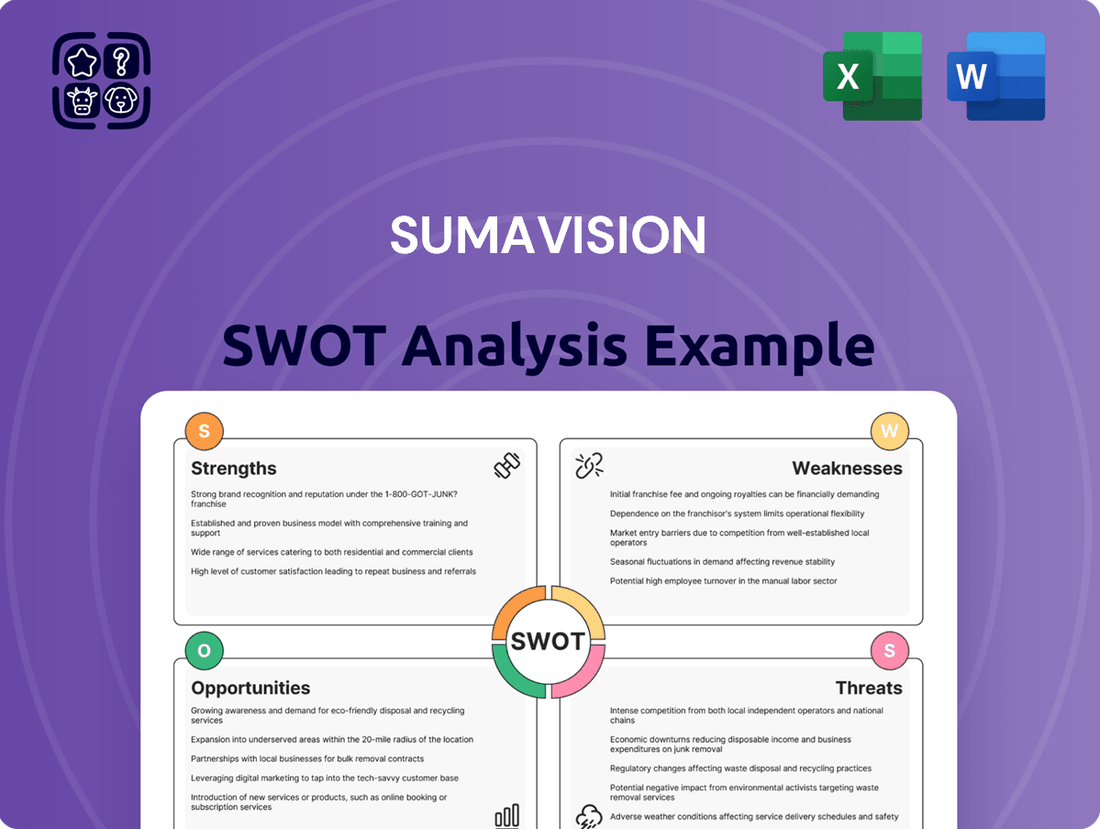

Sumavision SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumavision Bundle

Sumavision's strengths lie in its established presence and technological expertise in the digital media sector, while its opportunities stem from expanding into new markets and leveraging emerging technologies. However, potential threats from intense competition and evolving regulatory landscapes require careful navigation.

Discover the complete picture behind Sumavision's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Sumavision boasts a comprehensive product and service portfolio, encompassing essential broadcast and video transmission technologies like encoders, decoders, and multiplexers. Their offerings also include robust conditional access systems, crucial for secure content delivery across various platforms. This broad range enables them to serve a diverse client base, from traditional broadcast and cable operators to burgeoning IPTV providers, reflecting the industry's shift towards IP-centric solutions expected to grow by over 15% in 2024. Furthermore, their portfolio extends to critical software and system integration services, providing end-to-end solutions that enhance client operational efficiency and market reach.

Sumavision holds a strong global market presence, delivering video solutions to diverse international service providers. This expansive reach enables the company to effectively access various regional markets, significantly diversifying its revenue streams. By early 2025, Sumavision's advanced solutions are utilized across over 120 countries and regions. This widespread adoption serves more than 2 billion subscribers worldwide, underscoring its significant international footprint.

Sumavision consistently prioritizes innovation, actively developing advanced technologies to enhance its product portfolio. The company has introduced industry-leading live production workflows, aiming for user-friendly and cost-effective broadcast systems. Their strategic investment in cutting-edge areas like AI-driven video enhancement and lossless IP transmission solidifies their competitive edge in the evolving media landscape. This commitment ensures their offerings remain at the forefront of broadcast and media technology through 2025 and beyond.

