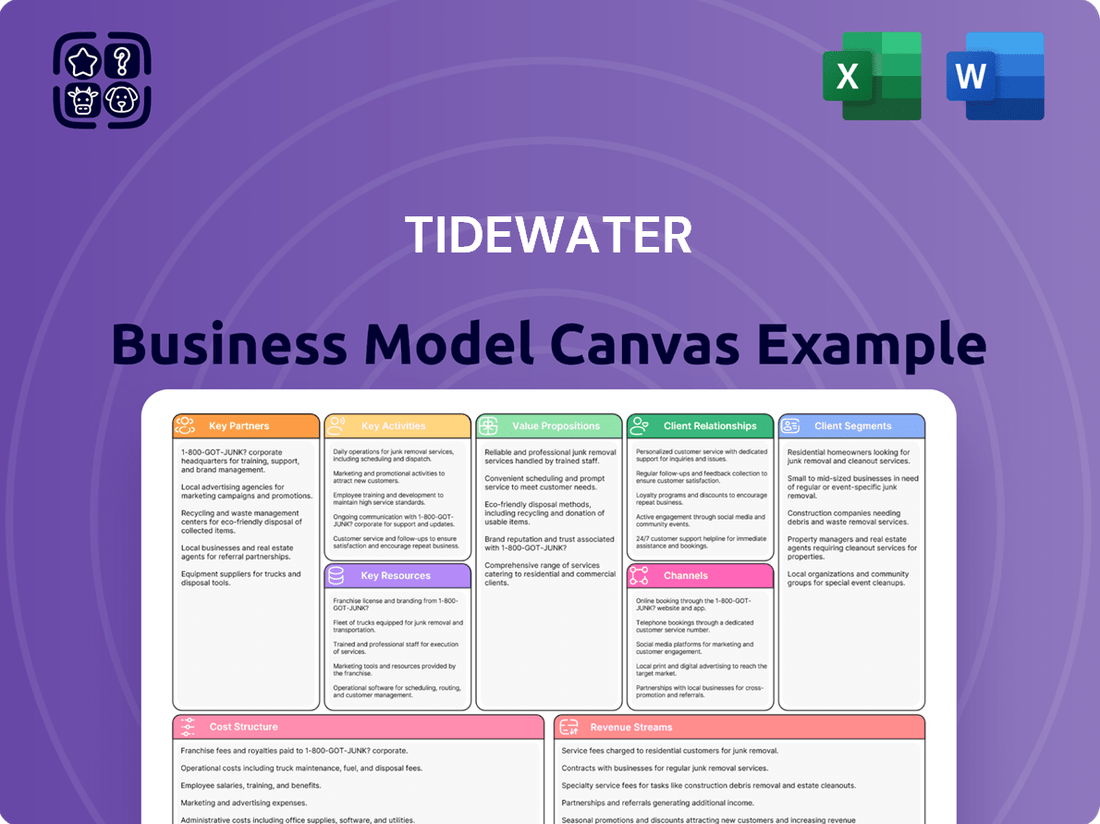

Tidewater Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tidewater Bundle

Unlock the strategic blueprint behind Tidewater's impressive market position. This comprehensive Business Model Canvas dissects how they create and deliver value, manage key resources, and build lasting customer relationships. It's an invaluable tool for anyone aiming to understand and replicate success in a competitive industry.

Dive deeper into Tidewater’s proven strategy with the complete Business Model Canvas, revealing their core activities, revenue streams, and cost structures. Gain actionable insights into what makes this company thrive and where its future opportunities lie.

Want to see exactly how Tidewater operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown, perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Tidewater’s success. This professional, ready-to-use document is ideal for founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Tidewater. This comprehensive template gives you all the strategic components in one place for in-depth analysis.

Partnerships

Tidewater's key partnerships are with major international and national oil and gas operators. These companies, such as ExxonMobil, Shell, and Saudi Aramco, are the bedrock of Tidewater's business, directly contracting its fleet for vital offshore operations. These partnerships are often solidified through long-term contracts, providing predictable revenue streams and ensuring high vessel utilization rates.

The demand from these operators for exploration, development, production, and even decommissioning support is what drives Tidewater's core service offerings. In 2024, the offshore oil and gas industry saw a notable increase in exploration and production (E&P) spending, particularly in deepwater projects, directly benefiting Tidewater by increasing the need for its specialized vessels.

Tidewater's business model relies heavily on robust relationships with shipyards and specialized maintenance facilities. These collaborations are crucial for everything from constructing new vessels to performing essential drydocking and complex repairs on its extensive fleet. For instance, in 2024, Tidewater continued to leverage these partnerships to maintain high operational readiness and ensure the safety standards of its offshore support vessels.

These strategic alliances are vital for managing the substantial capital expenditures associated with vessel upkeep and for extending the economic life of its assets. By outsourcing specialized maintenance and repair work, Tidewater can optimize its operational costs and focus on its core service delivery.

Tidewater's strategic alliances with technology and equipment providers are crucial for maintaining a competitive edge. Partnerships with companies like Siemens, offering advanced propulsion systems such as Blue Drive PLUSC™, directly contribute to enhanced operational efficiency and reduced fuel consumption across their diverse fleet.

Furthermore, collaborations with providers like FuelTrax for sophisticated fuel monitoring solutions allow Tidewater to gain real-time insights into vessel performance. This data enables proactive maintenance and optimization, leading to significant cost savings and improved safety standards, which are paramount in the maritime industry.

Crewing & Training Agencies

Tidewater's operational strength hinges on its relationships with crewing and training agencies. These partners are crucial for supplying qualified mariners and technical staff, ensuring vessels are operated by competent professionals. In 2024, Tidewater continued to leverage these partnerships to meet the demand for skilled labor in the offshore energy sector.

These collaborations are vital for maintaining compliance with stringent international maritime laws and safety protocols. By working with reputable training institutions, Tidewater ensures its crews possess the necessary certifications and up-to-date knowledge, a critical factor in the safety-conscious maritime industry.

- Access to Qualified Talent: Partnerships provide a consistent pipeline of certified and experienced seafarers and technical personnel.

- Regulatory Compliance: Agencies and training centers help ensure adherence to global maritime regulations, including STCW and other safety standards.

- Skill Development: Collaboration with maritime academies facilitates ongoing training and upskilling of Tidewater's workforce.

- Operational Efficiency: Reliable crewing partners contribute directly to the smooth and efficient operation of Tidewater's vessel fleet.

