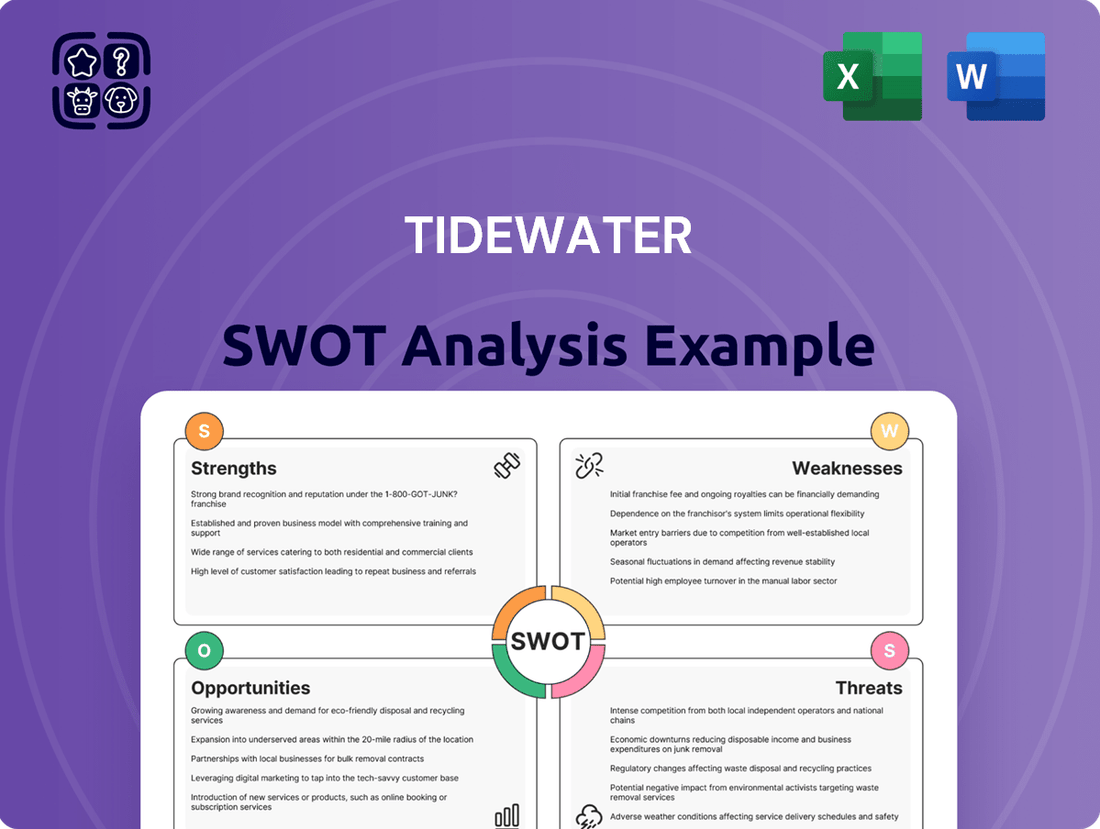

Tidewater SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tidewater Bundle

Tidewater's strengths lie in its established fleet and operational expertise, while its opportunities include expansion into new markets. However, the company faces challenges from intense competition and fluctuating industry demand. Understanding these dynamics is crucial for any stakeholder looking to navigate the maritime services sector. Want the full story behind Tidewater's market position and future potential?

Strengths

Tidewater commands market leadership with the world's largest fleet of offshore support vessels (OSVs), comprising 214 owned vessels. This substantial and varied fleet, including 18 cutting-edge hybrid vessels, grants a significant competitive edge, enabling Tidewater to cater to diverse client requirements across numerous offshore activities.

Tidewater showcased exceptional financial performance in 2024, achieving a significant 33.3% revenue increase, reaching $1.345.8 billion. This growth translated into a remarkable 85.9% surge in net income, totaling $180.7 million.

The company's ability to generate substantial free cash flow was a key strength, with $331.0 million generated in 2024. This represents an impressive 197.1% increase year-over-year, underscoring Tidewater's robust financial health and efficient operations.

Tidewater's strength lies in its extensive global presence and diversified operations, with a footprint across North America, South America, Europe, Africa, and Asia-Pacific. This geographic spread allows Tidewater to tap into a wide array of clients and mitigates risks associated with over-reliance on any single region. For instance, in 2023, the company reported that its international operations contributed a significant portion of its revenue, showcasing the benefits of this diversified approach in navigating varied economic landscapes and regulatory environments.

