SPI Energy Co. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPI Energy Co. Bundle

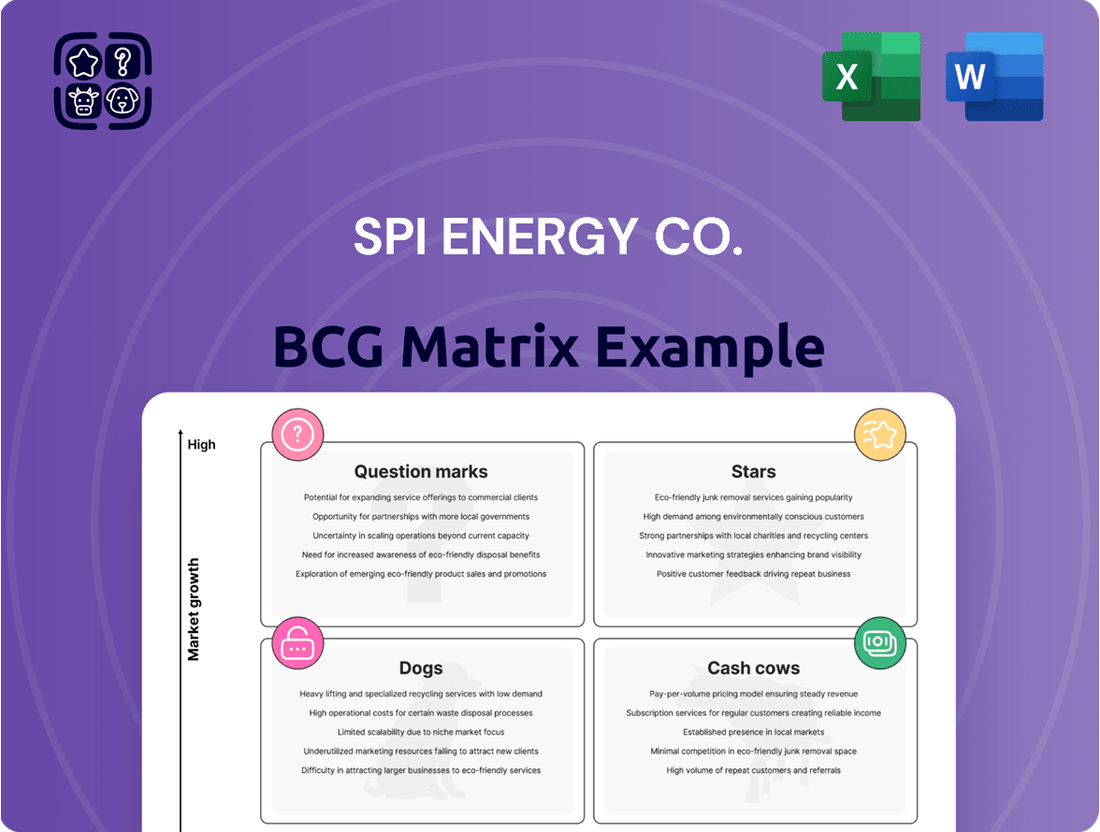

SPI Energy Co.'s position within the BCG Matrix offers a crucial lens through which to view its diverse portfolio. Understanding whether its solar energy solutions are burgeoning Stars, stable Cash Cows, underperforming Dogs, or nascent Question Marks is vital for strategic planning. This preview hints at the intricate dynamics at play, but to truly grasp the company's competitive landscape and unlock actionable growth strategies, a deeper dive is essential.

Don't miss out on the opportunity to gain a comprehensive understanding of SPI Energy Co.'s product portfolio and market standing. Purchase the full BCG Matrix report to receive detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing investments and product development.

Stars

SPI Energy Co. is actively developing and owning solar projects, a strategic move that places them in a rapidly expanding market. The recent re-consolidation of 26.57 MW of Greek photovoltaic parks is a prime example of this commitment.