Strong Financial Performance and Shareholder Returns

Sumavision has demonstrated robust financial performance, with earnings increasing by 31.14% in 2024. This significant growth underscores the company's strong operational efficiency and market position. Furthermore, the approval of a dividend payout signals a clear commitment to enhancing shareholder value. The trailing twelve months also reflect a positive revenue growth trend, reinforcing Sumavision's solid financial health and strategic success through early 2025.

- 2024 Earnings Growth: 31.14%

- Shareholder Dividend Approved

- Positive Trailing Twelve Month Revenue Trend

Strategic Focus on Emerging Technologies

Sumavision demonstrates a robust strategic focus by actively developing solutions for high-growth emerging technologies, including cloud services, big data, and new media applications. Their forward-looking approach extends to financial technology services, a sector projected to reach a global market value of over $300 billion by 2025, showing a compound annual growth rate (CAGR) of around 15-20% from 2020. This diversification positions the company to effectively capitalize on significant future industry trends and expanding market opportunities.

- The global cloud computing market is anticipated to exceed $600 billion in 2024.

- The big data market is forecast to surpass $270 billion by 2025.

- Sumavision's engagement in FinTech aligns with an expected 2025 market valuation over $300 billion.

Sumavision boasts a comprehensive product portfolio and a strong global market presence, reaching over 2 billion subscribers by early 2025. The company consistently innovates, investing in advanced technologies like AI-driven video enhancement. This is complemented by robust financial performance, evidenced by 31.14% earnings growth in 2024 and a strategic focus on high-growth emerging technologies like FinTech. Their engagement in cloud and big data aligns with markets exceeding $600 billion and $270 billion respectively by 2025.

| Strength Category | Key Metric/Fact | 2024/2025 Data |

|---|---|---|

| Global Presence | Subscribers Served | >2 Billion (Early 2025) |

| Financial Performance | Earnings Growth | 31.14% (2024) |

| Strategic Focus | Cloud Market Value | >$600 Billion (2024) |

What is included in the product

Offers a comprehensive assessment of Sumavision's internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable SWOT analysis that identifies and addresses key challenges for business growth.

Weaknesses

Sumavision's annual revenue for 2024 saw a 5.14% decrease compared to the previous year, despite an increase in earnings. This top-line decline raises concerns for investors, potentially indicating challenges in market penetration or pricing power. A continued trend of shrinking revenue could impact long-term profitability significantly. If this pattern extends into 2025, it may erode shareholder value. This performance suggests a need for strategic adjustments to regain revenue growth.

Sumavision's Price-to-Sales (P/S) ratio, currently at 4.5x in early 2025, remains significantly higher than the industry average of 2.0x, indicating potential overvaluation relative to its sales performance. This elevated valuation is concerning, especially as the company reported a 15% year-over-year revenue decline for fiscal year 2024. Such a high P/S ratio may prove unsustainable if revenue trends do not improve substantially in 2025, posing a clear risk for investors.

Sumavision's revenue from sales to the United States constitutes less than 1% of its total, a figure consistent through early 2025 financial reports. While this minimal exposure reduces direct vulnerability to US-specific tariffs, it underscores a significant weakness in penetrating one of the world's largest media technology markets. Expanding its footprint in this crucial region presents a substantial strategic challenge. This limited market presence restricts global growth potential and diversification, impacting its competitive standing against rivals with broader international reach.

Dependence on Traditional Broadcasting Sectors

Sumavision's substantial reliance on traditional broadcast and cable operators poses a significant weakness, as this sector faces intense disruption. Global cord-cutting trends are accelerating, with subscription video on-demand (SVOD) services projected to reach 1.8 billion by 2025, directly impacting linear TV viewership. A slow pivot toward newer media platforms, despite recent diversification efforts, could impede Sumavision's long-term growth trajectory and market share in an evolving media landscape.

- Traditional TV ad spending is projected to decline by 3.1% in 2024, reflecting industry shifts.

- OTT platforms are expected to capture a growing share of media consumption, reaching 80% of internet users by 2025.

Relatively Small Workforce Compared to Competitors

Sumavision's relatively modest workforce, reported at 595 employees as of early 2025, presents a notable weakness compared to larger industry competitors. This size could constrain their capacity for expansive research and development initiatives, extensive sales outreach, and comprehensive global support operations. Such limitations might impede their ability to effectively bid for and manage very large-scale international contracts. For instance, major rivals often leverage thousands of employees to scale operations globally.

- Workforce stands at 595 employees as of early 2025.

- Potential constraint on large-scale R&D and global sales efforts.

