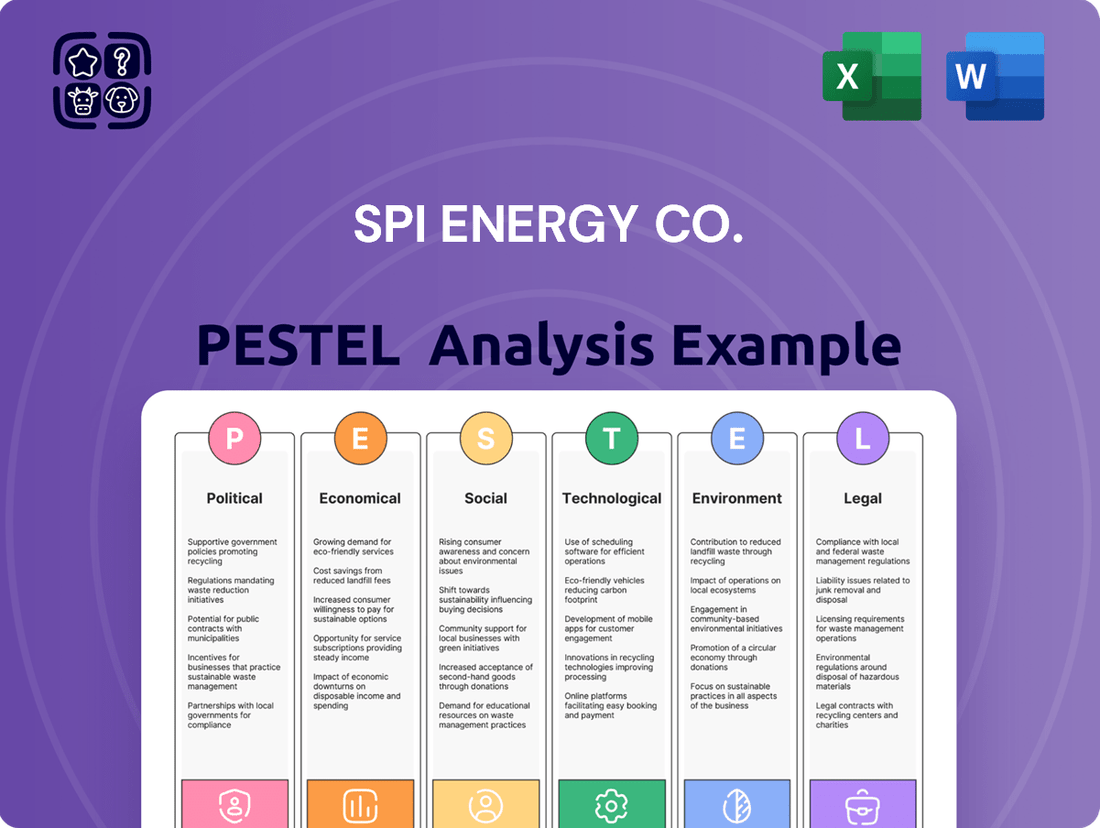

SPI Energy Co. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPI Energy Co. Bundle

Navigate the complex external forces shaping SPI Energy Co.'s future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges for the company.

Our expert-crafted PESTLE analysis delves into the social, environmental, and legal landscapes, providing critical insights for investors and strategists. Don't get left behind by evolving market dynamics.

Gain a competitive edge by understanding the intricate interplay of these factors on SPI Energy Co.'s operations and growth potential. Make informed decisions backed by solid market intelligence.

This ready-to-use PESTLE analysis is your key to unlocking SPI Energy Co.'s strategic positioning and anticipating future trends. Equip yourself with the knowledge to thrive.

Download the full PESTLE analysis now and transform your understanding of SPI Energy Co.'s external environment. Get actionable intelligence at your fingertips.

Political factors

Governments worldwide are actively promoting renewable energy adoption through incentives like tax credits and subsidies, a move that directly supports companies such as SPI Energy engaged in solar project development. The U.S. Inflation Reduction Act (IRA), for instance, substantially bolsters renewable energy initiatives through these very mechanisms.

While these tax credits are beneficial, their public and political backing can shift. In the U.S., for example, a dip in favorability for these credits was observed in 2025, with particular declines among Republican and independent voters.

Government mandates are a significant driver for the electric vehicle (EV) market, directly impacting companies like SPI Energy. The European Union's Alternative Fuels Infrastructure Regulation (AFIR), for example, is pushing for widespread EV charging infrastructure deployment. This regulation includes specific targets for charging point availability along major European roads by the close of 2025, alongside requirements for transparent pricing and digital connectivity at these stations.

The United Kingdom's Zero Emission Vehicle (ZEV) mandate also plays a crucial role. This policy sets escalating sales targets for electric vehicles for car manufacturers. These targets directly influence the demand for EV charging solutions, which is a key area for SPI Energy's business operations and revenue streams.

