SPI Energy Co. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPI Energy Co. Bundle

SPI Energy Co. navigates a dynamic solar energy landscape, where intense rivalry and the threat of substitutes significantly shape its market position. Understanding the bargaining power of both buyers and suppliers is crucial for sustained profitability. The looming threat of new entrants, while potentially disruptive, also signals growth opportunities within the sector.

The complete report reveals the real forces shaping SPI Energy Co.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The solar photovoltaic (PV) and electric vehicle (EV) charging sectors, where SPI Energy operates, are heavily dependent on specialized components. Think solar cells, inverters, battery parts, and sophisticated charging equipment. When only a handful of companies supply these essential items, their influence grows significantly.

SPI Energy's cost efficiency and ability to secure these vital components directly hinge on how concentrated the supplier market is. For instance, in 2023, the global solar inverter market saw significant revenue share held by key players, indicating a degree of supplier concentration for this critical PV component.

SPI Energy Co. faces considerable bargaining power from its suppliers due to high switching costs. These costs can manifest as significant expenses associated with re-engineering product designs, obtaining new certifications for components, and cultivating relationships with alternative financing partners. For instance, in the solar industry, changing a key inverter supplier might necessitate extensive testing and re-validation of the entire system, a process that can easily run into millions of dollars and cause project delays.

The substantial financial and operational hurdles involved in switching suppliers directly translate into increased dependency for SPI Energy on its existing partners. This dependence grants suppliers leverage, as they are aware that the cost and complexity of replacement make it advantageous for SPI Energy to maintain the status quo, even if pricing or terms are not optimal.

The uniqueness of inputs for SPI Energy Co. can significantly influence supplier bargaining power. For instance, specialized components critical for advanced solar technology or proprietary software for energy management might be sourced from only a handful of suppliers. If SPI Energy relies heavily on these unique inputs for its competitive edge, the suppliers of these components gain substantial leverage. This situation can limit SPI Energy's ability to switch suppliers without incurring significant costs or compromising product quality. In 2023, the global solar panel market saw prices for high-efficiency modules, often incorporating unique technologies, remain relatively firm despite broader market shifts, indicating supplier pricing power for differentiated products.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers significantly bolsters their bargaining power over SPI Energy. If suppliers of critical solar components or financing providers can credibly move into downstream solar project development or electric vehicle (EV) solutions, they gain leverage. This potential competition forces SPI Energy to negotiate more favorable terms to avoid direct rivalry from its own supply chain, directly impacting its market position and profitability.

For instance, a major solar panel manufacturer with strong R&D and distribution capabilities could decide to develop its own solar projects, directly competing with SPI Energy’s core business. Similarly, a large financial institution providing project financing might establish its own renewable energy development arm. Such moves would not only disrupt SPI Energy's operations but also create a more competitive landscape where suppliers dictate terms.

- Supplier Integration Risk: Suppliers of key solar components or financing could enter SPI Energy's downstream solar project development or EV solutions markets.

- Impact on Terms: This threat forces SPI Energy to accept less favorable contract terms to mitigate direct competition.

- Market Position: Forward integration by suppliers can weaken SPI Energy's competitive standing and reduce its profit margins.

Impact of Raw Material Price Volatility

Suppliers' costs for essential raw materials such as polysilicon, lithium, and copper are subject to considerable price swings. SPI Energy, like other solar and energy companies, is exposed to these fluctuations, which suppliers often pass on. This dynamic significantly amplifies supplier bargaining power, particularly when demand for these critical inputs outstrips available supply, or when supply chains face disruptions.

The impact of this raw material price volatility directly affects SPI Energy's profitability. For instance, polysilicon prices, a key component in solar panels, experienced notable volatility in 2023 and early 2024, influenced by production capacities and global demand. A significant increase in polysilicon costs, for example, could reduce SPI Energy's gross margins if the company cannot fully pass these increases to its customers.

- Polysilicon Price Volatility: Prices for polysilicon, a fundamental material for solar panels, saw fluctuations throughout 2023, impacting manufacturers' cost structures.

- Lithium and Copper Costs: The energy transition's demand for lithium and copper, essential for battery storage and electrical infrastructure, contributes to potential price pressures from suppliers in these sectors.

