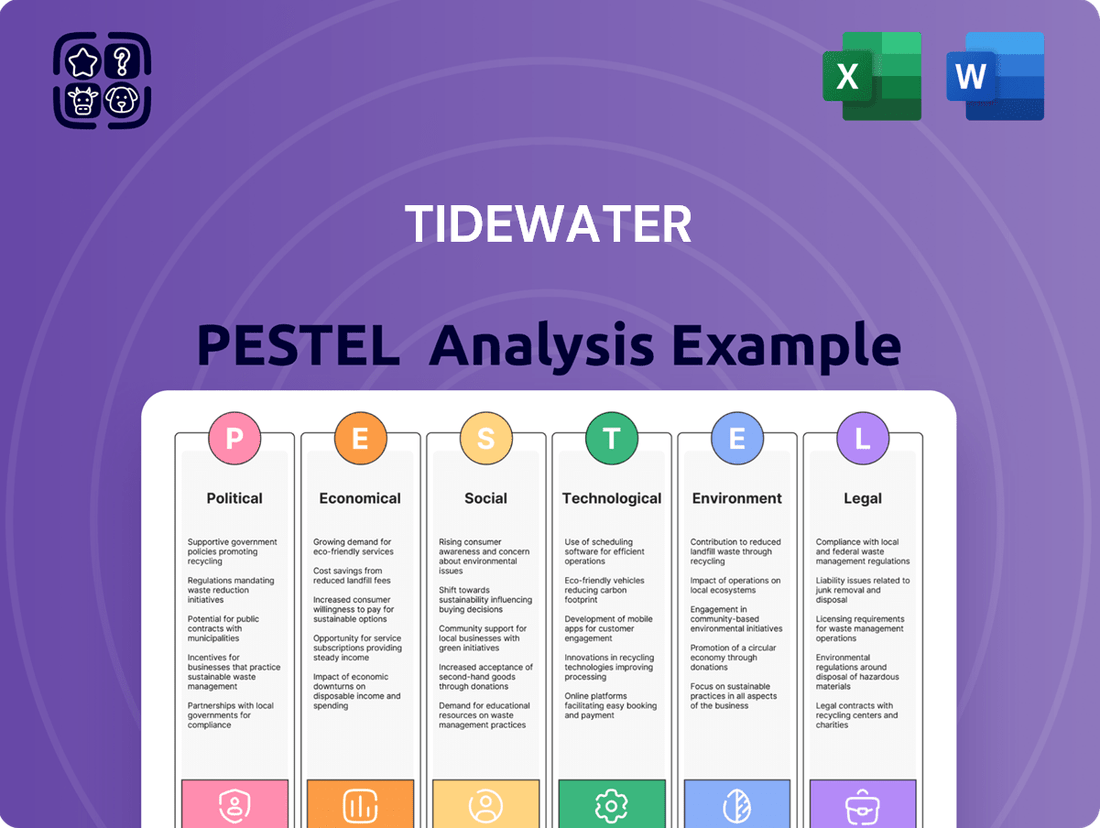

Tidewater PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tidewater Bundle

Unlock the hidden forces shaping Tidewater's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are crucial for strategic planning. This in-depth report offers actionable insights for investors, consultants, and business leaders looking to gain a competitive edge. Don't miss out on critical market intelligence; purchase the full version now for immediate access to Tidewater's complete external landscape.

Political factors

Government policies directly influence Tidewater's operations, particularly concerning offshore oil and gas exploration and production. For instance, regulatory shifts on decommissioning obligations can significantly alter long-term cost structures for vessel operators.

Environmental regulations, such as stricter emissions standards or new permitting requirements for offshore activities, can impact both operational expenses and the overall demand for Tidewater's specialized fleet. The International Maritime Organization's (IMO) 2020 sulfur cap, for example, required significant investment in fuel efficiency and exhaust gas cleaning systems across the maritime industry.

Political sentiment towards fossil fuels plays a crucial role in Tidewater's market outlook. In 2024, many governments continue to navigate energy transition goals, which can lead to policy uncertainties for new offshore oil and gas development projects, a key revenue driver for the company.

The Biden administration's approach to oil and gas leasing in the Gulf of Mexico, a significant operating region for Tidewater, highlights the impact of political decisions. While some lease sales have proceeded, the overall trend reflects a balancing act between energy security and climate objectives, directly affecting the pipeline of future offshore projects.

Geopolitical instability, particularly in key energy-producing regions like the Middle East and Eastern Europe, continues to be a significant factor for Tidewater. Tensions there can disrupt oil and gas supply chains, directly impacting global energy prices and, consequently, the demand for offshore support vessels. For instance, ongoing geopolitical complexities in Eastern Europe have contributed to volatile energy markets throughout 2024, influencing investment decisions in offshore exploration.

These instabilities directly affect Tidewater’s investment calculus for offshore projects, as uncertainty breeds caution among energy producers. For example, major oil companies may scale back or delay new offshore developments when geopolitical risks are high, leading to a reduced need for Tidewater's specialized fleet. This was observed in early 2025 when a flare-up in Middle Eastern tensions led to a temporary slowdown in new contract awards for offshore construction support.