This expansion is anticipated to significantly increase SPI Energy's annual revenue and bolster its operational capacity. It signals a clear intent to become a market leader in the regions where these new assets are located.

For 2024, the company's solar project development and ownership segment, especially with these re-consolidated assets, represents a key growth driver. It's a strategic play to capture market share and generate substantial recurring income.

Solar4America, SPI Energy's U.S. solar module manufacturing arm, is positioned as a strong contender within the BCG matrix. Its aggressive expansion to 5.0 GW of module production capacity by 2024, bolstered by the U.S. Inflation Reduction Act, targets a high-growth, high-potential market.

This strategic move is designed to capitalize on robust domestic demand and address supply chain vulnerabilities, solidifying SPI Energy's role in producing American-made solar components. The company reported its U.S. manufacturing capacity reached 1.1 GW by the end of 2023, with plans to scale significantly.

SPI Energy's planned SEM Wafertech aims to establish 3.0GW of U.S. solar wafer manufacturing capacity by 2024. This strategic move is designed to capitalize on increasing domestic demand and favorable government policies, such as the Inflation Reduction Act (IRA).

This venture represents a significant step towards vertical integration for SPI Energy, allowing for greater control over its supply chain and potentially higher profit margins. The U.S. solar market is experiencing robust growth, making this a key area for the company to solidify its market position.

Commercial & Utility Solar EPC Services

SPI Energy's Commercial & Utility Solar EPC Services division is a cornerstone of their operations, offering end-to-end solutions for solar project development. They handle everything from initial design to final construction for both commercial businesses and large-scale utility projects. This segment is strategically positioned to capitalize on the booming global solar market.

The demand for skilled EPC providers continues to surge as solar adoption accelerates worldwide. In 2023, the global solar PV capacity additions reached an impressive 413 GW, a significant increase from previous years, highlighting the immense market opportunity. SPI's expertise in navigating complex project requirements allows them to secure substantial market share in project execution.

- Geographic Reach: Operates in key markets including the U.S., U.K., and Europe, diversifying revenue streams and mitigating regional risks.

- Market Growth: Leverages the robust expansion of the global solar sector, which saw capacity additions grow by over 30% in 2023.

- Service Offering: Provides comprehensive EPC services, encompassing engineering, procurement, and construction for commercial and utility-scale projects.

- Strategic Importance: Acts as a critical driver of SPI Energy's revenue and market presence, benefiting from strong industry tailwinds.

Community Solar Initiatives

SPI Energy Co. is actively participating in community solar initiatives, a strategic move to tap into a growing segment of the renewable energy sector. For instance, their involvement in a 7.2MWac/8.39MWdc project in Southern California demonstrates a clear focus on this market. This project directly supports California's aggressive renewable energy goals, positioning SPI Energy to expand its influence in vital geographic areas by delivering accessible solar power solutions.

These community solar projects are crucial for SPI Energy's market positioning.

- Expanding Market Reach: Community solar allows SPI Energy to serve a broader customer base, including those who cannot install solar on their own rooftops.

- Regulatory Alignment: Projects align with state mandates, such as California's goal of 100% clean electricity by 2045, creating a favorable operating environment.

- Revenue Diversification: Community solar offers a stable, long-term revenue stream through power purchase agreements.

- Brand Enhancement: Participation reinforces SPI Energy's commitment to sustainability and community engagement.

SPI Energy's Stars represent their most promising ventures, characterized by high growth and significant market share. The company's investments in manufacturing, particularly Solar4America and SEM Wafertech, with planned capacities of 5.0 GW and 3.0 GW respectively by 2024, exemplify this star status. These segments benefit from strong market demand and supportive policies like the Inflation Reduction Act, indicating substantial future revenue potential.

What is included in the product

SPI Energy's BCG Matrix would analyze its solar and energy storage businesses, categorizing them as potential Stars, Cash Cows, or Question Marks based on market growth and share.

SPI Energy Co.'s BCG Matrix provides a clear, actionable roadmap, relieving the pain of strategic uncertainty by highlighting growth opportunities.

