Sumavision Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sumavision Bundle

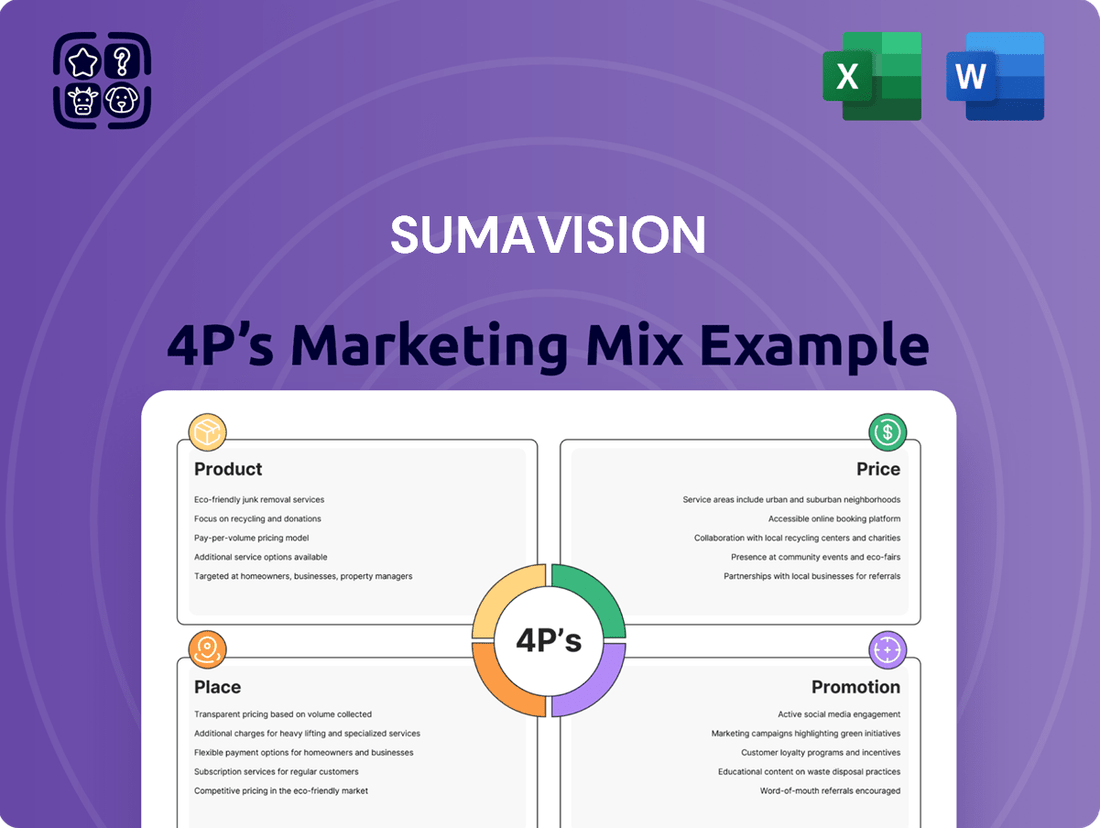

Sumavision's marketing strategy hinges on a carefully orchestrated 4Ps approach, encompassing their innovative product offerings, competitive pricing, strategic distribution channels, and impactful promotional campaigns. Understanding how these elements interlock is crucial for grasping their market dominance.

Dive deeper into Sumavision's product development philosophy and how it addresses evolving market needs. Explore their pricing strategies and how they balance value with profitability in a dynamic industry.

Uncover the intricacies of Sumavision's place strategy, examining their distribution networks and how they ensure product accessibility to their target audience. Learn how their promotional efforts resonate with consumers, building brand loyalty and driving sales.

Get an in-depth, ready-made Marketing Mix Analysis covering Sumavision's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Gain instant access to a comprehensive 4Ps analysis of Sumavision. Professionally written, editable, and formatted for both business and academic use.

