Shriram Properties Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shriram Properties Bundle

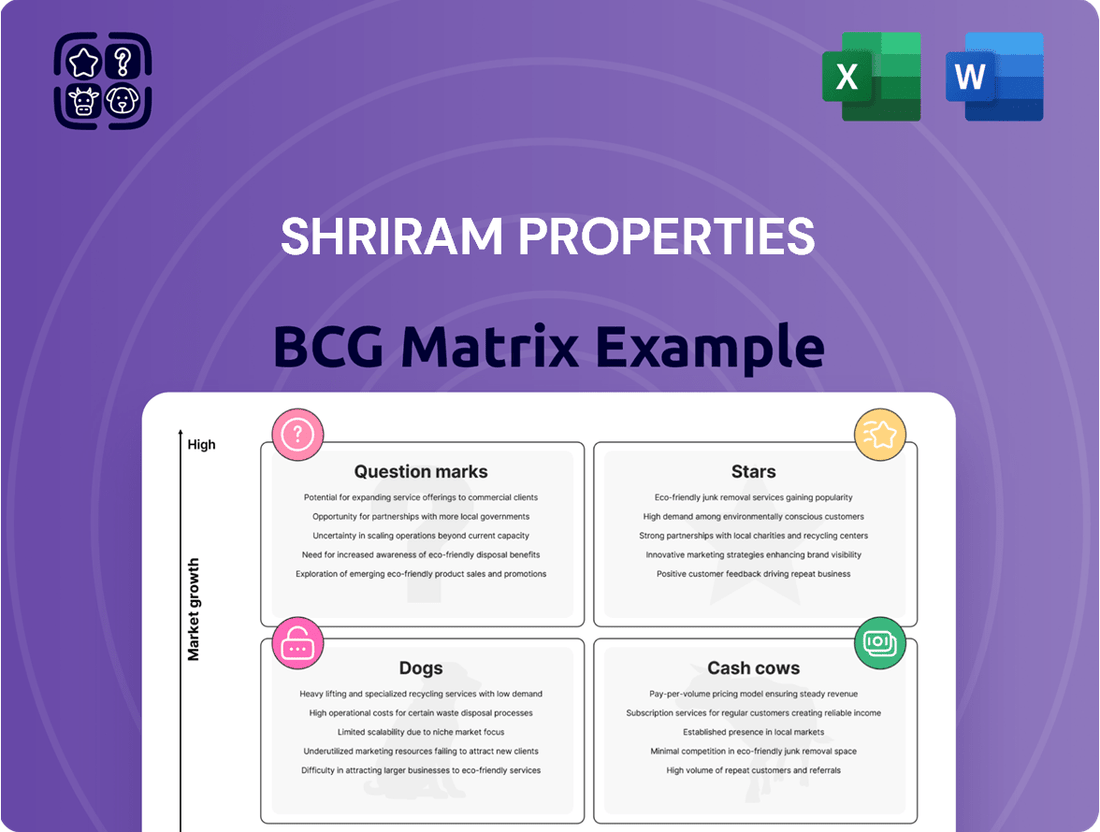

Curious about Shriram Properties' strategic positioning? Our BCG Matrix analysis helps you understand which projects are fueling growth and which might need a closer look. Are their residential projects Stars, generating significant returns, or Cash Cows, providing steady income? Perhaps some of their newer ventures are Question Marks, holding untapped potential but requiring investment.

This glimpse into Shriram Properties' portfolio is just the beginning. To truly grasp their market strength and identify future investment opportunities, you need the full BCG Matrix report. It provides a detailed breakdown of each business unit's placement, offering actionable insights for optimizing resource allocation and driving profitable growth.

Don't get left behind in the competitive real estate landscape. Purchase the complete BCG Matrix for Shriram Properties to gain a clear, data-driven roadmap for strategic decision-making. Understand their current market share and growth rate to make informed choices about where to invest your capital next.

Unlock the full strategic advantage by acquiring the complete Shriram Properties BCG Matrix. This comprehensive report delivers quadrant-by-quadrant insights and expert recommendations, empowering you to navigate the market with confidence and precision.