High-Specification and Modernized Fleet

Tidewater has significantly upgraded its vessel portfolio by selling older, smaller units and purchasing newer, more capable ones. This strategic move means roughly 67% of its fleet now comprises high-specification Offshore Support Vessels (OSVs).

This modernization effort has resulted in a fleet with an average age of 12.6 years. Such a contemporary fleet gives Tidewater a competitive edge, offering superior quality and capacity compared to many rivals.

- Fleet Modernization: Approximately 67% of Tidewater's fleet are high-specification OSVs.

- Average Vessel Age: The fleet's average age is 12.6 years.

- Competitive Advantage: A modern fleet enhances quality and capacity offerings.

- Strategic Disposal/Acquisition: Older, smaller vessels have been replaced with younger, higher-spec units.

Disciplined Capital Allocation and Shareholder Returns

Tidewater demonstrates a strong commitment to disciplined capital allocation, actively returning value to its shareholders. In 2024, the company repurchased approximately 1.4 million shares, amounting to $90.7 million. This proactive approach to shareholder returns is further evidenced by the authorization of a new share repurchase program valued at $90.3 million.

This strategic focus on capital return, alongside efforts to reduce net debt, underscores management's confidence in Tidewater's financial health and future prospects. Such actions are designed to directly enhance shareholder value.

- Shareholder Returns: Repurchased 1.4 million shares for $90.7 million in 2024.

- New Repurchase Authorization: Authorized an additional $90.3 million share repurchase program.

- Debt Reduction Focus: Actively working to reduce net debt.

- Value Enhancement: These actions collectively enhance shareholder value and reflect financial confidence.

Tidewater's substantial fleet of 214 vessels, including 18 modern hybrid units, positions it as a market leader. This diverse and high-specification fleet, with 67% of vessels being high-spec OSVs and an average age of 12.6 years, provides a significant competitive advantage in meeting varied client needs across global offshore operations.

The company's financial performance in 2024 was robust, marked by a 33.3% revenue increase to $1.345.8 billion and an 85.9% surge in net income to $180.7 million. This financial strength is further highlighted by $331.0 million in free cash flow generated in 2024, a 197.1% increase year-over-year.

Tidewater demonstrates strong financial discipline and a commitment to shareholder value. In 2024, it repurchased 1.4 million shares for $90.7 million and authorized an additional $90.3 million share repurchase program, alongside efforts to reduce net debt.

| Metric | 2024 Data | Significance |

|---|---|---|

| Total Vessels | 214 | Largest fleet globally |

| High-Specification OSVs | ~67% of fleet | Enhanced service capability |

| Average Vessel Age | 12.6 years | Modern and efficient fleet |

| 2024 Revenue | $1.345.8 billion | 33.3% increase |

| 2024 Net Income | $180.7 million | 85.9% increase |

| 2024 Free Cash Flow | $331.0 million | 197.1% increase |

| Share Repurchases (2024) | $90.7 million | Shareholder return initiative |

What is included in the product

Delivers a strategic overview of Tidewater’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address potential business challenges, transforming uncertainty into actionable strategies.

Weaknesses

Tidewater's core business is deeply intertwined with the offshore oil and gas sector, meaning its revenue is highly sensitive to the ups and downs of global energy demand and crude oil prices. This direct link makes the company vulnerable to market swings. For instance, if oil prices plummet, as they did with Brent crude falling to around $78 per barrel in late 2023, demand for offshore exploration and production services can significantly decrease, directly impacting Tidewater's earnings potential.

Tidewater expects a somewhat subdued beginning to 2025 for offshore drilling, with activity levels anticipated to be less robust than in 2024. This could translate to softer demand for their fleet of offshore support vessels during this period. While the company maintains a positive long-term view for the sector, this near-term lull might introduce some price pressure or slower contract awards.

While Tidewater operates globally, its performance isn't uniform across all regions. Some areas are showing signs of strain, impacting overall profitability.

For example, the North Sea market experienced a significant downturn, with operating profits dropping by 18% during the third quarter of 2024. This illustrates the challenge of maintaining consistent financial results across Tidewater's varied operational footprint.

High Operational Costs and Maintenance

Operating Tidewater's extensive and advanced fleet comes with substantial operational expenses. These costs are primarily driven by crew wages and the essential, ongoing maintenance required to keep such a complex fleet in peak condition. For instance, in the first quarter of 2024, Tidewater reported operating expenses of $174.6 million, highlighting the scale of these necessary expenditures.

