Swiss Prime Site Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swiss Prime Site Bundle

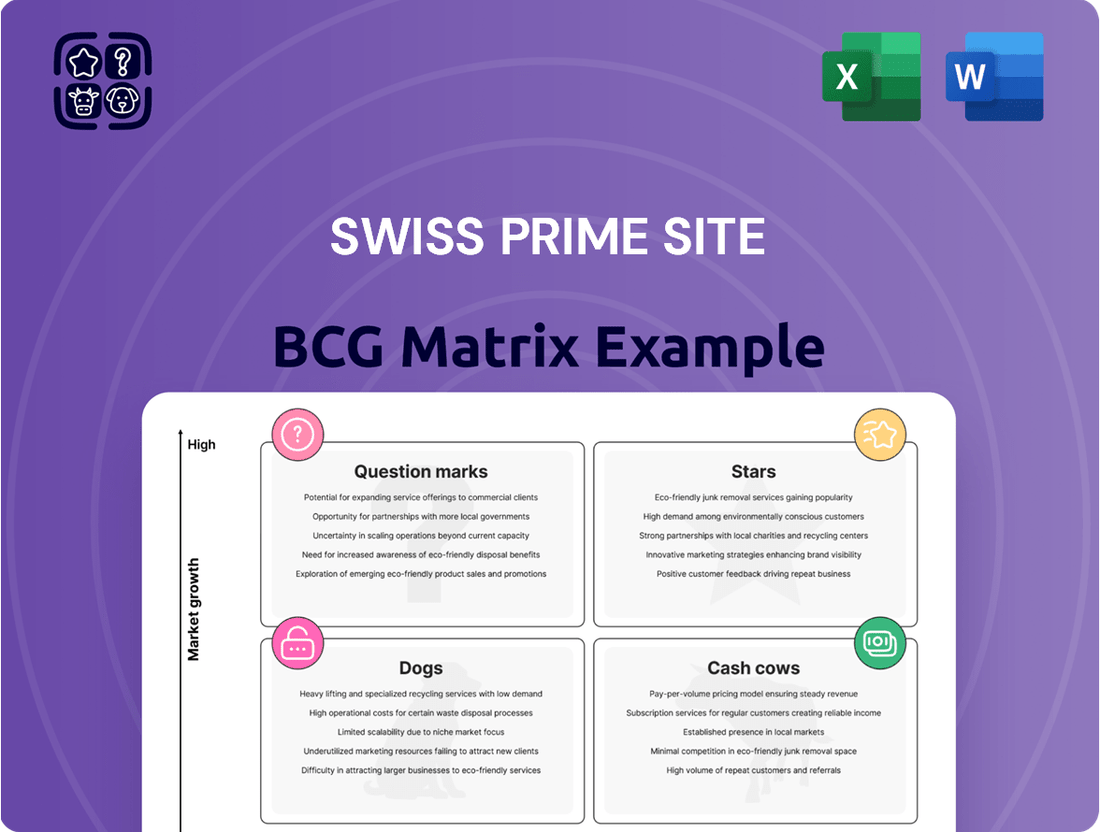

Curious about Swiss Prime Site's strategic positioning? This glimpse into their BCG Matrix highlights key areas of focus, but to truly grasp their market dynamics, you need the full picture. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed investment decisions.

Dive deeper into Swiss Prime Site's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Swiss Prime Site's prime commercial properties, particularly office and retail spaces situated in Switzerland's most vibrant economic hubs such as Zurich, Geneva, and Basel, are considered Stars in the BCG matrix. These strategically located assets benefit from robust demand, fueled by a thriving economy and a constant influx of skilled professionals, which translates into substantial rental income growth for the company.

The company's financial performance underscores this strength. In the 2024 financial year, Swiss Prime Site achieved a record CHF 464 million in rental income, marking a significant 6% increase. This impressive growth is primarily attributed to the successful leasing of new developments and the implementation of higher rental rates for renewed leases within these highly sought-after prime locations.