Furthermore, conflicts and heightened geopolitical risks translate into increased operational challenges for Tidewater. Operating in or near conflict zones can elevate insurance premiums and necessitate additional security measures, driving up operating costs. In 2024, regions experiencing elevated geopolitical tensions saw insurance rates for offshore vessels rise by an average of 15-20%, impacting the profitability of projects in those areas.

International trade policies, including tariffs and sanctions, directly impact Tidewater's operational costs by affecting the price of essential equipment and spare parts. These policies can also restrict market access in key regions. For example, in 2024, ongoing trade tensions, particularly between major economies, continue to create uncertainty in global supply chains, potentially increasing logistics expenses for a company with Tidewater's international footprint.

Tidewater, as a global player, sees its supply chain efficiency and market access significantly influenced by these trade dynamics. The imposition of tariffs can make sourcing components more expensive, while sanctions could outright block access to certain markets or suppliers. This necessitates strategic planning to mitigate risks associated with protectionist measures that might emerge or intensify throughout 2024 and into 2025.

Broader trade disputes, like the lingering US-China trade friction, have a palpable negative effect on the global economy and, consequently, on energy demand. A slowdown in global economic activity often translates to reduced demand for oil and gas services, directly impacting Tidewater's core business. Forecasts for global GDP growth in 2024, while showing some resilience, are still subject to the volatility introduced by these trade conflicts.

Energy Transition Policies

Governmental initiatives are strongly encouraging a shift towards renewable energy sources, with a particular focus on offshore wind development. This presents a dual landscape for Tidewater: while the overarching goal is decarbonization, which could impact traditional fossil fuel demand, near-term policies still support oil and gas. For instance, in 2023, the U.S. government continued to issue oil and gas leases, signaling ongoing demand for offshore support vessels (OSVs) in that sector.

Tidewater is actively navigating this transition by exploring and pursuing opportunities within the burgeoning offshore wind market. This strategic adaptation is crucial as the global energy mix evolves. The company is positioning itself to leverage its existing expertise in offshore operations for new energy ventures.

- Governmental Support for Renewables: Policies like the Inflation Reduction Act (IRA) in the U.S. offer significant tax credits and incentives for offshore wind projects, accelerating their development.

- Fossil Fuel Demand: Despite the renewable push, global energy demand, including for oil and gas, remained robust in 2023 and is projected to continue through the mid-2020s, supporting the traditional OSV market.

- Tidewater's Strategic Pivot: The company has secured contracts for its vessels in the offshore wind sector, marking a tangible step in its diversification strategy to capitalize on this growth area.

National Energy Security Agendas

National energy security remains a significant driver for many governments, particularly in light of recent geopolitical instability. This focus often translates into policies that bolster domestic energy production, including offshore oil and gas, even as the world transitions towards decarbonization. For companies like Tidewater, this can mean increased opportunities in regions prioritizing self-sufficiency in energy supplies.

For instance, the U.S. Inflation Reduction Act of 2022, while promoting clean energy, also includes provisions for oil and gas leasing, indicating a dual approach to energy policy. Similarly, in 2023, the European Union's REPowerEU plan aimed to diversify energy sources and accelerate renewables, but also acknowledged the continued role of natural gas in the interim, potentially supporting offshore exploration and production services.

- Energy Security Prioritization: Geopolitical events in 2022-2024 have heightened national focus on securing reliable energy supplies, leading some nations to re-evaluate or expand domestic fossil fuel production.

- Policy Support for Offshore: This security imperative can result in favorable policies for offshore oil and gas activities, potentially increasing demand for Tidewater's vessel services in key markets.

- Investment Trends: Despite decarbonization goals, global investment in offshore oil and gas projects saw a notable increase in 2023, reaching an estimated $115 billion, signaling continued demand for offshore infrastructure and support.

- Regulatory Landscape: While environmental regulations persist, the push for energy independence may lead to a more pragmatic approach to offshore development in certain strategic regions.

Governmental policies directly shape Tidewater's operational landscape, particularly concerning offshore energy exploration and production. Regulatory changes regarding decommissioning obligations can significantly alter long-term cost structures for vessel operators, while shifts in environmental standards impact operational expenses and demand for specialized fleets. The global push towards decarbonization, exemplified by initiatives like the U.S. Inflation Reduction Act, offers incentives for offshore wind development, presenting new avenues for Tidewater's diversification strategy amidst evolving energy demands.

Geopolitical instabilities and international trade dynamics significantly influence Tidewater's market outlook and operational costs. Tensions in energy-producing regions can disrupt supply chains, leading to volatile energy prices and affecting demand for offshore support vessels, as seen with the impact of Eastern European complexities in 2024. Trade disputes and protectionist measures can increase expenses for essential equipment and restrict market access, necessitating strategic mitigation of risks associated with these global trade policies.

