Soitec PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Soitec Bundle

Uncover the intricate web of external forces shaping Soitec's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends create both opportunities and challenges for the company's innovative semiconductor solutions. Don't just react to market shifts; anticipate them and build a resilient strategy. Download the full PESTLE analysis now to gain actionable intelligence and secure your competitive advantage.

Political factors

Government initiatives like the European Chips Act and the US CHIPS Act are significantly bolstering domestic semiconductor production.

The European Chips Act, with its €43 billion allocation, aims for Europe to secure 20% of the global semiconductor market by 2030, providing favorable regulations and funding directly benefiting Soitec's R&D and market expansion efforts.

Similarly, the US CHIPS and Science Act offers $52.7 billion for semiconductor manufacturing, creating substantial incentives for Soitec's growth in key North American markets.

The French government's ongoing investment in the digital economy and sustainability further aligns with Soitec's focus on energy-efficient materials, fostering a supportive domestic environment for its technological advancements.

The ongoing US-China tech rivalry, marked by advanced chip export controls implemented by the US through 2024, presents both risks and opportunities for Soitec. Trade tariffs and export restrictions, like those impacting semiconductor equipment flows, could disrupt global supply chains and shift demand patterns for Soitec's specialized silicon-on-insulator wafers. Soitec's strategic approach of maintaining neutrality in this rivalry allows it to navigate these challenges and sustain relationships with key players across both markets. This neutrality helps mitigate direct exposure to trade policy fluctuations, ensuring continued access to a broad customer base.

Governments globally are intensifying efforts to secure semiconductor supply chains, aiming to reduce reliance on single regions. This strategic push, evident in initiatives like the US CHIPS Act funding over $52 billion by 2025 and Europe's €43 billion Chips Act, directly fosters investments in domestic and allied manufacturing. Soitec, as a vital supplier of advanced silicon-on-insulator wafers, is a critical enabler for this supply chain resilience. Its unique materials position Soitec at the core of building more secure and diversified semiconductor ecosystems, crucial for future technological independence.

International Collaboration and Partnerships

Soitec actively forms partnerships with leading institutions like MIT, crucial for advancing semiconductor innovation, particularly in AI and advanced packaging. These collaborations, often bolstered by government-backed R&D grants and initiatives, ensure Soitec remains at the forefront of silicon-on-insulator (SOI) technology development. Such strategic alliances, vital for maintaining technological leadership through 2025, significantly enhance Soitec's research and development capabilities and strengthen its market presence in key regions like the United States.

- Soitec's R&D expenditure reached approximately €130 million in fiscal year 2024, partly driven by these collaborations.

- Government initiatives, such as the US CHIPS Act, provide incentives for onshore semiconductor research, benefiting partnerships.

- These collaborations are projected to contribute to over 20% of Soitec's new patent filings by 2025 in advanced materials.

Political Stability in Operating Regions

Political stability in its core operating regions is critical for Soitec, particularly given its significant manufacturing and R&D footprint in France and Singapore. A stable political environment in these nations ensures uninterrupted production, supports long-term investment planning, and fosters crucial R&D activities. Favorable government policies, like France's "France 2030" plan supporting industrial innovation, are essential for Soitec's continued growth and operational efficiency, safeguarding over 2,000 jobs in France alone as of early 2024. Singapore's consistent pro-business policies also underpin its strategic Asian operations.

- France's "France 2030" plan prioritizes semiconductor development, aligning with Soitec's growth strategy.

- Singapore maintains high political stability, ranking 9th globally in the 2024 World Bank Governance Indicators for Political Stability and Absence of Violence.

- Stable regulatory frameworks in these countries are vital for Soitec's ongoing capital expenditures, which exceeded €500 million in fiscal year 2024.

- Government incentives for sustainable manufacturing, like those in France, directly benefit Soitec's SmartSiC™ and SOI wafer production.

Global government initiatives, like the US CHIPS Act and European Chips Act, significantly bolster semiconductor production, offering Soitec substantial funding and market expansion opportunities.

