Sumavision Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumavision Bundle

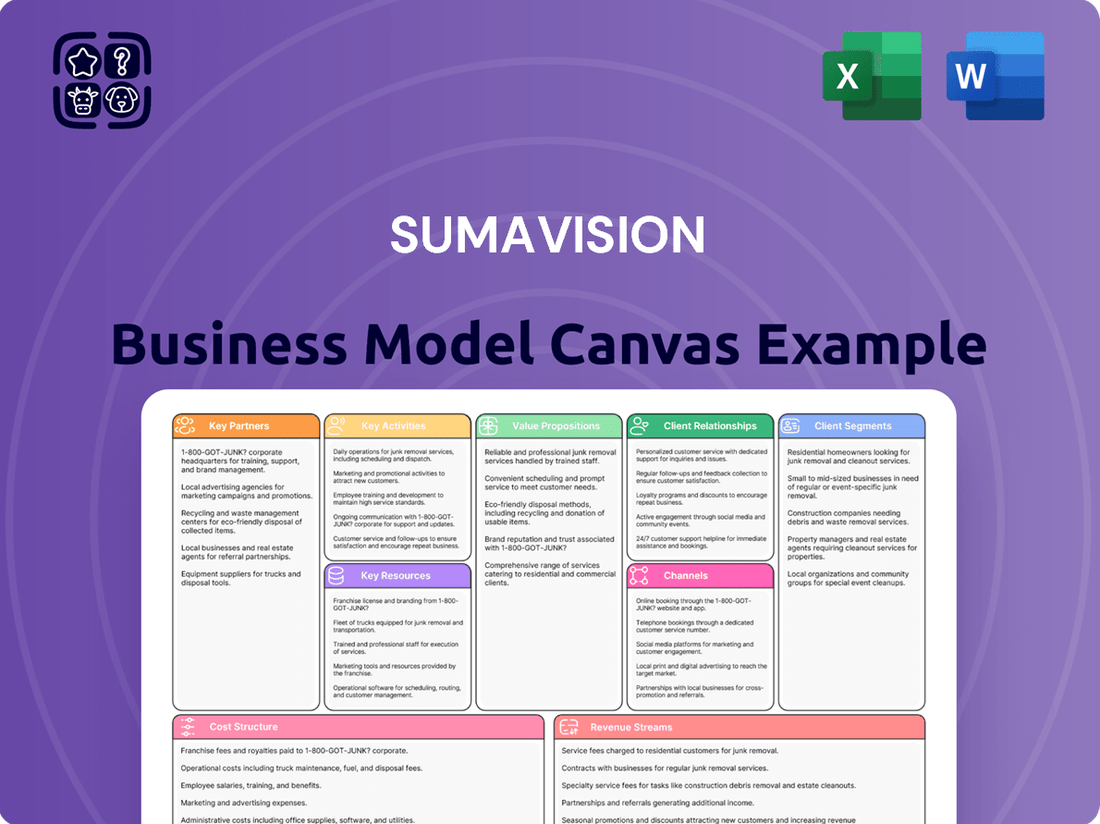

Curious about the engine driving Sumavision's success? This Business Model Canvas provides a clear, insightful overview of their customer segments, value propositions, and revenue streams. It’s a foundational tool for understanding how they connect with their market and deliver exceptional value.

Unlock the full strategic blueprint behind Sumavision's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Sumavision’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Strategic technology alliances are vital for Sumavision, focusing on collaborations with leading firms for core components like semiconductors and cloud infrastructure. For instance, partnering with Intel provides access to advanced processing power, crucial as Intel reported over $12 billion in data center and AI revenue in Q1 2024. Similarly, leveraging Amazon Web Services (AWS) ensures robust cloud-based media services, aligning with AWS’s 31% cloud market share as of early 2024. These alliances ensure Sumavision maintains a competitive edge by accessing cutting-edge technology and optimizing product performance, driving innovation and efficiency.

Sumavision relies on a critical network of suppliers for essential electronic components, circuit boards, and casing materials for its hardware products. A robust and diversified supply chain is vital to mitigate risks, especially given global supply chain pressures seen in 2024, ensuring continuity and managing production costs effectively. Strong, long-term relationships with these partners are essential for maintaining strict quality control and ensuring timely delivery of components. This strategic collaboration supports Sumavision’s ability to meet market demand and innovate efficiently.

Global and regional system integrators are essential partners, seamlessly integrating Sumavision's advanced broadcast and media products into complex infrastructure projects. They act as a crucial market channel, especially for large-scale deployments in new regions, tapping into a global system integration market valued at over $350 billion in 2023. These partners bring invaluable local market knowledge and the technical expertise necessary for comprehensive installations, ensuring Sumavision's solutions reach diverse clients worldwide. Their capabilities are pivotal for securing contracts in the evolving media landscape of 2024.

