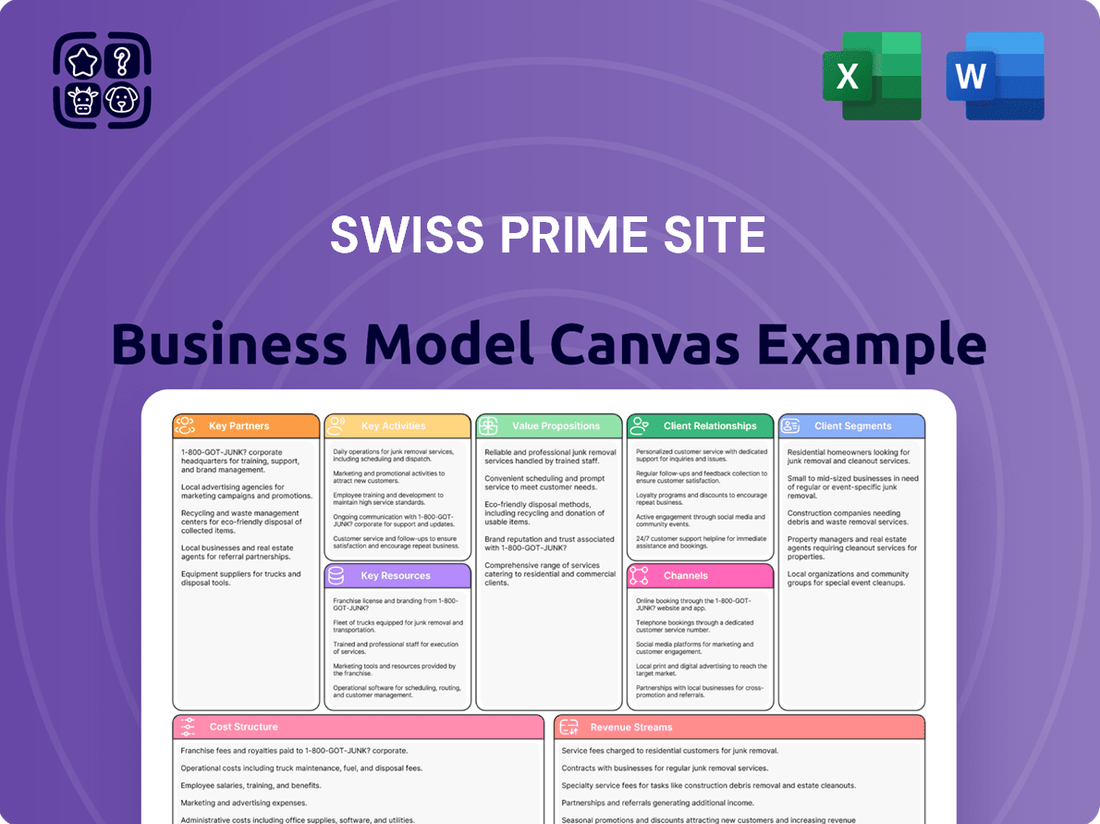

Swiss Prime Site Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swiss Prime Site Bundle

Uncover the core strategic framework behind Swiss Prime Site's thriving real estate empire with their comprehensive Business Model Canvas. This detailed breakdown illuminates how they create, deliver, and capture value in the dynamic property market.

Explore Swiss Prime Site's approach to customer relationships, key resources, and revenue streams. Understanding these elements is crucial for anyone aiming to replicate their success or analyze their competitive advantage.

Dive into the specifics of their value propositions and cost structure, gaining a clear picture of their operational efficiency and market positioning.

This professionally crafted Business Model Canvas is an invaluable tool for investors, strategists, and business students seeking to learn from a market leader.

Ready to gain a competitive edge? Download the full Swiss Prime Site Business Model Canvas to unlock actionable insights and accelerate your own strategic planning.

Partnerships

Swiss Prime Site actively partners with prominent construction and specialized development firms to bring new projects to life and update its existing properties. These collaborations are vital for maintaining superior construction quality, ensuring projects finish on schedule, and upholding environmentally friendly building standards. For instance, in 2023, Swiss Prime Site continued its focus on significant development projects, such as the ongoing expansion of the Jelmoli building in Zurich, which involves close coordination with multiple construction partners to manage complex urban development challenges.

Swiss Prime Site actively collaborates with a range of financial institutions and investors, including major banks, institutional investors, and experienced fund managers. These partnerships are crucial for securing the necessary financing for both acquiring new properties and undertaking significant development projects. This strategic reliance on financial partners allows Swiss Prime Site to execute its growth strategy effectively.

The company leverages these relationships to raise capital through various instruments. This includes securing traditional bank loans and issuing corporate bonds to the market. Furthermore, its dedicated Swiss Prime Site Solutions arm plays a pivotal role in managing investment funds, a business line that saw substantial growth in its assets under management during 2024, underscoring the strength of these financial collaborations.

Swiss Prime Site actively partners with PropTech and CleanTech startups, along with other technology providers. This collaboration focuses on embedding cutting-edge solutions directly into their real estate portfolio and daily operations. For instance, in 2023, their accelerator program reviewed over 200 applications, highlighting a strong pipeline of potential innovators in areas like smart building management and resource optimization.

Local Authorities and Urban Planners

Swiss Prime Site actively collaborates with local authorities and urban planners across Switzerland. These partnerships are crucial for navigating complex zoning laws and securing the necessary building permits for their development projects. For instance, in 2024, the company continued its engagement with cantonal governments to align its new construction and renovation plans with regional urban development strategies, ensuring their properties contribute positively to the urban fabric.

These collaborations are vital for streamlining project approvals and fostering the long-term value and successful integration of their real estate portfolio into existing urban environments. By working closely with these bodies, Swiss Prime Site ensures its developments meet regulatory requirements and also contribute to the overall liveability and economic vitality of the areas they operate in. This proactive approach helps to mitigate risks and accelerate project timelines.

- Zoning and Permitting: Facilitating approvals for new developments and renovations.

- Urban Development Alignment: Ensuring projects fit within cantonal and municipal planning goals.

- Risk Mitigation: Proactively addressing regulatory hurdles to ensure smoother project execution.

- Value Enhancement: Integrating properties thoughtfully to boost their long-term appeal and utility.

Specialized Service Providers (e.g., Healthcare)

Swiss Prime Site, through its subsidiary Tertianum, strategically partners with specialized service providers, particularly within the healthcare sector. These collaborations are vital for delivering a holistic living experience for residents in their senior living facilities.

