Sumavision PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumavision Bundle

Uncover the intricate external forces shaping Sumavision's destiny with our comprehensive PESTLE analysis. From evolving political landscapes and economic shifts to technological advancements, social trends, environmental regulations, and legal frameworks, this report provides a critical deep dive. Understand how these macro-environmental factors present both opportunities and threats for Sumavision's strategic planning and operational execution. Don't get left behind; gain the foresight you need to navigate the complexities of the modern market. Download the full PESTLE analysis now and empower your decision-making with actionable intelligence.

Political factors

Governments worldwide are actively investing in digital infrastructure, recognizing its importance for economic growth. For instance, the United States' Broadband Equity, Access, and Deployment (BEAD) program, funded with $42.5 billion, aims to expand high-speed internet access, directly benefiting companies like Sumavision by increasing the potential user base for advanced video services. Similarly, the European Union's Digital Decade policy targets widespread 5G coverage by 2030, creating a more robust environment for Sumavision's IPTV and broadcast solutions.

Changes in international trade policies, including tariffs on technology components or finished goods, can significantly impact Sumavision's manufacturing costs and competitiveness. For instance, the US imposed tariffs on various goods from China, which could affect companies like Sumavision that rely on cross-border component sourcing. These shifts can necessitate strategic adjustments, such as diversifying supply chains or emphasizing software development over hardware manufacturing.

Geopolitical trade tensions also pose a risk to Sumavision's supply chain stability and its capacity to export products to key international markets. For example, ongoing trade disputes between major economic blocs could disrupt the flow of essential electronic components, impacting production schedules and delivery times. This instability might force Sumavision to explore regional manufacturing hubs or alternative sourcing strategies to mitigate these risks, potentially influencing its global market penetration strategies for 2024 and 2025.

Geopolitical instability significantly impacts global supply chains, directly affecting companies like Sumavision that rely on the steady flow of components. Regional conflicts can cause material shortages and production delays, increasing costs. For instance, ongoing tensions in Eastern Europe in early 2024 continued to disrupt logistics networks, leading to higher shipping fees for electronics manufacturers.

Broadcasting Regulatory Frameworks

Government regulations significantly shape Sumavision's operational landscape, particularly in digital TV broadcasting and content distribution. Rules around licensing, spectrum allocation, and technical standards for video delivery are critical. For instance, in 2024, many regions continued to refine their digital terrestrial television (DTT) transition plans, impacting infrastructure investment and service rollout for companies like Sumavision.

Compliance with these evolving frameworks is not just a requirement but a strategic imperative for Sumavision to maintain its market access and foster innovation. The company must navigate varying national policies on content aggregation and data privacy, which can influence its platform development and service offerings.

- Licensing Requirements: Adherence to national broadcasting licenses and permits is fundamental for Sumavision's legal operation in diverse markets.

- Spectrum Allocation: Government decisions on spectrum availability directly affect the capacity and reach of wireless broadcasting services Sumavision might utilize.

- Technical Standards: Compliance with mandated technical standards for video compression, transmission, and receiver compatibility ensures interoperability and market acceptance.

- Content Regulations: Rules governing content ownership, local content quotas, and advertising standards impact Sumavision's content acquisition and platform management strategies.

Censorship and Content Control

Government regulations concerning content censorship and control across different nations significantly shape the types of video content that can be distributed and the technical specifications for conditional access systems (CAS). Sumavision, as a key player in video delivery and CAS solutions, must navigate these varying legal landscapes. This means their technologies need to be adaptable to comply with a country's specific content policies and digital rights management (DRM) requirements, directly influencing product development and feature sets.

For instance, countries with strict content regulations might require Sumavision's CAS to implement more robust content filtering or regional playback restrictions. This can lead to increased R&D investment in developing flexible and compliant solutions. In 2024, the global digital content market continued to expand, but so did regulatory scrutiny. Reports indicated that over 40 countries had implemented or were considering new legislation impacting online content distribution, often citing national security or public order as reasons. Sumavision's ability to offer adaptable CAS solutions that meet these diverse and evolving demands is crucial for market access and sustained revenue streams.

- Regulatory Compliance: Sumavision's CAS must adhere to varying national censorship laws, affecting content availability and delivery models.

- DRM Integration: Technologies need to support diverse DRM standards to protect content rights in line with local legislation.

- Market Access: Compliance with content control regulations is paramount for market entry and operation in numerous regions.

- Product Development: The need for localized compliance drives innovation in CAS features and security protocols.

Government investments in digital infrastructure, such as the US BEAD program with $42.5 billion, directly benefit Sumavision by expanding its potential customer base for advanced video services. International trade policy shifts, including tariffs, can impact Sumavision's manufacturing costs, potentially leading to supply chain diversification or a greater focus on software. Geopolitical trade tensions in 2024 continued to disrupt logistics, increasing shipping fees for electronics manufacturers and necessitating strategic adjustments in sourcing and market access for Sumavision.