Stars

Shriram Properties is making strategic moves with new mid-premium launches in key micro-markets. A prime example is 'Codename: The One' in Electronic City, South Bengaluru. This project offers 340 premium apartments, showcasing a significant investment in a rapidly developing urban pocket.

The revenue potential for 'Codename: The One' is projected to exceed ₹350 crore. Its location in Electronic City, a major IT hub with excellent metro connectivity, highlights Shriram Properties' focus on areas with strong growth prospects and high market demand.

These mid-premium launches align with the increasing demand for high-value homes across India. By targeting such segments, Shriram Properties is positioning these projects to become leaders within their specific micro-markets, capitalizing on current market trends.

Shriram Properties' venture into Pune, specifically through a joint development agreement for a mixed-use project in Undri, positions it as a Star in the BCG matrix. This initiative targets an impressive revenue of ₹700-750 crore, highlighting its significant growth potential.

Pune represents the second-largest residential market in India, exhibiting robust growth that aligns with Shriram's established operational strengths. This strategic expansion into a new, high-growth geography is a key driver for its Star classification.

The company's asset-light model is crucial here, enabling efficient capital deployment to seize market share in this promising new territory. This approach allows for flexibility and scalability, essential for capitalizing on Pune's burgeoning real estate landscape.

Shriram Properties is seeing strong demand for its plotted developments, especially in key growth areas like Bengaluru and Chennai. This segment is becoming a significant contributor to their sales.

The market appetite for plotted land is robust, with notable price appreciation observed in locations such as Doddaballapur in Bengaluru. This trend indicates a healthy investor interest in land parcels.

These developments are attracting buyers due to increasing investor confidence and a clear demand for projects with transparent land titles. Shriram Properties is capitalizing on this by offering such projects, which are driving substantial sales volumes.

Successfully Executed Projects with Rapid Sales Velocity

Shriram Properties has a track record of successfully executing projects that exhibit rapid sales velocity. A prime example is Shriram Sapphire, codenamed 'Ultimate'. This project achieved remarkable sales figures, with 70% of its inventory sold during the opening weekend and a staggering 80% within its first month of launch. Such swift absorption rates are a clear indicator of strong market demand and the company's ability to deliver products that resonate with buyers.

These successful project launches contribute significantly to Shriram Properties' financial performance. The rapid sales velocity allows for quicker capital realization, which can then be reinvested into future developments, fostering a virtuous cycle of growth. This operational efficiency directly supports the company's ability to maintain positive sales momentum and enhance its overall revenue streams.

- Shriram Sapphire ('Ultimate') sales performance: 70% sold in opening weekend, 80% sold within one month.

- Market acceptance: High absorption rates indicate strong demand and competitive advantage.

- Financial impact: Rapid sales velocity leads to quicker capital realization and supports revenue growth.

- Strategic advantage: Demonstrates the company's capability in identifying and capitalizing on market opportunities.

Flagship Projects in Established Core Markets

Shriram Properties' ongoing flagship residential projects in established core markets such as Bengaluru and Chennai are considered Stars in the BCG matrix. These projects consistently achieve high sales volumes and values, reflecting the company's strong brand recognition and proven delivery capabilities in these key urban centers. The persistent demand within these markets, coupled with Shriram's strategic focus on the mid-market and mid-premium segments, underpins their sustained high market share and growth trajectory.

- Bengaluru & Chennai Focus: Shriram Properties' flagship projects are strategically concentrated in Bengaluru and Chennai, core markets where the company has a well-established presence.

- High Sales Performance: These projects consistently demonstrate robust sales volumes and high overall sales values, indicating strong customer reception and market penetration.

- Brand Equity & Delivery Track Record: The company leverages its strong brand reputation and a history of successful project completion in these cities, fostering buyer confidence.

- Market Segmentation: Shriram's ability to cater effectively to the mid-market and mid-premium housing segments in these areas is a key driver of their continued success and market leadership.

