SPI Energy Co. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPI Energy Co. Bundle

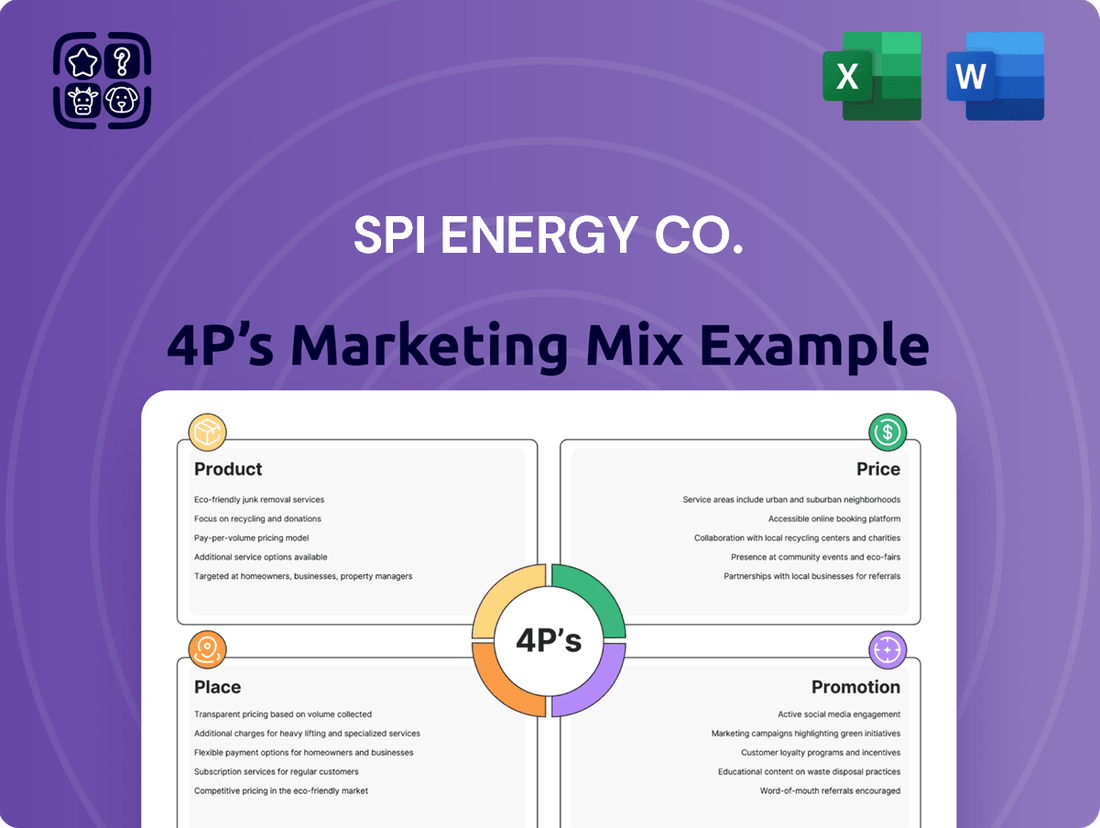

SPI Energy Co.'s marketing strategy is a dynamic interplay of its product offerings, pricing models, distribution channels, and promotional activities. Understanding how these elements combine is crucial for grasping their market position and competitive edge.

Dive deeper into SPI Energy Co.'s carefully crafted product portfolio, from solar panels to energy storage solutions, and see how it addresses diverse customer needs in the renewable energy sector.

Explore the pricing strategies SPI Energy Co. employs to remain competitive while capturing value, and discover how their distribution network ensures accessibility to their innovative energy products.

Uncover the promotional tactics SPI Energy Co. utilizes to build brand awareness and drive demand, from digital marketing to industry partnerships.

Gain actionable insights and a comprehensive understanding of SPI Energy Co.'s entire marketing mix by accessing the full, editable 4P's analysis today.