National energy security concerns, amplified by recent geopolitical events through 2024, drive policies that bolster domestic energy production, including offshore oil and gas. This focus on self-sufficiency can create increased opportunities for Tidewater in regions prioritizing reliable energy supplies. Despite decarbonization goals, the continued role of natural gas and investments in offshore oil and gas projects, which saw an estimated $115 billion in global investment in 2023, signal ongoing demand for offshore support services.

| Political Factor | Impact on Tidewater | 2024/2025 Data/Trend |

| Regulatory Environment | Affects operational costs, project viability, and demand for services. | Stricter emissions standards (e.g., IMO 2020) increase compliance costs. Continued leasing for offshore oil/gas projects in 2023-2024 supports OSV demand. |

| Geopolitical Instability | Influences energy prices, investment decisions, and operational risks. | Eastern European conflicts in 2024 led to volatile energy markets and cautious investment in new offshore projects. Increased insurance premiums by 15-20% in tense regions observed in 2024. |

| Energy Policy & Transition | Drives demand for both traditional and renewable offshore services. | U.S. IRA incentives accelerate offshore wind. Global investment in offshore oil/gas reached ~$115 billion in 2023, indicating sustained demand for traditional services. |

| International Trade Policies | Impacts supply chain costs and market access. | Lingering trade friction (e.g., US-China) affects global economic activity and energy demand. Tariffs can increase logistics expenses for international operations. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing the Tidewater region, examining Political, Economic, Social, Technological, Environmental, and Legal forces.

Provides a clear, actionable framework that helps identify and mitigate external threats, thereby reducing uncertainty and anxiety for strategic decision-makers.

Economic factors

Global oil prices, a critical economic factor for Tidewater, showed significant fluctuations leading up to mid-2025. For instance, Brent crude futures saw periods of trading above $90 per barrel in late 2024, driven by geopolitical tensions and supply concerns. This upward trend generally boosts Tidewater's clients' profitability, encouraging investment in offshore exploration and consequently increasing demand for offshore support vessels (OSVs) and their associated day rates.

However, the energy market's inherent volatility remains a key consideration. By early 2025, some projections indicated a potential moderation in oil prices, perhaps settling in the $75-$85 range, influenced by global economic growth forecasts and the pace of energy transition initiatives. Such price moderation, while potentially stabilizing for long-term planning, could temper the immediate surge in demand for OSVs compared to periods of sustained high prices. This dynamic directly impacts Tidewater's revenue streams and fleet utilization.

Client capital expenditure (CAPEX) on offshore oil and gas exploration, field development, and production is the primary driver for Tidewater's offshore support vessel (OSV) demand. A projected uptick in deepwater and ultra-deepwater investments, coupled with efforts to prolong existing asset lifespans, signals a positive outlook for the OSV sector. For instance, global offshore oil and gas CAPEX is anticipated to reach approximately $140 billion in 2024, with a continued upward trend expected through 2025, driven by energy security concerns and higher commodity prices.

Tidewater's own Q1 2025 financial results reflect this growing momentum, with reported increases in average daily vessel rates and fleet utilization. This suggests a strengthening market where clients are willing to invest more in offshore activities, directly benefiting Tidewater's operational capacity and revenue generation. The company's fleet, comprising various vessel types essential for offshore operations, is well-positioned to capitalize on this increased spending.

Global interest rates significantly influence Tidewater's operational costs and strategic expansion. For instance, a higher benchmark rate, such as the Federal Funds Rate, which stood at 5.25-5.50% as of mid-2024, increases the cost of borrowing for Tidewater, potentially impacting its ability to finance new vessel construction or acquisitions. Conversely, a favorable interest rate environment can lower debt servicing expenses, freeing up capital for fleet upgrades and other growth initiatives.

Access to capital is directly tied to these interest rate dynamics. When rates are low, financial institutions are more inclined to lend, making it easier for companies like Tidewater to secure the financing needed for significant capital expenditures. This was echoed in Tidewater's Q1 2025 earnings call, where management discussed exploring potential refinancing opportunities, suggesting a strategic move to capitalize on prevailing market conditions to optimize their capital structure and reduce future interest payments.

Global Economic Growth

Global economic growth is a significant driver for the offshore oil and gas sector, directly impacting energy demand. A healthy global economy typically translates to increased industrial activity and consumer spending, both of which boost energy consumption. This heightened demand underpins the necessity for sustained offshore production to meet global energy needs.

However, the outlook for global economic expansion can be influenced by various macroeconomic uncertainties. For instance, projections for global GDP growth in 2025, while generally positive, are subject to factors like inflation, geopolitical stability, and interest rate policies. These uncertainties can temper the expected growth in energy demand, consequently affecting the offshore oil and gas market.

The International Monetary Fund (IMF) projected global growth at 3.2% for 2024 and a similar pace for 2025, highlighting a stable but not exceptionally rapid expansion. This moderate growth suggests a steady, rather than booming, demand for energy. Factors to watch include:

- Inflationary Pressures: Persistent inflation could lead to tighter monetary policies, potentially slowing economic activity and energy demand.

- Geopolitical Risks: Conflicts and trade disputes can disrupt supply chains and dampen global economic sentiment, impacting investment in offshore projects.

- Energy Transition Policies: Government initiatives promoting renewable energy may gradually shift energy consumption patterns, influencing long-term offshore oil and gas investment.

- Commodity Price Volatility: Fluctuations in oil and gas prices, influenced by global demand and supply dynamics, directly affect the profitability and investment decisions within the offshore sector.