Geopolitical tensions, particularly the US-China tech rivalry with its 2024 export controls, create supply chain risks, which Soitec navigates through strategic neutrality.

Stable political environments in France and Singapore, supported by pro-business policies and initiatives such as France 2030, ensure operational continuity and foster Soitec's R&D and capital expenditures.

| Political Factor | Key Data (2024/2025) | Impact on Soitec |

|---|---|---|

| US CHIPS Act Funding | $52.7 billion allocation | Incentivizes North American growth |

| EU Chips Act Allocation | €43 billion target | Supports R&D, market expansion |

| FY2024 CapEx | Over €500 million | Underpinned by stable regulatory frameworks |

What is included in the product

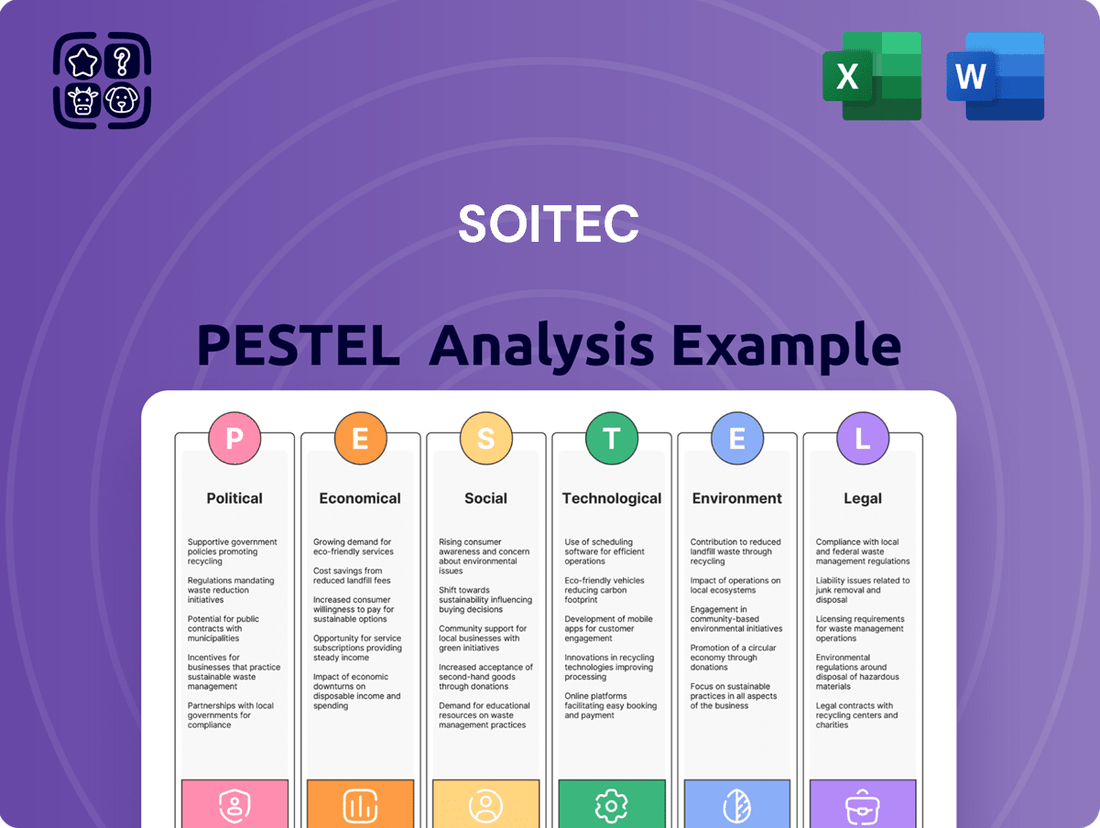

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing Soitec's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and data-backed evaluations to inform strategic decision-making and identify emerging opportunities and threats for Soitec.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, effectively addressing the pain point of time-consuming data compilation.

Helps support discussions on external risk and market positioning during planning sessions, alleviating the stress of uncertainty in strategic decision-making.

