Swiss Prime Site Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swiss Prime Site Bundle

Swiss Prime Site navigates a competitive landscape shaped by several key forces, impacting its profitability and strategic direction. Understanding the bargaining power of both buyers and suppliers is crucial, as their influence can significantly alter market dynamics.

The threat of new entrants and the availability of substitutes present constant challenges, requiring Swiss Prime Site to maintain strong competitive advantages and innovate continuously.

The intensity of rivalry among existing players further dictates pricing power and market share for Swiss Prime Site.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Swiss Prime Site’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The Swiss construction sector is grappling with escalating material prices and overall construction expenses. This trend significantly bolsters the bargaining power of suppliers of essential building materials and specialized services.

Supply chain disruptions, a persistent issue in recent years, further amplify this challenge. For Swiss Prime Site, these factors translate into potentially higher costs for their development and renovation projects.

For instance, in 2024, the Swiss construction price index saw a notable increase, driven by raw material costs such as steel and timber, impacting project budgets.

The scarcity of prime land in Switzerland is a significant factor influencing the bargaining power of suppliers for Swiss Prime Site. High-quality, well-located land is inherently limited, giving landowners considerable leverage in negotiations. This is particularly relevant for Swiss Prime Site, as their core strategy revolves around acquiring and developing premium properties in sought-after urban centers.

When Swiss Prime Site seeks to expand its portfolio, it often finds itself negotiating with a concentrated group of suppliers who control these scarce, highly desirable assets. This limited supply dynamic can naturally lead to higher acquisition costs, as landowners can command premium prices for their land. For instance, the average price of development land in Zurich, a key market for Swiss Prime Site, has seen consistent upward pressure due to ongoing demand and limited availability.

A scarcity of specialized talent, especially in fields like sustainable building practices and sophisticated property management systems, significantly elevates the leverage held by labor suppliers. This situation can translate into demands for increased compensation or a restricted availability of competent service providers, consequently affecting project schedules and overall expenditures.

Dependence on Key Service Providers

Swiss Prime Site, while controlling much of its operations, does exhibit some dependence on specialized external service providers. For instance, in areas requiring highly niche expertise such as cutting-edge sustainability consulting or unique architectural designs, a few key suppliers can hold significant bargaining power. This is particularly true if their skills or technologies are difficult to replicate or substitute, allowing them to command higher prices or more favorable terms.

This reliance can be amplified when these providers offer proprietary solutions that are integral to Swiss Prime Site's value proposition. For example, imagine a scenario where a specific IT infrastructure provider offers a unique, highly efficient energy management system that is critical for achieving ambitious ESG targets. In such cases, the supplier’s leverage increases due to the limited availability of alternatives that can deliver comparable performance or meet stringent regulatory requirements. In 2024, the demand for specialized green building expertise continued to rise, potentially increasing the bargaining power of those firms possessing such advanced capabilities.

- Niche Expertise: Reliance on specialized providers for sustainability consulting and architectural design.

- Limited Substitutability: Proprietary solutions or unique skills can restrict alternative options.

- Market Trends: Increased demand for green building expertise in 2024 strengthens supplier leverage in this area.

- Potential Cost Impact: Higher supplier power can translate to increased operational costs for Swiss Prime Site.

Monopoly or Oligopoly in Specific Segments

In certain niche areas of the Swiss construction or technology supply chains, a limited number of suppliers might dominate. This concentration means these few providers can exert considerable influence over pricing and contract conditions, impacting Swiss Prime Site's costs.

For instance, if a specialized construction material or a critical technology component is supplied by only one or two Swiss-based firms, they hold substantial leverage. This situation could lead to higher input costs for Swiss Prime Site, potentially affecting project profitability.

- Limited Competition: A small number of suppliers in specialized segments can dictate terms.

- Price Influence: Suppliers can command higher prices due to lack of alternatives.

- Contractual Leverage: Unique providers may impose less favorable contract terms.

- Impact on Costs: Increased supplier power directly translates to higher operational expenses for Swiss Prime Site.