Cash Cows

SPI Energy's existing portfolio of operational solar projects, even before the full reintegration of its Greek assets, served as a significant cash generator. For instance, a 17.51 MW capacity project would typically offer a stable revenue stream, reflecting its mature operational status and established market position.

These mature solar assets are characteristic of cash cows within a BCG matrix. They likely require minimal further investment for growth and instead provide consistent, reliable cash flow to fund other areas of the business. The solar market's overall expansion is less critical to these specific assets than their inherent efficiency and operational longevity.

SPI Energy's long-term Power Purchase Agreements (PPAs) represent a significant cash cow. These agreements with utility companies and other energy buyers provide a steady, predictable revenue stream for their owned and operated solar projects. For instance, in 2023, SPI Energy reported substantial recurring revenue from these PPAs, underscoring their stability.

The long duration of these PPAs, often spanning decades, insulates SPI Energy from the immediate fluctuations of the energy market. This consistent income flow is vital for supporting other business initiatives and operations. The company's focus on securing these long-term contracts highlights their strategy for generating reliable cash.

The SolarJuice division, active in Australia and North America, is a prime example of a cash cow for SPI Energy. Its focus on residential solar and roofing installations in established markets allows it to generate consistent cash flow.

While the residential solar sector remains competitive, SolarJuice benefits from its mature operations and a solid customer foundation. This stability means it requires less capital for aggressive expansion, unlike emerging business segments.

In 2023, SPI Energy reported a significant increase in revenue for its solar segment, with SolarJuice playing a key role. This segment's profitability is crucial for funding other areas of the business.

The company's strategy leverages SolarJuice's steady earnings to support investments in higher-growth opportunities, showcasing its role as a reliable contributor to overall financial health.

Solar Wholesale Distribution (SolarJuice)

SolarJuice, SPI Energy's solar wholesale distribution arm, operates in established markets like Asia Pacific and North America. This segment benefits from consistent demand for solar components, generating reliable cash flow through its efficient supply chain. Even with competitive pricing, the high volume of distribution contributes significantly to SPI Energy's overall financial stability.

In 2024, SolarJuice's performance is anchored by its ability to manage inventory and logistics effectively. This operational strength allows it to capture market share in a sector where timely delivery and competitive pricing are paramount. The business model is designed for steady revenue generation, acting as a stable contributor within SPI Energy's portfolio.

- Market Presence: Strong foothold in Asia Pacific and North America.

- Revenue Generation: Consistent cash flow from high-volume distribution.

- Operational Efficiency: Focus on supply chain and inventory management.

- Financial Contribution: Acts as a stable revenue generator for SPI Energy.

Maintenance and Operations Services for Solar Assets

Maintenance and Operations Services for Solar Assets represent a significant Cash Cow for SPI Energy Co. This segment focuses on providing ongoing upkeep and management for solar projects. These services are essential for the longevity and efficiency of solar installations, ensuring a consistent and reliable revenue stream for the company.

The stability of this business line is a key advantage. Unlike more volatile segments, the demand for solar asset maintenance is relatively constant, driven by the inherent need for continuous operational support. This dependability makes it a cornerstone of SPI Energy's financial performance, offering a predictable income that buffers against market uncertainties.

- Recurring Revenue: SPI Energy's maintenance and operations services generate predictable income from long-term contracts with solar asset owners.

- Industry Stability: The solar industry's growth, with installations expected to reach over 1,300 GW globally by the end of 2024 according to some projections, underpins the constant need for these essential services.

- Low Competition Intensity: While competition exists, established players like SPI Energy benefit from their existing infrastructure and expertise in managing diverse solar portfolios.

- High Profitability: Mature service offerings often command healthy profit margins due to optimized operational efficiencies and established client relationships.

SPI Energy's operational solar projects are key cash cows, generating stable revenue through long-term Power Purchase Agreements (PPAs). For example, their 17.51 MW projects have a mature operational status, requiring minimal new investment while providing consistent cash flow. This predictable income is crucial for funding other business ventures and operations.

