Swiss Prime Site Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Swiss Prime Site Bundle

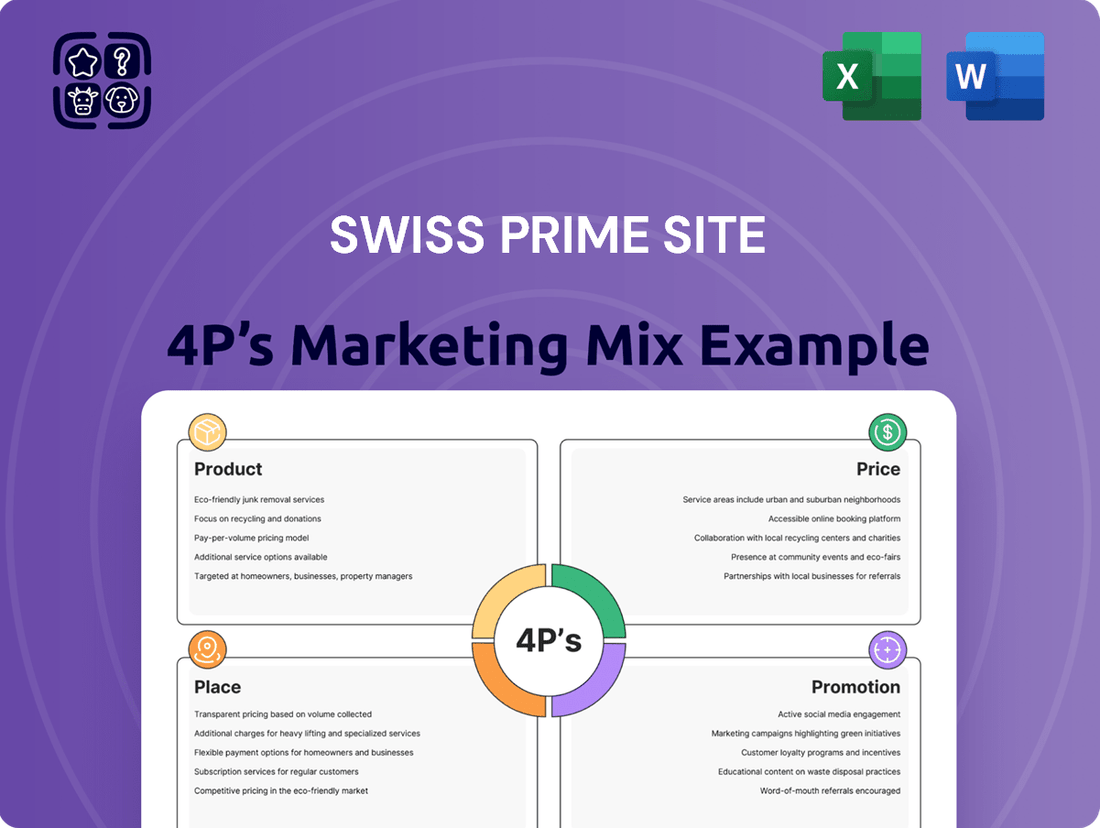

Swiss Prime Site's marketing prowess is built on a robust 4Ps strategy, meticulously aligning its prime real estate offerings with targeted pricing, strategic placement, and impactful promotions. Understanding these elements reveals the core of their market dominance.

Dive deeper into how Swiss Prime Site leverages its premium product portfolio, competitive pricing structures, prime location advantages, and tailored promotional campaigns to capture and retain market share. This analysis is essential for anyone seeking to understand successful real estate marketing.

Uncover the intricate details of Swiss Prime Site's product differentiation, pricing strategies, distribution channels, and communication mix. This comprehensive breakdown offers actionable insights for your own business or academic pursuits.

Gain instant access to a professionally crafted 4Ps Marketing Mix analysis for Swiss Prime Site, providing a clear roadmap of their market approach. This editable report is perfect for strategic planning, benchmarking, or in-depth study.

Explore the complete 4Ps framework for Swiss Prime Site, dissecting each component to understand their competitive edge. Get a ready-to-use document that saves you research time and delivers valuable strategic intelligence.