The bargaining power of suppliers for Swiss Prime Site is elevated due to the scarcity of prime land and specialized talent, particularly in sustainable building. This concentration of limited, high-quality resources grants landowners and niche service providers significant leverage, potentially increasing acquisition and development costs for Swiss Prime Site. In 2024, rising demand for green building expertise further amplified the power of specialized suppliers in this domain.

| Factor | Impact on Swiss Prime Site | Supporting Data (2024) |

| Land Scarcity (Prime Locations) | Higher acquisition costs, limited development options | Average development land prices in Zurich saw continued upward pressure. |

| Specialized Talent (Green Building) | Increased labor costs, potential project delays | Demand for sustainable construction expertise rose significantly. |

| Concentrated Niche Suppliers | Higher input prices for specialized materials/tech | Limited competition in certain tech components led to price increases. |

| Proprietary Solutions | Reduced negotiation flexibility, higher service fees | Key IT providers for energy management systems commanded premium rates. |

What is included in the product

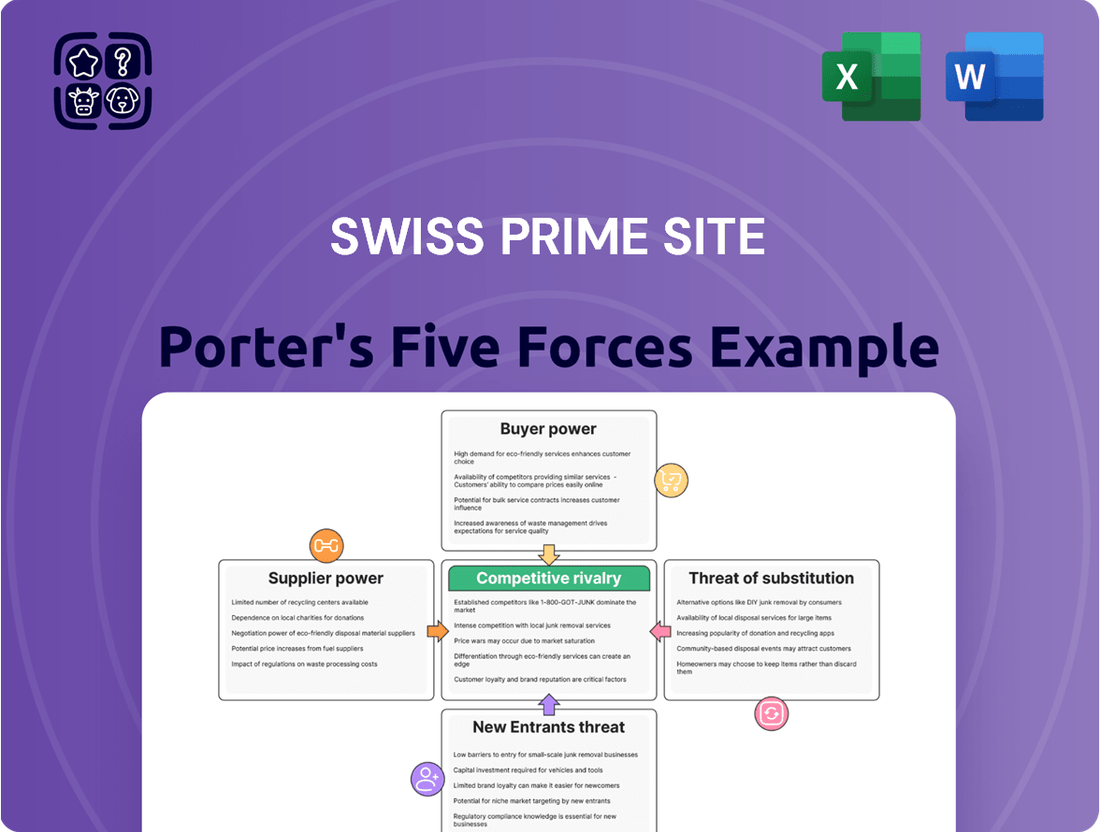

This analysis dissects the competitive landscape for Swiss Prime Site, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate sector.

Easily identify and mitigate competitive threats by visualizing the intensity of each force, streamlining strategic planning for Swiss Prime Site.