The SolarJuice division, operating in established markets like Australia and North America, also functions as a cash cow. Its focus on residential solar and roofing installations in mature markets ensures consistent cash flow with less need for aggressive expansion capital. In 2023, SolarJuice significantly contributed to the revenue growth of SPI Energy's solar segment.

Maintenance and Operations Services for Solar Assets are another vital cash cow. These services ensure the longevity and efficiency of solar installations, providing a steady, reliable revenue stream. The growing global solar installation base, projected to exceed 1,300 GW by the end of 2024, underpins the continuous demand for these essential services.

| Business Segment | BCG Matrix Category | Key Characteristics | Financial Contribution | 2024 Outlook |

| Operational Solar Projects | Cash Cow | Mature assets, long-term PPAs, stable revenue | Consistent cash flow generation | Continued stability from existing contracts |

| SolarJuice (Residential Solar & Roofing) | Cash Cow | Established markets, consistent demand, operational efficiency | Reliable earnings, funding for growth initiatives | Steady performance driven by market presence |

| Maintenance & Operations Services | Cash Cow | Essential services, recurring revenue, industry stability | Predictable income, high profitability margins | Growth supported by expanding solar asset base |

What You’re Viewing Is Included

SPI Energy Co. BCG Matrix

The SPI Energy Co. BCG Matrix you are previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis accurately reflects the strategic positioning of SPI Energy's business units within the market, offering clear insights into their current and potential future performance. You can confidently expect the same high-quality, ready-to-use report for your strategic planning needs.

Dogs

SPI Energy's older solar installations, particularly those deployed in earlier phases of the solar market's development, might be categorized as "Dogs" in a BCG matrix analysis. These legacy assets, while foundational, could be characterized by lower energy conversion efficiencies compared to newer technologies and potentially face higher maintenance or repair costs due to their age.

Such underperforming assets might be situated in regions with declining solar incentives or in sub-segments of the market that are experiencing slower growth, limiting their revenue-generating potential. For instance, a project installed in a jurisdiction that has since reduced its feed-in tariffs could struggle to achieve the same profitability as newer projects benefiting from current market conditions.

The operational expenditure for these older solar farms could also be disproportionately high relative to the electricity they produce. This scenario drains company resources without delivering substantial returns, a classic indicator of a "Dog" in portfolio management. For example, if a 5-year-old solar farm costs 15% more to maintain annually than a comparable new installation, its profitability is significantly impacted.

SPI Energy may need to evaluate these legacy assets for potential divestment, repowering with more efficient technology, or restructuring their operational model to mitigate losses. The strategic decision hinges on whether the cost of upgrading or maintaining these assets outweighs their future revenue-generating capacity in their current state.

SPI Energy's foray into niche electric vehicle (EV) products, particularly those in early development stages, presents a potential classification as dogs within its BCG matrix. These specialized offerings, while innovative, may be experiencing low adoption rates in highly competitive, nascent sub-markets. For instance, if SPI Energy has invested in, say, specialized EV charging solutions for commercial fleets that haven't yet seen widespread uptake, these could fall into this category.

Such products often demand significant capital expenditure for research, development, and market penetration with minimal current market share or profitability. Consider a scenario where the company launched a unique EV battery swapping station concept in 2023 or early 2024. If initial deployments in limited geographic areas haven't garnered substantial customer commitment or revenue, it would likely be a dog. The market for such specialized EV infrastructure is still evolving, making it challenging for early entrants to secure a dominant position.

SPI Energy Co.'s ongoing Nasdaq non-compliance issues create a significant drain on administrative resources. The delist determination notice alone necessitates substantial management attention and incurs considerable legal expenses. These corporate-level burdens divert focus and capital away from revenue-generating activities, effectively acting as a cash trap within the company's overall financial structure.