Product

Swiss Prime Site's Product strategy centers on a high-quality commercial property portfolio, primarily office and retail spaces strategically located in Switzerland's most central and desirable urban areas. This focus ensures consistent demand and premium rental yields. For instance, as of the first half of 2024, the company reported a rental income of CHF 238.2 million, underscoring the strength of its portfolio.

The portfolio is also intelligently diversified, extending beyond traditional office and retail to include specialized assets like city logistics hubs and modern laboratory facilities. This diversification aligns with the evolving needs of the service-oriented Swiss economy, reducing reliance on any single sector and enhancing resilience. In 2023, the company's total assets reached CHF 13.7 billion, reflecting the substantial scale and quality of its holdings.

By concentrating on modern, premium-quality properties, Swiss Prime Site attracts and retains a stable, long-term tenant base. This tenant profile, often comprising established corporations and growing businesses, contributes significantly to predictable and sustainable rental income streams. The occupancy rate remained high at 95.1% at the end of 2023, a testament to the desirability of their properties.

Swiss Prime Site's commitment to sustainable property development is a cornerstone of its product strategy, focusing on creating modern, adaptable spaces. This includes both new builds and the significant repositioning of existing properties to meet evolving market demands.

Notable projects like the revitalization of Jelmoli in Zurich and the 'Grand Passage' in Geneva exemplify this, transforming them into vibrant mixed-use hubs designed for long-term value and community integration.

The company has set ambitious environmental targets, aiming for climate neutrality in its operations by 2040. A key part of this is a strong focus on reducing the use of non-renewable primary raw materials in construction and development.

This dedication to sustainability is not just about environmental responsibility; it's about future-proofing assets and enhancing their appeal to a growing segment of environmentally conscious tenants and investors, a trend strongly evident in the 2024 real estate market.

Swiss Prime Site's comprehensive real estate services extend beyond mere property ownership and development. They actively engage in property acquisition, meticulous management, and strategic sales, covering the entire real estate value chain. This integrated approach ensures efficient operations and consistent value creation from an asset's inception through its entire lifecycle.

The company's portfolio management strategy is dynamic, heavily relying on capital recycling. In 2023, for instance, Swiss Prime Site continued to optimize its holdings by divesting certain assets to fund new, promising development projects, a core element of their value enhancement strategy.

Real Estate Asset Management Solutions

Swiss Prime Site's Real Estate Asset Management Solutions, primarily offered through Swiss Prime Site Solutions, cater to a broad range of institutional and private investors. The company provides a diverse array of investment products and specialized services, designed to meet varied financial objectives and risk appetites within the real estate sector. This segment is a cornerstone of their offering, aiming to attract capital for their portfolio and generate returns for their clients.

The strategic acquisition of Fundamenta Group in April 2024 was a pivotal moment, propelling Swiss Prime Site to become Switzerland's largest independent real estate asset manager. This move significantly bolstered their assets under management, enhancing their market position and expanding their service capabilities. The integration of Fundamenta Group's expertise and client base further solidifies their comprehensive approach to real estate investment management.

These asset management solutions are meticulously crafted to serve different investor profiles and property types. They encompass both commercial and residential real estate segments, offering a wide spectrum of attractive investment opportunities. The company leverages its deep market knowledge and extensive network to identify and capitalize on promising real estate ventures, ensuring value creation for investors.

- Broad Investor Base: Serves both institutional and private real estate investors.

- Market Leadership: Became Switzerland's largest independent real estate asset manager following the April 2024 acquisition of Fundamenta Group.

- Diverse Product Offering: Provides investment products and services across commercial and residential property types.

- Enhanced AUM: The Fundamenta Group acquisition significantly increased assets under management, demonstrating substantial growth.

Assisted Living and Healthcare Real Estate (Indirect)

While Swiss Prime Site exited its direct operational role in assisted living and healthcare in 2019, its strategic involvement continues through property ownership. The company still owns numerous properties within this specialized sector, which are then leased to operators like Tertianum. This arrangement ensures that these healthcare-focused real estate assets remain a crucial component of Swiss Prime Site's income-generating portfolio, contributing to rental revenue and bolstering its overall asset valuation.

