Shriram Properties SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shriram Properties Bundle

Shriram Properties exhibits strong brand recognition and a robust project pipeline, key strengths in the competitive real estate market. However, potential weaknesses include dependence on specific geographies and fluctuating market demand, which could impact revenue. Opportunities lie in expanding into new urban centers and leveraging digital marketing for wider reach.

Threats like rising interest rates and increasing construction costs pose significant challenges to their profitability and project execution. Understanding these dynamics is crucial for any investor or stakeholder looking to navigate the real estate sector.

Want the full story behind Shriram Properties' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Shriram Properties boasts a formidable regional footprint, particularly in South India's prime markets such as Bengaluru, Chennai, and Hyderabad. This strategic concentration isn't just about geography; it signifies a deep-rooted understanding of local consumer preferences and regulatory landscapes. For instance, in fiscal year 2023, Bengaluru contributed over 50% of Shriram Properties' total sales bookings, underscoring the strength of their presence in this key city.

This established presence translates into significant competitive advantages. Their brand is well-recognized and trusted in these core areas, facilitating quicker sales cycles and stronger pricing power. The company's long operational history in these cities, dating back to its inception, has cultivated invaluable local market expertise, enabling efficient project execution and risk mitigation.

Shriram Properties strategically focuses on the mid-market and affordable housing segments in India. This approach taps into a substantial and expanding customer base, appealing to a wide range of homebuyers prioritizing value. For instance, in FY24, Shriram Properties reported a significant portion of its sales originating from these segments, underscoring their importance to the company's revenue streams.

This targeted strategy ensures consistent demand, translating into predictable sales volumes and reliable cash collections. The company's ability to deliver properties in these price points is a key driver for its financial stability. As of early 2024, reports indicated continued strong buyer interest in affordable and mid-income housing, a trend expected to persist.

Shriram Properties boasts a diverse product portfolio encompassing residential offerings like apartments and villas, as well as plotted developments. This breadth extends to commercial and retail projects, catering to a wide spectrum of customer needs and market dynamics. Such diversification is crucial for mitigating risks tied to a singular segment, as seen in the real estate sector's cyclical nature.

Healthy Financial Performance and Improving Metrics

Shriram Properties has showcased a robust financial turnaround, highlighted by a substantial increase in profitability and revenue during the fourth quarter of fiscal year 2025. The company reported a more than two-fold surge in consolidated net profit for the quarter ending March 2025, reaching ₹220 crore, a significant leap from ₹85 crore in the corresponding period of the previous year. This impressive growth was complemented by a rise in revenue from operations, which climbed to ₹665 crore in Q4 FY25 from ₹440 crore in Q4 FY24.

The company achieved its highest-ever annual net profit in FY25, posting ₹530 crore, a remarkable improvement from ₹250 crore in FY24. This performance underscores strong operational efficiencies and effective financial management, positioning Shriram Properties favorably within the real estate sector.

- Strong Q4 FY25 Net Profit: ₹220 crore, more than double the previous year's ₹85 crore.

- Highest Annual Net Profit: Achieved ₹530 crore for FY25, up from ₹250 crore in FY24.

- Revenue Growth: Consolidated revenue from operations increased to ₹665 crore in Q4 FY25, compared to ₹440 crore in Q4 FY24.

- Improved Margins: The financial results suggest enhanced operational efficiency leading to better profitability.

Part of Reputable Shriram Group

Being associated with the Shriram Group, a conglomerate with a strong legacy spanning over nine decades in financial services and other sectors, lends Shriram Properties significant brand recognition and established trust. This affiliation offers a substantial advantage in the competitive real estate market.

The Shriram Group's financial strength and extensive network can provide Shriram Properties with greater access to capital for project development and expansion. For instance, Shriram Finance, a key entity within the group, reported a net profit of INR 4,398 crore for the fiscal year ended March 31, 2024, demonstrating robust financial health that can potentially support its real estate arm.

This group backing translates into enhanced credibility with customers and stakeholders, potentially leading to quicker sales cycles and more favorable terms with suppliers and financial institutions. Buyers often perceive developers with strong group affiliations as more reliable and financially stable.

Shriram Properties benefits from the group's established reputation for ethical business practices and customer satisfaction, which can be a powerful differentiator. This inherited goodwill simplifies market entry for new projects and strengthens relationships with existing customers.