What is included in the product

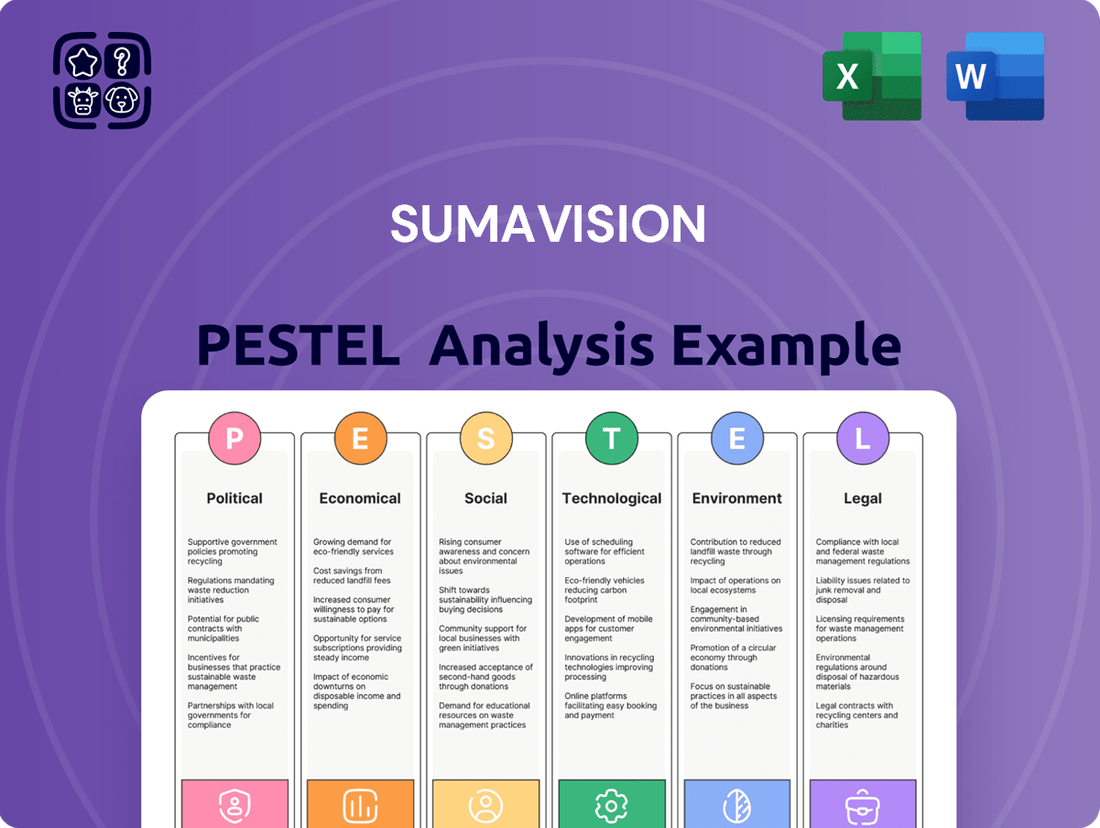

This Sumavision PESTLE Analysis dissects the influence of Political, Economic, Social, Technological, Environmental, and Legal forces on the company's operations and strategic direction.

It provides actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential growth avenues.

Provides a clear, concise overview of Sumavision's external environment, enabling swift identification of critical opportunities and threats to inform strategic decision-making.

Economic factors

Global economic growth significantly impacts Sumavision's market. A healthy global economy in 2024 and projected into 2025 generally translates to increased investment in media and entertainment infrastructure. This is because broadcast, cable, and IPTV operators are more likely to allocate capital for upgrades and expansion when economic conditions are favorable, directly benefiting demand for Sumavision's video delivery solutions.

Conversely, economic slowdowns or recessions can curb capital expenditure. For instance, if major economies experience a dip in GDP growth, as seen in some regions throughout 2023 and early 2024 projections, operators might postpone or scale back their infrastructure investments. This directly affects Sumavision's sales pipeline and revenue potential.

A strong economic climate also fuels consumer spending on digital media services. As disposable incomes rise, consumers are more willing to subscribe to premium content and adopt new streaming technologies. This increased consumer demand, in turn, drives the need for the underlying video delivery technologies that Sumavision provides, creating a positive feedback loop for the company.

Rising inflation presents a significant challenge for Sumavision, potentially escalating the costs of essential inputs like raw materials, skilled labor, and energy. For instance, global inflation rates remained elevated throughout 2023 and into early 2024, with many countries experiencing consumer price index (CPI) increases exceeding 5%.

These increased operational expenses can directly squeeze Sumavision's profit margins, particularly if the company faces difficulties in passing these higher costs onto its customer base through price adjustments. This delicate balance between absorbing costs and maintaining competitive pricing is a key concern.

Effectively navigating these inflationary headwinds necessitates a strong focus on optimizing the supply chain and implementing rigorous cost control measures across all operational facets. This proactive management is crucial for maintaining profitability and financial stability.

Currency exchange rate fluctuations significantly impact Sumavision's global operations. As a company operating internationally, its revenues earned in foreign currencies can translate to fewer or more domestic currency units depending on the prevailing exchange rates. For instance, if Sumavision earns revenue in Euros and the Euro weakens against the US Dollar, its reported revenue in USD will decrease, impacting overall financial performance.

