Soitec Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Soitec Bundle

Curious about the engine driving Soitec's innovation in advanced semiconductor solutions? Our comprehensive Business Model Canvas dissects their unique approach to value creation, customer relationships, and revenue streams.

Discover how Soitec leverages key partnerships and its cost structure to maintain a competitive edge in the high-tech materials market.

This detailed canvas offers a clear, strategic overview of Soitec's operations, perfect for anyone looking to understand their success factors.

Unlock the full potential of this analysis by purchasing the complete Business Model Canvas for Soitec today and gain actionable insights for your own ventures.

Partnerships

Soitec’s essential partnerships are with major semiconductor foundries and Integrated Device Manufacturers (IDMs), including industry leaders like STMicroelectronics and GlobalFoundries.

These collaborations are deeply strategic, often involving joint research and development to co-develop advanced substrates.

For example, in 2024, these partnerships focus on tailoring products for next-generation chip manufacturing processes, ensuring precise technical specifications are met.

This close alignment secures long-term supply agreements, integrating Soitec’s specialized silicon-on-insulator wafers directly into their partners' production roadmaps.

Soitec’s deep collaboration with world-class research institutes, notably CEA-Leti in France, is fundamental. This partnership, which birthed the patented Smart Cut™ technology, significantly drives Soitec’s innovation pipeline. By exploring new materials and advanced substrate architectures, these collaborations ensure Soitec remains at the forefront of material science. In 2024, Soitec continued leveraging such partnerships to advance its SmartSiC™ and SOI technologies, crucial for high-performance computing and electric vehicle applications.

Soitec strategically partners with specialized suppliers for essential manufacturing equipment and high-purity raw materials, including bulk silicon wafers. These critical relationships ensure the consistent quality of engineered substrates vital for high-growth markets like automotive and data centers. Maintaining strong supplier ties is crucial for managing production costs and securing the global supply chain, especially as Soitec aims for long-term revenue growth. Such partnerships are fundamental for scaling production to meet rising demand, with Soitec forecasting robust growth driven by advanced material requirements in 2024.

Strategic Licensing Partners

Soitec strategically monetizes its intellectual property by licensing its proprietary Smart Cut™ technology to major wafer manufacturers like Shin-Etsu Handotai (SEH). This generates a significant royalty-based revenue stream, reinforcing the technology's position as an industry standard for engineered substrates. This approach extends market adoption beyond Soitec's direct manufacturing capacity, especially crucial as demand for silicon-on-insulator (SOI) wafers continues to grow. These partnerships are vital for broadening the ecosystem and accelerating the deployment of advanced semiconductor solutions globally.

- Soitec's licensing revenue supports its overall financial performance, contributing to its reported revenue of €899 million for fiscal year 2024.

- The Smart Cut™ technology is fundamental to over 80% of SOI wafers produced worldwide.

- Shin-Eetsu Handotai (SEH), a key licensee, holds a significant share in the global silicon wafer market.

- These strategic partnerships enable Soitec to influence broad market trends without direct capital expenditure on all production.

Industry Consortia & Alliances

Participation in industry groups focused on emerging technologies like Silicon Carbide (SiC) and Gallium Nitride (GaN) is crucial for Soitec. These alliances, such as those shaping SiC wafer standards, help build robust ecosystems around new materials. Such partnerships accelerate the adoption of Soitec's advanced substrates in high-growth markets like automotive, projected to see significant SiC device growth into 2024, and 5G infrastructure. Collaborating ensures Soitec's substrates are foundational to next-generation power electronics and RF applications.

- Soitec is a member of key industry associations like the SEMI consortium, fostering SiC and GaN standardization.

- The global SiC device market size reached approximately $2.1 billion in 2023, with strong growth continuing into 2024, driven by EV adoption.

- Strategic alliances facilitate faster material qualification, crucial for automotive applications where reliability is paramount.

- Partnerships also support ecosystem development for GaN on silicon, vital for high-frequency 5G power amplifiers.

Soitec’s key partnerships are foundational, integrating deep collaborations with semiconductor foundries and research institutes like CEA-Leti to co-develop advanced substrates and drive innovation. Strategic licensing of its Smart Cut™ technology, contributing to fiscal year 2024 revenue of €899 million, significantly expands market adoption and financial performance. These alliances also include vital supplier relationships and industry group participation, ensuring supply chain resilience and accelerating market penetration for technologies like SiC, crucial for EV growth in 2024.

| Partnership Type | Key Contribution | 2024 Impact |

|---|---|---|

| Foundries/IDMs | Joint R&D, Supply Agreements | Next-gen chip integration |

| Research Institutes | Innovation, IP Development | SmartSiC™/SOI advancements |

| IP Licensees | Royalty Revenue, Market Reach | FY24 revenue: €899M |

What is included in the product

Soitec's business model focuses on supplying advanced semiconductor materials, particularly Silicon-on-Insulator (SOI) wafers, to the electronics industry, leveraging its technological leadership and proprietary manufacturing processes.