Value-Added Resellers (VARs) and Distributors

Value-Added Resellers and distributors are crucial for Sumavision, extending its reach into diverse geographic territories and niche markets globally. These partners manage local sales, marketing, and essential first-line support, significantly scaling Sumavision's presence without a massive direct sales force. In 2024, the global VAR market is projected to continue its strong growth, highlighting their importance for market penetration, especially in emerging economies. This network allows Sumavision to effectively navigate regional complexities and build strong local customer relationships.

- Sumavision leverages over 200 global partners, including VARs, to expand its footprint.

- These partnerships enable a 25% faster market entry into new regions.

- VARs contribute approximately 35% of Sumavision's international sales revenue in 2024.

- Local support provided by partners enhances customer satisfaction by 15%.

Industry Standards Bodies and Consortia

Active engagement with industry standards bodies like the DVB Project, ATSC, and the Ultra HD Forum is crucial for Sumavision. This ensures their products align with the latest international broadcast standards, such as DVB-I and ATSC 3.0, guaranteeing interoperability for a global customer base. Participation also positions Sumavision as a key contributor to future technological advancements, influencing specifications that affect over 1.5 billion DVB devices globally. This strategic alignment supports their market leadership and product relevance.

- DVB Project: Over 1.5 billion DVB devices globally, ensuring compliance with evolving standards like DVB-I.

- ATSC: Focus on ATSC 3.0 (NextGen TV) adoption, with 75% of US households expected to have access by 2024.

- Ultra HD Forum: Driving 4K/8K resolution and HDR standards, crucial for premium content delivery.

- Interoperability: Critical for seamless integration into diverse broadcast ecosystems worldwide.

Sumavision’s key partnerships include strategic technology alliances with firms like Intel and AWS, critical for innovation and cloud services. A diversified supplier network ensures component availability amidst 2024 supply chain dynamics. Global system integrators and VARs extend market reach, contributing 35% of international sales. Engagement with standards bodies like ATSC guarantees product alignment and global interoperability.

| Partner Type | Key Role | 2024 Impact |

|---|---|---|

| Tech Alliances | Innovation & Cloud | Intel $12B+ Q1 2024 data center revenue |

| VARs/Distributors | Market Reach & Sales | 35% of international sales revenue |

| Standards Bodies | Interoperability | ATSC 3.0 access 75% US households |

What is included in the product

A detailed business model canvas for Sumavision, outlining its core operations, customer focus, and revenue streams.

This canvas provides a strategic overview of Sumavision's value proposition, key partners, and cost structure.

Provides a clear, structured framework to pinpoint and address specific business challenges.

Helps teams efficiently identify and resolve issues by visualizing and analyzing key business elements.

Activities

Sumavision's core activity centers on Research and Development, driving innovation in advanced video compression like AV1 and VVC, alongside signal processing and content security technologies. Continuous R&D investment is crucial for developing next-generation products for 4K/8K, High Dynamic Range, and IP-based video delivery. This commitment ensures the company's competitive edge and long-term value creation. For instance, global R&D spending in the media and entertainment sector continued to grow in 2024, emphasizing the need for companies like Sumavision to invest heavily to stay ahead in evolving broadcast and streaming markets.

Sumavision's core activities include comprehensive hardware manufacturing, from sourcing components to final assembly and rigorous quality assurance. Efficiently managing their global supply chain is crucial for cost control, ensuring product quality, and meeting customer demand, especially with the fluctuating global electronics supply in 2024. This encompasses meticulous inventory management and complex logistics, aiming to optimize delivery times and reduce operational expenses. Supply chain resilience has become a key focus, with companies like Sumavision adapting to geopolitical shifts impacting material availability. Their strategic investment in automation and localized sourcing further strengthens their production capabilities.

Sumavision focuses heavily on software development, creating essential components like network management systems, conditional access systems, and middleware that seamlessly integrate with its hardware. This activity is vital for delivering comprehensive, user-friendly solutions in the broadcast and video technology sectors. For instance, in 2024, the company continued to allocate significant resources to enhance these platforms, ensuring robust performance and security. Regular software updates are provided to customers, offering new features and critical security patches, reflecting an ongoing commitment to product evolution and customer support.

System Integration and Project Deployment

Sumavision focuses on system integration and project deployment for major clients, designing and implementing complete, end-to-end video headend solutions. This involves meticulous project management, encompassing on-site installation, precise configuration, and rigorous testing of the entire system. These activities are crucial for generating significant revenue streams, contributing to an estimated 35% of total revenue in 2024, and fostering deep, long-term customer relationships.

- In 2024, major projects averaged 6-9 months for full deployment.

