Swiss Prime Site PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swiss Prime Site Bundle

Unlock the strategic advantages shaping Swiss Prime Site's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, societal trends, technological advancements, environmental regulations, and legal frameworks are all impacting this leading real estate company. Gain the foresight needed to navigate market complexities and identify emerging opportunities. Download the full analysis now to empower your strategic decision-making.

Political factors

Switzerland consistently ranks as one of the most politically stable countries globally, offering a highly predictable environment crucial for real estate investment. This stability, a hallmark of Swiss governance, directly benefits companies like Swiss Prime Site by minimizing uncertainties associated with policy shifts.

The nation's enduring commitment to a consistent regulatory framework, with minimal political upheaval, significantly reduces investment risk. This predictability allows Swiss Prime Site to engage in long-term strategic planning for its portfolio of high-quality commercial properties, fostering a secure operational landscape.

This political bedrock underpins strong investor confidence in the Swiss real estate market. For Swiss Prime Site, this translates into a more favorable capital environment, enabling sustained growth and development in a market characterized by its reliability and low risk profile.

Switzerland's stringent urban planning and zoning regulations, which differ across cantons and municipalities, present a significant hurdle for new development projects and dictate land availability. These rules often favor increasing density within existing urban centers, potentially limiting new construction in desirable areas but simultaneously bolstering the value of properties already in place. For instance, Basel-Stadt implemented a new cantonal building and zoning ordinance in 2022, emphasizing sustainable development and densification, which requires careful adaptation by developers like Swiss Prime Site.

Navigating this intricate web of local planning policies is crucial for Swiss Prime Site to successfully obtain permits for its development endeavors and to strategically manage its property portfolio. The company's ability to adapt to these evolving regulations, which can include height restrictions, green space requirements, and historical preservation mandates, directly impacts its capacity for growth and portfolio optimization. In 2024, the ongoing debate around housing shortages in major Swiss cities continues to shape zoning discussions, potentially leading to further densification mandates.

The Lex Koller law in Switzerland places specific limitations on foreign acquisition of residential and non-commercial real estate, but generally permits foreign ownership of commercial properties. This is a key consideration for Swiss Prime Site, as its portfolio largely comprises commercial assets, but international collaboration or divestment of mixed-use properties would still necessitate navigating these regulations.

While commercial real estate remains largely open to foreign investors under Lex Koller, potential changes to the law are frequently debated. For instance, discussions around tightening these regulations or introducing new categories of restricted properties could emerge, impacting future foreign investment appetite in sectors like logistics or office spaces that Swiss Prime Site targets.

Understanding the current framework and potential future shifts in foreign investment regulations is vital for Swiss Prime Site's strategic planning, particularly when evaluating international joint ventures or asset sales. The Swiss Federal Council periodically reviews Lex Koller, with the last significant assessment concluding in 2022, indicating a continuous governmental focus on its impact.

Healthcare Policy and Regulations

Government policies and regulations in the healthcare and assisted living sectors are a crucial factor for Swiss Prime Site, particularly through its subsidiary Tertianum. Shifts in how elder care is funded, evolving standards for assisted living, and new licensing rules can directly affect Tertianum's operating expenses and overall profitability. For instance, a 2023 report indicated that government subsidies for long-term care in Switzerland varied significantly by canton, impacting the revenue models for providers. Staying informed about these policy changes is vital for ensuring Tertianum's continued growth and long-term viability in the market.

Key policy areas to monitor include:

- Reimbursement rates for long-term care services: Changes here directly affect revenue streams.

- Quality and safety standards for assisted living facilities: Compliance can necessitate capital investments or operational adjustments.

- Licensing requirements for healthcare providers: Any new or revised regulations can impact market entry and operations.

- Government initiatives promoting aging-in-place technologies: These could create new opportunities or require adaptation of existing services.

ESG and Sustainability Policies

The Swiss government's escalating emphasis on ESG principles, including ambitious climate targets, is a significant political factor shaping the real estate sector. The upcoming Climate and Innovation Act, effective January 2025, directly influences how companies like Swiss Prime Site approach development and property management.

Swiss Prime Site is compelled to integrate national net-zero emission targets for 2050 into its operational strategy, alongside other stringent sustainability reporting mandates. This necessitates substantial investments in energy-efficient building technologies and environmentally conscious development methodologies to satisfy both legal requirements and growing stakeholder demand for sustainable practices.

- Climate and Innovation Act: Enters into force January 2025, setting new benchmarks for environmental performance.

- Net-Zero Target: Switzerland aims for net-zero emissions by 2050, requiring industry-wide adaptation.

- Sustainability Reporting: Increasing regulatory pressure for transparent reporting on ESG metrics.

- Investment in Efficiency: Companies must allocate capital towards energy-efficient retrofits and new sustainable constructions.

Switzerland's political stability is a cornerstone for Swiss Prime Site, offering a low-risk environment for its real estate investments. This consistent governance, with minimal policy volatility, allows for long-term strategic planning and fosters strong investor confidence, facilitating access to capital.

Complex and localized urban planning regulations, varying by canton and municipality, present challenges for new developments but can enhance the value of existing properties. Adapting to these rules, such as height restrictions or green space mandates, is crucial for project approvals and portfolio optimization, with densification policies being a key discussion point in 2024.