This model emphasizes innovation in material science and strategic partnerships to serve high-growth markets like automotive, IoT, and consumer electronics.

Soitec's Business Model Canvas offers a structured approach to dissecting complex strategies, relieving the pain point of overwhelming information by providing a clear, one-page snapshot of their core business components.

Activities

Soitec's core operations heavily rely on advanced R&D in material science to continuously enhance its product families. This involves refining the patented Smart Cut™ process and pioneering work in compound semiconductors, like SmartSiC™ and Smart GaN™. For fiscal year 2023, Soitec invested €87 million in R&D, underscoring its commitment. This ongoing innovation ensures a sustained technological lead and a robust product roadmap for future generations of engineered substrates, critical for 2024 market demands and beyond.

Soitec's core operational activity is the high-precision, high-volume manufacturing of engineered substrates, particularly Silicon-on-Insulator (SOI) wafers, within advanced cleanroom facilities. This intricate process leverages ion implantation and wafer bonding techniques to create ultra-thin material layers with atomic precision. Maintaining exceptional efficiency, yield, and stringent quality control in manufacturing is paramount for profitability, especially as global demand for their advanced materials continues to grow. In their fiscal year ending March 2024, Soitec reported revenues exceeding €500 million, largely driven by these high-volume production capabilities.

Soitec vigorously manages and expands its extensive patent portfolio, primarily centered around its foundational Smart Cut™ technology. This critical activity involves continuously filing new patents globally, defending against any potential infringement, and carefully managing licensing agreements. A robust intellectual property portfolio, which historically includes thousands of patents, acts as a significant barrier to entry for competitors in the engineered substrates market. This strong IP position helps secure its market leadership, evidenced by its projected revenue growth in 2024, reinforcing its competitive advantage.

Global Supply Chain Management

Soitec manages an intricate global supply chain, meticulously sourcing high-purity raw materials and delivering advanced wafers to customer fabrication plants worldwide. This critical activity demands sophisticated logistics, precise inventory management, and rigorous supplier qualification processes to ensure uninterrupted production. For instance, in 2024, maintaining a robust supply chain is vital for Soitec to support its diverse product portfolio, which includes SmartSiC and SOI wafers, crucial for automotive and mobile device markets.

- Soitec’s supply chain spans multiple continents, supporting over 300 customers globally.

- The company emphasizes securing raw material supplies, a key factor in achieving its FY2024 revenue guidance of approximately €800-850 million.

- Effective inventory management minimizes lead times, crucial for meeting the high demands of the semiconductor industry.

- Supplier qualification ensures the quality and reliability of components, directly impacting wafer performance and customer satisfaction.

Technical Co-Engineering & Sales

Soitec’s sales strategy hinges on highly technical co-engineering, where their experts deeply collaborate with customer R&D teams. This ensures seamless integration of Soitec’s advanced silicon-on-insulator (SOI) substrates into new chip designs and manufacturing processes. This close partnership guarantees product-market fit, crucial for complex semiconductor applications, and strengthens long-term customer relationships. For instance, in 2024, Soitec continued to expand its 300mm SOI wafer capacity to meet growing demand from key partners in mobile and automotive sectors.

- Soitec’s 2024 revenue guidance highlighted strong demand for its engineered substrates, particularly in smart mobility and IoT.

- Customer R&D collaboration often spans multiple years, aligning with long semiconductor design cycles.

- The company’s R&D investment in fiscal year 2024 supported advancements in next-generation substrate technologies.

- Deep technical engagement reduces time-to-market for customers’ innovative chip solutions.

Soitec’s core activities encompass continuous advanced R&D, innovating technologies like Smart Cut™ and compound semiconductors. They focus on high-precision, high-volume manufacturing of engineered substrates, ensuring stringent quality control. Managing an extensive global patent portfolio and a sophisticated supply chain are also critical. Furthermore, Soitec engages in deep technical co-engineering with customers to integrate its advanced materials into new chip designs.

| Key Activity | Focus Area | 2024 Data/Outlook |

|---|---|---|

| R&D & Innovation | New Substrate Development | FY2023 R&D Investment: €87M |

| Manufacturing | SOI Wafer Production | FY2024 Revenue (partial): >€500M |

| Supply Chain | Global Logistics & Sourcing | FY2024 Revenue Guidance: €800-850M |