- Impact on Margins: SPI Energy's ability to absorb or pass on these material cost increases directly influences its profit margins and overall financial performance.

SPI Energy faces significant supplier bargaining power due to the specialized nature of components like solar cells and inverters, where a few dominant players exist. In 2023, the global solar inverter market revenue was heavily concentrated among top suppliers, giving them considerable leverage over SPI Energy.

High switching costs, including re-engineering and certification expenses, further entrench SPI Energy's reliance on current suppliers. For example, changing a critical inverter supplier can incur millions in costs and project delays, a factor suppliers leverage in negotiations.

The potential for suppliers to integrate forward into areas like solar project development or EV charging solutions poses a threat, forcing SPI Energy to accept less favorable terms to avoid direct competition from its own supply chain.

Raw material price volatility for inputs like polysilicon, lithium, and copper directly impacts SPI Energy's costs and margins, as suppliers often pass on these fluctuating expenses.

| Component | Supplier Concentration Impact | Switching Cost Example | Raw Material Volatility Impact (2023-2024) |

|---|---|---|---|

| Solar Inverters | High concentration in global market | System re-engineering and certification | N/A (Component-specific) |

| Solar Cells | Concentrated manufacturing base | Securing new, certified suppliers | Polysilicon price fluctuations |

| Battery Components | Key material suppliers often dominant | Integration into EV systems | Lithium and copper price swings |

| EV Charging Equipment | Specialized technology providers | Compatibility and software integration | N/A (Component-specific) |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to SPI Energy Co.'s position in the solar energy sector.

Easily visualize competitive intensity and identify key threats to SPI Energy's market position, all within a single, actionable dashboard.

Customers Bargaining Power

Customer price sensitivity is a significant factor for SPI Energy. For their solar projects, whether residential, commercial, or utility-scale, and for EV charging solutions, customers meticulously evaluate the total cost of ownership and the projected return on investment. If these customers perceive solar or EV solutions as interchangeable commodities, they possess considerable leverage to push for lower prices, directly impacting SPI Energy's profit margins.

The solar project development and electric vehicle (EV) charging sectors are quite crowded, with many companies offering very similar services and products. This abundance of choice directly translates to increased bargaining power for customers. In 2024, the global solar PV market alone saw significant growth, indicating a robust competitive landscape where customers can readily find alternatives.

When customers have a wide array of providers to select from, their leverage in negotiations naturally grows. They can easily switch to a competitor if they are not satisfied with pricing or service terms. For SPI Energy, this means the imperative to clearly distinguish its offerings is paramount.

To counter this strong customer bargaining power, SPI Energy needs to focus on unique value propositions that go beyond just price. Differentiating through superior technology, enhanced customer service, or specialized project expertise is crucial for customer retention and avoiding a race to the bottom in pricing, especially as the EV charging infrastructure market continues to expand rapidly in 2024 and beyond.

For larger commercial and industrial clients, the ability to develop solar projects internally or manage their own electric vehicle charging infrastructure presents a significant alternative to SPI Energy. This self-sufficiency directly enhances their bargaining power, as they can choose to bypass external providers if SPI Energy's offerings are not competitive.

This capability means SPI Energy must consistently demonstrate superior value, whether through cost-effectiveness, technological innovation, or specialized expertise. For instance, if a large corporation can leverage its existing engineering staff and capital to install solar panels, SPI Energy's proposal needs to be demonstrably more attractive than this in-house option.

The trend towards greater energy independence among large consumers means SPI Energy faces increased pressure to provide compelling reasons to outsource these projects. Companies in 2024 are increasingly exploring distributed generation, making the threat of backward integration by customers a tangible factor in market dynamics.

SPI Energy's strategy must therefore focus on offering integrated solutions, advanced project management, and potentially financing options that are difficult for individual clients to replicate independently, thereby mitigating this customer power.

Low Switching Costs for Customers

SPI Energy Co. likely faces a scenario where customers can readily switch between solar project developers and EV solution providers. This ease of transition, often due to minimal contractual lock-ins or easily transferable technology, significantly bolsters customer bargaining power. When switching costs are low, customers are more inclined to shop around for the best pricing, service agreements, or product features, directly impacting SPI Energy's ability to command premium pricing or retain clients without competitive offerings.