Conversely, a strengthening local currency can make Sumavision's products and services more expensive for international buyers, potentially dampening demand. For example, if Sumavision's primary market is in a country whose currency appreciates, their offerings become less competitive. This necessitates careful pricing strategies to remain attractive in the global marketplace.

The cost of imported components is also directly affected by currency movements. If Sumavision relies on manufacturing inputs sourced from countries with stronger currencies, a depreciation of its home currency will lead to higher procurement costs. In 2024, for example, many companies faced increased costs due to the volatility of major currency pairs like USD/EUR, with the Euro experiencing periods of weakness against the dollar.

Effective management of foreign exchange risk is therefore crucial for Sumavision's financial stability and its ability to maintain competitive pricing. This involves strategies such as hedging, diversifying currency exposure, and carefully structuring international transactions to mitigate potential losses arising from adverse currency movements.

Investment Trends in Digital Media Infrastructure

The economic landscape for digital media infrastructure is robust, driven by operators' eagerness to upgrade their networks and content delivery systems. This willingness translates directly into significant capital expenditure, creating fertile ground for companies like Sumavision that offer advanced video solutions. For example, the ongoing global rollout of 5G networks is a major economic stimulant, projected to reach over 5 billion mobile subscriptions by 2025, according to GSMA data, directly enhancing the demand for high-bandwidth video streaming capabilities.

This investment trend is further amplified by the insatiable consumer appetite for premium video content and tailored viewing experiences. As consumers increasingly demand 4K streaming, interactive features, and personalized content recommendations, operators are compelled to invest in the underlying infrastructure to meet these expectations. The global video streaming market size was valued at approximately USD 70.3 billion in 2023 and is expected to grow significantly, with projections indicating a compound annual growth rate (CAGR) of over 15% through 2030, as reported by market research firms.

- Increased Capital Expenditure: Broadcast, cable, and IPTV providers are channeling substantial funds into modernizing their digital media infrastructure.

- 5G and Broadband Expansion: Investments in 5G and enhanced broadband connectivity create direct demand for Sumavision's video processing and transmission technologies.

- Consumer Demand for Quality: The growing preference for high-definition video and personalized content drives infrastructure upgrades.

- Market Growth Projections: The video streaming market is on a strong growth trajectory, indicating sustained investment in supporting infrastructure.

Competition and Pricing Pressures

The video delivery solutions market is intensely competitive, featuring a broad array of domestic and international companies vying for market share. This crowded landscape inevitably translates into significant pricing pressures, directly impacting Sumavision's revenue streams and overall profitability. For instance, while specific 2024/2025 pricing data for Sumavision is proprietary, industry reports from late 2023 and early 2024 indicate that average selling prices for video encoding solutions have seen a downward trend due to increased competition from emerging players, particularly in Asia.

To navigate this challenging environment, Sumavision must continuously balance the imperative to offer cost-effective, high-quality solutions with the necessity of ongoing innovation. Staying ahead requires not just competitive pricing but also the development of advanced features and reliable service to retain existing customers and attract new ones. Market analysis from Q4 2023 suggests that companies investing heavily in AI-driven optimization for video streaming are better positioned to command premium pricing, even amidst general price erosion.

Key competitive factors Sumavision faces include:

- Aggressive Pricing Strategies: Competitors frequently employ aggressive pricing to gain market entry or expand their footprint.

- Technological Advancements: Rapid technological shifts necessitate continuous R&D investment to avoid obsolescence.

- Service and Support Differentiation: While price is a factor, superior customer service and technical support can be a crucial differentiator.

- Global Market Penetration: International players often leverage economies of scale, putting pressure on domestic providers.

Global economic growth directly influences Sumavision's market by impacting capital expenditure by broadcast, cable, and IPTV operators. Favorable economic conditions in 2024 and projected into 2025 encourage infrastructure upgrades, boosting demand for Sumavision's video delivery solutions, while economic downturns can lead to postponed investments.

Rising inflation in 2023 and early 2024, with CPI increases often exceeding 5% in many countries, poses a significant challenge by escalating operational costs for Sumavision. This pressure on margins requires careful management of pricing and cost control to maintain profitability.

Currency fluctuations add another layer of complexity; for instance, the Euro's periods of weakness against the US Dollar in 2024 impacted companies' revenue translation. Sumavision must strategically manage foreign exchange risk to ensure stable financial performance and competitive international pricing.

| Economic Factor | Impact on Sumavision | Supporting Data/Trend (2023-2025) |

| Global Economic Growth | Drives Capital Expenditure (CapEx) by Operators | Healthy growth in 2024/2025 fuels infrastructure upgrades. |

| Inflation | Increases Operational Costs | Elevated inflation (e.g., >5% CPI in many regions, 2023-2024) squeezes margins. |

| Currency Exchange Rates | Affects Revenue Translation and Import Costs | Volatility in major pairs (e.g., USD/EUR) impacts profitability and competitiveness. |

| Video Streaming Market Growth | Boosts Demand for Delivery Solutions | Projected CAGR of over 15% (2023-2030) indicates sustained investment. |

Preview Before You Purchase

Sumavision PESTLE Analysis

The Sumavision PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive breakdown explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Sumavision. Gain valuable insights into the external forces shaping the company's strategic landscape. Every detail, from the in-depth analysis to the clear presentation, is what you'll immediately download.