The company benefits significantly from the inherent stability of demand within the assisted living and healthcare real estate segments. This consistent demand translates into reliable rental income streams, providing a defensive quality to its property portfolio. As of the first half of 2024, Swiss Prime Site reported a robust rental income, with its real estate portfolio demonstrating resilience, a trend likely supported by the ongoing need for such specialized facilities.

- Property Ownership: Swiss Prime Site retains ownership of key assisted living and healthcare properties post-divestment of direct operations.

- Rental Income Contribution: These properties generate consistent rental income, forming a stable part of the company's overall revenue.

- Market Demand: The sector benefits from stable and growing demand, driven by demographic trends like an aging population.

- Portfolio Diversification: Inclusion of these specialized real estate assets enhances the diversification and resilience of Swiss Prime Site's property holdings.

Swiss Prime Site's product offering centers on high-quality, strategically located commercial properties, predominantly offices and retail spaces in Switzerland's prime urban centers. This focus ensures strong rental demand and premium yields, as evidenced by CHF 238.2 million in rental income reported for the first half of 2024. The portfolio is further diversified with specialized assets like city logistics hubs and modern laboratory facilities, catering to evolving economic needs and enhancing resilience, with total assets reaching CHF 13.7 billion in 2023.

A commitment to sustainability shapes their product development, creating modern, adaptable spaces that appeal to environmentally conscious tenants and investors. Notable projects like the revitalization of Jelmoli in Zurich exemplify this forward-thinking approach. The company aims for climate neutrality by 2040, actively reducing non-renewable raw material use in construction, a strategy resonating with 2024 market trends.

| Property Type | Key Locations | 2023 Asset Value (CHF bn) | H1 2024 Rental Income (CHF m) | 2023 Occupancy Rate (%) |

|---|---|---|---|---|

| Office & Retail | Major Swiss Cities | 13.7 (Total Assets) | 238.2 | 95.1 |

| Specialized (Logistics, Labs) | Strategic Urban Areas | |||

| Assisted Living/Healthcare (Owned) | Various Locations |

What is included in the product

This analysis offers a comprehensive breakdown of Swiss Prime Site's Product, Price, Place, and Promotion strategies, grounded in real brand practices and competitive context.

It's designed for professionals seeking a deep understanding of Swiss Prime Site's marketing positioning, providing actionable insights and a strong foundation for strategic decision-making.

Simplifies complex marketing strategies by clearly outlining Swiss Prime Site's 4Ps, alleviating the pain of information overload for busy executives.

Provides a clear, actionable framework for understanding and implementing Swiss Prime Site's marketing approach, removing the guesswork from strategic planning.

Place

Swiss Prime Site strategically places its properties in Switzerland's most dynamic economic centers and highly accessible, prime locations. These areas typically boast robust economic expansion, increasing populations, and a consistent demand for premium commercial and residential spaces. This deliberate approach ensures high visibility and appeal for both tenants and investors.

The company's portfolio is thoughtfully spread across major Swiss cities, including Zurich, Geneva, and Bern. For example, as of late 2024, Zurich, Switzerland's largest city, continued to demonstrate strong economic activity, with office vacancy rates remaining low at approximately 2.5%. This diversification helps mitigate risks associated with any single regional market.

Swiss Prime Site directly manages the leasing of its extensive commercial property portfolio, serving a broad spectrum of around 2,000 tenants. This direct interaction fosters strong tenant relationships and ensures efficient property operations, contributing to a consistently low vacancy rate, a key indicator of market demand and property appeal.

When it comes to property sales, especially as part of strategic portfolio adjustments and capital recycling, Swiss Prime Site employs a direct handling approach or utilizes established real estate networks. This ensures that asset disposals are managed effectively, aligning with the company's financial objectives and market positioning.

Swiss Prime Site Solutions offers specialized investment platforms, like the Swiss Prime Investment Foundation and the Swiss Prime Site Solutions Investment Fund Commercial. These act as crucial avenues for qualified investors to access real estate assets. For example, as of the end of 2023, Swiss Prime Site Solutions managed a real estate portfolio with a total value of approximately CHF 12.4 billion, demonstrating significant scale.

