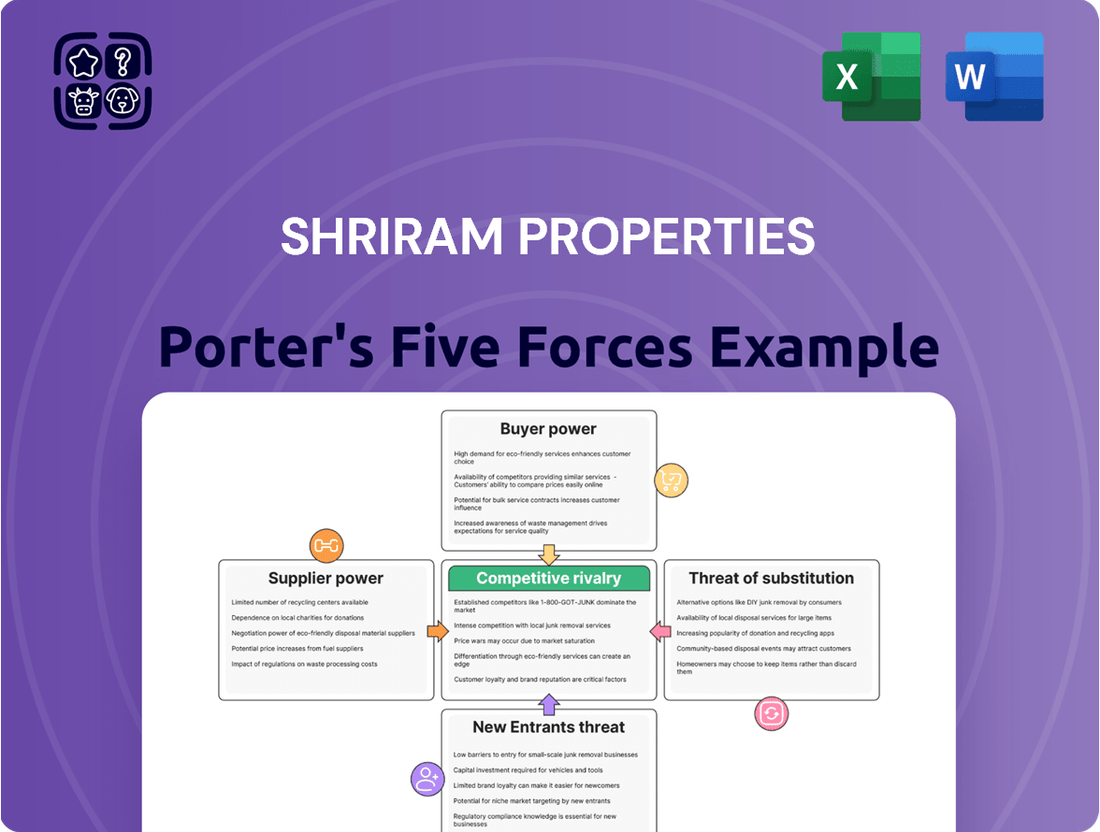

Shriram Properties Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shriram Properties Bundle

Shriram Properties operates within a dynamic real estate sector, facing considerable pressure from rivals and the looming threat of new entrants. Understanding the intensity of buyer bargaining power and the influence of suppliers is crucial for navigating this competitive landscape. The availability of substitutes further shapes strategic options.

The complete report reveals the real forces shaping Shriram Properties’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Indian construction materials market, encompassing essentials like cement, steel, and bricks, is largely fragmented. This fragmentation typically grants Shriram Properties a good degree of choice among suppliers, potentially mitigating the bargaining power of individual suppliers.

Despite the fragmented nature of the supply base, significant price volatility in these basic materials, often exacerbated by inflationary pressures and fluctuating demand, remains a key concern. For instance, steel prices in India saw substantial increases in 2021 and early 2022, impacting project budgets across the real estate sector.

This price volatility directly affects Shriram Properties' project costs and can squeeze profit margins. Effective supply chain management, including strategic procurement and hedging where possible, becomes crucial to navigate these market dynamics and maintain project profitability.

The availability and cost of labor significantly influence the bargaining power of suppliers in the construction sector. While India boasts a substantial workforce, the scarcity of highly skilled labor for specialized construction roles can drive up wages, enhancing supplier leverage. For instance, in 2024, the average daily wage for a skilled construction worker in major Indian metropolitan areas often exceeded INR 800, a notable increase from previous years due to demand.