New, centrally located, and sustainable development projects are a major Star for Swiss Prime Site. These initiatives are a key focus for the company, tapping into the increasing market demand for eco-friendly real estate and promising strong value creation. For example, the Stücki Park in Basel, finished in 2024, was built to meet current sustainability standards, showcasing their dedication and potential for substantial returns in this expanding market.

Life Sciences Real Estate is a Stars segment for Swiss Prime Site, characterized by significant investment in specialized infrastructure. The expansion at Stücki Park in Basel, increasing rental floor space for life sciences from 33,000 m2 to over 60,000 m2, exemplifies this strategic focus. This niche market is experiencing robust demand, positioning Swiss Prime Site as a leader in providing essential facilities for a high-growth industry.

Asset Management Segment (Swiss Prime Site Solutions)

The Asset Management Segment, operating as Swiss Prime Site Solutions, has emerged as a significant growth driver for Swiss Prime Site, solidifying its position as the largest independent real estate asset manager in Switzerland. This expansion was notably bolstered by the acquisition of Fundamenta Group in April 2024.

The segment's assets under management saw a substantial surge, reaching CHF 13.3 billion by the close of 2024. Looking ahead, the company anticipates this figure to climb to CHF 14 billion by the end of 2025, underscoring its high growth trajectory.

- High Growth Potential: Driven by robust investor interest and successful capital raises, Swiss Prime Site Solutions exhibits strong market momentum.

- Significant AUM Increase: Assets under management grew to CHF 13.3 billion by the end of 2024.

- Future Projections: Expected to reach CHF 14 billion in assets under management by the end of 2025.

- Earnings Contribution: This segment directly contributes to the company's overall earnings, reflecting its Star status.

High-Quality Office Buildings with Sustainability Standards

High-quality office buildings with sustainability standards are a key Star for Swiss Prime Site. The company's acquisition pipeline is focused on yielding, centrally located office properties in major Swiss cities that meet the highest quality and sustainability benchmarks.

This strategic focus is backed by significant financial commitment. Swiss Prime Site successfully raised CHF 300 million, specifically earmarked for acquiring these premium assets. These investments are projected to deliver over CHF 17 million in annual rental income, underscoring their profitability and appeal.

- Focus on Premium, Sustainable Office Spaces: Swiss Prime Site targets properties in high-demand urban centers.

- Financial Strength for Growth: CHF 300 million raised to fund strategic acquisitions.

- Projected Rental Income: Expected to generate over CHF 17 million annually.

- Market Leadership Position: Commitment to sustainability and quality drives continued growth.

Swiss Prime Site's prime commercial properties, particularly office and retail spaces situated in Switzerland's most vibrant economic hubs, are considered Stars. These strategically located assets benefit from robust demand, fueling substantial rental income growth. The company's financial performance underscores this strength, with a 6% increase in rental income to CHF 464 million in 2024, driven by successful leasing of new developments and higher rental rates.

New, centrally located, and sustainable development projects, such as the Stücki Park in Basel completed in 2024, represent major Stars. These initiatives tap into market demand for eco-friendly real estate, promising strong value creation. The Life Sciences Real Estate segment is also a Star, with significant investment in specialized infrastructure, like the expansion at Stücki Park increasing rental floor space for life sciences from 33,000 m2 to over 60,000 m2, positioning Swiss Prime Site as a leader in this high-growth industry.