Shriram Properties' flagship residential projects in Bengaluru and Chennai are classified as Stars within the BCG matrix. These projects benefit from strong brand equity and a proven delivery track record in these core markets. Their consistent high sales volumes and values, particularly in the mid-market and mid-premium segments, underscore a sustained high market share and growth trajectory, making them key revenue drivers.

| Project Category | Key Markets | BCG Classification | Key Strengths | Recent Performance Indicators |

|---|---|---|---|---|

| Flagship Residential Projects | Bengaluru, Chennai | Stars | Strong brand recognition, proven delivery, focus on mid-market/mid-premium segments | Consistent high sales volumes and values, strong market penetration |

| New Mid-Premium Launches | Bengaluru (Electronic City), Pune (Undri) | Stars (Pune) / Potential Stars (Bengaluru) | Strategic location in growth corridors, high revenue potential (e.g., ₹350cr+ in Bengaluru, ₹700-750cr in Pune) | Targeting high-value homes, capitalizing on increasing demand |

| Plotted Developments | Bengaluru, Chennai | Stars | Robust market appetite, increasing investor confidence, transparent land titles | Notable price appreciation in areas like Doddaballapur, driving substantial sales volumes |

What is included in the product

Shriram Properties' BCG Matrix highlights which business units to invest in, hold, or divest based on market growth and share.

The Shriram Properties BCG Matrix offers a clear visual roadmap, alleviating the pain of uncertain strategic allocation by defining each business unit's position and potential.

Cash Cows

Shriram Properties' completed projects with zero inventory are clear cash cows. This signifies a highly efficient sales and delivery model, with nearly 75% of their ongoing projects already sold. The fact that there are no unsold completed units means these projects are generating consistent, predictable cash flows from past sales and recent handovers.

This 'zero inventory' status in completed projects is a testament to strong market demand and effective project execution. It highlights the company's ability to transition developments into fully realized assets that are immediately generating revenue. Such a position allows for optimized capital deployment, focusing resources on new growth opportunities rather than carrying costs for unsold finished goods.

Mature phases of large-scale residential developments, like those seen in Shriram Properties' projects in Bengaluru and Chennai, are prime examples of Cash Cows. These established communities boast high occupancy rates and well-developed infrastructure.

These phases require significantly reduced marketing spend due to their established reputation and existing resident base. The primary income streams come from ongoing maintenance fees, ancillary services such as retail outlets or clubhouses, and the final collection of payments from earlier sales. For instance, Shriram Properties reported strong rental income and fee collections from its completed phases, contributing significantly to overall profitability.

The long-term presence and high customer satisfaction in these mature developments ensure a predictable and consistent revenue flow. This stability allows Shriram Properties to allocate resources to other growth areas within its portfolio, benefiting from the reliable cash generation of these established residential communities.

While Shriram Properties is primarily known for its residential developments, any stabilized commercial or retail assets it holds can function as cash cows. For instance, the planned monetization of the Gateway Mall in FY25 exemplifies this. These types of properties, once established, typically generate consistent rental income and operational cash flows.

The advantage of these stabilized assets lies in their ability to provide a predictable revenue stream with minimal ongoing capital investment. This stability is crucial for supporting the company's overall financial health and can be reinvested into other growth areas.

Consistent Collection from Ongoing Projects

Shriram Properties demonstrates a strong Cash Cow position through its consistent revenue generation from ongoing projects. In fiscal year 2025, the company achieved record collections totaling ₹1,484 crore. This robust inflow of cash, even from projects still under development, signifies the reliable income streams these assets provide.

The ability to secure such high collection rates is a direct indicator of sustained customer demand and strong project execution. This financial performance highlights the maturity and stability of these ongoing ventures, positioning them as key contributors to the company's overall financial health.

- Record Collections: Shriram Properties reported ₹1,484 crore in collections for FY25, underscoring the cash-generating power of its ongoing projects.

- Operational Stability: These projects, even with ongoing development, consistently produce cash through customer payments and milestone achievements.

- Customer Confidence: High collection rates reflect robust sales and trust from buyers, ensuring steady liquidity.