The implication of low switching costs is a constant pressure on SPI Energy to deliver superior value and maintain high levels of customer satisfaction. For instance, if a competitor offers a slightly better warranty or a more streamlined installation process, customers might migrate with little hesitation. In 2024, the renewable energy sector saw increased competition, with many new entrants aiming to capture market share by offering attractive initial deals, further amplifying the impact of low switching costs for customers.

- Low Switching Costs: Customers can easily move between solar and EV providers without significant financial or operational penalties.

- Enhanced Bargaining Power: This ease of switching empowers customers to demand better prices and services from SPI Energy.

- Competitive Pressure: SPI Energy must continuously innovate and offer competitive advantages to retain its customer base.

- Market Dynamics: Increased competition in the renewable energy and EV sectors in 2024 exacerbates the effect of low switching costs.

Customer Concentration

If SPI Energy Co. has a few major clients that account for a large chunk of its income, those clients gain significant leverage. This means they can push for better deals, like reduced prices or specially tailored services, simply because they buy so much. For instance, if a single customer represented over 10% of SPI Energy's revenue in a given period, their ability to negotiate would be heightened.

This customer concentration directly impacts SPI Energy's pricing power and profit margins. Customers with substantial purchasing volume can often dictate terms, forcing the company to compromise on profitability to retain their business. In 2023, for example, a notable portion of SPI Energy's revenue was derived from its larger project deployments, highlighting the importance of managing these key relationships.

- Customer Concentration Risk: A heavy reliance on a few large customers grants them increased bargaining power.

- Demand for Favorable Terms: These customers can demand lower prices and customized solutions due to their significant purchasing volume.

- Impact on Profitability: Customer concentration can pressure SPI Energy's profit margins and pricing flexibility.

- Mitigation Strategy: Diversifying the customer base is essential to reduce the dependency on any single buyer and lessen this bargaining power.

The bargaining power of customers for SPI Energy is substantial, driven by market competition and the nature of its services in the solar and EV charging sectors. Customers can easily compare offerings, leading them to seek the best value, which puts pressure on SPI Energy's pricing and profitability.

The ability for customers to switch providers with minimal hassle significantly amplifies their leverage. This dynamic is particularly relevant in 2024 as the renewable energy market continues to attract new players, offering customers more choices and the opportunity to negotiate favorable terms.

SPI Energy must therefore focus on building strong customer loyalty through superior service, technological innovation, and by demonstrating unique value propositions that extend beyond mere cost savings to mitigate this inherent customer power.

| Factor | Impact on SPI Energy | 2024 Context |

| Price Sensitivity | Customers scrutinize total cost and ROI, pushing for lower prices. | High competition in solar and EV markets intensifies price pressure. |

| Availability of Substitutes | Numerous providers offer similar solar and EV solutions. | Global solar PV market growth in 2024 indicates a crowded competitive landscape. |

| Low Switching Costs | Customers can easily change providers without significant penalties. | New entrants in 2024 often offer attractive initial deals, facilitating customer migration. |

| Customer Concentration | A few large clients hold significant negotiation power. | In 2023, a notable portion of SPI Energy's revenue came from larger projects, highlighting this risk. |