Supply Chain Dynamics and Inflation

Supply chain disruptions and ongoing inflationary pressures directly impact Tidewater's operational expenses. Costs for essential items like fuel, vessel maintenance, and the construction of new offshore support vessels have seen significant increases. For example, global inflation rates remained elevated through much of 2024, with some projections suggesting continued upward pressure on commodity prices into 2025.

These supply chain bottlenecks, particularly for specialized components crucial to offshore energy projects, can lead to project delays. Such delays directly reduce vessel utilization rates, a key metric for Tidewater's revenue generation. The International Energy Agency (IEA) has highlighted persistent supply chain issues in the energy sector, impacting everything from equipment manufacturing to project execution.

In this challenging economic climate, Tidewater's ability to manage costs efficiently becomes paramount for maintaining profitability. Strategic sourcing, inventory management, and operational optimization are critical levers. The company's financial reports for 2024 and early 2025 will likely reflect these cost pressures and highlight management's strategies to mitigate them.

- Increased Operational Costs: Fuel prices, maintenance expenses, and new vessel construction are subject to inflationary pressures.

- Project Delays: Bottlenecks in critical component supply can hinder project timelines, impacting vessel utilization.

- Cost Management Imperative: Efficient operational and financial management is vital for profitability amidst these economic headwinds.

- Global Inflationary Trends: Persistent inflation in key markets continues to affect input costs across the maritime and energy sectors.

Global economic growth trends directly influence energy demand, impacting Tidewater's operational landscape. Projections for 2024 and 2025 indicate moderate global GDP expansion, suggesting steady, rather than explosive, energy consumption. This sustained demand supports the offshore oil and gas sector, a key market for Tidewater's services. However, persistent inflation and geopolitical risks could temper economic expansion, indirectly affecting investment in offshore projects.

What You See Is What You Get

Tidewater PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Tidewater region provides a detailed examination of Political, Economic, Social, Technological, Legal, and Environmental factors impacting the area. Gain valuable insights into the strategic landscape to inform your business decisions and planning.

Sociological factors

Public sentiment towards fossil fuels is rapidly shifting, with a significant portion of the global population now prioritizing climate action. This growing awareness directly impacts the perceived viability of offshore oil and gas ventures, influencing both investment decisions and public acceptance of such projects.

Tidewater's business model, while currently serving vital energy needs, faces increasing scrutiny as societies push for more sustainable practices. This societal pressure necessitates a strategic adaptation towards renewable energy sources, shaping the company's long-term outlook and operational focus.

For instance, a 2024 survey indicated that over 60% of respondents globally expressed concern about climate change and supported a transition away from fossil fuels. This data highlights the critical need for companies like Tidewater to demonstrate a clear commitment to environmental, social, and governance (ESG) principles.

The ongoing energy transition, driven by these evolving societal attitudes, presents both challenges and opportunities for Tidewater. Navigating this landscape requires a proactive approach to integrating cleaner energy solutions and communicating transparently about sustainability efforts to maintain public trust and investor confidence.

The offshore energy sector, including Tidewater's vessel operations, is grappling with attracting and keeping skilled workers. A significant portion of experienced professionals are exploring opportunities in the growing renewable energy sector, creating a potential drain on traditional offshore talent. This trend, coupled with demographic shifts, could lead to critical skills shortages in the coming years.

Tidewater's success hinges on its specialized and experienced workforce. As the energy landscape evolves, a perceived decline in long-term career prospects within traditional offshore energy could exacerbate the challenge of filling vital roles. For example, in 2024, industry reports indicated an average of 15% of offshore workers expressed interest in transitioning to renewables, impacting recruitment pipelines.

Tidewater's dedication to a robust Health, Safety, and Environmental (HSE) culture is essential for its operational success and public image. This commitment is directly linked to maintaining their social license to operate, especially within the demanding maritime industry.

Increased public and regulatory attention on safety and environmental accountability, particularly following significant industry incidents, compels Tidewater to consistently invest in top-tier HSE practices and stringent compliance measures. For example, in 2024, the offshore energy sector faced heightened scrutiny after several high-profile environmental concerns, reinforcing the need for proactive HSE management.

This focus on HSE is a foundational element of Tidewater's broader sustainability initiatives. By prioritizing the well-being of its workforce and the environment, Tidewater aims to build trust and ensure long-term viability in an increasingly conscious global market.

Community Engagement and Local Impact

Tidewater's global operations necessitate strong community engagement, directly impacting its social license to operate. In 2024, the company emphasized strengthening ties with communities near its offshore support vessel bases, aiming to enhance local economic contributions. This focus is crucial for maintaining operational continuity and positive brand perception, especially as Tidewater navigates its expansion into new regions.

Ensuring local employment and minimizing environmental footprints are key components of Tidewater's community relations strategy. For instance, in West Africa, where Tidewater has a significant presence, local content policies are increasingly stringent, requiring companies to demonstrate tangible benefits for the host nation. Tidewater's commitment to these principles directly influences its ability to secure and maintain contracts, contributing to its overall social performance metrics.

- Local Employment: In 2024, Tidewater reported that over 60% of its onshore support staff in key operational hubs were locally hired, a figure it aims to increase by 5% by the end of 2025.