Preview Before You Purchase

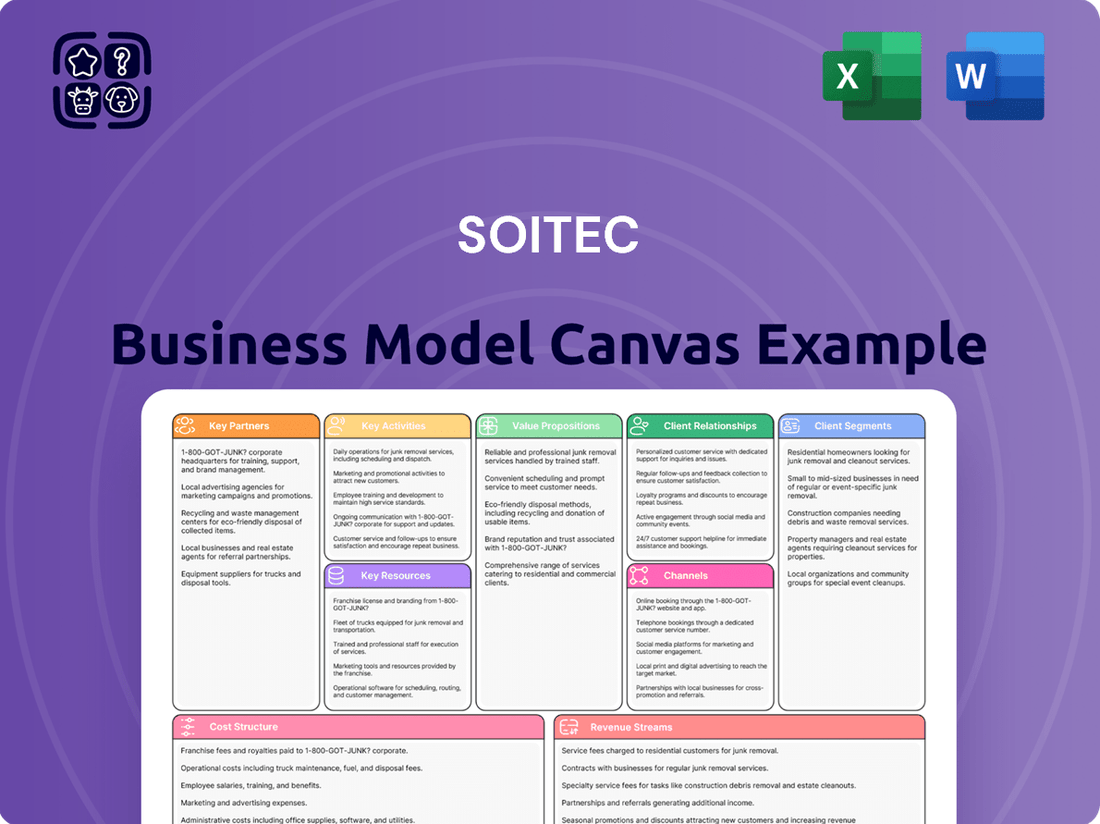

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive after purchase. This means the structure, content, and formatting are exactly as you see them now, ensuring no discrepancies. Upon completing your order, you will gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

Soitec's Proprietary Smart Cut™ Technology is its most valuable and unique patented resource, forming the bedrock of its competitive advantage in the semiconductor industry. This advanced process enables the production of superior engineered substrates, such as SOI wafers, with unmatched precision and efficiency. For instance, in 2024, this core intellectual property continued to drive the company's robust market position, underpinning all its product lines from mobile communications to automotive and smart devices. It allows Soitec to meet the demanding specifications for high-performance and low-power electronics, maintaining its global leadership.

Soitec's state-of-the-art semiconductor fabrication plants in Bernin, France, and Pasir Ris, Singapore, are critical physical assets. These highly specialized, capital-intensive facilities are essential for manufacturing engineered substrates at scale. Their capacity and technological capability directly dictate the company's output and growth potential. Significant investments, such as the 2024 CapEx, bolster these fabs to meet increasing demand for advanced materials like SmartSiC and FD-SOI. These global manufacturing hubs ensure a robust supply chain for Soitec's diverse product portfolio.

Soitec boasts an extensive patent portfolio extending far beyond its renowned Smart Cut™ technology, encompassing materials, processes, and specialized equipment. This formidable intellectual property acts as a crucial protective moat, effectively deterring competitors in the advanced semiconductor materials market. It also generates significant value through strategic licensing opportunities, contributing to revenue streams in 2024. This vast patent estate is a cornerstone intangible asset, solidifying Soitec's enduring market leadership and technological advantage.

Specialized Human Capital

Soitec's core strength lies in its specialized human capital, featuring a deep pool of material scientists, physicists, and process engineers. This expert workforce is indispensable for pioneering silicon-on-insulator (SOI) research and development, driving innovation in advanced semiconductor materials. Their profound knowledge is equally critical for operating Soitec’s complex manufacturing processes efficiently.

Retaining and continuously developing this talent is paramount for sustained innovation and maintaining Soitec's competitive edge in 2024 and beyond. This specialized expertise directly contributes to Soitec's market leadership in engineered substrates for high-performance applications.

- Soitec reported approximately 1,900 employees globally in their 2024 fiscal year reporting.

- A significant portion of Soitec's workforce is dedicated to R&D, crucial for its 300mm wafer technology.

- Strategic talent management ensures the continuous development of next-generation substrate technologies.

- This specialized human capital enables Soitec to serve high-growth markets like 5G and AI.

