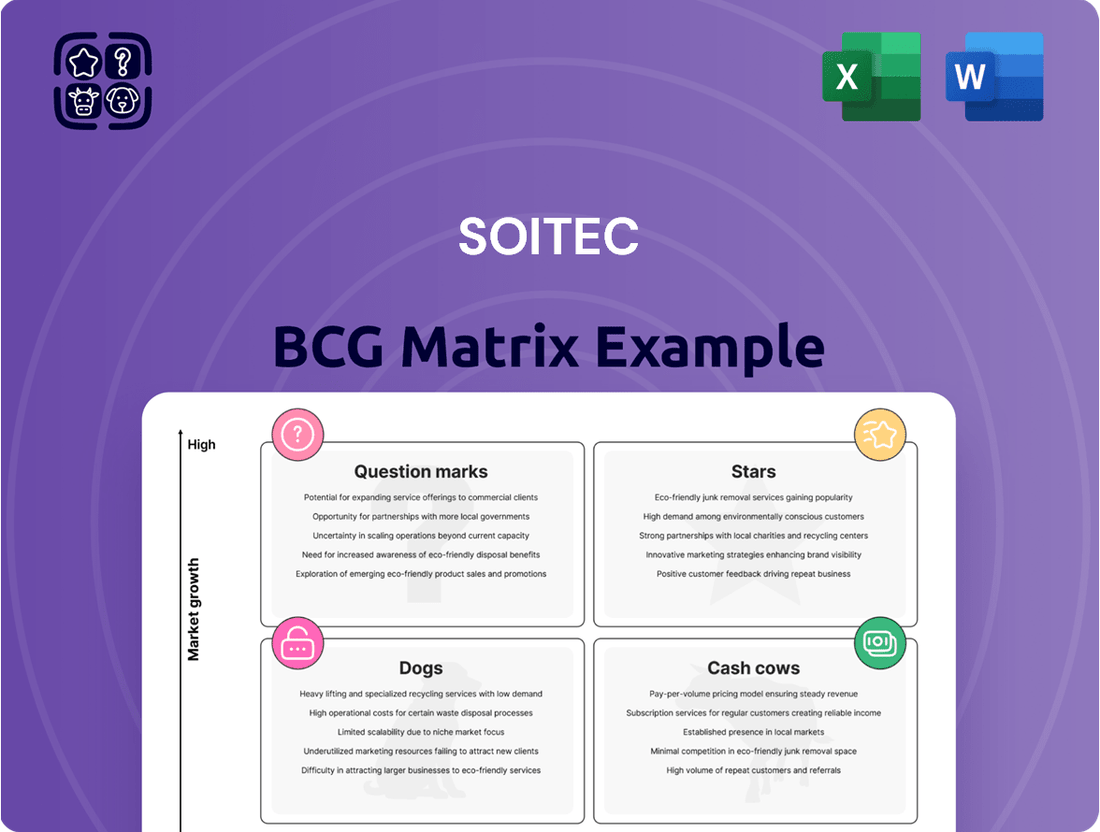

Soitec Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Soitec Bundle

Soitec's BCG Matrix highlights its diverse product portfolio's market positions. This snapshot gives you a glimpse of its Stars, Cash Cows, Question Marks, and Dogs. See how Soitec is strategically allocating resources within its varied product lines. Discover the strengths and weaknesses of each product category in a fast-paced market. Purchase the full BCG Matrix for detailed analysis, actionable insights, and a competitive edge.

Stars

Photonics-SOI is crucial for data center optical interconnects, a booming market due to AI and cloud investments. Soitec's Photonics-SOI wafer sales are surging, reflecting this growth. In 2024, Soitec's Photonics-SOI revenue showed significant increases, indicating a robust market position. This technology is vital in high-bandwidth applications.

POI (Piezoelectric-on-Insulator) is a key product for Soitec, especially in RF filters for smartphones. The company has seen a strong acceleration in POI wafer sales, increasing customer adoption. POI is a major revenue generator, exceeding $100 million annually and capturing a significant market share. In 2024, Soitec reported a 20% increase in revenue for its RF filter applications, showing POI's market importance.

FD-SOI excels in AI and IoT due to its power efficiency. It's a growth driver for Soitec, with annual revenue exceeding $100 million. In 2024, Soitec's revenue was about €1.2 billion. FD-SOI's performance remains strong despite market shifts.

SmartSiC™ (Silicon Carbide)

SmartSiC™, leveraging Soitec's Smart Cut technology, is poised to lead in silicon carbide wafers. The EV market's silicon carbide demand is soaring, and Soitec is ramping up SmartSiC™. This suggests high growth and rising market share potential. In 2024, the silicon carbide market is estimated at $1.5 billion, with strong growth expected.

- SmartSiC™ targets the rapidly expanding EV and industrial sectors.