Full Version Awaits

SPI Energy Co. Porter's Five Forces Analysis

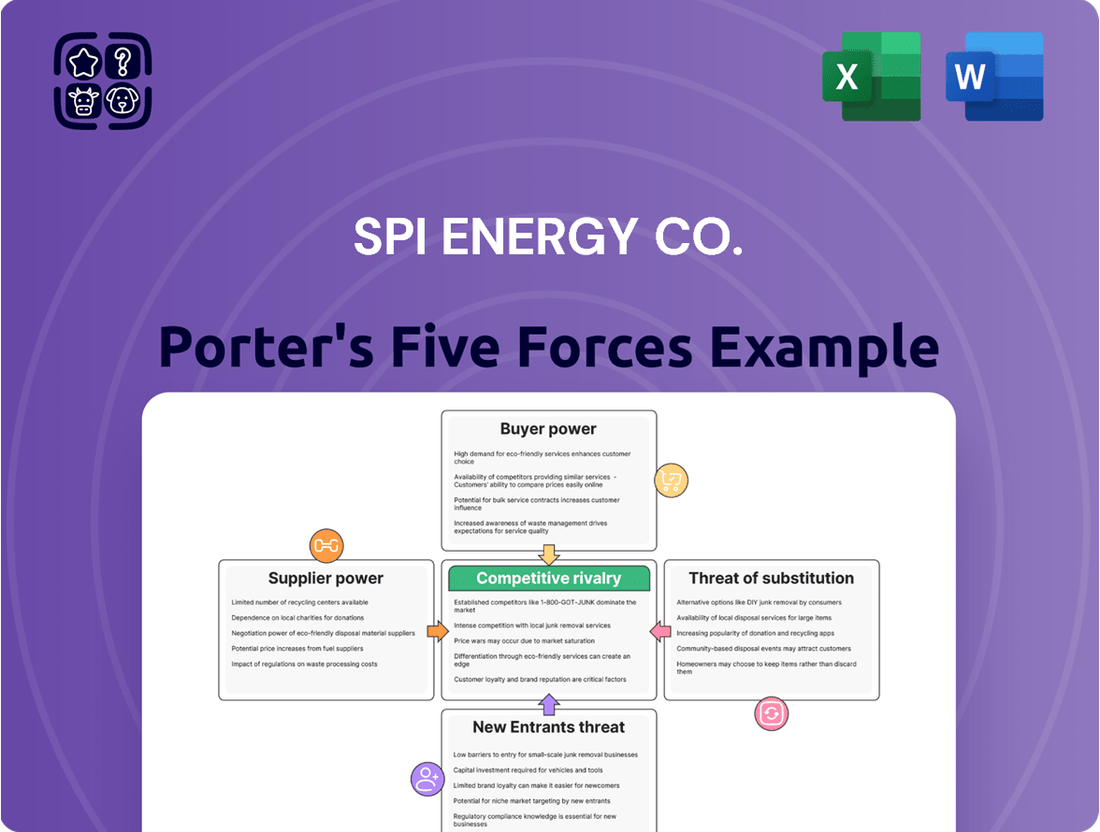

This preview showcases the comprehensive Porter's Five Forces analysis for SPI Energy Co., detailing the competitive landscape and strategic implications for the company. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. You're looking at the actual document, providing a thorough examination of the forces shaping SPI Energy's market position and operational strategies. Once you complete your purchase, you’ll get instant access to this exact file, empowering you with critical business intelligence for informed decision-making.

Rivalry Among Competitors

SPI Energy operates in a competitive landscape populated by a broad spectrum of companies, from global giants to specialized firms and agile startups. This diverse mix means competition isn't monolithic; it comes from various strategic directions and resource levels.

In 2024, the solar PV and EV solutions sectors are characterized by a high number of participants. For instance, the global solar PV market alone is projected to see significant growth, with new installations expected to reach hundreds of gigawatts annually, meaning many companies are vying for market share.

This sheer volume of competitors, each with unique approaches to product development, pricing, and market penetration, naturally heightens the intensity of rivalry. SPI Energy must therefore remain agile and continuously adapt its strategies to stay ahead.

The diversity extends to their business models; some focus on large-scale utility projects, others on residential installations, and some on technological innovation in battery storage or advanced PV materials, all of which present different competitive pressures.

SPI Energy Co. operates within the green energy sector, which is indeed experiencing robust growth. However, the pace of this expansion isn't uniform across all its segments. For instance, while the overall renewable energy market is expanding, specific areas like downstream solar installations or the burgeoning EV charging infrastructure might see more moderate growth rates compared to other segments. This variation is crucial because slower growth in a particular niche can heighten competitive rivalry as companies vie more intensely for existing customers rather than simply capturing new market share as the overall pie expands.

SPI Energy, like many in the solar and EV charging sectors, faces intense competition driven by substantial fixed costs. Developing solar farms and charging infrastructure requires massive initial investments in land, equipment, and technology. This capital-intensive nature means companies must strive for high utilization to spread these costs, often leading to price wars.

In 2024, the ongoing global push for renewable energy and EV adoption means many companies are expanding capacity. For instance, major solar developers are reporting billions in planned project pipelines, all requiring significant upfront capital. This drive for scale and market share, fueled by high fixed costs, puts considerable pressure on profit margins as companies compete aggressively for projects and operational efficiency.