These partnerships extend to healthcare professionals, dedicated care providers, and other specialized service companies. This ensures that residents receive high-quality assisted living and comprehensive healthcare services tailored to their individual needs, enhancing the overall value proposition.

For instance, Tertianum's network of partners enables the offering of specialized medical care, therapeutic services, and personalized support. This commitment to integrated services is a cornerstone of Swiss Prime Site's strategy to provide exceptional living environments for seniors.

In 2024, Tertianum continued to strengthen these alliances. The company reported that approximately 70% of its revenue is generated from services, highlighting the critical role of these specialized service provider partnerships in its business model.

- Healthcare Professionals: Doctors, nurses, and therapists providing on-site or readily accessible medical support.

- Care Providers: Dedicated staff offering personal care, assistance with daily living activities, and specialized dementia care.

- Specialized Service Companies: Entities providing ancillary services like physiotherapy, occupational therapy, nutrition, and wellness programs.

- Partnership Impact: These collaborations contribute to Tertianum's reputation for quality care and support, driving resident satisfaction and occupancy rates.

Swiss Prime Site's key partnerships extend to its property management and leasing activities, involving specialized real estate service providers and brokers. These collaborations are essential for optimizing occupancy rates, ensuring efficient property maintenance, and maximizing rental income across its diverse portfolio. For example, in 2024, the company continued to refine its tenant mix through strategic leasing agreements facilitated by its network of experienced real estate agents.

These partnerships also encompass collaborations with facility management companies and service providers that enhance the tenant experience and operational efficiency of its commercial properties, such as the Glattzentrum shopping center. Such alliances contribute to maintaining high standards of service and operational excellence, which are critical for tenant retention and attracting new business.

The company also engages with retail partners and brands to curate compelling tenant mixes within its shopping centers and mixed-use developments. These relationships are fundamental to creating vibrant retail environments that drive foot traffic and sales, thereby enhancing the overall attractiveness and profitability of its assets.

In 2023, Swiss Prime Site's portfolio occupancy rate remained robust, reflecting the success of these leasing and tenant relationship management efforts. The company's strategic focus on creating attractive retail and office environments, supported by its network of partners, underpins its continued market leadership.

| Partnership Type | Key Collaborators | Strategic Importance | 2023/2024 Data Point |

| Construction & Development | Specialized Developers, General Contractors | Project execution, quality assurance, sustainability | Continued focus on major projects like Jelmoli expansion. |

| Financial Institutions | Banks, Institutional Investors, Fund Managers | Financing acquisition and development | Swiss Prime Site Solutions saw growth in assets under management in 2024. |

| Technology Providers | PropTech & CleanTech Startups | Portfolio innovation, operational efficiency | Accelerator program reviewed over 200 applications in 2023. |

| Government & Planning Authorities | Local Municipalities, Cantonal Governments | Zoning, permitting, urban integration | Ongoing engagement in 2024 for new construction and renovation plans. |

| Healthcare & Senior Living Services | Healthcare Professionals, Care Providers | Holistic resident care, service delivery | Approx. 70% of Tertianum's revenue from services in 2024. |

| Real Estate Services | Property Managers, Leasing Agents, Brokers | Occupancy optimization, tenant experience | Refined tenant mix through strategic leasing in 2024. |

| Retail & Brand Partners | Key Retailers, Brands | Tenant mix curation, retail environment creation | Focus on vibrant retail environments driving foot traffic. |

What is included in the product

A detailed overview of Swiss Prime Site's business model, covering key partners, activities, resources, cost structure, and revenue streams. This canvas highlights their focus on prime real estate and long-term value creation for stakeholders.

Swiss Prime Site's Business Model Canvas offers a clear, one-page snapshot to identify core components, simplifying complex real estate strategies.

This structured approach to Swiss Prime Site's business model saves hours of formatting and structuring, making it ideal for fast deliverables.

Activities

Swiss Prime Site actively pursues the acquisition of premium commercial real estate situated in Switzerland's most desirable locations, aiming to bolster its existing portfolio with strategic purchases.

The company also engages in divestments of non-essential assets, a move designed to optimize its holdings and generate capital for new development projects, as evidenced by their portfolio streamlining activities in 2024.

Swiss Prime Site's key activities are centered on developing and renovating properties to create modern, sustainable, and adaptable spaces. This proactive approach ensures their portfolio remains competitive and attractive to tenants.

A significant part of this involves large-scale projects. For instance, the ongoing transformation of the Jelmoli building in Zurich is a prime example of their commitment to revitalizing existing assets. This project aims to enhance its appeal and functionality, contributing to future rental income streams.

In addition to refurbishments, Swiss Prime Site is actively engaged in new construction. The development of new buildings within Stücki Park in Basel represents their investment in expanding their portfolio with contemporary structures designed for long-term value and rental performance.

These development and construction efforts are crucial for generating and growing rental income. Upon completion, these projects are expected to significantly bolster the company's revenue, demonstrating the direct link between their key activities and financial performance.

Swiss Prime Site actively manages its substantial real estate holdings by offering comprehensive property and facility management services. This involves ensuring efficient operations, timely maintenance, and an excellent experience for all tenants across its diverse portfolio.

These core activities are designed to minimize vacancies and control property-related expenses, which directly contributes to strengthening rental income streams and enhancing overall operational efficiency for the company.

For instance, in 2024, Swiss Prime Site continued to focus on optimizing its portfolio, with a significant portion of its rental income generated from its well-managed properties, demonstrating the direct impact of these key activities on financial performance.

Asset Management for Third-Party Investors

Swiss Prime Site actively manages real estate assets for a range of institutional clients through its Swiss Prime Site Solutions division. This includes managing investment funds and handling direct mandates for these investors.

The company experienced robust expansion in this area during 2024. A key driver of this growth was the strategic acquisition of Fundamenta.

This acquisition significantly boosted their assets under management, pushing the total to over CHF 13 billion by the end of 2024. This demonstrates a successful strategy in expanding their third-party asset management capabilities.

- Asset Management Services: Swiss Prime Site Solutions manages real estate assets for institutional investors, including investment funds and direct mandates.

- 2024 Growth: The segment saw significant growth in 2024.

- Acquisition Impact: The acquisition of Fundamenta was a key factor in this expansion.

- Assets Under Management: As a result, assets under management surpassed CHF 13 billion.

Assisted Living and Healthcare Operations (Tertianum)

Swiss Prime Site, via its Tertianum division, manages a broad network of assisted living facilities and healthcare centers. These operations focus on delivering specialized care, comfortable living spaces, and a comprehensive suite of services designed for the unique requirements of senior residents. This segment is crucial for diversifying Swiss Prime Site's income streams.