Furthermore, adherence to India's labor regulations, including minimum wage laws and contributions to employee provident funds and other social welfare schemes, directly impacts the overall cost of employing labor. These mandated expenses represent a significant portion of a developer's operational expenditure, indirectly bolstering the bargaining power of labor suppliers and contractors who manage these human resources.

Land, a fundamental input for real estate development, presents significant bargaining power for suppliers, especially in India's burgeoning urban centers. The scarcity and complexity of acquiring clear titles, navigating zoning laws, and securing local permits mean that landowners often hold considerable sway, impacting Shriram Properties' project timelines and costs.

In 2024, the Indian real estate sector continued to grapple with these land acquisition hurdles. For instance, projects in major metropolitan areas like Bengaluru and Delhi NCR often faced delays extending beyond 12-24 months due to land-related litigations and regulatory approvals. This gives sellers leverage, as they can dictate terms and prices, knowing the developer's need for strategically located land is high.

Financial Institutions' Influence

Suppliers of capital, particularly banks and Non-Banking Financial Companies (NBFCs), wield considerable influence over Shriram Properties. They dictate terms and interest rates for the crucial project financing that fuels growth. Shriram Properties' financial health, reflected in its cost of debt, directly impacts its ability to negotiate favorable terms, as evidenced by their efforts to manage borrowing costs.

The bargaining power of these financial institutions is a key consideration. For instance, in 2023, the weighted average cost of capital for real estate developers in India saw fluctuations based on market liquidity and central bank policies, directly impacting Shriram Properties' financing costs.

- Banks and NBFCs can leverage their position by setting higher interest rates if Shriram Properties' financial risk profile is perceived to increase.

- The terms of loan agreements, including covenants and repayment schedules, are largely determined by the lenders, limiting Shriram Properties' financial flexibility.

- Access to capital can be restricted during periods of economic uncertainty, further strengthening the suppliers' position.

- Shriram Properties' strategy to diversify funding sources, including equity and internal accruals, aims to mitigate this supplier power.

Specialized Contractors and Technology Providers

The bargaining power of specialized contractors and technology providers is a significant factor for Shriram Properties. When a project demands unique construction methods, cutting-edge technology, or intricate amenity installations, the pool of qualified suppliers often shrinks. This scarcity directly translates into greater leverage for these specialized firms, allowing them to command higher prices.

Shriram Properties' commitment to delivering high-quality projects and adhering to strict timelines necessitates engaging these specialized suppliers. For instance, in 2024, the demand for sustainable building materials and smart home integration technologies has increased, with fewer providers offering certified expertise. This can lead to higher engagement costs, impacting project budgets.

- Limited Supplier Pool: For highly specialized construction techniques or proprietary technology integrations, the number of qualified contractors or providers is often limited, giving them considerable pricing power.

- Quality and Timeliness Demands: Shriram Properties' focus on quality and meeting delivery schedules means they may be compelled to use these specialized suppliers, even at a premium cost.

- Technological Advancements: The increasing integration of advanced technologies in real estate development, such as AI-driven building management systems or advanced prefabrication, creates dependence on a select group of innovators.

- Project Specificity: The unique requirements of certain Shriram Properties projects, like luxury amenities or complex structural designs, can further narrow the options for specialized suppliers, amplifying their bargaining strength.

While the construction materials market is fragmented, price volatility for essential inputs like steel and cement remains a significant challenge for Shriram Properties. This volatility, often driven by inflation and demand shifts, can directly impact project costs and profitability, necessitating strong supply chain management strategies.

The bargaining power of suppliers is also amplified by the scarcity of skilled labor and the complexities of land acquisition in India's urban centers. For instance, in 2024, skilled labor wages in major cities often exceeded INR 800 daily, and land acquisition for projects in cities like Bengaluru could face 12-24 month delays, giving sellers significant leverage.

Financial institutions and specialized contractors also exert considerable influence. Lenders dictate financing terms, with the weighted average cost of capital for Indian real estate developers fluctuating in 2023. Similarly, the limited pool of providers for advanced building technologies or specialized construction methods allows them to command premium prices, as seen with the growing demand for smart home integration in 2024.

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like Shriram Properties.

Instantly gauge competitive intensity and identify strategic vulnerabilities within the real estate sector, offering Shriram Properties a clear path to mitigate market pressures.