The Lex Koller law, while generally permitting foreign investment in commercial real estate, carries potential for regulatory shifts that could impact future foreign participation. Continuous monitoring of these regulations is essential for strategic decisions involving international partnerships or asset disposals.

Government policies significantly influence the healthcare and assisted living sectors, affecting Tertianum's operations through changes in reimbursement, standards, and licensing. Variations in cantonal subsidies for long-term care, as noted in 2023, highlight the need for ongoing awareness of policy developments.

The government's increasing focus on ESG, particularly the Climate and Innovation Act effective January 2025, mandates that Swiss Prime Site integrate net-zero targets by 2050 into its strategy. This requires significant investment in sustainable building technologies and reporting to meet legal and stakeholder expectations.

What is included in the product

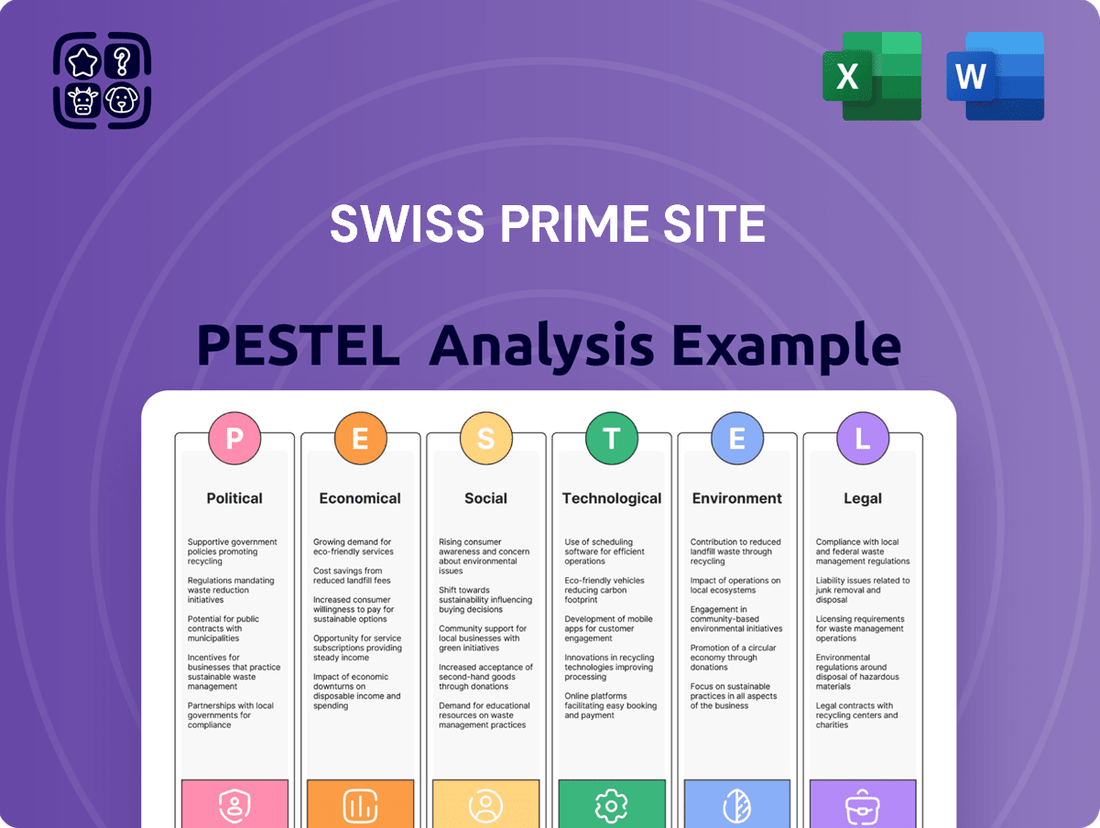

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Swiss Prime Site, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It identifies key trends and potential challenges, offering actionable insights for strategic decision-making and risk management within the Swiss real estate market.

A clear, actionable summary of Swiss Prime Site's PESTLE factors, transforming complex external analysis into easily digestible insights for strategic decision-making.

Economic factors

The interest rate environment is a critical factor for Swiss Prime Site, directly impacting financing costs for property acquisitions and development. The Swiss National Bank's (SNB) monetary policy, particularly its decisions on key interest rates, plays a pivotal role in shaping this landscape. For instance, the SNB's decision in March 2024 to cut its policy rate by 0.25% to 1.25% signaled a shift towards a more accommodative stance, making borrowing cheaper. This move by the SNB has the potential to decrease financing expenses for Swiss Prime Site’s development projects and acquisitions, thereby supporting profitability.

Lower interest rates generally enhance the attractiveness of real estate as an investment class compared to fixed-income securities, potentially boosting demand for Swiss Prime Site's properties and investment funds. As of early 2025, the ongoing trend of potentially stable or slightly decreasing interest rates, following the initial 2024 cuts, continues to support a favorable financing environment. This can translate into improved investor sentiment towards real estate portfolios, as the yield differential between property investments and lower-risk alternatives remains attractive.

Switzerland's economic growth has remained remarkably stable, with its Gross Domestic Product (GDP) consistently hovering around 1% in recent years, including figures for 2023 and projections for 2024. This steady expansion is a key factor supporting sustained demand for both commercial and residential real estate across the country.