Economic factors

The global semiconductor market is projected to reach nearly $700 billion in 2025, with forecasts indicating a potential $1 trillion valuation by 2030. This significant expansion is driven by robust demand from high-growth sectors like data centers, artificial intelligence, automotive, and advanced consumer electronics. While Soitec has navigated recent market headwinds, this overarching industry growth presents a substantial opportunity for the company's specialized silicon-on-insulator (SOI) wafers. The sustained demand for high-performance chips underpins Soitec's long-term growth potential within this expanding ecosystem.

The semiconductor industry's cyclical nature profoundly impacts Soitec, as its revenue is highly sensitive to demand fluctuations in key markets such as smartphones and automotive. Worsening conditions in these sectors have led to customers delaying orders, prompting Soitec to revise its FY2025 financial guidance downwards. The company's performance remains highly susceptible to ongoing inventory adjustments and the broader global economic health, with expectations for improvement later in calendar year 2024.

As a global enterprise headquartered in France, Soitec's financial outcomes are significantly influenced by currency exchange rate fluctuations, especially between the Euro and the US Dollar. These movements directly affect reported revenues and overall profitability, a key consideration for investors. For instance, in its FY2024 results, Soitec reported sales of 1,446 million euros, with currency impacts regularly noted in their performance analysis. To provide a clearer understanding of its underlying operational performance, Soitec frequently presents financial figures at constant exchange rates, demonstrating its core business growth independent of currency volatility. This practice helps stakeholders assess the company's true trajectory amidst a fluctuating global economic landscape in 2024 and 2025.

Inflation and Operational Costs

Persistent inflationary pressures, with global inflation rates projected at 4.9% for 2024, are increasing Soitec's operational costs across raw materials, energy, and labor. Managing these rising expenses is critical for maintaining the company's target EBITDA margin, which was anticipated to be around 35% for fiscal year 2025. Navigating these macroeconomic challenges, including potential wage inflation in 2025, is essential to ensure Soitec's sustained profitability and competitive pricing in the semiconductor materials market.

- Global inflation expected near 4.9% in 2024 directly impacts Soitec’s input costs.

- Soitec’s EBITDA margin target for FY2025 (ending March 2025) is approximately 35%.

- Rising energy costs remain a concern, influencing manufacturing expenses.

Capital Expenditure and Investment

Soitec continues to invest significantly in R&D and industrial capacity to meet future demand and maintain its technological edge. However, in response to evolving market conditions, the company has slightly adjusted its planned capital expenditures for fiscal year 2025. These investment decisions reflect a strategic balance between preparing for robust long-term growth and prudently managing short-term market uncertainties. This approach helps optimize resource allocation while safeguarding future innovation.

- Soitec's FY2025 capital expenditure is projected to be approximately 350-400 million euros.

- This adjustment from previous forecasts reflects a cautious yet strategic investment posture.

The global semiconductor market is projected to reach nearly $700 billion in 2025, buoyed by demand from AI and automotive sectors, yet Soitec faces volatility from industry cycles and customer order delays. Currency fluctuations, particularly EUR/USD movements, significantly impact reported revenues and profitability for the French-headquartered company. Persistent global inflation, estimated at 4.9% for 2024, elevates operational costs, challenging Soitec's target 35% EBITDA margin for FY2025. Strategic adjustments to FY2025 capital expenditures, now around 350-400 million euros, reflect a balanced approach to growth and market uncertainties.

| Economic Factor | 2024 Data | 2025 Projections |

|---|---|---|

| Global Semiconductor Market Value | N/A | ~$700 billion |

| Global Inflation Rate | 4.9% | N/A |

| Soitec FY2025 EBITDA Margin Target | N/A | ~35% |

| Soitec FY2025 Capital Expenditure | N/A | 350-400 million euros |

What You See Is What You Get

Soitec PESTLE Analysis

The preview shown here is the exact Soitec PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Soitec's operations.

Understand the market dynamics and strategic considerations that shape Soitec's future.

No placeholders, no teasers—this is the real, ready-to-use Soitec PESTLE Analysis file you’ll get upon purchase.

