Soitec Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Soitec Bundle

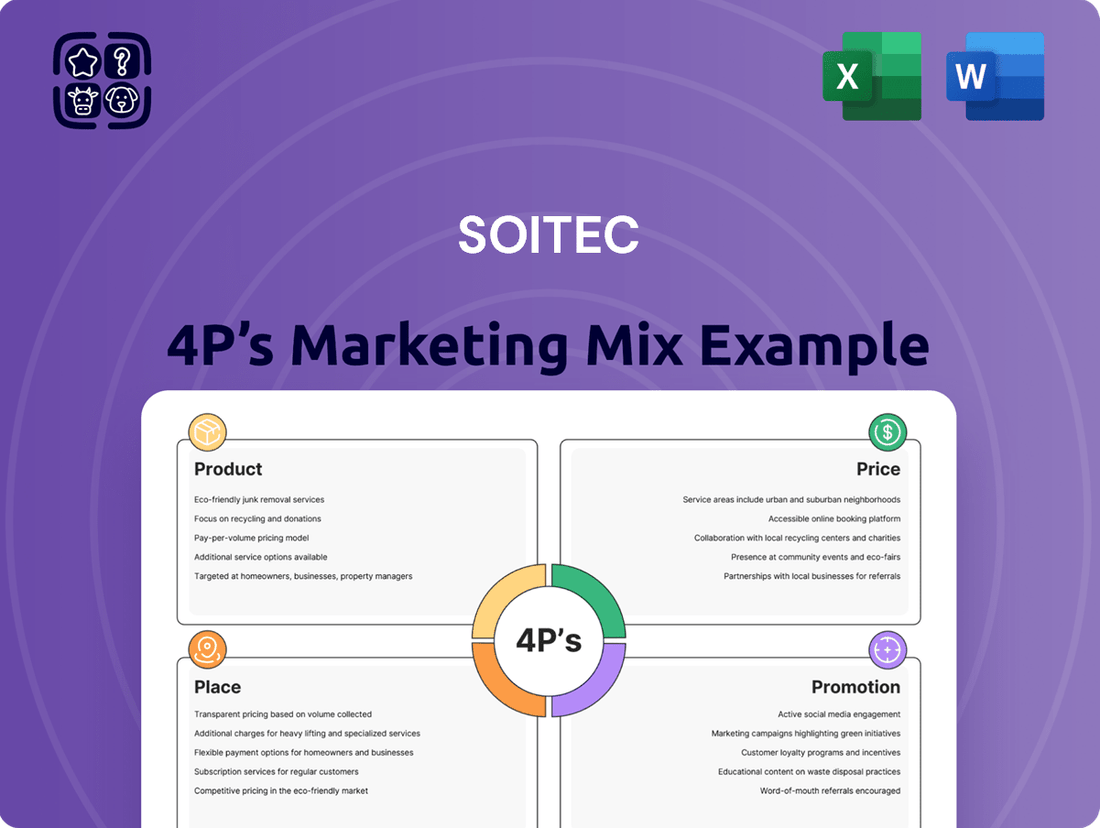

Uncover the strategic brilliance behind Soitec's market dominance by diving deep into their 4P's Marketing Mix. This analysis meticulously examines their innovative product development, competitive pricing structures, strategic distribution channels, and impactful promotional campaigns.

Discover how Soitec leverages each P to create a cohesive and powerful marketing strategy that resonates with their target audience and drives significant business growth.

This isn't just a surface-level overview; it's a comprehensive, actionable blueprint for understanding and replicating Soitec's marketing success.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Get the full analysis in an editable, presentation-ready format and transform your understanding of effective marketing execution.

Product

Soitec's core product portfolio centers on highly specialized engineered substrates, essential for advanced semiconductor manufacturing. This includes key families like Silicon-on-Insulator (SOI), Piezoelectric-on-Insulator (POI), Gallium Nitride (GaN), and Silicon Carbide (SiC) wafers. These are not commodity items but advanced materials, engineered to significantly boost microchip performance and energy efficiency, particularly critical as global semiconductor demand continues to grow into 2025. For instance, SOI wafers are crucial for 5G and IoT applications, with the overall SOI market projected to expand, supporting Soitec's strategic positioning.