A robust economy directly correlates with higher employment rates and a greater propensity for businesses to expand. This, in turn, drives demand for office spaces, retail locations, and other commercial properties, benefiting real estate portfolios.

For Swiss Prime Site, this positive macroeconomic environment is fundamental. It underpins the company's rental income streams and contributes significantly to the overall performance and valuation of its diverse real estate holdings.

The Swiss Federal Statistical Office reported a GDP growth of 0.7% in 2023, with forecasts for 2024 anticipating a similar rate of around 1.1%. This consistent, albeit moderate, growth provides a reliable foundation for the real estate market.

While Switzerland's overall inflation remained subdued in early 2024, the rental market experienced notable upswings. Asking rents, especially for residential properties, saw a significant surge, driven by persistent high demand and a constrained supply. This trend is a direct positive for Swiss Prime Site, bolstering its rental income streams.

The imbalance between available rental units and tenant interest, particularly in major Swiss cities, is a key factor expected to sustain upward pressure on rental prices throughout 2024 and into 2025. This dynamic bodes well for property portfolios like Swiss Prime Site's, as it translates into higher occupancy rates and increased rental yields.

Real Estate Market Supply and Demand

The Swiss real estate market consistently faces a significant imbalance between high demand and constrained supply, particularly in sought-after residential and prime commercial segments. This dynamic is further intensified by stringent zoning regulations and a generally slower pace of new construction compared to other European markets. As of early 2024, vacancy rates in prime office locations across major Swiss cities like Zurich and Geneva remained exceptionally low, often below 2%, pushing rental yields upwards.

This scarcity directly benefits entities like Swiss Prime Site, which strategically invests in high-quality, well-located properties. The company's portfolio, predominantly situated in central business districts, is well-positioned to capitalize on the persistent demand. For instance, in 2023, Swiss Prime Site reported a robust rental income growth, reflecting the pricing power derived from this supply-demand gap.

- Limited New Supply: Strict land-use regulations and lengthy approval processes in Switzerland contribute to a naturally restricted supply of new real estate developments.

- High Demand: A strong economy, high quality of life, and a stable political environment attract both domestic and international demand for Swiss property.

- Rental Price Growth: The imbalance fuels consistent upward pressure on rental prices, particularly in prime urban centers, benefiting property owners.

- Swiss Prime Site's Advantage: The company's focus on prime locations and high-quality assets allows it to benefit from this market condition, maintaining high occupancy rates and strong rental income.

Investor Confidence and Capital Flows

Investor confidence in the Swiss real estate market remains robust, buoyed by the relative underperformance of alternative asset classes. This has translated into a heightened attractiveness of the risk premium offered by Swiss property, drawing significant capital. Swiss Prime Site has successfully leveraged this sentiment, securing substantial new funding for its acquisition and development pipeline.

The strong appetite from investors directly bolsters Swiss Prime Site's asset management capabilities and reinforces its financial stability. This positive capital flow is crucial for sustaining the company's growth trajectory and ability to pursue strategic opportunities.

- Increased Investor Interest: Lower returns from alternative assets have made Swiss real estate, particularly prime properties, a more appealing investment.

- Capital Raising Success: Swiss Prime Site has demonstrated its ability to attract significant capital, evidenced by its successful fundraising efforts for new projects and acquisitions.

- Support for Asset Management: Strong investor demand underpins the company's asset management activities, allowing for effective portfolio growth and value enhancement.

- Financial Strength: The influx of capital contributes to Swiss Prime Site's overall financial resilience and its capacity to navigate market dynamics.

The Swiss economy demonstrated resilience through 2023 and into early 2024, with GDP growth projected around 1% for both years. This stability supports consistent demand for real estate. Furthermore, inflation remained relatively contained, although rental prices, particularly for residential properties, saw significant increases due to high demand and limited supply.

The Swiss National Bank's (SNB) monetary policy, including its March 2024 rate cut to 1.25%, has eased financing costs. This environment, coupled with strong investor confidence in Swiss property, has enabled companies like Swiss Prime Site to secure capital for development and acquisitions, reinforcing their financial stability.

The persistent imbalance between high demand and restricted new supply in the Swiss real estate market, especially in prime urban areas, continues to drive rental price growth. Low vacancy rates, often below 2% in key office locations as of early 2024, underscore this trend, directly benefiting property owners with strong rental income streams.

| Economic Factor | 2023 Data/Trend | 2024 Projection/Trend | Impact on Swiss Prime Site |

|---|---|---|---|

| GDP Growth | 0.7% | ~1.1% | Sustains demand for commercial and residential properties. |

| Inflation | Subdued | Expected to remain moderate | Supports stable operating costs, though rental price adjustments are key. |

| Interest Rates (SNB Policy Rate) | 1.75% (end of 2023) | Cut to 1.25% (March 2024) | Reduces financing costs for development and acquisitions; enhances property attractiveness. |

| Rental Market Dynamics | High demand, low supply, significant rent increases | Continued upward pressure on rents | Boosts rental income and occupancy rates for prime assets. |

| Investor Sentiment | Robust, capital inflow into real estate | Continued strong investor appetite | Facilitates capital raising for growth and reinforces financial stability. |

What You See Is What You Get

Swiss Prime Site PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Swiss Prime Site delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the strategic landscape and potential challenges and opportunities for Swiss Prime Site.