Sociological factors

A significant sociological shift is the escalating consumer and societal demand for electronic devices that are both powerful and remarkably energy-efficient. Soitec's advanced engineered substrates, including FD-SOI and Smart Cut technologies, are perfectly positioned to meet this crucial demand by enhancing device performance while drastically reducing power consumption. This trend is a fundamental driver for Soitec's sustained long-term growth strategy, as the market for energy-efficient semiconductors is projected to continue its robust expansion through 2025. This ensures Soitec remains at the forefront of innovation.

The global surge in connectivity, driven by smartphones and IoT devices, is exponentially increasing data consumption. This megatrend fuels strong demand for advanced semiconductors in data centers and communication networks, critical areas for Soitec. Projections indicate global data creation will exceed 180 zettabytes by 2025, significantly boosting the need for specialized substrates like Photonics-SOI. The rapid expansion of AI applications further accelerates this demand, as AI workloads require high-performance, energy-efficient chips.

Stakeholder expectations for corporate social responsibility are rapidly escalating, influencing consumer and investor decisions. Soitec has deeply integrated sustainability into its core strategy, evidenced by its 2023/2024 commitment to reduce Scope 1 and 2 emissions by 42% by 2030, a validated Science Based Target. This focus extends to promoting diversity with a 25% female representation in management by 2025 and robust ethical governance. Such proactive measures are crucial for Soitec to maintain its positive brand image and attract top talent in a competitive market, directly impacting its long-term viability and appeal to socially conscious investors.

Talent Attraction and Development

The semiconductor industry faces a global talent shortage, with an estimated 300,000 unfilled positions by 2030, intensifying competition for skilled engineers and researchers. Soitec's sustained growth hinges on its ability to attract and retain top-tier talent in specialized fields like advanced materials and wafer technology. The company prioritizes an inclusive and inspiring work environment, crucial for fostering innovation and employee loyalty. This focus helps them compete effectively for the diverse workforce needed to drive 2024 and 2025 strategic initiatives.

- Talent acquisition remains a top challenge for 60% of semiconductor companies in 2024.

- Soitec aims to maintain a high employee retention rate, crucial for knowledge continuity.

- Diversity and inclusion initiatives are key to attracting a broader talent pool for future growth.

Public Health and Safety Applications

Soitec's advanced materials are fundamental to public health and safety advancements, enhancing societal well-being. Their silicon-on-insulator (SOI) wafers are critical for high-performance sensors used in medical devices, such as diagnostic equipment and continuous glucose monitors, a market projected to exceed $15 billion by 2025. Additionally, Soitec's technology supports advanced driver-assistance systems (ADAS) in the automotive sector, with ADAS semiconductor revenue expected to reach over $25 billion by 2024. This strong alignment with critical societal needs boosts Soitec's market opportunities and reputation.

- Soitec's SOI wafers enable precise medical sensors for diagnostics.

- Their technology is integral to ADAS, improving vehicle safety.

- The global medical sensor market is expanding significantly by 2025.

- ADAS semiconductor revenue is projected to surpass $25 billion by 2024.

Sociological trends like increasing demand for energy-efficient electronics and surging global connectivity drive Soitec's growth, with data creation projected to exceed 180 zettabytes by 2025. Escalating corporate social responsibility expectations shape consumer and investor decisions, highlighted by Soitec's commitment to reduce Scope 1 and 2 emissions by 42% by 2030. The global semiconductor talent shortage, a top challenge for 60% of companies in 2024, impacts operations, while Soitec's role in public health (medical sensor market >$15B by 2025) and safety (ADAS semiconductor revenue >$25B by 2024) strengthens its market position.

| Sociological Factor | Key Impact | 2024/2025 Data |

|---|---|---|

| Energy Efficiency Demand | Drives product innovation | Market expansion through 2025 |

| Global Connectivity | Increases data center demand | >180 ZB data by 2025 |

| Talent Shortage | Hiring challenge | 60% of firms affected in 2024 |

| Public Health & Safety | New market opportunities | Medical sensors >$15B by 2025 |

Technological factors

The semiconductor industry demands continuous innovation for smaller, faster, and more efficient chips. Soitec's success hinges on its advanced engineered substrates, like SOI, which remain crucial for high-performance applications. The company significantly invests in research and development, with its 2024 R&D expenditure projected to support next-generation material platforms. This commitment ensures Soitec maintains its technological lead, vital as the global semiconductor market is expected to exceed 600 billion USD in 2025.