- Financial Backbone: The consistent cash flow from these Cash Cow projects provides the financial foundation for further investment and operational needs.

Established Brand in Mid-Market and Affordable Segments

Shriram Properties' established brand reputation and strong presence in the mid-market and affordable housing segments, particularly in South India's Bengaluru and Chennai, serve as its foundational Cash Cow. This strong brand equity translates into lower customer acquisition costs, as the company consistently attracts a broad customer base without the heavy marketing investment required by newer competitors. The ongoing, resilient demand in these core segments ensures a steady stream of revenue and profitability for the company. In fiscal year 2024, Shriram Properties reported significant sales volumes in these categories, demonstrating the ongoing strength of its market position.

- Brand Strength: Shriram Properties commands significant brand recognition in the mid-market and affordable housing sectors.

- Market Presence: A strong foothold in key South Indian cities like Bengaluru and Chennai underpins its Cash Cow status.

- Customer Acquisition: Established brand equity leads to efficient customer acquisition with reduced marketing expenses.

- Revenue Stability: Consistent demand in its core segments provides a reliable and predictable revenue base.

Shriram Properties' completed projects with zero inventory are clear cash cows, generating consistent, predictable cash flows. This efficiency is mirrored in ongoing projects, with nearly 75% already sold, indicating strong market demand and execution. These mature phases of large residential developments, particularly in Bengaluru and Chennai, benefit from high occupancy and established infrastructure, requiring minimal marketing spend.

The company's strong brand reputation in mid-market and affordable housing, especially in South India, acts as a foundational cash cow. This brand equity leads to lower customer acquisition costs and ensures a steady revenue stream. In fiscal year 2024, Shriram Properties saw robust sales volumes in these core segments, reinforcing their market position.

Shriram Properties demonstrates significant cash-generating power through its ongoing projects, evidenced by record collections of ₹1,484 crore in fiscal year 2025. This consistent inflow of cash highlights the stability and reliability of these ventures, providing a strong financial foundation for the company.

| Project Status | Sales Status | Cash Flow Indicator | FY25 Collections | Key Factor |

| Completed Projects | Zero Inventory | High & Predictable | N/A (Reflects past sales) | Operational Efficiency |

| Ongoing Projects | ~75% Sold | Consistent & Growing | ₹1,484 Crore | Customer Demand & Execution |

| Mature Phases | High Occupancy | Stable Ancillary Income | Strong Rental/Fee Income | Brand Reputation & Location |

| Brand Equity (Core Segments) | High Market Share | Reduced Acquisition Cost | Strong Sales Volumes (FY24) | Market Penetration |

Preview = Final Product

Shriram Properties BCG Matrix

The Shriram Properties BCG Matrix preview you're examining is the identical, fully-formatted report you'll receive immediately after purchase. This means you're seeing the complete strategic analysis, ready for immediate application without any watermarks or demo content. You can confidently use this preview to assess the value and accuracy of the insights provided, knowing the purchased version will be exactly the same, ensuring no surprises and immediate utility for your business planning.

Dogs

Even with strong sales in prime areas, Shriram Properties may have legacy inventory in less appealing micro-markets. These could be older units in completed projects or slower-selling phases of ongoing developments. For instance, a project launched in 2022 in a secondary location might still have a significant portion of inventory remaining if sales have been sluggish.

These units are problematic because they tie up valuable capital. Holding costs, such as property taxes and maintenance, continue to accumulate without contributing to revenue. In 2023, Shriram Properties reported a substantial increase in their net profit, but this doesn't negate the potential drag from such legacy assets.

Selling these slow-moving units often necessitates deep discounts or attractive bundled offers, which can significantly eat into profit margins. If a unit that cost ₹50 lakh to build and market is eventually sold for ₹45 lakh after months of holding costs, it represents a direct loss. Such inventory represents a challenge for the company's capital efficiency.