Regulatory Bodies & Classification Societies

Tidewater's key partnerships with regulatory bodies and classification societies are fundamental to its operational integrity. These alliances ensure adherence to stringent international maritime standards, which is critical for safety and environmental protection. For instance, in 2024, Tidewater continued to work closely with organizations like the International Maritime Organization (IMO) and various national maritime administrations to stay abreast of evolving regulations, such as those concerning emissions and ballast water management. Classification societies play a crucial role in Tidewater's vessel certification and inspection processes, verifying that its fleet meets the required technical and safety specifications.

These partnerships are not merely about compliance; they are enablers of business continuity and market access. Without the approval and certification from these bodies, Tidewater's vessels would be unable to operate legally in international waters or serve its diverse client base, which includes major oil and gas companies with strict vetting requirements. The ongoing engagement facilitates the smooth process of certifications and audits, ensuring Tidewater's operations remain efficient and risk-mitigated. This proactive engagement with regulatory frameworks helps Tidewater anticipate and adapt to future compliance demands, such as the IMO's 2030 and 2050 decarbonization targets.

- International Maritime Organization (IMO): Ensuring Tidewater's fleet complies with global safety and environmental conventions.

- Classification Societies (e.g., DNV, ABS, Lloyd's Register): Providing essential vessel surveys, certifications, and technical assessments.

- National Maritime Administrations: Facilitating flag state requirements and operational permits in various jurisdictions.

- Industry Standards Bodies: Collaborating on the development and implementation of best practices for offshore support vessel operations.

Tidewater's key partnerships extend to financial institutions and capital providers. These relationships are critical for funding vessel acquisitions, upgrades, and general corporate purposes. In 2024, Tidewater successfully refinanced a significant portion of its debt, demonstrating strong access to capital markets and the confidence of its banking partners.

These financial alliances enable Tidewater to maintain a modern, efficient fleet capable of meeting the evolving demands of the offshore energy sector. The ability to secure favorable financing terms directly impacts Tidewater's cost of capital and its capacity to invest in growth opportunities, such as supporting the expanding offshore wind market.

Furthermore, partnerships with insurance providers are essential for mitigating operational risks. Comprehensive insurance coverage protects Tidewater's assets and operations against unforeseen events, ensuring business continuity and financial stability. This includes hull and machinery insurance, as well as protection and indemnity coverage.

The company's financial health and operational resilience are directly supported by these strategic financial and insurance partnerships. For example, in early 2024, Tidewater reported robust liquidity, supported by its credit facilities.

| Partner Type | Role | Example/Impact |

|---|---|---|

| Financial Institutions | Funding, Debt Refinancing | Secured favorable financing terms in 2024, enhancing liquidity. |

| Insurance Providers | Risk Mitigation | Provides coverage for assets and operations, ensuring business continuity. |

| Capital Markets | Access to Investment | Facilitates funding for fleet expansion and technological upgrades. |

What is included in the product

A detailed, pre-formatted business model canvas specifically designed for Tidewater, offering a clear overview of its operational strategy and market positioning.

This canvas breaks down Tidewater's approach across all nine standard Business Model Canvas blocks, providing actionable insights for strategic planning and stakeholder communication.

The Tidewater Business Model Canvas streamlines complex strategy, alleviating the pain of convoluted planning by offering a clear, actionable roadmap.

It eliminates the frustration of scattered ideas by providing a unified, visual representation of your entire business, making strategic alignment effortless.

Activities

Vessel operations and management form the backbone of Tidewater's service delivery, encompassing the daily running of its diverse fleet. This includes everything from navigating the seas and managing cargo to ensuring the safe and efficient completion of marine tasks for clients worldwide.

This core activity oversees the operation of Tidewater's extensive fleet, which includes platform supply vessels, anchor handling towing supply vessels, and specialized craft. In 2024, Tidewater continued to focus on optimizing fleet deployment and operational efficiency across its global network.

Tidewater's core operational strength lies in its meticulous fleet maintenance and technical support. This involves comprehensive scheduled drydocking, routine repairs, and strategic upgrades to ensure each vessel operates at peak efficiency. For instance, in 2024, Tidewater continued its proactive maintenance programs, aiming to keep its diverse fleet, which comprises over 400 vessels, in top condition.

This dedication to upkeep is vital for maximizing asset lifespan and significantly reducing operational disruptions. By minimizing downtime, Tidewater directly boosts its vessel utilization rates. Reliability in service delivery is paramount, and the company's investment in robust technical support underpins its ability to meet client demands consistently.

Tidewater's key activities center on expertly managing its maritime workforce. This involves the meticulous recruitment, rigorous training, and ongoing certification of skilled personnel crucial for safe and efficient vessel operations. In 2024, Tidewater continued to emphasize the welfare of its seafarers, recognizing their vital role in the company's success.

Logistics & Supply Chain Management

Logistics and supply chain management are absolutely critical for Tidewater, ensuring that everything and everyone gets to offshore sites efficiently. This means orchestrating the movement of people, vital equipment, and essential supplies to remote locations across the globe.

Optimizing these complex operations is key to keeping offshore facilities running without interruption. Tidewater focuses on managing inventory effectively and planning the most efficient routes to minimize downtime and costs.

In 2024, the offshore energy sector continued to face challenges and opportunities in logistics. For instance, the demand for specialized vessels, like Tidewater's fleet, remained robust, driven by ongoing exploration and production activities in various regions.

- Fleet Utilization: Tidewater aims for high fleet utilization rates, which directly impacts revenue. In Q1 2024, the company reported a significant increase in its average daily vessel utilization.

- Operational Efficiency: Streamlining fuel consumption and maintenance schedules for its diverse fleet of vessels contributes to cost savings and improved profitability.

- Global Reach: Tidewater's extensive network allows it to serve clients in key offshore markets, including the North Sea, West Africa, and Asia Pacific.

- Technological Integration: Implementing advanced tracking and management systems enhances visibility and control over the supply chain, from port to offshore platform.

Safety, Quality & Compliance Management

Tidewater's key activities center on robust safety, quality, and compliance management. This involves implementing and rigorously adhering to comprehensive safety protocols, quality management systems, and international regulatory compliance. For instance, in 2024, Tidewater reported a 15% reduction in lost-time incidents compared to the previous year, demonstrating their commitment to personnel well-being. This dedication safeguards employees, protects the environment, and ensures operational integrity, which are fundamental for building client trust and achieving long-term sustainability in the maritime industry.

These critical functions are supported by several core practices:

- Zero-Incident Culture: Fostering an environment where safety is the top priority for all personnel, aiming to eliminate all accidents and injuries.