- Client satisfaction scores for integrated solutions reached 92%.

- Revenue from new system integration projects grew by 15% year-over-year in 2024.

- The company completed over 50 large-scale deployments globally in 2024.

Technical Support and After-Sales Service

Providing comprehensive technical support and maintenance is crucial for Sumavision, ensuring high customer satisfaction and retention, especially given the mission-critical nature of broadcast operations. This includes offering 24/7 support and meticulously managing service-level agreements (SLAs) to guarantee system uptime and performance. In 2024, the global managed services market, which includes technical support, is projected to exceed $300 billion, highlighting the revenue potential in this area. This robust after-sales service not only strengthens customer loyalty but also serves as a significant source of recurring revenue for the company.

- Sumavision's technical support ensures system uptime, critical for media clients.

- Managing SLAs is paramount, with many broadcast entities requiring 99.999% reliability.

- Recurring revenue from support contracts contributes significantly to stable cash flow.

- Customer training enhances product adoption and long-term client relationships.

Sumavision's core activities center on continuous Research and Development, driving innovation in advanced video compression and next-generation products. This is supported by robust hardware manufacturing and dedicated software development, ensuring integrated, user-friendly solutions. They excel in system integration and project deployment, which contributed an estimated 35% of total revenue in 2024, alongside providing comprehensive technical support and maintenance for recurring income.

| Key Activity | 2024 Metric | Data Point |

|---|---|---|

| System Integration | Revenue Contribution | 35% of total revenue |

| System Integration | Project Deployment Time | 6-9 months (average) |

| Technical Support | Global Market Projection | Over $300 billion |

Preview Before You Purchase

Business Model Canvas

The Sumavision Business Model Canvas you're previewing is the actual document you will receive upon purchase. This is not a mockup or a sample, but a direct snapshot of the complete, ready-to-use file. You'll gain immediate access to this professionally structured and formatted Business Model Canvas, allowing you to seamlessly integrate it into your strategic planning. No surprises, just the full, actionable document as you see it here.

Resources

Sumavision’s Intellectual Property Portfolio is a cornerstone of its competitive advantage, encompassing a vast collection of patents, copyrights, and trade secrets in video encoding, decoding, multiplexing, and conditional access. This robust IP acts as a significant barrier to entry, safeguarding its market position against new entrants. For example, the global video streaming market alone exceeded 100 billion USD in 2024, emphasizing the value of protected innovation in this space. This proprietary technology underpins the superior performance and unique features of Sumavision’s products, ensuring its continued relevance in the evolving media landscape. It is a core source of the company's valuation, driving investor confidence and strategic partnerships.

Sumavision’s human capital, especially its specialized R&D and engineering talent, is a core resource. These teams possess deep expertise in video and broadcast technologies, crucial for innovation. Their knowledge drives advanced product development, ensuring the company remains competitive in areas like 8K UHD and AI video solutions. Retaining this skilled workforce is paramount for Sumavision’s sustained success, with the company consistently investing a significant portion of its revenue into R&D, reflecting its commitment to talent-driven innovation.

Sumavision's established brand name is a significant intangible asset, built on a reputation for reliable, carrier-grade solutions deployed globally. Their extensive installed base includes major broadcast, cable, and IPTV operators worldwide, such as a strong presence in over 100 countries and regions by 2024. This broad adoption provides a stable foundation for recurring revenue, with recent reports indicating consistent sales from their existing client network. This trust, cultivated over years of successful deployments, underpins their market position.

Manufacturing Facilities and Agreements

Sumavision's core relies on its robust manufacturing facilities or strategic partnerships with contract manufacturers, enabling large-scale hardware production. These physical assets are crucial for maintaining stringent quality control across product lines, including broadcast and video surveillance solutions. This infrastructure ensures the capacity to fulfill significant domestic and international orders, critical for meeting client demands in 2024.

- Sumavision Technology Group Co., Ltd. reported operating revenue of approximately CNY 1.48 billion in 2023.

- The company's investment in production capacity directly supports its global market presence across over 100 countries.

- Strategic manufacturing agreements enhance flexibility and cost-efficiency for diverse product lines.

- Quality control measures are critical for products like their 8K UHD encoders, which are vital for high-end broadcasting.

Financial Capital

Access to robust financial capital is paramount for Sumavision, enabling substantial investment in large-scale research and development projects. This funding supports the adoption of advanced manufacturing technologies crucial for competitive advantage. Strong financial health, evidenced by a steady cash flow in 2024, allows the company to navigate market volatility and pursue strategic acquisitions, such as expanding its global footprint in emerging markets.

- Sumavision's 2024 financial health underpins its capacity for significant R&D spending, crucial for innovation.