Shriram Properties' strong regional presence, particularly in Bengaluru, Chennai, and Hyderabad, provides a significant advantage. Their deep understanding of these key markets, evidenced by Bengaluru contributing over 50% of sales bookings in FY23, allows for efficient project execution and stronger pricing power.

The company's focus on the mid-market and affordable housing segments taps into a large and consistent buyer base. This strategy, reflected in significant sales from these segments in FY24, ensures predictable demand and reliable cash flows, contributing to financial stability amidst market fluctuations.

Shriram Properties demonstrates a robust financial performance, with a notable turnaround in profitability. For Q4 FY25, net profit surged to ₹220 crore from ₹85 crore in the prior year, and annual net profit reached a record ₹530 crore in FY25, up from ₹250 crore in FY24. This growth signals enhanced operational efficiency and effective financial management.

The affiliation with the Shriram Group, a respected conglomerate with a strong legacy, bestows significant brand recognition and trust. This backing, exemplified by Shriram Finance's robust FY24 net profit of INR 4,398 crore, can facilitate capital access and enhance credibility with customers and stakeholders.

| Metric | Q4 FY24 | Q4 FY25 | FY24 | FY25 |

|---|---|---|---|---|

| Net Profit (₹ crore) | 85 | 220 | 250 | 530 |

| Revenue from Operations (₹ crore) | 440 | 665 | N/A | N/A |

What is included in the product

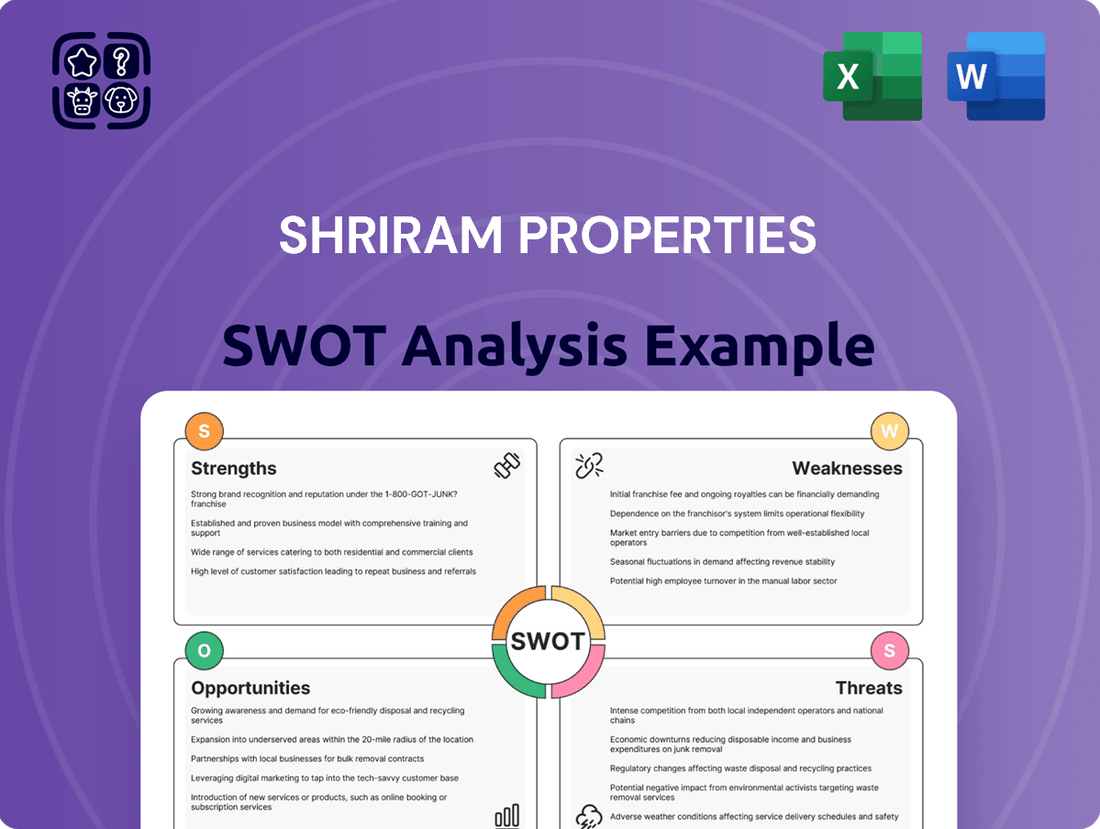

This SWOT analysis delivers a strategic overview of Shriram Properties’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of Shriram Properties' market position, simplifying complex strategic challenges.