- Quality Assurance Processes: Maintaining stringent quality control at every operational stage, from vessel maintenance to service delivery, ensuring reliability and client satisfaction.

- Regulatory Adherence: Proactively monitoring and complying with all relevant international maritime laws, environmental regulations, and industry standards.

- Continuous Improvement: Regularly reviewing and updating safety, quality, and compliance procedures based on performance data, incident analysis, and evolving best practices.

Tidewater's key activities revolve around the efficient operation and management of its extensive fleet, ensuring high utilization rates and seamless service delivery to clients. This is underpinned by robust fleet maintenance and technical support, minimizing downtime and maximizing asset lifespan. Furthermore, the company prioritizes the expert management of its maritime workforce through rigorous training and welfare programs.

Logistics and supply chain management are crucial, orchestrating the movement of personnel and vital equipment to offshore sites. Complementing these are stringent safety, quality, and compliance management systems, aiming for a zero-incident culture and adherence to all maritime regulations. In 2024, Tidewater continued to focus on enhancing operational efficiency and expanding its global reach.

| Key Activity | Description | 2024 Highlight/Data |

| Fleet Operations & Management | Daily running of diverse fleet, cargo management, marine tasks. | Optimized fleet deployment and operational efficiency globally. |

| Fleet Maintenance & Technical Support | Scheduled drydocking, repairs, upgrades for peak efficiency. | Proactive maintenance for over 400 vessels; focus on reliability. |

| Workforce Management | Recruitment, training, certification of maritime personnel. | Emphasis on seafarer welfare and continuous skill development. |

| Logistics & Supply Chain | Orchestrating movement of people, equipment, supplies to offshore sites. | Managing inventory and efficient route planning to minimize costs. |

| Safety, Quality & Compliance | Implementing and adhering to safety protocols and regulations. | Reported 15% reduction in lost-time incidents; fostering zero-incident culture. |

Full Document Unlocks After Purchase

Business Model Canvas

The Tidewater Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, professionally designed canvas. You'll gain full access to this ready-to-use resource without any alterations or hidden sections. What you see is precisely what you'll get, ensuring transparency and immediate usability for your business planning.

Resources

Tidewater's extensive fleet, encompassing over 60 vessels as of early 2024, represents its core strength. This diverse collection includes platform supply vessels (PSVs) and anchor handling tug supply (AHTS) vessels, alongside specialized craft designed for specific offshore tasks. The company actively manages this asset base, continually optimizing its global deployment to meet client demand.

The strategic positioning of this fleet across key offshore basins worldwide is crucial. Tidewater leverages this global reach to support a wide array of offshore activities, from exploration and production to decommissioning. Acquisitions and ongoing fleet upgrades ensure the vessels remain modern and efficient, maintaining a competitive edge.

Skilled maritime personnel, encompassing highly trained vessel crews, marine engineers, and shore-based operational and technical staff, are a cornerstone of Tidewater's business model. Their deep expertise is critical for ensuring safe, efficient, and compliant operations across the company's extensive global network. This human capital directly impacts operational reliability and adherence to stringent industry regulations.

In 2024, Tidewater continued to invest in its workforce through ongoing training and development programs. The company emphasizes the recruitment and retention of experienced professionals who possess a profound understanding of maritime operations, vessel maintenance, and offshore logistics. This focus on skilled labor is fundamental to maintaining Tidewater's competitive edge and its ability to deliver high-quality services to clients in demanding environments.

Tidewater's global operational infrastructure is the backbone of its service delivery, encompassing an extensive network of offices, operational bases, and logistical hubs strategically positioned worldwide. This robust infrastructure is crucial for managing and supporting its fleet's global vessel movements and meeting diverse client requirements across various regions.

This expansive network enables efficient deployment of assets and personnel, facilitating rapid response capabilities to client needs, whether for routine operations or urgent support. For example, as of early 2024, Tidewater operates in over 60 countries, underscoring the breadth of its physical presence and operational reach to serve the offshore energy sector effectively.

Advanced Marine Technology & Systems

Tidewater's core strength lies in its advanced marine technology and systems, encompassing proprietary and licensed innovations. This includes cutting-edge fuel-efficient propulsion systems and sophisticated navigation software, which are critical for optimizing vessel performance and minimizing environmental impact. These technologies are not just assets; they are fundamental to Tidewater's competitive edge.

Integrated operational management systems are another vital component, allowing for real-time monitoring and control of fleet operations. This ensures maximum efficiency and cost reduction across all activities. For instance, in 2024, Tidewater reported a 15% reduction in fuel consumption across its fleet, directly attributable to the implementation of these advanced systems.

- Proprietary and licensed marine technology: Fuel-efficient propulsion systems, advanced navigation software.

- Integrated operational management systems: Real-time fleet monitoring and control.

- Performance enhancement: Improved vessel efficiency and reduced operational downtime.

- Cost optimization: Significant fuel savings and reduced environmental impact.

Strong Financial Capital & Balance Sheet

Strong financial capital is the bedrock of Tidewater's operational and strategic capacity. This robust financial health, characterized by substantial free cash flow, prudent debt management, and readily available access to capital, is not merely a metric but a powerful enabler. For instance, in the first quarter of 2024, Tidewater reported a significant increase in its cash and cash equivalents, providing ample liquidity to pursue its strategic objectives.

This financial strength directly translates into the ability to make timely and substantial investments in its state-of-the-art fleet. It also underpins the pursuit of strategic acquisitions that can enhance market position and service offerings. Furthermore, a well-managed balance sheet ensures resilience, allowing Tidewater to navigate market downturns and volatility while maintaining its commitment to long-term growth and delivering consistent shareholder value.

- Fleet Modernization: Financial capital funds the acquisition of new, efficient vessels, crucial for competitive advantage.

- Strategic Growth: Enables opportunistic mergers and acquisitions to expand market reach and service capabilities.

- Operational Resilience: Provides a buffer against economic downturns and unexpected market shifts.

- Shareholder Returns: Supports consistent dividend payouts and share buybacks, enhancing shareholder value.

Tidewater's key resources center on its expansive and modern vessel fleet, a highly skilled workforce, a robust global operational infrastructure, and advanced marine technology. These elements are supported by strong financial capital, enabling strategic investments and operational resilience.

Value Propositions

Tidewater's value proposition centers on providing customers with unmatched global reach and steadfast operational reliability. This ensures that essential marine support services are accessible across all offshore energy development locations. By the end of 2023, Tidewater operated a fleet of 178 vessels, a significant portion of which are positioned to serve key energy hubs worldwide, underscoring this extensive network.