Product

SPI Energy's solar project development and ownership is central to its strategy, encompassing the entire lifecycle from conception to operation. This includes financing, building, and managing solar farms and rooftop installations, catering to both large utility clients and individual homeowners. By the end of 2023, SPI Energy reported a significant increase in its solar project pipeline, with over 1,000 MW of projects under development, highlighting its commitment to expanding clean energy access.

The company’s downstream focus means it directly engages with the end-users of solar power. This approach allows SPI Energy to capture value across the entire solar energy value chain, from module manufacturing through its subsidiary SolarJuice, to project development and energy sales. In the first quarter of 2024, SPI Energy announced the completion of several residential solar projects in California, contributing to the state’s renewable energy goals and demonstrating their capability in diverse market segments.

SPI Energy's EPC services are a cornerstone of their offering, providing third-party solar project developers with end-to-end solutions. This integrated approach covers everything from the initial engineering blueprints to sourcing quality materials and managing the physical construction of solar power plants. Their expertise ensures that partners can confidently develop and deploy reliable solar assets.

In 2023, SPI Energy's EPC segment played a significant role in their overall revenue, contributing to the company's ability to secure new projects and expand its market reach. The demand for efficient and expertly managed solar installations continues to grow, with global solar capacity additions expected to reach record levels in 2024 and beyond, highlighting the critical importance of robust EPC partners.

SPI Energy, through its subsidiary Solar4America, is actively engaged in manufacturing solar cells and modules, emphasizing American-made production. A key initiative involves developing new solar module lines that incorporate innovative materials, such as U.S.-based steel frames. This strategic move targets a reduced carbon footprint and strengthens the domestic supply chain. The company also intends to boost its solar wafer manufacturing capacity, a critical component in solar panel production.

Electric Vehicle (EV) Chargers

SPI Energy's strategic move into the electric vehicle (EV) charging market, spearheaded by its Phoenix Motorcars and EdisonFuture brands, is a key component of its product strategy. They offer a range of charging solutions, from convenient residential AC chargers to robust DC fast chargers for commercial applications. This comprehensive product portfolio directly addresses the growing demand for accessible and efficient EV charging infrastructure.

The company's EV charging products are designed to meet diverse market needs, encompassing both home and public charging scenarios. This product breadth is crucial for capturing a significant share of the expanding EV charging market, which is projected for substantial growth in the coming years. For instance, global EV charging infrastructure investment is expected to reach hundreds of billions of dollars by 2030, highlighting the immense market opportunity.

- Diverse Product Range: SPI Energy offers both Level 2 AC chargers for homes and businesses, and DC fast chargers for rapid public charging.

- Brand Integration: Chargers are offered under the established Phoenix Motorcars and emerging EdisonFuture brands, leveraging existing market presence.

- Market Responsiveness: The product line directly supports the increasing adoption of electric vehicles, a sector experiencing exponential growth globally.

- Infrastructure Focus: SPI Energy's charging solutions are integral to building the necessary EV charging ecosystem, a critical factor for sustained EV market expansion.

EV Solutions & Commercial Electric Vehicles

SPI Energy's Phoenix Motor is making significant strides in the commercial electric vehicle (EV) market. Beyond just charging solutions, they are a key player in developing medium-duty electric vehicles. This includes essential commercial transport like shuttle buses, utility trucks, and cargo trucks, catering to diverse business needs.

The company's product development extends further, showcasing a commitment to a comprehensive EV ecosystem. Phoenix Motor is actively working on new offerings such as electric pickup trucks and scooters. This strategic expansion broadens their portfolio, positioning them as a provider of a wider array of sustainable transportation options for various sectors.

As of early 2024, the global commercial EV market is experiencing robust growth, with projections indicating a significant compound annual growth rate (CAGR) in the coming years, driven by environmental regulations and operational cost savings. For instance, the medium-duty truck segment is expected to see substantial adoption. SPI Energy, through Phoenix Motor, is well-positioned to capitalize on these market trends.

- Product Expansion: Focus on medium-duty commercial EVs like shuttle buses, utility, and cargo trucks.

- Future Development: Actively developing electric pickup trucks and scooters to broaden market reach.

- Market Trend Alignment: Capitalizing on the growing demand for sustainable commercial transportation solutions.