These inherent costs can exert pressure on profit margins, particularly when vessel utilization rates dip. The company's commitment to efficiency is ongoing, but the fundamental expenses associated with managing a large, technologically advanced maritime service provider remain a significant factor.

- Crew Costs: A substantial portion of operational expenditure is allocated to skilled personnel managing the vessels.

- Vessel Maintenance: Regular and specialized upkeep is critical for safety and operational readiness, contributing significantly to expenses.

- Technological Sophistication: The advanced nature of the fleet requires specialized maintenance and skilled technicians, increasing costs.

- Margin Pressure: Fluctuations in market demand and utilization can directly impact how well these high operational costs are absorbed.

Dependence on Existing Debt Agreements for Share Repurchases

Tidewater's capacity for share repurchases is significantly tethered to its existing debt agreements. At various points, the company has found itself at the full extent of its allowable borrowing capacity, effectively capping its ability to buy back its own stock. While the anticipation of increased allowance exists, this dependency creates a constraint on its capital allocation flexibility for returning value to shareholders.

This reliance on debt covenants for share buybacks can limit strategic financial maneuvering. For instance, if market conditions present an attractive opportunity for Tidewater to repurchase shares at a discount, its existing debt structure might prevent such an action. This was a notable consideration in their capital planning throughout 2024, as they navigated covenant limitations.

The company's financial strategy for 2024 and projected into 2025 highlights this weakness. While Tidewater aims to enhance shareholder returns, the covenants within its debt agreements, particularly those related to leverage ratios and debt service coverage, directly impact the quantum of shares it can repurchase. The firm has been actively managing its debt profile to potentially create more headroom for future buybacks, but the current structure remains a key constraint.

Tidewater's heavy reliance on the volatile offshore oil and gas sector makes it susceptible to fluctuations in energy prices and demand. A downturn in oil prices, such as Brent crude trading around $78 per barrel in late 2023, directly dampens the need for offshore services, impacting Tidewater's revenue. Furthermore, the company anticipates a slower start to 2025 for offshore drilling activity, which could lead to reduced demand for its vessel fleet and potential pricing pressures.

The company's performance varies by region, with some markets showing financial strain. For example, the North Sea experienced an 18% drop in operating profits during Q3 2024, illustrating the challenge of maintaining consistent results across its global operations.

Significant operating expenses, including crew wages and vessel maintenance, are a constant pressure on Tidewater's profit margins, especially when vessel utilization rates are low. In Q1 2024, these operating expenses totaled $174.6 million, underscoring the substantial costs associated with maintaining its fleet.

Tidewater's ability to repurchase its own stock is constrained by its debt agreements, limiting its financial flexibility. Throughout 2024, the company navigated covenant limitations, which restricted its capacity for share buybacks and returning capital to shareholders, even when opportunities arose to purchase stock at a discount.

Preview the Actual Deliverable

Tidewater SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You're getting an accurate representation of the comprehensive insights you'll receive. This means you can be confident in the quality and completeness of the Tidewater SWOT analysis. Purchase today to unlock the full, actionable report.

Opportunities

The global push for cleaner energy sources is a major tailwind, and Tidewater is well-positioned to capitalize on the burgeoning offshore wind sector. This burgeoning market, projected to see substantial growth through 2030 and beyond, offers a significant avenue for service expansion. By leveraging its existing expertise in marine operations, Tidewater can tap into the increasing demand for specialized vessels and support services required for offshore wind farm construction and maintenance.

Tidewater's strategic investments in offshore wind infrastructure are a clear signal of its commitment to this opportunity. The company is actively working to bolster its active offshore wind vessel fleet, aiming to meet the projected surge in demand. For instance, the global offshore wind market was valued at approximately $30 billion in 2023 and is expected to reach over $100 billion by 2030, presenting a compelling growth trajectory for Tidewater.

Tidewater's investment in new technologies, like automation and hybrid propulsion, presents a significant opportunity. These advancements can boost efficiency and lower operating expenses. For instance, embracing data analytics can unlock insights for better decision-making, potentially leading to cost savings and improved service delivery.

Digitalization, including remote monitoring and predictive maintenance, offers further avenues for optimization. This can lead to reduced downtime for their fleet and more proactive management of assets. The company could see enhanced fleet performance and a more streamlined operational structure by adopting these digital tools.

