Tidewater Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tidewater Bundle

Curious about Tidewater's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas, but the real power lies in understanding the full picture. Are their vessels Stars poised for growth, or Cash Cows generating steady income? Perhaps some are Dogs needing a refresh, or Question Marks demanding careful consideration.

To truly unlock Tidewater's competitive advantage, dive deeper into their complete BCG Matrix. Gain a clear, quadrant-by-quadrant view of where each of their service offerings stands in the market, enabling you to make informed, data-driven decisions.

Purchase the full BCG Matrix for a comprehensive breakdown, including actionable insights and strategic recommendations tailored to Tidewater's specific market position. This is your shortcut to understanding their current performance and planning for future success.

Stars

Tidewater's fleet of high-specification vessels is a key asset, designed for demanding deepwater and complex offshore operations. These advanced vessels are strategically placed within a rapidly expanding sector of the energy market. The offshore oil and gas industry is anticipated to experience an 8.5% compound annual growth rate between 2025 and 2033, driven by substantial investments in deepwater projects.

These specialized vessels are capable of commanding premium day rates and achieving high utilization levels. This is a direct result of their sophisticated technology and the increasing complexity inherent in modern offshore projects. Consequently, they are recognized as leaders within their specific market niche.

Tidewater is actively expanding its presence in the burgeoning offshore wind sector, a strategic move driven by strong market growth projections. The demand for specialized vessels, such as Wind Turbine Installation Vessels (WTIVs) and Cable Laying Vessels (CLVs), is anticipated to climb as the global offshore wind market is forecast to grow at a robust 12% compound annual growth rate through 2030. This presents a significant high-growth opportunity where Tidewater is focused on capturing increased market share.

This segment of the marine support industry demands substantial capital investment for new vessel construction. Tidewater is well-positioned to capitalize on this, leveraging its ongoing fleet modernization and strategic acquisition initiatives to meet the escalating needs of offshore wind projects.

The demand for vessels supporting subsea construction and production is set for significant expansion, particularly anticipated from the latter half of 2025 onwards. Tidewater possesses a fleet of specialized vessels adept at these intricate subsea tasks, essential for optimizing resource extraction and preserving vital offshore infrastructure.

These specialized craft are crucial for supporting the complex operations involved in subsea construction and production. As the offshore industry increasingly focuses on maximizing output from existing fields and developing new deepwater reserves, the need for these high-value assets intensifies.

This segment of the offshore market presents a high-growth trajectory, demanding sophisticated and high-value assets. For instance, the global subsea construction market was projected to reach approximately $30 billion by 2024, indicating substantial underlying demand for the services Tidewater's specialized fleet can provide.

Vessels in High-Growth Regions (e.g., Brazil, Middle East)

Tidewater's vessels operating in burgeoning offshore arenas such as Brazil and the Middle East are demonstrating exceptional performance. This strength is largely attributed to heightened exploration and production initiatives, coupled with substantial capital investments in these key territories. These regions are pivotal in driving the expansion of the offshore support vessel market.

Brazil, in particular, is a significant growth engine, with Petrobras projecting considerable expenditure on exploration and production between 2025 and 2029. This strategic investment signals robust demand for offshore support services. Tidewater's well-entrenched operations and established partnerships in these high-potential markets position its fleet for continued success and market leadership.

- Brazil's Petrobras E&P Spending: Expected to exceed $100 billion between 2025-2029, fueling demand for OSVs.

- Middle East Growth: Driven by national oil companies' expansion plans and increasing crude oil production targets.

- Tidewater's Market Position: Benefiting from long-term contracts and a modern, efficient fleet tailored to regional needs.

- Geographic Diversification: Highlighting the strategic importance of these regions within Tidewater's global portfolio.

Newly Acquired, Younger, High-Specification Vessels

Tidewater's strategic acquisition of younger, high-specification vessels is a key driver of its portfolio strength. By focusing on modern assets, the company bolsters its competitive position in a market characterized by limited vessel availability. These newer ships offer enhanced fuel efficiency and advanced technology, crucial for meeting client demands and securing favorable day rates.