Non-core or underperforming small commercial ventures, such as retail spaces within Shriram Properties' mixed-use projects, can be classified as Dogs. These segments might struggle to secure tenants or generate adequate footfall, especially if they don't align with the primary residential offerings. For instance, if a commercial space in a new Shriram development experiences consistently low occupancy rates, say below 60% in 2024, it represents a drain on the company's resources and deviates from its core strength in residential real estate.

Shriram Properties’ divestment or monetization of non-strategic land parcels, like the mall land in Chennai slated for sale by December 2024, signifies a strategic exit from assets not core to its future growth. This move, generating a one-time cash infusion, indicates these parcels were either underperforming or no longer aligned with the company's long-term vision. Such decisions are typical for a company analyzing its portfolio, prioritizing resources for more promising ventures.

Segments with Strategic De-emphasis, e.g., Certain Affordable Housing

Shriram Properties has strategically de-emphasized certain affordable housing projects, a move influenced by a perceived lack of robust government incentives. This positioning means these specific projects are now viewed with caution regarding future capital allocation.

While the company has a history of success in affordable housing, its current reduced focus translates to minimal new investments in this area. Existing projects in this segment that are underperforming are prime candidates for resource minimization efforts.

The affordable housing segment, with the exception of specific markets like Kolkata, is no longer considered a primary growth engine for Shriram Properties. For instance, in the fiscal year ending March 31, 2024, Shriram Properties reported a revenue of INR 1,327 crore, with a significant portion attributed to its residential projects, but the affordable segment's contribution has seen a strategic recalibration.

- Strategic Shift: Reduced focus on affordable housing due to limited government support.

- Investment Caution: Projects in this segment are less likely to receive new investment.

- Resource Minimization: Underperforming affordable housing projects may see reduced resource allocation.

- Market Exception: Kolkata remains a key market for affordable housing focus.

Projects Facing Prolonged Regulatory or Approval Delays

Projects encountering substantial and extended regulatory or approval hurdles, which can postpone revenue recognition and escalate expenses, might temporarily align with the characteristics of a 'Dog' within the Shriram Properties BCG Matrix. These delays not only tie up valuable capital but also divert crucial management focus, consequently affecting overall profitability and cash flow. For instance, Shriram Properties experienced this in 2023 with certain projects in Pune and Bengaluru, where market launches were significantly deferred due to these external constraints. Although these projects were not fundamentally flawed in their market appeal, the persistent external roadblocks led to underperformance.

These "Dog" projects, characterized by their slow growth and low market share due to regulatory stagnation, present a unique challenge. The extended timelines inherent in these approvals can lead to increased holding costs and potential market shifts that diminish the project's original viability. By mid-2024, several developers, including those in Shriram Properties' portfolio, were still navigating these complex approval processes, highlighting the ongoing impact on capital deployment and project timelines.

- Delayed Revenue Recognition: Projects stuck in regulatory limbo, such as those facing extended environmental clearances or zoning disputes, directly impact the company's ability to book sales and recognize revenue, as observed in several stalled projects in the South Indian real estate market throughout 2023 and early 2024.

- Increased Holding Costs: Prolonged delays mean ongoing expenses like property taxes, maintenance, and financing costs continue to accrue without any corresponding income, eroding potential profit margins for projects like those experiencing land acquisition issues.

- Capital Inefficiency: Significant capital remains tied up in these stalled projects, preventing its redeployment into more promising ventures. This inefficiency is a hallmark of 'Dog' assets, limiting the company's overall financial agility.

- Management Bandwidth Drain: The extensive time and resources required to navigate complex regulatory environments for these delayed projects divert critical management attention away from other, potentially more successful, business areas.

Shriram Properties' "Dogs" likely include legacy inventory in less desirable locations and underperforming commercial spaces within mixed-use developments. These assets tie up capital and incur holding costs without generating significant returns. For instance, the company's strategic sale of mall land in Chennai by December 2024 exemplifies an exit from non-core, potentially underperforming assets.

The reduced focus on certain affordable housing projects, outside of key markets like Kolkata, also signals a recalibration of resources away from segments with perceived lower growth potential or weaker government support. Projects facing prolonged regulatory delays, such as those experienced in Pune and Bengaluru in 2023, also fit the 'Dog' profile due to their inability to progress and generate revenue.