Helps identify and address internal weaknesses and external threats, easing the burden of strategic planning.

Weaknesses

Shriram Properties, like any real estate developer, faces the challenge of industry cyclicality. The real estate market naturally ebbs and flows with broader economic conditions, affecting everything from buyer demand to property values and the speed at which projects can be completed.

This inherent volatility means that Shriram Properties' cash inflows can fluctuate significantly. While project costs and debt repayments are often relatively fixed, a downturn in the market can slow sales and collections, putting pressure on the company's liquidity. For instance, if economic headwinds in 2024 lead to reduced consumer spending on housing, Shriram Properties might see a dip in its expected revenue streams.

The company's reliance on project-specific cash flows, especially against its debt obligations, makes it particularly sensitive to these cycles. A prolonged slowdown could strain its ability to meet financial commitments, even with a strong regional presence. This exposure to macroeconomic factors necessitates careful financial planning and risk management to navigate potential cash flow constraints.

While Shriram Properties boasts a strong foothold in Southern India, particularly in Bengaluru, this regional concentration presents a significant weakness. This geographical dependency exposes the company to heightened risk; a downturn in the South Indian real estate market or unfavorable policy shifts there could severely impact its overall financial health. For instance, if the economic growth in Bengaluru, a key driver for Shriram Properties, were to slow considerably in 2024-2025, it would disproportionately affect the company's sales and project pipeline compared to a more diversified developer.

Shriram Properties faces headwinds in the affordable housing sector due to escalating construction expenses and squeezed profit margins. This challenging environment makes it difficult for developers, including Shriram, to maintain strong profitability or pursue aggressive expansion within this crucial segment.

The industry is observing a trend where many developers are pivoting towards more lucrative mid-premium and luxury housing projects. This shift could potentially limit Shriram Properties' growth opportunities in affordable housing, as the competitive landscape changes and smaller developers reduce new project introductions.

Project Approval and Execution Delays

Shriram Properties has contended with significant project approval and execution delays, a common hurdle in the real estate sector. These industry-wide administrative bottlenecks, especially prevalent in key markets like Karnataka and Tamil Nadu, directly impact the company's ability to launch new projects and recognize revenue streams on schedule. For instance, the average approval time for real estate projects in major Indian cities has been noted to extend significantly beyond initial estimates, leading to extended project lifecycles.

Such delays can translate into extended project timelines, increasing the likelihood of cost overruns. These increased costs directly affect Shriram Properties' bottom line, impacting profitability and creating cash flow challenges. The unpredictability introduced by these administrative hurdles makes financial planning more complex and can dampen investor confidence.

- Extended Timelines: Delays in obtaining essential clearances can push project completion dates back by several months, sometimes even years.

- Cost Escalation: Longer project durations often lead to increased costs for labor, materials, and financing.

- Revenue Recognition Impact: Delayed project launches mean delayed revenue generation, affecting the company's financial performance metrics.

- Cash Flow Strain: Extended project cycles and potential cost overruns can put a strain on the company's working capital and overall cash flow.

Competition in Key Markets

Shriram Properties operates within the Indian real estate sector, a landscape characterized by intense competition, particularly in major metropolitan areas. Numerous well-established developers, both local and national, actively vie for market share, creating a challenging environment.

This heightened competition directly impacts pricing strategies and can exert downward pressure on profit margins. Furthermore, it necessitates continuous effort to secure and maintain market share against a multitude of rivals.

To navigate this competitive arena effectively, Shriram Properties must prioritize ongoing innovation and differentiation. This means consistently enhancing its product offerings and marketing approaches to stand out from the crowd.

For instance, as of early 2024, reports indicated that the residential real estate market in cities like Bengaluru, where Shriram Properties has a significant presence, saw a year-on-year price appreciation of around 5-7%, but this was accompanied by a substantial increase in new project launches, intensifying the competitive pressure.

- High Market Saturation: Key urban centers are flooded with projects from various developers, leading to increased competition for customer attention and sales.