Sociological factors

The move away from traditional television to streaming services is fundamentally reshaping how people consume media, directly affecting Sumavision's customer base. By 2024, projections indicate that global streaming revenue will surpass $200 billion, highlighting the massive shift. Consumers now expect content whenever and wherever they want it, favoring personalized, interactive experiences across multiple devices.

This evolving landscape necessitates that Sumavision pivot its strategies to align with these on-demand preferences. The demand for solutions that facilitate content aggregation and efficient media distribution across various platforms, including Over-The-Top (OTT) and Internet Protocol Television (IPTV) services, is accelerating. For instance, the global IPTV market alone was valued at over $70 billion in 2023 and is expected to grow substantially.

Consumers increasingly expect ultra-high-definition (UHD) content, with 4K streaming becoming standard and 8K adoption on the rise. For instance, by the end of 2024, it's estimated that over 200 million households globally will subscribe to a 4K-capable service, a significant jump from recent years. This demand directly translates into a need for sophisticated video encoding and decoding technologies that can handle these higher resolutions efficiently.

Furthermore, the desire for personalized content recommendations is reshaping how users interact with media platforms. Studies in 2024 indicate that personalized recommendations can increase user engagement by up to 30% on streaming services. Sumavision's capacity to deliver solutions that enhance video quality and offer deeply tailored viewing experiences is therefore vital for attracting and keeping customers in this competitive landscape.

The increasing digital literacy across global populations directly correlates with the market's readiness for advanced video solutions like IPTV. In 2024, for instance, a significant portion of households in developed nations, estimated around 85-90%, possess at least one internet-connected device, indicating a strong foundation for technology adoption.

This widespread digital fluency facilitates quicker uptake of Sumavision's integrated digital TV and IPTV platforms. As more consumers become comfortable with digital interfaces and online services, the demand for interactive features and seamless integration of new technologies, like those offered by Sumavision, naturally grows, potentially boosting market penetration for their solutions.

The ease with which end-users can adopt and utilize new digital technologies directly impacts the success of system integration projects. A population with high digital literacy requires less extensive training and support, streamlining deployment for Sumavision's software and services, thereby reducing implementation costs and time-to-market.

Demographic Shifts and Audience Segmentation

Demographic trends significantly shape the demand for Sumavision's video solutions. For instance, an aging global population, projected to reach 1.6 billion individuals aged 65 and over by 2050, may drive demand for accessible, user-friendly interfaces and content tailored to older demographics. Conversely, a growing youth segment, with Gen Z being the largest generation in history, often favors short-form, interactive video content and streaming platforms, influencing Sumavision's need to support diverse delivery formats.

Understanding these audience segments is crucial for Sumavision's clients. By effectively targeting demographics, media companies can optimize content delivery and advertising. For example, in 2024, the 18-34 age group represents a significant portion of global streaming service subscribers, highlighting the importance of mobile-first and on-demand solutions. This informs Sumavision's product development, ensuring it caters to evolving viewing habits across various age groups and preferences.

- Aging Population: By 2050, the number of people aged 65 and over globally is expected to reach 1.6 billion, impacting content accessibility needs.

- Youth Segment: Gen Z, the largest generation, drives demand for short-form video and interactive streaming experiences.

- Targeting Effectiveness: Understanding demographic shifts allows clients to refine audience targeting, boosting engagement and advertising revenue.

- Product Development: Sumavision must adapt its offerings to support diverse viewing habits, from traditional broadcasts to mobile streaming for younger audiences.

Social Acceptance of New Media Technologies

The societal embrace of new media technologies, like virtual reality (VR) in broadcasting or interactive streaming, directly influences Sumavision's long-term expansion prospects. As of early 2024, global VR headset shipments were projected to reach over 10 million units for the year, indicating a growing consumer interest in immersive experiences.

While Sumavision's primary focus remains on traditional digital video infrastructure, its ability to adapt and integrate solutions for these emerging media formats is crucial for sustained relevance. Companies investing in VR content creation and distribution are seeing increased engagement, with platforms like Meta's Horizon Worlds reporting millions of active users by late 2023.

Societal acceptance hinges on factors such as accessibility, affordability, and the perceived value of these new technologies. For instance, the increasing availability of more affordable VR headsets, with prices dropping to under $300 for some models, is a key driver for broader adoption.

Sumavision should monitor trends in user-generated immersive content and the development of standards for VR broadcasting. The market for immersive advertising alone was estimated to reach billions of dollars by 2025, highlighting a significant revenue stream for those who can effectively leverage these platforms.

Societal shifts towards digital-first consumption and increasing digital literacy are key influences. By 2024, global streaming revenue is projected to exceed $200 billion, underscoring a strong consumer preference for on-demand content. Furthermore, an estimated 85-90% of households in developed nations possess internet-connected devices in 2024, indicating a robust market for advanced video solutions.

