SPI Energy Co. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPI Energy Co. Bundle

SPI Energy Co. demonstrates significant strengths in its expanding solar project portfolio and growing global presence, positioning it as a key player in the renewable energy sector. However, understanding the nuances of its operational efficiencies and potential market saturation is crucial for any strategic investor.

While SPI Energy benefits from supportive government policies and a rising demand for clean energy, it also faces considerable threats from intense competition and evolving regulatory landscapes. Unpacking these dynamics is essential for informed decision-making.

Discover the complete picture behind SPI Energy's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors seeking to capitalize on the renewable energy boom.

Strengths

SPI Energy Co., Ltd. boasts a significant strength through its diversified green energy portfolio, strategically positioned across both the photovoltaic (PV) and electric vehicle (EV) sectors.

This dual approach allows SPI Energy to capitalize on growth opportunities in two critical areas of the clean energy transition, creating multiple avenues for revenue generation.

The company's involvement spans the entire solar value chain, from project development and financing to operation, while also expanding into the increasingly vital EV charging infrastructure market.

This diversification mitigates risk and enhances resilience, as demonstrated by the company’s ongoing expansion of its solar projects and the growing demand for EV charging solutions, which saw a global market size of approximately $33.8 billion in 2023, projected to reach $150 billion by 2030.

SPI Energy Co.'s global operational presence is a significant strength, allowing it to tap into diverse renewable energy markets across North America, Australia, Asia, and Europe. This international footprint, with established operations in countries like the U.S., U.K., Greece, Japan, and Italy, grants access to varied growth opportunities and regulatory landscapes. For instance, the company's significant solar project development in the U.S. and its expansion into European markets highlight this broad reach.

SPI Energy boasts end-to-end capabilities in the solar sector, managing projects from initial development and financing through to ongoing ownership and operation. This full-spectrum approach grants them significant control over project quality and cost management, contributing to improved efficiency and profitability.

In 2023, SPI Energy's SolarGo platform facilitated the sale of over 15,000 solar energy systems, demonstrating the scale of their project execution capabilities. Their integrated model allows for streamlined processes, which is crucial for capturing value across the entire solar project lifecycle.

Commitment to American-Made Solar Manufacturing

SPI Energy's commitment to American-made solar manufacturing through its Solar4America subsidiary is a significant strength. The company has been actively expanding its domestic production capabilities, aiming for an impressive 2.4 gigawatts (GW) of solar module manufacturing capacity in 2023, with ambitious plans to reach 5.0 GW by 2024. This strategic move positions SPI Energy to capitalize on the growing demand for U.S.-sourced solar products.

This focus on domestic production allows SPI Energy to leverage significant government incentives, such as those provided by the Inflation Reduction Act. These incentives are designed to bolster American manufacturing and renewable energy deployment, offering a competitive advantage. By aligning with these policy tailwinds, SPI Energy is well-positioned to capture market share and drive growth in the burgeoning U.S. solar market.

- Expanded U.S. Manufacturing: SPI Energy's Solar4America subsidiary is increasing its U.S. solar module manufacturing capacity.

- Production Targets: Plans include reaching 2.4GW in 2023 and scaling to 5.0GW by 2024.

- Leveraging Incentives: This domestic focus is strategically aligned to benefit from government programs like the Inflation Reduction Act.

- Meeting Market Demand: The expansion addresses the increasing consumer and business preference for U.S.-made solar components.

Strategic Asset Reintegration and Revenue Potential

SPI Energy's strategic asset reintegration, particularly the January 2025 settlement in Greece, marks a significant strengthening. This agreement restored control over 26.57 MW of solar assets, more than doubling their operational solar capacity from 17.51 MW to approximately 44.08 MW.

The impact of this move is substantial, with the reintegrated projects expected to contribute an additional €8-10 million in annual revenue. This infusion of revenue not only bolsters SPI Energy's financial performance but also diversifies its income streams.

- Increased Operational Capacity: Gained control of 26.57 MW of Greek solar assets in January 2025, raising total operational solar capacity to ~44.08 MW.

- Revenue Enhancement: Projected to generate an additional €8-10 million in annual revenue from these restored projects.

- Financial De-risking: The expanded and stabilized asset base improves the company's financial profile and reduces operational risk.

- Strategic Market Position: Reasserts control over key energy assets, strengthening its position in the Greek market.

