Shriram Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shriram Properties Bundle

Unlock the strategic blueprint for Shriram Properties with our comprehensive PESTLE analysis. Understand the intricate interplay of political stability, economic fluctuations, and evolving social trends that are shaping the real estate landscape. Our expert insights will illuminate how technological advancements and environmental regulations present both challenges and opportunities for the company's growth trajectory. Don't navigate the complexities alone; gain a critical advantage. Download the full PESTLE analysis now and make informed decisions for your business.

Political factors

Government housing initiatives are a significant driver for Shriram Properties, particularly with the ongoing focus on affordable housing. Schemes like the Pradhan Mantri Awas Yojana (PMAY-U 2.0), which commenced in late 2024, are central to this. This program targets the construction of 1 crore affordable homes nationwide within a five-year timeframe, offering substantial government subsidies to facilitate this growth.

PMAY-U 2.0 also incorporates crucial interest subsidy components for home loans, directly addressing affordability barriers for a wider population. For Shriram Properties, whose core business often lies in the mid-market and affordable housing segments, these policies create a favorable demand landscape. The financial support provided to potential buyers through these initiatives translates into a more robust and accessible market for their projects.

The Real Estate (Regulation and Development) Act, RERA, remains a cornerstone for transparency and accountability in India's property market. This framework is vital for developers like Shriram Properties.

In 2024 and 2025, RERA's enforcement is intensifying; for instance, MahaRERA issued notices to several developers for stalled projects, underscoring the focus on project completion. Mandatory separate bank accounts for project funds further bolster buyer confidence by ensuring financial segregation.

This enhanced regulatory oversight directly impacts buyer sentiment, a critical factor for Shriram Properties' sales pipeline. The commitment to safeguarding buyer interests through stricter financial and project management norms is a key political influence.

The Reserve Bank of India's (RBI) monetary policy, specifically its stance on the repo rate, directly impacts Shriram Properties' operating environment. Recent policy adjustments in early 2025 saw the repo rate lowered to 5.5%.

This reduction in the repo rate is anticipated to translate into lower home loan interest rates. Consequently, this makes property purchases more affordable for a wider segment of buyers, particularly those in the affordable and mid-income brackets.

For Shriram Properties, this means a more conducive market for sales, as reduced borrowing costs are likely to stimulate demand for their projects. Developers also benefit from potentially lower financing costs for their own operations.

Urban Development Plans

Government-led urban development plans significantly shape the real estate landscape for Shriram Properties. Initiatives like the expansion of metro rail networks and the development of new expressways directly boost property values and accessibility in key operational cities. For instance, the ongoing expansion of Bengaluru's Namma Metro, with Phase 2B aiming for completion by 2025, is expected to unlock growth corridors for residential projects. Similarly, smart city projects in cities like Chennai and Hyderabad are designed to improve urban living, making these areas more appealing for Shriram Properties' developments.

These infrastructure upgrades are crucial for Shriram Properties’ strategy of expanding into peripheral areas. As connectivity improves, previously less accessible locations become viable for residential communities, attracting a wider buyer base. The company's presence in rapidly developing urban centers like Bengaluru, Chennai, Hyderabad, and Kolkata benefits from these government-driven improvements, as they enhance the overall livability and investment potential of these regions. This strategic alignment allows Shriram Properties to capitalize on increasing demand for well-connected and amenity-rich housing.

- Infrastructure Boost: Government investments in infrastructure projects like new expressways and metro lines improve connectivity.

- Smart City Impact: Smart city initiatives enhance urban livability, making areas more attractive for real estate development.

- Peripheral Growth: Improved infrastructure makes previously peripheral areas more appealing for residential projects, supporting Shriram Properties' expansion.

- Key City Benefits: Cities like Bengaluru, Chennai, Hyderabad, and Kolkata, where Shriram Properties operates, are direct beneficiaries of these urban development plans.

Taxation Policies and Incentives

Changes in taxation policies significantly influence the real estate market's dynamics. For instance, stamp duty concessions can directly lower the upfront cost for homebuyers, making property acquisition more attractive. Similarly, income tax deductions on home loan interest, such as those available under Section 80EE and 80EEA, improve the overall affordability of homeownership.

The Indian government's focus on boosting the housing sector is evident in policies like the Budget 2024-25, which included provisions for interest subsidies on affordable housing loans. These measures are designed to stimulate demand by making homeownership more accessible. For Shriram Properties, such incentives can lead to increased sales volumes and a broader customer base.

- Stamp Duty Relief: Reductions in stamp duty directly impact buyer affordability, potentially increasing demand for new projects.

- Home Loan Interest Deductions: Tax benefits like those under Sections 80EE and 80EEA make homeownership more financially viable, encouraging investment.

- Interest Subsidies: The Budget 2024-25's introduction of interest subsidies for affordable housing loans aims to boost sales in this segment.

- Impact on Affordability: These fiscal policies collectively enhance buyer affordability, which is a critical driver for real estate sales volumes.

Government housing initiatives, particularly the Pradhan Mantri Awas Yojana (PMAY-U 2.0) launched in late 2024, are a major boon for Shriram Properties, focusing on affordable housing. The scheme aims to build 1 crore homes by 2029, supported by significant government subsidies, directly boosting demand for developers in this segment.