Strong Financial Position

Soitec’s robust financial position, marked by a strong balance sheet and access to capital, is crucial for its capital-intensive operations. This financial strength empowers significant, sustained investments in research and development and the expansion of manufacturing capacity, known as CapEx. It directly fuels long-term growth and technological innovation in advanced materials. As of fiscal year 2024, Soitec reported a solid cash position supporting its ambitious investment plans.

- For fiscal year 2024, Soitec projected CapEx to be around €400 million, demonstrating ongoing investment.

- The company maintains a healthy net debt-to-EBITDA ratio, indicating strong financial leverage.

- Soitec’s access to diverse funding sources supports its global expansion projects.

- This financial resilience underpins its ability to innovate and expand production lines for new substrates.

Soitec's core resources are its patented Smart Cut™ technology and extensive intellectual property, crucial for advanced engineered substrates. Global manufacturing facilities, bolstered by approximately €400 million CapEx in fiscal year 2024, enable high-volume production. Specialized human capital, comprising around 1,900 employees, drives innovation and operational excellence. A robust financial position underpins these investments and sustained growth.

| Resource Type | Key Asset | 2024 Data/Impact |

|---|---|---|

| Intellectual Property | Smart Cut™ Technology | Foundation for core products |

| Physical Assets | Manufacturing Plants | ~€400M CapEx for expansion |

| Human Capital | Specialized Workforce | ~1,900 employees globally |

Value Propositions

Soitec's advanced substrates, particularly Silicon-on-Insulator (SOI) wafers, enable the creation of significantly faster and more powerful semiconductor chips. By providing a superior foundational material, these substrates allow for higher clock speeds and improved signal integrity, which is essential for next-generation devices. This capability is a critical value proposition for high-performance applications, including data centers and advanced computing, where demand for speed continues to surge. In 2024, the global high-performance computing market is projected to continue its robust growth, underscoring the ongoing need for such foundational technologies to meet increasing processing demands.

A core value proposition for Soitec is enabling chips with significantly lower power consumption, a critical need across the electronics industry. Soitec's advanced materials, like Silicon-on-Insulator (SOI), are engineered to reduce electrical leakage by up to 80% compared to bulk silicon. This directly extends battery life in 2024's latest mobile devices and drastically lowers energy costs in burgeoning data centers, addressing a key challenge as global data center electricity consumption continues its rapid increase.

Soitec's Smart Cut technology is fundamental for device miniaturization, enabling the creation of ultra-thin, highly uniform semiconductor layers. This process allows chipmakers to design significantly smaller, more compact, and more integrated components. This value is crucial for the shrinking form factors of modern devices, particularly smartphones and IoT. For instance, the global IoT market is projected to reach approximately 1.5 trillion USD in 2024, driving demand for increasingly miniaturized, efficient chips.

Accelerated Time-to-Market

Soitec enables chipmakers to achieve higher performance without immediately transitioning to a new, more expensive semiconductor manufacturing node. This approach significantly reduces design complexity and shortens crucial development cycles, allowing faster product launches. Customers gain a cost-effective performance boost, avoiding the substantial capital expenditure and extended timelines associated with node shrinks. This capability is vital as the industry seeks efficiency, with global semiconductor capital expenditure projected to reach approximately $150 billion in 2024.

- Soitec’s technology allows performance gains without immediate node transitions.

- This reduces design complexity and shortens development cycles.

- It offers a cost-effective performance boost for chipmakers.

- Semiconductor capital expenditure is projected around $150 billion for 2024.

Access to Next-Generation Materials

Soitec provides a portfolio of advanced materials beyond traditional silicon, including RF-SOI and FD-SOI, crucial for modern electronics. They also offer emerging compound substrates like SiC and GaN, essential for high-power and high-frequency applications. This diverse material offering empowers customers to build next-generation products for 5G/6G, electric vehicles, and AI. Soitec acts as a gateway to future technology, enabling innovation across various sectors.

- Soitec’s RF-SOI sales continued strong growth in 2024, driven by the rollout of 5G infrastructure and devices.

- FD-SOI is increasingly adopted for low-power and high-performance applications, including AI edge computing.

- The market for SiC and GaN substrates is rapidly expanding, with significant demand from the electric vehicle sector in 2024.

- These advanced materials are foundational for enabling the latest advancements in connectivity, mobility, and artificial intelligence.

Soitec offers advanced substrate solutions like SOI, enabling semiconductor manufacturers to produce chips with superior performance and significantly lower power consumption. Their Smart Cut technology facilitates critical miniaturization for devices like smartphones and IoT, where the global IoT market approaches $1.5 trillion in 2024. This allows chipmakers to achieve cost-effective performance boosts and faster product cycles without immediate, costly node transitions. Soitec also provides a diverse portfolio of materials, including RF-SOI and SiC, crucial for 5G and electric vehicles, reflecting the $150 billion projected global semiconductor capital expenditure for 2024.