SPI Energy's diversified green energy portfolio, encompassing both photovoltaic (PV) and electric vehicle (EV) sectors, presents a core strength. This dual focus allows the company to capitalize on growth across critical clean energy transition areas, generating multiple revenue streams.

The company's global operational presence across North America, Australia, Asia, and Europe provides access to varied markets and regulatory environments. SPI Energy's end-to-end capabilities in the solar sector, from development to operation, ensure project control and cost management.

A key strategic advantage is SPI Energy's commitment to American-made solar manufacturing through Solar4America, aiming to reach 5.0 GW of module manufacturing capacity by 2024. This aligns with government incentives like the Inflation Reduction Act, bolstering competitiveness in the U.S. market.

The January 2025 settlement in Greece significantly boosted SPI Energy's operational capacity by restoring control of 26.57 MW of solar assets, increasing total operational solar capacity to approximately 44.08 MW. These reintegrated projects are projected to add €8-10 million in annual revenue, enhancing financial performance and diversifying income.

| Strength | Description | Key Metric/Data |

|---|---|---|

| Diversified Portfolio | Presence in both PV and EV sectors | Global EV charging market size projected to reach $150 billion by 2030. |

| Global Operations | Operations in North America, Australia, Asia, Europe | Established operations in U.S., U.K., Greece, Japan, Italy. |

| End-to-End Solar Capabilities | Full lifecycle management of solar projects | SolarGo platform facilitated sale of over 15,000 systems in 2023. |

| U.S. Manufacturing Focus | Solar4America subsidiary | Targeting 5.0 GW solar module manufacturing capacity by 2024. |

| Asset Reintegration (Greece) | Restored control of 26.57 MW solar assets | Expected to add €8-10 million in annual revenue. |