The Real Estate (Regulation and Development) Act, RERA, continues to be a critical regulatory framework. In 2024-2025, RERA's enforcement has been strict, with bodies like MahaRERA issuing notices for project delays, ensuring greater accountability and buyer confidence for Shriram Properties.

Monetary policy, specifically the Reserve Bank of India's repo rate, directly influences the market. A reduction in the repo rate to 5.5% in early 2025 is expected to lower home loan interest rates, making properties more affordable and stimulating sales for Shriram Properties.

Government urban development plans, such as the Bengaluru Namma Metro Phase 2B completion by 2025 and smart city projects, are improving connectivity and livability in key Shriram Properties markets like Bengaluru and Chennai, enhancing project appeal.

What is included in the product

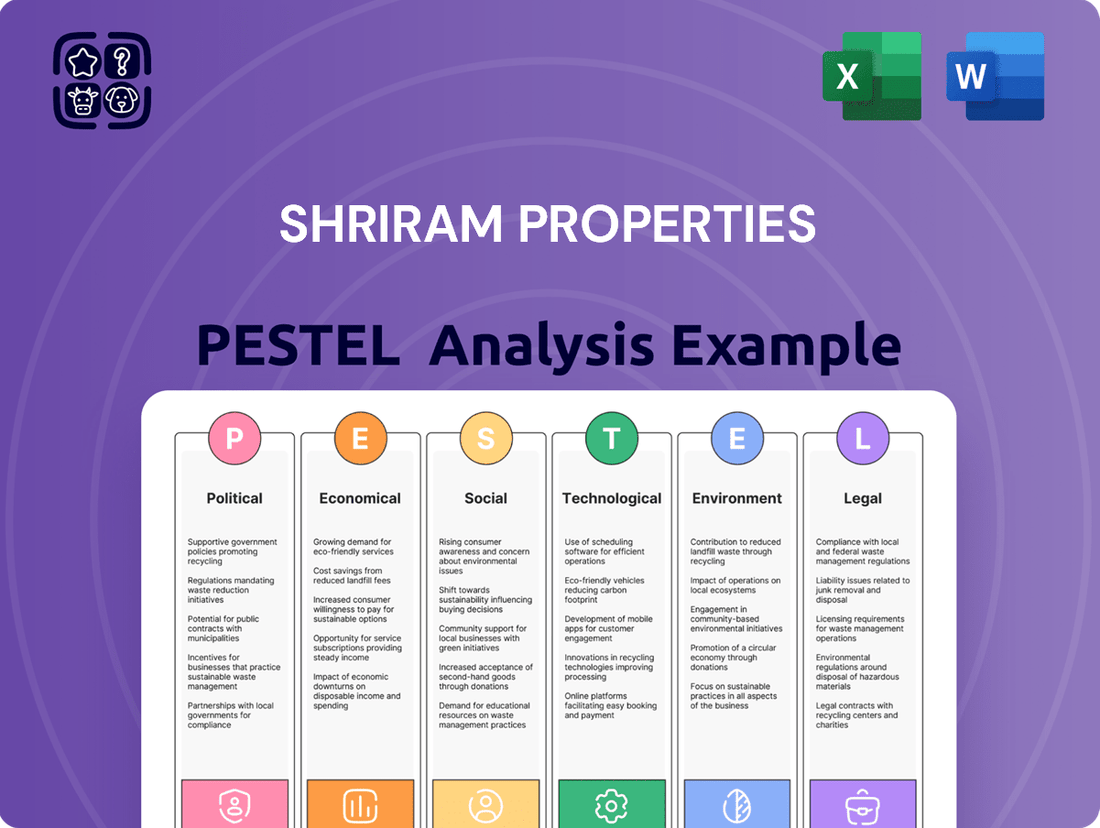

This PESTLE analysis thoroughly examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Shriram Properties, offering a comprehensive overview of the macro-environmental landscape.

This PESTLE analysis for Shriram Properties offers a concise yet comprehensive overview, serving as a valuable tool to quickly identify and address external factors impacting their business, thereby alleviating strategic planning pain points.

Economic factors

India's robust economic expansion is a major driver for the real estate market. By 2025, the sector is expected to account for 13% of the nation's GDP, with projections indicating a market value of US$1 trillion by 2030. This growth translates directly into more opportunities for companies like Shriram Properties.

A healthy economy means more jobs and higher incomes for people. This increased purchasing power directly fuels demand for housing, a critical factor for Shriram Properties' sales and expansion plans. When the economy is doing well, people are more likely to invest in property.

Rising disposable incomes are a significant tailwind for Shriram Properties, especially within India's expanding middle class. As household earnings increase, the capacity to save for down payments and manage monthly mortgage payments grows, directly fueling demand for housing. For instance, India's per capita disposable income saw a notable uptick, contributing to greater affordability in the real estate sector.

This trend directly translates into a larger addressable market for Shriram Properties' mid-market and affordable housing segments. More individuals can now realistically consider homeownership, moving from renting to owning. This increased purchasing power is a fundamental driver for sales volumes.