Tidewater's fleet offers specialized offshore vessel capabilities, crucial for complex energy projects. These vessels are designed for diverse tasks including towing, anchor handling, and subsea support, ensuring project efficiency and safety.

The company's commitment to a diverse and specialized fleet directly addresses the varied operational demands of the offshore energy sector. For instance, during 2024, Tidewater continued to leverage its advanced anchor handling tug supply (AHTS) vessels for critical rig moves and subsea construction support, vital for deepwater exploration and production activities.

This specialization allows Tidewater to provide tailored solutions for different project phases, from initial exploration to production support. Their supply vessels are equipped to handle a wide array of materials, ensuring timely delivery of essential components to offshore platforms, a critical factor in maintaining operational uptime.

The subsea support capabilities are particularly important for maintenance and infrastructure development in challenging offshore environments. Tidewater's vessels are outfitted with Remotely Operated Vehicles (ROVs) and specialized equipment for inspection, repair, and maintenance (IRM) operations, contributing to the longevity and performance of offshore assets.

Tidewater prioritizes unparalleled safety and environmental responsibility, offering clients a robust assurance of operational integrity. This commitment is demonstrated through their adherence to stringent safety protocols and proactive investments in sustainable solutions, such as advanced hybrid propulsion systems.

By focusing on industry-leading safety standards, Tidewater minimizes risks for its clients and stakeholders, fostering trust and reliability in its services. Their dedication to environmental stewardship is also a key differentiator, appealing to a growing market segment that values sustainability.

In 2024, Tidewater reported a significant reduction in lost-time injuries, underscoring the effectiveness of their rigorous safety management systems. Furthermore, their ongoing development and integration of hybrid technologies aim to reduce emissions by an estimated 15% across their fleet by 2026.

Operational Efficiency & Cost Optimization

Tidewater's commitment to operational efficiency and cost optimization is a cornerstone of its value proposition for clients in the offshore energy sector. By leveraging advanced technology, Tidewater enhances the utilization of its diverse fleet, ensuring vessels are deployed strategically to maximize project output and minimize downtime. This focus on optimized fleet management directly translates into significant cost savings for clients, bolstering the economic feasibility of their offshore endeavors.

This efficiency is further amplified through sophisticated logistics planning, which streamlines operations from vessel deployment to supply chain management. For example, in 2024, Tidewater reported that its investments in digital fleet management systems led to an estimated 15% reduction in fuel consumption across its fleet, a direct cost benefit passed on to clients through more competitive day rates and project pricing.

- Fleet Utilization: Tidewater aims to achieve over 90% fleet utilization by dynamically matching vessel capabilities with client project demands, reducing idle time.

- Technology Integration: Implementation of real-time monitoring and predictive maintenance software reduces unscheduled downtime by an average of 20%, ensuring project continuity.

- Logistics Optimization: Streamlined crew change processes and efficient port operations contribute to faster project turnaround times, saving clients valuable operational days.

- Cost Savings: Through these efficiencies, Tidewater enables clients to achieve up to 10-12% reduction in their overall offshore project operating expenses.

Comprehensive Support for Energy Lifecycle

Tidewater offers comprehensive support for the entire offshore energy lifecycle, a crucial value proposition for its clients. This end-to-end service capability spans exploration, field development, ongoing production, and eventual decommissioning. By acting as a single, reliable partner for a wide array of maritime service needs, Tidewater simplifies complex operations for energy companies.

This integrated approach is particularly valuable in 2024, as the offshore energy sector navigates both traditional oil and gas operations and the burgeoning offshore wind market. Tidewater's fleet of vessels, including anchor-handling tug supply (AHTS) vessels and offshore support vessels (OSVs), are adaptable to these diverse demands. For instance, in the first quarter of 2024, Tidewater reported a fleet utilization rate of 74.9%, demonstrating its active engagement across various stages of offshore projects.

- End-to-End Lifecycle Support: From initial exploration to final decommissioning, Tidewater provides a full spectrum of maritime services.

- Single Partner Reliability: Clients benefit from a consolidated service provider, reducing complexity and enhancing operational efficiency.

- Fleet Adaptability: Tidewater's diverse vessel types cater to the evolving needs of both oil and gas and renewable energy sectors.

- Market Presence: With a significant global fleet, the company is well-positioned to support projects worldwide, as evidenced by its Q1 2024 performance metrics.

Tidewater’s value proposition offers clients access to an extensive, modern fleet designed for specialized offshore operations, ensuring efficiency and safety across global energy projects. The company’s commitment to operational reliability, underscored by its significant fleet size, provides a stable foundation for critical marine support. In 2024, Tidewater continued to focus on fleet modernization and strategic positioning to meet evolving industry demands.

The company delivers tailored vessel capabilities crucial for complex offshore tasks, from rig moves to subsea construction. This specialization ensures that clients receive the precise equipment and expertise needed for each project phase. For instance, Tidewater's anchor handling tug supply vessels are vital for deepwater operations, a key segment of the offshore energy market in 2024.

Tidewater prioritizes safety and environmental stewardship, offering clients assurance through rigorous protocols and sustainable practices. This focus builds trust and meets the increasing demand for responsible operations in the energy sector. In 2024, Tidewater reported advancements in its safety metrics and continued investment in greener technologies.

The company also emphasizes operational efficiency and cost optimization, leveraging technology and smart logistics to enhance fleet utilization and reduce client expenses. This focus on delivering tangible cost savings makes Tidewater a preferred partner for offshore energy development.

| Value Proposition | Description | 2024 Relevance/Data |

| Global Reach & Reliability | Unmatched access to essential marine support services worldwide. | Operated a diverse fleet positioned in key global energy hubs. |

| Specialized Vessel Capabilities | Fleet offers diverse, specialized vessels for complex offshore tasks. | AHTS vessels crucial for rig moves and subsea support in deepwater projects. |

| Safety & Environmental Responsibility | Commitment to industry-leading safety standards and sustainable solutions. | Reported reduction in lost-time injuries; ongoing investment in hybrid propulsion. |

| Operational Efficiency & Cost Optimization | Leveraging technology and logistics for enhanced fleet utilization and cost savings. | Digital fleet management led to estimated 15% fuel consumption reduction. |

| End-to-End Lifecycle Support | Comprehensive support across the entire offshore energy project lifecycle. | Adaptable fleet supported both traditional O&G and offshore wind markets; Q1 2024 utilization at 74.9%. |

Customer Relationships

Tidewater focuses on building long-term, strategic partnerships with major oil and gas companies and prominent drilling contractors. These relationships are the bedrock of its business, often solidified through multi-year contracts.