Sociological factors

Switzerland's demographic landscape is evolving, marked by an aging populace and a steady migration towards urban areas. This dual trend fuels a robust demand for varied residential solutions, from accessible, senior-friendly living spaces to compact urban dwellings. The Swiss population aged 65 and over is projected to reach 2.4 million by 2030, a significant increase from approximately 1.7 million in 2020.

Swiss Prime Site, through its subsidiary Tertianum, is strategically positioned to capitalize on the growing need for assisted living facilities, directly serving the expanding elderly demographic. Simultaneously, its portfolio of commercial properties in prime urban locations aligns with the requirements of an increasingly concentrated urban workforce, reflecting the ongoing urbanization trend.

The shift towards hybrid work is fundamentally altering the demand for office spaces. Tenants are increasingly seeking flexibility and high-quality environments, prioritizing prime locations that facilitate collaboration. This trend means that while overall office footprints might shrink, the demand for desirable, well-appointed spaces in central business districts is likely to remain strong.

Swiss Prime Site is well-positioned to capitalize on this by focusing on prime urban locations and developing modern, adaptable office solutions. Their commitment to creating smart, amenity-rich environments caters directly to the evolving needs of businesses that value both employee well-being and operational efficiency. For example, their portfolio often includes properties with excellent public transport links, a key consideration for hybrid workforces.

Data from 2024 indicates a continued preference for hybrid models, with many companies maintaining policies that allow employees to work from home for a portion of the week. This sustained trend underscores the need for office spaces that are not just places to work, but hubs for collaboration and connection. Swiss Prime Site's investment in high-quality, centrally located properties aligns with this demand, ensuring their assets remain attractive to a discerning tenant base.

There's a clear societal shift towards wanting places that are good for us and the planet. This means people are actively seeking out homes and offices that are designed with sustainability and well-being in mind.

This preference directly impacts what tenants and buyers look for, driving up demand for buildings that boast green certifications and excellent energy efficiency. For instance, a 2024 survey indicated that over 70% of commercial property tenants consider sustainability a key factor in their leasing decisions.

Swiss Prime Site's proactive approach, evident in their significant investments in sustainable development and their pursuit of green building certifications like Minergie, directly addresses this growing demand. This strategic alignment not only meets current expectations but also bolsters the long-term appeal and intrinsic value of their property portfolio.

Lifestyle Changes and Retail Evolution

Consumer lifestyles are rapidly evolving, with a growing preference for convenience and digital interaction. This shift is directly impacting the retail sector, as seen in the continued expansion of e-commerce. In 2024, global e-commerce sales are projected to reach over $7 trillion, a significant increase from previous years. Consequently, demand for traditional brick-and-mortar retail spaces is being re-evaluated.

Swiss Prime Site's retail portfolio needs to adapt by embracing experiential retail concepts and mixed-use developments. This approach caters to consumers seeking more than just transactions, offering entertainment, dining, and social engagement. For instance, a focus on anchor tenants that provide unique experiences, like flagship stores or immersive leisure facilities, can drive foot traffic.

Strategic adjustments to tenant mix and property redesign are crucial for maintaining competitiveness. By incorporating a blend of retail, residential, and office spaces, properties can become vibrant hubs that reflect modern living patterns. This diversification not only spreads risk but also enhances the overall appeal and utility of the assets.

- E-commerce Growth: Global e-commerce sales are expected to exceed $7 trillion in 2024.

- Experiential Retail: Consumers increasingly seek engaging in-store experiences over simple transactions.

- Mixed-Use Development: Combining retail with residential and office spaces creates more resilient and attractive urban environments.

- Tenant Mix Adaptation: Retail properties are shifting towards a curated selection of tenants that offer unique value propositions.

Healthcare Needs and Assisted Living Demand

Switzerland's aging population is a key sociological driver, directly impacting healthcare needs and the demand for assisted living. With life expectancy consistently ranking among the highest globally, Switzerland is experiencing a significant increase in its elderly demographic, creating a robust and sustained need for specialized care and residential solutions. This trend is projected to continue, with the proportion of individuals aged 65 and over expected to rise further in the coming years.

Swiss Prime Site's strategic investment in Tertianum, a leading provider of senior living and care services, positions the company advantageously to capitalize on this demographic shift. Tertianum offers a comprehensive range of services, from independent living to intensive nursing care, catering to diverse senior needs. For instance, in 2023, Tertianum operated numerous residential and care facilities across Switzerland, demonstrating its extensive reach and capacity to serve this growing market segment.

- Rising Life Expectancy: Switzerland's life expectancy at birth reached approximately 83.8 years in 2023, contributing to a larger elderly population.

- Growing Elderly Population: The percentage of the Swiss population aged 65 and over is steadily increasing, projected to represent a substantial portion of the total population by 2030.

- Demand for Specialized Care: This demographic trend fuels a growing demand for high-quality assisted living, nursing care, and specialized healthcare services for seniors.

- Tertianum's Strategic Position: Swiss Prime Site's subsidiary, Tertianum, is well-equipped to meet this demand, operating a network of facilities offering a spectrum of senior care options.

Societal values are increasingly emphasizing health and well-being, influencing consumer preferences for both living and working environments. This translates into a higher demand for spaces that promote healthy lifestyles and offer amenities supporting physical and mental wellness.