These platforms allow for direct investment into meticulously chosen commercial and residential properties. They are designed to meet distinct investor requirements, providing diversified exposure specifically within the Swiss real estate market. This targeted approach aims to capture opportunities in a stable and sought-after market.

Digital Investor Relations and Reporting

Swiss Prime Site leverages its digital investor relations platform to provide transparent access to investment opportunities and financial performance data. Information regarding sustainability initiatives is also readily available, ensuring a comprehensive view for global stakeholders. This digital accessibility is crucial for informed decision-making by a diverse range of financially-literate individuals.

Online presentations and detailed reports offer in-depth insights into Swiss Prime Site's operational strategies and future outlook. For instance, the company's 2024 interim report, available digitally, details their financial performance and strategic advancements. This proactive digital engagement facilitates a deeper understanding of the company’s value proposition.

- Digital Accessibility: Comprehensive online channels including the company website and downloadable reports.

- Key Information: Investment opportunities, financial performance, and sustainability efforts are clearly communicated.

- Insight Delivery: Online presentations and detailed reports offer deep dives into operations and strategy.

- Data Availability: Easy access to critical data for global financially-literate decision-makers.

Strategic Partnerships and Networks

Swiss Prime Site actively cultivates strategic partnerships, leveraging its deep roots in the Swiss real estate ecosystem. This collaborative approach is crucial for both developing new projects and efficiently managing its extensive property portfolio. By engaging with a broad spectrum of stakeholders, the company solidifies its market position and drives operational excellence.

A key facet of this strategy involves fostering innovation through collaborations with startups. Swiss Prime Site's accelerator program actively supports ventures in PropTech and CleanTech, integrating cutting-edge solutions into its operations. This forward-thinking engagement not only injects new ideas but also enhances market reach and operational efficiencies.

- Innovation Hub: Swiss Prime Site's accelerator program actively supports startups, particularly in PropTech and CleanTech, as of the latest reporting periods in 2024.

- Portfolio Enhancement: Partnerships are instrumental in the strategic expansion and optimization of its diverse real estate holdings.

- Market Reach: Collaborations extend Swiss Prime Site's influence and access within the competitive Swiss real estate landscape.

- Operational Efficiency: Strategic alliances contribute to streamlined property management and development processes, bolstering overall performance.

Swiss Prime Site's placement strategy emphasizes prime, high-demand locations across major Swiss economic hubs like Zurich and Geneva. This focus ensures consistent tenant interest and investor appeal, with Zurich, for example, maintaining a low office vacancy rate around 2.5% as of late 2024. Their portfolio is geographically diversified, mitigating regional market risks.

What You See Is What You Get

Swiss Prime Site 4P's Marketing Mix Analysis

The preview shown here is the exact Swiss Prime Site 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis covers product, price, place, and promotion strategies tailored for Swiss Prime Site. You're viewing the actual, finished version, ready for immediate implementation. This isn't a demo or a sample; it's the complete report you'll download. Buy with full confidence, knowing you're getting the genuine article.

Promotion

Swiss Prime Site emphasizes clear communication with stakeholders via its annual and semi-annual reports, investor presentations, and timely ad-hoc announcements. These publications offer detailed insights into financial achievements, strategic advancements, and key operational metrics, serving as vital resources for investors and analysts.

For example, their 2024 annual report highlighted substantial increases in rental income and assets under management, demonstrating robust financial health and strategic execution.

Swiss Prime Site actively cultivates its investor relations, hosting capital markets days and analyst meetings to foster transparency. This proactive approach ensures both institutional and private investors receive comprehensive updates on the company's strategic direction, financial performance, and future projections. For instance, in 2023, the company reported a net profit of CHF 297 million, underscoring its financial stability.

Direct communication channels are maintained to provide timely information on crucial matters such as dividend proposals and financing activities. This commitment to open dialogue aims to build and sustain investor confidence by keeping stakeholders well-informed about the company's operational and financial developments, reinforcing their understanding of Swiss Prime Site's value proposition.

Swiss Prime Site actively showcases its dedication to sustainability via its annual sustainability reports, detailing its Environmental, Social, and Governance (ESG) performance. In 2023, the company achieved a significant milestone by reducing its CO2 emissions from heating by 32% compared to the 2019 baseline, demonstrating tangible progress towards its climate goals.