Geopolitical tensions and evolving international trade policies, particularly concerning tariffs on solar components, create significant ripples throughout the global solar photovoltaic (PV) supply chain. These policies can directly affect material costs and market access for companies like SPI Energy.

China's dominant position, holding nearly 95% of global polysilicon, ingot, and wafer production through 2025, highlights a critical vulnerability in the international solar supply chain. This concentration means that trade disputes or policy shifts involving China can disproportionately impact manufacturing and pricing worldwide.

SPI Energy's strategic move to bolster domestic manufacturing, exemplified by its Solar4America Technology initiative producing U.S.-based steel-framed modules, serves as a direct response to these supply chain risks. Such localization efforts are crucial for mitigating the impact of tariffs and aligning with national objectives to strengthen domestic industrial capacity.

Energy Security and Decarbonization Targets

Countries are rapidly increasing solar energy adoption, spurred by both environmental goals and the need for stable energy supplies. This trend is directly beneficial for SPI Energy, as it aligns with their core business. By 2025, renewable electricity is expected to overtake coal as the primary global energy source, a significant shift highlighting the growing importance of solar power. This global push for decarbonization and energy independence creates a robust and expanding market for SPI Energy's green energy solutions, offering a strong foundation for demand.

Several key statistics underscore this political momentum:

- Global renewable energy capacity is expected to reach 5,100 gigawatts (GW) by the end of 2024, with solar PV accounting for over half of this new capacity.

- The International Energy Agency (IEA) projects that solar PV will become the largest source of electricity generation globally by 2025, surpassing coal.

- Governments worldwide have set ambitious targets, with many aiming for 50% or more of their electricity to come from renewables by 2030, creating long-term policy support for companies like SPI Energy.

Regulatory Compliance and Delisting Risk

SPI Energy, like many publicly traded companies, navigates a complex web of regulatory compliance, especially concerning financial reporting accuracy and timeliness. Failure to meet these standards can trigger severe consequences. For instance, SPI Energy received multiple delisting notices from Nasdaq and was officially delisted on January 15, 2025. This action stemmed from non-compliance with critical requirements, including filing deadlines and maintaining the minimum bid price necessary for continued listing.

The implications of such regulatory actions are substantial. Delisting significantly curtails a company's access to capital markets, making it harder to raise funds for operations and growth. Moreover, it can erode investor confidence, leading to a decreased stock valuation and increased cost of capital. This regulatory hurdle poses a direct challenge to SPI Energy's ability to operate and expand within established financial frameworks.

- Delisting Date: SPI Energy was delisted from Nasdaq effective January 15, 2025.

- Reasons for Delisting: Non-compliance with Nasdaq's listing rules, specifically related to filing deadlines and minimum bid price requirements.

- Impact on Capital Access: Delisting severely restricts SPI Energy's ability to raise capital through public equity markets.

- Investor Confidence: Regulatory non-compliance and delisting typically lead to a significant drop in investor confidence.

Government policies continue to shape the renewable energy landscape, with a strong push for solar adoption driven by climate goals and energy independence initiatives. By 2025, solar PV is projected by the IEA to become the world's largest electricity source, surpassing coal, a testament to this political momentum.

However, regulatory compliance and adherence to listing standards are critical. SPI Energy faced delisting from Nasdaq effective January 15, 2025, due to non-compliance with filing deadlines and minimum bid price requirements, significantly impacting its access to capital markets and investor confidence.

Trade policies and geopolitical factors, particularly concerning China's dominance in solar component manufacturing, present ongoing challenges. SPI Energy's domestic manufacturing initiatives are a strategic response to mitigate risks associated with tariffs and supply chain vulnerabilities, aligning with national industrial capacity goals.

| Political Factor | Impact on SPI Energy | 2024/2025 Data/Trend |

|---|---|---|

| Renewable Energy Subsidies & Incentives | Directly supports solar project development and market expansion. | Global renewable energy capacity expected to reach 5,100 GW by end of 2024; solar PV accounts for over half of new capacity. |

| Government Mandates (e.g., ZEV) | Drives demand for EV charging infrastructure, a key business area for SPI Energy. | UK ZEV mandate sets escalating EV sales targets for manufacturers. EU AFIR mandates charging point availability by end of 2025. |

| Trade Policies & Tariffs | Affects material costs and market access for solar components. | China holds ~95% of global polysilicon, ingot, and wafer production through 2025, creating supply chain concentration risk. |

| Regulatory Compliance & Listing Standards | Impacts access to capital and investor confidence; non-compliance can lead to delisting. | SPI Energy delisted from Nasdaq effective January 15, 2025, due to non-compliance with listing rules. |

What is included in the product

SPI Energy Co.'s PESTLE analysis examines the impact of political stability, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks on its operations and strategic planning.

Provides a concise version of SPI Energy's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Helps support discussions on external risks and market positioning for SPI Energy by offering a clear, summarized PESTLE overview during planning sessions.