Customers Bargaining Power

Swiss Prime Site benefits from robust demand for its commercial properties in key Swiss cities like Zurich and Geneva. This strong tenant interest translates to consistently low vacancy rates, a significant factor that inherently limits the bargaining power of individual customers. For instance, in 2023, Swiss Prime Site reported an occupancy rate of 97.3% across its portfolio, underscoring the high demand.

The consistent demand for prime urban locations empowers Swiss Prime Site to maintain and even increase rental income, as evidenced by the 4.3% like-for-like rental growth reported for its commercial portfolio in 2023. This market dynamic shifts the advantage towards the landlord, reducing the leverage that any single tenant might have in negotiating lease terms or rental prices.

Swiss Prime Site's extensive use of long-term lease agreements significantly curbs the bargaining power of its customers. These extended contracts, often spanning many years, create a stable revenue stream by locking in tenants and limiting their flexibility to renegotiate terms or seek alternative properties in the short to medium term. This stability is a key factor in maintaining predictable income for the company, as evidenced by their portfolio's high occupancy rates.

The 'flight to quality' trend in real estate significantly impacts the bargaining power of customers. Tenants are increasingly seeking modern, energy-efficient, and strategically located properties. This preference gives them leverage when faced with a market offering many older or less sustainable alternatives, compelling landlords to invest in property upgrades to remain competitive.

In 2024, the demand for prime office space with high sustainability ratings and excellent amenities continued to outpace that for older, less efficient buildings. For instance, vacancy rates for Grade A office spaces in major European cities remained notably lower than for Grade B or C properties, reflecting tenant willingness to pay a premium for quality. This dynamic shifts bargaining power towards tenants who can afford to be selective, especially if landlords are reluctant to invest in necessary renovations.

Customer Choice in Assisted Living

In the assisted living and healthcare sectors, customers and their families possess a degree of bargaining power. While Tertianum holds a strong market position, the availability of alternative providers means that quality of care, service offerings, and location all influence consumer choice. This competitive landscape allows customers to negotiate, particularly regarding personalized care plans and service bundles.

The bargaining power of customers in assisted living is influenced by several factors:

- Availability of Alternatives: The presence of multiple assisted living facilities in a given area directly increases customer leverage. For instance, in 2024, regions with a higher density of senior living facilities often saw more competitive pricing and service differentiation.

- Information Accessibility: Increased transparency in service quality and pricing, often through online reviews and comparison platforms, empowers customers to make more informed decisions and demand better value.

- Switching Costs: While moving can be disruptive, the perceived cost of switching between providers, especially if dissatisfaction arises, can still be a factor. However, the desire for optimal care can outweigh these costs for many families.

- Service Customization: Customers can exert influence by seeking facilities that offer flexible service packages tailored to individual needs, pushing providers to adapt their offerings.

Impact of Hybrid Work Models

The increasing adoption of hybrid work models, while less widespread in Switzerland than in some other nations, can subtly impact the bargaining power of office space customers. Companies embracing flexible arrangements may reassess their space needs, potentially leading to reduced demand for traditional office layouts.

This shift could translate into customers seeking more adaptable lease terms or even smaller footprints when negotiating renewals or new contracts. For instance, a 2024 survey indicated that a significant portion of Swiss companies were considering hybrid models, suggesting a growing trend that landlords need to acknowledge.

Consequently, landlords might face increased pressure to offer competitive rental rates or innovative space solutions to retain tenants. This dynamic could particularly affect older office buildings that may not easily accommodate the flexible requirements of modern hybrid workplaces.

- Hybrid Work Influence: Affects office space demand and landlord negotiation power.

- Swiss Adoption: Growing, though less pronounced than in other markets.

- Customer Pressure: Potential for reduced space needs and demand for flexible leases.

- Landlord Response: Need for competitive rates and adaptable office solutions.

Swiss Prime Site's strong market position, particularly in prime urban locations, generally limits the bargaining power of its commercial tenants. High occupancy rates, such as the 97.3% reported in 2023, and consistent rental growth, like the 4.3% for the commercial portfolio in the same year, indicate robust demand that favors the landlord.