What is included in the product

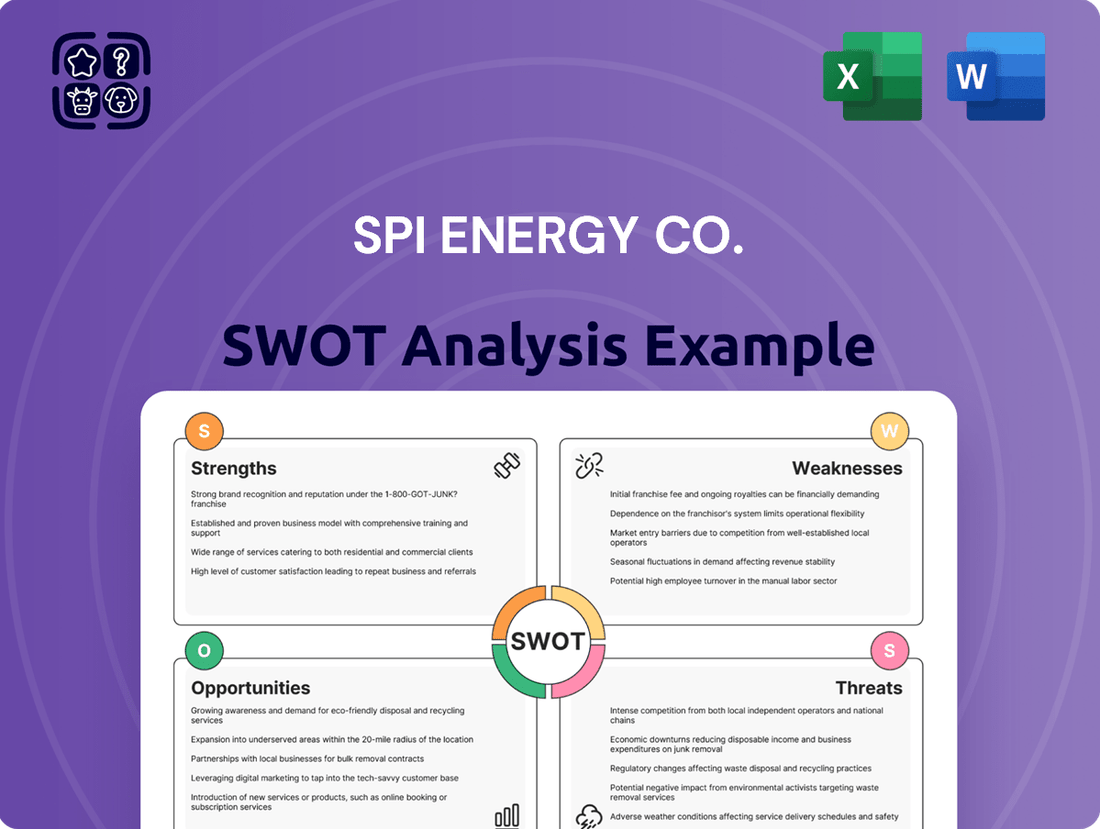

SPI Energy Co.'s SWOT analysis identifies key internal strengths and weaknesses alongside external opportunities and threats, offering a comprehensive view of its strategic position and market challenges.

Offers a clear breakdown of SPI Energy's competitive landscape, highlighting areas for strategic improvement and risk mitigation.

Weaknesses

SPI Energy Co. has struggled to translate revenue growth into consistent profits, frequently reporting net losses. This trend continued into 2023, with the company posting a significant net loss of $103.55 million, following a loss of $33.42 million in 2022. Such persistent unprofitability raises serious questions about the company's long-term financial health and its capacity to deliver sustainable shareholder value.

SPI Energy Co. faces a significant challenge with its substantial debt burden. As of the first quarter of 2024, the company reported total debt of approximately $230 million. This level of indebtedness creates considerable financial pressure, requiring substantial interest payments and posing risks if market conditions deteriorate or revenue streams falter.

Furthermore, the company exhibits a concerning trend of rapid cash burn. In Q1 2024, SPI Energy's operating cash flow was negative $15.5 million. This ongoing depletion of cash reserves, coupled with short-term obligations that have at times outweighed its liquid assets, highlights potential liquidity issues. Such a situation could necessitate additional financing, potentially at less favorable terms, or even impact the company's ability to meet its immediate financial commitments.

SPI Energy faces a significant weakness in its potential delisting from the Nasdaq. The company has repeatedly received notices for failing to meet minimum bid price requirements and for delays in submitting crucial financial reports, including its 2023 annual report and the first two quarterly reports of 2024. This persistent non-compliance creates a substantial risk that could severely impact its market standing.

The ongoing threat of Nasdaq delisting directly undermines investor confidence in SPI Energy. Such a delisting would drastically reduce the liquidity of its shares, making it much harder for investors to buy or sell. Furthermore, it would severely hinder the company's capacity to attract new capital, a critical factor for growth and operational stability in the competitive energy sector.

Operational Setbacks in Manufacturing Facilities

SPI Energy has faced significant operational setbacks. As of April 2025, their panel-manufacturing facility located in California has ceased operations. Furthermore, the planned cell-production site in South Carolina never actually became operational.

These developments underscore considerable challenges in executing manufacturing expansion strategies. The inability to bring these facilities online directly impacts SPI Energy's domestic production capabilities and supply chain reliability.

- California Plant Closure: The panel-manufacturing plant in California is no longer in operation as of April 2025.

- South Carolina Facility Inactivity: The cell-production site in South Carolina never commenced operations.

- Execution Failure: These events highlight a failure to execute on announced manufacturing expansion plans.

- Reduced Domestic Production: The shutdowns directly diminish the company's domestic manufacturing capacity.

Volatile Stock Performance and Low Market Capitalization

SPI Energy Co. has grappled with significant stock price instability. The company’s shares saw a sharp decline, hitting a 52-week low of $0.27 in August 2024. This volatility culminated in its delisting from the Nasdaq exchange in January 2025, severely impacting investor confidence and liquidity.

The firm’s relatively small market capitalization, reported at $15.28 million in April 2024, presents a notable weakness. This modest valuation suggests a limited scale of operations within the broader renewable energy industry. Such a characteristic can hinder its capacity to secure substantial funding for expansion or research and development initiatives, putting it at a disadvantage compared to larger, more established competitors.

- Volatile Stock Performance: Reached a 52-week low of $0.27 in August 2024.

- Delisting from Nasdaq: Occurred in January 2025, indicating compliance or financial distress issues.

- Low Market Capitalization: Stood at $15.28 million as of April 2024.

- Limited Capital Raising Ability: Small scale restricts access to funding for growth and investment.