- Community Investment: The company allocated $5 million in 2024 towards community development projects, focusing on education and infrastructure improvements in areas surrounding its major port facilities.

- Stakeholder Dialogue: Regular consultations with community leaders and local government officials are conducted to address concerns and align operational plans with community needs.

Diversity, Equity, and Inclusion (DEI)

Societal expectations around Diversity, Equity, and Inclusion (DEI) are significantly shaping corporate governance and workforce strategies. Tidewater is increasingly expected to demonstrate a robust approach to DEI across its global operations, focusing on fair employment and fostering inclusive environments. This commitment is becoming a critical factor for stakeholders, including employees, investors, and clients, and is frequently highlighted in corporate sustainability reports.

Tidewater's dedication to DEI is becoming a key performance indicator. For example, many companies in 2024 and 2025 are setting ambitious DEI targets, with reports indicating that firms with strong DEI initiatives often see improved employee retention and innovation. Tidewater's approach is likely being evaluated against these evolving industry benchmarks and stakeholder demands, influencing its reputation and operational practices.

The emphasis on DEI extends to how companies like Tidewater manage their talent and engage with their communities. This includes ensuring equitable pay, providing equal opportunities for advancement, and cultivating a workplace where all employees feel valued and respected. Such practices are not only ethical imperatives but also strategic advantages in attracting and retaining top talent in a competitive global market.

Key aspects of Tidewater's DEI focus might include:

- Workforce Diversity Metrics: Tracking representation across various demographics in hiring and leadership roles.

- Inclusive Culture Initiatives: Implementing programs and training to promote understanding and belonging.

- Pay Equity Audits: Regularly reviewing compensation to ensure fairness across gender, race, and other identities.

- Supplier Diversity Programs: Encouraging and supporting businesses owned by underrepresented groups.

Societal shifts towards sustainability and climate action are profoundly influencing the offshore energy sector. Growing public demand for environmentally responsible operations pressures companies like Tidewater to integrate greener practices and renewable energy solutions. This evolving sentiment, underscored by a 2024 global survey showing over 60% concern for climate change, necessitates a strong commitment to ESG principles to maintain social license and investor confidence.

The talent pool for the offshore energy industry is experiencing a shift, with a notable portion of skilled workers eyeing opportunities in the burgeoning renewable energy sector. Industry reports from 2024 indicated that approximately 15% of offshore personnel were considering transitions to renewables, potentially creating a skills gap for traditional offshore operations. Tidewater must address this trend to secure its experienced workforce.

A robust Health, Safety, and Environmental (HSE) culture is paramount for Tidewater's operational integrity and public perception, especially given heightened scrutiny in 2024 following environmental concerns in the broader offshore sector. Maintaining stringent compliance and investing in top-tier HSE practices are crucial for ensuring long-term viability and stakeholder trust.

Community engagement is vital for Tidewater's social license to operate, with a focus in 2024 on strengthening local ties and economic contributions. In regions like West Africa, stringent local content policies require demonstrable benefits for host nations, directly impacting Tidewater's ability to secure contracts and enhance its social performance metrics.

Diversity, Equity, and Inclusion (DEI) are increasingly critical for corporate governance and workforce strategy in 2024-2025. Companies with strong DEI initiatives are often rewarded with better employee retention and innovation, setting a benchmark that influences Tidewater's reputation and operational practices as it navigates global markets and talent acquisition.

| Sociological Factor | Tidewater Relevance | 2024/2025 Data Point |

| Public Sentiment on Environment | Impacts social license and investment in offshore energy. | 60%+ global concern for climate change (2024 survey). |

| Workforce Transition | Risk of skills shortage in traditional offshore roles. | 15% of offshore workers considering renewable energy jobs (2024 reports). |

| HSE Culture | Essential for operational safety, compliance, and reputation. | Increased regulatory scrutiny on environmental accountability in 2024. |

| Community Engagement | Key to securing and maintaining operational permits and contracts. | 60% of onshore support staff in key hubs locally hired (Tidewater 2024 report). |

| DEI Expectations | Influences talent attraction, retention, and corporate standing. | Companies with strong DEI see improved employee retention and innovation (2024-2025 trend). |

Technological factors

Technological advancements are reshaping the offshore vessel sector. Tidewater, like its peers, is seeing significant progress in vessel design and propulsion. The push towards greener operations means more investment in hybrid power systems and vessels capable of running on liquefied natural gas (LNG).

These innovations are not just about environmental compliance; they directly impact operational costs. For instance, hybrid systems can reduce fuel consumption by up to 15% in certain operating conditions, a crucial factor given fluctuating fuel prices. Tidewater's commitment to modernizing its fleet with these technologies positions it to meet stricter emissions standards, which are expected to become even more stringent through 2025 and beyond.

Digitalization and data analytics are transforming the maritime industry, including the Oil and Gas Service Vessel (OSV) sector. Initiatives like real-time monitoring and predictive maintenance are becoming standard, enhancing operational efficiency and safety. For instance, by mid-2024, many OSV operators are implementing advanced fleet management software that leverages AI for optimized routing and fuel consumption, leading to estimated fuel savings of 5-10%.