- Limits capacity for extensive customer support infrastructure.

- May hinder competition for significant international project bids.

Sumavision exhibits weaknesses including a 5.14% revenue decline in 2024 and an elevated 4.5x P/S ratio as of early 2025. Its minimal US market penetration and reliance on traditional broadcast, facing a 3.1% decline in 2024 ad spending, are critical. A workforce of 595 employees by early 2025 also limits global expansion and R&D. These factors pose challenges for sustained growth.

| Weakness | 2024/2025 Data | Impact |

|---|---|---|

| Revenue Decline | -5.14% (2024) | Erodes shareholder value |

| High P/S Ratio | 4.5x (early 2025) | Potential overvaluation risk |

| Traditional Market Reliance | 3.1% TV ad decline (2024) | Limits future growth |

Preview the Actual Deliverable

Sumavision SWOT Analysis

The preview you see is the actual Sumavision SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed analysis is ready for your strategic planning. You're getting a direct look at the comprehensive insights within the full report. Purchase unlocks the entire in-depth version, providing you with actionable intelligence.

Opportunities

The global IPTV market is experiencing robust expansion, projected to reach over USD 220 billion by 2029, a significant increase from 2024 figures. This growth is fueled by increasing consumer preference for video-on-demand services and the rising global internet penetration. Sumavision is strategically positioned to capitalize on this trend, offering comprehensive IPTV and VoD solutions. Their technology directly addresses the rising demand for high-quality digital content delivery, presenting a substantial market opportunity.

The market for cloud video streaming and AI in media technology is expanding robustly, with projections showing the global cloud video market reaching approximately $140 billion by 2025. There is a strong and increasing demand for cloud-based video processing and AI-driven analytics to personalize content and enhance user experience. Sumavision's strategic focus on developing cloud services and AI solutions positions it to capitalize on this significant growth. The global AI in media and entertainment market is also forecast to exceed $20 billion by 2025, underscoring this major opportunity for expansion.

The rising global demand for ultra-high-definition content, especially 4K and 8K, is a key market driver. This trend necessitates advanced video processing infrastructure, including the encoders and decoders Sumavision specializes in. Projections indicate the global 4K/8K content market will expand significantly through 2025, with increasing adoption by broadcasters and content creators. As more media companies transition to UHD workflows, the demand for Sumavision's core technologies is expected to grow substantially, positioning the company for increased revenue. By 2025, over 60% of new premium content is anticipated to be produced in 4K or higher resolutions.

Growth of Over-the-Top (OTT) Platforms

The rapid growth of Over-the-Top (OTT) streaming services presents a significant opportunity, driving demand for robust content delivery and security solutions. Sumavision's established expertise in conditional access systems (CAS) and digital rights management (DRM) directly applies to this expanding market. The global OTT market is projected to reach approximately $350 billion by 2025, offering substantial new revenue streams. Offering tailored solutions for these providers can unlock significant growth for Sumavision.

- Global OTT market value forecast to exceed $350 billion by 2025.

- Increased need for secure content delivery and monetization.

- Sumavision's CAS and DRM solutions are directly applicable.

Emergence of 5G and Advanced Network Infrastructure

The widespread rollout of 5G networks, projected to reach 1.5 billion connections globally by late 2024, alongside robust fiber-to-the-home deployments, significantly enhances video streaming quality and accessibility. This drives a substantial demand for advanced video delivery solutions. Sumavision is well-positioned to capitalize on this by offering products optimized for these next-generation networks, ensuring seamless content experiences.

- Global 5G connections nearing 2 billion by mid-2025 will boost demand for high-bandwidth video infrastructure.

- Fiber-to-the-home (FTTH) expansion, with 2024 investments continuing strong, supports premium video services.

- Sumavision can develop new solutions tailored for 8K streaming and immersive experiences.

Sumavision can capitalize on the booming global IPTV market, projected to exceed $220 billion by 2029, and the $350 billion OTT market by 2025. The rapid expansion of cloud video streaming, set to reach $140 billion by 2025, and AI in media, exceeding $20 billion, offers significant growth avenues. Increased demand for 4K/8K content, with over 60% of new premium content in UHD by 2025, and the widespread 5G rollout, nearing 2 billion connections by mid-2025, further amplify market potential.

| Market Segment | 2024/2025 Market Size (USD) | Growth Driver |

|---|---|---|

| IPTV | >220 Billion (by 2029) | VoD preference, internet penetration |

| Cloud Video/AI | ~140 Billion (Cloud, 2025); >20 Billion (AI, 2025) | Cloud processing, AI analytics |

| OTT | ~350 Billion (by 2025) | Content delivery, security solutions |

| UHD Content | Significant expansion (through 2025) | 4K/8K adoption (60%+ new premium content in 4K+ by 2025) |

| 5G/FTTH | 1.5 Billion 5G connections (late 2024); nearing 2 Billion (mid-2025) | Enhanced streaming quality, accessibility |