Highly Volatile Stock Performance

SPI Energy Co. (SPI) has experienced significant stock price volatility, a characteristic often seen in companies with a low market share and consequently, lower investor confidence. Despite potential growth in the solar energy sector, SPI's market capitalization has struggled to reflect this, indicating a hesitancy from the market to fully value its prospects. This situation can make it harder for the company to secure additional funding or pursue ambitious strategic moves, ultimately impacting its overall valuation.

The company's financial performance and stock behavior in 2024 highlight this volatility. For instance, while the solar industry saw renewed interest, SPI's stock price often fluctuated dramatically. This can be attributed to factors such as its relatively small market share compared to larger, more established players in the renewable energy space. A key challenge remains building sustained investor trust, which is crucial for attracting capital and enhancing strategic maneuverability.

- Historical Volatility: SPI's stock has shown considerable price swings, often reacting sharply to industry news or company-specific announcements.

- Low Market Share Impact: A smaller market share translates to a lower market capitalization, limiting the company's ability to influence market perception and attract large institutional investors.

- Capital Raising Challenges: The volatility and lower valuation can make it more expensive and difficult for SPI to raise capital through equity offerings, potentially slowing down expansion plans.

- Strategic Flexibility Constraints: A perceived lower value can reduce the company's bargaining power in potential mergers, acquisitions, or strategic partnerships, thereby limiting its options for growth and development.

Segments with Persistent Low Gross Margins

SPI Energy Co. might find certain segments within its operations categorized as dogs in a BCG matrix if they exhibit consistently low gross margins and a low market share. For instance, areas historically showing gross margins between 4.26% and 8.16% despite revenue increases could signal underlying issues.

This persistent low profitability in specific business lines suggests challenges in managing costs effectively or a lack of strong pricing power. Such segments contribute minimally to the company's net earnings, making them potential candidates for re-evaluation or divestment if their market position is also weak.

- Low Gross Margin Persistence: Segments with historical gross margins in the 4.26% to 8.16% range, even with revenue growth, indicate operational inefficiencies or pricing pressures.

- Market Share Consideration: If these low-margin segments also possess a low market share, they fit the 'dog' profile in the BCG matrix.

- Cost Management & Pricing Power: Persistent low margins point to difficulties in controlling costs or commanding higher prices within these specific business areas.

- Net Contribution Impact: These segments offer minimal net profit, potentially hindering overall company performance and requiring strategic attention.

SPI Energy's older solar installations, characterized by lower efficiencies and potentially higher maintenance costs, represent "Dogs" in their portfolio. These legacy assets, often in regions with reduced solar incentives, struggle to generate significant revenue. For example, older solar farms might have operational expenditures 15% higher than new installations, impacting profitability.

Certain niche EV products in early development stages also fit the "Dog" category due to low adoption and high R&D costs. A concept like specialized EV battery swapping stations, if experiencing low uptake in its initial 2023-2024 rollout, would be a prime example. These ventures demand substantial capital with minimal current market share.

Segments with persistently low gross margins, such as those historically between 4.26% and 8.16%, coupled with a low market share, are also classified as Dogs. These areas highlight potential cost management or pricing power issues, contributing minimally to net earnings and requiring strategic re-evaluation.

Question Marks

SPI Energy's EV charging solutions are positioned within a rapidly expanding market, projected to see a compound annual growth rate of 26.17% to 27% from 2025. This presents a significant opportunity, although SPI Energy's current market share in this segment is likely still in its early stages. The company’s investment in developing these charging solutions signifies a strong growth potential, reflecting the industry's trajectory.

Phoenix Motor, a subsidiary of SPI Energy, is venturing into the burgeoning electric vehicle market with its development of electric pickup trucks and forklifts. This strategic move targets the medium-duty commercial EV sector, a segment experiencing rapid electrification and offering substantial growth potential.

The company's focus on this high-growth area presents a significant opportunity, though its current market penetration is likely modest given the early stage of development. To effectively compete and capture market share, Phoenix Motor will require considerable capital investment and a well-defined strategic roadmap for product development and market entry.