Predictive maintenance, powered by data analytics, is crucial for minimizing costly downtime. By analyzing sensor data from vessel engines and equipment, potential failures can be identified and addressed proactively. This approach is projected to reduce unscheduled maintenance by up to 20% by the end of 2025, directly impacting profitability and vessel availability for critical offshore operations.

The maritime sector is increasingly exploring autonomous and remotely operated vessels. Companies are actively developing and testing these technologies, aiming to improve safety and reduce manning levels. For instance, in 2023, Rolls-Royce reported significant progress in its autonomous ship technology, envisioning a future where operational costs could be reduced by up to 10-15% through automation and optimized routing.

This shift promises to boost operational efficiency by enabling continuous monitoring and data-driven decision-making, potentially leading to fuel savings and optimized vessel deployment. While full autonomy is still evolving, even partial remote operation capabilities can enhance Tidewater's fleet management and responsiveness to market demands.

Subsea Technology and Equipment

Innovations in subsea technology are reshaping offshore oil and gas exploration and production, directly impacting the demand for specialized offshore support vessels (OSVs) like those operated by Tidewater. Advancements in areas like subsea processing and autonomous underwater vehicles (AUVs) are enabling more complex and efficient deepwater operations. For instance, the increasing sophistication of subsea tie-backs, which connect multiple subsea wells to a central processing facility, requires highly capable and specialized OSVs for installation, maintenance, and intervention tasks. This trend is expected to continue, with significant investment in subsea technology projected through 2025 and beyond, as operators seek to optimize production from existing fields and access new, more challenging reserves.

The drive for enhanced equipment durability and reliability in subsea environments also plays a crucial role. As subsea components are designed to withstand harsher conditions and operate for longer periods without intervention, the need for specialized OSV support during their installation and occasional maintenance remains critical. This technological evolution can lead to extended asset lifespans, thereby sustaining demand for OSV services over a longer horizon. The market for subsea equipment and services was valued at approximately $45 billion in 2023 and is anticipated to grow steadily, driven by these technological advancements and the pursuit of operational efficiencies offshore.

- Technological Advancements: Innovations in subsea processing, robotics, and automation are increasing the complexity and efficiency of offshore operations.

- Extended Asset Lifespans: Improved durability of subsea equipment, driven by new materials and designs, can prolong the operational life of offshore assets.

- Demand for Specialized OSVs: The increasing complexity of subsea installations and maintenance necessitates specialized OSVs equipped for deepwater and challenging environments.

- Market Growth: The global subsea technology and equipment market is projected for continued growth, supporting sustained demand for OSV services through 2025.

Cybersecurity in Maritime Operations

As Tidewater's fleet becomes more digitized, cybersecurity is paramount. The increasing reliance on connected systems for navigation, cargo management, and operational efficiency exposes vessels to significant cyber risks. A breach could disrupt operations, compromise sensitive cargo data, or even lead to physical damage.

Investing in advanced cybersecurity is no longer optional but a necessity for maritime operators like Tidewater. The International Maritime Organization (IMO) has recognized this, implementing resolutions requiring shipping companies to address cyber risks in their safety management systems. The global maritime cybersecurity market is projected to grow substantially, with some estimates placing its value at over $10 billion by 2027, highlighting the escalating threat landscape and the industry's response.

- Increased Connectivity: Modern vessels utilize integrated systems for navigation, communication, and cargo tracking, creating a larger attack surface.

- Data Protection: Securing sensitive operational data, crew information, and cargo manifests from unauthorized access and theft is crucial.

- Operational Disruption: Cyberattacks can cripple vessel operations, leading to significant financial losses and safety hazards.

- Regulatory Compliance: Adhering to evolving international and national cybersecurity regulations is essential for continued operation.

Technological advancements are driving efficiency and sustainability in the offshore vessel sector. Tidewater is actively integrating innovations like hybrid propulsion systems, which can improve fuel efficiency by up to 15%, and digital fleet management tools that offer estimated fuel savings of 5-10% through optimized routing. The increasing sophistication of subsea operations also necessitates specialized vessels, sustaining demand for Tidewater's services as the subsea market grows.

| Technology Area | Impact on Operations | Estimated Efficiency Gain | Market Trend (by 2025) |

|---|---|---|---|

| Hybrid Propulsion | Reduced fuel consumption, lower emissions | Up to 15% fuel savings | Increased adoption for new builds and retrofits |

| Digitalization & AI | Optimized routing, predictive maintenance | 5-10% fuel savings, up to 20% reduction in unscheduled maintenance | Widespread implementation of advanced fleet management software |

| Subsea Technology | Enables complex deepwater operations | Sustains demand for specialized OSVs | Continued growth in subsea equipment and services market |

Legal factors

Tidewater navigates a rigorous international maritime regulatory landscape, primarily dictated by the International Maritime Organization (IMO). Compliance with evolving standards like MARPOL Annex VI, which targets emissions, and the Ballast Water Management Convention, is paramount. These rules necessitate ongoing investment in vessel technology and operational adjustments to ensure adherence, impacting capital expenditure and operational efficiency.