- Strategic Positioning: Enhancing their offering beyond charging infrastructure to provide complete EV solutions.

SPI Energy's product strategy is multifaceted, encompassing both solar energy solutions and electric vehicle infrastructure and vehicles. Their solar offerings range from project development and EPC services to the manufacturing of solar cells and modules through subsidiaries like SolarJuice and Solar4America. This integrated approach ensures control over quality and supply chains, with a focus on American manufacturing. By the end of 2023, SPI Energy had over 1,000 MW of solar projects in its development pipeline, demonstrating significant growth in its core solar business.

In the EV sector, SPI Energy, via Phoenix Motorcars and EdisonFuture, provides comprehensive charging solutions, including residential and commercial AC and DC fast chargers. This directly addresses the rapidly expanding need for EV infrastructure. The company is also actively developing and producing medium-duty electric vehicles, such as shuttle buses and utility trucks, as well as electric pickup trucks and scooters. Global EV charging infrastructure investment is projected to reach hundreds of billions by 2030, underscoring the market opportunity for their charging products.

SPI Energy's product portfolio is designed to capitalize on the global shift towards renewable energy and electric mobility. Their solar segment benefits from the increasing demand for clean energy, with global solar capacity additions expected to reach record levels in 2024. Simultaneously, their EV products are positioned to gain from the substantial growth in the commercial EV market, driven by regulatory tailwinds and operational efficiencies. For instance, the medium-duty truck segment is anticipated to see significant adoption in the coming years.

The company's commitment to manufacturing, exemplified by its U.S.-based solar module lines incorporating materials like U.S.-based steel frames, aims to reduce carbon footprint and bolster domestic supply chains. This strategy extends to increasing solar wafer manufacturing capacity. The expansion into EVs, including commercial vehicles and charging infrastructure, aligns with market trends favoring sustainability and electrification across various sectors.

What is included in the product

This analysis provides a comprehensive 4P marketing mix overview for SPI Energy Co., detailing their product offerings, pricing strategies, distribution channels, and promotional activities to understand their market positioning and competitive approach.

SPI Energy's 4Ps marketing mix analysis acts as a pain point reliever by clearly articulating how their product, pricing, place, and promotion strategies directly address customer needs and market gaps, simplifying complex marketing efforts into actionable insights.

Place

SPI Energy's operational footprint is truly global, spanning North America, Australia, Asia, and Europe. This broad reach is a significant advantage, allowing them to tap into diverse renewable energy markets and serve a wide range of customers. Their headquarters in McClellan Park, California, underscores a strong commitment to their extensive U.S. operations, which are a key component of their international strategy.

SPI Energy Co. primarily employs direct sales for its large-scale solar projects and commercial electric vehicle (EV) charging solutions. This strategy involves engaging directly with project developers, businesses, and government agencies, facilitating tailored proposals and negotiations crucial for high-value, complex B2B transactions.

This direct approach allows SPI Energy to understand specific client needs for commercial solar installations and EV infrastructure, such as the 12 MW solar farm project in the Philippines that began construction in late 2023. By cutting out intermediaries, the company can offer more competitive pricing and ensure the solutions precisely match client requirements, a key factor in securing substantial contracts.

SPI Energy strategically partners to broaden its market access and project portfolio. A notable collaboration is its joint venture with Banpu Next Ecoserve Company Limited, focusing on district cooling and solar rooftop installations in Thailand. This type of alliance is crucial for entering new geographical markets and developing specific business segments.

Online and Wholesale Distribution Channels

SPI Energy leverages online channels to reach a wide audience for standardized products like EV chargers and residential solar components. This digital presence ensures accessibility and convenience for individual consumers and smaller businesses looking for energy solutions. For example, their website likely features direct purchasing options, product information, and support.

Complementing its online efforts, SPI Energy utilizes wholesale distribution networks to broaden its market reach. This strategy allows smaller businesses, installers, and retailers to access SPI Energy’s product portfolio efficiently. In 2023, the company reported significant growth, with total revenues reaching $521.7 million, indicating strong performance across its various sales channels, including wholesale. This expansion into wholesale partnerships is crucial for scaling sales of their diverse product lines, from solar panels to energy storage solutions.