SPI Energy Co. faces ongoing financial instability, evidenced by persistent net losses. For instance, the company reported a substantial net loss of $103.55 million in 2023. This unprofitability raises concerns about its ability to generate sustainable returns for investors.

The company carries a significant debt load, with total debt reported at approximately $230 million as of Q1 2024. This high leverage creates financial strain, demanding considerable interest payments and amplifying risks during economic downturns.

SPI Energy has also demonstrated a pattern of rapid cash depletion. In Q1 2024, operating cash flow was negative $15.5 million, indicating an ongoing outflow of cash that could strain liquidity and necessitate costly financing.

The company's operational execution has been flawed, with its California panel-manufacturing facility ceasing operations in April 2025 and a South Carolina cell-production site never becoming operational. These failures significantly curtail its domestic manufacturing capabilities and supply chain reliability.

SPI Energy's stock experienced extreme volatility, hitting a 52-week low of $0.27 in August 2024, and was subsequently delisted from the Nasdaq in January 2025. This delisting severely impacts investor confidence and the liquidity of its shares, making it harder to trade and attract new capital.

The company's small market capitalization, just $15.28 million in April 2024, limits its ability to secure substantial funding for growth initiatives. This positions SPI Energy at a disadvantage against larger competitors in the renewable energy sector.

| Financial Metric | 2023 (Millions USD) | Q1 2024 (Millions USD) | April 2024 (Millions USD) |

|---|---|---|---|

| Net Loss | $103.55 | N/A | N/A |

| Total Debt | N/A | $230 | N/A |

| Operating Cash Flow | N/A | ($15.5) | N/A |

| Market Capitalization | N/A | N/A | $15.28 |

Preview the Actual Deliverable

SPI Energy Co. SWOT Analysis

This is the actual SPI Energy Co. SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It meticulously details their Strengths, Weaknesses, Opportunities, and Threats. This comprehensive overview provides actionable insights into the company's strategic position. Purchase unlocks the entire in-depth version for your analysis needs.

Opportunities

The worldwide movement towards cleaner energy sources is a major plus for SPI Energy. This trend means more people and businesses want solar power and electric vehicle (EV) charging solutions, which SPI Energy offers. Governments around the globe are pushing for greener practices, creating a steady demand for these technologies.

Globally, renewable energy capacity is on the rise. For instance, solar power installations are projected to reach over 2,500 GW by the end of 2025, a significant jump from previous years. This expanding market means more opportunities for companies like SPI Energy to grow their presence and sales in both solar energy systems and EV charging infrastructure.

The global electric vehicle (EV) charging infrastructure market is a significant growth area, expected to reach $2.8 billion in 2024. This market is forecast to expand at a compound annual growth rate (CAGR) of 23.1% from 2025 through 2034, indicating a substantial upward trend.

SPI Energy's established portfolio of EV charging solutions, encompassing both hardware and associated services, places the company in a strong position to leverage this market expansion. As the adoption of electric vehicles continues to accelerate worldwide, the demand for robust and accessible charging networks will only increase.

This burgeoning market presents a clear opportunity for SPI Energy to broaden its market share and revenue streams by offering its expertise and products to meet the growing global demand for EV charging infrastructure.

Government incentives and favorable policies are a significant tailwind for SPI Energy. For instance, the Inflation Reduction Act (IRA) in the U.S. provides substantial tax credits and incentives for renewable energy projects and electric vehicle (EV) adoption. These policies directly translate into increased demand and more attractive project economics for companies like SPI Energy, facilitating greater investment in solar and EV charging infrastructure.

The IRA, enacted in August 2022, allocates over $370 billion towards climate and energy security, with a significant portion dedicated to clean energy tax credits. These credits, such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC), can reduce the upfront cost of solar installations and improve the long-term profitability of renewable energy projects. This makes SPI Energy's offerings more competitive and accessible to a broader market.

Beyond the U.S., other regions are also implementing supportive measures. Many countries are setting ambitious renewable energy targets and offering various financial mechanisms, including feed-in tariffs and grants, to accelerate the transition to cleaner energy sources. These global trends create a more robust and expanding market for SPI Energy's solar and EV solutions.

Technological Advancements in Solar and EV

SPI Energy's commitment to research and development is a significant opportunity, particularly in enhancing solar module efficiency and advancing EV charging solutions. This focus on innovation, especially with technologies like n-type TOPCon solar cells, positions the company to capture new market segments and boost its competitive standing.