The company emphasizes its commitment to circular economy principles and its portfolio of properties holds numerous certifications, such as DGNB and LEED, reflecting high standards in sustainable building practices. This transparent reporting on ESG metrics and concrete sustainability actions appeals strongly to the growing segment of responsible investors.

By detailing progress on climate targets, property certifications, and circular economy initiatives, Swiss Prime Site not only aligns with investor expectations but also strengthens its overall corporate reputation as a forward-thinking and responsible real estate entity.

Targeted Media Releases and News Coverage

Swiss Prime Site strategically leverages targeted media releases to communicate key developments. For instance, in early 2024, the company announced its acquisition of the Klybeckplus site in Basel, a significant move for its development pipeline. These announcements are disseminated through established financial news services, ensuring reach to investors and industry analysts.

The company's commitment to transparency is evident in its regular reporting of financial results. In their 2023 annual report, Swiss Prime Site highlighted a net profit of CHF 208 million, demonstrating solid financial performance. This data is crucial for stakeholders assessing the company's value and stability.

Swiss Prime Site utilizes its own communication channels, including a dedicated investor relations section on its website, to complement external media coverage. This direct approach reinforces the message and provides immediate access to information for a broad audience. The company's strategy ensures that vital corporate updates, from property transactions to financial health, are effectively communicated.

- Property Acquisitions: Timely announcements of strategic property purchases, like the Klybeckplus site in Basel in early 2024.

- Development Milestones: Updates on progress in significant development projects across Switzerland.

- Financial Results: Regular dissemination of financial performance, such as the CHF 208 million net profit reported for 2023.

- Distribution Channels: Utilization of financial news platforms and the company's own media for broad coverage.

Innovation and Ecosystem Engagement

Swiss Prime Site actively fosters innovation and engages with its ecosystem through programs like its Start-up Accelerator. This initiative specifically seeks out and supports emerging technologies in key sectors such as real estate technology, mobility solutions, and clean energy. By championing these advancements, Swiss Prime Site not only injects fresh ideas into the property sector but also solidifies its reputation as a forward-thinking leader.

This commitment to innovation through its accelerator program, which has seen participation from numerous startups aiming to disrupt the built environment, attracts a wider audience. It draws the attention of the broader technology and innovation community, creating valuable connections and potential partnerships. For example, in 2024, the accelerator program reported a 30% increase in applications compared to the previous year, highlighting growing interest and the program's expanding reach.

- Start-up Accelerator Programme: Focuses on real estate tech, mobility, and clean technology.

- Industry Leadership: Positions Swiss Prime Site as a pioneer in adopting future-oriented solutions.

- Ecosystem Engagement: Attracts and connects with the broader tech and innovation community.

- Growth in Participation: Saw a 30% rise in applications in 2024, indicating strong ecosystem interest.

Swiss Prime Site effectively promotes its brand and offerings through consistent communication of its financial performance and strategic initiatives. For instance, the company reported a net profit of CHF 208 million for 2023, a figure prominently shared to underscore its financial stability and operational success. This clear articulation of financial health, alongside announcements of key acquisitions like the Klybeckplus site in Basel in early 2024, builds investor confidence and market awareness.

| Promotional Activity | Key Data/Event | Impact |

|---|---|---|

| Financial Reporting | Net Profit 2023: CHF 208 million | Demonstrates financial strength and stability |

| Strategic Announcements | Klybeckplus Site Acquisition (Early 2024) | Highlights growth strategy and development pipeline |

| Innovation Programs | Start-up Accelerator (30% application increase in 2024) | Positions company as forward-thinking and attracts tech talent |

| Sustainability Communication | 32% CO2 reduction (vs. 2019 baseline) | Appeals to ESG-conscious investors and enhances reputation |

Price

Swiss Prime Site's rental income is a cornerstone of its financial strength, consistently delivering stable cash flows supported by remarkably low vacancy rates. This reliability is a key attraction for investors seeking dependable returns.

The company boasts a weighted average unexpired lease term (WAULT) that is notably long, providing a predictable revenue stream for years to come. This long-term visibility is crucial for financial planning and valuation.