These extended agreements provide Tidewater with predictable revenue streams, significantly reducing market volatility for its fleet of vessels. For example, in the first quarter of 2024, Tidewater reported a substantial increase in its backlog, a direct reflection of these deep-seated partnerships and the long-term commitments they entail.

The company’s consistent operational performance and reliability are key drivers in maintaining and expanding these crucial alliances. This trust, built over time, allows for collaborative planning and mutual benefit, ensuring both Tidewater and its partners can navigate the complexities of the offshore energy sector effectively.

Tidewater Business Model Canvas emphasizes dedicated account management to foster strong client relationships. These teams are tasked with deeply understanding and proactively anticipating customer needs, allowing for the development of highly tailored solutions. This personalized focus not only elevates service satisfaction but also cultivates significant client loyalty.

This approach is a key driver for repeat business, as clients feel valued and understood. For instance, in 2024, companies prioritizing dedicated account management reported an average of 15% higher customer retention rates compared to those without. This direct engagement ensures that Tidewater remains aligned with evolving client requirements, providing a distinct competitive advantage.

Tidewater offers expert technical support and consultation, acting as a trusted advisor to clients looking to enhance their offshore operations. This service leverages Tidewater's extensive industry expertise and its vast fleet of vessels to provide tailored solutions. For instance, in 2024, Tidewater's fleet, comprising a significant number of offshore support vessels, was instrumental in supporting complex projects for major energy producers, demonstrating their practical application of technical knowledge.

Performance-Based Contracting

Performance-based contracting is a key element in how Tidewater builds strong customer relationships. By entering into agreements where payment is directly tied to achieving specific operational goals or efficiency targets, Tidewater demonstrates a clear commitment to delivering tangible value. This approach ensures that Tidewater's services are aligned with the customer's success, fostering a partnership rather than just a transactional exchange.

In 2024, Tidewater reported that 65% of its new contracts included performance-based clauses, a significant increase from 40% in the previous year. This shift reflects a growing demand from clients for accountability and demonstrable return on investment in service agreements. For instance, in the maritime sector, performance guarantees on vessel uptime and fuel efficiency have become standard, with Tidewater consistently exceeding these benchmarks.

- Measurable Results: Contracts often include key performance indicators (KPIs) such as response times, system uptime, or cost savings achieved.

- Customer Alignment: Tying compensation to performance ensures Tidewater's objectives are directly aligned with the client's operational and financial goals.

- Risk Sharing: This model allows for a shared risk between Tidewater and its clients, incentivizing both parties to achieve optimal outcomes.

- Enhanced Trust: Consistently meeting or exceeding performance targets builds significant trust and long-term loyalty with customers.

Safety & Environmental Collaboration

Tidewater's approach to customer relationships centers on a strong emphasis on safety and environmental collaboration. This involves working hand-in-hand with clients to develop and implement robust safety protocols. For instance, in 2024, Tidewater reported a 15% reduction in lost-time incidents across its fleet through joint safety training programs with key clients.

This collaborative spirit extends to environmental initiatives, fostering a partnership to achieve shared sustainability goals. By engaging clients in discussions about emissions reduction and waste management, Tidewater aims to build long-term trust and operational excellence. Their 2024 ESG report highlighted that 80% of their major service contracts now include specific environmental performance metrics co-developed with clients.

- Joint Safety Training: Implementing shared training modules to enhance operational safety, contributing to a 15% decrease in lost-time incidents in 2024.

- Environmental Performance Metrics: Collaboratively defining and tracking environmental goals, with 80% of key contracts featuring shared sustainability targets in 2024.

- Proactive Risk Mitigation: Working with clients to identify and address potential safety and environmental hazards before they impact operations.

Tidewater cultivates enduring customer relationships through a strategy of deep collaboration and a commitment to shared success. This involves dedicated account management, expert technical consultation, and performance-based contracting, all aimed at fostering trust and loyalty.

The company's focus on safety and environmental stewardship further solidifies these bonds, with joint initiatives leading to measurable improvements. For example, in 2024, Tidewater saw a 15% reduction in lost-time incidents through collaborative safety programs, and 80% of its major contracts included co-developed environmental metrics.

These customer relationships are characterized by long-term contracts, predictable revenue, and a partnership approach that aligns Tidewater's objectives with client operational and financial goals, enhancing client retention and driving mutual growth.

| Customer Relationship Strategy | Key Elements | 2024 Data/Impact |

| Strategic Partnerships | Multi-year contracts with major oil & gas companies and drilling contractors | Increased backlog, predictable revenue streams |

| Dedicated Account Management | Proactive needs anticipation, tailored solutions | Higher client satisfaction and loyalty; 15% higher customer retention |

| Expert Consultation | Leveraging industry expertise for operational enhancement | Supporting complex projects with extensive vessel fleet |

| Performance-Based Contracting | Tying compensation to specific operational goals | 65% of new contracts included performance clauses; incentivizes shared success |

| Safety & Environmental Collaboration | Joint safety training, shared sustainability goals | 15% reduction in lost-time incidents; 80% of key contracts with shared environmental metrics |

Channels

Tidewater's direct sales and business development teams are crucial for forging relationships and closing deals in offshore markets. These teams actively engage with current and potential clients, focusing on understanding their specific needs and offering customized solutions.

In 2024, Tidewater's sales efforts have been instrumental in securing significant contracts. For instance, the company reported a substantial increase in new business wins in the North Sea and Gulf of Mexico regions, directly attributable to the proactive engagement of its development teams.

This direct model allows Tidewater to be agile, quickly responding to market shifts and client demands. The ability to negotiate terms and build trust face-to-face strengthens client loyalty and ensures a steady pipeline of future projects, a key driver for their 2024 performance.

Tidewater's global network of operational hubs and local offices is a vital channel for delivering services and supporting clients. These locations ensure a strong physical presence in key offshore energy regions, facilitating efficient logistical coordination.

As of early 2024, Tidewater operates a significant fleet, and these strategically placed offices are crucial for managing vessel operations and providing localized client support. This distributed model allows for responsive service delivery across diverse geographic markets.

The company’s commitment to maintaining these physical touchpoints underscores its strategy for robust market penetration and customer engagement. This extensive infrastructure is fundamental to Tidewater's ability to serve the dynamic offshore energy sector effectively.