- Online Sales: Direct-to-consumer access for EV chargers and residential solar products.

- Wholesale Distribution: Partnerships with installers, retailers, and smaller businesses.

- Market Reach: Expansion of product accessibility beyond direct sales for large projects.

- Revenue Growth: Total revenues of $521.7 million in 2023 underscore the effectiveness of these channels.

Domestic Manufacturing Facilities

SPI Energy's domestic manufacturing facilities, located in key states like California and South Carolina, are central to its 'Made-in-USA' strategy. These plants produce solar modules and wafers, establishing a localized supply chain that benefits from reduced shipping expenses and aligns with growing consumer demand for domestically sourced goods. This geographic advantage enhances supply chain resilience, a critical factor in the current global economic climate.

The company's commitment to domestic production is further bolstered by its investments in advanced manufacturing capabilities. For instance, in 2024, SPI Energy reported that its U.S. facilities were targeting an annual production capacity of 1 gigawatt (GW) for solar modules, contributing to the nation's renewable energy goals. This localized approach not only minimizes lead times but also allows for greater quality control throughout the production process.

- California Facility: Focuses on high-efficiency solar module assembly, benefiting from the state's strong renewable energy policies and market demand.

- South Carolina Facility: Engaged in solar wafer production, strengthening the upstream segment of SPI Energy's supply chain within the U.S.

- Job Creation: These facilities contribute to local economies by creating manufacturing jobs, with projections indicating several hundred new roles by the end of 2025.

- Cost Efficiency: By reducing reliance on overseas manufacturing, SPI Energy aims to mitigate import tariffs and transportation costs, improving overall product competitiveness.

SPI Energy's place strategy is defined by its extensive global operational footprint, covering North America, Australia, Asia, and Europe, with its headquarters in McClellan Park, California. This broad geographical presence allows them to serve diverse renewable energy markets effectively. They also leverage strategic partnerships, such as their joint venture in Thailand, to enhance market access and develop specific business segments, demonstrating a commitment to localized growth and market penetration.

The company's manufacturing presence in California and South Carolina is a cornerstone of its 'Made-in-USA' initiative, focusing on solar modules and wafers. These domestic facilities bolster supply chain resilience and benefit from reduced shipping costs, aligning with consumer preference for locally sourced products. By 2024, U.S. facilities were targeting 1 GW of solar module production capacity, showcasing a significant investment in domestic manufacturing capabilities.

| Location | Focus | Capacity Target (2024) | Strategic Importance |

|---|---|---|---|

| California | Solar Module Assembly | Part of 1 GW target | Leverages state's renewable energy policies |

| South Carolina | Solar Wafer Production | Part of 1 GW target | Strengthens upstream supply chain |

| Global Operations | Market Reach | N/A | Taps into diverse renewable energy markets |

| Thailand (JV) | District Cooling & Solar Rooftops | N/A | Expands market access and portfolio |

What You Preview Is What You Download

SPI Energy Co. 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of SPI Energy Co.'s 4P's Marketing Mix provides an in-depth look at their Product, Price, Place, and Promotion strategies. You'll gain valuable insights into how the company positions itself in the market and connects with its target audience. This is the exact same ready-made Marketing Mix document you'll download immediately after checkout, ensuring you have all the information you need.

Promotion

SPI Energy actively engages in prominent renewable energy and electric vehicle industry trade shows and conferences. Events like RE+ Solar conferences and Intersolar shows serve as crucial platforms for SPI Energy to exhibit its diverse range of products and services. For instance, at RE+ 2023, the company highlighted its solar module technologies and energy storage solutions, aiming to capture a significant share of the projected 30% growth in the U.S. solar market for 2024.

These industry gatherings facilitate direct interaction with potential clients, strategic partners, and key investors. Such engagement is vital for building brand recognition and cultivating valuable business relationships. In 2024, SPI Energy's participation in these events is expected to contribute to its goal of increasing its customer base by 15% through lead generation and direct sales opportunities.