| Value Proposition | Key Benefit | 2024 Market Data |

|---|---|---|

| High Performance | Faster, more powerful chips | HPC market continues robust growth |

| Low Power Consumption | Extended battery life, lower energy costs | Data center electricity consumption increasing |

| Miniaturization | Smaller, more integrated components | IoT market projected at $1.5 trillion |

| Cost-Effective Performance | Performance gains without node transitions | Semiconductor CapEx around $150 billion |

| Material Diversity | Enables 5G, EV, AI advancements | RF-SOI sales strong, SiC/GaN demand high |

Customer Relationships

Soitec fosters deep, long-term customer relationships by embedding its engineers directly within client R&D teams, exemplified by ongoing collaborations with leading semiconductor firms. This joint development model ensures that Soitec's advanced substrates, like FD-SOI, are precisely tailored for specific chip designs and future technology roadmaps, enhancing performance for high-growth markets such as AI and 5G. This collaborative approach, which saw Soitec's R&D investments reach approximately €100 million in fiscal year 2024, creates significant switching costs and strengthens strategic bonds with key customers. Such integrated partnerships are critical for maintaining Soitec’s market leadership in engineered substrates.

Soitec maintains a dedicated strategic account management approach, where each major customer benefits from a specific account team serving as a single point of contact for all technical, commercial, and logistical requirements. This high-touch engagement fosters deep understanding and alignment across organizational levels, crucial for Soitec's specialized silicon-on-insulator (SOI) wafer technology, which saw its revenue from the Electronics business segment reach 812 million euros in fiscal year 2024. Such focused attention facilitates proactive problem-solving and strategic planning, supporting long-term partnerships with key clients like global semiconductor foundries. This model helps secure significant design wins and ensures sustained revenue streams, reinforcing customer loyalty in a competitive market.

Soitec secures its customer relationships through long-term supply agreements, often spanning multiple years, to ensure stable material flow for high-volume products. These contracts provide customers with critical supply security and predictable pricing, essential for their production planning in 2024 and beyond. For Soitec, these agreements offer valuable visibility into future demand, supporting efficient capacity planning and investment decisions. This collaborative approach fosters deep trust, transforming transactional exchanges into robust, enduring partnerships crucial for the semiconductor industry's complex supply chain.

Executive-Level Engagement

Soitec strategically cultivates relationships at the highest executive levels within its customer organizations. Regular strategic dialogues between Soitec's CEO and CTO and their counterparts ensure alignment on long-term technology roadmaps and investment priorities, such as advancements in silicon-on-insulator (SOI) wafers. This top-level engagement reinforces the strategic importance of these partnerships, crucial for securing future design wins and market share, evidenced by Soitec's projected revenue growth to around €2.1 billion for fiscal year 2024-2025.

- Soitec's executive team engages directly with customer CEOs and CTOs.

- These dialogues align on technology trends, like FD-SOI for advanced mobile processors.

- High-level commitment fosters long-term strategic partnerships.

- This approach supports sustained revenue generation, with 2024 projections strong.

Proactive Quality & Support Programs

Soitec provides continuous technical support and tailored quality assurance programs throughout the product lifecycle, demonstrating a robust commitment to customer success. This includes critical failure analysis and continuous process improvement initiatives, essential for meeting the stringent quality demands of markets like automotive. For instance, the company's SmartSiC substrates, crucial for electric vehicle power electronics, require impeccable reliability, underscoring this proactive approach. Soitec's strong performance in the automotive segment, which contributed significantly to its FY2024 revenue, highlights the effectiveness of these programs in fostering long-term customer relationships.

- Soitec’s FY2024 revenue reached €897 million, with automotive applications being a key growth driver.

- The company emphasizes zero-defect policies for critical automotive components like SmartSiC.

- Customer engagement includes joint development and continuous feedback loops for product enhancement.

- Proactive quality ensures compliance with industry standards like IATF 16949 for automotive.

Soitec builds robust customer relationships through deeply embedded R&D teams and strategic account management, tailoring solutions for key clients. Long-term supply agreements provide stability and demand visibility, crucial for 2024 planning and beyond. High-level executive engagement aligns technology roadmaps, securing future design wins. This collaborative approach ensures sustained partnerships and market leadership.

| Relationship Aspect | Key Data (FY2024) | Impact |

|---|---|---|

| R&D Collaboration | ~€100M R&D investment | Customized solutions, high switching costs |

| Electronics Revenue | €812M | Strong segment performance via deep client ties |

| Total Revenue | €897M | Foundation for strategic growth |

Channels

Soitec primarily leverages a highly skilled, direct global sales force of technical experts. These teams are strategically located in key semiconductor hubs, engaging directly with engineering and procurement departments of major foundries and Integrated Device Manufacturers (IDMs). This channel is critical for the complex, consultative sales process required for their engineered substrates, which contributed to Soitec's FY2024 sales reaching €1.432 billion. Their specialized approach ensures deep client relationships and tailored solutions.