Product and Service Differentiation

The competitive rivalry within the solar and EV sectors hinges significantly on product and service differentiation. When competitors can offer distinct advantages in areas like solar project efficiency, innovative financing, or superior operations and maintenance (O&M) services, it lessens the pressure to compete solely on price. Similarly, in the EV charging space, advancements in charger technology, the reliability of charging networks, and sophisticated software features create competitive moats. SPI Energy's success is tied to its ability to carve out these differentiation points.

The solar industry, in particular, has seen a trend towards commoditization, where basic solar panel installations can become price-driven. However, companies that offer integrated solutions, such as advanced energy storage or smart grid integration, can stand out. In 2023, for example, the global solar PV market saw continued growth, with installations reaching new heights, intensifying the need for differentiation beyond just panel wattage. Companies that can offer compelling value through extended warranties, performance guarantees, or specialized installation services tend to fare better in this competitive landscape.

For SPI Energy, this means focusing on aspects that truly set its solar projects and EV solutions apart. This could involve developing proprietary technology for enhanced energy capture in solar, or offering unique subscription models for EV charging that include benefits like priority access or bundled services. The company's ability to innovate in its service offerings, not just its core products, will be a crucial factor in mitigating intense price competition and capturing market share. SPI Energy's strategy needs to emphasize these differentiating factors to avoid being drawn into a race to the bottom on pricing.

- Solar Project Differentiation: Competitors differentiate through efficiency ratings, financing options, and O&M service quality.

- EV Solution Differentiation: Key differentiators include charger technology, network uptime, and software capabilities.

- Impact of Commoditization: When offerings are similar, price becomes the primary competitive battleground.

- SPI Energy's Need: Strong differentiation is essential for SPI Energy to command premium pricing and build customer loyalty.

Exit Barriers

SPI Energy Co. likely faces significant competitive rivalry due to high exit barriers in the solar energy sector. These barriers, such as specialized manufacturing equipment and long-term power purchase agreements, make it costly and difficult for companies to cease operations. This situation can trap underperforming firms in the market, prolonging overcapacity and intensifying price wars, even when profit margins are thin.

The persistence of these exit barriers directly fuels ongoing rivalry among solar energy providers. Companies might be compelled to continue operating at reduced profitability rather than absorb substantial exit costs. For instance, in 2024, the global solar panel manufacturing capacity significantly outpaced demand, a scenario exacerbated by companies unable to exit due to sunk costs in specialized production lines.

- High Capital Investment: The solar industry requires substantial upfront investment in manufacturing facilities and technology, creating a significant financial hurdle for exiting.

- Specialized Assets: Solar panel production involves highly specialized machinery and processes that have limited alternative uses, increasing the cost of disposal or repurposing.

- Long-Term Contracts: Many solar projects are underpinned by long-term power purchase agreements (PPAs), obligating companies to continue operations for extended periods.

- Skilled Labor Dependencies: The industry relies on a specialized workforce; the social and financial costs of laying off these employees can act as an additional exit barrier.

SPI Energy Co. encounters fierce competition in the renewable energy and EV charging sectors. The sheer number of players, from large global entities to niche startups, creates a dynamic and often aggressive market. This rivalry is amplified by substantial fixed costs associated with infrastructure development, pushing companies towards high utilization and potentially price competition.

Differentiation remains a key strategy, with companies vying to stand out through technological innovation, service quality, and integrated solutions, rather than solely on price. However, industry trends like commoditization in basic solar installations mean that companies must continually innovate to maintain margins and market share.