The offshore industry's increasing emphasis on decommissioning aging infrastructure and a strong demand for subsea services present significant growth opportunities for offshore support vessel (OSV) providers. Tidewater, with its diverse fleet and operational expertise, is strategically positioned to benefit from this trend.

In 2024, the global offshore decommissioning market is projected to see substantial activity, driven by evolving environmental regulations and the need to clear aging platforms. This translates to a heightened need for specialized vessels capable of complex subsea operations, including remotely operated vehicles (ROVs) and heavy lift capabilities, areas where Tidewater has invested and demonstrated strength.

The subsea segment, encompassing installation, maintenance, and inspection of subsea equipment, continues to be a vital component of offshore energy production. As exploration and production activities continue, particularly in deepwater and challenging environments, the demand for sophisticated OSVs to support these subsea endeavors remains robust, offering a steady revenue stream and expansion potential for Tidewater.

Strategic Acquisitions and Fleet Optimization

Tidewater's track record of strategic acquisitions, including the integration of 84 high-quality vessels through M&A in the past three years, demonstrates a proven ability to enhance its fleet. This approach offers a significant opportunity to further solidify its market dominance and elevate the overall caliber of its offshore support vessel (OSV) fleet. Continued, disciplined acquisitions can capitalize on market dislocations, allowing Tidewater to acquire assets at attractive valuations.

Further fleet optimization through strategic acquisitions presents several key advantages:

- Market Consolidation: Acquiring competitors or their assets can lead to greater market share and pricing power.

- Fleet Modernization: Targeting acquisitions of newer, more fuel-efficient vessels can reduce operating costs and improve environmental performance.

- Synergistic Efficiencies: Integrating acquired fleets can unlock operational synergies, such as combining crewing, maintenance, and administrative functions.

- Geographic Expansion: Acquisitions can provide immediate access to new or under-served geographic markets.

Emerging Markets and Increased Offshore Infrastructure Investment

As global energy demand continues its upward trend, especially within rapidly developing economies, Tidewater is well-positioned to leverage these expanding markets. Emerging nations are increasingly investing in their energy infrastructure, creating significant new avenues for Tidewater's specialized offshore support vessel (OSV) services.

The push towards deeper and more complex offshore oil and gas projects, including those in ultra-deepwater environments, directly fuels the need for the sophisticated vessels and services Tidewater provides. This trend is particularly evident as major energy producers focus on accessing previously untapped reserves.

- Global energy demand is projected to rise significantly by 2025, driven by emerging economies.

- Offshore infrastructure development, especially in deepwater, is a key focus for national oil companies and international oil companies alike.

- Tidewater's fleet is designed to meet the evolving technical requirements of these advanced offshore projects.

- Increased offshore activity translates directly into higher utilization rates and charter day rates for OSV operators like Tidewater.

Tidewater stands to benefit significantly from the global shift towards renewable energy, particularly the rapidly expanding offshore wind sector. The company's existing marine expertise allows it to efficiently enter and grow within this market, which saw substantial investment in 2024. This expansion is further supported by Tidewater's strategic fleet upgrades and adoption of new technologies, enhancing operational efficiency and service offerings.

The increasing global focus on decommissioning aging offshore infrastructure presents a strong demand for specialized subsea services. Tidewater is well-positioned to capture this market, bolstered by its diverse fleet and proven capabilities in complex marine operations. Furthermore, the ongoing development of deepwater oil and gas projects, especially in emerging economies, directly increases the need for Tidewater's advanced offshore support vessels.

| Opportunity Area | Market Insight/Projection | Tidewater's Position/Action |

|---|---|---|

| Offshore Wind Expansion | Global offshore wind market projected to exceed $100 billion by 2030. | Leveraging marine expertise; actively growing offshore wind vessel fleet. |

| Decommissioning & Subsea Services | Significant activity driven by environmental regulations and infrastructure needs. | Diverse fleet and operational expertise suited for complex subsea operations. |

| Deepwater Exploration & Emerging Markets | Rising global energy demand fuels infrastructure development in new regions. | Fleet designed for advanced projects; well-positioned to serve expanding markets. |

| Technology Adoption | Focus on automation, hybrid propulsion, and digitalization for efficiency. | Investing in new technologies to reduce costs and improve service delivery. |

Threats

The offshore service industry is characterized by fierce competition, with many companies actively seeking contracts. This crowded landscape can translate into downward pressure on pricing, potentially impacting Tidewater's profit margins. For instance, major competitors such as Edison Chouest Offshore and Hornbeck Offshore Services are significant players, creating a challenging environment for market share acquisition.