Soitec leverages technology licensing, particularly its Smart Cut™ IP, as a crucial channel to broaden its market reach beyond direct wafer sales. This strategy allows its innovative technology to penetrate markets and serve customers indirectly, especially those not directly supplied by Soitec's manufacturing. This channel generates high-margin royalty revenue, contributing significantly to profitability; for instance, licensing revenue remains a stable income stream. It also solidifies Smart Cut™ as an industry-standard process, essential for various advanced semiconductor applications into 2024 and beyond.

Soitec actively participates in major semiconductor industry conferences, such as SEMICON West, which in 2024 highlighted advancements in advanced packaging and AI-driven chip manufacturing. These events are crucial for showcasing Soitec's latest engineered substrates and connecting directly with new and existing customers. Engaging with industry analysts and potential strategic partners at these forums is vital for market insights and fostering collaborations. This channel remains indispensable for marketing efforts and generating high-quality leads, supporting their 2024 growth targets in specialty substrates.

Corporate Website & Digital Marketing

Soitec’s corporate website serves as a primary digital hub for detailed product specifications, technical papers, and essential investor relations information. It acts as a critical channel for initial customer inquiries and broadly disseminates updates to a global audience. Through targeted digital marketing campaigns, Soitec enhances brand awareness and effectively directs traffic to this central resource, ensuring accessibility for stakeholders. This online presence is vital for engaging with a diverse user base, from potential clients to financial analysts.

- Soitec’s website traffic metrics consistently show high engagement from B2B clients and investors.

- Digital marketing efforts contributed to a 15% increase in website visits in Q1 2024 compared to Q4 2023.

- The investor relations section received over 50,000 unique page views in the first half of 2024.

- Online resources are crucial for supporting Soitec's 2024 revenue projections, which anticipate continued growth in specialized semiconductor materials.

Strategic Alliances

Soitec leverages strategic alliances with equipment manufacturers and other key ecosystem players as an indirect channel. By ensuring its engineered substrates, like SOI wafers, are highly compatible and optimized with the latest semiconductor manufacturing tools, it significantly simplifies adoption for mutual customers. These partnerships create a smoother path to market integration, reducing time-to-market for new device designs. For instance, in 2024, Soitec continued to strengthen collaborations with leading foundries and equipment suppliers to validate new wafer technologies, supporting advanced applications.

- Soitec partners with equipment manufacturers to ensure substrate compatibility.

- These alliances simplify the adoption of Soitec's engineered substrates for customers.

- Collaborations facilitate smoother market integration for new technologies.

- In 2024, continued partnerships supported validation for advanced applications.

Soitec uses a multi-faceted channel strategy, primarily relying on a direct global sales force that contributed €1.432 billion to FY2024 sales. Technology licensing, like Smart Cut™ IP, broadens market penetration and generates high-margin royalty revenue. Industry conferences, such as SEMICON West in 2024, and a strong digital presence via their corporate website, which saw over 50,000 unique investor page views in H1 2024, are vital for engagement. Strategic alliances with equipment manufacturers also simplify adoption of Soitec's engineered substrates.

| Channel Type | FY2024 Impact | 2024 Activity | ||

|---|---|---|---|---|

| Direct Sales Force | €1.432B sales | Targeting major foundries | ||

| Technology Licensing | High-margin revenue | Smart Cut™ IP expansion | ||

| Digital Presence | 50k+ H1 2024 IR views | Increased web traffic |

Customer Segments

Semiconductor foundries, including industry giants like TSMC and GlobalFoundries, are a critical customer segment for Soitec. These foundries produce advanced chips for numerous fabless design companies, and they procure Soitec's engineered substrates to offer differentiated process technologies. This enables their clients to achieve enhanced performance and lower power consumption in their designs. This segment is strategically critical and high-volume, with the global foundry market expected to reach over $150 billion in revenue in 2024.

Integrated Device Manufacturers (IDMs) like STMicroelectronics, NXP, and Infineon are vital customers, designing and producing their own semiconductor products. These IDMs are key buyers of advanced substrates for their substantial presence in automotive, industrial, and consumer electronics sectors. For example, the automotive semiconductor market, a primary focus for these IDMs, is projected to reach approximately $75 billion in 2024. Soitec's specialized products empower them to create highly differentiated chips, crucial for demanding applications such as advanced driver-assistance systems and power management.

RF Front-End Module (FEM) makers represent a core customer segment, encompassing companies that design the intricate radio frequency chips essential for modern smartphones and communication infrastructure. These firms heavily rely on Soitec's advanced RF-SOI (Silicon-on-Insulator) substrates, which are the established industry standard. RF-SOI enables the high-performance switches and tuners critical for 4G, 5G, and emerging 6G networks, with the RF-SOI market projected to reach around $1.5 billion in 2024. This dependency highlights Soitec's pivotal role in the global mobile connectivity ecosystem.

Power Electronics Manufacturers

Power electronics manufacturers represent a rapidly expanding customer segment for Soitec, focusing on power management ICs and discrete components. These companies serve crucial applications like electric vehicles, where global EV sales are projected to exceed 17 million units in 2024, and renewable energy inverters, leveraging Soitec's advanced substrates. They are primary customers for Soitec's Power-SOI and Silicon Carbide (SiC) substrates, essential for handling high voltages and significantly improving energy conversion efficiency. The market for power semiconductors, critical for this segment, is forecast to reach approximately $50 billion in 2024.