Soitec's proprietary Smart Cut™ technology is the core of its product offering, facilitating the transfer of ultra-thin, perfectly uniform semiconductor layers onto support substrates. This patented process enables the creation of advanced composite substrates, critical for high-performance applications in 2024 and 2025, unlike conventional methods. It underpins Soitec's strong position in the global silicon-on-insulator (SOI) market, which is projected to reach significant growth, driven by demand for 5G and AI. This technological edge provides Soitec a substantial competitive advantage in the semiconductor industry.

Soitec strategically targets high-growth applications, focusing on Mobile Communications, Automotive & Industrial, and Edge & Cloud AI. For mobile, its RF-SOI and POI substrates are crucial for 5G components, supporting an estimated 800 million 5G smartphone shipments in 2024. In automotive, Power-SOI and SmartSiC™ wafers are vital for electric vehicles, with global EV sales projected to exceed 17 million units in 2024. Photonics-SOI enables high-speed data transfer for AI and data centers, aligning with significant growth in AI server deployments through 2025.

Continuous Innovation and R&D

Soitec heavily invests in innovation, dedicating approximately 14-17% of its revenue to Research and Development. This commitment fuels a robust product roadmap, focusing on next-generation materials such as Fully Depleted SOI (FD-SOI) and new compound substrates. The company maintains a strong intellectual property portfolio, holding over 4,300 active patents as of 2024, ensuring its technological leadership. This continuous R&D focus positions Soitec at the forefront of advanced semiconductor materials for 2025 and beyond.

- R&D Investment: Soitec allocates about 14-17% of its revenue to R&D.

- Key Materials: Focus includes FD-SOI and new compound substrates.

- Patent Portfolio: Over 4,300 active patents secure technological edge.

Value Proposition of Performance and Efficiency

Soitec’s fundamental value proposition centers on delivering exceptional performance and efficiency through its engineered substrates. These specialized wafers empower chipmakers to develop semiconductors that are inherently faster, consume less power, and boast superior reliability, directly addressing critical industry demands. This translates into tangible benefits for end-users, such as smartphones offering significantly longer battery life, electric vehicles achieving greater range and enhanced reliability, and data centers realizing substantial reductions in energy consumption, aligning with 2025 sustainability goals.

- Soitec’s SOI wafers can reduce power consumption in mobile processors by up to 30% compared to bulk silicon, extending device battery life.

- For data centers, these substrates contribute to up to 20% energy savings in server processors, crucial as global data center energy demand is projected to rise by 20-30% by 2025.

- In automotive applications, Soitec’s technology enhances chip reliability essential for advanced driver-assistance systems (ADAS) and power electronics in EVs.

Soitec’s product portfolio features highly specialized engineered substrates, including SOI and SiC wafers, essential for advanced semiconductor manufacturing. These products, enabled by the proprietary Smart Cut™ technology, significantly boost microchip performance and energy efficiency. They are critical for high-growth sectors like 5G, automotive EVs, and AI, with SOI wafers reducing power consumption by up to 30% in mobile devices. Soitec maintains its product leadership through continuous innovation, backed by over 4,300 active patents and 14-17% revenue invested in R&D for 2024-2025.

| Product Category | Key Substrates | 2024/2025 Impact |

|---|---|---|

| Mobile Communications | RF-SOI, POI | Supports 800M 5G smartphone shipments (2024) |

| Automotive & Industrial | Power-SOI, SmartSiC™ | Vital for >17M EV sales (2024) |

| Edge & Cloud AI | Photonics-SOI | Enables high-speed data for AI server growth (2025) |

What is included in the product

This analysis offers a comprehensive breakdown of Soitec's marketing mix, detailing their Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Soitec's market positioning and competitive advantages, providing actionable insights for strategic planning.

Provides a clear, actionable framework for Soitec's marketing strategy, addressing potential market uncertainties and clarifying strategic choices.