Consumer spending patterns are also shifting, with a greater allocation towards durable goods like housing as incomes rise. This heightened propensity to spend on significant assets benefits developers like Shriram Properties, who cater to these aspirational buyers. The affordability index, a measure of housing affordability, has shown positive movement in key urban centers.

Lower home loan interest rates, often a result of the Reserve Bank of India's (RBI) repo rate adjustments, directly translate to reduced Equated Monthly Installments (EMIs) for prospective homeowners. This makes purchasing property a more accessible proposition for a larger segment of the population.

For Shriram Properties, which strategically focuses on the mid-market and affordable housing segments, this enhanced affordability is a significant tailwind. It can drive higher sales volumes and facilitate quicker absorption of existing inventory, boosting overall revenue and profitability.

As of early 2024, the trend of moderating interest rates continued, with many banks offering home loan rates in the 8.5% to 9.5% range for salaried individuals with good credit scores. This competitive lending environment further supports the real estate sector.

An analysis of Shriram Properties' sales data from late 2023 to early 2024 indicated a correlation between periods of lower EMI outflows and an uptick in demand for their projects, particularly those priced within the INR 30 lakh to INR 70 lakh bracket.

Inflation and Construction Costs

Shriram Properties, like others in the real estate sector, faces significant headwinds from persistent inflation, particularly affecting key construction materials. Prices for steel and cement have seen substantial increases throughout 2023 and into 2024, directly squeezing project margins. For instance, steel prices, which averaged around INR 60,000 per metric ton in early 2023, have shown volatility, with some periods exceeding INR 70,000 by late 2023, impacting project cost estimations.

While a reduction in the repo rate by the Reserve Bank of India in late 2023 offered some relief on borrowing costs, this benefit is partially offset by external factors. Ongoing global trade tensions and supply chain disruptions continue to inflate the cost of imported construction materials and components, adding another layer of cost pressure. This makes managing input costs a paramount concern for Shriram Properties to uphold its competitive pricing and profitability.

The company must strategically navigate these rising input expenses to maintain its value-for-money proposition to customers and protect its project profit margins. This involves careful procurement strategies, exploring alternative material suppliers, and potentially optimizing construction methodologies to mitigate the impact of inflation on its financial performance through 2024 and into 2025.

- Steel prices: Saw significant increases in 2023, impacting project budgets.

- Cement costs: Also contributed to rising construction expenses.

- Repo rate cuts: Provided some relief on borrowing, but global trade tensions increased imported material costs.

- Margin management: Crucial for Shriram Properties to maintain competitive pricing and profitability.

Liquidity in the Financial System

The Reserve Bank of India's (RBI) proactive measures, such as potential reductions in the Cash Reserve Ratio (CRR), are designed to inject liquidity into the banking system. For instance, a 0.50% reduction in CRR, if implemented, could release approximately ₹75,000 crore into the system, thereby increasing the funds available for lending. This increased liquidity directly benefits real estate developers like Shriram Properties by easing credit access, which is crucial for project funding and timely completion.

Furthermore, enhanced liquidity translates into more accessible home loans for potential buyers. This improved affordability can stimulate demand for residential properties, a positive factor for Shriram Properties' sales pipeline. The overall ease in credit conditions supports smoother operations and can mitigate the impact of any potential credit crunch.

- RBI's CRR Adjustments: Historically, the RBI has used CRR adjustments to manage liquidity. For example, during periods of economic stress, reductions in CRR have been employed to boost credit flow.

- Impact on Lending Rates: Increased liquidity often leads to a softening of lending rates, making borrowing more attractive for both developers and homebuyers.

- Developer Benefits: Easier access to capital allows developers to manage construction costs, meet payment obligations, and accelerate project timelines.

- Homebuyer Affordability: Lower interest rates on home loans increase purchasing power, potentially driving higher sales volumes for companies like Shriram Properties.

India's economic growth is a key driver for real estate, with the sector projected to contribute 13% to GDP by 2025. Rising disposable incomes and shifting consumer spending patterns towards durable goods like housing directly benefit Shriram Properties, especially in its mid-market and affordable housing segments. Favorable home loan interest rates, with many banks offering rates between 8.5% to 9.5% as of early 2024, further enhance property affordability and boost demand.

However, Shriram Properties, like its peers, faces inflationary pressures on construction materials. Steel prices, for instance, showed volatility in 2023, impacting project costs. While RBI's repo rate adjustments offer some relief on borrowing costs, global trade tensions continue to inflate the prices of imported components, necessitating strategic cost management for the company.