Customers Bargaining Power

Shriram Properties largely focuses on the mid-market and affordable housing sectors. In these segments, customers tend to be very aware of pricing. This means they actively compare prices from different developers before deciding on a property.

For instance, in 2024, the average price per square foot for affordable housing in major Indian cities remained a critical decision-making factor for buyers. Developers like Shriram Properties must remain competitive to attract this demographic, as even small price differences can sway purchasing decisions. This intense price scrutiny directly impacts Shriram's ability to command premium pricing.

Customers in the Indian real estate sector, particularly in 2024, benefit from unprecedented information access. Online platforms like 99acres, MagicBricks, and Housing.com provide extensive listings, project details, and price trends. This readily available data allows buyers to meticulously compare offerings from various developers, including Shriram Properties, directly impacting their ability to negotiate favorable terms.

Shriram Properties operates in the Indian real estate market, particularly in major metropolitan areas. This sector is highly competitive, with numerous developers offering comparable residential projects. In 2024, the sheer volume of available housing options across these cities means customers have a wide array of choices.

This abundance of alternatives significantly dilutes the bargaining power of any single developer like Shriram Properties. Buyers can easily switch to a competitor if they are dissatisfied with pricing, project features, or terms. For example, in Bengaluru, a key market for Shriram, the supply of new residential units from various builders remains robust, giving purchasers considerable leverage.

Significance of the Purchase Decision

The significance of purchasing a home in India cannot be overstated. It represents a major financial commitment and a life-altering decision for individuals and families. This profound importance naturally drives customers to conduct extensive research, compare various options meticulously, and actively seek favorable terms, including price, payment schedules, and included amenities. This thorough approach directly amplifies their bargaining power.

The high stakes involved in buying property mean customers are less likely to make impulsive decisions. They invest considerable time and effort in understanding market conditions, developer reputation, and project specifics. This diligence empowers them to negotiate effectively, often leading to concessions from developers. For instance, a 2024 report indicated that in major Indian cities, buyers were successfully negotiating discounts averaging 5-8% on property prices, particularly for units that had been on the market for an extended period.

- High Financial Stakes: Homeownership is typically the largest single purchase an individual makes, creating significant leverage for buyers.

- Information Availability: Increased access to online property portals, reviews, and market data allows customers to be better informed and compare offerings easily.

- Price Sensitivity: The substantial financial outlay makes customers highly sensitive to price, encouraging them to negotiate aggressively.

- Developer Competition: In competitive markets, developers are more willing to offer concessions to secure sales, further enhancing customer power.

Impact of Developer Reputation and Trust

While customers wield significant bargaining power, a developer's strong reputation can be a powerful counter. Shriram Properties' established track record for quality construction and on-time project completion helps build buyer trust, directly influencing their willingness to pay. This trust can mitigate the impact of price sensitivity and the availability of alternative housing options.

Shriram Properties has consistently focused on delivering value for money, which resonates with its customer base. This strategy, evident in their project offerings, fosters loyalty and reduces the likelihood of customers aggressively negotiating prices. By building this trust, Shriram can maintain healthier margins.

- Brand Strength: A developer's reputation for reliability and customer satisfaction directly impacts buyer perception and price sensitivity.

- Quality and Timeliness: Consistent delivery of high-quality projects on schedule builds trust, a key factor in reducing customer bargaining power.

- Value Proposition: Shriram Properties' focus on providing value for money strengthens its market position and can lessen the impact of price-based negotiations.

- Customer Service: Excellent post-sales support and responsive communication further solidify customer relationships, diminishing their leverage.

Customers in Shriram Properties' target segments, particularly affordable and mid-market housing, exhibit strong bargaining power. This is driven by high price sensitivity, extensive information availability through online platforms, and the significant financial commitment involved in property purchases.

In 2024, the competitive Indian real estate market, with numerous developers offering similar projects, further empowers buyers. For instance, in Bengaluru, a key Shriram market, the ample supply of new residential units provides buyers with considerable leverage to negotiate terms and prices.

The sheer volume of available housing options across major Indian cities in 2024 means customers can easily switch developers if unsatisfied with pricing or features. This abundance of alternatives significantly dilutes any single developer's ability to command premium pricing.