The key activities for Tertianum include the day-to-day management of these residences, ensuring high standards of medical and personal care are met. They also handle resident acquisition and retention, service development, and property maintenance to create a supportive and engaging environment. In 2024, Tertianum continued its strategic expansion, acquiring new facilities to bolster its market presence.

- Operations Management: Overseeing the daily running of assisted living and healthcare facilities, including staffing, resident care, and facility upkeep.

- Care and Service Provision: Delivering tailored medical, personal, and social support services to senior residents, ensuring their well-being and quality of life.

- Resident Relations: Managing resident admissions, fostering a community atmosphere, and addressing resident and family concerns.

- Business Development: Identifying opportunities for expansion through acquisitions or new builds, and optimizing service offerings to meet evolving market demands.

Swiss Prime Site's key activities involve developing, managing, and optimizing a substantial portfolio of prime commercial real estate in Switzerland. This includes strategic acquisitions and divestments to refine holdings, with a focus on creating modern, sustainable spaces. The company is actively engaged in large-scale development projects, such as the Jelmoli building transformation in Zurich, and new construction like the Stücki Park development in Basel, directly impacting future rental income streams.

Furthermore, Swiss Prime Site Solutions manages real estate assets for institutional clients, significantly expanding its assets under management to over CHF 13 billion by the end of 2024, notably through the acquisition of Fundamenta. The Tertianum division operates a network of assisted living facilities and healthcare centers, focusing on high standards of care and resident well-being, while also pursuing strategic expansion in 2024.

| Key Activity Area | Description | 2024 Highlight | Impact |

|---|---|---|---|

| Real Estate Development & Management | Acquisition, development, renovation, and management of premium Swiss commercial real estate. | Ongoing revitalization of Jelmoli building; new construction in Stücki Park, Basel. | Strengthens rental income and portfolio value. |

| Asset Management Services (Swiss Prime Site Solutions) | Managing real estate for institutional investors, including funds and direct mandates. | Acquisition of Fundamenta; assets under management exceeded CHF 13 billion. | Diversifies revenue and expands service offerings. |

| Assisted Living & Healthcare (Tertianum) | Operating assisted living facilities and healthcare centers with specialized care. | Strategic expansion through acquisition of new facilities. | Contributes to diversified income and addresses senior care market. |

Preview Before You Purchase

Business Model Canvas

The Swiss Prime Site Business Model Canvas you are previewing is an exact representation of the document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the comprehensive file, offering full visibility of its structure and content. Once your transaction is complete, you will gain immediate access to this identical, professionally formatted Business Model Canvas, ready for your strategic analysis and application.

Resources

Swiss Prime Site's high-quality real estate portfolio forms the bedrock of its business. This collection of prime commercial properties is strategically concentrated in Switzerland's most significant economic centers, including Zurich, Geneva, and Basel.

As of late 2024, the company's own holdings within this portfolio are valued at approximately CHF 13.1 billion. This substantial asset base underscores the quality and prime positioning of their real estate investments.

Furthermore, the portfolio managed by Swiss Prime Site, encompassing assets under asset management, reaches a value of CHF 13.3 billion. This dual figure highlights both the direct ownership strength and the extensive reach of their property management capabilities.

Financial capital, encompassing equity, debt, and investor funds, is a cornerstone resource for Swiss Prime Site. This allows for strategic acquisitions and development projects, while a conservative capital structure ensures stability.

In early 2025, Swiss Prime Site demonstrated its robust financial standing by successfully raising CHF 300 million. This capital injection is earmarked for further portfolio expansion, reinforcing its capacity for growth and investment in prime real estate assets.

Swiss Prime Site's success hinges on its expert human capital, a team boasting deep knowledge in real estate development, asset management, property management, finance, and the healthcare sector. This diverse expertise is the engine driving their strategic choices and operational efficiency.

In 2024, Swiss Prime Site continued to emphasize the development of its workforce, recognizing that skilled professionals are key to navigating the complexities of the real estate market. Their investment in talent directly impacts their ability to innovate and maintain excellence across their extensive portfolio.

The company's commitment to attracting and retaining top talent in specialized fields like sustainable building practices and digital property management ensures they remain at the forefront of industry trends. This focus on specialized skills is crucial for maximizing value from their real estate assets.

This human capital is instrumental in executing Swiss Prime Site's strategy, from identifying lucrative development opportunities to efficiently managing existing properties and ensuring financial stability. Their collective experience underpins the company's robust performance.

Brand Reputation and Market Leadership

Swiss Prime Site's brand reputation as a premier Swiss real estate company is a cornerstone of its business model, signifying quality, sustainability, and unwavering reliability. This strong public image acts as a significant intangible asset, drawing in high-caliber tenants, attracting discerning investors, and fostering robust partnerships, all of which solidify its dominant market position.

The company's market leadership is not merely a title but a tangible outcome of its consistent delivery on these core values. This leadership translates into preferential tenant selection, often commanding premium rental rates and achieving high occupancy levels, even in challenging economic climates. For instance, in 2024, Swiss Prime Site continued to demonstrate resilience, maintaining a high occupancy rate across its prime portfolio.

- Established Reputation: Swiss Prime Site is widely recognized for its commitment to quality, sustainability, and reliability in the Swiss real estate market.

- Tenant Attraction: Its strong brand attracts premium tenants, contributing to high occupancy rates and stable rental income.

- Investor Confidence: The company's reputation fosters investor trust, supporting its access to capital for growth and development.

- Market Leadership: Swiss Prime Site consistently ranks among the top real estate companies in Switzerland, reinforcing its competitive advantage.

Technology and Digital Infrastructure

Swiss Prime Site leverages advanced technology, including sophisticated property management systems and data analytics tools, to ensure operational efficiency and facilitate informed decision-making across its portfolio. Digital platforms are central to enhancing customer interactions and streamlining service delivery.

The company's strategic focus on PropTech and CleanTech investments underscores its commitment to innovation. In 2023, Swiss Prime Site reported investments in digital solutions aimed at optimizing building performance and tenant experience. For example, their digital twin initiatives are designed to provide real-time data on building usage and energy consumption, aiding in proactive maintenance and sustainability efforts.

- PropTech Investment: Swiss Prime Site actively integrates new property technologies to improve building management and user experience.

- Data Analytics: Utilization of data analytics supports data-driven decisions in asset management and development.

- Digital Platforms: Development and deployment of digital platforms enhance tenant services and operational transparency.

- CleanTech Focus: Strategic investments in CleanTech align with sustainability goals and operational efficiency improvements.