The trend towards 'flight to quality' in real estate, where tenants prioritize modern, sustainable properties, can give selective customers leverage. In 2024, Grade A office spaces continued to see lower vacancies than older buildings, allowing tenants who can afford premium spaces more negotiation power if landlords are slow to upgrade.

In the assisted living sector, customer bargaining power is influenced by the availability of alternative providers and increased information accessibility. Regions with more senior living facilities in 2024 saw greater competition, empowering customers to negotiate on service customization and pricing.

The increasing adoption of hybrid work models in 2024 may subtly shift bargaining power for office tenants. Companies seeking more flexible lease terms or smaller footprints could put pressure on landlords to offer competitive rates, especially for older office stock less suited to hybrid work.

| Segment | Factor Affecting Customer Bargaining Power | 2023/2024 Data Point |

|---|---|---|

| Commercial Real Estate | Tenant Demand for Prime Locations | 97.3% Occupancy Rate (2023) |

| Commercial Real Estate | Rental Growth Potential | 4.3% Like-for-like rental growth (Commercial Portfolio, 2023) |

| Commercial Real Estate | 'Flight to Quality' Preference | Lower vacancy rates for Grade A vs. Grade B/C offices (2024) |

| Assisted Living | Availability of Alternative Providers | Increased competition in regions with higher facility density (2024) |

| Office Space | Hybrid Work Model Adoption | Growing consideration of hybrid models by Swiss companies (2024 survey) |

Preview Before You Purchase

Swiss Prime Site Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive analysis of Swiss Prime Site's Porter's Five Forces covers the bargaining power of buyers, the threat of new entrants, the intensity of rivalry, the bargaining power of suppliers, and the threat of substitute products, all presented in a ready-to-use format.

Rivalry Among Competitors

The Swiss real estate arena is quite crowded, featuring a wide array of players. Swiss Prime Site doesn't just go head-to-head with other publicly traded real estate firms, but also with agile private equity funds, large institutional investors with deep pockets, and numerous local developers who know their specific markets intimately. This makes competition fierce across the board for prime properties, promising development sites, and desirable tenants.

This broad competitive landscape means Swiss Prime Site constantly faces opportunities and challenges from many directions. For instance, in 2023, the total transaction volume in the Swiss real estate market reached approximately CHF 70 billion, highlighting the sheer scale of activity and the number of participants vying for market share and assets. The presence of so many diverse entities, each with different strategies and risk appetites, intensifies the rivalry for attractive investment and development projects.

Swiss Prime Site’s strategic focus on premium commercial properties situated in Switzerland’s most desirable urban centers naturally places it in a highly competitive arena. This segment attracts significant interest from numerous domestic and international real estate investors and developers, all vying for the same prime opportunities.

The intense rivalry for these coveted assets means that acquisition processes are frequently characterized by competitive bidding wars. For instance, in 2023, the Swiss real estate market saw continued strong demand for well-located commercial spaces, driving up prices and potentially compressing initial yields for buyers like Swiss Prime Site.

This heightened competition can influence the cost of acquiring new properties and development sites, directly impacting the profitability and return on investment for Swiss Prime Site’s portfolio expansion efforts. Successfully navigating this environment requires astute market analysis and a robust financial capacity to secure attractive deals.

A favorable interest rate environment, characterized by lower rates, significantly fuels demand for real estate investments. This heightened investor appetite directly intensifies competition among players like Swiss Prime Site for prime properties. For instance, in 2024, the persistent low-interest rate environment across many developed economies continued to draw capital into real estate, pushing up acquisition prices.

This increased competition can lead to inflated property values and a compression of rental yields. Consequently, Swiss Prime Site might find it more challenging to acquire assets at attractive entry points, potentially impacting its investment strategy and the profitability of new acquisitions. In 2024, many prime commercial real estate markets experienced a noticeable tightening of yields due to robust investor demand.

Competition in Assisted Living Sector

While Tertianum holds a significant position, the Swiss assisted living and healthcare market is not without its rivals. Other private operators, public institutions, and niche care providers actively compete for market share. This dynamic environment requires continuous adaptation and enhancement of services to remain competitive and retain customers.