This trend is reflected in the growing popularity of properties featuring green spaces, fitness facilities, and access to natural light. In 2024, reports indicate that buildings with enhanced wellness features can command rental premiums of up to 10% compared to standard properties.

Swiss Prime Site's focus on developing high-quality, well-located properties with a strong emphasis on tenant amenities and sustainable design directly aligns with these evolving societal expectations. Their investments in modern office environments that include elements like ample natural light and communal green areas cater to this growing demand for healthier and more engaging spaces.

The increasing importance of ESG (Environmental, Social, and Governance) factors in investment decisions and consumer choices is a significant sociological trend. Stakeholders, including investors and tenants, are prioritizing companies and properties that demonstrate strong social responsibility and environmental stewardship.

Swiss Prime Site's commitment to sustainability, evidenced by its significant investments in energy-efficient building technologies and its pursuit of certifications like Minergie, positions it favorably within this evolving landscape. By adhering to stringent ESG criteria, the company not only meets current market demands but also enhances its long-term value proposition and attractiveness to a socially conscious audience.

Technological factors

Proptech is rapidly transforming real estate, with digital solutions boosting efficiency and innovation. Think smarter property management, streamlined online transactions, and data-driven market analysis. For instance, the global proptech market was valued at approximately $26.7 billion in 2023 and is projected to reach $90.6 billion by 2030, showing a significant growth trajectory.

Swiss Prime Site can harness these advancements to optimize its operations, improve the experience for its tenants, and solidify its market position. By integrating advanced digital tools, the company can achieve greater operational agility and offer more tailored services, thereby gaining a competitive advantage in the evolving real estate landscape.

The integration of smart building technologies, like IoT devices and advanced sensors, is becoming increasingly vital for Swiss Prime Site. These systems are key to optimizing energy usage, a critical factor in reducing operational costs and boosting sustainability. For instance, smart lighting and HVAC controls can significantly cut down electricity consumption, contributing to lower utility bills and a smaller environmental footprint.

These technologies directly enhance a building's performance and occupant experience. Automation systems can manage everything from security access to environmental controls, ensuring comfort and safety for tenants. This focus on modern, efficient, and responsible property management aligns with current market demands and regulatory trends, positioning Swiss Prime Site favorably.

The market for smart building technology is experiencing robust growth. Globally, the smart buildings market was valued at an estimated $80.2 billion in 2023 and is projected to reach $230.5 billion by 2030, growing at a CAGR of 16.3%. This trend underscores the strategic importance of adopting and expanding these capabilities within Swiss Prime Site's portfolio to maintain competitiveness and tenant appeal.

Swiss Prime Site leverages advanced data analytics to gain critical market insights, a key technological factor. By utilizing big data, the company can better understand evolving market trends, refine property valuations, and pinpoint specific tenant preferences. This capability is crucial for making smarter investment decisions and optimizing their diverse real estate portfolio.

The application of predictive analytics offers Swiss Prime Site a significant advantage in anticipating future market shifts and proactively mitigating potential risks. For instance, analyzing historical rental data and economic indicators allows for more accurate forecasting of occupancy rates and rental income, a vital aspect of their 2024 strategy. This data-driven approach enhances strategic planning and portfolio management.

Virtual and Augmented Reality in Real Estate

Virtual and Augmented Reality (VR/AR) are revolutionizing real estate marketing, allowing for immersive virtual property tours and enhanced viewing experiences. Swiss Prime Site can leverage these technologies to showcase its commercial and residential portfolios more effectively. This can attract a wider audience of potential tenants and buyers, streamlining the sales and leasing processes.

By integrating VR/AR, Swiss Prime Site can offer prospective clients the ability to explore properties remotely with a high degree of realism. This technology has seen significant growth, with the global VR in real estate market projected to reach $1.6 billion by 2026, indicating a strong adoption trend. For instance, a recent report highlighted that 70% of buyers are more likely to purchase a property they viewed virtually. This presents a clear opportunity for Swiss Prime Site to differentiate its offerings.

- Enhanced Property Showcasing: VR/AR allows for detailed, 360-degree virtual tours, providing an in-depth look at spaces without physical presence.

- Broader Market Reach: These technologies transcend geographical limitations, enabling international investors and potential tenants to experience properties.

- Improved Sales Efficiency: Virtual viewings can pre-qualify leads, saving time for both the client and Swiss Prime Site’s sales teams.

- Increased Engagement: Interactive AR features, such as visualizing furniture placement or structural changes, can boost client interest and decision-making.

Automation in Property Management

Automation is revolutionizing property management, offering substantial gains in efficiency and cost reduction. For Swiss Prime Site, this translates into optimizing the performance of their extensive real estate holdings.

Automated systems for climate control, advanced security features, and proactive maintenance scheduling are key technological advancements. These not only streamline operations but also enhance the living and working environments for tenants. For instance, smart building technology can reduce energy consumption by up to 20% by intelligently managing HVAC and lighting systems, a significant saving that directly impacts operational costs.

Swiss Prime Site can leverage these technologies to boost their portfolio's attractiveness and tenant satisfaction. Consider the integration of AI-powered analytics for predictive maintenance; this could prevent costly breakdowns and minimize tenant disruption. A study by Deloitte in 2024 indicated that companies adopting comprehensive smart building solutions saw an average of a 15% increase in operational efficiency.