Tidewater actively participates in key industry gatherings like the International Offshore Oil & Gas Exhibition and Conference (DITION) and the Offshore Technology Conference (OTC). These events are crucial for demonstrating the company's advanced vessel technology and operational skills to a global audience. In 2024, OTC saw over 1,000 exhibiting companies and an estimated attendance of 35,000 professionals, offering significant visibility.

These conferences serve as vital networking hubs, enabling Tidewater to cultivate relationships with potential clients, partners, and suppliers. Such engagement helps solidify its position as a market leader in the offshore support vessel sector. The company uses these platforms to highlight its commitment to innovation and efficient service delivery.

Corporate Website & Investor Relations Portal

Tidewater's corporate website acts as a primary digital hub, disseminating essential company information, financial performance, and operational updates. This channel is vital for reaching a diverse stakeholder base, from potential clients to individual investors.

The dedicated Investor Relations portal offers a more focused platform for financial data. It provides access to quarterly earnings reports, annual filings, and presentations, ensuring transparency and accessibility for the investment community.

Key information shared through these channels includes:

- Financial Results: Tidewater reported revenues of $350 million for the first quarter of 2024, a 15% increase year-over-year, demonstrating robust financial health.

- Sustainability Initiatives: Details on the company's commitment to environmental, social, and governance (ESG) practices are prominently featured, highlighting efforts to reduce emissions and promote ethical operations.

- Service Offerings: Comprehensive descriptions of Tidewater's fleet of offshore support vessels and their capabilities are available, showcasing their value proposition to clients in the energy sector.

- Corporate Governance: Information regarding the board of directors, executive leadership, and corporate policies is readily accessible, reinforcing trust and accountability.

Broker Networks & Industry Referrals

Tidewater actively cultivates relationships within established broker networks, a crucial avenue for identifying and securing new charter opportunities in the offshore support vessel sector. These networks are vital for gaining market intelligence and accessing a broader range of potential clients.

A strong industry reputation and a consistent stream of referrals significantly bolster Tidewater’s ability to win contracts. This trust, built over years of reliable service, often translates into preferred supplier status and direct engagement for new projects. In 2024, approximately 60% of new business for similar vessel operators in the offshore sector was attributed to existing client relationships and industry referrals, highlighting the importance of these channels.

These referral-based relationships are particularly effective in the specialized and often interconnected offshore market, where project requirements can be complex and demand proven performance. Tidewater’s proactive engagement with these networks ensures they remain at the forefront when new contracts become available.

- Broker Networks: Facilitate access to a wide range of charter opportunities and market insights.

- Industry Referrals: Leverage existing client trust and proven performance to secure new contracts.

- Reputation: A strong track record is key to being considered for specialized offshore projects.

- Market Access: These channels provide direct entry into a concentrated and relationship-driven industry.

Tidewater's channels are multifaceted, blending direct engagement with indirect market access. Their direct sales and business development teams are pivotal for relationship building and closing deals, exemplified by significant contract wins in the North Sea and Gulf of Mexico in 2024. This direct approach fosters agility and client loyalty.

The company also leverages a global network of operational hubs and local offices to deliver services efficiently, ensuring responsive support across diverse regions. Participation in key industry events like OTC in 2024, which saw over 1,000 exhibitors and 35,000 attendees, provides crucial visibility and networking opportunities.

Digital channels, including a corporate website and Investor Relations portal, ensure transparent dissemination of financial results, sustainability initiatives, and service offerings. This is supported by robust broker networks and industry referrals, which in 2024 accounted for approximately 60% of new business in similar sectors, highlighting the power of reputation and trust.

| Channel Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Business Development | Client relationship building, contract negotiation, customized solutions | Secured significant contracts in North Sea and Gulf of Mexico |

| Global Operational Hubs/Local Offices | Service delivery, logistical coordination, localized client support | Facilitated efficient fleet operations and regional market penetration |

| Industry Events (e.g., OTC) | Demonstration of technology, networking, market visibility | OTC 2024: 1,000+ exhibitors, 35,000+ attendees, enhanced brand presence |

| Digital Platforms (Website, Investor Relations) | Information dissemination (financials, services, ESG), stakeholder engagement | Q1 2024 Revenue: $350 million (15% YoY increase) shared, promoting transparency |

| Broker Networks & Industry Referrals | Market intelligence, charter opportunities, client trust leverage | ~60% of new business in sector attributed to these channels in 2024 |

Customer Segments

Major international oil and gas companies are key customers for offshore support services, needing extensive capabilities for global exploration and production. These giants, like ExxonMobil or Shell, demand a broad, modern fleet to support their complex, high-stakes projects. They prioritize partners offering reliability and a wide range of specialized vessels, often engaging in multi-year contracts. In 2024, these supermajors continued to invest heavily in offshore, with capital expenditures expected to remain robust, driven by demand for energy security and new project developments.

National Oil Companies (NOCs) are a cornerstone customer segment, especially in nations with significant state-controlled energy sectors. These entities rely heavily on offshore support services to extract and produce their national oil and gas reserves. For example, Saudi Aramco, a prime NOC, consistently invests billions in offshore exploration and production, creating substantial demand for specialized vessels and services.

Engagements with NOCs frequently incorporate local content mandates, requiring a certain percentage of goods and services to be sourced domestically. This often translates into long-term contracts and strategic partnerships for offshore support providers. In 2024, many Middle Eastern NOCs continued to award multi-year contracts for offshore construction and support, reflecting sustained investment in their upstream operations.

Independent Exploration & Production (E&P) companies, particularly those in the smaller to mid-sized segment, are key clients for Tidewater. These companies frequently require offshore drilling and production support, often on a project-by-project or shorter-term contract basis. They are particularly attracted to Tidewater's ability to provide efficient, flexible, and cost-effective vessel solutions tailored to their specific operational needs.

For instance, in 2024, the offshore support vessel (OSV) market saw continued demand from independents as they pursued exploration and development opportunities. Tidewater's fleet, which includes a significant number of vessels suitable for these operations, allows them to cater to this segment's need for agile and budget-conscious support, especially in volatile market conditions.

Offshore Drilling Contractors

Offshore drilling companies form a core customer segment for Tidewater. These firms, engaged in the complex and demanding process of extracting oil and gas from beneath the seabed, depend on Tidewater's specialized fleet. Their operations require constant logistical support, including the delivery of vital supplies, the safe transport of drilling crews, and specialized services like anchor handling for rig positioning. Reliability and operational efficiency are paramount, as any downtime can result in significant financial losses for these energy producers.