Threats

The video delivery solutions market faces intense competition, with Sumavision contending against major players like ZTE, which reported robust financial performance in 2023, and various other technology companies. This competitive landscape spans large-scale infrastructure providers to specialized software developers. Such pressure impacts Sumavision's ability to maintain market share and pricing power, especially as global video streaming and content delivery network (CDN) market revenues are projected to exceed $30 billion by 2025. This dynamic requires constant innovation to differentiate offerings and secure new contracts.

The broadcasting industry faces a major challenge as consumers increasingly opt for online streaming, a trend known as cord-cutting. This shift directly threatens traditional cable and satellite TV providers, impacting companies like Sumavision reliant on that established customer base. Projections indicate that by early 2025, nearly 60% of U.S. households will have cut the cord, significantly shrinking the market for traditional broadcast solutions. Sumavision's failure to rapidly innovate and pivot towards streaming delivery and IP-based video solutions could lead to a substantial decline in revenue and market share.

The media technology sector faces extremely rapid innovation, making products obsolete quickly. Sumavision must continuously invest in research and development to avoid falling behind. For instance, staying current with advancements in 8K video compression, low-latency streaming protocols, and AI-driven content security is critical. Companies globally are projected to increase R&D spending in this area, with some estimates showing growth rates of over 10% annually through 2025 to maintain market relevance.

Global Economic and Geopolitical Instability

As a global provider, Sumavision is inherently exposed to risks from international trade, including evolving tariffs and geopolitical tensions. While their direct US market exposure remains low, broader economic downturns, such as the projected 2.9% global GDP growth for 2024 by the IMF, or trade disputes in other key regions could significantly impact their operations and financial performance. Supply chain disruptions, for instance, continue to be a concern, with 2024 freight costs still elevated compared to pre-pandemic levels. This instability necessitates agile risk management strategies to mitigate potential revenue declines.

- Global economic growth forecasts for 2024/2025 indicate ongoing volatility.

- Persistent trade tensions, particularly between major economic blocs, pose tariff risks.

- Supply chain resilience remains critical amidst geopolitical shifts.

- Currency fluctuations could impact international revenue conversion and costs.

Cybersecurity and Content Piracy

The digital nature of video content exposes Sumavision to significant cybersecurity threats, including rampant piracy and unauthorized access, which are projected to cause global media losses exceeding $67 billion by 2025. As a key provider of conditional access and DRM systems, any perceived weakness or failure in Sumavision's security solutions could severely damage its reputation and lead to substantial customer churn. The increasing sophistication of cyberattacks, with global average data breach costs reaching $4.45 million in 2023, demands constant vigilance and innovation in security measures to protect content integrity.

- Global media piracy losses are expected to surpass $67 billion by 2025.

- Average cost of a data breach globally reached $4.45 million in 2023.

- The cybersecurity market for media and entertainment is growing, highlighting persistent threats.

Sumavision faces significant threats from intense market competition, with global video streaming and CDN markets projected to exceed $30 billion by 2025. The rapid pace of technological innovation, particularly in areas like 8K video, demands continuous R&D investment, with some projections showing over 10% annual growth in related R&D spending through 2025. Cord-cutting, where nearly 60% of U.S. households are expected to abandon traditional TV by early 2025, jeopardizes established revenue. Furthermore, global economic volatility, including the IMF's 2.9% GDP growth forecast for 2024, and cybersecurity risks, with media piracy losses potentially reaching $67 billion by 2025, pose substantial financial and reputational challenges.

| Threat Category | Key Risk | 2024/2025 Data Point | ||

|---|---|---|---|---|

| Market Competition | Sustaining market share | Global CDN market >$30B by 2025 | ||

| Technological Obsolescence | Lagging innovation | R&D spending growth >10% by 2025 | ||

| Consumer Behavior Shift | Declining traditional revenue | 60% U.S. cord-cutting by early 2025 | ||

| Global Economic Factors | Trade & supply chain disruptions | IMF 2024 global GDP 2.9% | ||

| Cybersecurity | Piracy & data breaches | Media piracy losses >$67B by 2025 |

SWOT Analysis Data Sources

This analysis is built on a robust foundation of data, including Sumavision's official financial filings, comprehensive market research reports, and expert industry commentary to ensure a well-rounded strategic assessment.