- Improved Efficiency: Automation streamlines routine tasks, freeing up human resources for more strategic activities.

- Cost Reduction: Optimized energy usage and predictive maintenance directly lower operating expenses.

- Enhanced Tenant Experience: Smart systems contribute to greater comfort, security, and responsiveness.

- Data-Driven Decisions: Automation provides valuable data for performance analysis and future investment planning.

Technological advancements are reshaping the real estate sector, with proptech solutions driving efficiency and innovation. Swiss Prime Site can leverage these digital tools for smarter property management, streamlined transactions, and data-driven insights to optimize operations and enhance tenant experiences.

The adoption of smart building technologies, including IoT and advanced sensors, is crucial for optimizing energy usage and reducing operational costs. Technologies like smart lighting and HVAC controls can significantly cut electricity consumption, contributing to sustainability goals and lower utility expenses.

Virtual and Augmented Reality (VR/AR) offer immersive property tours, broadening market reach and improving sales efficiency. Swiss Prime Site can utilize VR/AR to showcase its portfolio effectively, attracting a wider range of potential tenants and buyers by offering realistic remote viewing experiences.

| Technology Area | Market Value (2023) | Projected Market Value (2030) | Compound Annual Growth Rate (CAGR) |

|---|---|---|---|

| Proptech | $26.7 billion | $90.6 billion | 18.2% |

| Smart Buildings | $80.2 billion | $230.5 billion | 16.3% |

| VR in Real Estate | N/A (Market growing) | $1.6 billion (by 2026) | N/A |

Legal factors

Swiss real estate operates under a robust legal framework, primarily guided by federal statutes such as the Swiss Civil Code and the Swiss Code of Obligations. These laws dictate crucial aspects of property, including ownership rights, the processes for transferring titles, and the intricacies of lease agreements. For Swiss Prime Site, adherence to these fundamental legal principles is paramount across all facets of its operations, from acquiring new properties and undertaking development projects to managing its existing portfolio.

Beyond these overarching federal laws, specific regulations are in place that differentiate between commercial and residential properties. Swiss Prime Site must navigate these distinctions carefully, ensuring compliance with rules tailored to business premises and those governing residential units. This nuanced legal landscape underscores the importance of diligent legal oversight in the company's real estate endeavors.

Switzerland enforces rigorous building codes and construction regulations covering safety, accessibility, and energy efficiency for all development projects. These stringent requirements necessitate meticulous planning and execution by companies like Swiss Prime Site.

Recent reforms in Swiss construction law, particularly those enhancing buyer protection against defects, directly influence developer liabilities and project cost structures. For instance, the updated construction contract law, which came into effect in 2020, introduced stricter rules for defect identification and rectification, potentially increasing compliance costs for developers.

Adherence to these evolving legal frameworks is paramount for Swiss Prime Site to ensure project viability and mitigate legal risks. Non-compliance can lead to significant fines, project delays, and reputational damage.

The upcoming Climate and Innovation Act, effective January 2025, will impose stricter emissions reduction targets on the building sector, a key area for Swiss Prime Site. This legislation also mandates enhanced non-financial reporting, pushing companies to disclose their environmental, social, and governance (ESG) performance more transparently. For instance, the Swiss Federal Council aims for a 50% reduction in greenhouse gas emissions by 2030 compared to 1990 levels, with buildings playing a crucial role.

As a public interest entity, Swiss Prime Site faces mandatory compliance with these evolving ESG disclosure requirements. This means integrating sustainable practices across its operations, from construction and property management to investment strategies, to meet growing investor and regulatory expectations for environmental stewardship.

Tenant Rights and Lease Agreements

Swiss law offers robust protections for tenants, significantly shaping the terms and conditions of lease agreements. These regulations dictate aspects like permissible rent increases, security deposit requirements, and the landlord's obligations for property maintenance and repairs. For a company like Swiss Prime Site, a prominent property owner, adherence to these legal frameworks is paramount. This includes ensuring all lease contracts are compliant and that property management practices align with tenant rights as defined by federal and cantonal legislation, as well as evolving case law.

Understanding specific tenant rights is crucial for Swiss Prime Site's operations. For instance, rental laws often stipulate procedures for rent adjustments, typically linked to official indices or a reference rate, and specify notice periods for contract terminations. Landlords are generally obligated to maintain properties in a habitable condition, addressing issues like structural integrity and essential services. Failure to comply can lead to legal disputes and financial penalties, underscoring the importance of meticulous contract drafting and diligent property upkeep.

- Tenant Protections: Swiss law, particularly the Code of Obligations, safeguards tenants against arbitrary rent hikes and unfair evictions.

- Lease Agreement Compliance: Swiss Prime Site must ensure its standard lease agreements reflect current legal requirements regarding duration, termination clauses, and tenant responsibilities.

- Maintenance Obligations: Landlords are legally bound to perform necessary repairs and ensure the property is fit for habitation, impacting operational costs and tenant satisfaction.

- Rent Control Mechanisms: While not strict rent control, Swiss law implements mechanisms to moderate rent increases, often referencing the Swiss National Bank's policy rate or consumer price index, which influences Swiss Prime Site's revenue projections.