These 'Dog' assets, whether unsold inventory, struggling commercial spaces, or stalled projects, represent a drag on Shriram Properties' financial performance. The company's reported revenue of INR 1,327 crore for the fiscal year ending March 31, 2024, would be stronger if these 'Dog' segments were more productive or efficiently managed.

Shriram Properties categorizes certain projects and ventures as 'Dogs' within its portfolio, primarily those with low market share and slow growth prospects. These include older, slow-moving inventory, particularly in less sought-after micro-markets, and non-core commercial spaces like retail units within residential projects that exhibit consistently low occupancy, such as those with occupancy rates below 60% in 2024. Additionally, affordable housing projects facing a strategic de-emphasis due to limited government incentives, coupled with projects experiencing significant regulatory delays, such as those seen in 2023 in Pune and Bengaluru, also fall into this category.

| Category | Characteristics | Example (Shriram Properties) | Impact | 2023-2024 Data Point |

| Legacy Inventory | Slow-selling units in completed or ongoing projects in secondary locations. | Older units in a 2022 project in a secondary location with sluggish sales. | Ties up capital, incurs holding costs, requires discounts for sale. | Increased holding costs on unsold inventory. |

| Underperforming Commercial Ventures | Retail or office spaces within mixed-use developments with low tenant interest or footfall. | Retail spaces in new developments with consistently low occupancy rates. | Drain on resources, deviates from core residential strength. | Commercial spaces with occupancy below 60% in 2024. |

| De-emphasized Affordable Housing | Projects in segments with reduced strategic focus due to limited government incentives. | Affordable housing projects outside of key markets like Kolkata. | Minimal new investment, potential resource minimization for underperforming projects. | Strategic recalibration of affordable housing contribution to revenue. |

| Regulatory-Stalled Projects | Projects facing prolonged delays in approvals, impacting revenue recognition and increasing expenses. | Projects in Pune and Bengaluru experiencing significant launch deferrals due to external roadblocks in 2023. | Delayed revenue, increased holding costs, capital inefficiency, management bandwidth drain. | Extended approval timelines impacting capital deployment throughout 2023-2024. |

Question Marks

Shriram Properties' entry into Pune with a significant mixed-use development positions it as a Question Mark in their BCG Matrix. While the Pune market offers substantial revenue potential, Shriram's current market share and brand awareness are still developing in this region, especially when contrasted with its stronger foothold in South India.

The company's investment in establishing a presence in Pune is substantial, aiming to build brand equity and operational capacity. This initial phase requires significant capital outlay to gain traction and compete effectively against established developers.

The success of this Pune venture hinges on its ability to capture market share and increase brand recognition. If successful, this investment could transition the Pune project from a Question Mark to a Star in Shriram Properties' portfolio.

Early-stage premium/luxury ventures for Shriram Properties would likely be categorized as Question Marks in the BCG Matrix. This is because these segments represent new growth areas where the company may have limited established expertise or market presence compared to its core mid-market offerings.

While India's luxury housing market is indeed seeing robust expansion, with reports indicating a growth rate of over 20% year-on-year in major metros by late 2024, Shriram's capacity to secure a substantial and consistent market share in this highly competitive niche is still developing. For instance, in 2024, the luxury segment accounted for approximately 10-15% of new launches in key cities, a segment Shriram is exploring.

Shriram Properties' recent acquisition of a 5-acre land parcel in Yelahanka, North Bengaluru, for a row house and villa project, exemplifies a potential Stars or Question Marks in the BCG matrix. This strategic move, targeting a Gross Development Value (GDV) of ₹200-250 crore, signals ambitious growth aspirations.

However, these newly acquired parcels are in the nascent stages of planning and are slated for launch in the second half of FY26. This early-stage positioning means they are capital-intensive, requiring significant upfront investment for land acquisition and regulatory approvals before any revenue generation is realized.