Tidewater, like all offshore service vessel operators, navigates a complex web of regulatory challenges. These stringent rules, particularly concerning environmental protection and safety, directly translate into increased compliance costs and potential operational risks. For instance, evolving emissions standards necessitate ongoing investment in cleaner technologies and operational adjustments.

The financial impact of these regulations can be substantial. Companies must factor in the cost of retrofitting older vessels or acquiring new ones that meet stricter environmental criteria. In 2024, the maritime industry continued to grapple with the International Maritime Organization's (IMO) greenhouse gas strategy, requiring significant adaptation and investment in alternative fuels and energy efficiency measures.

Failure to comply can result in hefty fines, operational disruptions, and reputational damage, all of which can negatively affect Tidewater's financial performance and market position. The ongoing push for decarbonization across global shipping means these compliance costs are likely to escalate in the coming years, demanding continuous strategic planning and capital allocation.

Geopolitical instability in regions where Tidewater operates, such as West Africa or Southeast Asia, poses a significant threat by potentially disrupting service delivery and impacting project timelines. For instance, political unrest in Nigeria in early 2024 led to supply chain challenges for many offshore service providers.

Macroeconomic uncertainty projected into 2025, characterized by fluctuating inflation rates and interest rate policies globally, could directly influence offshore operators' capital expenditure decisions. This uncertainty might lead to delayed project sanctioning and reduced demand for Tidewater's fleet, potentially affecting day rates and vessel utilization.

Furthermore, shifts in global energy policies driven by geopolitical tensions could impact commodity prices, specifically oil and gas. A sharp decline in oil prices, which has historically seen volatility with geopolitical events, would likely dampen exploration and production activities, directly reducing the need for offshore support vessels.

Limited Shipyard Capacity and Financing for New Builds

The global shipyard capacity has seen a notable reduction, impacting the availability and cost of new vessel construction. This constricted supply chain, coupled with a withdrawal of many traditional maritime lenders from the sector, has made securing financing for new builds increasingly difficult. For instance, in 2024, the order book for offshore support vessels (OSVs) remained relatively tight compared to historical peaks, reflecting this capacity constraint.

While this situation acts as a deterrent for new entrants, it also presents a significant challenge for Tidewater. The company faces limitations in its ability to quickly scale its fleet or undertake substantial fleet renewal if market demand surges.

The implications for Tidewater include:

- Potential for extended lead times on new vessel orders.

- Increased capital costs for fleet expansion or modernization.

- A strategic need to carefully manage existing fleet utilization and maintenance.

- A competitive advantage for Tidewater if it possesses access to alternative financing or already has a modern, efficient fleet.

Crew Costs and Personnel Retention Challenges

Crew costs represent a significant operational expense for Tidewater, particularly as the company integrates more technologically advanced vessels into its fleet. The demand for skilled mariners familiar with sophisticated equipment, such as dynamic positioning systems and advanced navigation technology, is high. This scarcity can drive up wages and training expenses, directly impacting profitability. For instance, in 2024, the global shortage of experienced maritime officers was estimated to be around 16.5%, a figure projected to grow.

Intensifying competition for qualified seafarers, both from other offshore service providers and different maritime sectors, further exacerbates these challenges. This competitive landscape necessitates attractive compensation packages and robust retention strategies. Tidewater’s ability to attract and keep experienced crew members is crucial for maintaining operational efficiency and safety standards, especially given the specialized nature of its services.

- Rising Labor Costs: Increased demand for skilled personnel in 2024 and 2025 is likely to push average crew wages higher.

- Training Investment: The need to train existing and new crew on advanced vessel technologies adds to personnel expenses.

- Retention Incentives: Competitive pay and benefits are essential to mitigate turnover, which can disrupt operations and increase recruitment costs.

- Geopolitical Impacts: Global events can affect the availability of seafarers from certain regions, potentially increasing reliance on more expensive labor markets.

The offshore service industry faces significant threats from intensified competition, potentially leading to price wars and reduced profit margins. Geopolitical instability and macroeconomic uncertainty also pose risks by disrupting operations and dampening demand for Tidewater's services. Furthermore, a constrained global shipyard capacity and rising crew costs present considerable challenges for fleet expansion and operational expenses.

SWOT Analysis Data Sources

This Tidewater SWOT analysis is meticulously crafted from a blend of robust financial reports, current market intelligence, and expert industry forecasts, ensuring a comprehensive and data-backed strategic overview.