- Fleet Modernization: Tidewater's commitment to acquiring newer, high-spec vessels directly addresses the market need for advanced offshore support capabilities.

- Operational Efficiency: Younger vessels typically exhibit superior fuel economy, reducing operating costs and environmental impact.

- Premium Day Rates: The advanced specifications of these vessels enable Tidewater to command higher day rates compared to older, less capable tonnage.

- Market Competitiveness: This ongoing fleet renewal strategy ensures Tidewater remains a preferred partner for clients seeking reliable and efficient offshore services, particularly in areas requiring specialized equipment.

Stars represent the highest growth and high market share segments within the BCG matrix. Tidewater's deepwater vessels, servicing the expanding offshore oil and gas sector with an anticipated 8.5% CAGR through 2033, are a prime example of this category. Their specialized nature allows for premium day rates and high utilization, solidifying their leadership in this niche market.

What is included in the product

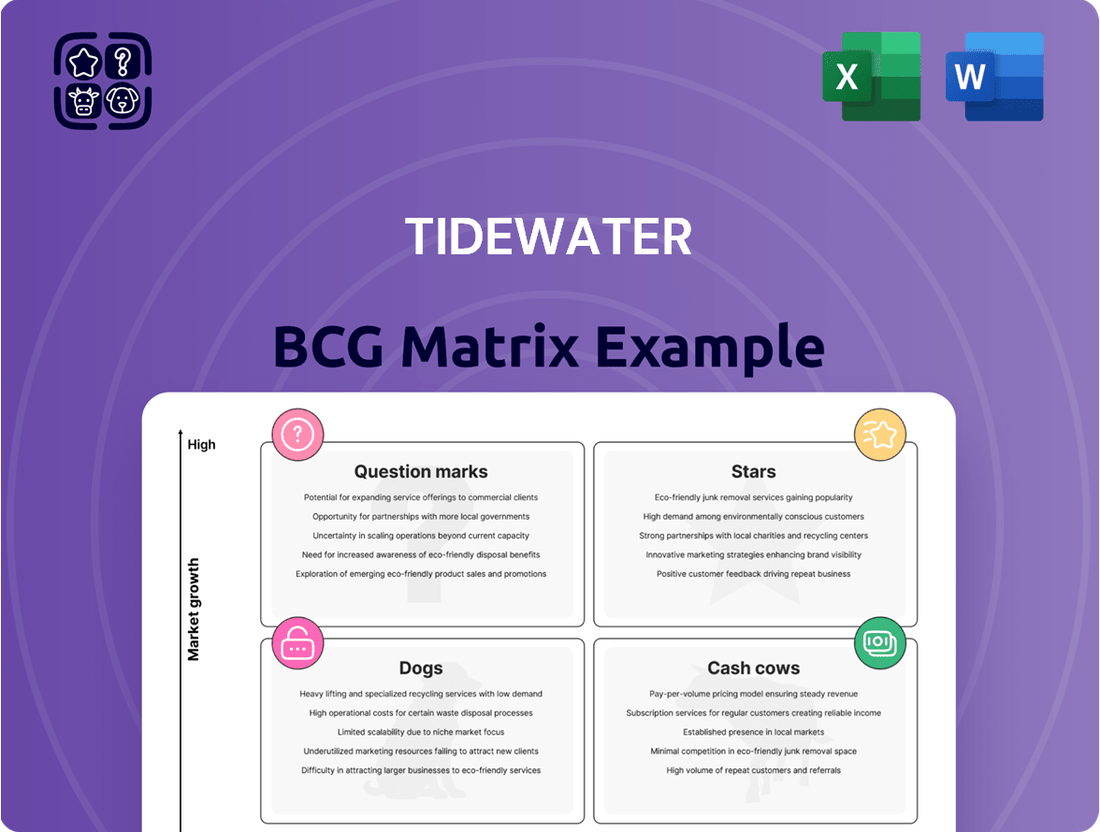

The Tidewater BCG Matrix offers a strategic overview of a company's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

The Tidewater BCG Matrix provides a clear, quadrant-based overview, instantly clarifying the strategic position of each business unit to alleviate decision-making bottlenecks.