Simplifies complex marketing decisions for Soitec by offering a structured approach to product, price, place, and promotion, easing the burden of strategic planning.

Place

Soitec strategically operates state-of-the-art manufacturing facilities, or fabs, in key global regions. Its primary production and research and development hub is located in Bernin, France, which continues to be a cornerstone of its silicon-on-insulator (SOI) wafer production, serving a significant portion of its global demand. A major production site in Singapore complements this, specifically catering to the growing Asian market and enhancing supply chain resilience. This dual-hub strategy ensures proximity to key customer ecosystems and supports the company's projected revenue growth, with sales expected to reach approximately 2.1 billion euros by fiscal year 2026. This global footprint strengthens Soitec's ability to meet increasing demand for advanced materials in sectors like mobile communications and automotive.

Soitec, as a B2B enterprise specializing in highly technical silicon-on-insulator (SOI) substrates, employs a direct sales model. Its sales and engineering teams work in deep collaboration with the R&D and procurement departments of major semiconductor foundries and integrated device manufacturers. This close partnership, critical for complex product cycles, ensures optimal integration of Soitec's advanced substrates into customer designs, like those for 5G, AI, and automotive applications. This direct engagement fosters long-term relationships, crucial given Soitec's projected revenue of around €800 million for fiscal year 2025.

Soitec strategically maintains a global network of sales offices and R&D centers across vital semiconductor markets. Their presence in the United States, Japan, China, Taiwan, South Korea, and Germany ensures close commercial and technical support for key clients. This proximity is essential for facilitating deep partnerships and co-development of next-generation technologies. For instance, close collaboration within these regions helps drive advancements in FD-SOI and SiC substrates, critical for 2025 market demands.

Collaborative Ecosystem and Partnerships

Soitec's distribution extends beyond direct sales, integrating deeply within the global semiconductor ecosystem through strategic partnerships. Collaborations with research hubs like CEA-Leti in France and MIT in the US are crucial, fostering innovation for new products like SmartSiC. These alliances, alongside those with equipment suppliers and major customers, ensure accelerated market adoption, driving demand for engineered substrates. For instance, Soitec's 2024 capital expenditure plans include significant investments in capacity expansion, supported by these ecosystem ties.

- Soitec invests approximately 20-25% of its revenue annually into R&D, much of which is driven by collaborative projects.

- The company anticipates its SmartSiC substrate production capacity to reach 1 million 8-inch wafers per year by 2026, supported by key industry partnerships.

- Soitec’s FD-SOI technology adoption is projected to grow significantly, with over 10 billion FD-SOI chips expected to ship by 2025 across various applications.

Supply Chain Management and LTAs

Soitec strategically employs long-term agreements (LTAs) with major customers, crucial for managing its specialized supply chain and ensuring stability. These agreements offer vital visibility into future volumes and pricing, essential for planning raw material procurement and capacity expansions through 2025. This strategy mitigates market volatility, securing supply for key partners and supporting Soitec's consistent growth trajectory.

- Soitec's LTA coverage typically accounts for a significant portion of its order book, providing strong revenue predictability for fiscal year 2025.

- These agreements are critical for securing rare earth elements and other specialized substrates, central to FD-SOI and SmartSiC production.

- LTAs enable efficient capital expenditure planning for new fabs, such as the Singapore expansion to be operational by 2026.

- The contractual stability helps Soitec maintain a lean inventory while ensuring timely deliveries to tier-one semiconductor clients globally.

Soitec strategically employs a dual-hub manufacturing model in Bernin, France, and Singapore, enhancing supply chain resilience and proximity to global semiconductor markets. Its direct sales approach, supported by a worldwide network of sales and R&D offices, fosters deep collaboration with key clients for complex product integration. Strategic partnerships with research institutions and long-term agreements ensure accelerated market adoption and revenue predictability, with fiscal year 2025 revenue projected around €800 million. This comprehensive place strategy supports the projected shipment of over 10 billion FD-SOI chips by 2025.