Swiss Prime Site's robust portfolio of prime Swiss real estate, valued at approximately CHF 13.1 billion in direct holdings as of late 2024, forms its primary tangible asset. This is complemented by CHF 13.3 billion in assets under management, showcasing significant operational scale and expertise. Their financial capital, bolstered by a successful CHF 300 million capital raise in early 2025, provides the necessary liquidity for strategic expansion and development initiatives.

Expert human capital, encompassing deep knowledge in real estate development, asset management, finance, and healthcare, drives the company's strategic direction and operational excellence. This skilled workforce is crucial for navigating market complexities and capitalizing on opportunities. The company's strong brand reputation, built on quality, sustainability, and reliability, attracts premium tenants and fosters investor confidence, reinforcing its market leadership and premium rental income streams.

Technological assets, including advanced property management systems and data analytics tools, enhance operational efficiency and inform decision-making. Investments in PropTech and CleanTech, such as digital twin initiatives reported in 2023, aim to optimize building performance and tenant experience, aligning with sustainability goals and driving innovation.

| Key Resource | Description | 2024/2025 Data Point |

|---|---|---|

| Real Estate Portfolio | Prime commercial properties in key Swiss economic centers. | CHF 13.1 billion (direct holdings, late 2024) |

| Assets Under Management | Properties managed on behalf of third parties. | CHF 13.3 billion (late 2024) |

| Financial Capital | Equity, debt, and investor funds for acquisitions and development. | CHF 300 million capital raise (early 2025) |

| Human Capital | Expertise in real estate, finance, and healthcare sectors. | Continued emphasis on workforce development in 2024. |

| Brand Reputation | Signifies quality, sustainability, and reliability. | Maintained high occupancy rates in 2024. |

| Technology & Innovation | PropTech and CleanTech for operational efficiency. | Digital twin initiatives reported in 2023. |

Value Propositions

Swiss Prime Site provides access to modern, high-quality commercial spaces in Switzerland's most desirable and central urban hubs. These properties are strategically located to offer unparalleled connectivity and visibility for businesses. For example, in 2024, their portfolio consistently commands premium rental rates due to this prime positioning.

The company's properties are designed to cater to a wide range of business requirements, fostering a prestigious and highly functional operational setting. This focus on quality and adaptability ensures tenants can thrive. Swiss Prime Site's commitment to maintaining these standards contributes to their strong occupancy rates, often exceeding 95% across their prime assets.

Swiss Prime Site is deeply committed to sustainable development, aiming for climate neutrality across its portfolio by 2040. This forward-thinking approach resonates strongly with tenants and investors who prioritize environmental responsibility and seek investments that are built for the long term.

The company actively pursues high environmental certification rates for its properties, such as DGNB or LEED, demonstrating a tangible commitment to green building practices. In 2023, Swiss Prime Site reported a significant portion of its portfolio already met stringent sustainability standards, with ongoing investments directed towards enhancing energy efficiency and reducing the carbon footprint of its assets.

This focus on sustainability isn't just about environmental stewardship; it's a strategic advantage that attracts a growing segment of the market. Businesses increasingly choose locations that align with their own corporate social responsibility goals, making sustainable properties a key differentiator in the competitive real estate landscape.

Swiss Prime Site offers clients a complete suite of real estate services, covering every stage from acquiring properties and developing new projects to the detailed management and eventual sale of assets. This end-to-end capability simplifies the process for clients, providing a single point of contact for all their real estate needs.

This integrated model ensures that clients benefit from specialized expertise at each step, leading to maximized value and superior property performance throughout the entire lifecycle. For instance, in 2023, Swiss Prime Site's portfolio occupancy rate remained high at 98.2%, demonstrating effective property management that preserves asset value.

Stable and Attractive Investment Opportunities

For investors seeking stability and growth, Swiss Prime Site offers a compelling proposition. They provide access to a diversified real estate portfolio, consistently delivering attractive returns. This is underpinned by robust rental income and expert asset management, ensuring long-term value creation.

The company's commitment to high-quality, strategically located properties in Switzerland is a key differentiator. This focus translates into resilient rental income streams, even in fluctuating economic conditions. For instance, in 2023, Swiss Prime Site reported a net profit of CHF 224.4 million, demonstrating sustained financial strength.

- Diversified Portfolio: Access to a range of high-quality properties across Switzerland.

- Attractive Returns: Proven track record of delivering competitive investment yields.

- Strong Rental Income: Stable income generated from well-leased properties.

- Expert Asset Management: Professional management to maximize property value and performance.

Specialized Assisted Living and Healthcare

Swiss Prime Site, through its subsidiary Tertianum, provides specialized assisted living and healthcare services. These offerings focus on delivering security, comfort, and professional care within a nurturing environment, addressing the increasing demand from an aging population for premium residential and care solutions.

In 2024, the senior living sector continued to see robust demand, with an estimated 10,000 new units needed annually in Switzerland to meet projected demographic shifts. Tertianum's model directly taps into this, offering tailored support that enhances quality of life for its residents.

The value proposition is built on a foundation of trust and quality, ensuring residents receive comprehensive support. This includes:

- Premium living environments: High-quality residences designed for comfort and accessibility.

- Professional healthcare: Access to skilled medical and care professionals.

- Supportive community: A safe and engaging social setting for seniors.

- Tailored care plans: Personalized services to meet individual health and lifestyle needs.

Swiss Prime Site offers prime commercial real estate in Switzerland's most sought-after urban locations, providing businesses with excellent visibility and connectivity. Their portfolio consistently achieves premium rental rates, reflecting the strategic value of these central sites.

The company's properties are designed for versatility and prestige, supporting a wide array of business needs and maintaining high occupancy, often above 95% in key assets.

Sustainability is a core value, with a commitment to climate neutrality by 2040 and a focus on high environmental certifications like DGNB and LEED, attracting environmentally conscious tenants and investors.

Swiss Prime Site provides comprehensive real estate services, from development to management, ensuring clients receive expert support throughout the property lifecycle and maximizing asset value.

For investors, Swiss Prime Site presents a stable and growing opportunity through a diversified portfolio, strong rental income, and expert management, evidenced by a net profit of CHF 224.4 million in 2023.

Through Tertianum, Swiss Prime Site offers premium senior living and healthcare services, catering to the growing demand for quality care and supported living environments for an aging population.