The success and eventual market performance of these developments remain speculative at this juncture. While the revenue potential is substantial, the lack of established market traction and the lengthy development cycle place them in a category that demands careful monitoring and strategic resource allocation.

Pilot Projects Incorporating Advanced Technologies or Niche Concepts

Pilot projects by Shriram Properties, exploring advanced smart home features, integrated townships, or unique lifestyle concepts, would likely be categorized as Question Marks in a BCG matrix. These initiatives target burgeoning market segments, reflecting a strategic move towards innovation and differentiation in the real estate sector.

These ventures, while promising growth, necessitate significant capital infusion for research and development, alongside robust marketing efforts to cultivate buyer interest and secure a meaningful market presence. The success hinges critically on achieving strong market acceptance and effectively distinguishing these offerings from competitors.

- Smart Home Features: Projects incorporating AI-powered home management systems, IoT integration, and enhanced security could appeal to a tech-savvy demographic.

- Integrated Townships: Developments offering a holistic living experience with residential, commercial, and recreational spaces, fostering community and convenience.

- Niche Lifestyle Concepts: Initiatives catering to specific lifestyle preferences, such as wellness-focused communities or co-living spaces, tapping into specialized demand.

- Investment & Adoption: These pilots require substantial upfront investment, with market adoption dependent on perceived value and effective communication of benefits.

Unlaunched Projects in Pipeline Awaiting Approvals and Market Timing

Shriram Properties' pipeline includes numerous unlaunched projects, many of which are in the waiting phase for crucial approvals or strategic market entry timing. These represent potential future cash cows but are currently in a question mark phase, consuming capital and resources without immediate returns.

As of late 2024, Shriram Properties has a substantial development pipeline totaling approximately 42 million sq ft of saleable area across 42 projects. A significant portion of this inventory is categorized as unlaunched, particularly those awaiting regulatory clearances or dependent on opportune market conditions for a successful debut.

- Unlaunched Projects: A considerable segment of the 42 million sq ft pipeline, representing future growth potential, is currently in the pre-launch or approval stage.

- Resource Consumption: These projects are actively consuming company resources for planning, design, and obtaining necessary approvals, without generating revenue.

- Market Timing Dependency: The ultimate success and cash generation from these projects are heavily reliant on entering the market when conditions are favorable and demand is robust.

- Potential Cash Cows: Once launched successfully, these projects have the potential to become significant contributors to the company's revenue and profitability, moving them out of the question mark category.

Shriram Properties' ventures into new geographies like Pune, or into nascent segments like premium/luxury housing, are prime examples of Question Marks. These initiatives, while holding significant future potential, require substantial investment and are in the early stages of establishing market presence and brand recognition. Their success is not yet guaranteed, demanding careful strategic execution and resource allocation to potentially transition them into Stars.

For instance, Shriram Properties' foray into Pune, a market where its presence is still developing compared to its strongholds in South India, represents a classic Question Mark. The company is investing heavily to build brand equity and operational capacity in this new territory. By late 2024, the luxury housing market in India, a segment Shriram is exploring, was experiencing growth exceeding 20% year-on-year in major metros, highlighting the opportunity but also the competitive landscape for a new entrant.

The company's pipeline of unlaunched projects, many awaiting approvals or opportune market entry, also fall into the Question Mark category. As of late 2024, Shriram Properties had a substantial development pipeline of approximately 42 million sq ft across 42 projects, with a significant portion still unlaunched. These projects consume resources without immediate returns, their future performance as cash cows dependent on successful launches and market acceptance.

Pilot projects focusing on innovative concepts like smart home features or integrated townships are also classified as Question Marks. These require considerable R&D and marketing investment, with market adoption hinging on demonstrating clear value propositions. For example, projects incorporating AI-powered home management systems are targeting a tech-savvy demographic, a segment requiring tailored strategies for effective market penetration.

BCG Matrix Data Sources

Shriram Properties' BCG Matrix leverages comprehensive data from internal financial statements, recent market research reports, and publicly available competitor performance metrics to ensure accurate strategic positioning.