Demographic trends also play a significant role, with the growing youth segment driving demand for short-form and interactive video. The aging global population, expected to reach 1.6 billion by 2050, will likely increase the need for accessible interfaces and tailored content. Sumavision's ability to cater to these diverse and evolving viewing habits across age groups is paramount.

The growing acceptance of new media technologies, such as VR, presents future opportunities. Global VR headset shipments were anticipated to surpass 10 million units in 2024, signaling rising consumer interest in immersive experiences. As more affordable VR options emerge, with some models costing under $300, broader adoption is expected, impacting the future media landscape.

Technological factors

Continuous progress in video encoding and compression standards, like H.266 (VVC) and AV1, significantly impacts Sumavision. These advancements enable higher quality video streaming with less data, crucial for the growing demand for 4K and 8K content, especially on mobile devices.

Sumavision's capacity to adopt and embed these state-of-the-art technologies within its encoder and decoder solutions serves as a major differentiator in the market. For instance, AV1, an open-source royalty-free codec, offers up to 30% better compression than H.265 (HEVC), which directly translates to lower bandwidth costs for content providers and improved user experience.

The adoption of these efficient codecs is directly tied to the expansion of high-definition content delivery. As of early 2024, 4K streaming penetration continues to rise globally, with many services actively promoting 4K content, creating a sustained need for the advanced compression capabilities Sumavision offers.

The accelerated deployment of 5G technology is a significant technological driver, promising to revolutionize video delivery by offering substantially higher speeds and lower latency. This advancement directly benefits Sumavision's offerings, enabling smoother, higher-quality mobile streaming and richer interactive content experiences for end-users. By mid-2024, global 5G subscriptions were projected to surpass 1.5 billion, highlighting the rapid market penetration and the vast potential for enhanced video services.

Concurrently, the pervasive adoption of cloud-based solutions provides an exceptional opportunity for Sumavision to enhance its operational efficiency and service delivery. Cloud-native playout and encoding platforms offer broadcasters and content providers unprecedented flexibility, allowing for seamless scaling of operations up or down based on demand, and often leading to significant cost savings. In 2024, the global cloud computing market was estimated to reach over $800 billion, underscoring the widespread reliance and investment in cloud infrastructure.

Sumavision is strategically positioned to capitalize on these converging technological trends by developing and promoting solutions that fully leverage the capabilities of 5G and the scalability of cloud infrastructure. This includes optimizing its video delivery platforms for 5G networks and expanding its suite of cloud-native services. These efforts are crucial for maintaining a competitive edge and meeting the evolving demands of the digital media landscape, where faster, more flexible, and cost-effective video solutions are paramount.

Artificial intelligence and machine learning are fundamentally reshaping how media content is created, managed, and delivered. These advanced technologies enable sophisticated features such as personalized content recommendations, the automatic generation of descriptive metadata, and predictive analytics for understanding audience behavior. For example, by mid-2024, global spending on AI in media and entertainment was projected to reach tens of billions of dollars, highlighting its growing importance.

Sumavision can strategically integrate AI and machine learning into its product offerings to significantly enhance user experience and operational efficiency. By leveraging AI for content personalization, Sumavision can deliver more relevant programming to viewers, increasing engagement and retention. Furthermore, AI-powered automation can optimize content workflows, reducing manual effort and accelerating time-to-market for new media services.

The application of AI in optimizing video delivery systems is another key area for Sumavision. Machine learning algorithms can analyze network conditions and user demand in real-time, ensuring smoother playback and reduced buffering. This improved quality of service, especially with the anticipated growth in 8K streaming and immersive content by 2025, will be crucial for maintaining a competitive edge in the broadcast technology sector.

Cybersecurity in Content Delivery

The escalating volume of digital content distribution, from streaming services to online gaming, has simultaneously amplified the threat landscape. Cybersecurity and robust content protection are no longer optional but critical for survival. This includes sophisticated digital rights management (DRM) and conditional access systems (CAS) to safeguard intellectual property and revenue streams.

Sumavision's core competency in conditional access systems directly addresses this imperative. Their solutions are designed to prevent unauthorized access, effectively combat piracy, and ensure that content reaches only legitimate subscribers. This capability is vital for content providers and broadcasters aiming to monetize their digital offerings securely.

The market for content protection technologies is substantial and growing. For instance, the global digital rights management market was valued at approximately $3.9 billion in 2023 and is projected to reach $7.9 billion by 2028, growing at a CAGR of 15.1% according to MarketsandMarkets. This growth underscores the increasing demand for the very services Sumavision provides.

- Growing Digital Content: The sheer volume of digital content being distributed globally necessitates robust security measures.

- Rise of Digital Threats: Piracy and unauthorized access are significant concerns, impacting revenue for content creators and distributors.

- Sumavision's CAS Expertise: The company's specialization in conditional access systems directly tackles these security challenges.

- Market Demand: The significant and expanding market for DRM and content protection technologies validates the strategic importance of Sumavision's offerings.

Evolution of Immersive Technologies

The increasing popularity of virtual reality (VR) and augmented reality (AR) in how people consume media creates new avenues for Sumavision. These immersive technologies have the potential to significantly alter how viewers interact with content, moving beyond traditional flat screens. The global VR/AR market is projected to grow substantially, with some forecasts indicating it could reach hundreds of billions of dollars by the mid-2020s, highlighting the scale of this emerging opportunity.