Economic factors

Interest rate fluctuations present a significant hurdle for SPI Energy’s project financing. High rates, which hovered around 6-8% in 2024, directly translate to increased borrowing costs for both consumers and developers, making solar installations less affordable and impacting project economics.

While the Federal Reserve’s rate cut late last year brought rates down to a range of 4.25-4.5% in early 2025, these levels are still elevated compared to prior years, meaning financing remains a critical consideration for project viability and growth.

This economic climate compels SPI Energy to lean on alternative financing structures such as solar leases and Power Purchase Agreements (PPAs). These models help mitigate the impact of higher interest rates by shifting upfront costs and providing more predictable, affordable energy pricing for end-users, thereby supporting continued project development.

The overall health of the global economy is a significant driver for energy demand, including for green energy solutions like those offered by SPI Energy. As economies expand, so does the need for power, which can translate into greater investment in renewable energy infrastructure.

Sustained economic growth, particularly in major markets, often fuels increased capital expenditure on new solar projects and accelerates the adoption of electric vehicles, both key areas for SPI Energy. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that influences investment sentiment in the energy sector.

Conversely, macroeconomic headwinds, such as inflation or geopolitical instability, can create market uncertainty. This uncertainty might lead to a tempering of growth in the solar photovoltaic (PV) market as businesses and consumers delay significant capital outlays.

For example, while the clean energy transition remains a long-term trend, short-term economic slowdowns can impact the pace of solar PV market expansion. The US solar market, a key region for many companies, saw installations grow by 7% in 2023, indicating resilience but also sensitivity to broader economic conditions.

The cost competitiveness of renewable energy, particularly solar photovoltaic (PV) technology, is a significant economic factor. In 2024, solar PV emerged as the most affordable power generation method in numerous global regions. This trend is directly linked to substantial manufacturing overcapacity and historic lows in solar component pricing, making solar a compelling alternative to conventional energy sources.

This enhanced cost-effectiveness directly benefits SPI Energy's primary operations, bolstering the economic viability of its solar projects and products. For instance, the average global cost of solar PV electricity generation fell to an estimated $0.049 per kilowatt-hour (kWh) in 2024, a notable decrease that amplifies its competitive edge.

Investment Trends in Clean Energy

Global investment in the energy transition surged to a record $1.7 trillion in 2023, signaling robust growth opportunities across the clean energy sector. This significant capital inflow benefits companies like SPI Energy, enabling expansion and innovation in solar and other renewable technologies. Households are also increasingly participating through distributed generation and energy storage solutions.

While the voluntary carbon offset market for renewables has experienced some recalibration, investor focus is actively pivoting towards carbon dioxide removal (CDR) credits. This shift highlights evolving priorities within the broader clean energy investment landscape, potentially creating new avenues for carbon reduction projects and related financial instruments. SPI Energy's strategic positioning in solar technology aligns with this overarching trend toward decarbonization.

Key investment trends impacting SPI Energy include:

- Record Energy Transition Investment: Global investment reached $1.7 trillion in 2023, a strong indicator of market expansion.

- Shifting Carbon Markets: A move from traditional voluntary carbon offsets to a greater emphasis on carbon dioxide removal (CDR) credits.

- Household Participation: Increased adoption of distributed solar and storage solutions by consumers.

- Technological Advancements: Continued innovation in solar panel efficiency and battery storage driving market growth.

Supply Chain Costs and Market Dynamics

The solar photovoltaic (PV) market is currently experiencing an oversupply, driving down prices for PV modules significantly. For instance, reports from late 2023 and early 2024 indicated that prices for polysilicon, a key component in solar panels, dropped by over 50% compared to the previous year. This oversupply, despite ongoing geopolitical risks, translates into lower equipment costs for companies like SPI Energy.

However, this favorable pricing environment is coupled with intense competition among manufacturers. The pressure to move inventory means producers are cutting margins, leading to market volatility. SPI Energy must effectively manage these fluctuating material costs and navigate the highly competitive landscape to ensure its profitability remains stable.

- Price Decreases: Polysilicon prices saw a substantial decline of over 50% in late 2023/early 2024 due to oversupply.

- Market Volatility: The oversupply creates price instability and a challenging competitive environment for solar module producers.

- Profitability Challenge: SPI Energy faces the task of maintaining profitability amidst fluctuating input costs and aggressive market competition.

- Strategic Navigation: Success hinges on SPI Energy's ability to adapt to these dynamic supply chain cost pressures and market conditions.

The overall economic outlook directly influences demand for solar energy solutions. With global growth projected at 3.2% in 2024 by the IMF, there's a positive signal for increased capital expenditure in renewable infrastructure. However, persistent inflation and geopolitical tensions can temper this growth, as seen with a 7% expansion in the US solar market in 2023, highlighting its sensitivity to broader economic conditions.