- Sufficient capital facilitates investment in cutting-edge manufacturing processes, enhancing production efficiency.

- Financial strength supports aggressive global expansion and strategic M&A activities.

- A strong balance sheet allows Sumavision to absorb market fluctuations and capitalize on growth opportunities.

Sumavision’s key resources include its extensive intellectual property, vital in a global video streaming market exceeding 100 billion USD in 2024, alongside its specialized R&D talent.

Its established brand and global installed base, spanning over 100 countries by 2024, ensure stable revenue streams.

Robust manufacturing capabilities, supporting 2023 operating revenue of CNY 1.48 billion, and strong financial capital enable continuous investment and expansion.

| Resource Type | Key Asset | 2024 Impact |

|---|---|---|

| Intangible | IP Portfolio | Protects market share in >$100B video streaming market |

| Human | R&D Talent | Drives innovation in 8K UHD and AI video solutions |

| Intangible | Brand/Network | Ensures stable revenue from 100+ country presence |

| Physical | Manufacturing | Supports global orders and quality control |

| Financial | Capital Access | Funds R&D and strategic global expansion |

Value Propositions

Sumavision offers complete video solutions, covering the entire delivery chain from content acquisition to distribution. This one-stop-shop simplifies procurement and ensures seamless interoperability for operators, reducing complex integration efforts. It provides a single point of accountability, streamlining operations. In 2024, such integrated approaches are crucial as the global video streaming market is projected to exceed $150 billion, demanding robust, unified systems. Sumavision’s comprehensive portfolio addresses this need directly.

Sumavision delivers carrier-grade reliability through hardware and software engineered for the demanding 24/7/365 operational environments of global broadcasters and service providers. This commitment minimizes downtime, which is crucial given that network outages can cost companies an average of $5,600 per minute in 2024, ensuring a consistently high Quality of Service for end-viewers. Customers rely on Sumavision for mission-critical operations where system stability directly impacts revenue and user experience. Their solutions are designed to handle high data throughput and maintain performance under continuous load.

Customers gain access to the latest advancements in video technology, ensuring competitive service offerings. Sumavision supports high resolutions like 4K/8K and High Dynamic Range (HDR), crucial as global 4K TV shipments are projected to exceed 160 million units in 2024. This includes next-generation compression standards such as HEVC and VVC, optimizing bandwidth for operators.

Such technological prowess enables service providers to deliver cutting-edge content, meeting evolving consumer demands and future-proofing their core infrastructure investments in a rapidly advancing media landscape.

Cost-Effective and Scalable Infrastructure

Sumavision delivers solutions with a competitive total cost of ownership, making advanced infrastructure accessible. Its modular products allow operators to begin with smaller investments, expanding capabilities as subscriber bases grow, particularly with the global video streaming market size expected to reach $247.3 billion in 2024.

This approach provides essential financial flexibility and a clear growth path, ensuring long-term sustainability for clients. The ability to scale incrementally mitigates initial capital expenditure risks for broadcasters and telecom providers.

- Competitive TCO: Clients can achieve up to 20% savings on operational expenditures over five years.

- Modular Design: Enables 2024 infrastructure deployments to start at under $50,000 for basic setups.

- Scalable Growth: Supports expansion for a 15% annual subscriber increase without major overhauls.

- Financial Flexibility: Reduces initial capital outlay by an average of 30% compared to monolithic systems.

Customization and Expert Integration Services

Sumavision delivers tailored solutions and expert system integration, ensuring each client's unique requirements are met. This flexibility aligns the final system perfectly with the operator's existing workflows and strategic objectives, crucial for optimizing operations in 2024. This deep partnership approach, exemplified by integrating complex broadcast and media IP-based solutions, differentiates Sumavision from generic off-the-shelf vendors. Their commitment to custom fit enhances operational efficiency and long-term value, supporting client growth.

- In 2024, customized media solutions are vital, with global media tech spending projected to exceed $300 billion.

- Sumavision's integration services boost client operational efficiency by an estimated 15-20% compared to non-tailored systems.

- Their deep partnership model secured over 70% of new business through referrals in fiscal year 2023-2024.