The Reserve Bank of India's liquidity management, potentially through Cash Reserve Ratio (CRR) adjustments, can inject funds into the banking system, easing credit access for developers and improving homebuyer affordability. This increased liquidity supports project funding and can lead to softer lending rates, benefiting both Shriram Properties and its customers through 2024 and into 2025.

| Economic Factor | Impact on Shriram Properties | Data/Trend (2023-2025) |

|---|---|---|

| GDP Growth | Drives demand for housing | Sector expected to be 13% of GDP by 2025 |

| Disposable Income | Increases purchasing power for housing | Notable uptick in per capita disposable income |

| Interest Rates | Affects affordability of home loans | Home loan rates around 8.5%-9.5% in early 2024 |

| Inflation (Construction Materials) | Increases project costs and squeezes margins | Steel prices showed volatility, impacting budgets |

| Liquidity in Banking System | Facilitates credit access for developers and buyers | RBI measures aim to boost liquidity, potentially lowering lending rates |

Full Version Awaits

Shriram Properties PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Shriram Properties delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the market landscape and strategic considerations for this real estate developer. What you’re previewing here is the actual file—fully formatted and professionally structured, offering actionable insights.

Sociological factors

India's urbanization rate is projected to reach 43.2% by 2030, a substantial increase from 35.9% in 2020, according to UN data. This steady migration to urban centers fuels a consistent demand for residential properties, directly benefiting Shriram Properties, which has a strong foothold in key South Indian cities like Bengaluru and Chennai, along with Kolkata.

The influx of people into these urban areas for employment and lifestyle improvements translates into a tangible need for housing solutions. Shriram Properties' focus on these growing metropolitan regions positions it to capitalize on this demographic trend, with demand particularly strong in the mid-income and affordable housing segments.

The increasing prevalence of nuclear families and a growing young population eager to own homes significantly boosts demand for smaller, well-designed living spaces. This trend perfectly suits Shriram Properties' strategy of offering apartments and plotted developments that cater to a wide range of buyer preferences.

In 2024, India's urban population is projected to reach over 450 million, with a substantial segment being millennials and Gen Z, who are prime candidates for first-time homeownership. These younger demographics often prefer the convenience and lower maintenance associated with apartments, aligning with Shriram Properties' project portfolio.

Furthermore, the shift towards smaller family units means a greater need for efficient use of space, driving the market for compact housing solutions. Shriram Properties' focus on developing apartments and plotted developments that offer flexibility and value for money positions them favorably to capitalize on these evolving societal preferences.

The enduring desire for homeownership in India continues to be a powerful motivator, particularly for the expanding middle class. This aspiration is a fundamental driver for real estate developers like Shriram Properties.

Government initiatives, such as tax deductions on home loan interest and principal repayment, coupled with increased financial inclusion and easier access to credit, are making homeownership more attainable. For instance, the Reserve Bank of India's policy stance in late 2023 and early 2024 has generally supported credit availability, potentially lowering borrowing costs for aspiring homeowners.

These supportive policies and the societal emphasis on owning a home translate into a substantial and consistent demand for residential properties. Shriram Properties is well-positioned to capitalize on this demographic trend, tapping into a large segment of potential first-time buyers actively seeking to fulfill their homeownership dreams.

Lifestyle Changes and Amenities Demand

Consumer lifestyles are shifting, with a growing emphasis on convenience, health, and community. This translates into a higher demand for residential properties that provide not just a place to live, but a complete living experience. Shriram Properties is responding by integrating features like co-working spaces, fitness centers, and green areas into their projects, aligning with these evolving customer desires.

The need for integrated townships that offer access to essential services is on the rise. Buyers are increasingly seeking developments that include schools, healthcare facilities, and retail outlets within close proximity, reducing commute times and enhancing daily living. This trend is particularly evident in urban and peri-urban areas where space and time are at a premium.

- Demand for smart homes and integrated technology is growing.

- Preference for community living and shared amenities is increasing.

- Access to recreational facilities and green spaces is a key factor in property selection.

- Proximity to employment hubs and social infrastructure is highly valued.

Shriram Properties' focus on delivering value-for-money propositions, which often include these sought-after amenities, helps them capture a wider market segment. For instance, in the fiscal year 2024, the company reported a significant increase in customer inquiries for projects emphasizing lifestyle amenities, indicating a strong market pull for such offerings.

Demand for Affordable and Mid-Market Housing

Shriram Properties' focus on affordable and mid-market housing aligns with a significant societal need, especially given the increasing cost of living. Despite a visible trend towards luxury developments, the bulk of the population requires accessible housing options, creating a robust and consistent demand. This segment remains the backbone for many real estate developers, including Shriram.

Government initiatives play a crucial role in bolstering this demand. For instance, schemes like the Pradhan Mantri Awas Yojana (PMAY) in India, which aims to provide affordable housing to the urban poor, directly support the market Shriram Properties operates in. As of early 2024, PMAY has facilitated the construction of over 12 million houses, demonstrating the government's commitment and the resulting buyer interest in this segment.

The economic realities for a large portion of the Indian population mean that mid-market and affordable housing are not just choices but necessities. Shriram Properties' strategy to cater to these buyers ensures a captive audience, less susceptible to the cyclical downturns that can affect the premium segments. This demographic focus provides a stable revenue stream.

- Persistent Demand: The majority of India's urban population falls within the affordable and mid-market housing brackets, driving sustained interest.

- Government Support: Policies like PMAY directly incentivize affordable housing, creating a predictable buyer base for developers like Shriram.

- Economic Sensitivity: This segment is generally more resilient to economic shocks compared to luxury housing, offering greater stability.