The cost-effectiveness of solar PV is increasingly favorable, with global generation costs averaging $0.049 per kWh in 2024, driven by manufacturing overcapacity. This makes solar highly competitive against traditional energy sources, directly benefiting SPI Energy's project economics and product appeal.

Investment in the energy transition reached a record $1.7 trillion in 2023, indicating significant opportunities, while a shift towards carbon dioxide removal (CDR) credits signals evolving investor priorities within the clean energy landscape.

A notable oversupply in solar PV modules led to a more than 50% drop in polysilicon prices in late 2023/early 2024, reducing equipment costs for SPI Energy. This scenario, however, intensifies competition, requiring careful management of fluctuating input costs and market dynamics for sustained profitability.

| Economic Factor | 2023/2024 Data Point | Impact on SPI Energy |

|---|---|---|

| Global Economic Growth | Projected 3.2% in 2024 (IMF) | Positive impact on energy demand and investment |

| Solar PV Generation Cost | Approx. $0.049/kWh globally in 2024 | Enhances cost-competitiveness and project viability |

| Energy Transition Investment | Record $1.7 trillion in 2023 | Indicates substantial growth opportunities |

| Polysilicon Price Change | Over 50% decrease (late 2023/early 2024) | Reduces equipment costs but increases market competition |

Same Document Delivered

SPI Energy Co. PESTLE Analysis

The preview you see of the SPI Energy Co. PESTLE Analysis is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting SPI Energy. You'll gain crucial insights into market dynamics and strategic positioning. This is the real, ready-to-use file you’ll get upon purchase, offering a complete picture of the company's external environment.

Sociological factors

Public awareness and acceptance of renewable energy, like solar and wind, are vital for ongoing expansion. A significant portion of the American public still backs the objective of carbon neutrality by 2050.

However, recent data from 2023 suggests a dip in public endorsement for green energy tax credits and the proliferation of solar panel farms compared to 2022 levels. This trend highlights the necessity for continuous public outreach and educational initiatives to maintain momentum.

Growing environmental awareness is fueling a significant shift in consumer preferences towards sustainable transportation options, particularly electric vehicles (EVs). This trend is supported by a desire for more eco-friendly living. For instance, in early 2024, surveys indicated that while interest in EVs remains, the pace of purchase intent saw a slight dip compared to the previous year, with some analysts pointing to evolving consumer priorities.

Public opinion on aggressive mandates for phasing out gasoline-powered vehicles also shows a nuanced picture, with support levels fluctuating. A key factor influencing consumer trust and the speed of EV adoption is the perceived availability and reliability of charging infrastructure. Without robust and widespread charging networks, widespread consumer confidence in making the switch remains a challenge.

Investors and the public are increasingly scrutinizing companies on their environmental, social, and governance (ESG) practices. SPI Energy's commitment to green energy solutions directly addresses these rising expectations, which can significantly impact investment flows, brand image, and consumer choices. For instance, in 2024, global sustainable investment assets were projected to reach $37 trillion, highlighting the financial weight of ESG considerations.

Sustainable manufacturing processes and the adoption of circular economy principles within supply chains are now considered vital investment criteria. Companies demonstrating strong ESG performance, like SPI Energy's focus on solar and battery solutions, are often favored by institutional investors seeking long-term value and reduced risk. A 2024 report indicated that over 70% of investors consider ESG factors in their decision-making.

Community Engagement and Local Impact

SPI Energy's solar projects, like any large infrastructure development, can encounter local resistance. Effective community engagement is crucial for smoothing this process. For instance, by 2024, many renewable energy projects are incorporating benefit-sharing models to ensure local communities see tangible advantages, which can significantly reduce opposition.

Community solar programs offer a way to broaden participation. These initiatives allow individuals who might not own suitable property to invest in or benefit from solar energy. This approach not only aids in overcoming local hesitancy but also builds broader public support for renewable energy, a key factor for SPI Energy's long-term success.

SPI Energy's approach to community engagement is critical for project viability. Successful community solar models, such as those gaining traction in states like New York, have demonstrated the potential to unlock greater public acceptance. In 2024, the Inflation Reduction Act continues to incentivize such models, making them more financially attractive for developers and communities alike.

- Community Acceptance: Local opposition can delay or halt large-scale solar projects, highlighting the need for proactive engagement.

- Benefit Sharing: Schemes that offer financial or energy-related benefits to local communities are becoming standard practice to foster goodwill.

- Community Solar Models: These programs expand solar access and can mitigate local resistance by allowing broader participation and shared benefits.

- Policy Support: Federal incentives, like those from the 2022 Inflation Reduction Act, encourage community-based renewable energy development.

Workforce Development in Green Sectors

The surge in green energy, encompassing solar and electric vehicle (EV) infrastructure, is driving a significant need for specialized skills. This demand directly impacts workforce development within sectors like those SPI Energy operates in. The availability of professionals trained in solar project development, installation, and the maintenance of EV charging stations is a crucial sociological consideration for the industry's expansion.