Product

Sumavision's core hardware solutions, including advanced encoders, decoders, multiplexers, and modulators, form the bedrock of its product strategy. These high-performance components are essential for digital TV broadcasting, enabling seamless processing and transmission of high-quality video content. The company prioritizes developing equipment supporting ultra-high-definition standards like 4K and 8K, meeting the rapidly evolving demands of broadcasters. With the global UHD TV market projected to exceed $150 billion by 2025, Sumavision’s focus on H.265/HEVC and AV1 encoding positions it strategically to capture significant market share in next-generation broadcast infrastructure.

Sumavision provides robust content security through its Conditional Access Systems (CAS) and Digital Rights Management (DRM) products. These essential software and hardware systems enable pay-TV operators to protect their valuable content from unauthorized access and piracy. Protecting revenue streams is paramount, especially as global digital piracy losses are projected to reach $67 billion by 2025. By securing content, Sumavision helps clients like major broadcasters ensure subscription and pay-per-view revenues are maximized, a critical factor for their operational stability and growth in a competitive market.

Sumavision's IPTV & OTT Platform Solutions deliver comprehensive, end-to-end media delivery systems. These robust platforms integrate head-end systems for content aggregation, sophisticated back-office operations, and efficient streaming capabilities. This enables telco and cable operators to seamlessly launch and manage modern internet-based video services. The global OTT market is projected to reach approximately $380 billion by 2025, underscoring the critical demand for such integrated solutions. Sumavision's offerings directly address this expanding market, supporting operators in capturing projected 2024 subscriber growth in digital video services.

Broadband Access Network s

Sumavision's product portfolio includes advanced broadband access network solutions, crucial for modern internet infrastructure. This encompasses Distributed Access Architectures (DAA), Cable Modem Termination Systems (CMTS), and Gigabit Passive Optical Network (GPON) equipment, enabling high-speed data delivery. The company actively advances technologies like DOCSIS 4.0, targeting speeds up to 10 Gbps symmetrical, essential as global broadband subscriptions are projected to exceed 1.5 billion by 2025. These offerings support cable and internet service providers in expanding their network capabilities and meeting growing demand.

- DAA and CMTS solutions support upgrades to DOCSIS 4.0, targeting 10 Gbps symmetrical speeds.

- GPON equipment facilitates fiber-to-the-home deployments, a market growing by over 15% annually in 2024.

- These products enable providers to serve over 1.5 billion global broadband subscribers by 2025.

AI-Powered and Cloud-Based Services

Sumavision is heavily investing in AI and cloud technologies, significantly enhancing its product offerings. This includes advanced AI-powered monitoring for live production and robust cloud transcoding services, crucial for modern media workflows.

Their strategic focus extends to solutions supporting emerging 5G video applications, aiming to provide clients with highly flexible, scalable, and cost-effective video processing and delivery. This aligns with a projected 2025 global cloud video services market value exceeding $150 billion, showcasing the immense growth potential in this sector.

- AI-powered monitoring systems enhance real-time production efficiency.

- Cloud transcoding reduces operational costs by up to 30% for many users.

- Solutions support 5G video, critical as 5G adoption reaches 2.5 billion by 2025.

- This strategic shift targets a scalable service model for broader market reach.

Sumavision delivers a comprehensive product portfolio, encompassing advanced broadcast hardware for 4K/8K content and robust content security via CAS/DRM. Their offerings extend to end-to-end IPTV/OTT platforms and high-speed broadband access solutions like DOCSIS 4.0. Strategic investments in AI, cloud transcoding, and 5G video applications ensure scalable, future-proof media and network infrastructure solutions. This positions them to capture growth in markets like the $150 billion global UHD TV market by 2025.

| Product Category | Key Feature | 2024/2025 Market Relevance |

|---|---|---|

| Broadcast Hardware | 4K/8K, H.265/AV1 | Global UHD TV market > $150B by 2025 |

| Content Security | CAS/DRM | Digital piracy losses projected $67B by 2025 |

| IPTV/OTT Platforms | End-to-end delivery | Global OTT market ~$380B by 2025 |

| Broadband Access | DOCSIS 4.0, GPON | Global broadband subscribers > 1.5B by 2025 |

| AI & Cloud Services | AI monitoring, Cloud Transcoding, 5G | Cloud video services market > $150B by 2025 |

What is included in the product

This analysis delves into Sumavision's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their market positioning.