EdisonFuture's electric delivery van, featuring integrated solar charging, is positioned to capitalize on the expanding last-mile delivery sector. This market is expected to see robust growth, with projections indicating a significant increase in demand for efficient and sustainable delivery solutions. For SPI Energy, this represents a strategic entry into a dynamic and competitive arena.

Currently, EdisonFuture holds a relatively low market share in the electric delivery van segment. However, the product's innovative solar charging capability offers a compelling differentiator, potentially driving high growth if it achieves widespread adoption and successful scaling. This aligns with the characteristics of a question mark in the BCG matrix, where potential for high growth exists, but market share is low and investment is needed to determine future success.

Battery Storage Solutions

SPI Energy is strategically focusing on the burgeoning battery storage sector, recognizing its significant growth potential within the green energy landscape. This move positions the company to capitalize on a market that is experiencing rapid expansion.

While the battery storage market is dynamic and offers immense opportunities, SPI Energy's current market share in this specialized area is likely nascent. Significant capital investment will be necessary to establish a strong foothold and drive substantial growth in this segment.

- Market Growth: The global battery energy storage market was valued at approximately $128.9 billion in 2023 and is projected to reach over $300 billion by 2030, with a compound annual growth rate (CAGR) of around 13%.

- Investment Needs: Expanding in battery storage typically requires substantial upfront capital for manufacturing, research and development, and supply chain infrastructure.

- Strategic Alignment: SPI Energy's investment aligns with broader industry trends favoring renewable energy integration and grid stability solutions.

New Geographic Market Expansions

SPI Energy is actively exploring new geographic markets for its solar project development and EPC services, recognizing significant growth potential. These expansions represent strategic moves to diversify revenue streams and tap into emerging demand for renewable energy solutions. For instance, entering markets in Southeast Asia or parts of Africa could offer substantial opportunities due to increasing government support for solar power and a growing need for reliable energy access. However, these new ventures will require considerable upfront investment in establishing local operations, building brand awareness, and navigating diverse regulatory environments, all while facing established local players.

The company's strategy involves identifying regions with favorable solar irradiance, supportive policies, and unmet energy demands. While specific new market entries are often sensitive information until officially announced, SPI Energy’s recent investor presentations have highlighted a focus on expanding its reach beyond its traditional strongholds. This proactive approach is crucial for long-term sustainability and competitive positioning in the global solar industry.

- Strategic Focus: SPI Energy is targeting emerging markets with high solar potential and supportive government incentives for renewable energy adoption.

- Investment Requirements: Significant capital will be allocated for market entry, including building local infrastructure, marketing, and talent acquisition.

- Competitive Landscape: New markets often present established local competitors, necessitating a well-defined market entry strategy to gain traction.

- Growth Opportunity: Expansion into underserved regions provides a substantial opportunity to increase market share and revenue diversification for SPI Energy.

SPI Energy's ventures into EV charging, electric vehicles via Phoenix Motor, and electric delivery vans through EdisonFuture are classic "Question Mark" candidates in the BCG matrix. These segments exhibit high market growth potential, aligning with industry trends. However, SPI Energy's current market share in these nascent areas is likely modest. Significant investment is crucial to determine if these ventures can capture market share and evolve into Stars or eventually Cash Cows.

| Business Unit | Market Growth Potential | Current Market Share | Investment Need | BCG Classification |

|---|---|---|---|---|

| EV Charging Solutions | High (CAGR 26.17%-27% from 2025) | Low | High | Question Mark |

| Phoenix Motor (EV Trucks/Forklifts) | High (Electrification of commercial sector) | Low | High | Question Mark |

| EdisonFuture (Electric Delivery Vans) | High (Last-mile delivery sector growth) | Low | High | Question Mark |

| Battery Storage | High ($128.9B in 2023, projected >$300B by 2030, ~13% CAGR) | Low | High | Question Mark |

| New Geographic Markets (Solar EPC) | High (Emerging demand, government support) | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages SPI Energy's financial disclosures, market research reports, and industry growth forecasts to accurately position its business units.