SPI Energy's capacity for growth is intrinsically linked to its ability to tap into a pool of competent labor capable of handling these specialized technical requirements. For instance, by late 2023, the International Renewable Energy Agency (IRENA) reported that the renewable energy sector globally employed over 13.7 million people, with solar PV alone accounting for a substantial portion, highlighting the growing importance of a skilled workforce.

The development of training programs and educational pathways is therefore paramount.

- Growing Demand for Green Skills: The global push towards sustainability is creating unprecedented demand for workers in renewable energy, particularly solar and EV charging infrastructure.

- Skills Gap in Solar and EV: A notable challenge is the existing skills gap in specialized areas like solar panel installation, battery technology, and EV charger maintenance.

- Impact on SPI Energy: SPI Energy's ability to scale its operations, especially in developing and maintaining solar projects and EV charging networks, is directly influenced by the availability of qualified personnel.

- Investment in Training: Companies and governments are increasingly investing in vocational training and educational initiatives to bridge this gap and ensure a steady supply of skilled labor for the green transition.

Societal attitudes towards renewable energy and environmental sustainability continue to shape the market for companies like SPI Energy. While public support for carbon neutrality goals remains strong, recent data from 2023 indicated a slight cooling in enthusiasm for specific green energy incentives compared to the previous year, underscoring the need for sustained public engagement.

Consumer preferences are increasingly leaning towards eco-friendly options, such as electric vehicles, though adoption rates in early 2024 showed some moderation, influenced by factors like charging infrastructure availability. Investors are also placing greater emphasis on Environmental, Social, and Governance (ESG) factors, with global sustainable investment assets projected to reach $37 trillion by 2024, making SPI Energy's green focus a significant advantage.

Community acceptance of renewable energy projects is paramount, and SPI Energy's engagement strategies, including benefit-sharing models and community solar programs, are crucial for mitigating local opposition. The success of community solar initiatives, bolstered by federal incentives like the 2022 Inflation Reduction Act, highlights the positive impact of inclusive development models on public perception and project viability.

The expanding green energy sector, particularly solar and EV infrastructure, is creating a substantial demand for specialized skills. SPI Energy's growth is directly tied to the availability of a qualified workforce, a factor supported by IRENA's 2023 report that the renewable energy sector globally employed over 13.7 million people. Addressing the skills gap through training is essential for the industry's continued expansion.

| Sociological Factor | Trend/Observation (2023-2024) | Impact on SPI Energy |

|---|---|---|

| Public Support for Green Energy | Broad support for carbon neutrality; slight dip in enthusiasm for specific incentives in 2023. | Requires ongoing public education and demonstration of tangible benefits. |

| Consumer Preference for Sustainability | Growing interest in EVs, but purchase intent saw slight moderation in early 2024 due to infrastructure concerns. | Highlights the importance of reliable charging networks for EV adoption, a potential service area. |

| ESG Investment Focus | Over 70% of investors consider ESG; global sustainable investments projected to reach $37 trillion by 2024. | SPI Energy's green portfolio aligns with investor demand, potentially attracting capital. |

| Community Acceptance of Projects | Local opposition can be a barrier; benefit-sharing and community solar models are gaining traction. | Effective community engagement and inclusive models are critical for project approvals and expansion. |

| Workforce Skills Demand | High demand for specialized solar and EV skills; a global skills gap exists. | Access to skilled labor is crucial for project development, installation, and maintenance. |

Technological factors

Technological advancements are significantly boosting solar panel efficiency. Breakthroughs are anticipated to nearly double current efficiency levels by 2025, with some innovative technologies potentially achieving 45% solar energy conversion rates. This leap forward is largely driven by developments such as perovskite solar cells, often combined with silicon, and bifacial panels that absorb sunlight from both sides.

These innovations translate to greater energy production from a more compact area, making solar installations more cost-effective. For instance, the global average efficiency for commercial silicon solar panels hovers around 20-23%, meaning a potential doubling would represent a monumental shift in the energy sector. SPI Energy, through its subsidiaries like Solar Technology Inc., is positioned to leverage these advancements.

Battery technology is evolving at an impressive pace, with solid-state and sodium-ion batteries increasingly seen as strong contenders to traditional lithium-ion. These new chemistries are key to unlocking greater energy density and faster charging capabilities.

Leading manufacturers like CATL are at the forefront, developing battery chemistries that significantly boost energy density and charging speeds. This directly impacts the range and performance of electric vehicles, a core area for SPI Energy.

These technological leaps are not just for electric vehicles; they are equally vital for grid-scale energy storage solutions. SPI Energy's ability to leverage these advancements will be critical for its success in providing comprehensive energy storage systems.