Buyers' diligence, fueled by the high stakes of homeownership, leads them to seek favorable terms, such as discounts. Reports from 2024 indicated average negotiation discounts of 5-8% on property prices in major cities, especially for units on the market longer.

| Factor | Impact on Shriram Properties | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High | Buyers actively compare prices, making competitive pricing crucial. |

| Information Availability | High | Online platforms provide extensive data, enabling informed comparisons. |

| Availability of Substitutes | High | Numerous developers offer comparable projects, giving buyers choices. |

| Customer Negotiation Leverage | Significant | Buyers successfully negotiate discounts due to market competition and high financial stakes. |

Same Document Delivered

Shriram Properties Porter's Five Forces Analysis

This preview showcases the comprehensive Shriram Properties Porter's Five Forces Analysis you will receive immediately after purchase. You're looking at the actual, fully formatted document, ensuring no surprises or placeholder content, just the complete strategic insight you need.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing a thorough examination of competitive forces impacting Shriram Properties.

You're looking at the actual document, detailing the industry's competitive landscape through Porter's Five Forces for Shriram Properties; once you complete your purchase, you’ll get instant access to this exact file.

The document you see is your deliverable, a professionally crafted Porter's Five Forces Analysis for Shriram Properties, ready for immediate use with no customization or setup required.

Rivalry Among Competitors

The Indian residential real estate sector is characterized by its fragmented nature, featuring a multitude of local, regional, and national developers vying for market share. This fragmentation naturally fuels intense competitive rivalry. Shriram Properties, operating primarily in South India and Kolkata, encounters a broad spectrum of competitors in these key operational geographies.

In 2023, the Indian real estate market saw a significant increase in launches, with residential sales in the top eight cities reaching approximately 300,000 units, a substantial jump from previous years. This heightened activity intensifies the competitive landscape for established players like Shriram Properties, as new projects constantly emerge, demanding attention and capital.

Shriram Properties competes not only with other listed developers but also with numerous unlisted and smaller regional builders who often possess strong local brand recognition and established customer bases. This makes it challenging to capture and retain market share, as each competitor targets specific customer segments and project types within Shriram's core markets.

In the mid-market and affordable housing sectors, Shriram Properties faces intense competition due to a lack of significant product differentiation. Beyond prime locations and standard amenities, many offerings are quite similar, leading to a homogeneous market.

This product similarity forces developers, including Shriram Properties, to engage in aggressive price competition, attractive payment schemes, and frequent promotional activities to capture market share. For instance, in 2024, the Indian real estate market, particularly in these segments, saw a surge in discounts and bundled offers as developers aimed to clear inventory and attract buyers.

The reliance on price and promotions as primary competitive tools intensifies rivalry among players. This dynamic means that Shriram Properties must constantly monitor competitor pricing and marketing strategies to remain competitive, impacting profit margins.

The real estate sector, including companies like Shriram Properties, is characterized by significant capital commitments in land acquisition and lengthy development timelines. These factors create substantial exit barriers, meaning developers find it difficult and costly to leave the market once they've entered. This inherent stickiness discourages companies from withdrawing during economic slowdowns, ensuring a consistent level of competition.

For instance, Shriram Properties, like many in its industry, invests heavily in land banks, which are illiquid assets. A prolonged project cycle, often spanning several years from conception to sale, further locks in capital. This means that even when market conditions are unfavorable, developers are compelled to continue operations and manage existing projects rather than easily exiting, thereby perpetuating intense competitive rivalry.

Market Growth and Inventory Absorption

The Indian real estate sector is indeed seeing strong growth, especially in the mid-income and premium housing categories. However, the pace at which new housing units are being sold, known as absorption rates, differs significantly across major cities. This variation directly impacts competitive rivalry among developers.

When absorption rates are high, it means demand is strong and developers can sell their inventory quickly, which generally eases competitive pressures. Conversely, cities or specific market segments with high unsold inventory can lead to more intense competition as developers vie for a smaller pool of readily available buyers. For instance, while national housing sales might be up, a specific micro-market with many ongoing projects and slower sales will see fiercer competition.

- Market Growth: The Indian residential real estate market saw a significant year-on-year growth in sales volume in 2023, with some reports indicating an increase of over 15% in major cities.

- Inventory Levels: While overall inventory is reducing, certain micro-markets or specific property types may still have a substantial number of unsold units, contributing to competitive intensity.

- Absorption Rates: Absorption rates in key metropolitan areas like Bengaluru and Mumbai have remained robust, aiding developers in managing their inventory and potentially reducing direct rivalry.