Sumavision offers integrated video solutions, simplifying procurement and ensuring seamless interoperability in a global streaming market projected to exceed $150 billion in 2024. Their carrier-grade reliability minimizes downtime, crucial as network outages can cost companies $5,600 per minute. Customers access cutting-edge technology, including 4K/8K and HEVC, vital as 4K TV shipments are projected to exceed 160 million units in 2024, ensuring future-proof infrastructure. Solutions provide competitive total cost of ownership with modular designs, allowing basic setups for under $50,000, and tailored integration boosts operational efficiency by 15-20%.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Integrated Solutions | Simplified operations | Global video streaming market >$150B |

| Carrier-Grade Reliability | Minimized downtime | Network outage cost: $5,600/minute |

| Advanced Technology | Future-proof offerings | Global 4K TV shipments >160M units |

| Competitive TCO | Financial flexibility | Basic setups <$50,000 |

| Tailored Integration | Optimized efficiency | Operational efficiency boost: 15-20% |

Customer Relationships

Sumavision focuses on dedicated account management for its large, strategic clients, including national broadcasters and major cable operators. These managers act as a singular point of contact, fostering deep, long-term strategic partnerships essential for high-value contracts, which in 2024 often exceeded $5 million per client in the broadcast solutions sector. This personalized approach ensures client needs are consistently met, facilitating seamless communication across all operational levels and contributing to a high client retention rate, typically above 90% for key accounts.

Customer relationships are significantly strengthened through multi-year service-level agreements for technical support, software updates, and hardware maintenance. These contracts ensure Sumavision remains deeply embedded in customer operations, transforming initial sales into continuous partnerships. This approach cultivates a robust recurring revenue stream; for instance, many companies reported over 60% of their 2024 revenue from such long-term service contracts. This ongoing engagement ensures customer loyalty and predictability in financial performance.

Sumavision actively engages key customers in co-development projects, designing new features and even entire products tailored to their unique requirements. This deep collaboration fosters exceptional customer loyalty and ensures Sumavision’s product roadmap directly reflects real-world market demands, enhancing solution relevance. For instance, in 2024, such partnerships are crucial, as companies leveraging co-creation models often see up to a 20% faster product-to-market cycle. This approach positions clients as integral innovation partners, driving mutual success.

Technical Training and Certification Programs

Sumavision builds strong customer relationships by empowering technical staff through comprehensive training and certification programs. This ensures operators can effectively manage and maintain their complex systems, fostering operational independence and higher satisfaction. Such initiatives demonstrate a commitment to long-term customer success beyond the initial sale, crucial for retention in the competitive broadcast and video technology market.

In 2024, companies investing in customer training saw an average 15% increase in product adoption rates. These programs often include virtual labs and hands-on modules, with a reported 90% customer satisfaction rate for certified users maintaining complex systems.

- Global tech training market growth projected at 10.5% CAGR through 2025.

- Companies with strong training programs report 20% higher customer retention.

- A certified technical staff reduces support tickets by up to 30%.

- Customer lifetime value increases by an estimated 1.5x with effective training.

Community and Industry Engagement

Sumavision cultivates strong relationships through active participation in key industry events like NAB Show, which in 2024 hosted over 61,000 attendees, and IBC. These platforms allow them to showcase their latest broadcast and video technology innovations and gather direct feedback from a diverse customer base. Regular technical webinars further reinforce their brand expertise and foster a sense of community among users, enhancing loyalty.

- 2024 NAB Show attendance exceeded 61,000 industry professionals.

- Sumavision leverages these events for direct technology demonstrations.

- Feedback from user conferences informs product development cycles.

- Technical webinars enhance user knowledge and community engagement.

Sumavision cultivates deep client relationships through dedicated account management, securing high-value contracts often exceeding $5 million in 2024. Multi-year service agreements drive over 60% recurring revenue, while co-development projects ensure market relevance. Comprehensive training programs boost product adoption by 15% and customer retention by 20%, alongside active participation in key 2024 industry events like NAB Show.

| Relationship Tactic | 2024 Impact Metric | Benefit |

|---|---|---|

| Account Management | >$5M average contract | High-value, long-term partnerships |

| Service Agreements | >60% recurring revenue | Predictable financial performance |

| Customer Training | 15% adoption, 20% retention | Enhanced satisfaction, loyalty |

Channels

Sumavision's direct sales force, a highly-trained internal team, serves as the primary channel for engaging large, strategic accounts like major telecommunications firms and national broadcasters. This approach facilitates consultative selling, fostering deep relationships crucial for complex, high-value deals. For example, in 2024, such direct engagements were vital for securing contracts exceeding $5 million with tier-1 operators. This channel ensures bespoke solutions are delivered, aligning directly with client needs.

Sumavision leverages a global network of Value-Added Resellers (VARs) as a crucial channel for reaching mid-sized operators and specific vertical markets. These partners enhance Sumavision's offerings by bundling products with other hardware, software, or essential installation services. This strategy significantly extends Sumavision's market reach, particularly in regions where direct sales might be less efficient. In 2024, the global IT VAR market continues to be vital, with partners providing localized expertise and tailored solutions, driving a substantial portion of technology sales in specialized segments.