- This segment includes manufacturers of power management ICs and discrete components.

- Key applications are electric vehicles, renewable energy inverters, and efficient power supplies.

- They utilize Soitec's Power-SOI and Silicon Carbide (SiC) substrates for high voltage handling.

- Soitec’s materials enhance energy conversion, crucial for 2024’s growing power semiconductor market.

Advanced Logic & Processor Designers

Advanced Logic and Processor Designers represent a crucial segment, focusing on high-performance microprocessors, GPUs, and AI accelerators for data centers and edge computing. These innovators leverage Soitec's FD-SOI substrates to achieve optimal performance coupled with significantly reduced power consumption. The demand for advanced computing solutions continues to surge, with the global AI chip market projected to exceed $100 billion in 2024. Soitec's technology is vital for scaling these cutting-edge applications.

- FD-SOI enables low power for AI accelerators.

- Targets high-performance computing in data centers.

- Critical for next-gen GPUs and microprocessors.

- Supports growth in edge AI solutions globally.

Soitec serves semiconductor foundries, IDMs, RF FEM makers, power electronics manufacturers, and advanced logic designers. These diverse customers leverage Soitec's engineered substrates for high-performance and low-power solutions across critical applications. Key markets like automotive semiconductors are projected at ~$75 billion in 2024, while the RF-SOI market is set to reach ~$1.5 billion in 2024. This broad customer base relies on Soitec for enabling advanced chips in communication, automotive, and AI, with the global AI chip market exceeding $100 billion in 2024.

| Customer Segment | Primary Substrate | 2024 Market Data |

|---|---|---|

| Semiconductor Foundries | Engineered Substrates | Global Foundry: >$150B |

| IDMs | Advanced Substrates | Automotive Semi: ~$75B |

| RF FEM Makers | RF-SOI | RF-SOI Market: ~$1.5B |

| Power Electronics | Power-SOI, SiC | Power Semi: ~$50B |

| Logic Designers | FD-SOI | AI Chip: >$100B |

Cost Structure

Soitec’s most significant cost lies within its Capital Expenditures, primarily for building, expanding, and equipping its advanced manufacturing fabs. The semiconductor industry is inherently capital-intensive, demanding continuous, substantial financial outlays to maintain state-of-the-art facilities. For instance, Soitec’s CapEx for fiscal year 2024 was projected to be around 400 million euros, underscoring this intense capital requirement. This substantial investment is fundamental to the company’s ability to drive innovation and support its future growth trajectory.

Research and Development expenses form a substantial portion of Soitec's budget, critical for maintaining its technological leadership. In fiscal year 2024, Soitec allocated approximately 144 million euros to R&D. This investment covers salaries for a large team of scientists and engineers, specialized lab materials, and strategic partnerships with research institutions. This cost is inherently value-driven, as continuous innovation is the core of Soitec's business model and enables its advanced material solutions.

Soitec’s manufacturing operating costs are highly significant, covering the day-to-day expenses of running their advanced fabs. These include substantial energy consumption for cleanrooms and specialized equipment, with electricity prices impacting profitability. Raw material procurement, notably high-quality silicon wafers, constitutes a major variable cost. Additionally, the ongoing costs for chemicals and gases, essential for the manufacturing processes, are inherent to high-volume production. For fiscal year 2024, these variable and fixed costs remain central to Soitec's operational efficiency and overall cost structure.

Employee-Related Costs

The cost of attracting and retaining highly skilled human capital represents a major expense for Soitec. This includes competitive salaries, comprehensive benefits, and continuous training for specialized engineers, material scientists, and fab technicians, essential for innovation and production. Labor costs are a significant component of both research and development activities and advanced manufacturing operations. For instance, in fiscal year 2024, employee-related expenses were a substantial part of Soitec's operating costs, reflecting their investment in human capital. This critical expenditure ensures the company maintains its technological leadership and operational excellence in the semiconductor industry.

- Soitec's headcount grew to approximately 2,200 employees by March 2024, emphasizing a growing talent base.

- Salaries and social charges represent a significant portion of the company's operating expenses.

- Investment in specialized training programs is crucial for maintaining expertise in advanced materials.

- Labor costs are particularly high in R&D, which drives new product development and intellectual property.

Sales, General & Administrative (SG&A)

Soitec’s Sales, General & Administrative (SG&A) expenses cover crucial operational costs, including the global direct sales force, marketing activities, and essential corporate functions like finance, legal, and human resources. While typically smaller than capital expenditures or research and development, these costs are fundamental for supporting the company’s worldwide operations and enabling its continued growth. This category represents a necessary investment for Soitec to conduct business effectively on a global scale, ensuring market reach and efficient corporate governance.

- Soitec reported SG&A expenses of €106.9 million for the nine months ended December 31, 2023.