The push for stricter environmental controls, such as the Energy Efficiency Design Index (EEDI) Phase 3, which targets new ship designs for reduced greenhouse gas emissions, is a key factor. Furthermore, the implementation of the Hong Kong Convention for Ship Recycling adds another layer of compliance, requiring responsible end-of-life management for vessels. Failure to meet these IMO mandates can result in significant penalties and operational disruptions.

Regional environmental regulations like the EU Emissions Trading System (ETS) and FuelEU Maritime are increasingly shaping maritime operations. These rules mandate specific greenhouse gas (GHG) intensity reduction targets for vessels.

Starting in 2025, these regulations will encompass offshore vessels exceeding 5,000 GT that call at EU ports. Non-compliance can result in significant financial penalties, underscoring the need for proactive adaptation.

Tidewater, as a global operator, must adhere to a complex web of national offshore drilling and safety laws in each country where it conducts business. These regulations, covering everything from drilling practices to environmental safeguards, vary significantly and are subject to change based on political shifts. For instance, in the United States, the Bureau of Safety and Environmental Enforcement (BSEE) sets stringent standards, while other nations might have different enforcement mechanisms and compliance requirements, directly impacting operational costs and strategic planning.

Labor Laws and Seafarer Regulations

Tidewater’s global operations necessitate strict adherence to international and national labor laws. This includes compliance with the Standards of Training, Certification and Watchkeeping for Seafarers (STCW) convention, which governs seafarer training and certification. Ensuring seafarers meet these rigorous standards is paramount for safe navigation and operational efficiency. Failure to comply can lead to significant penalties and operational disruptions.

These regulations directly impact Tidewater's human capital management and operational expenses. For instance, stipulated working hours and minimum wage requirements for seafarers, as outlined by the International Labour Organization (ILO) Maritime Labour Convention, can influence crewing costs. In 2024, the global maritime industry continued to navigate evolving labor standards, with a focus on crew welfare and fair compensation packages to attract and retain skilled personnel.

- STCW Compliance: Ensuring all seafarers possess current STCW certifications is a baseline requirement for Tidewater's fleet operations.

- Working Conditions: Adherence to ILO conventions regarding working hours, rest periods, and onboard living conditions is critical for crew well-being and retention.

- Wages and Benefits: Competitive and legally compliant wage structures and benefits packages are essential for attracting and keeping qualified maritime professionals in a tight labor market.

- Safety Regulations: Labor laws often intersect with safety regulations, mandating specific training and manning levels to prevent accidents and ensure operational integrity.

Contractual and Commercial Legal Frameworks

Tidewater's operations are intrinsically tied to its contractual relationships within the energy sector. Navigating complex contract law, which governs vessel chartering, pricing, and risk allocation, is paramount for sustained business. For instance, in 2024, Tidewater reported that a significant portion of its revenue was derived from long-term contracts, highlighting the importance of these agreements.

The integration of new regulatory stipulations into these commercial contracts is a critical ongoing task. Regulations like FuelEU Maritime, which aim to reduce greenhouse gas emissions from shipping, necessitate updated clauses covering fuel sourcing, reporting, and compliance costs. This directly impacts how Tidewater structures its agreements and manages operational expenses moving forward.

- Contractual Reliance: Tidewater's revenue streams are primarily secured through service contracts with oil and gas companies.

- Key Contract Terms: Agreements typically detail vessel utilization rates, daily charter rates, and specific liability limitations.

- Regulatory Integration: New environmental regulations, such as FuelEU, require careful incorporation into commercial agreements to ensure compliance and cost allocation.

- Impact on Operations: Adherence to these legal frameworks directly influences operational efficiency and financial performance.

Legal factors significantly shape Tidewater's operational landscape, demanding strict adherence to international maritime laws and national regulations. Compliance with emissions standards like MARPOL Annex VI and ballast water management is non-negotiable, influencing vessel upgrades and operational costs. The company must also navigate diverse national offshore drilling and safety statutes, which vary considerably and impact strategic planning.

Labor laws, including the STCW and ILO conventions, are critical for managing human capital, affecting crewing costs and ensuring seafarer welfare. Furthermore, Tidewater's reliance on long-term contracts means that integrating evolving regulatory stipulations, such as those impacting emissions, into these agreements is a constant challenge. Failure to comply with any of these legal frameworks can lead to severe penalties and operational disruptions.

Environmental factors

Global efforts to combat climate change, with many nations aiming for net-zero emissions by 2050, are significantly impacting the maritime sector. This push for decarbonization requires the industry to adopt cleaner energy sources and optimize vessel performance.

Tidewater is actively engaged in reducing its operational CO2-e intensity, a commitment that directly shapes its investment in and adoption of greener fuels and more efficient ship technologies. This focus is crucial for meeting evolving environmental regulations.

These decarbonization targets are not just operational guidelines; they are foundational to Tidewater's long-term strategic planning and capital allocation decisions. For example, investments in vessels capable of running on alternative fuels like ammonia or methanol are becoming increasingly important.

The International Maritime Organization's (IMO) strategy aims to reduce greenhouse gas emissions from international shipping by at least 50% by 2050 compared to 2008 levels, with a strong push for further reductions. This regulatory landscape directly influences fleet modernization and operational expenditures for companies like Tidewater.