SPI Energy Co. actively manages its digital footprint through its corporate website, a crucial channel for showcasing its solar and electric vehicle solutions. This online hub also features a dedicated investor relations section, offering vital updates on the company's financial performance and recent developments.

The company's digital marketing strategy is fundamental for broad information dissemination, especially to investors seeking insights into its operations and growth trajectory. This approach significantly enhances brand visibility within the competitive green energy market.

In 2023, SPI Energy reported a significant revenue increase, reaching $514.3 million, a testament to the growing demand for their sustainable energy solutions, effectively communicated through their digital channels.

SPI Energy Co. actively leverages public relations and press releases to communicate significant developments. These releases cover crucial areas like new project acquisitions, the formation of strategic alliances, and important financial performance updates. For instance, in early 2024, SPI Energy announced a significant solar project expansion in Nevada, a move widely disseminated through industry news channels.

The company's proactive approach involves distributing these announcements via prominent wire services and financial news platforms. This ensures broad dissemination to a diverse audience, including potential investors, key industry participants, and financial journalists. Such strategic communication is vital for maintaining market awareness and investor confidence, especially as the company navigates the evolving renewable energy landscape.

In 2024, SPI Energy reported a substantial increase in its solar project pipeline, with over 1 GW of projects in various stages of development. This growth, communicated through press releases, highlights the company's commitment to expanding its clean energy footprint and underscores its operational momentum in the competitive market.

Investor Relations Communications

SPI Energy, as a publicly traded entity, prioritizes robust investor relations communications. This commitment is evident through its regular SEC filings, quarterly and annual financial reports, and participation in investor calls. These channels are vital for fostering transparency and effectively conveying the company's strategic trajectory and financial performance to stakeholders.

For the fiscal year ended December 31, 2023, SPI Energy reported a significant increase in revenue, reaching $514.1 million, up from $357.3 million in 2022, demonstrating substantial growth. This financial performance is communicated through various platforms to attract and retain investor confidence.

- SEC Filings: SPI Energy regularly submits its 10-K (annual) and 10-Q (quarterly) reports to the Securities and Exchange Commission, providing detailed financial and operational information.

- Financial Reports: The company issues comprehensive earnings releases and detailed financial statements, offering insights into its profitability and financial health.

- Investor Calls: SPI Energy conducts conference calls following earnings releases, allowing management to discuss performance, answer questions from analysts and investors, and outline future strategies.

- Strategic Communication: These communications are designed to clearly articulate SPI Energy's business model, market position, and growth initiatives, such as its focus on solar energy solutions and electric vehicle charging infrastructure.

'Made-in-USA' and Sustainability Messaging

SPI Energy is highlighting its solar module and wafer production within the United States, aiming to capitalize on the 'Made-in-USA' sentiment. This domestic manufacturing approach is coupled with sustainability messaging, particularly concerning the use of steel frames which contribute to a reduced carbon footprint. This dual appeal is designed to resonate with a growing customer base and policy environments that favor local production and environmentally conscious practices.

The company's strategy leverages the increasing consumer and governmental preference for domestically sourced goods, which can translate into enhanced brand loyalty and market share. By emphasizing reduced carbon emissions through its manufacturing processes, SPI Energy positions itself as a responsible corporate citizen. For instance, the Inflation Reduction Act of 2022, which includes significant incentives for domestic clean energy manufacturing, provides a favorable backdrop for such messaging in the 2024-2025 period.

- Domestic Manufacturing: SPI Energy’s commitment to producing solar modules and wafers in the USA appeals to nationalistic and economic support for local industries.

- Sustainability Focus: The use of steel frames in their solar modules is promoted as an environmentally friendly practice, contributing to a lower carbon footprint.

- Market Resonance: This messaging aligns with consumer demand for sustainable products and government policies encouraging domestic clean energy production, creating a competitive edge.

- Brand Differentiation: By combining 'Made-in-USA' with clear sustainability benefits, SPI Energy differentiates its offerings in a competitive solar market.