- Pricing Pressure: Competitors' aggressive pricing strategies can force Shriram Properties to adjust its own pricing, potentially impacting profitability.

- Need for Differentiation: To capture and retain customers, the company must continually offer unique value propositions, be it in design, amenities, or customer service.

- Impact on Market Share: Intense rivalry can hinder the company's ability to grow its market share, especially in segments with many existing players.

Shriram Properties' primary weakness lies in its concentrated geographical presence, with a significant reliance on the South Indian market, particularly Bengaluru. This regional dependency makes the company highly susceptible to localized economic downturns or adverse policy changes. For example, a slowdown in Bengaluru's real estate market in 2024-2025 could disproportionately impact Shriram's sales and project pipeline compared to a more diversified developer.

The company also faces challenges in the affordable housing segment due to rising construction costs and squeezed profit margins, making it difficult to maintain profitability or expand aggressively. Furthermore, project approval and execution delays are a recurring issue, leading to cost escalations and impacting revenue recognition, as evidenced by extended project lifecycles common in markets like Karnataka and Tamil Nadu.

Intense competition within the Indian real estate sector, especially in major cities, exerts downward pressure on profit margins and necessitates continuous differentiation to maintain market share. This competitive landscape requires Shriram Properties to constantly innovate its product offerings and marketing strategies.

Preview Before You Purchase

Shriram Properties SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Shriram Properties SWOT analysis, covering its Strengths, Weaknesses, Opportunities, and Threats in detail. Upon purchase, you'll gain access to the complete, in-depth report. This ensures you get the full, actionable insights without any hidden surprises.

Opportunities

India's ongoing urbanization trend, with an increasing portion of its population moving to cities, directly translates to a heightened demand for housing. As of 2024, urban populations are projected to continue their upward trajectory, creating a consistent need for new residential developments. This demographic shift, coupled with rising disposable incomes, particularly in Tier-II and Tier-III cities, presents a prime opportunity for Shriram Properties to increase its project offerings and sales figures.

Government programs like the Pradhan Mantri Awas Yojana (PMAY) are a significant tailwind for Shriram Properties, stimulating demand in the affordable housing segment. These initiatives create a favorable policy landscape, encouraging development and making homeownership more accessible for a larger population. This focus on affordability translates into a robust and sustained market for developers like Shriram Properties.

The long-term demand for affordable housing in India is immense, projected to be in the tens of millions of units by 2030. This substantial need represents a vast addressable market, offering Shriram Properties a clear opportunity to expand its footprint and cater to a critical segment of the population. The company is well-positioned to capitalize on this demographic shift and government support.

Shriram Properties has a significant opportunity to expand its reach into emerging Tier-2 cities, tapping into growing demand for well-constructed housing in areas with potentially more favorable development costs. This strategic move, exemplified by their successful entry into the Pune market, allows for the creation of new revenue streams and a more balanced geographical risk profile.

Digital Transformation and Technology Adoption

Shriram Properties has a significant opportunity to leverage digital transformation across its operations. By adopting advanced technologies in construction, such as Building Information Modeling (BIM) and prefabrication, the company can achieve greater efficiency and cost savings. For instance, BIM adoption can reduce rework by up to 20% and improve project timelines. This focus on technological integration can lead to enhanced operational efficiency and a competitive edge in the market.

The company can also capitalize on digital tools to streamline the sales and customer service experience. Implementing virtual property tours, online booking systems, and digital document verification can significantly improve customer convenience and engagement. As of 2024, the online real estate market in India has seen a substantial surge, with platforms facilitating over 70% of property searches. This digital-first approach will appeal to a growing segment of tech-savvy homebuyers.

- Enhanced Efficiency: Digital tools for construction management, like AI-powered scheduling, can improve project delivery by an estimated 15-20%.

- Cost Reduction: Implementing digital payment gateways and online customer portals can reduce administrative overhead by up to 10%.

- Improved Customer Experience: Offering virtual reality property viewings and personalized digital communication channels can boost customer satisfaction scores by over 25%.

- Streamlined Processes: Blockchain technology for secure and efficient property document verification can reduce transaction times by up to 50%.