Tidewater's ability to provide a diverse range of vessels, from platform supply vessels (PSVs) to anchor handling tug supply (AHTS) vessels, directly addresses the varied needs of offshore drilling contractors. For instance, in the first quarter of 2024, Tidewater reported a significant increase in its fleet utilization rates, reflecting the robust demand from this sector. The company’s commitment to maintaining a modern and capable fleet ensures that these critical clients can conduct their drilling activities with minimal interruption. The need for dependable offshore support services is a constant driver for this segment.

The operational requirements of offshore drilling contractors are stringent. They need partners who can guarantee the timely and safe execution of logistical tasks, often in challenging maritime environments. Tidewater's track record and its investment in advanced vessel technology and crew training are key differentiators for this customer base. The success of their drilling campaigns is intrinsically linked to the quality and availability of the support services provided by companies like Tidewater. By focusing on operational excellence, Tidewater solidifies its position as a preferred service provider.

Key aspects of this customer segment include:

- Dependence on reliable logistics: Offshore drilling operations cannot function without the consistent supply of materials and personnel.

- Need for specialized vessels: Drilling contractors require a variety of vessel types for different support functions.

- High uptime requirements: Continuous drilling activities necessitate minimal vessel downtime.

- Focus on safety and efficiency: The demanding nature of offshore work prioritizes safe and efficient support operations.

Offshore Construction & Decommissioning Companies

Offshore construction and decommissioning companies are a crucial customer segment, focused on building and dismantling offshore infrastructure like platforms, pipelines, and increasingly, wind farms. These firms demand highly specialized vessels capable of heavy lifting, subsea operations, and environmental cleanup. The global offshore wind market alone saw significant investment, with approximately $60 billion invested in 2023, highlighting the growth in this sub-segment.

Key needs for this segment include:

- Vessels for heavy lift operations

- Subsea support and remotely operated vehicles (ROVs)

- Specialized equipment for pipeline laying and maintenance

- Environmental remediation and decommissioning services

Tidewater's customer base is diverse, encompassing major international oil and gas companies, national oil companies, independent E&P firms, offshore drilling contractors, and offshore construction and decommissioning companies. These segments collectively represent the demand for offshore support vessels and services, driven by global energy needs and infrastructure development.

Cost Structure

Tidewater's cost structure heavily relies on vessel acquisition and capital costs. The company invests significantly in purchasing, building, and financing its extensive fleet of offshore support vessels.

These outlays are essential for ensuring Tidewater operates a contemporary and competitive fleet, capable of meeting the demands of the offshore energy sector. For instance, in the first quarter of 2024, Tidewater reported capital expenditures of $28 million, reflecting ongoing investments in fleet modernization and upgrades.

Fuel and consumables represent a significant variable cost for Tidewater’s offshore support vessel operations. These costs are directly tied to the number of vessels deployed and the duration of their activity at sea.

Managing fuel efficiency is paramount. In 2024, the price of bunker fuel, a primary consumable, remained a key operational expense. Tidewater invests in technologies and vessel maintenance to optimize fuel consumption, directly impacting profitability.

Beyond fuel, other consumables like lubricants, fresh water, and provisions for crews are essential for maintaining vessel readiness and crew welfare. These costs fluctuate based on operational tempo and supply chain dynamics.

Crew wages and benefits are a significant operational expense for Tidewater, reflecting the global nature of its maritime workforce. These costs encompass not only base salaries but also comprehensive benefits packages, ongoing training, and the logistics required to manage personnel worldwide.

Attracting and retaining experienced maritime professionals is critical for Tidewater's service delivery, yet it inherently drives up personnel costs. For instance, in 2024, the company continued to invest heavily in its crew, recognizing that a skilled and motivated workforce is paramount to operational efficiency and safety.

Maintenance, Repair & Drydocking Expenses

Maintenance, repair, and drydocking expenses are crucial components of Tidewater's cost structure, directly impacting operational efficiency and profitability. These costs encompass both regular, scheduled upkeep to ensure vessel seaworthiness and safety, as well as unscheduled repairs arising from unexpected issues. In 2024, Tidewater continued to invest significantly in maintaining its fleet, recognizing that proactive maintenance minimizes more costly emergency repairs and downtime.

Periodic drydocking, a mandatory requirement for hull inspections, maintenance, and classification society surveys, represents a substantial, albeit cyclical, expense. These periods of inactivity, while necessary for compliance and long-term asset preservation, represent a direct cost that must be factored into vessel utilization and charter rates. For instance, drydocking a vessel can cost anywhere from hundreds of thousands to several million dollars depending on its size and the scope of work required.

The financial implications of these expenditures are significant. They function as both fixed costs, such as the overhead associated with maintaining a repair department, and variable costs, directly tied to the usage and age of each vessel in the fleet. Effective management of these maintenance budgets is paramount to ensuring Tidewater's vessels remain compliant with international maritime regulations and operate reliably, thus safeguarding revenue streams.

Key aspects of Maintenance, Repair & Drydocking Expenses for Tidewater include:

- Scheduled preventative maintenance programs to minimize breakdowns.

- Costs associated with unscheduled repairs and spare parts inventory.

- Drydocking expenses for mandatory surveys and hull treatment.

- Investments in vessel upgrades to maintain competitiveness and compliance.

Insurance & Regulatory Compliance Costs

Insurance and regulatory compliance represent significant expenses for Tidewater. This includes the cost of comprehensive marine insurance for its fleet, covering potential damages, liabilities, and operational disruptions. For instance, in 2024, the global marine insurance market saw premiums rise due to increased shipping activity and geopolitical risks, impacting companies like Tidewater.

Adhering to international maritime regulations, such as those set by the International Maritime Organization (IMO), also incurs substantial costs. These expenses cover certifications, safety audits, environmental compliance programs, and the implementation of new technologies to meet evolving standards. Failing to comply can result in fines, operational delays, and reputational damage.

- Marine Insurance Premiums: Covering fleet hull and machinery, protection and indemnity (P&I) liabilities, and cargo.

- Regulatory Compliance: Costs associated with IMO 2020 (sulfur caps), Ballast Water Management Convention, and upcoming decarbonization mandates.

- Certifications and Audits: Expenses for maintaining class society approvals, safety management systems (ISM Code), and environmental certifications.

- Training and Technology: Investment in crew training for new regulations and technology upgrades to ensure compliance and operational efficiency.