Smart grid integration, powered by artificial intelligence, is revolutionizing how SPI Energy manages its solar assets. AI algorithms are actively optimizing energy generation by analyzing real-time weather data and grid demand, leading to more efficient power delivery. For instance, predictive maintenance models, a key AI application, are reducing downtime by anticipating equipment failures, a critical factor in maximizing revenue from solar farms.

The adoption of AI in energy management is not just about efficiency; it’s about enhancing the overall reliability of renewable energy systems. By enabling better monitoring and control, these technologies help stabilize the grid, a crucial step as renewable energy sources like solar become a larger part of the energy mix. SPI Energy's investment in these areas positions them to capitalize on the growing demand for dependable green energy solutions.

Electric Vehicle Charging Infrastructure Innovation

Technological advancements in electric vehicle (EV) charging are rapidly evolving, focusing on significantly faster charging times, more intuitive user interfaces, and streamlined payment processes. These improvements are crucial for overcoming range anxiety and making EV ownership more convenient. For instance, ultra-fast chargers capable of adding hundreds of miles of range in under 20 minutes are becoming more common.

The global push towards digitally connected and smart-charging infrastructure is a significant technological trend. Regulations like the EU's Alternative Fuels Infrastructure Regulation (AFIR) mandate the deployment of charging points, encouraging interoperability and smart grid integration. This ensures that charging can be managed efficiently, often during off-peak hours, which can help stabilize the grid and reduce costs. SPI Energy's EV solutions segment is directly positioned to benefit from and contribute to these innovations.

- Charging Speed: Development of DC fast chargers exceeding 350 kW, aiming for 500 kW in the near future.

- User Experience: Integration of mobile apps for locating chargers, initiating charging sessions, and processing payments, often supporting Plug and Charge technology.

- Smart Charging: Implementation of Vehicle-to-Grid (V2G) and Vehicle-to-Home (V2H) capabilities, allowing EVs to supply power back to the grid or home.

- Infrastructure Growth: Global EV charging infrastructure is projected to grow substantially, with estimates suggesting millions of charging points will be deployed by 2030 to meet demand.

Emerging Solar Applications

Technological advancements are broadening solar energy's reach beyond conventional installations. Emerging applications like solar-powered electric vehicles (EVs) and floating solar farms are gaining traction. For instance, by 2024, the global market for floating solar power plants was projected to exceed 13 GW, showcasing significant growth.

Innovations such as transparent solar panels for windows and solar paint are also in development, hinting at a future where solar energy generation is seamlessly integrated into everyday structures and surfaces. These developments are creating new avenues for companies like SPI Energy Co. to tap into the expanding green energy market.

- Solar-powered EVs: Integration of solar panels into vehicle bodies to supplement battery charging.

- Floating solar farms: Installation of solar panels on bodies of water, conserving land use.

- Transparent solar panels: Development of photovoltaic glass for buildings and windows.

- Solar paint: Research into sprayable coatings that can generate electricity.

Technological advancements are continuously improving solar panel efficiency, with innovations like perovskite-silicon tandem cells projected to reach efficiencies of 45% by 2025, nearly doubling current commercial silicon panel efficiency around 20-23%. SPI Energy, through its subsidiaries, is poised to integrate these higher-performing, more cost-effective solutions.

Battery technology is rapidly advancing, with solid-state and sodium-ion batteries showing promise for increased energy density and faster charging. This evolution is critical for SPI Energy's electric vehicle solutions and grid-scale energy storage systems, supporting greater EV range and grid stability.

AI-driven smart grid integration optimizes SPI Energy's solar asset management through real-time data analysis for energy generation and predictive maintenance, reducing downtime and enhancing grid reliability. This AI integration is vital for the growing demand for dependable green energy.

The EV charging sector is seeing faster charging speeds, with DC fast chargers exceeding 350 kW and aiming for 500 kW, alongside improved user experience via mobile apps and smart charging capabilities like V2G. The global EV charging infrastructure is expected to expand significantly, with millions of charging points anticipated by 2030.

New solar applications are emerging, such as transparent solar panels for buildings and solar paint, alongside the growth of floating solar farms, which exceeded 13 GW globally by 2024. These innovations create new market opportunities for SPI Energy in integrated solar solutions.

Legal factors

SPI Energy has encountered considerable legal hurdles concerning its Nasdaq listing. The company received several notices for not submitting financial reports on time, including for Q1 2024, FY 2023 10-K, Q2 2024, and Q3 2024. This ongoing struggle with compliance led to the delisting of SPI Energy's shares from Nasdaq, effective January 15, 2025. Maintaining adherence to these strict regulations is crucial for any public company to retain its status and the confidence of its investors.

The regulatory environment for electric vehicle (EV) charging is currently a significant factor, especially within the European Union. The Alternative Fuels Infrastructure Regulation (AFIR), which became effective in April 2024, sets clear mandates for public charging stations. This includes requirements for easy payment options, transparent pricing, and essential digital connectivity, aiming to simplify the user experience.