Furthermore, Swiss Prime Site benefits from regular rental increases, often tied to inflation through indexation clauses. For example, in 2024, inflation adjustments played a significant role in bolstering rental income across their portfolio.

This combination of long leases and built-in rental growth mechanisms creates a robust and resilient income base, underpinning the company's overall market valuation and investor appeal.

Swiss Prime Site's asset management fee income is a key growth driver, primarily from its Swiss Prime Site Solutions division. This segment has seen substantial expansion, especially following the acquisition of Fundamenta, which broadened its assets under management significantly. As of the first half of 2024, assets under management for Swiss Prime Site Solutions reached CHF 14.5 billion, directly boosting fee-related earnings. This growing fee income diversifies revenue and enhances the company's financial stability.

Swiss Prime Site strategically manages its property portfolio by actively selling mature assets, often at prices exceeding appraisals. For instance, in 2023, the company reported gains from property sales, demonstrating a successful capital recycling approach. This generates capital for reinvestment in high-potential development projects and accretive acquisitions, thereby optimizing the overall asset base and enhancing financial flexibility.

Conservative Financing and Capital Structure

Swiss Prime Site champions a conservative financial approach, prioritizing a robust equity foundation to maintain a loan-to-value ratio below 40%. This prudent strategy underpins their financial resilience and facilitates access to favorable financing terms.

The company diversifies its funding streams, notably through sustainability-linked bonds, and strategically raises capital via share placements and fund issuances. This multi-pronged approach strengthens their financial flexibility.

- Conservative LTV: Aims to keep the loan-to-value ratio under 40%, as of recent reports.

- Diverse Funding: Utilizes sustainability-linked bonds, share placements, and fund issues.

- Financial Stability: This conservative financing strategy ensures strong financial health.

- Attractive Conditions: Facilitates access to competitive financing rates and terms.

Attractive Shareholder Distributions

Swiss Prime Site demonstrates a strong commitment to rewarding its shareholders through attractive distributions. For the 2024 financial year, the company proposed an increased dividend per share, building on robust earnings growth. This policy is designed to appeal to investors prioritizing steady income streams from their investments.

The company targets a high payout ratio from its funds from operations (FFO I), a key metric for real estate investment trusts. This focus on distributing a significant portion of its operational earnings underscores its dedication to shareholder returns.

- Proposed Dividend for 2024: CHF 3.40 per share, an increase from CHF 3.30 in 2023.

- Payout Ratio Target: Aiming for a payout ratio of approximately 75% of FFO I.

- Attractiveness to Income Investors: The consistent dividend growth and high payout ratio make Swiss Prime Site shares appealing for income-focused portfolios.

- Shareholder Value Creation: This distribution policy is a cornerstone of the company's strategy to enhance overall shareholder value.

Swiss Prime Site's pricing strategy is deeply intertwined with the quality and desirability of its prime real estate locations. The company focuses on premium rental income, reflecting the high demand and inherent value of its properties in top Swiss cities like Zurich, Geneva, and Bern. This premium positioning allows for consistently strong rental yields.

The rental income is further enhanced by contractual rent increases, often linked to inflation, ensuring that revenue keeps pace with economic conditions. For example, the company's rental income for the first half of 2024 showed resilience, partly due to these indexation clauses. This predictable escalation of rental income supports a premium valuation for the company's assets.

Furthermore, Swiss Prime Site's development pipeline, focused on high-growth urban centers, contributes to future rental income potential. Projects in prime locations are priced to capture maximum market value upon completion, reinforcing the premium pricing approach across the portfolio.

| Metric | Value (H1 2024) | Commentary |

|---|---|---|

| Rental Income Growth | Reported positive growth | Driven by indexation and occupancy |

| Average Rent per Sqm | Premium market rates | Reflects prime locations |

| Development Pipeline Value | Significant ongoing projects | Supports future rental premium |

4P's Marketing Mix Analysis Data Sources

Our Swiss Prime Site 4P's analysis is built on a foundation of verifiable data, including official company reports, investor relations materials, and detailed property portfolio information. We also incorporate market research, competitive intelligence, and publicly available real estate transaction data to ensure a comprehensive view.