The Asset Management Segment, Swiss Prime Site Solutions, has emerged as a significant growth driver, solidifying its position as the largest independent real estate asset manager in Switzerland. The acquisition of Fundamenta Group in April 2024 boosted its assets under management to CHF 13.3 billion by the close of 2024, with projections to reach CHF 14 billion by the end of 2025.

| Star Segment | Key Characteristics | 2024 Performance/Data | Future Outlook |

|---|---|---|---|

| Prime Commercial Properties | Prime locations (Zurich, Geneva, Basel), robust demand | Record CHF 464 million rental income (+6%) | Continued rental growth |

| New Sustainable Developments | Centrally located, eco-friendly, value creation focus | Stücki Park Basel completion (2024) | Strong returns from expanding market |

| Life Sciences Real Estate | Specialized infrastructure, high demand niche | Stücki Park expansion (33,000 m2 to >60,000 m2) | Leadership in high-growth industry |

| Asset Management (Solutions) | Largest independent Swiss asset manager | CHF 13.3 billion AUM (end 2024) | Projected CHF 14 billion AUM (end 2025) |

| Premium Sustainable Offices | High-quality, centrally located, sustainability benchmarks | CHF 300 million raised for acquisitions | Projected >CHF 17 million annual rental income |

What is included in the product

Highlights which Swiss Prime Site units to invest in, hold, or divest based on market growth and share.

The Swiss Prime Site BCG Matrix provides a clear, one-page overview of each business unit's position, alleviating the pain of deciphering complex portfolios.

Cash Cows

Mature, fully leased commercial properties represent the robust cash cows within Swiss Prime Site's portfolio. These are prime assets, typically in established, stable locations across Switzerland, that consistently command high occupancy rates. For example, as of the first half of 2024, Swiss Prime Site reported an occupancy rate of 96.1% across its entire portfolio, with its mature properties being the bedrock of this stability.

These properties, often benefiting from long-term leases with creditworthy tenants, require minimal marketing expenditure. Their established market position and strong tenant relationships mean they generate predictable, reliable rental income without the need for significant promotional investment. This consistent cash flow is crucial for funding other strategic initiatives.

The stable returns from these cash cows provide the financial fuel to reinvest in or acquire properties with higher growth potential, such as development projects or properties in emerging urban centers. This strategic allocation of capital ensures the overall portfolio remains dynamic and positioned for future appreciation, a key element of Swiss Prime Site's long-term strategy.

Core retail properties with long-term tenants are prime examples of cash cows within the Swiss Prime Site portfolio. These assets, often situated in prime urban centers with consistent customer traffic, benefit from the stability provided by established businesses occupying the spaces under extended lease agreements.

Despite broader retail sector challenges, these properties exhibit remarkable resilience, consistently generating substantial and predictable cash flows. This stability is a direct result of their high market share within their respective sub-markets and their mature, low-growth nature, aligning perfectly with the definition of a cash cow.

For instance, Swiss Prime Site's portfolio often includes high-street retail locations with anchor tenants that have been in place for decades, demonstrating a strong track record of profitability. As of early 2024, such properties continue to be the bedrock of rental income, contributing significantly to the company's overall financial health.

Properties categorized under infrastructure, such as specialized logistics hubs or commercial spaces with long-term, stable contracts, function as Cash Cows for Swiss Prime Site.

These assets thrive in mature, essential service sectors where the company possesses a dominant market position. This dominance translates into reliable and consistent revenue streams, a hallmark of Cash Cow businesses.

For instance, Swiss Prime Site's significant presence in the logistics sector, characterized by high occupancy rates and long-term leases, exemplifies this Cash Cow status. As of the first half of 2024, the company reported stable rental income from its diversified portfolio, underscoring the resilience of these infrastructure-related properties.

Tertianum's Established Assisted Living Facilities

Tertianum's established assisted living facilities are firmly positioned as Cash Cows within the Swiss Prime Site BCG Matrix. These well-established residential and care centers consistently generate significant revenue due to a steady demand from Switzerland's aging demographic, ensuring high occupancy rates. For instance, as of 2024, Tertianum operates over 100 locations across Switzerland, catering to a substantial number of residents, which contributes to its reliable cash flow.