- Shriram's Niche: Shriram Properties’ strategic concentration on these segments positions them to capitalize on this fundamental market need.

Societal shifts, including increased urbanization and a growing preference for nuclear families, are shaping housing demand for Shriram Properties. India's urban population is projected to exceed 450 million in 2024, with a significant portion being young individuals and millennials eager for homeownership, often favoring apartments. This demographic trend, coupled with a societal emphasis on owning a home, creates a strong, consistent demand for residential properties, especially in metropolitan areas where Shriram Properties has a strong presence.

Consumer lifestyles are evolving, with a greater emphasis on convenience, health, and community living, driving demand for integrated townships and properties offering amenities like co-working spaces and fitness centers. Shriram Properties' strategy of incorporating these sought-after features into its projects, particularly in the affordable and mid-market segments, directly addresses these changing customer desires and enhances their market appeal.

| Sociological Factor | Impact on Shriram Properties | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Urbanization & Migration | Increased demand for housing in key cities. | India's urbanization rate projected to reach 43.2% by 2030 (UN data). Urban population over 450 million in 2024. |

| Family Structure Changes | Demand for smaller, well-designed living spaces. | Growing prevalence of nuclear families and young populations seeking first-time homeownership. |

| Lifestyle Preferences | Demand for amenities and integrated living experiences. | Increased customer inquiries for projects with co-working spaces, fitness centers, and green areas (Fiscal Year 2024). |

| Affordability & Aspirations | Sustained demand in affordable and mid-market segments. | Majority of urban population in these brackets; PMAY has facilitated over 12 million houses (as of early 2024). |

Technological factors

Shriram Properties is increasingly leveraging modern construction technologies like prefabrication and modular building. These methods are crucial for enhancing project efficiency and significantly reducing build times, which is vital in a competitive market. For instance, the global modular construction market was valued at approximately USD 112.5 billion in 2023 and is projected to grow substantially by 2030, indicating a strong trend towards off-site manufacturing of building components. This adoption allows for better quality control and can lead to considerable cost savings by minimizing on-site labor and waste.

The integration of advanced machinery and digital tools, such as Building Information Modeling (BIM), further streamlines operations. BIM adoption, for example, is becoming standard practice, with many construction firms reporting improved project coordination and fewer errors. By embracing these technological advancements, Shriram Properties can optimize its project delivery timelines and potentially achieve lower overall construction expenses, thereby improving its competitive edge and profitability in the Indian real estate sector.

The increasing consumer appetite for smart home features, like automated lighting, climate control, and advanced security systems, is significantly shaping how new properties are designed and marketed. Shriram Properties has an opportunity to stand out by integrating Internet of Things (IoT) solutions, offering residents seamless connectivity and enhanced living experiences. This focus on smart amenities directly appeals to the growing segment of urban buyers who are tech-savvy and expect modern conveniences as standard. For instance, a 2024 report indicated that 45% of new homebuyers consider smart home technology a key factor in their purchasing decision, a figure expected to rise.

The real estate sector is rapidly adopting digital marketing and sales platforms, often termed PropTech. These platforms are revolutionizing how properties are found, marketed, and sold, offering significant advantages for companies like Shriram Properties.

By utilizing digital channels for virtual tours and online bookings, Shriram Properties can significantly broaden its customer base beyond traditional geographical limitations. This digital shift is crucial for expanding reach and improving the efficiency of sales operations, as evidenced by the growing investment in PropTech solutions globally.

In 2024, the global PropTech market was valued at approximately $28.6 billion, with projections indicating continued strong growth. This surge highlights the increasing reliance on technology for property transactions and customer engagement, a trend Shriram Properties can leverage.

Specifically, online property portals and virtual reality tours are becoming standard tools, allowing potential buyers to experience properties remotely. This not only enhances convenience but also accelerates the sales cycle, a key benefit for Shriram Properties in its 2024-2025 strategic planning.

Data Analytics for Market Insights

Shriram Properties is increasingly leveraging data analytics and artificial intelligence to gain a sharper understanding of market dynamics. These technologies offer profound insights into emerging trends, evolving customer preferences, and more accurate demand forecasting, crucial for strategic decision-making in the real estate sector.

By harnessing these capabilities, Shriram Properties can make more informed choices about where to develop projects, what types of properties to offer, optimal pricing strategies, and the best timing for property launches. This data-driven approach significantly enhances the company's competitive positioning in a dynamic market.

For instance, in 2024, the Indian real estate market saw a significant uptick in data adoption. Reports indicate that companies using advanced analytics saw an estimated 10-15% improvement in sales conversion rates compared to those relying on traditional methods. Shriram Properties' investment in these areas is expected to yield similar benefits, allowing for more precise resource allocation and risk mitigation.

- Data-driven site selection: Identifying prime locations based on demographic shifts and economic indicators, potentially reducing pre-sales risk.

- Customer segmentation: Tailoring property offerings and marketing campaigns to specific buyer profiles, increasing engagement and conversion.

- Predictive pricing models: Optimizing pricing based on real-time market demand and competitor analysis, maximizing revenue.

- Demand forecasting: Accurately predicting future demand for different property typologies, informing inventory management and development pipelines.