The development of megawatt charging technologies is another key avenue for growth, promising to unlock greater efficiency and broader adoption of electric vehicles.

As of early 2024, the global solar market continues its robust expansion, with projections indicating sustained growth driven by technological advancements and supportive policies. Similarly, the electric vehicle market is experiencing exponential growth, with charging infrastructure development being a critical enabler. SPI Energy's investments in these areas align directly with these powerful market trends.

Key opportunities stemming from technological advancements include:

- Enhanced Product Performance: Continued R&D in high-efficiency solar modules and advanced EV charging can lead to superior product offerings.

- Market Segment Expansion: Innovations like n-type TOPCon solar cells and megawatt charging can open doors to previously inaccessible markets.

- Improved Operational Efficiency: Technological upgrades can streamline manufacturing processes and charging operations, reducing costs.

- Strategic Partnerships: Technological leadership can attract strategic partnerships with automotive manufacturers and energy providers.

Strategic Partnerships and Market Diversification

SPI Energy's strategic partnerships are a key opportunity for expansion. For instance, their joint agreement with Liuzhou Liancheng Industrial Co., Ltd. and Guangxi Dazhou Automobile Sales Co., Ltd. aims to build out electric vehicle (EV) supply chains and sales networks. This type of collaboration can unlock new markets, especially in regions like South America and the Asia Pacific, driving significant growth.

Diversifying into adjacent green industries presents another avenue for leveraging SPI Energy's core competencies. Expanding into battery storage solutions, for example, capitalizes on the increasing demand for renewable energy integration. This strategic move allows the company to utilize its existing expertise and financial resources to tap into rapidly expanding sectors, further solidifying its market position.

- Market Expansion: Partnerships like the one with Liuzhou Liancheng Industrial Co., Ltd. and Guangxi Dazhou Automobile Sales Co., Ltd. are designed to enhance market access in untapped regions such as South America and the Asia Pacific.

- EV Supply Chain Integration: Collaborations focus on building robust supply chains and sales infrastructure for electric vehicles, a rapidly growing segment of the automotive market.

- Industry Diversification: SPI Energy can capitalize on its financial strength and technical knowledge by expanding into areas like battery storage, a critical component of the renewable energy ecosystem.

- Revenue Growth: Diversification into fast-growing green industries and expansion into new geographic markets are projected to contribute to increased revenue streams and overall financial performance.

The global push for renewable energy and electric vehicles creates substantial opportunities for SPI Energy. The company is well-positioned to capitalize on the projected growth in solar installations, which are expected to exceed 2,500 GW by the end of 2025. Furthermore, the EV charging infrastructure market is anticipated to reach $2.8 billion in 2024 and grow at a CAGR of 23.1% through 2034, offering a significant expansion runway for SPI Energy's charging solutions.

Threats

SPI Energy operates in exceptionally crowded markets. The renewable energy sector, particularly solar, sees fierce competition from global giants and emerging local players, all vying for installations and project development. Similarly, the electric vehicle (EV) market is experiencing rapid growth, attracting a multitude of established automakers and a wave of new, innovative EV manufacturers, leading to intense pressure on product differentiation and pricing.

This competitive landscape directly impacts SPI Energy's ability to maintain pricing power and secure market share. For instance, in 2023, the global solar PV market saw significant price declines in modules due to oversupply, a trend that continued into early 2024, squeezing margins for many participants. In the EV space, new model launches and aggressive sales incentives by major players like Tesla and BYD in 2024 further intensify the challenge for companies like SPI Energy to capture and retain customers.

To counter these threats, SPI Energy must constantly innovate its product offerings and optimize its operational efficiencies. This includes investing in research and development for more advanced solar technologies and battery solutions, while also streamlining its supply chain and manufacturing processes. Failure to do so could lead to erosion of profitability and a shrinking market presence as competitors with more advanced or cost-effective solutions gain traction.

Changes in government policies, regulations, or a reduction in subsidies for renewable energy and electric vehicles could significantly impact project viability and demand for SPI Energy's offerings. The company's reliance on a supportive policy environment makes it susceptible to shifts in political and economic landscapes. For instance, in late 2023 and early 2024, discussions around potential adjustments to renewable energy tax credits in various regions could introduce uncertainty for future project financing and development.