The mature nature of these facilities means they require minimal new investment to maintain their market share, allowing them to distribute substantial profits. This consistent performance makes them the bedrock of Swiss Prime Site's portfolio, enabling the company to fund growth in other areas. The healthcare and assisted living sector in Switzerland saw continued growth in 2024, with Tertianum benefiting from its strong brand recognition and operational efficiency.

- Market Dominance: Tertianum holds a significant share in the Swiss assisted living market, benefiting from its established network and reputation.

- Consistent Cash Flow: High occupancy rates and predictable demand from an aging population ensure a steady and reliable income stream.

- Low Investment Needs: Mature facilities require less capital expenditure, leading to higher profit margins and cash generation.

- Strategic Importance: These cash cows provide the financial stability needed to support investments in emerging or high-growth areas within Swiss Prime Site's portfolio.

Properties with Streamlined Operations and High Efficiency

Properties within the Swiss Prime Site portfolio that have successfully implemented streamlined operations and efficiency improvements are categorized as Cash Cows. These assets are characterized by their stable, predictable cash flows and high profitability due to optimized management and reduced operational expenditures.

Swiss Prime Site's strategic focus on portfolio streamlining has yielded significant results. The company successfully reduced vacancy rates to a record low of 3.8% in 2024, a key indicator of asset desirability and operational efficiency. This focus on reducing vacancies and meticulously optimizing property costs directly translates into enhanced profit margins and robust cash flow generation from these mature, well-performing assets.

- Streamlined Operations: Properties benefiting from optimized management and reduced operational costs.

- High Efficiency: Assets demonstrating consistent performance and strong rental income.

- Record Low Vacancy: A 3.8% vacancy rate in 2024 highlights the attractiveness and efficiency of the portfolio.

- Increased Profit Margins: Direct consequence of cost optimization and high occupancy.

Mature, fully leased commercial properties are the bedrock of Swiss Prime Site's Cash Cow strategy. These assets, often in prime Swiss locations, consistently deliver predictable rental income with high occupancy rates. For instance, Swiss Prime Site reported an impressive 96.1% portfolio occupancy in H1 2024, with these mature properties being the primary drivers of this stability.

These properties benefit from long-term leases with creditworthy tenants, minimizing the need for extensive marketing or management intervention. Their established market presence and tenant relationships ensure a steady cash flow, vital for funding growth initiatives elsewhere in the portfolio. This reliable income stream is essential for maintaining financial health and strategic flexibility.

The consistent returns from these Cash Cows allow Swiss Prime Site to strategically invest in properties with higher growth potential or to develop new projects. This balanced approach ensures the company's portfolio remains dynamic, with mature assets providing stability while newer ventures drive future appreciation. This is a key element of their long-term value creation strategy.

| Asset Type | Key Characteristics | Financial Contribution |

| Mature Commercial Properties | Prime locations, high occupancy, long-term leases | Consistent, predictable rental income |

| Core Retail Locations | High-street presence, anchor tenants, stable demand | Substantial and reliable cash flows |

| Infrastructure Assets | Logistics hubs, specialized spaces, stable contracts | Dominant market position, consistent revenue |

| Assisted Living Facilities (Tertianum) | Established network, high occupancy, aging demographic demand | Significant, steady revenue stream |

What You See Is What You Get

Swiss Prime Site BCG Matrix

The Swiss Prime Site BCG Matrix preview you're examining is the identical, fully editable document you will receive upon purchase. This means no hidden watermarks or incomplete sections—just a professionally formatted, analysis-ready report designed to empower your strategic decision-making. You can confidently use this preview as a direct representation of the high-quality, comprehensive BCG Matrix you'll immediately download and integrate into your business planning. It's crafted to provide clear insights into Swiss Prime Site's portfolio, enabling you to pinpoint growth opportunities and manage potential challenges effectively.

Dogs

Underperforming legacy properties in declining areas represent the Dogs in Swiss Prime Site's portfolio. These are typically older buildings in peripheral urban locations or regions with shrinking economies and reduced demand for commercial real estate, such as certain parts of the canton of Jura or less dynamic neighborhoods within larger cities.