High exit barriers, such as specialized equipment and long-term contracts, also contribute to sustained rivalry. Companies may remain in the market even with thin margins due to the difficulty and cost of exiting, leading to persistent overcapacity and intense competition, particularly evident in 2024 with significant global solar manufacturing capacity exceeding demand.

| Key Competitor Aspects | Description | 2024 Market Context |

| Number of Competitors | High, diverse range from large corporations to startups | Global solar PV installations projected to add hundreds of gigawatts annually, indicating broad market participation. |

| Fixed Costs & Pricing Pressure | Capital-intensive infrastructure (solar farms, EV charging) necessitates high utilization, leading to price competition. | Billions in planned project pipelines for solar developers highlight the scale of investment and the drive for market share. |

| Differentiation Strategies | Focus on technology, efficiency, financing, O&M, and integrated solutions (e.g., battery storage). | The solar PV market saw continued growth in 2023, intensifying the need for differentiation beyond basic product offerings. |

| Exit Barriers | Specialized assets, long-term contracts, and skilled labor dependencies make exiting costly. | Global solar panel manufacturing capacity significantly outpaced demand in 2024, partly due to companies being unable to exit due to sunk costs. |

SSubstitutes Threaten

For SPI Energy Co., the threat of substitutes is significant, primarily from alternative energy sources. These include traditional fossil fuels like coal and natural gas, as well as nuclear, hydro, wind, and geothermal power. The cost-effectiveness, reliability, and environmental considerations of these alternatives directly impact the demand for solar energy projects. For instance, fluctuations in natural gas prices, a key substitute, can make solar less or more competitive. In 2023, global energy markets saw continued volatility, with fossil fuel prices experiencing significant swings, indirectly influencing the investment appeal of solar.

For SPI Energy Co., the threat of substitutes in the electric vehicle (EV) sector is significant. Traditional gasoline and diesel vehicles remain a powerful alternative, especially as internal combustion engine (ICE) efficiency continues to improve. In 2024, gasoline prices have seen fluctuations, but the established infrastructure and lower upfront cost of ICE vehicles still make them a compelling option for many consumers.

Public transportation networks also serve as a substitute, particularly in densely populated urban areas. The convenience and cost-effectiveness of buses, trains, and subways can reduce the perceived need for personal EV ownership. Furthermore, emerging fuel technologies, such as hydrogen fuel cells, represent another potential substitute, though their market penetration is currently limited.

Infrastructure limitations for EVs, such as the availability and speed of charging stations, can also bolster the appeal of substitute options. While the EV charging network is expanding, gaps in coverage and charging times can deter potential buyers, making conventional fueling stations or readily available public transit more attractive.

The attractiveness of substitutes for SPI Energy's solar and electric vehicle (EV) charging solutions hinges on their cost-performance ratio. If alternative energy sources or charging methods become substantially more affordable, efficient, or user-friendly, customers might shift away from SPI's offerings.

For instance, advancements in battery technology for electric vehicles could lead to lower upfront costs and longer ranges, making ICE vehicles with efficient fuel consumption a more compelling substitute for certain consumer segments. Similarly, breakthroughs in grid-scale energy storage could reduce the reliance on distributed solar generation, impacting SPI's market share.

SPI Energy's continued success relies on its ability to innovate. In 2024, the global solar PV market saw continued growth, with analysts projecting shipments to reach over 1.2 terawatts by year-end, driven by falling costs and supportive policies. However, the EV market is also experiencing rapid evolution, with new players and technologies constantly emerging.

To counter the threat of substitutes, SPI Energy must prioritize ongoing research and development. This includes improving the efficiency of their solar panels, reducing manufacturing costs, and enhancing the user experience of their charging infrastructure. Staying ahead of the curve in terms of performance and price is crucial to retaining customers in a dynamic market.

Customer Switching Costs to Substitutes

The threat of substitutes for SPI Energy Co. is influenced by how easily customers can switch to alternative energy sources or modes of transportation. For instance, consumers considering solar energy installations face costs related to the purchase and installation of panels, inverters, and potentially battery storage systems. These upfront investments represent significant switching costs, making it less likely for customers to abandon solar for, say, traditional grid power or other renewable sources without substantial financial justification. In 2023, the average residential solar installation cost in the U.S. ranged from $15,000 to $25,000 before incentives, a figure that deters casual switching.

Similarly, for SPI Energy's electric vehicle (EV) charging business, the switching costs from traditional gasoline-powered vehicles to EVs are a key factor. While the upfront cost of an EV remains a barrier, the increasing availability of charging infrastructure and evolving battery technology are gradually lowering these switching costs over time. Government incentives, such as federal tax credits for EV purchases, further reduce the effective switching cost for consumers, potentially increasing the threat from traditional vehicle manufacturers if EV adoption accelerates.