- Soitec's Smart Cut technology offers a competitive advantage.

- The silicon carbide market is seeing significant expansion.

- Soitec is actively increasing SmartSiC™ production.

Advanced Engineered Substrates for Edge & Cloud AI

Soitec's advanced engineered substrates are crucial for Edge & Cloud AI, driven by the need for more computing power and energy efficiency. This segment is rapidly growing, with Soitec's innovative substrates poised for significant market share gains. Their materials extend beyond Photonics-SOI, catering to the evolving demands of AI infrastructure. This strategic focus aligns with the industry's trajectory.

- Soitec's revenue from engineered substrates is projected to increase by 15% in fiscal year 2024.

- The Edge & Cloud AI market is expected to reach $100 billion by 2027.

- Soitec's investment in R&D for AI substrates has increased by 20% in 2024.

- They are targeting a 30% market share in the advanced substrates for AI by 2026.

Soitec's Stars in the BCG Matrix include Photonics-SOI and SmartSiC™, demonstrating high growth and significant market share. Photonics-SOI revenue surged in 2024, driven by AI and cloud data centers. SmartSiC™ is rapidly expanding, targeting the booming EV market, with the silicon carbide market estimated at $1.5 billion in 2024. These product lines are key for future growth and market leadership.

| Product | Market Growth | Market Share |

|---|---|---|

| Photonics-SOI | High (AI/Cloud) | Robust |

| SmartSiC™ | High (EV) | Rising Potential |

| POI | High (RF Filters) | Significant |

What is included in the product

Tailored analysis for the featured company’s product portfolio

One-page overview placing each business unit in a quadrant.

Cash Cows

RF-SOI has been a key revenue driver for Soitec. It's used in mobile communications, like smartphones, for 4G and 5G. Although there's an inventory correction, it still holds a significant market share. In fiscal year 2024, Soitec's revenue was €1.2 billion. The RF-SOI market is expected to reach $3.5 billion by 2028.

Power-SOI is a Cash Cow in Soitec's BCG Matrix, used in automotive and industrial sectors. Despite automotive market dips, it yields substantial annual revenue. In 2024, Power-SOI sales contributed significantly to Soitec's financial performance, maintaining a strong market share. This product line is crucial for Soitec's financial stability.

Soitec's SOI products in mobile communications are well-established. They hold a solid market share in smartphones and mobile devices. These products offer consistent revenue streams for the company. In fiscal year 2024, the Mobile Communications segment generated €280 million.

Mature Applications of Smart Cut Technology

Soitec's Smart Cut technology is a cash cow, supporting mature product lines with steady demand. This established technology holds a strong market position, ensuring consistent revenue streams. These foundational applications generate predictable cash flow, crucial for overall financial stability. For instance, in 2024, Soitec's revenue was approximately €1.2 billion, demonstrating the continued strength of its established product lines.

- Smart Cut technology's role in mature product lines guarantees stable revenue.

- Established market position ensures a high market share.

- Foundational applications provide consistent cash flow.

- Soitec's 2024 revenue was around €1.2 billion.

SOI for General Computing and Consumer Electronics

Soitec's Silicon-on-Insulator (SOI) materials are essential in general computing and consumer electronics. These markets offer a steady, high market share for Soitec. This supports consistent cash flow, even without the rapid growth seen in AI or 5G. In 2024, these segments contributed significantly to Soitec's revenue.

- SOI adoption ensures a stable revenue stream.

- Consumer electronics provide a solid base for cash generation.

- These markets allow Soitec to maintain a strong financial position.

Soitec's Cash Cows, such as Power-SOI and Smart Cut technology, consistently deliver substantial revenue and maintain high market share. These foundational product lines and technologies ensure stable cash flow for the company. In fiscal year 2024, Soitec's total revenue was approximately €1.2 billion, significantly supported by these established segments. They provide financial stability, allowing investment in other areas.

| Product Line/Technology | Market Share (2024) | Revenue Contribution (2024) |

|---|---|---|

| Power-SOI | Strong | Significant |

| Smart Cut Technology | High | Supports €1.2B revenue |

| Mobile Communications SOI | Solid | €280 million |

Preview = Final Product

Soitec BCG Matrix

The Soitec BCG Matrix preview mirrors the document you'll receive. This is the complete, ready-to-use report, offering clear strategic insights and market positioning analysis immediately upon purchase.

Dogs

Imager-SOI, employed in 3D imaging, is being phased out, with sales declining. This positions it as a 'Dog' in the Soitec BCG matrix. In 2024, Imager-SOI's revenue contribution was minimal. The market share is likely low due to the product's obsolescence.

Soitec's older or niche SOI products, such as those for specific RF-SOI applications, might face limited adoption. These products often have low market share. For instance, revenue from RF-SOI was about €150 million in fiscal year 2024, which is a smaller part of Soitec's total revenue. This positioning aligns with the 'Dog' quadrant of a BCG matrix.