These assets likely hold a small market share within their respective submarkets and face dim growth prospects due to the prevailing economic conditions. Their value is often stagnant or declining, and they may demand significant capital for upkeep without generating substantial returns.

For instance, if a property in a formerly industrial zone that has seen little new investment were to be analyzed, its low rental yields and high vacancy rates would point to its Dog status. Such properties contribute minimally to overall portfolio growth.

Swiss Prime Site’s strategic approach involves identifying and divesting these underperforming assets to streamline the portfolio and reallocate capital to more promising opportunities, a move consistent with optimizing returns on investment.

Retail spaces struggling to adapt to evolving consumer habits and situated outside prime locations are increasingly vulnerable to e-commerce competition. These properties, characterized by low market share and shrinking rental income or rising vacancies, are likely candidates for the Dogs quadrant within the Swiss Prime Site BCG Matrix. For instance, in 2024, a significant portion of traditional retail malls reported occupancy rates below 80%, a direct consequence of online shopping's dominance.

Properties consistently exhibiting high vacancy rates and minimal revaluation potential, even when the broader market improves, fall into the Dogs category within a strategic portfolio analysis, such as the BCG Matrix. These assets represent a drain on capital, failing to generate adequate returns. For instance, during 2024, some commercial real estate segments saw a modest recovery, yet specific properties in this quadrant continued to struggle, with vacancy rates remaining stubbornly above 20% in certain submarkets, according to industry reports.

These underperforming assets consume resources—maintenance, taxes, and administrative costs—without contributing meaningfully to profitability. Their lack of appreciation potential signifies a lost opportunity for capital growth. Divestment becomes a strategic imperative to reallocate capital towards more promising investments, thereby optimizing the overall portfolio and enhancing financial performance.

Non-Core Divested Properties

Non-core divested properties represent assets that Swiss Prime Site is strategically moving away from, often because they don't fit the company's long-term vision of prime, sustainable real estate. This divestment strategy helps sharpen the company's focus on its most valuable and strategically important holdings.

In 2024, Swiss Prime Site demonstrated this commitment by selling 23 properties. These divested assets had a combined fair value of CHF 345 million. This significant transaction highlights a proactive approach to portfolio management, ensuring resources are concentrated on core business objectives.

The divestment of these properties is a key indicator of how Swiss Prime Site is repositioning its portfolio. By shedding non-core assets, the company can unlock capital and streamline operations, allowing for greater investment in and development of its prime property portfolio.

- Divestment Activity: Sale of 23 properties in 2024.

- Fair Value of Divested Assets: CHF 345 million.

- Strategic Rationale: Focus on prime, centrally located, and sustainable properties.

- Portfolio Optimization: Enhancing focus on core, high-value assets.

Properties Requiring Extensive, Unprofitable Renovations

Older properties needing significant, unprofitable renovations fall into the "Dogs" category within Swiss Prime Site's portfolio. These assets demand substantial capital investment to meet contemporary standards or attract tenants, yet the projected returns simply don't justify the expenditure. For instance, a property built in the late 20th century might require a complete overhaul of its HVAC systems, insulation, and digital infrastructure. Such upgrades could easily run into millions of Swiss Francs, with the potential rental income not covering these costs within a reasonable timeframe.

These "Dogs" represent a drain on resources, tying up capital without a clear path to profitability. Swiss Prime Site's strategy emphasizes efficient capital recycling, meaning these underperforming assets are prime candidates for divestment or strategic repositioning. By identifying and addressing these properties, the company aims to free up capital for more lucrative opportunities. In 2023, Swiss Prime Site reported a portfolio value exceeding CHF 11 billion, highlighting the scale of their holdings and the importance of such strategic portfolio management.