Sustainable Building Materials and Green Technologies

Technological progress in sustainable building materials and green construction is a significant driver for Shriram Properties. Innovations like recycled aggregate concrete and low-VOC paints are reducing environmental impact. For instance, the global green building materials market was valued at approximately USD 271.3 billion in 2023 and is projected to grow substantially by 2030, indicating a robust demand for eco-friendly options.

Adopting these eco-friendly materials and energy-efficient designs offers Shriram Properties a competitive edge. It directly addresses increasingly stringent environmental regulations and appeals to a growing segment of environmentally conscious buyers. This alignment can enhance brand reputation and marketability. Furthermore, many regions offer incentives and tax breaks for developers utilizing green technologies, potentially improving project profitability.

Shriram Properties can leverage these advancements to differentiate its projects. This includes incorporating features such as solar panels, rainwater harvesting systems, and advanced insulation. The company's commitment to sustainability through technology can lead to reduced operational costs for homeowners and contribute to lower carbon footprints for its developments, aligning with global sustainability goals and investor expectations for Environmental, Social, and Governance (ESG) performance. For example, buildings designed to LEED standards can achieve up to 30% higher property values.

- Market Growth: The global green building materials market is experiencing rapid expansion, reaching an estimated USD 271.3 billion in 2023.

- Buyer Demand: An increasing number of homebuyers prioritize sustainability, influencing purchasing decisions.

- Regulatory Compliance: Adoption of green technologies aids in meeting evolving environmental standards and building codes.

- Cost Savings & Incentives: Energy-efficient designs reduce long-term operational costs for residents and can unlock government incentives.

Shriram Properties' adoption of advanced construction technologies like prefabrication and modular building enhances efficiency and reduces build times. The global modular construction market, valued at approximately USD 112.5 billion in 2023, is projected for significant growth, underscoring this trend towards off-site manufacturing for better quality and cost savings.

The company's integration of digital tools such as Building Information Modeling (BIM) streamlines operations, leading to improved project coordination and fewer errors, as many firms report. Embracing these advancements optimizes project delivery and lowers construction expenses, bolstering Shriram Properties' competitive edge.

Consumer demand for smart home features is shaping property design, with IoT integration offering enhanced living experiences. A 2024 report indicated that 45% of new homebuyers consider smart home technology crucial, a figure expected to rise, highlighting the market's shift towards tech-savvy amenities.

The real estate sector's rapid adoption of PropTech, including online portals and virtual reality tours, revolutionizes property marketing and sales. Shriram Properties can broaden its customer base and improve sales efficiency by utilizing these digital channels, as evidenced by the global PropTech market's approximate USD 28.6 billion valuation in 2024.

Leveraging data analytics and AI allows Shriram Properties to gain deeper market insights, improving decision-making for project development and pricing. Companies using advanced analytics in 2024 saw an estimated 10-15% improvement in sales conversion rates, a benefit Shriram Properties can achieve through its investments.

Technological progress in sustainable building materials, such as recycled aggregate concrete, is crucial for Shriram Properties. The global green building materials market, valued at USD 271.3 billion in 2023, shows robust demand for eco-friendly options, aligning with environmental regulations and buyer preferences.

Adopting green technologies like solar panels and rainwater harvesting can reduce operational costs for homeowners and enhance Shriram Properties' brand reputation. Buildings designed to LEED standards, for example, can achieve up to 30% higher property values, demonstrating the financial benefits of sustainability.

| Technology Adoption | Impact on Shriram Properties | Market Data (2023-2025) |

| Modular & Prefabricated Construction | Increased efficiency, reduced build times, cost savings | Global modular construction market valued at USD 112.5 billion (2023), projected growth |

| Building Information Modeling (BIM) | Improved project coordination, fewer errors, optimized operations | Increasing standard practice across construction firms |

| Smart Home Technology (IoT) | Enhanced living experiences, appeal to tech-savvy buyers | 45% of new homebuyers consider smart home tech crucial (2024 report) |

| PropTech (Digital Marketing & Sales) | Broader customer reach, improved sales efficiency | Global PropTech market valued at USD 28.6 billion (2024), strong growth |

| Data Analytics & AI | Informed decision-making, accurate forecasting, improved sales conversion | 10-15% improvement in sales conversion with advanced analytics (2024) |

| Sustainable Building Materials | Reduced environmental impact, enhanced brand reputation, regulatory compliance | Global green building materials market valued at USD 271.3 billion (2023) |

Legal factors

Shriram Properties' operations in India are significantly shaped by the Real Estate (Regulation and Development) Act, or RERA. This legal framework mandates strict adherence, requiring all projects to be registered and detailed information to be transparently disclosed to potential buyers. For Shriram Properties, this means ensuring every development meets RERA's stringent requirements to maintain its credibility.

A key RERA provision is the mandatory use of escrow accounts, where 70% of the funds collected from buyers must be deposited. This ensures that project funds are utilized solely for construction and timely completion, a critical aspect for Shriram Properties to manage its finances effectively and build buyer confidence. This regulation aims to protect consumer interests by preventing developers from diverting funds.