Stricter environmental regulations are a significant factor for Tidewater. New rules targeting air emissions like sulfur oxides (SOx) and nitrogen oxides (NOx), along with stricter limits on water discharges such as ballast water and oily mixtures, necessitate continuous investment in advanced emission control systems and operational changes. For example, the expansion of Emission Control Areas (ECAs), like the recent designation of the Mediterranean Sea, means companies must adapt to more stringent standards across a wider operational footprint.

Tidewater's operations, particularly in offshore services, inherently place it within sensitive marine environments. The company must navigate stringent regulations designed to safeguard biodiversity and prevent disruption to vital marine habitats. This commitment is crucial for maintaining its license to operate and for corporate social responsibility.

Key to Tidewater's environmental strategy is robust oil spill prevention and response. While specific incident data for 2024/2025 is still emerging, the industry's focus remains on minimizing the likelihood and impact of such events. This includes advanced vessel design, rigorous crew training, and comprehensive containment and cleanup protocols.

Effective waste management is another critical environmental factor. Tidewater implements procedures for the responsible disposal of waste generated from its vessels and offshore platforms. This adheres to international maritime regulations and aims to prevent pollution of marine ecosystems, ensuring compliance with standards like MARPOL.

Avoiding disruption to marine habitats involves careful planning and execution of offshore activities. This can include measures like noise reduction during drilling operations and careful route planning for support vessels to minimize impact on marine life, such as cetaceans or sensitive seabed communities.

Waste Management and Circular Economy Principles

The maritime industry, including offshore support vessel operators like Tidewater, is increasingly adopting circular economy principles. This shift emphasizes better waste management and robust recycling programs, aiming to minimize environmental footprints across the entire vessel lifecycle. For instance, initiatives focused on reducing single-use plastics onboard and optimizing waste segregation for recycling are becoming standard operating procedures.

Tidewater's commitment to responsibly recycling its older vessels directly supports these circular economy goals. This practice not only diverts waste from landfills but also allows for the recovery of valuable materials, thereby reducing the demand for virgin resources. Such strategies are crucial for a sector under growing pressure to demonstrate environmental stewardship.

- Sustainable Supply Chains: Companies are scrutinizing their supply chains to ensure materials and components are sourced responsibly and can be reused or recycled at end-of-life.

- Vessel Decommissioning: Responsible decommissioning and recycling of offshore vessels are gaining prominence, with a focus on maximizing material recovery and minimizing hazardous waste.

- Regulatory Push: International and national regulations, such as those from the IMO, are driving stricter waste management protocols and encouraging circular practices within the maritime sector.

- Economic Benefits: The circular economy offers potential cost savings through resource efficiency and new revenue streams from recycled materials.

Adaptation to Physical Climate Risks

While Tidewater's core business is offshore, long-term physical climate risks like rising sea levels and more extreme weather events present potential, albeit less direct, challenges to their operations and infrastructure. These shifts could impact port access, supply chain reliability, and the longevity of coastal facilities supporting their fleet. Ensuring operational resilience and adaptability to evolving environmental conditions is therefore critical for maintaining business continuity and mitigating potential disruptions.

Tidewater's fleet, crucial for offshore energy exploration and production, may face indirect impacts from climate change. For instance, changes in ocean currents or increased storm frequency could affect vessel transit times and safety protocols. The company's commitment to maintaining a modern and efficient fleet, as evidenced by their fleet modernization programs, indirectly supports their ability to adapt to these potential environmental shifts.

- Fleet Modernization: Tidewater continues to invest in newer, more fuel-efficient vessels, which are often designed with enhanced structural integrity and operational capabilities, potentially offering greater resilience against adverse weather conditions.

- Operational Risk Management: The company likely has robust risk management frameworks in place to assess and mitigate the impact of severe weather events on offshore activities, including contingency planning for vessel positioning and crew safety.

- Geographic Diversification: Tidewater's global operational footprint can help mitigate the impact of localized extreme weather events, as operations in one region may be unaffected by conditions in another.

Global decarbonization efforts are significantly shaping the maritime sector, pushing for cleaner energy and efficient operations. Tidewater is actively reducing its CO2-e intensity, investing in greener fuels and technologies to meet evolving environmental regulations, such as the IMO's 2050 emissions reduction targets.

Stricter environmental rules, including those for air and water emissions, require continuous investment in advanced systems. The expansion of Emission Control Areas (ECAs) means companies like Tidewater must adapt to more stringent standards across a wider operational footprint.

Tidewater's operations in sensitive marine environments necessitate adherence to regulations safeguarding biodiversity and preventing habitat disruption. This commitment is vital for maintaining its license to operate and fulfilling corporate social responsibility mandates.

The company also focuses on robust oil spill prevention and effective waste management, adhering to international standards like MARPOL to prevent marine pollution. Furthermore, Tidewater is embracing circular economy principles, focusing on responsible vessel decommissioning and recycling to minimize its environmental impact.

PESTLE Analysis Data Sources

Our Tidewater PESTLE analysis is meticulously constructed using data from national and regional government reports, leading economic forecasting agencies, and reputable industry-specific publications. We prioritize credible data to ensure each factor, from political stability to technological advancements, is thoroughly informed.