Cash Cows

Tidewater's extensive fleet of conventional Platform Supply Vessels (PSVs) deployed in mature offshore oil and gas regions worldwide are a prime example of cash cows within its business model. These vessels are vital for ongoing operations, handling essential logistics like supply runs and crew transport to established production facilities.

While the growth trajectory for these established markets is more modest, Tidewater's significant market presence and operational expertise allow it to maintain strong profitability and generate consistent, substantial cash flow. For instance, in 2024, the demand for these services remained steady, underpinning the reliable revenue streams from these assets.

Tidewater's fleet of Anchor Handling Towing Supply (AHTS) vessels, especially those operating under stable, long-term contracts, function as significant cash cows. These workhorses are vital for towing, anchor handling, and rig movements, particularly in established offshore oil and gas fields, generating consistent revenue with minimal need for aggressive marketing or new placement efforts. Their fundamental role in supporting offshore operations guarantees sustained demand, even when the broader market experiences slower growth.

As offshore oil and gas fields age, the decommissioning market is expanding, offering a steady revenue stream for companies like Tidewater. This segment, characterized by low growth but high necessity due to regulations, provides predictable income as old infrastructure must be removed. Tidewater's existing fleet and experience are well-suited to meet this demand.

In 2024, the global offshore decommissioning market was estimated to be worth billions, with projections showing continued growth as more fields reach the end of their productive lives. Tidewater's vessels are crucial for these operations, performing tasks such as anchor handling, towing, and platform support, all essential for safe and efficient dismantling.

Global Fleet with High Utilization Rates

Tidewater's global fleet is a significant cash cow, evidenced by its consistently high utilization rates. In 2023, the company achieved a utilization rate of 79.1%, and this trend continued strongly into the first half of 2024 with an 81% utilization.

This strong performance is driven by tight capacity and robust demand within the offshore vessel sector. These market conditions translate into improved day rates and operational efficiency, enabling Tidewater to generate substantial free cash flow from its existing assets.

- High Utilization: 79.1% in 2023 and 81% in H1 2024.

- Market Strength: Tight capacity and strong demand in the OSV sector.

- Financial Impact: Strengthened day rates and efficient operations.

- Cash Flow Generation: Maximized asset productivity and minimized idle time.

Established Long-Term Contracts with Blue-Chip Customers

Tidewater's established long-term contracts with blue-chip customers, including major international and national oil companies, are a cornerstone of its cash cow status within the BCG matrix. These agreements provide a predictable and stable revenue stream, insulating the company from the immediate fluctuations of the oil and gas market. For instance, securing multi-year charters for its Offshore Support Vessels (OSVs) means consistent utilization rates and dependable income, even during periods of lower spot market activity.

These long-term commitments reduce Tidewater's exposure to market volatility and ensure a steady demand for its essential offshore services. This stability directly translates into high profit margins and robust cash generation, as operational costs become more predictable and economies of scale can be leveraged effectively. The company's ability to maintain these relationships highlights its operational reliability and the critical nature of its services to major energy producers.

- Stable Revenue: Long-term contracts with IOCs/NOCs provide a predictable income base.

- Reduced Volatility: Contracts shield Tidewater from short-term market price swings.

- High Profitability: Consistent demand and operational efficiency contribute to strong profit margins.

- Consistent Cash Flow: Predictable revenue fuels robust and reliable cash generation.