The widespread adoption of 5G networks, with global subscriptions projected to exceed 2.7 billion by 2025, along with the rapid expansion of AI and IoT applications, significantly drives the semiconductor market. These technologies demand high-performance, energy-efficient chips, creating robust demand for Soitec's specialized substrates like RF-SOI and Photonics-SOI. The global AI market is forecast to surpass $300 billion in 2024, further fueling this need. Soitec's growth trajectory remains closely tied to these accelerating technology adoption rates and the projected 17 billion IoT connections by 2024.

While Soitec leads in Silicon-on-Insulator (SOI) technology, the semiconductor industry is rapidly advancing new substrate materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) for high-growth applications, especially in power electronics and electric vehicles. The global SiC device market is projected to exceed $5 billion by 2025, driven by EV adoption. Soitec is strategically involved in this shift, actively developing its SmartSiC™ substrates, with significant ramp-up expected in 2024 and 2025 to meet surging automotive demand. This diversification is essential to address the accelerating market for high-efficiency power solutions, as EV SiC content continues its strong growth trajectory.

Advanced Packaging and Chiplet Design

The semiconductor industry is rapidly embracing chiplet-based designs and heterogeneous integration, a shift that necessitates advanced substrate solutions. This involves combining multiple specialized chiplets in a single package, demanding high-performance substrates to ensure efficient data transfer and power delivery. Soitec is actively collaborating with industry leaders to develop innovative engineered substrates, like their Smart Cut technology, essential for these advanced packaging technologies. Market forecasts indicate the advanced packaging market could reach over $65 billion by 2025, highlighting the critical demand for Soitec's specialized silicon-on-insulator (SOI) wafers.

- Global advanced packaging market projected to exceed $65 billion by 2025.

- Chiplet integration enhances performance for AI and high-performance computing (HPC) applications.

- Soitec's engineered substrates are crucial for 3D stacking and heterogeneous integration.

Use of AI in Chip Design and Manufacturing

Artificial intelligence is not only a key market driver for semiconductors but is rapidly becoming an indispensable tool to optimize chip design and manufacturing processes. AI algorithms can significantly enhance circuit layouts, automate complex testing phases, and boost production yields, which is crucial as global semiconductor sales are projected to exceed $600 billion in 2024. By embracing AI in its own operations, Soitec can improve efficiency and accelerate innovation, potentially reducing design cycles by up to 30% and increasing yield rates by 5-10% for advanced substrates by late 2025.

- AI-driven design tools are expected to reduce time-to-market for new chip designs by 20% by 2025.

- Automated AI testing can decrease defect rates by 15% in high-volume manufacturing.

- Production yield improvements through AI could add millions to Soitec's bottom line annually.

- Investment in AI for semiconductor manufacturing reached $5.5 billion in 2024.

Soitec’s technological edge in engineered substrates, like SOI and SmartSiC™, is critical for high-growth sectors such as AI, 5G, and electric vehicles. Continuous R&D investment, projected for 2024, ensures its leadership in advanced materials, vital as the global semiconductor market nears 600 billion USD in 2025. The company’s focus on chiplet integration and AI-driven manufacturing further solidifies its position in an evolving industry.

| Technological Factor | Key Metric (2024/2025) | Projection |

|---|---|---|

| Global Semiconductor Market | 2025 Market Size | >600 Billion USD |

| Advanced Packaging | 2025 Market Value | >65 Billion USD |

| Global SiC Device Market | 2025 Market Value | >5 Billion USD |

Legal factors

Protecting its extensive intellectual property, especially the patented Smart Cut™ technology, is crucial for Soitec's market leadership and business model. The company actively maintains a portfolio of over 4,000 patents globally and rigorously defends against any infringement. A substantial portion of Soitec's revenue, estimated around 20% in fiscal year 2024, comes from licensing agreements, underscoring the vital financial importance of robust intellectual property rights protection. This strong legal framework ensures their competitive advantage in the advanced materials sector.