Tertianum's value proposition centers on trust and quality, providing residents with excellent living spaces, professional healthcare, and a supportive community, addressing the significant need for senior housing in Switzerland.

| Value Proposition | Description | Key Metric/Fact |

|---|---|---|

| Prime Locations | Access to modern, high-quality commercial spaces in central Swiss urban hubs. | Consistently commands premium rental rates. |

| High-Quality & Adaptable Spaces | Prestigious and functional settings for diverse business requirements. | Occupancy rates often exceeding 95% across prime assets. |

| Sustainability Focus | Commitment to climate neutrality by 2040 and high environmental certifications. | Significant portion of portfolio met stringent sustainability standards in 2023. |

| Integrated Real Estate Services | End-to-end property lifecycle management from acquisition to sale. | Portfolio occupancy rate of 98.2% in 2023 due to effective management. |

| Attractive Investment Opportunity | Diversified portfolio delivering stable returns and strong rental income. | Net profit of CHF 224.4 million reported in 2023. |

| Senior Living & Healthcare (Tertianum) | Premium assisted living and care services for an aging population. | Addresses robust demand in the senior living sector, with an estimated 10,000 new units needed annually in Switzerland. |

Customer Relationships

Swiss Prime Site cultivates enduring partnerships with its corporate and institutional clientele by assigning dedicated account managers. This approach guarantees a highly personalized service experience, characterized by proactive engagement and customized solutions precisely aligned with the unique needs of both tenants and investors.

These dedicated managers act as a single point of contact, streamlining communication and ensuring that all client requirements, from leasing inquiries to investment opportunities, are addressed efficiently and effectively. This focus on relationship building is a cornerstone of Swiss Prime Site's strategy to maintain high client retention and satisfaction.

For instance, Swiss Prime Site reported a robust portfolio occupancy rate of 96.4% as of the end of 2023, underscoring the success of their client-centric approach in retaining tenants within their prime properties.

Swiss Prime Site cultivates enduring partnerships with tenants and investors, prioritizing mutual growth and value creation. This long-term perspective is fundamental to their strategy, aiming to foster loyalty and sustained business relationships.

Understanding and adapting to the evolving needs of their stakeholders is paramount. By offering tailored solutions and services, they ensure tenant satisfaction and investor confidence, which is key to retaining high-value clients in a competitive market.

In 2024, Swiss Prime Site reported a robust portfolio, with a significant portion of rental income secured through long-term contracts. This stability underscores their success in building lasting relationships, contributing to their predictable revenue streams and resilience.

Swiss Prime Site prioritizes a service-oriented and responsive approach to customer relationships, ensuring high-quality support for property management, facility services, and tenant inquiries.

This customer-centric strategy is fundamental to their operations, aiming to enhance tenant satisfaction by addressing issues promptly and maintaining operational efficiency across their diverse portfolio.

In 2024, Swiss Prime Site's commitment to tenant well-being is underscored by their proactive management style, which contributes to strong occupancy rates, a key performance indicator for real estate assets.

Digital Platforms and Communication

Swiss Prime Site actively leverages digital platforms to foster robust customer relationships. Online portals serve as a central hub for tenants and investors, facilitating seamless communication and access to crucial information.

These digital channels are instrumental in streamlining interactions by providing easy access to property details, financial reports, and company news. This proactive approach enhances transparency and keeps stakeholders well-informed about Swiss Prime Site's operations and performance.

- Digital Platforms: Swiss Prime Site utilizes dedicated online portals for tenants and investors, offering a centralized point for information and communication.

- Information Sharing: These platforms provide access to property-specific data, financial reports, and company updates, ensuring transparency.

- Service Requests: Digital channels simplify the process for tenants to submit service requests, improving response times and overall satisfaction.

- Enhanced Accessibility: The digital infrastructure ensures that tenants and investors can access information and services conveniently, anytime and anywhere.

Community Engagement and Well-being

Swiss Prime Site, through its subsidiary Tertianum, cultivates strong community bonds for its assisted living residents, prioritizing their overall well-being and fostering social engagement. This commitment is evident in the diverse array of services and activities meticulously curated to enrich residents' daily lives and promote a vibrant living experience.

The focus on community engagement directly translates to enhanced resident satisfaction and a higher quality of life. For instance, Tertianum's facilities often feature communal dining areas, recreational spaces, and organized events that encourage interaction among residents. This social fabric is crucial for combating isolation and promoting mental and emotional health among seniors.

- Community Focus: Tertianum's assisted living model emphasizes creating a supportive and interactive environment, aiming to prevent social isolation among residents.

- Well-being Initiatives: A variety of activities, from social gatherings to gentle exercise programs, are offered to promote physical and mental well-being.

- Resident Quality of Life: The services are designed to ensure residents feel connected, valued, and enjoy a fulfilling lifestyle within the community.

- Engagement Metrics: While specific engagement metrics for 2024 are not publicly detailed, Tertianum's operational philosophy consistently highlights resident participation and satisfaction as key performance indicators.

Swiss Prime Site prioritizes personalized service through dedicated account managers, fostering strong, long-term relationships with both tenants and investors. This client-centric approach, evident in their 96.4% portfolio occupancy rate at the end of 2023, ensures tailored solutions and efficient communication, driving high client retention.

Leveraging digital platforms, Swiss Prime Site enhances transparency and accessibility by providing online portals for seamless information sharing and service requests. This digital strategy complements their commitment to responsive property management and tenant well-being, which is crucial for maintaining strong occupancy rates.

Furthermore, through Tertianum, Swiss Prime Site cultivates community bonds for assisted living residents, focusing on well-being and social engagement. This model aims to combat isolation and promote a high quality of life, with resident participation and satisfaction being key performance indicators.

| Customer Segment | Relationship Type | Key Activities/Platforms |

|---|---|---|

| Corporate & Institutional Clients | Dedicated Account Management, Long-term Partnerships | Personalized service, Proactive engagement, Online portals, Financial reporting |

| Assisted Living Residents (Tertianum) | Community Building, Well-being Focus | Social activities, Communal spaces, Responsive support |

| Investors | Trust & Transparency | Online portals, Financial updates, Company news |

Channels

Swiss Prime Site leverages its dedicated, in-house sales and leasing teams to directly connect with prospective corporate tenants and investors. This direct approach is crucial for managing complex, large-scale property transactions and investment opportunities.

These teams are instrumental in crafting bespoke presentations that highlight the unique value propositions of Swiss Prime Site's portfolio, fostering deeper engagement with potential clients.

Their expertise allows for nuanced negotiation and the cultivation of robust, long-term relationships, which are essential for securing significant leases and investment mandates.

For instance, in 2024, Swiss Prime Site's direct sales and leasing efforts were key to their reported rental income, demonstrating the effectiveness of this channel in driving revenue and occupancy for their prime real estate assets.

Swiss Prime Site collaborates with external real estate brokers and agencies to broaden its property leasing and sales reach. This strategy is particularly effective for individual units and niche market segments, tapping into their established networks and specialized knowledge.