Consider the following characteristics of these "Dog" properties:

- High Capital Expenditure Needs: Significant investment required for modernization, structural repairs, or energy efficiency upgrades.

- Low Future Profitability Potential: Projected rental income or sale value does not justify the renovation costs.

- Suboptimal Location or Design: Properties may be in less desirable areas or have layouts that are difficult to adapt to current market demands.

- Negative Impact on Portfolio Returns: These assets can drag down overall portfolio yield and return on equity.

Properties classified as Dogs within Swiss Prime Site's portfolio are those with low market share and minimal growth prospects, often requiring substantial investment without commensurate returns. These can include retail spaces struggling against e-commerce, as seen with many malls reporting occupancy below 80% in 2024, or older buildings in less dynamic urban areas. Such assets often have high vacancy rates, remaining stubbornly above 20% in certain submarkets even during market recoveries in 2024, and represent a drag on capital and overall portfolio performance.

Swiss Prime Site actively manages these Dogs through divestment, as evidenced by the sale of 23 properties in 2024, valued at CHF 345 million. This strategy aims to streamline the portfolio, focusing resources on prime, sustainable assets and optimizing capital allocation for higher returns.

| Asset Type Example | Key Characteristics | 2024 Market Indicator | Strategic Action |

|---|---|---|---|

| Underperforming Retail Unit | Low foot traffic, high vacancy, declining rental income | Malls occupancy < 80% | Divestment |

| Older Industrial Property | Obsolete infrastructure, limited demand, high maintenance costs | Vacancy rates > 20% in some submarkets | Divestment |

| Properties Needing Major Renovation | High CapEx needs, low projected returns on investment | Portfolio value > CHF 11 billion (2023) highlights scale of management | Divestment or strategic repositioning |

Question Marks

New development projects in their early stages, like those Swiss Prime Site might be considering, are essentially question marks in the BCG matrix. These are ventures with potential, often in promising markets, but they haven't proven themselves yet. Think of them as a gamble, requiring substantial investment now with the hope of future big returns.

These early-stage projects are characterized by high growth potential, aiming to become future Stars. However, at this point, they typically demand significant capital expenditure and ongoing resource allocation. For instance, the extensive renovation and repositioning of a prime asset like the Jelmoli building in Zurich, while a strategic move, will naturally tie up capital and resources during its transformation phase, delaying immediate significant income generation.

Swiss Prime Site's engagement in its Start-up Accelerator Programme, specifically targeting PropTech and CleanTech, signals a strategic pivot towards future-oriented innovation. These sectors represent substantial growth opportunities and the potential to reshape the real estate landscape. While direct market share in these nascent technologies is presently minimal, this proactive approach lays the groundwork for future leadership.

The company's investment in these disruptive fields, such as the reported CHF 10 million allocated to its venture arm in 2023, underscores a commitment to exploring new frontiers. Success in these ventures will depend on continued strategic investment and effective integration of these emerging technologies into their existing portfolio, aiming to capture significant market share in the coming years.

Swiss Prime Site has been actively exploring and investing in nascent niche real estate segments, aiming to diversify its portfolio beyond traditional office and retail spaces. For example, the company has been looking at specialized co-living and co-working concepts. These emerging markets offer significant growth potential, as demonstrated by the increasing demand for flexible and community-oriented living and working solutions.

In 2024, the co-living sector, in particular, has seen a notable uptick in interest and investment, with reports indicating a projected market growth of over 15% annually in key European cities. While Swiss Prime Site’s presence in these specific niches might still be developing, their strategic entry aligns with broader market trends favoring adaptable real estate solutions.

Strategic Acquisitions of Smaller, High-Growth Portfolios

The recent CHF 300 million capital raise by Swiss Prime Site for property acquisitions, especially those in high-demand segments not yet fully optimized, positions these as potential Question Marks within the BCG matrix. These strategic moves are designed to inject new growth potential, but their ultimate success hinges on effective integration and value enhancement to transition them into Stars.