Tidewater's significant fleet of Platform Supply Vessels (PSVs) and Anchor Handling Towing Supply (AHTS) vessels, particularly those supporting established offshore oil and gas operations and the growing decommissioning sector, represent its primary cash cows. These assets generate consistent, substantial cash flow due to stable demand and high utilization rates, such as the 81% achieved in the first half of 2024. This reliability is further bolstered by long-term contracts with major oil companies, ensuring predictable revenue streams and strong profit margins even in slower growth markets.

| Asset Type | Primary Role | Market Segment | Cash Cow Characteristics | 2024 Data Point |

| Platform Supply Vessels (PSVs) | Logistics, crew transport | Mature offshore regions | Vital for ongoing operations, steady demand | High utilization supporting stable revenue |

| Anchor Handling Towing Supply (AHTS) | Towing, anchor handling, rig moves | Established fields, decommissioning | Essential workhorses, consistent revenue | Stable demand due to critical support functions |

| Decommissioning Support Vessels | Platform support, anchor handling | Aging offshore infrastructure | Low growth, high necessity, predictable income | Billions market value, driven by regulatory needs |

Preview = Final Product

Tidewater BCG Matrix

The Tidewater BCG Matrix you are currently previewing is the identical, fully formatted document you will receive immediately after your purchase. This means you get the complete strategic analysis, free from any watermarks or placeholder text, ready for immediate implementation in your business planning.

Dogs

Older, lower-specification vessels are generally considered cash traps for Tidewater. These ships, often exceeding 10 years in age, face declining demand as the industry increasingly favors newer, more advanced tonnage. Their lower utilization rates, sometimes as low as 48%, coupled with higher maintenance and operational expenses, make them less profitable compared to their modern counterparts.

In markets like the Asia Pacific and the Americas, Tidewater's Q4 2024 earnings indicated a slowdown in offshore activity, potentially housing 'Dog' assets. These regions, marked by structural decline or intense fragmentation, present limited growth opportunities.

Assets in these declining or fragmented markets struggle to gain traction, offering meager returns and making further investment questionable. This situation dilutes overall market share and profitability for Tidewater.

The low growth prospects in these specific regions mean that any capital invested is unlikely to yield significant returns. Tidewater must carefully assess these 'Dog' assets to decide on divestment or strategic repositioning.

Non-core or underperforming specialty vessels within Tidewater's expansive fleet, those that consistently struggle with low utilization, diminished day rates, or lagging profitability, and don't fit into the company's strategic growth plans, fall into this category. These assets often demand significant maintenance and operational expenditures without delivering commensurate returns, signaling them as potential divestiture candidates. Tidewater's ongoing fleet optimization efforts are designed to identify and address these underperforming units.

For instance, a specialty vessel type that saw a decline in demand or faced intense competition in 2024 might exemplify this classification. If such a vessel type experienced an average utilization rate below 40% throughout the year, compared to a fleet average of 70%, it would strongly suggest it is a candidate for rationalization. The company's strategic focus, as highlighted in its 2024 investor presentations, emphasizes modern, efficient vessels that command premium rates, making older or less specialized assets less attractive.

Legacy Assets with High Maintenance Costs

Older vessels in Tidewater's fleet that demand substantial and expensive upkeep, such as frequent drydocking and repairs, without yielding correspondingly higher daily charter rates are considered legacy assets with high maintenance costs. These assets can become a drain on resources.

While Tidewater actively modernizes its fleet, those vessels nearing the end of their operational lifespan, which consume significant capital merely to stay functional, represent this category. The company's strategy focuses on reducing these types of financial burdens.

- Fleet Modernization: Tidewater has been investing in its fleet, but older, less efficient vessels require disproportionate maintenance spending.

- Economic Life: Assets at the end of their economic life may incur high operational costs without generating sufficient revenue.

- Profitability Impact: Such assets can negatively impact overall profitability by consuming capital that could be better allocated to newer, more productive assets.

- Strategic Focus: Tidewater aims to minimize the number of these high-maintenance legacy assets to improve operational efficiency and financial performance.

Services Highly Dependent on Volatile Spot Market

Tidewater's offshore support vessel (OSV) services, particularly those operating in the spot market, face significant challenges due to rate volatility. When day rates frequently dip below profitability thresholds, these segments can be categorized as question marks in the BCG matrix. This reliance on short-term contracts, without substantial long-term coverage, exposes the company to considerable market fluctuations and unpredictable earnings.