These partnerships are crucial for accessing a wider pool of potential tenants and buyers, enhancing market penetration beyond internal capabilities. For instance, in 2024, the Swiss commercial real estate market saw continued demand for prime office and retail spaces, making strategic broker engagement vital for Swiss Prime Site’s portfolio occupancy rates.

Swiss Prime Site's corporate website is the central hub for engaging with stakeholders worldwide. It offers a comprehensive overview of their diverse real estate portfolio, detailing services, financial results, and their commitment to sustainability. In 2024, this digital presence is crucial for reaching investors, potential tenants, and the general public with up-to-date information.

The website provides direct access to key documents like annual reports, investor presentations, and press releases, ensuring transparency. This allows stakeholders to delve into the company's performance and strategic direction, fostering trust and informed decision-making. For instance, tracking the website's traffic and engagement metrics in 2024 would offer insights into stakeholder interest.

Investor Relations and Capital Markets Events

Swiss Prime Site prioritizes direct engagement with the financial world. They actively participate in investor relations, host capital market days, and attend key industry conferences. This proactive approach is vital for both attracting new investment and fostering trust with their current shareholder base.

These interactions are not just about communication; they are strategic opportunities. By clearly articulating their business model, growth strategies, and financial performance, Swiss Prime Site aims to build a strong reputation in the capital markets. For instance, in 2024, their consistent dividend payouts and positive rental income growth, reported at CHF 322.5 million for 2023, helped solidify investor confidence.

- Investor Engagement: Regular communication through investor relations and capital market days.

- Market Presence: Active participation in industry conferences to enhance visibility.

- Transparency: Providing clear financial updates to existing and potential shareholders.

- Attracting Capital: Demonstrating value to draw in new investment.

Specialized for Tertianum

For Tertianum's assisted living and healthcare segment, reaching potential residents and their families is paramount. Direct outreach plays a significant role, involving personalized communication and information sharing about the specialized care and vibrant living environments. This direct approach allows for a deeper understanding of individual needs.

Referrals from healthcare professionals are another crucial channel. Doctors, hospital discharge planners, and therapists often recommend Tertianum's facilities to patients and their families seeking quality assisted living and healthcare services. Building strong relationships within the medical community ensures a steady stream of informed leads.

Specialized marketing campaigns are vital to highlight Tertianum's unique offerings. These campaigns focus on the distinct services, amenities, and the overall lifestyle experience available. For instance, in 2024, Swiss Prime Site reported a strong performance in its healthcare segment, which includes Tertianum, demonstrating the effectiveness of targeted marketing efforts in attracting residents.

- Direct Outreach: Engaging seniors and their families directly through personalized communication and information sessions.

- Healthcare Professional Referrals: Building and maintaining relationships with doctors, hospitals, and therapists to secure resident referrals.

- Specialized Marketing Campaigns: Developing and executing targeted campaigns that emphasize Tertianum's unique services, facilities, and lifestyle.

Swiss Prime Site utilizes its corporate website as a primary channel for information dissemination and stakeholder engagement. This digital platform provides comprehensive details on its property portfolio, financial performance, and sustainability initiatives, crucial for reaching investors and potential tenants globally. The website also serves as a repository for essential documents like annual reports, enhancing transparency.

Direct investor relations activities, including participation in capital market days and industry conferences, form another key channel. These interactions allow Swiss Prime Site to articulate its strategy and financial health, fostering trust and attracting capital. For example, their reported rental income of CHF 322.5 million for 2023 highlights the financial strength that underpins these investor conversations.

The company also relies on external real estate brokers to expand its market reach, particularly for specific units or niche segments. This partnership strategy is vital for maximizing occupancy in the dynamic Swiss real estate market, where demand for prime spaces remained robust through 2024.

For Tertianum's healthcare segment, direct outreach and referrals from healthcare professionals are critical channels. Targeted marketing campaigns further amplify their unique service offerings. The strong performance reported in Swiss Prime Site's healthcare division in 2024 underscores the success of these focused engagement strategies.

Customer Segments

Institutional investors like pension funds and insurance companies are key customers for Swiss Prime Site. These entities are looking for secure, long-term investments, and Swiss Prime Site's substantial and well-managed real estate portfolio aligns perfectly with their objectives.

These investors value Swiss Prime Site's proven track record of stable returns and reliable asset management. For instance, as of the end of 2023, Swiss Prime Site reported a net asset value (NAV) of CHF 10.0 billion, demonstrating the scale and stability that appeals to large financial institutions.

The diversification across office, retail, and logistics sectors within Swiss Prime Site's holdings is particularly attractive. This spread mitigates risk, a crucial consideration for institutional portfolios aiming for consistent capital preservation and growth.

Furthermore, the company's commitment to sustainability and ESG principles is an increasingly important factor for institutional investors in 2024, as they increasingly integrate environmental, social, and governance criteria into their investment decisions.

Swiss Prime Site's corporate tenant segment is broad, encompassing both large national and international corporations as well as small and medium-sized enterprises (SMEs). These businesses are actively seeking premium office, retail, and industrial spaces strategically situated in Switzerland's most desirable locations. Their needs often center on state-of-the-art infrastructure, adaptable space configurations to suit evolving operational requirements, and a strong emphasis on environmentally sustainable building designs and operations, reflecting a growing corporate commitment to ESG principles.

In 2024, the demand for high-quality, well-located commercial real estate remained robust, driven by companies looking to attract and retain talent in attractive urban centers. Swiss Prime Site's portfolio, with its focus on prime Swiss cities, aligns perfectly with this demand. For example, the company's rental income from its office and retail properties, a key indicator of corporate tenant activity, has shown consistent performance, underscoring the appeal of its offerings to a diverse corporate clientele. This segment is crucial for maintaining high occupancy rates and stable, long-term rental agreements.

Retail tenants within Swiss Prime Site's portfolio are primarily businesses operating physical stores in prime urban locations. These range from large anchor tenants with flagship stores to smaller, specialized boutiques, all seeking the advantage of high foot traffic and visibility that these central commercial properties offer.

For example, in 2024, Swiss Prime Site's retail segment continued to be a significant contributor to its overall revenue, benefiting from the strong post-pandemic recovery in consumer spending in Switzerland. The company's focus on accessible, well-connected urban centers ensures these retail tenants are positioned to capture a broad customer base.

The attractiveness of these locations translates into consistent demand from a diverse array of retail formats, from fashion and electronics to food and beverage. This tenant base relies on Swiss Prime Site for prime real estate that supports their brand presence and sales performance.