- Segment Variation: The mid-income and premium segments generally exhibit higher absorption rates compared to the affordable housing segment in some regions, leading to varied competitive dynamics across different price points.

Aggressive Marketing and Sales Strategies

Shriram Properties faces intense competition, with rivals actively employing aggressive marketing and sales tactics. These strategies often include significant discounts, attractive flexible payment plans, and the bundling of value-added services to draw in potential homebuyers. This ongoing competition for market share significantly pressures profit margins for all players in the sector.

The need to constantly innovate in sales approaches is paramount. For instance, in 2024, the Indian real estate market saw developers offering compelling deals to stimulate demand amidst varying economic conditions. Companies like Shriram Properties must continually refine their customer acquisition strategies to stay ahead.

- Aggressive Promotions: Competitors frequently roll out discounts and special offers.

- Payment Flexibility: Attractive and flexible payment schemes are common sales tools.

- Value-Added Services: Offering extras like free parking or home interiors helps differentiate.

- Market Share Focus: The drive to capture market share intensifies competitive pressures.

Competitive rivalry in the Indian real estate market, where Shriram Properties operates, is exceptionally high due to market fragmentation and a proliferation of developers. This intense competition is further fueled by a lack of significant product differentiation, particularly in the mid-market and affordable housing segments.

Developers, including Shriram Properties, are compelled to engage in aggressive pricing, offer attractive payment schemes, and implement frequent promotional activities to secure market share. This dynamic is evident in 2024, with developers leveraging discounts and bundled offers to drive sales amidst varying economic conditions.

The high capital requirements and long development cycles in real estate create substantial exit barriers, ensuring sustained competitive intensity as developers are reluctant to withdraw even during market downturns. This forces companies to continuously innovate their sales strategies to attract buyers and maintain profitability.

| Metric | 2023 Data | 2024 Outlook/Trend |

|---|---|---|

| Residential Sales Volume (Top 8 Cities) | Approx. 300,000 units | Continued robust sales, potential for further growth |

| Year-on-Year Sales Growth | Over 15% in major cities | Expected to remain strong, though growth rate may moderate |

| Inventory Levels | Reducing overall, but micro-market variations exist | Focus on faster inventory turnover through competitive strategies |

| Absorption Rates | Robust in key metros (e.g., Bengaluru, Mumbai) | Generally positive, but project-specific and micro-market dependent |

SSubstitutes Threaten

Renting continues to be a strong substitute for buying a home, especially for younger individuals, those who move frequently for work, or people who prefer not to tie themselves down with a long-term mortgage. In 2024, the median rent for a one-bedroom apartment in major metropolitan areas has seen an upward trend, making homeownership a more attractive proposition for some as rental costs climb.

Potential homebuyers often weigh real estate against other investment avenues. If stocks or bonds, for instance, promise more attractive or readily accessible returns, capital that might otherwise go into property can be diverted. This is particularly relevant when real estate appreciation appears to be slowing down.

For example, in early 2024, the S&P 500 saw significant gains, potentially drawing investor interest away from less liquid assets like real estate. Similarly, rising interest rates on bonds can make them a more compelling alternative for risk-averse investors.

The allure of gold as a safe-haven asset also presents a substitution threat. During periods of economic uncertainty, investors might shift funds towards gold, reducing the pool of capital available for property purchases.

This competition from other asset classes directly impacts demand for Shriram Properties' offerings. A strong performance in the equity or bond markets, or a surge in gold prices, can diminish the attractiveness of real estate investments.

The rise of co-living and managed accommodations presents a significant threat of substitutes for Shriram Properties. These newer models offer flexible leases and built-in communities, directly competing for younger renters who might otherwise consider traditional apartment rentals. For instance, in 2024, the co-living sector saw significant investment, with companies like Homu expanding their offerings, indicating a growing market preference for these alternatives.

Rural or Tier 2/3 City Housing

The threat of substitutes for Shriram Properties' housing offerings in metropolitan areas is amplified by the growing appeal of Tier 2, Tier 3, and rural locations. As property prices in major cities continue to climb, individuals are increasingly considering more affordable alternatives. This shift is partly driven by evolving work dynamics, with remote and hybrid work models making it feasible for people to live further from traditional employment hubs.

Lifestyle preferences also play a significant role. Many individuals seek a slower pace of life, lower cost of living, and potentially more space, which rural or smaller city environments can offer. For instance, while specific comparative data for Shriram Properties' market segments isn't readily available, broader trends show a migration away from expensive metros. In 2023, some reports indicated a noticeable increase in property searches and inquiries in Tier 2 cities compared to Tier 1 cities, suggesting a growing demand for these substitute locations.