The company's strategy involves utilizing short-term contracts, but prolonged periods of weak demand in the spot market diminish the attractiveness of these arrangements. For example, in 2024, the average day rates for certain OSV classes experienced significant swings, with some periods seeing rates barely cover operating expenses. This dynamic directly impacts the profitability and strategic positioning of these service lines.

- Spot Market Dependence: Services heavily reliant on fluctuating spot market rates are vulnerable to periods of low demand.

- Profitability Thresholds: Day rates frequently falling below profitability thresholds indicate potential question mark status.

- Short-Term Contract Risks: While used, short-term contracts offer less revenue predictability compared to long-term agreements.

- Market Volatility Exposure: Prolonged low demand in the spot market significantly impacts returns and increases business risk.

Assets classified as Dogs within Tidewater's fleet are typically older, less efficient vessels with low utilization rates, often below 50% in 2024. These assets struggle in markets with limited growth or high fragmentation, such as certain regions in the Asia Pacific and Americas, as noted in Q4 2024 earnings. They incur high maintenance costs without generating commensurate returns, making them candidates for divestment or strategic repositioning to improve overall fleet performance and financial health.

| Asset Type | Age (Years) | 2024 Utilization (%) | Market Outlook | BCG Classification |

|---|---|---|---|---|

| Older OSVs | 10+ | 48 (example) | Declining/Fragmented | Dogs |

| Underperforming Specialty Vessels | Varies | < 40 (example) | Low Demand/High Competition | Dogs |

Question Marks

Tidewater's potential involvement in nascent offshore renewable energy sectors beyond established wind, such as wave, tidal, or floating solar, would represent a strategic move into areas with high growth potential but currently underdeveloped markets. These emerging sectors have a low current market share for Offshore Support Vessel (OSV) services, meaning Tidewater could be an early mover.

Significant investment would be required to establish a foothold and develop specialized capabilities for these novel offshore energy sources. For instance, the global wave and tidal energy market was valued at approximately $1.5 billion in 2023 and is projected to reach $4.5 billion by 2030, indicating substantial future opportunities but also the need for early-stage capital commitment. Floating solar, while also nascent, saw installations grow by over 30% in 2023, highlighting rapid, albeit small-scale, expansion.

New geographical markets with untapped potential represent the 'Question Marks' in Tidewater's BCG Matrix for offshore support. These are regions where Tidewater has a low presence but which show promise for future energy development.

Exploring these markets, such as parts of Southeast Asia or certain emerging African coastlines, offers high growth prospects. For instance, the West African offshore sector has seen increased exploration activity, with countries like Senegal and Mauritania attracting significant investment. Tidewater's current market share in these specific areas is relatively low, making them prime candidates for strategic expansion.

However, entering these question mark markets involves substantial upfront investment. This includes costs for new vessel acquisition or deployment, understanding diverse regulatory frameworks, and building local relationships. The risk of not achieving sufficient market share against established local or international competitors is also a significant consideration.

Tidewater's exploration into advanced digitalization and automation for fleet operations presents a classic 'Question Mark' scenario within the BCG framework. The potential for significant gains in operational efficiency, fuel management, and predictive maintenance is undeniable, aiming to streamline complex logistics and reduce downtime. For instance, the maritime industry saw a surge in IoT adoption, with reports in 2024 indicating a growing demand for real-time vessel tracking and performance monitoring systems.

However, the substantial capital expenditure required for implementing these cutting-edge technologies, such as AI-driven route optimization or autonomous vessel components, poses a significant hurdle. The return on investment (ROI) timeline for such advanced systems can be lengthy and is contingent on widespread customer acceptance and integration across the industry. This uncertainty in immediate profitability and market penetration places it firmly in the 'Question Mark' category, requiring careful strategic evaluation and phased investment.