Seniors and Their Families (Assisted Living)

This segment includes seniors actively searching for assisted living, comprehensive nursing care, or specific senior residences, as well as their families who often play a crucial role in the decision-making process. These individuals and families place a high value on the quality of care provided, ensuring a safe and comfortable living environment, and the availability of a supportive community, all of which are core offerings of Tertianum.

In 2023, the demand for senior living solutions continued to grow, with a significant portion of the population aged 65 and over. For instance, by the end of 2023, approximately 17.3% of the Swiss population was over 65, highlighting a substantial and expanding market for assisted living services. Families are increasingly involved in these decisions, seeking transparency and reassurance regarding the well-being of their loved ones.

- Target Audience: Seniors needing assisted living, nursing care, or specialized residences, and their concerned family members.

- Key Motivations: Prioritizing high-quality care, safety, comfort, and a strong sense of community.

- Decision Drivers: Trust in the provider (like Tertianum), personalized care plans, and the overall living experience.

- Market Relevance: Growing elderly population in Switzerland underscores the increasing need for reliable senior housing solutions.

Public Sector Entities and NGOs

Public sector entities and NGOs represent a stable and dependable customer segment for Swiss Prime Site. These organizations, including government bodies and non-profit groups, frequently lease commercial spaces for essential functions like administrative offices or community service delivery. They typically prioritize long-term leases and properties that are consistently well-maintained, aligning with the high standards of Swiss Prime Site's portfolio.

In 2024, the demand for office space from public sector clients remained robust, especially in prime urban locations. These entities often seek secure and predictable rental costs, making them attractive tenants for long-term stability. Their operational needs are usually consistent, leading to lower tenant turnover compared to other segments.

- Government agencies lease office space for administrative and operational functions.

- Non-profit organizations secure locations for community services and program delivery.

- These customers often prefer long-term rental agreements to ensure stability.

- Property maintenance and location are key factors in their leasing decisions.

The primary customer segments for Swiss Prime Site are institutional investors, corporate tenants, and seniors seeking residential care. These groups are attracted by the company's prime real estate holdings, stable returns, and commitment to quality and sustainability.

Institutional investors, such as pension funds, value Swiss Prime Site's large, well-managed portfolio and proven track record. For example, the company's net asset value (NAV) stood at CHF 10.0 billion at the end of 2023, demonstrating the scale sought by these entities. Corporate tenants, from large corporations to SMEs, seek premium, adaptable, and sustainably designed office and retail spaces in sought-after Swiss locations, a demand met by Swiss Prime Site's prime urban properties.

The senior living segment, primarily through its subsidiary Tertianum, caters to the growing elderly population needing assisted living and nursing care. As of 2023, over 17% of Switzerland's population was over 65, indicating a substantial market for these services. These customers prioritize high-quality care, safety, and community, with families often playing a key role in selection.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Institutional Investors | Pension funds, insurance companies seeking long-term, stable investments. Value NAV, diversification, and ESG. | NAV of CHF 10.0 billion (end 2023) highlights portfolio scale. Increasing ESG focus in 2024. |

| Corporate Tenants | Large corporations and SMEs needing premium office, retail, and industrial spaces. Focus on location, infrastructure, and sustainability. | Robust demand for high-quality, well-located spaces in 2024 to attract talent. |

| Retail Tenants | Businesses in prime urban locations, from anchor stores to boutiques, seeking high foot traffic and visibility. | Significant revenue contributor, benefiting from consumer spending recovery in 2024. |

| Seniors/Families | Individuals needing assisted living, nursing care, or senior residences. Prioritize quality of care, safety, and community. | Growing segment, with over 17% of Swiss population aged 65+ in 2023. Families increasingly involved in decision-making. |

| Public Sector/NGOs | Government bodies and non-profits seeking stable, well-maintained commercial spaces for administrative or community functions. | Consistent demand for office space in prime locations in 2024, preferring long-term leases for predictability. |

Cost Structure

Swiss Prime Site’s property acquisition and development costs represent a significant portion of their expense structure. These outlays involve substantial capital for securing new land, purchasing existing properties, and undertaking extensive construction or renovation projects for their real estate portfolio. For instance, in 2024, the company continued to invest heavily in its development pipeline, with major projects contributing to these capital-intensive expenditures. This upfront investment is crucial for expanding and modernizing their strategically located assets.

Property operations and maintenance expenses are a significant part of Swiss Prime Site's cost structure, encompassing all ongoing costs related to managing their extensive real estate portfolio. This includes essential services like utilities, cleaning, and security, crucial for maintaining the value and appeal of their properties.

Repair and maintenance activities are also a substantial component, ensuring the physical integrity and functionality of buildings. For instance, in 2023, Swiss Prime Site reported property operating expenses of CHF 133.6 million, highlighting the substantial investment required to keep their portfolio in top condition.

Efficient facility management is key to controlling these operational expenses. By optimizing utility consumption, implementing preventative maintenance schedules, and leveraging technology for security, Swiss Prime Site aims to minimize these costs while maximizing tenant satisfaction and property longevity.

Personnel costs represent a significant expenditure for Swiss Prime Site, encompassing salaries, benefits, and other employment-related expenses for a broad workforce. This includes individuals dedicated to real estate management, development, asset management, finance, administration, and the provision of healthcare services.

In 2024, Swiss Prime Site's commitment to its extensive team is reflected in its operational expenses. The company's financial reports for the period leading up to mid-2025 will provide precise figures, but historically, personnel costs have been a substantial component of its overhead, directly impacting profitability and strategic investment capacity.

Financing Costs and Interest Expenses

Financing costs, particularly interest expenses on loans and bonds, represent a key element in Swiss Prime Site's cost structure. These costs are sensitive to fluctuations in the interest rate environment, impacting overall profitability. In 2023, Swiss Prime Site reported financing costs of CHF 107.4 million.

The company prioritizes a conservative financing strategy to manage these expenses effectively. This approach aims to ensure financial stability and flexibility, even amidst evolving market conditions.

- Financing Costs (2023): CHF 107.4 million.

- Debt Financing: Includes interest payments on loans and bonds.

- Interest Rate Sensitivity: Costs are influenced by prevailing interest rates.

- Strategic Approach: Emphasis on a conservative financing strategy.

Marketing, Sales, and Administrative Overheads

Swiss Prime Site's marketing, sales, and administrative (MSA) expenses are crucial for maintaining its market position and supporting leasing activities. These costs encompass a range of functions, from attracting tenants and investors to managing the company's overall operations.