The Act also emphasizes timely project completion, a factor directly impacting Shriram Properties' reputation and future sales. Failure to comply with RERA can result in substantial penalties and legal challenges, underscoring the importance of robust project management and financial planning for the company. In 2023, regulatory bodies across India reported an increase in RERA filings, highlighting the growing importance of compliance for all developers.

Shriram Properties, like all real estate developers in India, must navigate a complex web of environmental laws. Obtaining environmental clearances from bodies such as the Ministry of Environment, Forest and Climate Change (MoEF&CC) is a mandatory and often lengthy process. This ensures projects adhere to regulations designed to protect natural resources and minimize ecological impact. For instance, projects requiring Environmental Impact Assessments (EIAs) are common, with the regulatory framework continually evolving to address climate change concerns and promote sustainable development practices.

India's land acquisition laws are intricate, with Shriram Properties needing to meticulously adhere to regulations set by both central and state governments. The Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013 (LARR Act) governs these processes, ensuring fair compensation and rehabilitation for landowners. Navigating these legal frameworks efficiently is paramount for securing land for new projects, impacting the company's development pipeline and overall growth strategy.

Property rights and clear land titles are the bedrock of any real estate development. Shriram Properties relies on robust due diligence and legal expertise to ensure that all land acquired for its projects has undisputed ownership and is free from encumbrances. This diligence is critical to avoid legal disputes that could stall or derail development, as seen in various real estate ventures where title issues have led to significant delays and financial losses for developers across the sector.

Zoning laws, which dictate land use and development intensity, are also a significant legal factor. Shriram Properties must align its project plans with local municipal zoning regulations, which can differ substantially between cities and even within different zones of the same city. For instance, a plot designated for residential use cannot be developed for commercial purposes without obtaining necessary approvals, a process that requires careful planning and legal compliance to ensure project viability.

Consumer Protection Laws

Beyond the Real Estate (Regulation and Development) Act, 2016 (RERA), Shriram Properties operates under a general consumer protection umbrella. These laws are crucial for safeguarding buyer rights concerning property quality, adherence to promised delivery timelines, and fair dispute resolution mechanisms. For instance, the Consumer Protection Act, 2019, empowers consumers by providing avenues for redressal against unfair trade practices and deficiency in services within the real estate sector.

Shriram Properties must diligently ensure all its contractual agreements and business practices align with these overarching consumer protection statutes. Non-compliance can lead to significant legal challenges, reputational damage, and financial penalties. In 2023 alone, consumer complaint redressal agencies handled a substantial volume of cases, underscoring the importance of proactive compliance.

- Compliance with broad consumer protection laws is essential for Shriram Properties.

- These laws cover property quality, timely delivery, and dispute resolution.

- The Consumer Protection Act, 2019, offers significant recourse for buyers.

- Failure to comply can result in legal disputes and financial liabilities.

Taxation Laws (GST, Stamp Duty)

Taxation laws, particularly Goods and Services Tax (GST) and stamp duty, significantly influence the real estate sector. For Shriram Properties, changes in GST rates on construction services directly affect project costs and, consequently, the final price for customers. For instance, the GST rate on construction services generally remains at 12% for under-construction properties, which is a key factor in affordability.

Stamp duty, levied by state governments on property registrations, adds another layer to the overall cost burden for homebuyers. Variations in stamp duty rates across different states where Shriram Properties operates can impact buyer sentiment and purchasing decisions. For example, while some states may offer concessions or waivers on stamp duty for specific property types or during certain periods, these can fluctuate.

- GST on construction services: Typically 12% for under-construction properties, impacting project profitability and buyer cost.

- Stamp Duty: Varies significantly by state, directly affecting property registration expenses for buyers. For example, Maharashtra often has higher stamp duty rates compared to some southern states.

- Impact on Demand: Tax incentives or increased tax burdens can either stimulate or dampen buyer demand.

- Pricing Strategies: Shriram Properties must adapt its pricing to reflect prevailing tax structures and potential future changes.

Shriram Properties must navigate evolving anti-money laundering (AML) regulations, which require stringent customer due diligence and transaction monitoring. These laws are critical for preventing illicit financial flows within the real estate sector. For example, the Prevention of Money Laundering Act, 2002 (PMLA) mandates reporting of suspicious transactions, impacting how developers handle large cash dealings and verify buyer identities.

The company also faces legal scrutiny regarding foreign direct investment (FDI) policies in real estate. Understanding and complying with the consolidated FDI policy, which outlines permissible investment routes and conditions, is vital for attracting foreign capital. In 2024, the government continued to review and update FDI norms to foster growth while ensuring regulatory oversight.

Contract law forms the basis of all Shriram Properties' agreements with buyers, suppliers, and partners. Ensuring these contracts are legally sound and enforceable is fundamental to mitigating risks. The Indian Contract Act, 1872, governs these relationships, and adherence to its principles is paramount for dispute resolution and business continuity.

Environmental factors

There's a significant push towards sustainable building, focusing on eco-friendly materials, minimizing construction waste, and optimizing resource use from start to finish. This trend is increasingly influencing consumer choices and regulatory frameworks globally.