Preview the Actual Deliverable

Soitec 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Soitec 4P's Marketing Mix Analysis delves into product, price, place, and promotion strategies. You'll gain insights into their innovative product offerings, competitive pricing structures, global distribution channels, and impactful promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout.

Promotion

Soitec solidifies its position as a technology leader by publishing technical articles and white papers, alongside presentations at key scientific conferences like SEMICON Europa 2024. This content-driven promotion targets engineers and technical decision-makers, showcasing the superior performance of its engineered substrates for applications like 5G and AI. The company's robust patent portfolio, exceeding 3,800 active patents globally by early 2024, also serves as a crucial promotional asset, underscoring its relentless innovation and market leadership.

Soitec actively engages in premier global semiconductor trade shows and conferences, including SEMICON and Mobile World Congress (MWC), reinforcing its market leadership. These platforms are crucial for showcasing new engineered substrate innovations and announcing strategic partnerships, such as collaborations seen at SEMICON Europa 2024. Direct engagement with customers and industry analysts at these events enhances visibility and supports the company's projected revenue growth towards its 2026 targets. Participation ensures Soitec remains at the forefront of semiconductor material advancements, fostering key industry connections.

Soitec's primary promotional strategy involves deep technical co-development with customer R&D teams, particularly for advanced semiconductor applications. This direct engagement ensures their Smart Cut technology and engineered substrates are designed into next-generation devices, aligning Soitec's product roadmap with evolving market demands. This collaborative approach effectively promotes their materials as integral components, securing long-term partnerships and future revenue streams. For instance, this strategy is crucial as the industry shifts towards AI accelerators and 5G infrastructure in 2024-2025, where advanced substrate performance is critical.

Investor and Financial Relations

Soitec maintains a robust investor relations program, crucial for shareholder confidence and capital access. This includes regular financial reporting, like its H1 FY2025 results expected in late 2024, and subsequent earnings calls. Clear communication of its strategic focus, such as the SmartSiC platform's growth, is vital for analysts and investors. Presenting at key investor conferences ensures transparency and helps secure funding for ongoing projects.

- Soitec’s FY2024 annual report was released in June 2024, providing comprehensive financial data.

- The company regularly hosts earnings calls, with the next expected for H1 FY2025 results around November 2024.

- Soitec actively participates in global investor conferences, presenting its market outlook and technological advancements.

- Effective communication supports capital market access, essential for funding 2025 expansion initiatives.

Strategic Corporate Communications

Soitec leverages strategic corporate communications, including press releases and targeted media relations, to announce key milestones. These communications highlight new customer agreements, such as those driving growth in RF-SOI for 5G applications, and significant capacity expansions, like the ongoing ramp-up at its Bernin facility. The company also promotes technological breakthroughs, such as advancements in SmartSiC, reinforcing its narrative of innovation and market leadership to financial and semiconductor trade press. As of early 2025, their investor relations communications emphasized a strong order book and projected FY2025 revenue growth.

- FY2024 revenue reached €899 million, with strong momentum expected into FY2025.

- Press releases frequently cover new product qualifications and strategic partnerships in diverse markets.

- Targeted media outreach reinforces Soitec's position as a critical enabler in semiconductor innovation.

Soitec’s promotion strategy leverages deep technical co-development with customer R&D teams, ensuring its engineered substrates are integral to next-gen devices for 5G and AI, crucial in 2024-2025. The company reinforces its market leadership through active participation in key industry events like SEMICON Europa 2024, showcasing innovations and strategic partnerships. Robust investor relations, including H1 FY2025 results expected late 2024, alongside targeted corporate communications, highlight its strong order book and projected FY2025 revenue growth from €899 million in FY2024.

| Area | Key Activity | 2024/2025 Data | ||

|---|---|---|---|---|

| Technical | Co-development & Conferences | SEMICON Europa 2024, 3,800+ patents | AI/5G focus | Smart Cut |

| Financial | Investor Relations | H1 FY2025 results (Nov 2024) | FY2024 Revenue: €899M | FY2025 growth projected |

| Corporate | Media & Press | New RF-SOI agreements | Bernin capacity ramp-up | SmartSiC advancements |