In 2024, these overheads are expected to reflect ongoing investment in property marketing campaigns and the sales efforts required to secure and retain tenants in a competitive real estate market. Furthermore, the expenses include the essential costs of corporate administration, ensuring smooth day-to-day operations, as well as legal fees and compliance requirements that are fundamental to operating within Switzerland's regulatory framework.

- Marketing and Sales: Costs associated with advertising, property showcases, and sales commissions to attract and secure tenants.

- Administrative Expenses: Salaries for management and support staff, office rent, and general operational costs.

- Legal and Compliance: Fees for legal counsel, regulatory filings, and ensuring adherence to all relevant laws and standards.

- Property Management Support: Overheads that indirectly support the leasing and operational management of the real estate portfolio.

Swiss Prime Site's cost structure is heavily influenced by property acquisition and development, alongside ongoing operations and maintenance. Personnel and financing costs are also significant components, with marketing, sales, and administrative expenses supporting overall business functions.

| Cost Category | 2023 Actual (CHF million) | 2024 Outlook/Notes |

|---|---|---|

| Property Operations & Maintenance | 133.6 | Ongoing investment to maintain portfolio quality and tenant satisfaction. |

| Financing Costs | 107.4 | Sensitive to interest rate fluctuations; managed through conservative financing. |

| Personnel Costs | Not explicitly detailed in provided snippet, but historically substantial. | Reflects investment in a broad workforce across real estate and healthcare. |

| Marketing, Sales & Administration (MSA) | Not explicitly detailed in provided snippet, but ongoing. | Includes property marketing, sales efforts, and general corporate administration. |

| Property Acquisition & Development | Not explicitly detailed in provided snippet, but significant capital investment. | Crucial for expanding and modernizing the strategically located assets. |

Revenue Streams

Swiss Prime Site's main income comes from renting out its commercial properties, which include office spaces, shops, and mixed-use buildings. In 2024, this rental income grew substantially, boosted by the completion of new projects and adjustments to existing rental rates.

The company reported a significant increase in rental income for its portfolio in the first half of 2024, reaching CHF 174.6 million. This represents a 4.4% rise compared to the same period in 2023, showcasing the consistent demand for their well-located and modern properties.

This robust performance in rental income is a direct result of strategic investments in developing high-quality assets and effectively managing their existing portfolio. The successful leasing of newly constructed spaces and the ability to implement favorable rent adjustments are key drivers of this growth.

Swiss Prime Site generates revenue through the strategic sale of properties. This often involves divesting non-core assets or completed development projects that no longer align with their long-term strategy or have reached optimal value.

These property sales are crucial for capital recycling, allowing the company to reinvest in new, promising development opportunities and continuously optimize its real estate portfolio. For instance, in 2023, Swiss Prime Site reported total revenue of CHF 1.28 billion, with a portion of this stemming from property disposals contributing to strategic portfolio adjustments.

Swiss Prime Site's asset management arm, Swiss Prime Site Solutions, generates significant revenue by managing real estate investment funds and fulfilling mandates for external investors. This fee-based income stream is a crucial component of their business model, demonstrating their expertise in real estate fund administration and investment management.

In 2023, this segment was a major contributor to the company's overall financial performance, bolstering consolidated EBITDA. The ongoing growth in this area underscores the trust third-party investors place in Swiss Prime Site's capabilities to manage their real estate assets effectively.

Development and Project Management Fees

Swiss Prime Site generates revenue from development and project management fees, primarily by overseeing construction and renovation projects within its extensive real estate portfolio. These fees are earned for managing projects from initial planning through to final completion, ensuring efficient execution and quality outcomes.

This revenue stream is crucial as it reflects the company's expertise in property development and asset enhancement. While the core focus is on their own assets, there's potential to extend these services to third parties, further diversifying income. For instance, in 2023, Swiss Prime Site reported strong operational performance, underscoring the effectiveness of its project management capabilities in driving value.

- Core Revenue Source: Fees from managing construction and renovation of its own real estate holdings.

- Expertise Monetization: Leveraging in-house development and project management skills.

- Potential Diversification: Opportunity to offer services to external clients.

Healthcare and Assisted Living Service Fees

Swiss Prime Site's Tertianum subsidiary generates significant revenue through healthcare and assisted living service fees. These fees encompass a range of offerings, from comprehensive assisted living and nursing care to specialized therapeutic services provided to residents.

This revenue stream is primarily structured around tiered service packages, allowing residents to select the level of care that best suits their needs. Accommodation fees, which cover housing and associated amenities, form another core component of this income generation.

In 2024, the demand for high-quality senior living solutions remained robust, contributing to the consistent performance of Tertianum's service fee revenue. The aging population demographic in Switzerland continues to be a key driver for these services.

- Service Packages: Revenue from various care and support service bundles tailored to individual resident requirements.

- Accommodation Fees: Income derived from housing, meals, and facility usage charges.

- Ancillary Services: Additional revenue from optional services such as physiotherapy, wellness programs, and personal care assistance.

- Occupancy Rates: Directly impacts revenue, with high occupancy translating to greater fee generation.

Swiss Prime Site's rental income from its commercial properties, including offices and retail spaces, forms its primary revenue stream. In the first half of 2024, this segment saw a healthy 4.4% increase, reaching CHF 174.6 million, driven by new developments and strategic rent adjustments.

The company also generates revenue through property sales, a strategic method for capital recycling and portfolio optimization. In 2023, property disposals contributed to their total revenue of CHF 1.28 billion, facilitating reinvestment in new projects.

Furthermore, Swiss Prime Site Solutions, the asset management division, earns fees from managing real estate investment funds and fulfilling mandates for external investors, a key contributor to consolidated EBITDA in 2023.

The Tertianum subsidiary adds to revenue through healthcare and assisted living service fees, alongside accommodation charges, catering to Switzerland's growing senior population.

| Revenue Stream | Description | 2023 Data (if available) | 2024 Data (H1) |

|---|---|---|---|

| Rental Income | Leasing of commercial properties (offices, retail) | N/A | CHF 174.6 million (H1) |

| Property Sales | Divestment of assets or completed projects | Contributed to CHF 1.28 billion total revenue | N/A |

| Asset Management Fees | Fees from managing funds and mandates (Swiss Prime Site Solutions) | Bolstered consolidated EBITDA | N/A |

| Healthcare & Assisted Living Fees | Service fees and accommodation from Tertianum | N/A | N/A |

Business Model Canvas Data Sources

The Swiss Prime Site Business Model Canvas is constructed using a robust combination of internal financial disclosures, real estate market analysis, and strategic planning documents. These sources provide the foundation for understanding customer segments, value propositions, and revenue streams.