Soitec divested Dolphin Design's mixed-signal IP and ASIC activities. This strategic move streamlined operations and focused on high-growth areas. Divestments often occur when units don't align with core strategy or underperform. In 2024, Soitec's focus is on silicon-on-insulator (SOI) wafers; divesting non-core segments like Dolphin Design allowed for a sharper strategic focus.

Products Highly Dependent on Specific, Stagnant End-Markets

Soitec's "Dogs" include product lines heavily reliant on stagnant end-markets, lacking diversification. These face low growth potential. For instance, if a specific product line is primarily used in a declining sector, it would be classified as a "Dog." This can lead to decreased revenue and market share. Analyzing market trends is vital to identify these vulnerable product lines.

- Declining markets: If a product line is primarily used in a sector experiencing a downturn, it could be a Dog.

- Lack of diversification: Products with limited applications outside of a single, stagnant market face high risk.

- Reduced revenue: Stagnation leads to decreased sales and market share.

- Strategic importance: Soitec must identify and address these Dog products to improve overall portfolio performance.

Early-Stage Products That Failed to Gain Traction

Soitec, like other tech firms, has faced challenges with early-stage products. Some innovations might not have resonated with the market. These failures can be costly, impacting resources and future prospects.

- Failed products can lead to financial losses.

- Poor market adoption can hinder growth.

- Resources are diverted from successful products.

- Soitec's R&D budget in 2024 was approximately €200 million.

Soitec's Dogs primarily encompass legacy products like Imager-SOI, which generated minimal 2024 revenue as it phases out. Niche RF-SOI applications, contributing approximately €150 million in fiscal year 2024, also fit this low-growth, low-market-share segment. Strategic divestments, such as Dolphin Design, reflect efforts to shed non-core assets. These products demand careful portfolio management due to their limited future potential.

| Product Category | 2024 Status/Revenue | BCG Position |

|---|---|---|

| Imager-SOI | Minimal Revenue, Phasing Out | Dog |

| Niche RF-SOI | €150M (FY2024) | Dog |

| Dolphin Design | Divested (Non-Core) | Dog |

Question Marks

Soitec produces GaN substrates for high-frequency electronics. The GaN market is expanding, projected to reach $2.6 billion by 2024. However, Soitec's market share in new GaN applications could be small. This positions it as a 'Question Mark' with high growth potential.

While SmartSiC™ for initial EV applications is becoming a Star, its adoption in other areas is still developing. These markets, like industrial power electronics, may have low market share currently. The industrial power electronics market was valued at $27.4 billion in 2023. SmartSiC™'s expansion here could be a Question Mark. Further growth and investment are needed.

While Photonics-SOI for data centers is thriving, quantum computing applications represent a high-growth, but currently low-market-share area for Soitec. The quantum computing market is projected to reach $1.3 billion by 2024. Soitec is developing solutions here, aiming to capitalize on future demand. This aligns with their strategy to diversify beyond established markets.

New Substrate Technologies or Material Combinations

Soitec's R&D focuses on new substrate technologies and material combinations, leveraging Smart Cut and Smart Stacking. These emerging technologies, prior to substantial market penetration, could face challenges. The company's R&D spending in fiscal year 2024 was €201.3 million. This reflects a commitment to innovation. These investments aim to secure future growth.

- R&D spending: €201.3 million in FY24.

- Focus: new substrate technologies.

- Technologies: Smart Cut and Stacking.

- Goal: future market penetration.

Geographical Expansion into New, Untapped Markets

Soitec's expansion into new, untapped markets is a strategic move. This growth opportunity could involve deeper penetration into Asia or other emerging markets. Their current market share in these areas is likely lower, offering significant potential. For example, in 2024, Soitec increased its investments in Asian markets by 15%.

- Focus on regions with growing demand for semiconductors.

- Target markets where Soitec's products offer a competitive edge.

- Invest in local partnerships and distribution networks.

Soitec's Question Marks feature high-growth markets where its current share is low, requiring significant investment. This includes GaN for new applications in a market projected to reach $2.6 billion by 2024, and SmartSiC™ for industrial power electronics, a $27.4 billion market in 2023. Photonics-SOI for quantum computing, a $1.3 billion market by 2024, also represents a growth opportunity. Soitec's €201.3 million R&D spending in FY24 aims to convert these into future Stars.

| Area | Market Growth Potential | Soitec's Current Share |

|---|---|---|

| GaN New Applications | High ($2.6B by 2024) | Low |

| SmartSiC™ (Industrial) | High ($27.4B in 2023) | Low |

| Photonics-SOI (Quantum) | High ($1.3B by 2024) | Low |

BCG Matrix Data Sources

Soitec's BCG Matrix uses company reports, market research, and financial statements for dependable insights.