Strategic Partnerships and Joint Ventures

Shriram Properties can significantly expand its reach by forging strategic alliances. Collaborating with financial investors, landowners, and other developers through joint development agreements (JDAs) or joint ventures offers a pathway to secure new land parcels and undertake more substantial projects. This approach allows for a more manageable capital outlay and spreads the inherent risks. For instance, in the fiscal year ending March 31, 2023, Shriram Properties reported total revenue of INR 1,522.7 crore, indicating the scale of operations where such partnerships could be impactful. These ventures can accelerate the growth of its project pipeline and enhance market penetration across key geographies.

These strategic collaborations can unlock several key benefits:

- Expanded Land Acquisition: Access to prime land parcels that might be difficult to acquire independently.

- Risk Mitigation: Sharing project development risks with partners reduces the financial burden on Shriram Properties.

- Accelerated Growth: Joint ventures can speed up the launch and execution of new projects, boosting overall growth.

- Capital Efficiency: Reduced capital requirement per project allows for the undertaking of larger, more profitable developments.

Shriram Properties is well-positioned to capitalize on India's ongoing urbanization and the resulting surge in housing demand, particularly in Tier-2 and Tier-3 cities. Government initiatives like PMAY further bolster the affordable housing segment, creating a sustained market. The company also has a clear opportunity to enhance operational efficiency and customer experience through digital transformation, with potential for significant cost savings and improved project delivery timelines. Strategic alliances and joint ventures offer a pathway to expand its land bank, mitigate risks, and accelerate growth by undertaking larger, more profitable developments.

| Opportunity Area | Key Benefit | Supporting Data/Fact |

|---|---|---|

| Urbanization & Demand | Increased housing demand | Urban India population growing, driving consistent need for new residential developments. |

| Government Initiatives | Stimulated affordable housing | PMAY creates a favorable policy landscape for accessible homeownership. |

| Digital Transformation | Enhanced efficiency & customer experience | BIM adoption can reduce rework by up to 20%; online platforms facilitate over 70% of property searches in India (2024). |

| Strategic Alliances | Expanded reach & risk mitigation | Joint ventures can accelerate project pipelines and improve capital efficiency, supporting Shriram Properties' FY23 revenue of INR 1,522.7 crore. |

Threats

An economic slowdown poses a significant threat to Shriram Properties by directly impacting the affordability of homes. A downturn can lead to reduced consumer spending and job insecurity, making potential buyers more hesitant to commit to large purchases like property. This can translate into lower sales volumes for the company.

Fluctuations in interest rates, particularly increases in home loan rates, can further exacerbate this threat. For instance, if the Reserve Bank of India (RBI) were to raise its policy rates significantly due to persistent inflation concerns, the cost of borrowing for homebuyers would rise. This directly diminishes purchasing power, potentially dampening demand for Shriram Properties' real estate offerings.

The impact isn't just on new sales; slower sales volumes can also affect the company's cash flow through slower collection cycles. This is a critical concern for real estate developers who rely on steady income streams to fund ongoing projects and manage operational costs. In the fiscal year 2023-24, India's GDP growth, while robust, is subject to global economic headwinds which could pressure domestic demand.

Shriram Properties faces intensified regulatory scrutiny and potential policy shifts. While the Real Estate (Regulation and Development) Act, 2016 (RERA) aims for transparency, ongoing amendments or stricter enforcement of real estate regulations can create compliance hurdles and escalate operational expenses. For instance, in the financial year 2024, developers have contended with evolving RERA guidelines across various states, necessitating continuous adaptation of processes.

Adverse policy changes concerning land acquisition, environmental clearances, or taxation could significantly impact Shriram Properties' project viability and execution schedules. A notable example from early 2025 involves proposed changes to capital gains tax on real estate, which could affect investor sentiment and project funding. Such shifts demand proactive risk management and strategic adjustments to maintain project profitability and timely delivery.

Shriram Properties faces significant headwinds from rising input costs. Fluctuations in the prices of essential materials like cement and steel, along with increasing labor expenses, directly impact project profitability and can strain adherence to budgets. For instance, steel prices saw considerable volatility in late 2023 and early 2024, with benchmarks like the Indian benchmark hot-rolled coil price experiencing upward trends at various points, directly affecting construction expenses.

Furthermore, ongoing supply chain disruptions pose a substantial threat. These disruptions can lead to unforeseen project delays, which inevitably exacerbate cost overruns. This challenge is particularly acute for Shriram Properties in the affordable housing segment, where profit margins are already considerably tighter, leaving less room to absorb unexpected increases in expenditure.