- Targeting High-Demand Segments: Swiss Prime Site is focusing its acquisition strategy on niche, high-growth property sectors that offer significant upside potential, even if currently underperforming or not fully developed.

- Capital Infusion for Growth: The CHF 300 million capital raise directly supports these strategic acquisitions, providing the necessary financial firepower to pursue promising portfolios.

- Integration and Optimization Challenge: The success of these acquisitions as future Stars depends on Swiss Prime Site's ability to successfully integrate them into its existing operations and optimize their performance.

- Potential for Future Stars: By acquiring these properties, Swiss Prime Site aims to cultivate them into high-growth, high-market-share assets, thereby strengthening its overall portfolio and market position.

Projects Aimed at Achieving Net-Zero Emissions by 2040

Swiss Prime Site's commitment to achieving net-zero emissions by 2040 involves specific, forward-thinking projects. These initiatives often center on deep retrofitting of existing properties to enhance energy efficiency and the integration of circular economy principles into construction and renovation processes. For instance, projects focused on replacing outdated heating systems with geothermal or heat pump solutions, coupled with advanced insulation upgrades, are critical.

While these projects align with the significant growth trend in sustainability, their financial viability in the initial stages can present challenges. The upfront capital expenditure for comprehensive retrofitting or implementing novel circular economy practices is substantial. Furthermore, predicting the exact market adoption rates and the speed of return on investment for these pioneering efforts remains an area of active assessment.

- Deep Retrofitting: Projects targeting a significant reduction in energy consumption through building envelope improvements and system upgrades, aiming for a substantial decrease in operational carbon emissions.

- Circular Economy Integration: Initiatives focused on material reuse, waste reduction, and sustainable sourcing throughout the lifecycle of buildings, aligning with a less resource-intensive future.

- Renewable Energy Adoption: Investments in on-site renewable energy generation, such as solar photovoltaics, to power operations and further decarbonize the portfolio.

- Technological Innovation: Exploring and implementing new technologies in building management systems and materials that contribute to emission reduction goals.

Question Marks in Swiss Prime Site's portfolio represent investments with uncertain futures. These are typically new ventures or niche market entries where the potential for high growth exists, but market share is currently low and the outcome is not guaranteed. Significant investment is required to nurture these into Stars.

Swiss Prime Site's strategy includes investments in nascent areas like PropTech and CleanTech through its accelerator programs, signaling a move into high-growth but unproven markets. These ventures, while promising, demand substantial capital and their success in capturing future market share is yet to be determined, placing them firmly in the Question Mark category.

Acquisitions in emerging real estate segments, such as specialized co-living and co-working spaces, also fall under Question Marks. Despite growing demand, as seen with the co-living sector's projected 15% annual growth in key European cities in 2024, Swiss Prime Site's market penetration in these specific niches is still developing.

The company’s focus on sustainability projects, like deep retrofitting for net-zero emissions by 2040, also represents a Question Mark. The substantial upfront investment and the inherent uncertainty in predicting exact market adoption rates and ROI for these innovative, capital-intensive initiatives highlight their classification.

| Category | Swiss Prime Site Example | Market Growth Potential | Current Market Share | Investment Required |

|---|---|---|---|---|

| New Ventures/Niche Markets | PropTech & CleanTech Accelerator Investments | High | Low | High |

| Emerging Real Estate Segments | Co-living & Co-working Concepts | High (e.g., Co-living >15% annual growth in Europe projected for 2024) | Developing | Moderate to High |

| Sustainability Projects | Deep Retrofitting for Net-Zero Emissions | High (driven by regulatory and societal demand) | Low to Moderate (for specific technologies) | High |

BCG Matrix Data Sources

Our Swiss Prime Site BCG Matrix is informed by robust data, leveraging company financial disclosures, real estate market trend analysis, and expert industry insights for accurate strategic positioning.