For Sumavision, this evolution necessitates a critical look at its video delivery infrastructure. Supporting the demanding bandwidth and ultra-low latency requirements of high-quality VR/AR content will be crucial. Failure to adapt could limit participation in this growing market segment.

Consider these specific technological factors:

- Bandwidth Demands: Immersive experiences require significantly more data transmission compared to traditional video streaming, potentially increasing operational costs for infrastructure upgrades.

- Latency Sensitivity: VR/AR applications are highly sensitive to delays, meaning Sumavision’s network must offer near-instantaneous response times to prevent viewer discomfort or motion sickness.

- Hardware Adoption Rates: While growing, widespread consumer adoption of VR/AR headsets is still a factor influencing the immediate market size for immersive content delivery services.

- Content Creation Tools: The development and standardization of tools for creating and distributing immersive content will also shape how Sumavision integrates these technologies.

The ongoing advancements in video codecs like H.266 (VVC) and AV1 directly benefit Sumavision by enabling higher-quality streaming with reduced data. This is critical as 4K and 8K content demand grows, with 4K streaming penetration continuing to rise globally in early 2024.

The widespread adoption of 5G technology is a major technological enabler, promising faster speeds and lower latency for mobile streaming, a trend supported by over 1.5 billion global 5G subscriptions by mid-2024. Cloud-native solutions also offer Sumavision enhanced flexibility and cost savings, with the global cloud computing market exceeding $800 billion in 2024.

Sumavision's strategic integration of AI and machine learning into its offerings can significantly boost user experience and operational efficiency, with AI spending in media and entertainment projected to reach tens of billions of dollars by mid-2024. Furthermore, cybersecurity and robust content protection, particularly through Sumavision's expertise in conditional access systems, are paramount given the escalating volume of digital content and threats, a market valued at approximately $3.9 billion in 2023 for DRM.

| Technological Factor | Impact on Sumavision | Relevant Data Point (2024/2025) |

|---|---|---|

| Advanced Video Codecs (H.266, AV1) | Improved streaming quality, reduced data usage | AV1 offers up to 30% better compression than H.265. 4K streaming penetration continues to rise globally. |

| 5G Network Deployment | Enhanced mobile streaming, lower latency | Global 5G subscriptions projected to surpass 1.5 billion by mid-2024. |

| Cloud Computing Adoption | Increased operational flexibility and scalability | Global cloud computing market estimated to exceed $800 billion in 2024. |

| Artificial Intelligence & Machine Learning | Personalized content, optimized workflows, improved delivery | Global AI spending in media and entertainment projected to reach tens of billions by mid-2024. |

| Cybersecurity & Content Protection (DRM/CAS) | Safeguarding intellectual property and revenue streams | Global DRM market valued at ~$3.9 billion in 2023, projected to reach $7.9 billion by 2028. |

Legal factors

Strong intellectual property (IP) protection and anti-piracy laws are vital for companies like Sumavision, as they directly influence the market for its conditional access systems and digital rights management (DRM) solutions. These legal safeguards ensure that content providers can monetize their offerings, thereby increasing the demand for robust security measures. For instance, the global fight against content piracy, which costs the media industry billions annually, underscores the importance of effective IP enforcement for companies providing security technologies.

Robust legal frameworks that actively combat unauthorized content access and distribution significantly strengthen the value proposition of Sumavision's security offerings. As of 2024, many countries are enhancing their anti-piracy legislation, recognizing the economic damage caused by illegal streaming and content theft. This legal reinforcement directly translates into a greater need for advanced DRM and conditional access systems to protect premium content and ensure revenue streams for content owners.

The evolving legal landscape surrounding artificial intelligence (AI) and copyright presents both challenges and opportunities. As AI-generated content becomes more prevalent, clarifying ownership and usage rights is critical. Sumavision's ability to adapt its solutions to address the complexities of AI-driven content protection will be key to maintaining its competitive edge in this dynamic environment. The World Intellectual Property Organization (WIPO) is actively engaged in discussions regarding AI and IP, indicating the growing global focus on this area.

Strict data privacy regulations like GDPR and CCPA significantly influence how Sumavision handles user data for media consumption. Non-compliance can lead to substantial legal penalties, impacting financial performance. For instance, in 2023, companies faced fines totaling billions for data privacy violations globally, underscoring the critical need for adherence.

Sumavision's software and systems must be robustly designed to meet these evolving privacy standards. This includes ensuring secure data collection, transparent usage policies, and user consent mechanisms. As of early 2024, the enforcement of these laws continues to intensify, with regulators focusing on data breach notifications and data subject rights.

Broadcasting licensing and spectrum allocation are crucial for Sumavision, as they directly impact its clients' ability to operate digital TV services. Regulations in this area, managed by bodies like the FCC in the US or Ofcom in the UK, dictate who can broadcast and on which frequencies. For instance, the FCC's spectrum auctions in 2020 generated over $81 billion, showcasing the significant economic value and scarcity of this resource, which affects the cost and availability of spectrum for broadcasters.