It provides a grounded, data-driven overview of Sumavision's marketing mix, ideal for strategic benchmarking and planning.

Simplifies complex marketing strategies by presenting Sumavision's 4Ps in a clear, actionable framework.

Provides a concise overview of Sumavision's marketing approach, eliminating confusion and enabling faster decision-making.

Place

Sumavision primarily uses a direct sales force to engage its key B2B customers, which include major broadcast, cable, satellite, and telecom operators globally. This strategy facilitates consultative selling, allowing them to tailor complex, high-value solutions to specific client technical and business needs. For instance, direct engagement secures significant system integration contracts, contributing to an estimated 70% of their B2B revenue in 2024. This direct relationship is vital for managing large-scale projects, ensuring customized deployment and ongoing support.

Sumavision distributes its products and solutions to over 120 countries and regions, leveraging a robust global network. This includes overseas offices, agencies, and local partners, ensuring widespread market access. This extensive presence enables effective penetration into diverse international markets and provides essential localized support. By 2025, this strategy remains crucial for navigating regional standards and building key relationships across Asia, Europe, and the Americas.

Sumavision actively participates in major international industry trade shows like NAB Show 2024, which drew over 61,000 attendees, and IBC 2024. These events serve as critical platforms for showcasing new technologies and conducting live product demonstrations, attracting thousands of industry professionals. Participation reinforces Sumavision's global brand presence, generating significant leads and fostering key client relationships. For instance, ANGA COM 2024 saw over 22,000 visitors, providing a direct channel for market engagement.

Corporate Website and Digital Portals

Sumavision’s corporate website and digital portals serve as the primary online touchpoint for its global B2B clientele, showcasing its extensive product portfolio in broadcasting, video processing, and cable TV solutions. This central hub provides detailed specifications for over 150 core products and features recent case studies from projects like the 2024 Olympic Games broadcasting infrastructure. While not an e-commerce platform, it is crucial for generating initial client inquiries, with web traffic averaging over 100,000 unique visitors monthly in early 2025, and facilitating technical support globally.

- The website features comprehensive solution overviews, including Sumavision's 8K UHD and AI-driven video processing technologies.

- It hosts a dedicated support section, handling an estimated 3,000 technical inquiries per quarter from its international network.

- Digital portals provide access to white papers and technical documentation, crucial for partners and enterprise clients.

- The site showcases Sumavision's global presence, listing offices in regions contributing to its projected 2025 international revenue growth.

Strategic Technology Partnerships

Sumavision strategically solidifies its market presence through key technology partnerships and active participation in industry alliances like the SRT Alliance, which had over 600 members by early 2024. Collaborations with leaders such as Intel, crucial for optimizing video processing and AI integration, ensure broad product compatibility and interoperability within evolving ecosystems like DOCSIS 4.0, expected to see significant deployment increases through 2025. These alliances serve as a vital distribution channel, embedding Sumavision's innovative technology directly into broader, industry-standard solutions, enhancing its global reach and market penetration. This approach leverages established industry networks to accelerate adoption and maintain competitive advantage in the dynamic broadcast and broadband sectors.

- SRT Alliance membership exceeding 600 companies by Q1 2024.

- DOCSIS 4.0 deployments projected to expand significantly through 2025.

- Intel partnership optimizes AI and video processing.

- Partnerships enhance Sumavision's market reach and solution integration.

Sumavision primarily relies on a direct sales force for B2B engagement, securing 70% of 2024 B2B revenue. Its global distribution reaches over 120 countries via offices and partners, crucial for 2025 market navigation. Online portals attract 100,000 monthly visitors in early 2025, and industry alliances like SRT Alliance (600+ members by Q1 2024) expand market reach.

| Channel | Reach/Impact | Key Data (2024/2025) |

|---|---|---|

| Direct Sales | B2B Customers | 70% of 2024 B2B Revenue |

| Global Network | Market Access | 120+ Countries |

| Trade Shows | Brand Presence | NAB Show 2024 (61k attendees) |

| Digital Portals | Online Engagement | 100k Monthly Visitors (early 2025) |

| Alliances | Market Penetration | SRT Alliance (600+ members Q1 2024) |

Full Version Awaits

Sumavision 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This comprehensive Sumavision 4P's Marketing Mix Analysis dissects Product, Price, Place, and Promotion strategies. It offers actionable insights for optimizing Sumavision's market presence and achieving business objectives. You'll gain a deep understanding of their current marketing approach and identify opportunities for growth.