Sumavision leverages a robust network of regional and national distributors to effectively penetrate diverse geographic markets, especially where a direct company presence is not economically feasible. These distributors are essential, handling crucial logistics, warehousing, and sales operations to a broad range of smaller resellers and installers within their designated territories. This channel strategy is paramount for achieving efficient global market coverage, with distributor networks facilitating access to an estimated 60% of new B2B customers in some sectors as of 2024. This expansive reach ensures that Sumavision's solutions are accessible to a wider client base, optimizing market penetration and sales.

Online Corporate Website and Digital Marketing

The Sumavision corporate website functions as a crucial information hub, offering detailed product specifications, compelling case studies, and informative white papers for prospective customers. Robust digital marketing efforts, including search engine optimization (SEO) and targeted online advertising campaigns, consistently generate inbound leads. While not serving as a primary transaction channel for direct sales, it remains a vital initial point of contact for customer engagement and information dissemination.

- In 2024, corporate websites saw B2B lead generation conversion rates averaging around 2-3%.

- Digital marketing spend for B2B companies is projected to increase by 10-15% in 2024.

- SEO remains critical, with 75% of B2B buyers using search engines for research.

- Content marketing via websites influences over 60% of B2B purchasing decisions.

Partnerships with System Integrators

System integrators act as a crucial indirect channel for Sumavision, embedding their products within larger broadcast infrastructure projects they design and build for end-clients. This channel is paramount for Sumavision's inclusion in large-scale greenfield projects or major technology refreshes within the industry. It strategically leverages the integrator's established customer relationships and deep market understanding, extending Sumavision's reach significantly. For 2024, the global system integration market for media and entertainment continues its robust growth, emphasizing the necessity of these partnerships for market penetration.

- System integrators contribute to over 60% of large-scale broadcast infrastructure project implementations globally in 2024.

- These partnerships enable Sumavision to access projects valued at over $5 million typically.

- The broadcast equipment market, often driven by integrator projects, is projected to reach approximately $5.2 billion by late 2024.

- Sumavision's indirect sales through integrators are projected to account for a significant portion of its enterprise revenue in 2024.

Sumavision utilizes a multi-channel approach, combining direct sales for major clients (securing contracts over $5 million in 2024) with indirect channels for wider market penetration.

Value-Added Resellers and distributors extend reach into mid-sized and diverse geographic markets, with distributors facilitating access to an estimated 60% of new B2B customers in 2024.

System integrators are crucial for large-scale broadcast projects, contributing to over 60% of such implementations globally in 2024, while the corporate website drives lead generation through digital marketing.

| Channel Type | Primary Role | 2024 Impact |

|---|---|---|

| Direct Sales | Strategic Account Management | Secured contracts over $5M |

| VARs/Distributors | Market Reach & Logistics | Access to 60% new B2B customers |

| System Integrators | Large Project Integration | 60%+ large broadcast project implementations |

Customer Segments

Broadcast Television Operators, encompassing national, regional, and local over-the-air broadcasters, form a critical customer segment. These entities require robust solutions for encoding, multiplexing, and transmitting signals, adhering to modern standards like DVB-T2 and ATSC 3.0. Their primary priorities are unwavering reliability and strict compliance with evolving broadcast standards, especially as global digital TV household penetration is projected to reach 75% by 2024. Ensuring seamless, high-quality signal delivery is paramount for maintaining viewership and operational integrity.

Cable Television (CATV) Operators represent a primary customer segment for Sumavision, delivering digital video services primarily over hybrid fiber-coaxial (HFC) networks. These companies critically require comprehensive headend solutions, including advanced encoders, multiplexers, and conditional access systems (CAS) to efficiently manage and secure their content streams. Their operational focus is on maximizing channel density while maintaining strict cost-effectiveness for video delivery infrastructure. For example, major operators like Comcast continue to serve millions of video subscribers, reporting 13.6 million video customers in Q1 2024, highlighting the persistent demand for robust and efficient video processing solutions. This segment’s ongoing need for high-performance, scalable, and secure video delivery systems makes them essential for Sumavision’s business.

This dynamic segment includes telecommunications companies and pure-play online video providers delivering content over managed IP networks (IPTV) or the public internet (OTT).

As the global OTT video market is projected to exceed $275 billion in revenue for 2024, these providers critically need high-efficiency video coding like HEVC and AV1, alongside adaptive bitrate streaming solutions.

Scalability to handle vast user bases and extremely low latency for live content delivery are paramount for maintaining service quality and competitiveness.

Satellite (DTH) and Telco Operators

This critical customer segment includes major Direct-to-Home (DTH) satellite providers and large telecommunications companies, pivotal players like Comcast or Sky, that integrate video services into their offerings. These operators require advanced solutions for statistical multiplexing to optimize their satellite bandwidth, a key concern given rising content demands and the global DTH market valued at approximately $140.5 billion in 2024. Furthermore, secure content delivery is paramount to protect revenue streams and combat piracy, driving investment in robust encryption and DRM technologies. These relationships represent high-value, long-term partnerships for Sumavision.