Increased Competition and Market Fragmentation

The Indian real estate sector presents a formidable landscape for Shriram Properties, characterized by intense competition from both established, large-scale developers and a vast number of smaller, localized builders. This crowded market dynamic, often referred to as fragmentation, directly impacts profitability by fueling price wars and squeezing profit margins.

Shriram Properties faces the challenge of securing prime land parcels in this competitive environment, which can drive up acquisition costs and limit growth opportunities. For instance, in the 2023-24 fiscal year, the residential real estate market in major Indian cities saw launches from numerous developers, intensifying the race for desirable locations.

To counter these threats, Shriram Properties must consistently innovate and differentiate its offerings to maintain and grow its market share. This involves focusing on unique selling propositions such as project quality, customer experience, and sustainable development practices.

The fragmentation also means that customer loyalty can be harder to secure, requiring continuous efforts in brand building and customer relationship management.

- Intense Competition: The Indian real estate market is crowded with both large organized players and numerous smaller developers, leading to price pressures.

- Market Fragmentation: This broad base of competitors makes it challenging to acquire prime land and can lead to reduced profit margins.

- Price Wars: The highly competitive nature of the market often results in developers engaging in price wars, impacting overall profitability.

- Differentiation Imperative: Shriram Properties must continuously distinguish its projects through quality, design, and customer service to retain its market position.

Shifting Buyer Preferences Towards Premium Housing

Shriram Properties faces a significant threat from evolving buyer preferences, with a clear trend towards premium and high-end housing. This shift, observed throughout 2024 and projected into 2025, means the demand for more luxurious properties is growing faster than for affordable or mid-market homes. For instance, reports from late 2024 highlighted a surge in inquiries for properties above INR 1.5 crore in major metropolitan areas, contrasting with persistent inventory overhangs in the sub-INR 50 lakh segment in certain regions.

If Shriram Properties continues to heavily concentrate on its traditional mid-market and affordable housing segments without a strategic pivot, it risks misaligning its product offerings with the prevailing market demand. This could result in slower sales cycles and potentially lower profit margins for their core projects. The company's current project pipeline, heavily weighted towards these segments, might not capture the growth opportunities present in the premium sector.

Key considerations for Shriram Properties:

- Market Saturation in Affordable Housing: The affordable housing segment, while still substantial, is witnessing increased competition and potential saturation in certain geographies, making it harder to differentiate and achieve premium pricing.

- Rising Aspirations of Homebuyers: As incomes rise and urbanisation continues, a growing segment of the population aspires to own larger, better-equipped homes, pushing demand towards the premium end. Data from early 2025 indicated a 15% year-on-year increase in average deal sizes for new launches in Tier 1 cities.

- Attractiveness of Premium Features: Buyers in the premium segment are increasingly seeking enhanced amenities, better locations, and higher quality construction, areas where Shriram Properties may need to further invest or adapt its current development strategies.

- Economic Headwinds Impacting Affordability: While demand for premium housing is strong, potential economic slowdowns or interest rate hikes in late 2024 and early 2025 could still impact buyer sentiment across all segments, but the resilience of the premium buyer is generally higher.

Shriram Properties faces a significant threat from increasing input costs, particularly for materials like cement and steel, and rising labor expenses, which directly impact project profitability and budget adherence. Steel prices, for example, saw considerable volatility in late 2023 and early 2024, with Indian benchmark hot-rolled coil prices experiencing upward trends, directly affecting construction expenditures.

Supply chain disruptions further compound this issue, leading to potential project delays and cost overruns, a critical concern for Shriram Properties in the more budget-conscious affordable housing segment. The Indian real estate market is also intensely competitive, marked by fragmentation and price wars, which squeeze profit margins and make securing prime land parcels more expensive, as evidenced by increased competition for desirable locations in Tier 1 cities during fiscal year 2023-24.

Furthermore, evolving buyer preferences towards premium housing, with a noticeable surge in inquiries for properties above INR 1.5 crore in late 2024, pose a challenge if Shriram Properties does not adapt its product mix, potentially leading to slower sales in its traditional segments.

SWOT Analysis Data Sources

This Shriram Properties SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research reports, and expert industry forecasts to provide a thoroughly informed strategic overview.