SPI Energy faces significant risks from fluctuating raw material costs, particularly for polysilicon and other components essential for solar panel production. For instance, polysilicon prices saw considerable volatility in 2023, with some periods experiencing double-digit percentage increases, directly impacting manufacturing expenses. This volatility, coupled with potential supply chain disruptions stemming from geopolitical tensions or trade restrictions, could squeeze SPI Energy's gross margins and affect its cost of revenues.

Capital Intensity and Access to Financing

SPI Energy's solar and electric vehicle (EV) projects demand significant upfront capital for development, financing, ownership, and ongoing operations. This capital intensity is a major hurdle. For instance, large-scale solar farms can cost tens to hundreds of millions of dollars to build.

The company's existing financial position, including its debt load and liquidity challenges, directly impacts its ability to attract new funding. Difficulty in securing sufficient and reasonably priced financing could severely restrict SPI Energy's expansion plans and even threaten its day-to-day operational stability.

- High Capital Requirements: Developing and operating solar and EV projects necessitates substantial financial investment.

- Debt Burden Impact: SPI Energy's existing debt may make it harder to secure additional financing on favorable terms.

- Liquidity Constraints: Limited cash flow can impede the company's ability to fund new projects or manage existing ones.

- Growth Hindrance: Access to capital is critical for scaling operations, and any disruption here directly impacts growth potential.

Technological Obsolescence and Rapid Innovation Cycles

The relentless pace of technological advancement in solar and electric vehicle (EV) sectors presents a significant risk of obsolescence for SPI Energy's current offerings. Competitors consistently introduce more efficient and cost-effective solutions, pressuring SPI Energy to keep pace.

To counter this, substantial and ongoing investment in research and development is critical. For instance, solar panel efficiency continues to climb, with advancements like heterojunction technology pushing conversion rates beyond 25% in some lab settings as of early 2025. Similarly, EV battery technology is seeing rapid improvements in energy density and charging speeds. SPI Energy's ability to innovate and integrate these new technologies will be paramount to maintaining its competitive edge.

- Rapid Innovation: The solar industry saw module efficiencies increase by an average of 0.5% annually in recent years, while EV battery costs per kWh have fallen by over 10% year-over-year.

- R&D Investment: Companies in the renewable energy sector are allocating an increasing portion of their revenue to R&D, with some leaders investing upwards of 5% to stay ahead.

- Competitive Landscape: Failure to adapt to new technologies, such as perovskite solar cells or solid-state batteries, could lead to significant market share erosion.

- Product Lifecycles: Shorter product lifecycles in both solar and EV markets necessitate a proactive approach to technology adoption and product upgrades.

SPI Energy faces intense competition in both the solar and electric vehicle (EV) markets, with global giants and emerging players constantly vying for market share. This crowded environment, coupled with rapid technological advancements in both sectors, puts significant pressure on pricing and product differentiation. For example, in 2024, continued price declines in solar modules due to oversupply and aggressive EV pricing strategies from major automakers are squeezing profit margins for companies like SPI Energy.

The company's substantial capital requirements for project development and operations, combined with existing debt and potential liquidity constraints, create a significant barrier to growth and operational stability. Securing adequate and affordable financing is crucial, especially as large-scale solar projects can cost hundreds of millions of dollars. Any disruption in accessing capital directly hinders expansion plans.

Changes in government policies and subsidies for renewable energy and EVs pose a considerable threat, as SPI Energy relies on a supportive regulatory environment. For instance, potential adjustments to renewable energy tax credits in various regions in late 2023 and early 2024 introduce uncertainty for future project financing. Furthermore, fluctuating raw material costs, such as volatile polysilicon prices observed in 2023, directly impact manufacturing expenses and can squeeze gross margins.

The rapid pace of technological innovation in solar and EV sectors risks rendering SPI Energy's current offerings obsolete. Companies are investing heavily in R&D, with solar panel efficiencies steadily increasing and EV battery technology seeing rapid improvements in energy density and charging speeds. For instance, advancements in solar panel efficiency are pushing conversion rates beyond 25% in lab settings as of early 2025, necessitating continuous adaptation.

SWOT Analysis Data Sources

This SPI Energy Co. SWOT analysis is built upon comprehensive financial reports, detailed market intelligence, and expert industry commentary to provide a robust and actionable overview.