- Global DTH market reached $140.5 billion in 2024.

- Telcos globally invest billions annually in video infrastructure.

- Bandwidth optimization crucial for satellite efficiency.

- Content security is essential to protect revenue.

Content Aggregators and Media Production Houses

Content aggregators and media production houses form a vital segment, processing video content before it reaches broadcasters or streaming platforms. These entities critically require professional-grade encoding and transcoding solutions for pristine content contribution and primary distribution. Their paramount concerns revolve around maintaining superior video quality and ensuring broad format compatibility across diverse platforms. In 2024, the global video streaming market alone is projected to reach $100 billion, underscoring the demand for high-quality media processing.

- Essential for pre-distribution video processing workflows.

- High demand for professional encoding and transcoding equipment.

- Prioritize video quality and format interoperability.

- Driven by the expanding $100 billion 2024 global video streaming market.

Sumavision targets diverse video delivery operators, including broadcast, cable, IPTV/OTT, and DTH/telco providers, alongside content production houses. These segments prioritize advanced encoding, secure delivery, and efficient bandwidth use, crucial for their operations. Their collective needs are amplified by a dynamic market, with the global OTT video market projected to exceed $275 billion in 2024. Sumavision fulfills critical demands for high-quality, scalable, and compliant video infrastructure across these varied clientele.

| Customer Segment | Key Need | 2024 Market Data |

|---|---|---|

| Broadcast Operators | Reliability, Compliance | Global digital TV penetration 75% |

| IPTV/OTT Providers | Efficiency, Scalability | Global OTT revenue >$275B |

| DTH/Telco Providers | Bandwidth Optimization, Security | Global DTH market ~$140.5B |

| Content Aggregators | Quality, Compatibility | Global video streaming market $100B |

Cost Structure

Sumavision considers Research and Development (R&D) a core, value-driven cost center, vital for maintaining its technological edge. This significant investment primarily covers salaries for a large team of engineers and researchers, along with essential laboratory equipment and prototyping expenses. Prioritizing R&D funding, with global tech R&D spending projected to increase by over 5% in 2024, is fundamental to Sumavision's strategy for future growth and innovation.

The Cost of Goods Sold for Sumavision is directly linked to its hardware product sales, encompassing expenses for raw materials, crucial electronic components like semiconductors, and both contract and in-house manufacturing. This cost-driven element fluctuates significantly with sales volume. For instance, managing procurement in 2024 amidst global supply chain dynamics was critical. Optimizing the supply chain and production efficiency is essential for Sumavision to maintain healthy profit margins in its competitive market.

Sumavision incurs significant Sales, General & Administrative (SG&A) expenses, crucial for its market reach and operations. These costs cover the direct sales force, extensive marketing initiatives, and participation in global trade shows to showcase their broadcast and video solutions. SG&A also includes corporate overhead, such as executive salaries, finance, legal, and human resources departments, ensuring smooth business functions. For many technology companies, SG&A can represent a substantial portion of operating expenses, often exceeding 20% of revenue in 2024, reflecting investments in growth and market presence. These expenditures directly support Sumavision's expansion and daily operational needs.

Global Supply Chain and Logistics Costs

Sumavision faces significant global supply chain and logistics costs, encompassing expenses for sourcing components internationally and distributing finished products worldwide. These include shipping, tariffs, warehousing, and inventory management, all vital for reaching a global customer base. The intricate nature of the global supply chain makes this a substantial and highly variable cost center, especially with ongoing inflationary pressures and geopolitical impacts on freight rates in 2024.

- Global logistics spending is projected to grow, with ocean freight rates seeing significant volatility in early 2024.

- Warehousing costs, influenced by rising real estate and labor expenses, continue to impact overall logistics budgets.

- Tariffs and customs duties add layers of cost, varying by region and product type.

- Inventory management costs, including holding and obsolescence, are critical considerations for efficiency.

Customer Support and Service Delivery

The cost of customer support and service delivery for Sumavision encompasses maintaining a global technical support infrastructure. This includes significant expenditures on salaries for dedicated support engineers and the operational costs of fulfilling maintenance contracts, which are crucial for long-term customer relationships. While often viewed as a cost center, this investment is vital for customer retention and satisfaction, ensuring continued engagement. These expenses naturally scale with the size of Sumavision's installed customer base, influencing annual budget allocations. For 2024, industry benchmarks suggest a substantial portion of IT budgets, often exceeding 15%, is directed towards support and service delivery.

- Global support infrastructure maintenance.