Development of Hybrid or Alternative Fuel Vessels

The development and deployment of hybrid or alternative fuel vessels, such as those powered by Liquefied Natural Gas (LNG) or battery-hybrid systems, currently fall into the Question Mark category for Tidewater. This segment exhibits high-growth potential, driven by increasingly stringent environmental regulations and global sustainability mandates. For instance, the International Maritime Organization (IMO) aims to reduce greenhouse gas emissions by at least 50% by 2050 compared to 2008 levels, creating a strong demand for cleaner shipping solutions.

Tidewater's current market share in this specific, emerging vessel type is likely low, necessitating significant investment in research and development (R&D) and substantial capital expenditure to achieve scalability. The initial costs associated with designing and building these advanced vessels can be considerably higher than traditional fuel-powered counterparts. For example, the upfront cost for an LNG-powered vessel can be 10-20% higher than a conventional vessel, reflecting the specialized fuel storage and handling equipment required.

- High Growth Potential: Driven by IMO 2030 and 2050 decarbonization targets, the market for alternative fuel vessels is expanding rapidly.

- Nascent Market Share: Tidewater’s current presence in this specific niche is likely limited, requiring strategic market entry.

- Significant Investment Required: R&D and capital expenditure are essential to develop and scale these technologically advanced vessels.

- Technological Uncertainty: While promising, the long-term viability and widespread adoption of specific alternative fuels and hybrid technologies still involve some degree of market uncertainty.

Expansion into Specialized Subsea Equipment Ownership/Operation

Expanding into owning and operating highly specialized subsea equipment, such as remotely operated vehicles (ROVs) or advanced subsea cranes beyond current vessel capabilities, would likely place Tidewater in the Question Mark category of the BCG matrix. This is because the subsea sector is experiencing robust growth, particularly in deepwater exploration and production activities, a trend that is expected to continue through 2024 and beyond. However, entering this niche requires substantial capital investment and the development of specialized technical expertise to compete effectively.

The market for advanced subsea equipment is capital-intensive, demanding significant upfront investment in technology and personnel. For example, a high-end ROV system can cost several million dollars, and operating these requires highly trained technicians and engineers. Tidewater would need to acquire or develop these capabilities to capture market share.

- Market Potential: The global subsea equipment market is projected for strong growth, driven by increasing demand for offshore oil and gas production, particularly in deepwater and ultra-deepwater environments.

- Investment Requirements: Acquiring and maintaining specialized subsea assets like ROVs and advanced subsea construction equipment necessitates substantial capital outlay, potentially impacting Tidewater's financial flexibility.

- Competitive Landscape: This segment is characterized by established players with deep technical expertise and existing client relationships, posing a challenge for new entrants seeking to gain significant market share.

- Strategic Fit: While complementary to Tidewater's existing offshore support services, a move into direct equipment ownership and operation requires a distinct business model and operational focus.

Expanding into new geographical markets with underdeveloped offshore energy sectors represents a 'Question Mark' for Tidewater. These regions offer high growth potential but currently have a low market share for OSV services, requiring substantial upfront investment and posing risks of market entry challenges.

Emerging renewable energy technologies like wave, tidal, and floating solar also fit the Question Mark profile. While projected for significant growth, these sectors demand considerable capital for specialized capabilities and face technological uncertainties, demanding careful strategic evaluation.

The adoption of advanced digitalization and automation in fleet operations is another Question Mark. The potential for efficiency gains is high, but the substantial capital expenditure and lengthy ROI timelines create uncertainty regarding immediate profitability and market penetration.

Developing and deploying hybrid or alternative fuel vessels, such as LNG or battery-hybrid systems, also falls into the Question Mark category. The strong demand driven by decarbonization targets is clear, but the higher initial costs and the need for R&D and scalability present significant investment hurdles and technological uncertainties.

Entering the specialized subsea equipment market, like ROVs, is a Question Mark due to robust growth potential, particularly in deepwater activities. However, it requires substantial capital investment, specialized technical expertise, and navigating a competitive landscape of established players.

BCG Matrix Data Sources

Our Tidewater BCG Matrix leverages comprehensive market data, including sales figures, industry growth rates, and competitor analysis, to provide accurate strategic insights.