Competition Law and Mergers & Acquisitions

Competition law plays a crucial role in shaping strategic moves for companies like Swiss Prime Site. The Swiss Competition Commission (ComCo) actively scrutinizes mergers and acquisitions (M&A) when specific financial thresholds are surpassed. This oversight is particularly pertinent for Swiss Prime Site, as demonstrated by its acquisition of Fundamenta, which would have been subject to ComCo's review if it met the notification requirements.

While Switzerland does not have a broad foreign direct investment (FDI) law, it's important to note that sector-specific regulations can still influence a company's expansion or divestment plans. These regulations, though not a general FDI framework, can impose conditions or require approvals that impact international transactions, potentially affecting Swiss Prime Site's long-term growth strategies or the disposal of assets.

- ComCo Thresholds: In 2024, ComCo's turnover thresholds for merger control typically involve combined worldwide turnover exceeding CHF 300 million and Swiss turnover exceeding CHF 100 million for at least two of the involved undertakings.

- Fundamenta Acquisition: Swiss Prime Site's acquisition of Fundamenta, completed in 2023, was a significant transaction that likely underwent ComCo review based on its size and market impact.

- Sector-Specific Regulations: For example, while not directly impacting real estate broadly, specific property types or development projects might fall under particular planning or environmental regulations that could influence M&A activities.

- Impact on Strategy: Understanding and adhering to these competition and sector-specific legal frameworks is vital for Swiss Prime Site to execute its acquisition and divestment strategies effectively and without regulatory hurdles.

Swiss Prime Site must navigate a complex web of legal requirements governing property ownership, leasing, and development. Adherence to federal laws like the Swiss Civil Code and Code of Obligations is fundamental, dictating everything from title transfers to lease agreements. The company also faces distinct regulations for commercial versus residential properties, demanding careful compliance to avoid penalties.

Recent legal shifts, such as the 2020 construction law reforms enhancing buyer protection, directly impact developer liabilities and project costs for Swiss Prime Site. Furthermore, the upcoming Climate and Innovation Act from January 2025 will impose stricter emissions targets on the building sector, mandating enhanced ESG reporting and influencing operational strategies.

Tenant protections are a significant legal factor, with laws dictating rent increases, security deposits, and maintenance obligations. Swiss Prime Site must ensure all lease agreements comply with these tenant rights, as failure to do so can result in legal disputes and financial repercussions.

Competition law, enforced by the Swiss Competition Commission (ComCo), scrutinizes mergers and acquisitions above certain financial thresholds. For instance, ComCo's 2024 turnover thresholds for merger control typically involve combined worldwide turnover exceeding CHF 300 million and Swiss turnover exceeding CHF 100 million for at least two involved undertakings. Swiss Prime Site's 2023 acquisition of Fundamenta likely underwent such review, highlighting the importance of legal compliance in strategic transactions.

Environmental factors

Switzerland's commitment to achieving net-zero emissions by 2050, with specific interim targets for the building sector, directly influences Swiss Prime Site's operations. The Climate and Innovation Act, enacted to drive these reductions, imposes mandates on emissions and encourages sustainable growth, requiring substantial capital allocation towards energy-efficient upgrades and eco-friendly construction methods throughout their extensive property holdings.

For instance, the Swiss Federal Office of Energy reported that the building sector accounted for approximately 24% of total final energy consumption in 2023, highlighting the critical role of real estate companies like Swiss Prime Site in meeting national climate goals. This regulatory environment compels Swiss Prime Site to integrate advanced green building technologies and retrofitting strategies, impacting both operational costs and long-term asset value.

Switzerland is actively pursuing ambitious climate targets, leading to increasingly stringent energy efficiency standards for buildings. For instance, the Energy Act and the associated Ordinance on Energy Efficiency (EnV) set clear benchmarks for new constructions and major renovations, impacting everything from insulation levels to heating and cooling systems. This regulatory push is a significant environmental factor influencing the real estate sector.

Swiss Prime Site, as a major owner of commercial and residential properties, must navigate these evolving regulations. Meeting these standards often necessitates investments in retrofitting older buildings, which can be a substantial cost. However, compliance also presents opportunities, as energy-efficient buildings are more attractive to tenants and buyers, potentially increasing property values and reducing operational expenses in the long run.

By 2025, Switzerland aims to further reduce its CO2 emissions, which will likely translate into even tighter energy efficiency requirements. For example, the Swiss Federal Office of Energy is continuously evaluating and updating guidelines related to building materials and energy consumption. Swiss Prime Site's proactive approach to sustainability and energy management, as demonstrated by its ongoing modernization projects, positions it to adapt to these environmental pressures and capitalize on the demand for greener real estate.

The market increasingly favors properties with green building certifications like Minergie and LEED, with demand for sustainable spaces on the rise. Swiss Prime Site's dedication to sustainable development, evidenced by its pursuit of these certifications, positions it well to capture this demand. For instance, buildings achieving higher sustainability ratings often command premium rents and experience lower tenant turnover, enhancing long-term asset value. This strategic alignment with environmental responsibility is becoming a key differentiator in the real estate sector.

Resource Scarcity and Waste Management

Concerns surrounding resource scarcity, particularly for materials like concrete and steel, coupled with the significant environmental impact of construction and demolition waste, are increasingly pushing the real estate sector towards embracing circular economy principles. Swiss Prime Site is therefore compelled to integrate sustainable construction materials and optimize resource utilization across its portfolio. For instance, the European Commission's Circular Economy Action Plan aims to reduce construction and demolition waste by 30% by 2030, a target that directly influences Swiss Prime Site's operational strategies.