As a global supplier, Soitec must navigate a complex web of international trade regulations, including export controls and tariffs, especially impacting its key markets like the US, Europe, and Asia. Compliance with these regulations across its operating regions is critical to avoid supply chain disruptions, which could impact its 2024-2025 revenue forecasts. Geopolitical shifts, such as ongoing trade tensions, continuously alter these regulatory landscapes, demanding constant monitoring. For example, the CHIPS Act in the US and similar European initiatives influence semiconductor material flows, directly affecting Soitec's strategic planning and operational compliance.

The semiconductor manufacturing process, vital to Soitec, inherently involves significant use of chemicals, energy, and water, subjecting operations to stringent global environmental regulations. Soitec is committed to not just meeting but exceeding these evolving standards, notably targeting a 42% reduction in Scope 1 and 2 CO2 emissions by 2030 from a 2020 base, aligning with a 1.5°C trajectory. This proactive stance includes responsible water management and minimizing waste across its facilities, like its Bernin site. The company's dedication to environmental compliance is a core pillar of its sustainability strategy, reinforcing its market position amidst increasing regulatory scrutiny in 2024 and 2025.

Employment and Labor Laws

Soitec, operating globally, must meticulously adhere to diverse employment and labor laws across its regions, including France, Singapore, and the United States. These regulations dictate working conditions, employee relations, and critical health and safety standards. Ensuring compliance is vital for fostering a positive work environment and mitigating potential legal challenges, protecting its workforce of over 2,200 employees as of early 2024. Non-compliance could lead to significant fines or operational disruptions, impacting its 2024-2025 financial performance.

- Global Compliance: Soitec manages varied labor laws in countries like France, Singapore, and the US.

- Workforce Protection: Strict adherence to health and safety protocols is paramount for its 2,200+ employees.

- Risk Mitigation: Avoiding legal disputes and fines is crucial for stable operations and financial health in 2024-2025.

Data Privacy and Security Laws

Soitec operates within a global value chain heavily influenced by evolving data privacy regulations, such as the EU General Data Protection Regulation (GDPR) which saw over €2 billion in fines by late 2024. Although not consumer-facing, the design of Soitec's advanced semiconductor materials must increasingly incorporate security features. This ensures end-product manufacturers can comply with stringent data protection laws. Staying abreast of these legal requirements is crucial for Soitec to meet customer demands and maintain its competitive edge in the 2025 market.

- GDPR fines surpassed €2 billion by late 2024, highlighting enforcement intensity.

- Upcoming EU AI Act (effective 2025) mandates robust security for AI-enabled devices, impacting chip design.

- Over 150 countries enacted data privacy laws by 2024, creating complex compliance landscapes.

- Global semiconductor market security feature demand projected to increase 15% by 2025.

Soitec operates within a complex global legal framework, with intellectual property defense, notably for Smart Cut™ technology, and strict international trade compliance being critical for its 2024-2025 market position. Adherence to evolving environmental regulations, like the EU Green Deal impacting manufacturing, and diverse labor laws across its 2,200+ employee base is essential. Data privacy laws, such as the EU AI Act effective 2025, also influence chip design, demanding continuous legal vigilance. Proactive compliance mitigates significant risks, including potential fines and supply chain disruptions, ensuring operational stability.

| Legal Area | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Intellectual Property | Revenue Generation & Protection | 20% of FY2024 revenue from licensing; 4,000+ global patents |

| Trade Regulations | Supply Chain Stability | US CHIPS Act & EU initiatives shaping 2025 semiconductor flows |

| Environmental Compliance | Operational Sustainability | Targeting 42% CO2 reduction by 2030; EU Green Deal influence |

| Data Privacy | Product Design & Trust | EU AI Act (effective 2025) mandates security; 15% projected rise in security feature demand by 2025 |