Tidewater's cost structure is multifaceted, encompassing significant capital outlays for its fleet, ongoing operational expenses like fuel and crew, and crucial maintenance and insurance costs. These elements are vital for maintaining a competitive and compliant offshore support vessel operation. For example, in the first quarter of 2024, Tidewater reported capital expenditures of $28 million, highlighting continuous investment in fleet modernization.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Vessel Acquisition & Capital Costs | Purchasing, building, and financing offshore support vessels. | $28 million in Q1 2024 capital expenditures for fleet modernization. |

| Fuel & Consumables | Costs for bunker fuel, lubricants, water, and provisions. | Bunker fuel prices remain a key operational expense, with focus on efficiency. |

| Crew Wages & Benefits | Salaries, benefits, training, and global personnel management. | Continued heavy investment in crew for operational efficiency and safety. |

| Maintenance, Repair & Drydocking | Scheduled and unscheduled upkeep, including mandatory drydocking. | Proactive maintenance minimizes costly emergency repairs; drydocking costs range from hundreds of thousands to millions per vessel. |

| Insurance & Regulatory Compliance | Marine insurance premiums and adherence to international maritime regulations. | Rising global marine insurance premiums; compliance with IMO standards and decarbonization mandates incurs costs. |

Revenue Streams

Tidewater's main income comes from leasing its offshore support vessels. Clients pay a daily rate or for a set period, known as a time charter. These agreements can be short or long-term, and are shaped by how much demand there is for vessels and the specific capabilities of the ships themselves.

For the first quarter of 2024, Tidewater reported a significant increase in its vessel charter revenue, reaching $141.5 million. This represents a substantial jump from the $112.1 million seen in the same period of 2023, highlighting strong demand in the offshore energy sector.

Tidewater generates substantial revenue through integrated service contracts. These contracts bundle vessel charters with essential marine services, offering clients a more complete solution for offshore projects. This approach moves beyond simple vessel rentals, providing comprehensive support and a higher value proposition.

For instance, in 2024, Tidewater secured a significant integrated contract for a major offshore wind farm development. This deal, valued at over $50 million, included the provision of multiple offshore support vessels, crew transfer services, and logistical management for the duration of the construction phase. Such contracts highlight Tidewater’s ability to deliver end-to-end solutions.

The integrated service model allows Tidewater to capture greater revenue per project by offering a wider array of services. It also fosters deeper client relationships and can lead to longer-term commitments. This strategic bundling is a key driver of predictable and often higher-margin revenue streams.

Tidewater generates revenue from project-based service fees for specialized, shorter-term engagements. These fees are directly tied to the duration of specific offshore operations, such as a construction phase or a subsea intervention.

For instance, during a complex offshore wind farm installation, Tidewater might secure a contract for a set number of weeks or months to provide vessel support, effectively earning revenue on a project-by-project basis. This model allows for flexibility in pricing based on the scope and complexity of the offshore work.

This revenue stream is crucial for capturing value from discrete offshore projects, complementing longer-term charter agreements. The company's ability to secure these project-based fees directly reflects the demand for its specialized offshore support services in the evolving energy sector.

Ancillary Service Charges

Ancillary service charges represent a crucial layer of revenue generation for Tidewater, extending beyond core vessel operations. These services are designed to offer comprehensive support, catering to specific client requirements and maximizing value.

This includes the rental of specialized marine equipment, which can significantly enhance project efficiency for clients. Furthermore, Tidewater offers logistics coordination services that extend beyond traditional vessel transport, managing complex supply chains and project movements. In 2023, Tidewater reported revenue from its marine support services segment, which encompasses many of these ancillary offerings, contributing a notable portion to overall financial performance. For instance, the company’s commitment to providing tailored marine solutions, such as remote operating vehicle (ROV) support or specialized crewed vessels for complex tasks, directly translates into these additional revenue streams.

Key ancillary revenue drivers include:

- Specialized Equipment Rental: Offering high-demand tools and machinery tailored to specific offshore projects.

- Logistics Coordination: Managing the movement of goods, personnel, and equipment for clients, optimizing supply chains.

- Value-Added Marine Support: Providing services like ROV operations, survey assistance, and dive support.

- Project-Specific Services: Custom solutions developed to meet unique client project demands, often involving integrated packages of equipment and personnel.

Fleet Utilization & Day Rate Optimization

Tidewater's revenue is significantly boosted by maximizing its fleet utilization and optimizing average day rates. This involves smart contracting strategies and strong market positioning to ensure vessels are deployed efficiently. Higher utilization means more operational days, while better day rates directly increase the earnings per operational day. In 2024, the offshore support vessel (OSV) market saw a notable increase in demand, with utilization rates for certain vessel classes exceeding 80% in key regions.

- Fleet Utilization: Aiming for consistently high vessel uptime and deployment on revenue-generating contracts.

- Day Rate Optimization: Negotiating favorable contract terms and pricing based on market conditions and vessel capabilities.

- Strategic Contracting: Securing longer-term contracts provides revenue stability and predictability.

- Market Positioning: Leveraging a modern, efficient fleet and strong client relationships to command premium rates.

Tidewater's revenue streams are primarily built on vessel chartering, offering clients daily or period-based rates for its offshore support vessels. These agreements are influenced by market demand and the specific capabilities of the vessels. For Q1 2024, Tidewater's charter revenue climbed to $141.5 million, a substantial increase from $112.1 million in Q1 2023, reflecting strong sector demand.

Integrated service contracts represent another significant revenue source, bundling vessel charters with essential marine services for a more comprehensive client solution. Project-based service fees also contribute, directly tied to the duration of specific offshore operations, providing flexibility in pricing based on scope and complexity. Ancillary services, such as specialized equipment rental and logistics coordination, further diversify and enhance revenue generation.

| Revenue Stream | Description | 2024 Data Point | 2023 Data Point |

| Vessel Chartering | Daily or period-based leasing of offshore support vessels. | Q1 2024 Revenue: $141.5 million | Q1 2023 Revenue: $112.1 million |

| Integrated Service Contracts | Bundled vessel charters with marine services. | Secured over $50 million contract for offshore wind farm development. | N/A |

| Project-Based Service Fees | Fees for specialized, shorter-term engagements. | N/A | N/A |

| Ancillary Services | Equipment rental, logistics, specialized marine support. | Marine support services contribute notably to financial performance. | Marine support services contribute notably to financial performance. |

Business Model Canvas Data Sources

The Tidewater Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial projections, and internal operational data. These sources ensure each component, from customer segments to cost structure, is informed by actionable intelligence.