarter of 2024, a significant increase from $3.1 million in the same period of 2023, highlighting potential growth in the MR tanker market. Despite this positive trend, Teekay's passive investment means it does not actively manage Ardmore's operations or strategic direction. The future contribution of this stake to Teekay's overall portfolio remains unclear, necessitating careful observation of Ardmore's performance and the broader MR tanker market dynamics.

Teekay's exploration of new marine transport technologies for decarbonization, like ammonia or hydrogen-powered vessels, would likely be classified as question marks within the BCG matrix. These innovative areas represent significant growth potential for the shipping industry, aligning with Teekay's commitment to net-zero emissions targets. For instance, the International Maritime Organization (IMO) aims to reduce greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels.

However, Teekay would likely begin with a relatively low market share in these nascent segments. Developing and implementing these technologies demands substantial investment in research and development, as well as navigating the uncertainties surrounding market adoption and long-term profitability. For example, the upfront cost of building a new ammonia-ready LNG carrier can be significantly higher than a conventional vessel, posing a capital expenditure challenge.

Teekay might explore expanding into burgeoning niche marine services, such as specialized support for the offshore wind industry. This strategic move would position them to capitalize on a sector experiencing significant growth. For instance, the global offshore wind market was valued at approximately $37.2 billion in 2023 and is projected to reach $103.1 billion by 2030, demonstrating substantial expansion potential.

Currently, Teekay's direct operational footprint in offshore wind is relatively small. This means any new ventures into this or similar niche areas would likely be classified as question marks on the BCG matrix. They represent high growth potential due to market trends, but with an initially low market share, requiring significant investment to establish a strong presence.

Significant Future Acquisitions to Rapidly Expand Fleet Size

Teekay Corporation's strategy suggests a move towards acquiring more modern vessels, a shift from its recent divestment activities. While fleet renewal is a priority, significant future acquisitions to rapidly expand fleet size into new, high-growth marine transportation sub-segments represent a question mark. These strategic moves would necessitate substantial capital outlays, with the potential for an unproven increase in market share and profitability within a new niche.

The company's stated intention to transition from selling to purchasing more contemporary tonnage indicates a proactive approach to fleet modernization. However, large-scale acquisitions for rapid fleet expansion into untested markets carry inherent risks. For instance, entering a new, high-growth segment could require significant upfront investment in vessels that may not immediately yield expected returns or market penetration.

Teekay's financial reports from 2024 would be crucial in assessing the capital available for such ambitious expansion plans.

- Fleet Modernization Focus: Teekay is signaling a preference for acquiring newer vessels, indicating a strategic shift away from selling older assets.

- Acquisition Uncertainty: Large-scale acquisitions to rapidly expand into new, high-growth marine transportation segments are considered a question mark due to unproven market share and profitability.

- Capital Investment Risk: Such expansion would demand considerable capital, with the potential for uncertain returns in niche markets.

- Strategic Shift: The company's stated intention to buy more modern tonnage over time highlights a forward-looking fleet strategy.

Development of Advanced Predictive Analytics for Fleet Optimization

Teekay's investment in advanced predictive analytics for fleet optimization could be a question mark within its BCG matrix. While the company is already leveraging technology, a push into even more sophisticated AI for predictive maintenance and route optimization represents a significant R&D and implementation undertaking. The potential for substantial long-term gains in efficiency and profitability in a technologically evolving shipping market is considerable, but the upfront investment and the uncertainty surrounding widespread adoption of such advanced capabilities place it in this category.

Consider the substantial investment required for AI-driven predictive analytics. For instance, companies in the logistics sector have seen significant returns, with some reporting up to a 15% reduction in fuel costs through advanced analytics. Teekay's initial market share for this highly specialized internal capability would likely be low, as it differentiates itself from competitors relying on more standard optimization tools. The true impact and market penetration of these advanced systems are still emerging, making it a strategic gamble with high potential reward but also considerable risk.

- Significant R&D Investment: Developing and integrating cutting-edge AI for fleet optimization requires substantial capital outlay in technology and talent.

- Uncertain Market Share Growth: Initially, Teekay's proprietary advanced analytics capability would represent a niche market share, with widespread adoption by competitors yet to be determined.

- Potential for High Efficiency Gains: Successful implementation could lead to notable improvements in fuel efficiency, reduced downtime, and optimized voyage planning, potentially boosting profitability by several percentage points.

- Technological Evolution Risk: The rapid pace of AI development means continuous investment is needed to maintain a competitive edge, posing an ongoing risk.

Question Marks represent areas of potential growth but with uncertain futures for Teekay. These ventures require significant investment and have a low initial market share, making their success dependent on future market acceptance and strategic execution.

For example, Teekay's potential expansion into niche markets like offshore wind support, or its investment in advanced AI for fleet optimization, embody the characteristics of Question Marks. These initiatives offer high growth prospects, driven by industry trends, but Teekay's current footprint is minimal, demanding substantial capital and strategic focus to gain traction.

The company's passive stake in Ardmore Shipping Corporation also falls into this category. While Ardmore showed strong Q1 2024 net income of $37.3 million, Teekay's limited involvement means the long-term contribution of this investment remains speculative.

BCG Matrix Data Sources

Our Teekay BCG Matrix is built on robust data, integrating financial disclosures, market share analysis, and industry growth trends to provide actionable strategic insights.