Furthermore, the AFIR imposes obligations on commercial properties. As of January 2025, non-residential buildings across the EU that have more than 20 parking spaces are required to have at least one EV charging point installed, driving broader adoption of charging infrastructure.

SPI Energy Co., like all players in the green energy sector, navigates a complex web of environmental and safety regulations. These rules govern everything from how solar farms are built to how old solar panels and batteries are handled. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) continued to emphasize responsible disposal of electronic waste, a category that increasingly includes solar components.

Meeting these stringent requirements is not optional; it's essential for maintaining operational permits and ensuring public safety. Failure to comply can lead to significant fines and project delays. The growing focus on circular economy principles means companies like SPI Energy must invest in robust recycling and waste management strategies, a trend expected to intensify through 2025.

Contractual Obligations and Legal Disputes

SPI Energy's operations are deeply intertwined with contractual obligations, particularly in solar project development, financing, and ongoing operations. These agreements are the bedrock of its business, and any disputes can have significant ripple effects.

The company's recent legal maneuvers highlight this. In January 2025, SPI Energy announced a settlement agreement with SINSIN. This agreement resolved longstanding disputes stemming from a 2014 share sale agreement. The resolution also paved the way for the reconsolidation of certain Greek photovoltaic (PV) projects back into SPI Energy's portfolio.

Such legal resolutions are not mere procedural events; they directly influence a company's asset base and overall financial health. The successful reconsolidation of the Greek PV projects, for instance, is expected to bolster SPI Energy's operational capacity and revenue streams, demonstrating the tangible financial impact of resolving legal entanglements.

- Contractual Complexity: SPI Energy's business model relies on intricate contracts for project lifecycle management.

- Dispute Resolution Impact: The January 2025 settlement with SINSIN resolved a 2014 share sale dispute.

- Asset Reintegration: This settlement led to the reconsolidation of specific Greek PV projects.

- Financial Ramifications: Legal resolutions like these directly affect a company's assets and financial standing.

Data Privacy and Cybersecurity Laws

As electric vehicle (EV) charging infrastructure becomes more digitally connected and integrates with smart grids, data privacy and cybersecurity regulations are gaining significant importance for companies like SPI Energy. Laws governing how user data from EV chargers and smart solar solutions are collected, stored, and utilized are becoming critical. For instance, the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States set stringent standards for data handling, impacting how SPI Energy manages customer information related to its charging and solar services.

Compliance with these evolving legal frameworks is not just a matter of avoiding penalties; it's essential for protecting consumer information and maintaining the operational integrity of their connected systems. A data breach could severely damage customer trust and lead to significant financial and reputational harm. As of early 2025, regulators are increasingly scrutinizing companies' data security practices, particularly in critical infrastructure sectors like energy and transportation.

- Data Handling: SPI Energy must ensure its EV charging and solar platforms adhere to global data privacy laws, managing personal data ethically and securely.

- Cybersecurity Mandates: Increasing regulatory focus on cybersecurity for connected devices means SPI Energy needs robust defenses against potential threats to its smart grid integrations.

- Consumer Trust: Proactive compliance with data privacy laws builds consumer confidence in SPI Energy's digital services, a key factor in adoption of EV charging and smart solar solutions.

- Operational Resilience: Strong cybersecurity measures are vital to prevent disruptions to energy services and protect sensitive operational data.

SPI Energy's legal landscape has been significantly shaped by its Nasdaq listing issues, with the company facing delisting effective January 15, 2025, due to repeated failures to submit timely financial reports, including for Q1 2024 and FY 2023. This highlights the critical importance of regulatory compliance for public entities. Furthermore, the company's January 2025 settlement with SINSIN resolved a decade-old dispute from a 2014 share sale agreement, leading to the reconsolidation of valuable Greek PV projects, demonstrating how legal resolutions directly impact asset recovery and financial health.

Environmental factors

The global push to reduce carbon emissions significantly boosts the market for companies like SPI Energy, which specialize in solar energy solutions. Many nations are establishing ambitious climate targets, creating a favorable environment for renewable energy adoption.

For instance, the European Union is working towards a 55% reduction in greenhouse gas emissions by 2030 and a 90% cut in transport emissions by 2050. These targets underscore the critical role of solar photovoltaic (PV) technology, which is a major contributor to new renewable energy capacity additions worldwide.

The manufacturing of solar panels and electric vehicle batteries is heavily dependent on critical minerals like silicon, lithium, and cobalt. Concerns about the future availability of these resources and the significant environmental footprint associated with their extraction are growing. For instance, the International Energy Agency (IEA) projected in 2024 that demand for critical minerals could surge by 40 times by 2040 for clean energy technologies.

Furthermore, the concentration of processing for these essential materials in a few geographical regions creates vulnerabilities in global supply chains. This reliance raises questions about long-term sustainability and geopolitical stability. Diversifying sourcing and processing capabilities is becoming a strategic imperative for the renewable energy sector.