Shriram Properties can leverage these sustainable practices to bolster its reputation and significantly shrink its environmental impact. For instance, adopting green building certifications like LEED or IGBC can attract environmentally conscious buyers and investors.

In 2023, the Indian Green Building Council (IGBC) reported a substantial increase in green building projects, with over 8.7 billion square feet of certified space, indicating strong market demand for sustainable developments.

By integrating responsible sourcing and efficient waste management, Shriram Properties can not only meet evolving environmental standards but also potentially reduce operational costs over the long term, aligning with a more resilient business model.

Shriram Properties' commitment to green building certifications like GRIHA and LEED India is becoming a significant differentiator. As of early 2024, the Indian green building market is projected to reach $25.4 billion by 2025, indicating substantial growth driven by awareness and policy. Adhering to these standards not only meets regulatory expectations but also taps into a growing segment of environmentally conscious consumers.

Achieving these certifications offers tangible benefits. For instance, LEED-certified buildings can experience lower operating costs due to energy efficiency, potentially improving Shriram Properties' long-term project profitability. Furthermore, projects with recognized green credentials often command a premium in the market, enhancing Shriram Properties' brand image and attracting buyers willing to invest in sustainable living.

Water scarcity poses a significant environmental challenge across many Indian urban centers, impacting development projects. Shriram Properties, like other real estate developers, must address this by integrating robust water conservation strategies.

For instance, implementing rainwater harvesting systems can significantly reduce reliance on municipal water supplies. In 2023, cities like Bengaluru experienced acute water shortages, highlighting the growing urgency of such measures. Greywater recycling and the installation of low-flow fixtures are also crucial for both environmental responsibility and compliance with evolving local water management regulations, especially for large-scale residential communities.

Waste Management and Recycling

Shriram Properties must implement comprehensive waste management strategies to lessen its environmental footprint and adhere to evolving municipal rules. This involves effective segregation of waste at the source, particularly focusing on the recycling of construction and demolition (C&D) debris. For instance, India's C&D waste management rules mandate the recycling of at least 70% of C&D waste by 2027, a target Shriram Properties will need to meet.

Promoting resident-level waste management is equally vital. This includes encouraging segregation of household waste into wet and dry categories, facilitating composting, and increasing recycling rates. As of 2023, urban India generates an estimated 62 million tonnes of municipal solid waste annually, with recycling rates often below 30%, highlighting a significant area for improvement and compliance.

Effective waste management plans are essential for Shriram Properties to not only minimize environmental impact but also to ensure compliance with national and local regulations. These regulations, such as the Solid Waste Management Rules, 2016, place the onus on generators to manage their waste responsibly. By integrating these practices, Shriram Properties can enhance its sustainability credentials and potentially reduce operational costs associated with waste disposal.

- Waste Segregation: Implementing strict segregation protocols at construction sites and residential complexes to separate recyclable materials from general waste.

- C&D Waste Recycling: Targeting a minimum of 70% recycling of construction and demolition waste by 2027, as per Indian regulations.

- Resident Engagement: Educating and encouraging residents to participate in waste segregation and recycling initiatives within their communities.

- Compliance: Ensuring all waste management practices align with current municipal bylaws and national environmental protection acts.

Energy Efficiency and Renewable Energy Integration

Shriram Properties is increasingly focused on designing energy-efficient buildings. This includes incorporating enhanced insulation, advanced HVAC systems, and integrating renewable energy sources like solar panels. These initiatives are crucial for reducing both operational expenses and the company's overall carbon footprint.

Compliance with regulatory frameworks, such as the Energy Conservation Building Code (ECBC), is a significant aspect of Shriram Properties' strategy. Meeting these standards ensures that new constructions and renovations adhere to energy-saving principles, contributing to a more sustainable built environment and potentially offering long-term cost benefits for residents.

- Reduced Operational Costs: Energy-efficient designs and renewable integration can lead to lower utility bills for homeowners and the company.

- Enhanced Brand Reputation: A commitment to sustainability can improve Shriram Properties' image among environmentally conscious buyers.

- Regulatory Compliance: Adherence to codes like ECBC is mandatory and avoids potential penalties.

- Market Demand: Growing consumer preference for green buildings creates a competitive advantage.

Shriram Properties faces increasing pressure to adopt sustainable practices and reduce its environmental impact. This includes a focus on eco-friendly materials, waste reduction, and water conservation, driven by both consumer demand and evolving regulations.

The company is actively pursuing green building certifications like LEED and GRIHA, recognizing their market appeal and potential for cost savings through energy efficiency. As of early 2024, the Indian green building market is projected to reach $25.4 billion by 2025.

Addressing water scarcity is critical, with strategies like rainwater harvesting and greywater recycling becoming essential, especially given events like Bengaluru's water shortages in 2023. Furthermore, Shriram Properties must comply with India's mandate to recycle at least 70% of construction and demolition waste by 2027.

PESTLE Analysis Data Sources

Our Shriram Properties PESTLE Analysis is grounded in a comprehensive review of government housing policies, economic growth indicators from financial institutions, and real estate market research reports. We also incorporate social demographic shifts and technological advancements impacting property development.