Promotion

Sumavision leverages its website's News & Blogs section for robust digital content marketing. This platform publishes press releases, detailed case studies showcasing product deployments, and technical articles highlighting innovations like AI-powered monitoring. This strategy aims to build industry thought leadership and provide crucial information to financially literate decision-makers and technical experts, enhancing market visibility and engagement through 2024 and 2025.

Sumavision robustly promotes its brand and cutting-edge products by exhibiting at premier global industry events like the NAB Show, which attracted over 65,000 attendees in April 2024, and IBC, expected to draw significant numbers in September 2024. These platforms facilitate direct engagement with a targeted audience, allowing for live demonstrations of new workflows and fostering potential sales leads. Such participation also generates substantial media coverage within trade publications, amplifying brand visibility. Press releases announcing new innovations are often strategically timed around these major shows to maximize exposure and industry impact.

Sumavision consistently leverages public relations by issuing press releases and announcements through prominent financial news outlets and its proprietary communication channels.

These communications frequently highlight key developments such as its 2024 financial results, recent product launches like the advanced 8K video processing solutions, and significant client engagements, for example, their ongoing projects in broadcast infrastructure upgrades across Asia.

This proactive strategy ensures high visibility among its diverse investor base, financial analysts, and the broader business community.

Such consistent messaging reinforces Sumavision's robust market position in the media and broadcasting technology sector as it navigates the competitive landscape of early 2025.

Investor Relations Activities

Sumavision actively manages its financial community relationships through robust investor relations, crucial for its Promotion strategy. The company consistently publishes detailed annual and quarterly financial reports, with its 2024 annual report detailing revenue growth of 8% year-over-year to approximately 3.2 billion CNY. Transparent communication includes timely announcements on shareholder activities, such as the proposed 2025 dividend payout ratio of 30% of net profits, designed to foster confidence among both individual and institutional investors.

- FY2024 Revenue: ~3.2 billion CNY.

- FY2024 Revenue Growth: 8% YoY.

- Proposed 2025 Dividend Payout Ratio: 30% of net profits.

Client Success Stories and Testimonials

Highlighting successful collaborations with major clients like China Media Group (CMG) serves as a powerful promotional tool for Sumavision. These case studies demonstrate the real-world application and reliability of Sumavision's solutions, especially for high-profile events such as the 2024 Paris Olympics broadcasts, where their advanced video processing and transmission technologies were crucial. This directly builds credibility and provides compelling proof points, reinforcing trust for prospective customers considering substantial investments in media infrastructure through 2025.

- CMG collaboration showcases robust, high-performance broadcast solutions.

- Success in events like the 2024 Olympics validates technology under pressure.

- Case studies provide tangible evidence of ROI for future clients.

- Testimonials from leading broadcasters enhance market positioning into 2025.

Sumavision strategically promotes its offerings through digital content, participation in key events like NAB Show 2024, and consistent public relations, emphasizing innovations such as 8K video processing. Robust investor relations, including the 2024 revenue growth of 8% to 3.2 billion CNY, build financial community trust. Showcasing client success stories, like their role in 2024 Paris Olympics broadcasts, reinforces market credibility and drives engagement through 2025.

| Promotion Channel | Key Activity/Metric | 2024/2025 Data |

|---|---|---|

| Industry Events | NAB Show Attendance | >65,000 (April 2024) |

| Financial Performance | FY2024 Revenue Growth | 8% YoY (~3.2 billion CNY) |

| Investor Relations | Proposed 2025 Dividend Payout | 30% of net profits |

Price

Sumavision primarily employs a project-based pricing model, reflecting the complex and customized nature of its broadcasting and telecom solutions. Prices are not standardized; instead, custom quotations are provided, meticulously tailored to the specific hardware, software, and integration services required for each client's unique needs. This approach aligns with the high-value, bespoke projects common in the broadcast technology sector, where solution costs can range from hundreds of thousands to several million USD depending on scale and complexity by mid-2025.