Price

Soitec’s pricing strategy is firmly rooted in the substantial value its engineered substrates deliver, rather than merely production costs. The price of an advanced substrate is determined by the significant performance enhancements and energy efficiency gains it enables for chip manufacturers. This value-based approach allows Soitec to command a premium, reflecting the critical role its products play in high-growth segments like 5G and AI. For instance, their FD-SOI technology, vital for power-efficient chips, contributed significantly to Soitec's FY2024 revenue of approximately €1.4 billion, underscoring the market's willingness to pay for superior component value.

Soitec leverages multi-year long-term agreements (LTAs) for a substantial portion of its business, ensuring predictable revenue streams and pricing stability. These contracts shield the company from short-term market volatility, a critical aspect given the semiconductor industry's cyclical nature. For customers, these LTAs guarantee a consistent supply of essential, high-performance engineered substrates, crucial for their production timelines. This strategy underpins Soitec's financial resilience, with such agreements contributing significantly to its projected FY2025 revenue.

Soitec implements a tiered pricing model, aligning costs with the advanced nature and value of its silicon-on-insulator substrates. Products like SmartSiC for power electronics or FD-SOI for 5G and AI applications command premium prices, reflecting significant R&D and manufacturing complexity. In contrast, more mature SOI products for general consumer electronics might be priced more competitively. This strategy optimizes revenue streams, with high-performance solutions contributing disproportionately, as seen in their projected 2025 revenue mix emphasizing advanced nodes. The pricing structure directly mirrors the distinct value propositions and technological investments across their diverse portfolio.

Pricing to Support R&D Investment

Soitec's pricing model is strategically designed to support its significant and continuous investment in research and development. The premium margins generated from its highly innovative engineered substrates are directly reinvested, ensuring a sustainable innovation cycle. This commitment helps maintain the company's long-term competitive advantage in advanced semiconductor materials. For instance, Soitec's R&D expenses were approximately €115 million in fiscal year 2023, a trend expected to continue into fiscal year 2025.

- Soitec consistently reinvests premium margins into R&D, with fiscal year 2023 R&D expenses around €115 million.

- This reinvestment strategy underpins the development of next-generation semiconductor materials for advanced electronics.

Market Dynamics and Competitive Positioning

Soitec's pricing strategy, while value-based, is significantly shaped by market dynamics, especially demand from key sectors like smartphones and electric vehicles. Their leadership and proprietary silicon-on-insulator (SOI) technology, which saw a Q3 FY2024 revenue of €143 million, grant considerable pricing power. However, to drive widespread adoption of advanced substrates like SmartSiC for power electronics, competitive pricing is essential. The company also generates revenue by licensing its intellectual property, further influenced by the value of its technology.

- Soitec's Q3 FY2024 revenue reached €143 million, reflecting market demand.

- Proprietary SOI technology underpins strong pricing power.

- Competitive pricing is crucial for new substrate adoption in EVs.

- IP licensing generates additional revenue streams.

Soitec employs a value-based pricing strategy, leveraging its engineered substrates' performance benefits in high-growth sectors like 5G and AI. Long-term agreements provide revenue predictability, while a tiered model ensures premium pricing for advanced products like SmartSiC. This strategy supports significant R&D investments, maintaining Soitec's competitive edge in advanced semiconductor materials. Market demand and IP licensing further influence their pricing power.

| Metric | FY2024 (Approx) | FY2023 (Actual) |

|---|---|---|

| Revenue | €1.4 billion | €1.09 billion |

| Q3 FY2024 Revenue | €143 million | N/A |

| R&D Expenses | N/A | €115 million |

4P's Marketing Mix Analysis Data Sources

Our Soitec 4P's Marketing Mix Analysis leverages a comprehensive array of data sources, including official company reports, investor relations materials, and industry-specific market intelligence. We meticulously examine Soitec's product portfolios, pricing strategies, distribution channels, and promotional activities.