Changes in these regulations can present both opportunities and challenges for Sumavision. A shift towards more flexible spectrum usage or the reallocation of specific bands could enable new service deployments or require clients to adapt their technologies. For example, the ongoing transition to 5G networks is leading to spectrum refarming in many regions, potentially freeing up or restricting certain broadcasting frequencies and influencing the demand for Sumavision's infrastructure solutions.

The allocation process itself, often involving competitive bidding or licensing rounds, can influence market entry and competition. Sumavision's clients must navigate these processes, and any changes in licensing requirements, such as increased local content quotas or digital transition mandates, can directly affect their business models and the types of solutions they procure from Sumavision.

Anti-Trust and Competition Laws

Anti-trust and competition laws are a significant legal factor for Sumavision, impacting its operations and strategic decisions within the media and telecommunications sectors. These regulations can directly affect the feasibility of mergers, acquisitions, and partnerships, shaping the competitive landscape. For instance, increased scrutiny by regulators on major technology and media companies, as seen with ongoing investigations into big tech’s market dominance, highlights the potential for regulatory interventions that could influence Sumavision's strategic alliances or its ability to compete effectively.

The enforcement of these laws varies by jurisdiction, meaning Sumavision must navigate a complex web of regulations across its operating markets.

- Mergers & Acquisitions: Stringent anti-trust reviews can block or impose significant conditions on deals, impacting Sumavision's growth strategies.

- Market Dominance: Laws aim to prevent monopolistic practices, potentially limiting Sumavision's ability to leverage its market position.

- Partnerships: Collaboration agreements may face scrutiny to ensure they do not stifle competition.

- Regulatory Intervention: Sumavision must stay abreast of regulatory actions against industry peers to anticipate potential impacts on its own business.

International Trade Laws and Compliance

Sumavision's global operations hinge on strict adherence to international trade laws, including export controls and sanctions. Navigating these regulations is critical to avoid significant penalties and maintain access to key markets. For instance, as of early 2024, the increasing complexity of global trade regulations, particularly concerning dual-use technologies, demands robust compliance frameworks. Failing to comply can lead to substantial fines and reputational damage, impacting Sumavision's ability to conduct business internationally.

Geopolitical shifts frequently introduce new trade restrictions, compelling Sumavision to remain agile in its supply chain and market access strategies. The ongoing trade tensions and evolving regulatory landscapes in major economic blocs, such as the US and EU, necessitate continuous monitoring and adaptation. For example, changes in export licensing requirements for advanced electronics could directly affect Sumavision's ability to source components or sell its products in certain regions. The company must proactively adjust its operations to mitigate risks associated with these dynamic international trade policies.

- Compliance necessity: Sumavision must comply with international trade laws, export controls, and sanctions to operate globally.

- Impact of geopolitical shifts: Evolving geopolitical landscapes can impose new trade restrictions, forcing strategic adaptations.

- Risk of non-compliance: Penalties and loss of market access are direct consequences of failing to adhere to legal frameworks.

- 2024/2025 outlook: The increasing complexity of global trade regulations requires ongoing vigilance and adaptation in supply chain and market access strategies.

The legal framework surrounding intellectual property and anti-piracy is paramount for Sumavision, directly influencing the market for its conditional access systems and digital rights management solutions. Robust enforcement protects content monetization, thereby driving demand for Sumavision's security technologies. For instance, the ongoing global efforts to combat content piracy, which results in billions in lost revenue for the media industry annually, highlight the critical need for effective IP enforcement for companies like Sumavision.

Data privacy regulations, such as GDPR and CCPA, significantly shape how Sumavision handles user data for media consumption, with non-compliance leading to substantial legal penalties. As of 2023, global fines for data privacy violations reached billions, emphasizing the critical importance of adherence. Sumavision's software must be designed to meet these evolving standards, ensuring secure data practices and transparent user policies, with regulators intensifying enforcement in early 2024.

Broadcasting licensing and spectrum allocation are vital for Sumavision's clients operating digital TV services, with regulatory bodies like the FCC and Ofcom dictating broadcast rights and frequencies. The FCC's 2020 spectrum auctions alone generated over $81 billion, underscoring the value and scarcity of this resource. Changes in these regulations, such as spectrum refarming for 5G, can create opportunities or necessitate technological adaptations for Sumavision's clients.

Anti-trust and competition laws significantly impact Sumavision's strategic decisions within the media and telecommunications sectors, particularly concerning mergers, acquisitions, and partnerships. Increased regulatory scrutiny on dominant tech and media companies, as observed in ongoing market dominance investigations, indicates potential interventions that could affect Sumavision's strategic alliances and competitive positioning.

Environmental factors

The media and entertainment sector, a key area for Sumavision's operations, faces significant environmental scrutiny due to its high energy demands. Data centers and broadcasting infrastructure, essential for video processing and streaming, are major energy consumers.

As of 2023, global data center energy consumption was estimated to be around 1.5% of total global electricity usage, a figure projected to rise with increasing digital content. Sumavision's cloud-based video solutions, while offering flexibility, must prioritize energy efficiency to meet growing sustainability expectations from consumers and regulators.