The ease of switching is also affected by the availability and cost of substitute products or services. If alternative energy providers offer comparable solar solutions at a significantly lower price or with more attractive financing options, SPI Energy could face increased pressure.

- High upfront costs for solar installations act as a significant barrier to switching for consumers.

- Policy incentives, like tax credits for EVs, can effectively lower switching costs for consumers, increasing competitive pressure.

- The increasing accessibility and affordability of electric vehicles and charging infrastructure are reducing the threat from traditional automotive energy sources.

- Comparatively lower pricing or more favorable financing from competing renewable energy providers can heighten the threat of substitutes.

Technological Advancements in Substitutes

Technological advancements are a significant threat to SPI Energy. For instance, breakthroughs in battery technology, such as solid-state batteries, could dramatically improve the energy density and charging times of electric vehicles, making them a more compelling alternative to internal combustion engines. Similarly, improvements in grid management software and smart grid technologies can enhance the reliability and efficiency of traditional power sources, potentially reducing the perceived need for distributed solar generation. SPI Energy needs to stay ahead of these innovations.

The pace of innovation in energy storage and electric vehicle powertrains is particularly noteworthy. By mid-2024, several leading automotive manufacturers announced plans to accelerate their EV production, with some aiming for over 50% of their sales to be electric by 2030. This aggressive push means that the cost and performance of EV substitutes are improving rapidly. Furthermore, advancements in hydrogen fuel cell technology continue, offering another potential avenue for decarbonization that could compete with solar power in certain applications, especially heavy transport.

SPI Energy's strategy must account for the evolving landscape of energy substitutes.

- Rapid improvements in battery energy density and cost reductions are making electric vehicles increasingly competitive.

- Enhancements in traditional energy grid efficiency and reliability can lessen the appeal of distributed solar solutions.

- Ongoing development in hydrogen fuel cell technology presents a potential long-term competitor in various energy sectors.

- SPI Energy must actively monitor and invest in R&D to counter the threat posed by these evolving substitute technologies.

The threat of substitutes for SPI Energy Co. is substantial, stemming from both alternative energy sources and transportation methods. For its solar business, traditional fossil fuels like natural gas and coal, alongside nuclear and other renewables such as wind and hydro, represent viable alternatives. These substitutes' cost-effectiveness and reliability directly influence demand for solar projects. For example, volatile natural gas prices in 2023 impacted the competitiveness of solar power.

In the electric vehicle (EV) charging sector, gasoline and diesel vehicles remain strong substitutes, especially as internal combustion engine (ICE) technology advances. Despite price fluctuations in 2024, the established infrastructure and lower initial cost of ICE vehicles continue to appeal to many consumers. Public transportation also acts as a substitute, particularly in urban areas, reducing the need for personal EV ownership.

Technological advancements are a key driver of substitute threat. Improvements in battery technology, like solid-state batteries, could significantly enhance EV performance and charging speed, making them more competitive against ICE vehicles. Similarly, advancements in grid management can boost the efficiency of traditional power sources, potentially diminishing the perceived need for distributed solar solutions. SPI Energy must stay abreast of these innovations to maintain its market position.

| Substitute Category | Key Substitutes | Impact on SPI Energy | 2023/2024 Data Point |

|---|---|---|---|

| Energy Sources | Natural Gas, Coal, Nuclear, Wind, Hydro | Direct competition impacting solar demand and pricing. | Natural gas prices saw significant volatility in 2023. |

| Transportation | Gasoline/Diesel Vehicles (ICE) | Competition for EV charging infrastructure and sales. | ICE vehicle efficiency improvements continue. |

| Energy Storage/Grid Tech | Advancements in battery tech, grid management | Potential to reduce reliance on distributed solar. | Over 1.2 terawatts of solar PV projected for global shipments in 2024. |

Entrants Threaten

The solar project development and EV charging infrastructure sectors are inherently capital-intensive. Companies need substantial upfront investment for equipment, land acquisition, securing permits, and arranging project financing. For instance, developing a utility-scale solar farm can cost tens to hundreds of millions of dollars, while establishing a robust EV charging network requires significant capital for hardware, installation, and grid integration. These high capital requirements act as a considerable barrier, effectively deterring smaller, less-capitalized entities from easily entering the market and competing with established players like SPI Energy.