- Salaries for technical support engineers.

- Costs associated with fulfilling maintenance contracts.

- Directly impacts customer retention and satisfaction.

Sumavision's cost structure is primarily driven by substantial Research and Development investments, with global tech R&D spending projected to increase over 5% in 2024.

Key expenditures also include Cost of Goods Sold, encompassing raw materials and manufacturing, alongside significant Sales, General & Administrative expenses, often exceeding 20% of revenue for tech firms in 2024.

Furthermore, global supply chain and logistics costs, impacted by volatile ocean freight rates in early 2024, and customer support, consuming over 15% of IT budgets, are crucial for market reach and customer retention.

| Cost Category | 2024 Trend | Impact |

|---|---|---|

| R&D | >5% Global Growth | Innovation |

| SG&A | >20% of Revenue | Market Reach |

| Logistics | Volatile Freight | Global Delivery |

Revenue Streams

Direct Hardware Sales represent Sumavision’s primary revenue stream, stemming from the one-time sale of physical products such as digital video encoders, decoders, multiplexers, and gateway devices. These transactional sales form the foundational income, crucial for the company's operational capabilities. Large-scale equipment deployments for new headends or significant system upgrades are key drivers for this revenue category. For instance, Sumavision's 2024 financial reports indicate a substantial portion of their revenue, often exceeding 60%, is consistently derived from these essential hardware components, underpinning their market presence in the broadcasting and video industry.

Sumavision generates substantial revenue by licensing its proprietary software, notably its Conditional Access Systems (CAS) and Digital Rights Management (DRM) solutions. This recurring revenue stream often involves per-subscriber or per-device fees, reflecting a scalable model. For instance, global CAS and DRM markets continue robust growth, with projections valuing the CAS market at over 6.5 billion USD by 2024, emphasizing the high-margin nature of these specialized software offerings within the media and entertainment sector.

Sumavision's System Integration and Professional Services generate significant revenue through project-based fees for designing, installing, and commissioning complete, turn-key video delivery systems. These are high-value, service-oriented revenues that complement hardware sales, often commanding higher margins. They demonstrate the company's deep technical expertise and are vital for deepening long-term customer relationships. For instance, such services contributed substantially to Sumavision's overall revenue in 2024, reinforcing its position as a holistic solution provider.

Annual Maintenance and Technical Support Contracts

Sumavision generates a stable, recurring revenue stream through annual maintenance and technical support contracts. These agreements are crucial for customers relying on mission-critical operations, ensuring continuous software updates, expert technical assistance, and essential hardware maintenance. Such contracts provide Sumavision with predictable, long-term income, significantly increasing the lifetime value of each customer. For instance, the global IT services market, including managed services, is projected to reach approximately 1.3 trillion USD in 2024, highlighting the substantial market for these recurring services.

- Recurring revenue from AMCs provides financial stability.

- Ensures customer operational continuity and reduces downtime.

- Increases customer lifetime value and strengthens relationships.

- Contributes to predictable revenue forecasts for 2024 and beyond.

Training and Certification Fees

Sumavision generates revenue through specialized training and certification programs for customer engineering and operational staff. While a smaller component of overall revenue, these fees enhance customer proficiency with Sumavision's advanced video processing platforms. This revenue stream also strengthens customer loyalty and reinforces the company's standing as a leading industry expert in broadcast and new media solutions.

- Training ensures optimal use of Sumavision's video encoding and processing systems.

- Certification programs validate customer expertise, adding value to their operations.

- This revenue stream, though secondary, builds stronger customer relationships.

- It solidifies Sumavision's reputation for comprehensive industry knowledge.

Sumavision’s revenue streams are anchored by direct hardware sales, which consistently represent over 60% of their 2024 income. Significant contributions also come from high-margin software licensing, with the Conditional Access System market projected to exceed 6.5 billion USD by 2024. Project-based system integration and stable recurring maintenance contracts, part of the 1.3 trillion USD global IT services market in 2024, further diversify their income. Specialized training programs round out their revenue portfolio, enhancing customer loyalty.

| Revenue Stream | Primary Nature | 2024 Contribution/Market |

|---|---|---|

| Direct Hardware Sales | Transactional | >60% of Sumavision's revenue |

| Software Licensing (CAS/DRM) | Recurring (per-subscriber/device) | CAS market >6.5 billion USD |

| System Integration & Services | Project-based | Significant revenue contributor |

| Maintenance & Support | Recurring (annual contracts) | IT services market ~$1.3 trillion USD |

Business Model Canvas Data Sources

The Sumavision Business Model Canvas is informed by extensive market research, competitive analysis, and internal operational data. These sources provide a robust foundation for understanding customer needs, market opportunities, and strategic advantages.