Implementing efficient waste management practices, from segregation at source to exploring recycling and reuse opportunities, is crucial for Swiss Prime Site. This approach not only minimizes its environmental footprint but also offers tangible benefits through reduced disposal costs and potential revenue from salvaged materials. In 2023, the global construction industry generated an estimated 2.3 billion tonnes of waste, highlighting the urgency for companies like Swiss Prime Site to innovate in this area.

- Focus on circular building materials: Prioritizing recycled content and materials designed for disassembly and reuse.

- Optimize resource efficiency: Minimizing material consumption through precise planning and advanced construction techniques.

- Enhance waste management: Implementing robust systems for waste segregation, recycling, and exploring upcycling opportunities.

- Lifecycle assessment: Evaluating the environmental impact of materials and processes from cradle to grave.

Biodiversity and Green Spaces

The growing emphasis on preserving biodiversity and integrating green spaces into urban development is a significant environmental factor. Urban planning regulations increasingly mandate ecological compensation measures and the development of green infrastructure. For instance, in 2024, Swiss cities are intensifying efforts to meet biodiversity targets, with many development projects needing to demonstrate a net gain for local ecosystems.

Swiss Prime Site can leverage this trend to enhance the attractiveness and value of its properties. By incorporating features like green roofs, vertical gardens, and accessible public green areas, the company can contribute positively to urban biodiversity and enhance the well-being of occupants and surrounding communities. This approach aligns with the evolving expectations for sustainable and livable urban environments.

- Growing Regulatory Focus: Urban planning in Switzerland is increasingly incorporating biodiversity protection and green space mandates, influencing development requirements.

- Property Value Enhancement: Integrating green elements like green roofs and vertical gardens can boost the aesthetic appeal and perceived value of Swiss Prime Site's real estate portfolio.

- Contribution to Urban Ecology: By creating green spaces, Swiss Prime Site actively contributes to local biodiversity and improves the environmental quality of urban areas.

- Tenant and Community Appeal: Properties with integrated green infrastructure are often more attractive to tenants seeking sustainable and pleasant working or living environments.

Switzerland's commitment to net-zero by 2050, with the building sector playing a crucial role, means Swiss Prime Site must invest heavily in energy efficiency and eco-friendly construction. The Climate and Innovation Act drives these changes, impacting how properties are managed and developed. The building sector's significant energy consumption, around 24% in 2023, underscores the responsibility of major real estate players like Swiss Prime Site in meeting national climate goals.

Stricter energy efficiency standards, driven by the Energy Act and its ordinances, are a key environmental factor. These regulations affect new builds and renovations, pushing for better insulation and systems. Swiss Prime Site faces costs for retrofitting older buildings but also gains opportunities through increased property value and reduced operational expenses for compliant, energy-efficient properties.

By 2025, expect even tighter energy efficiency requirements as Switzerland works to cut CO2 emissions. The Swiss Federal Office of Energy continually updates building material and energy consumption guidelines. Swiss Prime Site’s focus on sustainability and modernization positions it to adapt and benefit from the demand for greener real estate, as evidenced by its ongoing projects and pursuit of certifications like Minergie.

The market increasingly favors green certifications like Minergie and LEED, boosting demand for sustainable spaces. Swiss Prime Site's commitment to these certifications helps it capture this demand, as higher sustainability ratings often lead to premium rents and lower tenant turnover, enhancing long-term asset value.

Resource scarcity and construction waste are pushing circular economy principles in real estate. Swiss Prime Site must integrate sustainable materials and optimize resource use, influenced by targets like the EU's goal to reduce construction waste by 30% by 2030. Efficient waste management, including recycling, is vital, especially considering the global construction industry generated approximately 2.3 billion tonnes of waste in 2023.

Urban planning increasingly mandates biodiversity protection and green spaces. In 2024, Swiss cities are focusing on biodiversity targets, requiring development projects to show a net gain for local ecosystems. Swiss Prime Site can enhance property value and appeal by incorporating green roofs, vertical gardens, and accessible green areas, contributing to urban biodiversity and occupant well-being.

| Environmental Factor | Impact on Swiss Prime Site | Key Data/Trend |

| Climate Change & Net-Zero Targets | Increased investment in energy efficiency and sustainable construction methods required. | Switzerland aims for net-zero by 2050; building sector targeted for emission reductions. |

| Energy Efficiency Regulations | Compliance necessitates retrofitting older buildings and adopting advanced building technologies. | Swiss building sector accounted for 24% of final energy consumption in 2023. |

| Circular Economy & Waste Management | Emphasis on sustainable materials, resource optimization, and waste reduction in construction. | Global construction waste reached 2.3 billion tonnes in 2023; EU aims for 30% reduction by 2030. |

| Biodiversity & Green Spaces | Opportunity to enhance property value and appeal by integrating green infrastructure. | Swiss cities increasingly mandate biodiversity net gain in new developments (2024 focus). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Swiss Prime Site is grounded in data from official Swiss government statistics, reputable economic forecasting bodies, and leading real estate market research reports. We ensure comprehensive coverage by incorporating insights from environmental agencies and relevant legislative updates.