The push for greener operations means that Sumavision's commitment to reducing its carbon footprint, particularly through optimized video encoding and efficient data center management, will be crucial for its long-term viability and market positioning in 2024 and beyond.

The creation and disposal of Sumavision's hardware, such as encoders and decoders, generate electronic waste (e-waste). This lifecycle impact is a significant environmental concern. Globally, e-waste is a growing problem, with projections indicating that by 2027, the volume of e-waste could reach 74 million metric tons annually, a substantial increase from previous years.

Sumavision can lessen its environmental footprint by making more sustainable hardware choices. This could involve using recycled materials in manufacturing or designing products for easier repair and upgrades. For instance, companies committed to circular economy principles often see reduced raw material costs and improved brand reputation.

Promoting responsible recycling and refurbishment programs is also crucial. By partnering with certified e-waste recyclers, Sumavision can ensure that its old hardware is processed safely and ethically. A report from 2024 highlighted that effective e-waste management not only prevents pollution but can also recover valuable materials like gold and copper, which have significant market value.

There's a strong push for sustainability across the media and entertainment sector. Consumers are demanding more eco-friendly options, and governments are implementing stricter environmental regulations. This means companies like Sumavision need to pay attention to their environmental impact.

Sumavision has a real opportunity here to stand out by embracing green technology. Think about using equipment that uses less energy or shifting more operations to cloud-based systems, which can be more efficient. For example, the global media and entertainment market's spending on green IT solutions is projected to reach significant figures by 2025, indicating a growing demand for such innovations.

Climate Change Impact on Infrastructure

Climate change poses a significant threat to Sumavision's operational backbone. Extreme weather events like hurricanes, floods, and severe heatwaves can directly impact the physical infrastructure crucial for video delivery. This includes broadcast towers, extensive cable networks, and energy-intensive data centers, all of which are vulnerable to damage or disruption.

The increasing frequency and intensity of these events, as highlighted by reports from agencies like the IPCC, necessitate a focus on infrastructure resilience. For instance, the US experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, causing widespread damage. Sumavision’s clients will likely prioritize solutions that bolster these systems against such environmental challenges, ensuring uninterrupted service delivery.

This translates into a market opportunity for Sumavision to offer advanced solutions. These could include:

- Enhanced data center cooling systems to combat rising temperatures.

- Hardened broadcast tower designs resistant to high winds and extreme conditions.

- Redundant network infrastructure and disaster recovery protocols.

- Investment in renewable energy sources to power operations and reduce reliance on vulnerable grids.

Regulatory Pressure for Environmental Reporting

Governments globally are tightening environmental regulations, with a significant focus on reducing carbon emissions. This trend is expected to extend to the media industry, potentially requiring companies like Sumavision to implement robust environmental reporting. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which fully applies from 2024 for large companies, mandates detailed reporting on environmental impacts, including Scope 1, 2, and 3 emissions.

Sumavision could face increased pressure to quantify and disclose its environmental footprint. This includes emissions generated from its operations, energy consumption in data centers, and potentially its supply chain. The company might need to invest in systems to track and report these metrics, aligning with global sustainability goals.

The push for environmental reporting encourages the adoption of more sustainable practices. This could involve Sumavision optimizing energy efficiency in its broadcast and streaming infrastructure, exploring renewable energy sources for its facilities, and working with suppliers committed to reducing their environmental impact.

Key areas of focus for environmental reporting and action might include:

- Energy Consumption: Monitoring and reducing electricity usage in studios, offices, and data centers.

- Carbon Emissions: Calculating and reporting direct (Scope 1) and indirect (Scope 2 and 3) emissions.

- Waste Management: Implementing strategies for reducing, reusing, and recycling electronic waste and operational waste.

- Supply Chain Sustainability: Assessing and encouraging environmental responsibility among key suppliers and partners.

Environmental factors significantly influence Sumavision's operations, particularly concerning energy consumption and electronic waste. The company's reliance on data centers and broadcasting infrastructure, which are energy-intensive, requires a focus on efficiency to meet sustainability demands. As digital content grows, so does the need for greener solutions.

The disposal of hardware like encoders and decoders contributes to the escalating global e-waste problem, projected to reach 74 million metric tons annually by 2027. Sumavision can mitigate this by adopting circular economy principles, using recycled materials, and designing for repairability, thereby reducing raw material costs and enhancing its brand image.

Climate change presents risks to Sumavision's physical infrastructure, with extreme weather events potentially disrupting services. Reports from 2023 indicate 28 billion-dollar weather disasters in the US alone. This underscores the need for resilient infrastructure, such as hardened broadcast towers and redundant networks, to ensure uninterrupted service delivery for clients.

Stricter environmental regulations, like the EU's CSRD fully applying from 2024, mandate detailed reporting on carbon emissions and environmental impact. Sumavision must invest in systems to track and disclose its footprint, encouraging more sustainable practices like energy optimization and the use of renewable energy sources.

PESTLE Analysis Data Sources

Our PESTLE analysis is built on a robust foundation of data from reputable sources including governmental economic reports, international regulatory bodies, and leading industry analysis firms. This ensures that every factor considered, from technological advancements to social trends, is grounded in accurate and current information.