The competitive landscape is further shaped by the need for ongoing innovation in service quality and offerings. For instance, as of early 2024, the Swiss senior living market is seeing increased demand for specialized care, such as dementia support and rehabilitation services, creating opportunities for differentiated players. Swiss Prime Site's Tertianum segment, a leading provider, must therefore consistently invest in upgrading facilities and training staff to meet evolving resident expectations and stay ahead of emerging competitors.

- Market Share Dynamics: Tertianum is a leader, but faces competition from various private and public entities.

- Innovation Imperative: Continuous improvement in services and quality is crucial to maintain market position.

- Sector Growth: The assisted living sector in Switzerland is experiencing growth, attracting new entrants and fostering competition.

- Specialized Care Demand: Increasing demand for specialized services like dementia care presents both challenges and opportunities for established operators.

Emphasis on Sustainability and Modernization

Competitive rivalry in the Swiss real estate market is intensifying, with a pronounced emphasis on sustainability and modernization. Competitors are actively developing and offering properties that are not only energy-efficient but also integrate cutting-edge technology to attract and retain tenants. This trend necessitates continuous investment from all market participants, including Swiss Prime Site, to ensure their portfolios remain competitive and appealing to a discerning tenant base.

This strategic shift towards green and smart buildings means that failing to adapt can lead to a significant disadvantage. For instance, many new office developments in Switzerland in 2024 are achieving DGNB or Minergie certifications, signaling a clear market preference. Swiss Prime Site, like its peers, must therefore allocate substantial capital towards upgrading existing properties and constructing new ones that meet these evolving environmental and technological standards to maintain its market position and attract high-quality tenants.

- Increased tenant demand for certified sustainable buildings.

- Higher operational costs for non-modernized properties.

- Pressure to invest in green technologies and smart building solutions.

- Risk of portfolio obsolescence if modernization lags.

Swiss Prime Site operates within a highly competitive real estate sector, facing rivals that range from large institutional investors and private equity firms to numerous local developers. This broad competition intensifies the pursuit of prime properties and development sites, particularly in Switzerland's most sought-after urban locations. The market's robustness, as evidenced by a CHF 70 billion transaction volume in 2023, underscores the intense rivalry for assets.

The pressure to acquire attractive properties is further amplified by a sustained low-interest rate environment, which has driven up acquisition prices and compressed initial yields, a trend observed throughout 2024. This environment forces Swiss Prime Site to continually invest in modernization and sustainability, as buildings achieving certifications like Minergie are increasingly preferred by tenants in 2024, thereby raising the bar for all market participants.

Within the assisted living sector, Swiss Prime Site's Tertianum brand contends with various private operators and public institutions, all seeking to capture market share. The growing demand for specialized care, such as dementia support, necessitates ongoing service innovation and facility upgrades to remain competitive. This dynamic ensures that differentiation through quality and specialized offerings is paramount for success in this growing segment.

| Competitor Type | Key Characteristics | Impact on Swiss Prime Site |

|---|---|---|

| Publicly Traded Real Estate Firms | Significant scale, diversified portfolios, access to capital markets | Direct competition for prime assets, price pressure |

| Private Equity Funds | Agile, opportunistic, often focused on specific niches or value-add strategies | Can drive up acquisition prices, potential for rapid market shifts |

| Institutional Investors | Large capital reserves, long-term investment horizons, focus on stable income | Intense competition for high-quality, income-generating properties |

| Local Developers | Deep market knowledge, strong local relationships, focus on specific project types | Competition for development sites and local tenant relationships |

| Assisted Living Operators (e.g., Tertianum rivals) | Focus on specialized care, service quality, facility modernization | Need for continuous investment in services and infrastructure to retain residents |

SSubstitutes Threaten

The burgeoning popularity of flexible workspaces and coworking solutions poses a significant threat of substitution for traditional office leases. These alternatives, offering agility and cost-efficiency, are particularly attractive to startups and businesses embracing hybrid work, as seen in the continued expansion of coworking networks globally. For instance, the flexible office market saw substantial growth in 2023, with many providers reporting high occupancy rates, indicating a clear preference for adaptable space solutions over long-term commitments for certain segments of the market.