SPI Energy, like other players in the solar and EV infrastructure sectors, faces significant barriers to entry due to stringent regulatory environments. Navigating zoning laws, environmental impact assessments, and complex grid interconnection agreements can be a protracted and costly endeavor, demanding specialized legal and technical expertise. These regulatory hurdles can delay project commencement and increase upfront investment, thereby deterring potential new competitors from entering the market.

New companies entering the solar and EV charging sectors face significant hurdles in securing critical distribution channels and reliable supply chains. SPI Energy, for instance, has cultivated long-standing relationships with manufacturers and logistics providers, giving it an edge that newcomers struggle to match. This established network is crucial for timely project execution and cost efficiency, creating a substantial barrier to entry.

Economies of Scale and Experience Curve

SPI Energy Co., like many in the solar industry, faces a significant barrier to entry due to existing players' economies of scale. Established companies can negotiate better prices for raw materials like polysilicon and solar panels, and their larger project pipelines allow for more efficient deployment and lower operational costs per megawatt. For instance, in 2024, major solar manufacturers continued to leverage massive production volumes, often exceeding 10 GW annually, which translates into substantial cost advantages that new, smaller-scale entrants find difficult to overcome from the outset.

Furthermore, the experience curve plays a crucial role. Companies that have been developing and installing solar projects for years have refined their processes, from site selection and permitting to engineering and construction. This accumulated knowledge reduces project risks and improves efficiency, leading to lower overall costs. SPI Energy's long operational history means they have likely optimized these aspects, creating a cost and execution advantage that newcomers must diligently work to replicate. This learning-by-doing effect is a tangible asset, making direct cost competition challenging for new market entrants in 2024.

- Economies of Scale: Existing solar developers benefit from bulk purchasing power for components, significantly lowering per-unit costs.

- Experience Curve Advantage: Years of project execution have honed operational efficiencies and risk management for established firms like SPI Energy.

- Cost Inefficiencies for New Entrants: Start-ups struggle to match the cost-effectiveness of mature players due to smaller scale and less refined processes in 2024.

- Procurement Savings: Large-scale procurement in 2024 allowed established companies to secure materials at prices new entrants cannot easily access.

Brand Loyalty and Reputation

Brand loyalty is a significant barrier for new entrants in the solar and electric vehicle (EV) sectors, and SPI Energy Co. is no exception. A strong reputation for reliability, quality, and successful project execution is crucial. Established players like SPI Energy have cultivated trust with customers and financial backers over years of operation. For instance, SPI Energy's track record in delivering solar projects, including its involvement in various community solar initiatives, demonstrates this established credibility. Newcomers must invest heavily and take considerable time to build a comparable brand image and trustworthy reputation, a hurdle that can deter potential market entrants.

Building this trust is not an overnight process. It requires consistent delivery of high-quality products and services, coupled with positive customer experiences. SPI Energy's global presence and partnerships, such as its collaborations in various international solar markets, contribute to its established brand recognition. New companies entering these competitive fields face the daunting task of not only offering competitive pricing but also proving their long-term viability and dependability to a discerning customer base and cautious investors. This can make it difficult for them to gain market share quickly.

- Established trust: SPI Energy benefits from years of demonstrated reliability in the solar industry.

- Project success: A history of successful solar installations builds confidence for customers and financiers.

- Brand building cost: New entrants need substantial time and investment to establish a comparable reputation.

- Market entry challenge: Overcoming established brand loyalty requires significant differentiation and proof of quality.

The threat of new entrants for SPI Energy Co. is moderate due to significant capital requirements and regulatory hurdles in the solar and EV charging sectors. Developing large-scale projects demands hundreds of millions of dollars, and navigating complex permits and grid connections requires specialized expertise, acting as substantial deterrents. Furthermore, established players like SPI Energy benefit from strong supply chain relationships and economies of scale, making it difficult for newcomers to compete on cost and efficiency in 2024.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for SPI Energy Co. utilizes data from their SEC filings, annual reports, and investor presentations to understand their financial health and strategic positioning. We also incorporate industry reports from reputable sources like BloombergNEF and various renewable energy associations to gauge market dynamics and competitive pressures.