Environmental factors

Soitec actively supports the Paris Agreement, setting ambitious targets to significantly reduce its greenhouse gas (GHG) emissions. Their commitment is rigorously monitored and validated by the Science Based Targets initiative (SBTi), ensuring alignment with climate science. A key focus involves reducing energy consumption across manufacturing processes, contributing to a more sustainable operational footprint. By 2025, Soitec aims for a 30% reduction in Scope 1 and 2 GHG emissions per unit of production compared to 2019, reflecting their environmental stewardship.

Semiconductor manufacturing, central to Soitec's operations, remains notably energy and water-intensive. Soitec is actively improving the energy efficiency of its production processes, targeting a 10% reduction in water consumption intensity by 2025 compared to 2020 levels. The company's commitment to sustainability involves finding innovative ways to reduce its reliance on these vital resources. This focus aligns with their broader environmental goals, including a 42% absolute reduction in Scope 1 and 2 GHG emissions by 2030.

Soitec is actively implementing a circular economy framework to boost the recycling and repurposing of manufacturing waste, aligning with stringent environmental regulations expected by 2025. This strategy significantly enhances corporate responsibility and targets cost savings through efficient resource management. For instance, their 2023-2024 efforts focused on increasing material recovery rates, aiming to reduce non-recycled waste by 10% by late 2024 compared to 2023 levels. Proper management of hazardous materials, such as solvents and etching chemicals, remains a critical environmental focus to minimize ecological impact.

Sustainable Innovation and Product Life Cycle

Soitec’s environmental strategy is deeply rooted in developing products that significantly enhance customer energy efficiency and reduce carbon footprints. By innovating advanced substrates, such as those for power electronics, Soitec enables the creation of more energy-efficient devices across their entire life cycle. This commitment aligns directly with Soitec’s stated purpose, aiming to contribute to a more sustainable world through its technology. For instance, their SOI technologies are crucial for reducing power consumption in 5G and data center applications.

- Soitec’s substrates enable up to 20% energy savings in some power applications.

- The company targets a 40% reduction in its own operational carbon emissions by 2030 (Scope 1 and 2).

- Their silicon-on-insulator (SOI) wafers are foundational for high-performance, low-power chips.

Biodiversity Preservation

Soitec integrates biodiversity preservation into its comprehensive sustainability policy, actively assessing and mitigating the environmental impact of its operations on local ecosystems. This commitment extends beyond typical emissions and resource consumption, demonstrating a broader dedication to environmental stewardship. The company focuses on minimizing disturbance in regions where its facilities are located, aligning with global environmental objectives. Their efforts reflect an understanding that operational footprint includes natural habitats, crucial for long-term ecological balance.

- Soitec's sustainability reports for 2023-2024 detail ongoing efforts in assessing environmental footprints.

- The company prioritizes local ecosystem impact assessments for new and existing sites.

- Commitments include mitigating operational disturbances to biodiversity.

Soitec targets a 30% reduction in Scope 1 and 2 GHG emissions per production unit by 2025 compared to 2019, validated by SBTi. The company also aims for a 10% reduction in water consumption intensity by 2025, while enhancing manufacturing waste recycling by 10% by late 2024. Their advanced substrates enable customers to achieve up to 20% energy savings in various applications.

| Environmental Focus | 2025 Target | 2024/2025 Progress |

|---|---|---|

| GHG Emissions (Scope 1 & 2) | -30% per unit (vs 2019) | On track for SBTi validation |

| Water Consumption Intensity | -10% (vs 2020) | Continuous efficiency gains |

| Non-recycled Waste | -10% (by late 2024 vs 2023) | Increased material recovery rates |

PESTLE Analysis Data Sources

Our Soitec PESTLE Analysis draws upon a robust blend of data, including official semiconductor industry reports, global economic indicators, and governmental policy updates. We incorporate insights from leading market research firms and technology trend analyses to ensure comprehensive coverage.