The rise of remote work presents a significant threat of substitution for traditional office spaces. While Switzerland's adoption might be more measured than in some other nations, a continued trend towards flexible work arrangements could lead businesses to downsize their physical footprints. This shift means that virtual collaboration tools and home offices can act as viable substitutes for leased commercial properties.

In 2024, the demand for prime office space in Switzerland remained resilient, but the underlying trend of hybrid work models is undeniable. Companies are re-evaluating their space needs, potentially opting for smaller, more flexible leases or even a reduced overall office presence. This behavioral change directly substitutes the need for the extensive square footage that companies like Swiss Prime Site traditionally provide.

The increasing digitalization of business processes presents a significant threat of substitution for traditional office space demands. As companies embrace cloud-based solutions and remote work capabilities, the necessity for large, centralized physical offices diminishes. For instance, a significant portion of Swiss companies, perhaps around 30% by 2024, are likely to have adopted hybrid work models, reducing their physical footprint.

This shift means that many business functions previously requiring dedicated office space can now be managed remotely or through smaller, more agile co-working environments. This directly substitutes the need for the extensive square footage that companies like Swiss Prime Site typically provide, potentially impacting rental demand for larger, conventional office buildings.

Home Care and Community-Based Senior Services

The increasing preference for aging in place presents a significant substitute threat to traditional assisted living facilities. Advancements in home care services and community-based senior support programs allow individuals to receive care and maintain independence in their own homes. This trend could impact the demand for institutional residential care, influencing the revenue streams of companies like Tertianum, a Swiss operator of senior care facilities.

In 2024, the global home healthcare market was projected to reach over $400 billion, demonstrating substantial growth and consumer preference for in-home solutions. This indicates a strong availability of substitutes for residential care settings. For instance, the number of individuals utilizing home health services in Switzerland has been steadily increasing, offering a direct alternative to assisted living.

- Aging in Place Preference: A growing societal trend favors seniors remaining in their familiar surroundings for as long as possible.

- Home Care Service Advancements: Technology and service innovations in home care make it a more viable and attractive substitute.

- Community Support Programs: Local initiatives and community centers offer social engagement and practical assistance, reducing reliance on residential facilities.

- Market Data: The robust growth of the home healthcare market underscores the significant availability and appeal of substitute options.

Mixed-Use Developments and Urban Living Trends

The growing popularity of mixed-use developments presents a potential substitute threat to traditional, single-purpose commercial properties. These integrated spaces, which combine residential, retail, and office functions, cater to evolving urban living trends.

For instance, in 2024, urban centers continued to see a surge in demand for walkable neighborhoods where living, working, and leisure are all within close proximity. This preference can reduce the reliance on dedicated office buildings if employees can live and work within the same development, or nearby integrated hubs.

- Trend: Increasing preference for integrated urban living-working environments.

- Impact: Reduced demand for standalone commercial office spaces as alternatives emerge.

- Data Point: Many major global cities reported a significant uptick in mixed-use project approvals and completions in the lead-up to and through 2024.

- Strategic Implication: Companies may find that the need for traditional office leases is partially offset by employees opting for co-working spaces within mixed-use developments or fully remote work arrangements facilitated by such integrated communities.

The rise of coworking and flexible office solutions presents a significant substitute threat for traditional long-term office leases. These adaptable spaces cater to evolving work styles, appealing to businesses seeking agility and cost-effectiveness. For instance, the flexible workspace sector continued its expansion through 2023 and into 2024, with many providers reporting robust occupancy rates, indicating a clear market preference for flexibility over rigid commitments for certain user groups.

Entrants Threaten

Entering the Swiss real estate market, especially for prime commercial properties and extensive development projects, necessitates significant financial outlay. This substantial capital requirement acts as a formidable barrier, making it difficult for new entrants to challenge established firms like Swiss Prime Site.

For instance, acquiring a prime office building in Zurich or Geneva can easily cost hundreds of millions of Swiss francs, a sum that deters many smaller or less capitalized competitors. In 2024, the average price for prime office space in major Swiss cities remained exceptionally high, reflecting this ongoing trend.

The scarcity of prime development land in Switzerland's most sought-after urban centers, such as Zurich and Geneva, acts as a significant deterrent for new entrants. For instance, in 2024, the average price per square meter for commercial land in central Zurich remained exceptionally high, making it prohibitively expensive for newcomers to acquire suitable plots for large-scale projects.