SPI Energy's initiative to establish U.S.-based manufacturing for its solar products directly addresses these environmental and geopolitical challenges. By localizing its supply chain, the company aims to mitigate risks associated with global resource availability and processing concentration, contributing to a more resilient and sustainable energy future.

As solar panels and electric vehicle (EV) batteries approach the end of their service lives, the development of effective waste management and recycling strategies is paramount. By 2025, significant advancements in solar panel recycling technologies are anticipated, focusing on recovering valuable components and reducing ecological footprints.

SPI Energy, operating within the green technology sector, faces indirect implications from the growing necessity for comprehensive end-of-life solutions for its product portfolio. The global solar PV waste is projected to reach 60 million tons by 2030, highlighting the urgency for scalable recycling infrastructure.

Land Use and Ecosystem Impact of Projects

SPI Energy's solar projects, particularly large-scale installations, necessitate considerable land footprints. This can raise issues regarding land use, potential habitat fragmentation, and the aesthetic impact on landscapes. For instance, a typical utility-scale solar farm can require 5 to 10 acres per megawatt.

The growing adoption of floating solar farms presents a compelling solution to these land-use challenges. By utilizing existing water bodies, such as reservoirs and lakes, this approach avoids competition for terrestrial land and can even offer efficiency gains due to the cooling effect of water, potentially increasing energy output by up to 10% in some cases.

Strategic site selection and careful project planning are therefore crucial for SPI Energy to address and mitigate these environmental considerations. This includes thorough environmental impact assessments and community engagement to balance energy needs with ecological preservation.

- Land Requirements: Utility-scale solar farms can consume 5-10 acres per megawatt of capacity.

- Habitat Concerns: Large land areas can lead to disruption of local ecosystems and wildlife habitats.

- Floating Solar: This technology mitigates land-use conflicts and can boost efficiency by up to 10% due to water cooling.

- Mitigation Strategies: SPI Energy must prioritize environmental impact assessments and responsible site selection.

Carbon Footprint of Manufacturing and Operations

While SPI Energy's core business, green energy, inherently reduces operational emissions, the manufacturing of solar modules and related components still carries a significant carbon footprint. This includes energy consumption and material sourcing during production. For instance, the production of silicon, a key component in solar panels, is an energy-intensive process.

SPI Energy is actively addressing this by exploring innovations like their use of U.S.-based steel frames for solar modules. This initiative aims to reduce the carbon footprint associated with the production and transportation of these frames, contributing to a more localized and potentially lower-emission supply chain. Such strategies are becoming increasingly critical as the industry prioritizes sustainability throughout the entire product lifecycle.

The solar industry is placing a growing emphasis on adopting sustainable manufacturing practices and conducting comprehensive lifecycle assessments. These efforts are crucial for minimizing the overall environmental impact, from raw material extraction to end-of-life disposal.

- Manufacturing Emissions: The production of solar panels, particularly the purification of silicon, requires substantial energy, contributing to the manufacturing carbon footprint.

- Supply Chain Impact: Sourcing materials and components, like steel for frames, involves transportation and production processes that generate emissions.

- Industry Focus: There's a clear industry trend towards reducing the embodied carbon in solar products through material innovation and localized production.

- Lifecycle Assessment: Companies are increasingly using lifecycle assessments to understand and mitigate environmental impacts across all stages of a product's existence.

Environmental regulations and the global drive for decarbonization present significant opportunities for SPI Energy. As nations implement stricter emissions standards and invest in renewable energy infrastructure, the demand for solar solutions is expected to surge. For instance, the International Energy Agency (IEA) projected in 2024 that global renewable capacity additions would continue to break records, with solar PV leading the growth.

However, the reliance on critical minerals like silicon, lithium, and cobalt for solar panel and battery manufacturing poses supply chain risks and environmental concerns, with the IEA forecasting a potential 40-fold increase in demand for these minerals by 2040 for clean energy technologies. Additionally, the land footprint required for utility-scale solar farms, often needing 5 to 10 acres per megawatt, can lead to habitat concerns, making innovative solutions like floating solar farms, which can boost efficiency by up to 10%, increasingly important for SPI Energy to consider.

The manufacturing process itself, particularly silicon purification, is energy-intensive, contributing to the embodied carbon of solar products, a challenge SPI Energy is addressing through initiatives like U.S.-based steel frames to lower its supply chain's carbon footprint. Furthermore, the growing volume of solar panel waste, projected to reach 60 million tons by 2030, necessitates robust recycling strategies, a critical factor for the long-term sustainability of SPI Energy's business model.

PESTLE Analysis Data Sources

Our SPI Energy PESTLE Analysis is meticulously constructed using data from reputable government publications, leading financial news outlets, and established industry research firms. This ensures a comprehensive understanding of political stability, economic trends, technological advancements, and environmental regulations impacting the renewable energy sector.