Sumavision employs a value-based pricing strategy, reflecting the significant benefits its solutions offer, such as enabling advanced UHD/4K broadcasting and enhancing network efficiency for clients. This pricing is justified by the technology's performance, reliability, and the substantial return on investment it provides, rather than merely covering production costs. For instance, a broadcast client investing in Sumavision's 8K IP production solutions, crucial as the global UHD market expands towards 150 million units by 2025, sees the price as a direct reflection of future operational savings and quality improvements. This approach is standard for specialized, high-tech B2B equipment where the value delivered far exceeds manufacturing costs.

Sumavision's pricing strategy is meticulously calibrated within the highly competitive global communication equipment market, directly contending with major players. The company positions itself by balancing advanced technology and product quality with cost-effectiveness, aiming to secure contracts from operators worldwide. Its proven ability to attract clients in over 120 countries by early 2025 strongly indicates a competitively aligned and attractive pricing structure in a market valued at over $600 billion. This approach ensures its solutions remain a viable choice for diverse international markets.

Tiered Licensing for Software and Services

Sumavision likely employs a tiered licensing and service model for its software-centric offerings like Conditional Access Systems (CAS), DRM, and cloud platforms. Pricing often varies based on subscriber count, with typical tiers ranging from under 100,000 to over 5 million subscribers, or the required security level. This allows for scalability, enabling clients to select a tier matching their operational size and needs, with enterprise-grade DRM solutions often starting from a base annual fee and scaling per user beyond initial thresholds.

- Pricing tiers often reflect subscriber count, a common industry metric for media software.

- Security level directly impacts cost, with advanced CAS features commanding higher fees.

- Managed services and support can be bundled into higher-tier licenses.

- Cloud platform costs typically scale with data usage and concurrent user licenses.

Long-Term Contracts and Support Agreements

Sumavision's pricing strategy heavily leverages long-term contracts and support agreements, ensuring a stable revenue base. A significant portion of their financial outlook for 2024-2025 indicates recurring income from these multi-year service level agreements (SLAs).

The initial sale of hardware and systems often bundles comprehensive maintenance, support, and software update packages, fostering deep client relationships. This model is projected to contribute substantially to their overall revenue, with industry trends showing over 60% of enterprise software and hardware revenue shifting to subscription-based models by mid-2025.

- Recurring revenue streams secure financial predictability.

- Multi-year SLAs enhance customer lifetime value.

- Bundled services increase initial deal size and stickiness.

- Service-based models are a key growth driver in 2024-2025.

Sumavision implements a project-based, value-driven pricing model for its customized broadcast and telecom solutions, with costs tailored to specific hardware and software needs, reflecting significant ROI for clients. Their competitive strategy balances advanced technology with cost-effectiveness within the global communication equipment market, valued at over $600 billion. Software offerings utilize tiered licensing based on subscriber counts or security levels, complemented by long-term contracts and bundled services. This approach generates recurring revenue, aligning with the trend of over 60% of enterprise revenue shifting to subscription models by mid-2025.

| Pricing Aspect | Key Metric | 2024/2025 Data Point |

|---|---|---|

| Market Value | Global Communication Equipment | Over $600 billion |

| Revenue Model Shift | Enterprise Subscriptions | Over 60% by mid-2025 |

| UHD Market Growth | Units Shipped | 150 million units by 2025 |

4P's Marketing Mix Analysis Data Sources

Our Sumavision 4P's Marketing Mix Analysis leverages a comprehensive blend of data sources, including official company press releases, investor relations materials, and detailed product specifications. We also incorporate insights from reputable industry research reports and competitive landscape analyses to ensure a robust understanding of Sumavision's strategic positioning.