- Remote Work Enablement: The widespread adoption of remote work, accelerated by events in recent years, removes geographical constraints for many professionals.

- Affordability Advantage: Property prices in Tier 2, Tier 3, and rural areas can be substantially lower, offering a significant cost-saving substitute for metropolitan housing.

- Lifestyle Preferences: A desire for a less congested environment, a lower cost of living, and a different quality of life drives some consumers towards these alternative locations.

- Infrastructure Development: Improvements in digital infrastructure and connectivity in smaller cities and towns make them increasingly viable living and working options.

Delaying Home Purchase Decisions

Consumers may opt to delay their home purchases, a strategic "no-purchase" choice that functions as a substitute for immediate acquisition. This delay is often driven by economic uncertainty, elevated property prices, or the anticipation of future interest rate adjustments. For instance, in early 2024, many potential homebuyers were likely observing the trajectory of mortgage rates, which had remained elevated throughout 2023, impacting affordability and purchasing power.

This deferral strategy directly impacts demand for new properties, as buyers wait for more favorable economic conditions or clearer interest rate signals. Such hesitancy can be particularly pronounced when inflation remains a concern, further eroding purchasing power. The decision to wait is a powerful substitute, as it offers consumers the option to avoid current market risks, effectively bypassing the need to buy now.

- Economic Uncertainty: High inflation and potential recession fears in late 2023 and early 2024 led many consumers to postpone major financial commitments like home buying.

- High Property Prices: Despite some regional fluctuations, overall property prices remained a significant barrier for many first-time buyers throughout 2023, encouraging a wait-and-see approach.

- Interest Rate Expectations: The anticipation of potential interest rate cuts in 2024, following aggressive hikes in previous years, encouraged some buyers to delay their purchases, hoping for lower borrowing costs.

The threat of substitutes for Shriram Properties is multifaceted, encompassing alternative housing arrangements, different investment vehicles, and the decision to delay purchases. Renting, especially with rising median rents in major cities in 2024, remains a key substitute. Furthermore, the strong performance of asset classes like the S&P 500 in early 2024 drew investor capital away from real estate, highlighting the competition from stocks and bonds. The growing popularity of co-living spaces, exemplified by sector investments in 2024, offers flexible alternatives that appeal to younger demographics.

The migration towards Tier 2, Tier 3, and rural locations presents another significant substitution threat, driven by affordability and remote work trends. Property searches in Tier 2 cities saw an increase in 2023 compared to Tier 1 cities, indicating this shift. Consumers also strategically delay purchases due to economic uncertainty and high property prices; many potential buyers in early 2024 were observing elevated mortgage rates from 2023, waiting for more favorable borrowing conditions.

| Substitute Category | Key Characteristics | Impact on Shriram Properties | 2024 Data/Trend |

| Renting | Flexibility, lower upfront cost | Reduces demand for homeownership | Median rents in major metros increased |

| Alternative Investments | Higher or more accessible returns | Diverts capital from real estate | S&P 500 showed strong gains in early 2024 |

| Co-living/Managed Accommodations | Flexible leases, community focus | Competes for younger renters | Significant investment in the co-living sector |

| Lower Tier/Rural Locations | Affordability, lifestyle | Shifts buyer preference away from metros | Increased property searches in Tier 2 cities (2023) |

| Delayed Purchase ("No-Purchase") | Economic uncertainty, price/rate expectations | Reduces immediate demand | Buyers observing elevated mortgage rates (from 2023) |

Entrants Threaten

The real estate development industry, particularly for significant residential ventures like those undertaken by Shriram Properties, presents a formidable barrier to entry due to exceptionally high capital requirements. Aspiring developers must secure substantial funding for land acquisition, which can run into millions or even billions of rupees depending on the location and scale.

Beyond land, the costs associated with construction, including materials, labor, and regulatory approvals, are immense. For instance, a mid-sized residential project in a Tier-1 Indian city can easily require an upfront investment of several hundred crores of rupees.

Marketing and sales efforts also demand significant financial outlay. This financial hurdle effectively screens out smaller players and individual investors, leaving the field predominantly to well-capitalized companies with access to robust financing.