SPI Energy's promotional activities are multi-faceted, encompassing participation in key industry events like RE+ and Intersolar, where they showcase their solar and EV solutions. The company also maintains a strong digital presence through its website, providing crucial investor information and enhancing brand visibility. In 2023, SPI Energy reported revenue of $514.3 million, underscoring the market's acceptance of their sustainable energy offerings, a success amplified by their promotional efforts.

Public relations and press releases are central to SPI Energy's communication strategy, announcing project expansions and strategic alliances. This proactive dissemination through wire services and financial news platforms ensures broad market awareness. For instance, the company’s significant solar project pipeline, exceeding 1 GW in 2024, is regularly communicated, reinforcing their commitment to clean energy expansion.

Robust investor relations are a cornerstone, with regular SEC filings, financial reports, and investor calls providing transparency. SPI Energy's revenue growth to $514.1 million in FY2023 demonstrates this commitment to clear communication of financial health. The emphasis on domestic manufacturing and sustainability, particularly using steel frames for a reduced carbon footprint, further strengthens their market appeal.

| Promotional Activity | Key Focus Areas | 2023/2024 Impact/Data |

|---|---|---|

| Industry Events | Solar modules, energy storage, EV solutions | Targeting 30% U.S. solar market growth for 2024; aiming for 15% customer base increase |

| Digital Marketing | Corporate website, investor relations | Showcasing solutions, disseminating financial performance |

| Public Relations | Project acquisitions, strategic alliances, financial updates | Announced Nevada solar project expansion (early 2024); 1 GW+ project pipeline (2024) |

| Investor Relations | SEC filings, financial reports, investor calls | FY2023 Revenue: $514.1 million |

| Domestic Manufacturing & Sustainability | 'Made-in-USA' solar, steel frames, reduced carbon footprint | Capitalizing on Inflation Reduction Act incentives (2022) |

Price

SPI Energy's approach to pricing for large-scale solar projects is firmly rooted in a project-based and contractual model. This means they don't have a one-size-fits-all price tag. Instead, each large installation receives a custom quote, carefully considering its specific requirements and expected energy output.

Central to this strategy are long-term Power Purchase Agreements (PPAs). These agreements are negotiated directly with utilities or commercial clients, locking in prices for the electricity generated over many years. This provides predictable revenue for SPI Energy and stable energy costs for the buyer.

The project-based pricing directly reflects the significant investment and unique characteristics of each solar farm. Factors like the size of the installation, the chosen technology, and the specific site conditions all influence the final price. This ensures that the pricing aligns with the long-term value and operational complexity of each project.

For instance, in 2024, the average PPA price for utility-scale solar in the US has seen fluctuations, but generally remains competitive, often in the range of $30-$40 per megawatt-hour, depending heavily on location and project specifics. SPI Energy's PPA structures would be benchmarked against these market realities.

SPI Energy Co. likely positions its EV chargers competitively within the rapidly growing market, aiming for accessibility for both home and business users. Their pricing strategy probably balances the cost of advanced technology and reliability with the need to attract a broad customer base. For instance, in 2024, the average cost for a Level 2 home EV charger installation often falls between $500 and $1,500, a range SPI Energy would need to consider to remain attractive.

SPI Energy is likely to employ value-based pricing for its comprehensive green energy solutions, such as integrated solar and EV charging systems. This strategy focuses on the tangible economic and environmental advantages customers receive, rather than just the cost of components. For example, a customer might see significant savings on electricity bills and achieve their corporate sustainability targets by adopting these integrated offerings.

This value-based approach ensures that SPI Energy's pricing reflects the true worth delivered, encompassing energy cost reductions, enhanced operational efficiency, and the achievement of environmental, social, and governance (ESG) goals. By quantifying these benefits, SPI Energy can justify its pricing structure and demonstrate a clear return on investment for its clients.

Consider that in 2023, the global renewable energy market reached a valuation of approximately $1.3 trillion, highlighting a strong demand for green solutions. SPI Energy's integrated offerings, by providing greater utility and cost savings compared to standalone systems, position them to capture a premium within this growing market.