This difficulty and expense in acquiring suitable development sites in these competitive locations directly hinders the ability of new companies to establish a significant presence. Newcomers often face bidding wars for limited available land, driving up acquisition costs and impacting the viability of their business models.

The Swiss real estate market presents a formidable challenge for new entrants due to its intricate web of zoning laws, environmental regulations, and protracted permitting procedures. These requirements operate across federal, cantonal, and municipal levels, demanding extensive localized knowledge.

Successfully navigating these regulatory landscapes necessitates substantial expertise and considerable time investment, effectively acting as a significant deterrent for any aspiring newcomers aiming to establish a presence.

For instance, in 2024, the average time to obtain building permits in major Swiss cities often extended beyond six months, with some complex projects taking over a year, highlighting the operational friction newcomers must overcome.

This complexity means that established players, like Swiss Prime Site, with their deep understanding and existing relationships within these regulatory frameworks, possess a distinct advantage, thereby reinforcing the barrier to entry.

Established Market Players and Brand Recognition

Established market players like Swiss Prime Site benefit from significant advantages that create a substantial barrier to entry. These incumbents boast well-developed portfolios, deeply ingrained brand recognition, and an intimate understanding of market dynamics. For instance, Swiss Prime Site's substantial real estate holdings, valued at CHF 13.7 billion as of December 31, 2023, represent a considerable hurdle for newcomers.

New entrants must contend with the arduous task of cultivating trust and securing prime assets in a competitive landscape. They face the challenge of building brand equity from scratch while simultaneously navigating established relationships and competing for desirable tenants and investment opportunities against entities with proven track records. This often translates to higher initial capital requirements and a prolonged period to achieve comparable market penetration.

The threat of new entrants is thus mitigated by the entrenched position of existing firms. Key factors contributing to this include:

- Economies of Scale: Incumbents often achieve lower per-unit costs due to their size and operational efficiency.

- Capital Requirements: The significant investment needed to acquire prime real estate and establish a competitive presence deters many potential entrants.

- Brand Loyalty and Reputation: Swiss Prime Site's long-standing presence and reputation foster tenant loyalty and investor confidence.

- Access to Distribution Channels: Established networks for leasing and property management are difficult for new firms to replicate quickly.

Expertise in Sustainable Development and Management

The growing emphasis on sustainable development and management presents a significant hurdle for new companies entering the real estate market. Meeting the escalating demand for properties that are not only energy-efficient but also incorporate green building certifications, renewable energy sources, and circular economy principles requires specialized knowledge and investment. For instance, achieving certifications like LEED Platinum or DGNB Diamond involves substantial upfront costs and technical proficiency that new entrants may lack. This expertise barrier, coupled with the long-term commitment needed to implement these practices effectively, can deter potential competitors from challenging established players like Swiss Prime Site, who have already invested in building these capabilities.

The high capital expenditure required for prime Swiss real estate, coupled with scarce development land in prime urban areas, significantly deters new entrants. For example, in 2024, acquiring prime office space in Zurich continued to demand hundreds of millions of Swiss francs, a barrier that smaller competitors find difficult to overcome.

Navigating Switzerland's complex zoning laws and lengthy permitting processes, which can take over a year for intricate projects as seen in 2024, also presents a substantial challenge for newcomers. Established firms like Swiss Prime Site, with their deep regulatory understanding, possess a distinct advantage.

| Factor | Impact on New Entrants | 2024 Data/Observation |

| Capital Requirements | High barrier due to property acquisition costs | Prime Zurich office space acquisition costs remain in the hundreds of millions CHF. |

| Land Availability | Scarcity of prime development sites | High per-square-meter costs for commercial land in central Zurich persist. |

| Regulatory Complexity | Demands extensive local knowledge and time | Permit acquisition for complex projects averaged over six months in major Swiss cities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Swiss Prime Site is built upon a robust foundation of data from annual reports, investor presentations, and reputable real estate industry publications. We supplement this with economic indicators and market trend analyses from established financial data providers to ensure a comprehensive understanding of the competitive landscape.