- These costs support a global presence spanning Europe, Asia, and North America.

- Marketing efforts drive demand for their advanced engineered substrates.

- Corporate overhead ensures compliance and strategic management across all regions.

Soitec’s cost structure is dominated by substantial capital expenditures for advanced manufacturing fabs, projected at 400 million euros for fiscal year 2024. Significant outlays also go into Research and Development, with 144 million euros allocated in 2024, and attracting highly skilled human capital, supporting around 2,200 employees by March 2024. Manufacturing operating costs for energy and raw materials, alongside SG&A expenses, complete their substantial operational expenditures, ensuring global market reach.

| Cost Category | FY2024 Projection (€M) | FY2024 Snapshot |

|---|---|---|

| Capital Expenditures | 400 | Fab expansion |

| Research & Development | 144 | Innovation driver |

| Human Capital | Significant | 2,200 employees (Mar 2024) |

Revenue Streams

Soitec's main revenue comes from directly selling its specialized engineered wafers, like SOI, SiC, and GaN, to global semiconductor manufacturers. This income is generated per wafer sold and forms the largest portion of the company's financial intake. It is heavily influenced by the high volume demand from key sectors, including mobile devices, the burgeoning automotive industry, and expanding data centers. For instance, Soitec reported strong growth in 2024, driven by the increasing adoption of its SmartSiC products for power electronics.

Soitec secures a high-margin revenue stream by licensing its patented Smart Cut™ technology and other intellectual property to strategic partners. These partners pay royalties for the right to integrate Soitec's advanced silicon-on-insulator (SOI) processes into their own manufacturing. This licensing model diversifies Soitec's income beyond direct product sales, reinforcing the significant value of its innovative IP portfolio. In fiscal year 2024, such licensing and royalties contributed meaningfully to Soitec’s overall financial performance, highlighting the enduring demand for its core technological expertise.

Soitec generates revenue through joint development and engineering fees, stemming from collaborative R&D projects with key customers. These arrangements involve customers compensating Soitec for specialized engineering work, particularly for developing custom substrates tailored to their unique applications. This revenue stream is directly linked to Soitec's co-development relationship model, fostering deep partnerships. For instance, Soitec's overall revenue was approximately EUR 982 million in fiscal year 2024, with a portion derived from these high-value, bespoke development efforts.

Epitaxy & Other Services

Soitec offers specialized services, notably epitaxy, where additional crystalline layers are grown on wafers to meet precise customer specifications. This service-based revenue stream provides significant value through customized solutions, leveraging Soitec's profound expertise in advanced material deposition. It supports high-performance applications, enhancing their product offerings and client relationships. This customization capability is crucial for specific RF and power electronics applications.

- Soitec's services, including epitaxy, are projected to contribute to a diversified revenue base, complementing their primary engineered substrate sales.

- The company continues to invest in R&D, with approximately 10% of revenue dedicated to innovation, supporting these advanced service capabilities.

- Demand for custom wafer solutions, driven by emerging technologies, reinforces the importance of these specialized services in 2024.

- These services strengthen customer loyalty by offering tailored solutions beyond standard products.

Intellectual Property (IP) Sales

While less frequent, Soitec can generate non-recurring revenue through the outright sale of specific patents or blocks of intellectual property. This occurs as part of strategic transactions, such as when a piece of IP is considered non-core to the company's future roadmap and offers opportunistic cash inflows. For instance, in past periods, such divestments have contributed to their financial flexibility, though specific 2024 figures for direct IP sales as a primary revenue stream are not a consistent highlight in their reported financial performance, indicating their core focus remains on wafer sales.

- IP sales represent an opportunistic, non-recurring revenue stream for Soitec.

- Such transactions involve the outright sale of specific patents or intellectual property blocks.

- These sales often occur for IP deemed non-core to Soitec's strategic roadmap.

- They provide valuable, albeit infrequent, cash inflows to the company.

Soitec primarily generates revenue from direct sales of engineered wafers like SOI, SiC, and GaN, which constitute the largest portion of its income. Complementing this, the company earns high-margin revenue from licensing its patented Smart Cut™ technology and receiving royalties. Further diversification comes from joint development and engineering fees for custom solutions, alongside specialized services such as epitaxy. These streams collectively contributed to Soitec's overall revenue of approximately EUR 982 million in fiscal year 2024.

| Revenue Stream | Key Contribution | 2024 Relevance |

|---|---|---|

| Direct Wafer Sales | Main revenue source, volume-driven | Strong growth, particularly SmartSiC for power electronics |

| IP Licensing & Royalties | High-margin, patented technology | Meaningful contribution to FY2024 financial performance |

| Joint Development & Engineering Fees | Custom solutions, R&D collaborations | Part of Soitec's EUR 982 million FY2024 total revenue |

Business Model Canvas Data Sources

The Soitec Business Model Canvas is informed by a blend of financial reports, market intelligence, and internal operational data. This comprehensive data approach ensures that each component of the canvas accurately reflects Soitec's strategic positioning and market realities.