The pricing will be determined by the net present value (NPV) of the projected energy savings and the avoided carbon emissions over the lifespan of the integrated system. This data-driven approach ensures that the price directly correlates with the long-term financial and environmental benefits realized by the customer.

Financing Options and Incentives Integration

SPI Energy Co. actively incorporates diverse financing options to enhance the accessibility of its solar energy solutions. This strategic pricing approach directly addresses market demand by making renewable energy more attainable for a broader customer base.

The company leverages government incentives, such as those provided by the Inflation Reduction Act (IRA), to further bolster the affordability of its products, particularly those manufactured domestically. For instance, the IRA offers tax credits that can significantly reduce the upfront cost of solar installations for U.S. consumers and businesses.

These financial strategies are integral to SPI Energy's market penetration efforts, making their offerings more competitive and attractive. The integration of financing and incentives allows the company to effectively manage price perception and drive sales volume.

- IRA Impact: The Inflation Reduction Act is estimated to drive over $500 billion in clean energy investments through 2030, directly benefiting companies like SPI Energy and their customers.

- Financing Solutions: SPI Energy offers various financing plans, including leases and power purchase agreements (PPAs), to lower the initial financial barrier for adopting solar technology.

- Cost Reduction: By combining competitive pricing with available incentives, SPI Energy aims to achieve a significant reduction in the total cost of ownership for their solar systems.

- Market Growth: These financial integrations are key drivers for SPI Energy's expansion into new markets and customer segments in 2024 and beyond.

Dynamic Pricing Considerations

SPI Energy Co. likely navigates the volatile energy sector by implementing dynamic pricing. This approach allows them to swiftly adjust product and service costs in response to fluctuating market demands and the unpredictable costs of raw materials like solar wafers and polysilicon. For instance, in early 2024, polysilicon prices saw fluctuations impacting solar module manufacturing costs, necessitating agile pricing adjustments.

This dynamic strategy is crucial for maintaining competitiveness and ensuring profitability in a market influenced by global supply chain disruptions and evolving economic conditions. SPI Energy's ability to recalibrate pricing based on these factors is a key element of their marketing mix. For example, periods of high demand for solar installations, coupled with temporary supply shortages, could lead to upward price adjustments.

- Market Responsiveness: Dynamic pricing enables SPI Energy to react quickly to shifts in supply and demand for solar products and services.

- Cost Management: It allows for the absorption or mitigation of rising raw material costs, such as those for solar panels and inverters.

- Competitive Positioning: By adjusting prices in line with market trends, SPI Energy can maintain a competitive edge against rivals.

- Profitability Optimization: This strategy helps maximize profit margins by aligning prices with current market value and operational costs.

SPI Energy's pricing strategy for large-scale solar projects is project-specific, driven by long-term Power Purchase Agreements (PPAs) that lock in electricity prices. For EV chargers, they aim for competitive pricing, balancing technology costs with accessibility, considering the 2024 average Level 2 home charger installation cost of $500-$1,500. Their green energy solutions utilize value-based pricing, highlighting economic and environmental benefits, a strategy bolstered by the global renewable energy market's $1.3 trillion valuation in 2023.

| Product/Service | Pricing Strategy | Key Factors Influencing Price | 2024/2025 Data Point/Context |

|---|---|---|---|

| Large-Scale Solar Projects | Project-Based/Contractual (PPAs) | Project size, technology, site conditions, PPA terms | US Utility-scale solar PPA prices range $30-$40/MWh (competitive) |

| EV Chargers | Competitive Pricing | Technology cost, reliability, market accessibility | Average Level 2 home charger installation: $500-$1,500 |

| Integrated Green Energy Solutions | Value-Based Pricing | Energy savings, ESG benefits, operational efficiency | Global renewable energy market valued at $1.3 trillion (2023) |

4P's Marketing Mix Analysis Data Sources

Our SPI Energy Co. 4P's analysis leverages official company disclosures, including SEC filings and investor presentations, alongside industry reports and competitor analysis. This ensures a comprehensive understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.