In 2024, the average cost of land acquisition for large-scale projects in prime Indian metropolitan areas often constitutes 30-40% of the total project cost, underscoring the sheer capital intensity of this sector and limiting the threat of new entrants.

The Indian real estate sector is a complex landscape, heavily shaped by regulations. Laws like the Real Estate (Regulation and Development) Act (RERA), coupled with stringent environmental clearances and various local body approvals, create a significant hurdle for newcomers. For instance, in 2024, the timeline for obtaining multiple approvals could extend significantly, adding substantial cost and uncertainty for any new developer entering the market.

Navigating this bureaucratic maze is a formidable barrier. Obtaining timely permissions requires considerable expertise and resources, often involving multiple government agencies. This inherent complexity deters many potential entrants who may lack the established relationships or understanding of the process necessary to succeed in the Indian real estate market.

The threat of new entrants for Shriram Properties is significantly mitigated by the considerable challenges in land acquisition and securing clear titles, particularly in prime urban areas. Fragmented ownership, ongoing legal disputes, and escalating land prices create substantial hurdles. For instance, in 2023, average land acquisition costs in Tier-1 Indian cities saw an increase of 8-12%, making it difficult for new developers to compete without deep pockets or established relationships.

Brand Reputation and Trust Deficit

The threat of new entrants in the real estate sector is significantly mitigated by the established brand reputation and the inherent trust deficit new players face. Developers like Shriram Properties have cultivated strong brand recognition over decades, a critical asset in an industry where buyer confidence is paramount. For instance, Shriram Properties has a legacy spanning over 35 years, delivering numerous projects and building a loyal customer base.

New entrants find it challenging to replicate this level of trust, making it difficult to attract customers away from established names. This hurdle is amplified by the substantial capital investment required and the complex regulatory landscape, which further deters nascent companies. Building a reputation takes time and consistent delivery, a significant barrier for any newcomer aiming to disrupt the market.

- Established Brand Equity: Shriram Properties benefits from over 35 years of operational history and a proven track record of project delivery, fostering deep customer trust.

- Trust Deficit for Newcomers: Potential buyers often gravitate towards developers with a history of reliability, creating a significant barrier for new entrants to gain market share.

- High Capital Requirements: The real estate market demands substantial upfront investment, making it difficult for new companies to compete with well-capitalized, established developers.

- Regulatory Hurdles: Navigating the intricate web of permits and approvals in real estate development adds another layer of complexity that can deter new market entrants.

Access to Supply Chain and Distribution Networks

New entrants into the real estate sector, like Shriram Properties, often struggle to gain access to crucial supply chain and distribution networks. Building these relationships takes time and significant investment, as established players have cultivated strong ties with suppliers, contractors, and sales agents over years.

These existing relationships grant incumbents advantages such as preferential pricing due to bulk purchasing and access to established sales channels. For instance, in 2023, the Indian real estate sector saw a significant increase in project launches, yet new developers often found it challenging to secure reliable construction materials at competitive rates compared to those with long-term supplier contracts.

- Supplier Relationships: Established developers secure better terms and priority delivery from material suppliers.

- Contractor Access: Experienced builders have pre-vetted, reliable contractor networks.

- Distribution Channels: Existing firms leverage established sales teams and broker relationships for faster project sales.

- Negotiating Power: Bulk procurement by incumbents leads to cost advantages, making it harder for new entrants to compete on price.

The threat of new entrants for Shriram Properties is low due to substantial capital requirements, with land acquisition alone often accounting for 30-40% of total project costs in prime Indian cities in 2024. Established brands like Shriram Properties, with over 35 years of history, enjoy a trust advantage that new players struggle to overcome. Furthermore, navigating complex regulations and securing reliable supply chains presents significant barriers, limiting the influx of new competition.

| Factor | Impact on New Entrants | Example/Data (2023-2024) |

|---|---|---|

| Capital Requirements | High Barrier | Land acquisition costs 30-40% of project cost in Tier-1 cities. |

| Brand Reputation & Trust | Significant Challenge | Shriram Properties' 35+ year legacy builds customer confidence. |

| Regulatory Complexity | Deterrent | Lengthy approval timelines in 2024 add cost and uncertainty. |

| Supply Chain Access | Difficult to Establish | Newcomers struggle to match established pricing and delivery terms. |

Porter's Five Forces Analysis Data Sources

Our Shriram Properties Porter's Five Forces analysis is built upon a robust foundation of data, drawing from the company's official annual reports, investor presentations, and regulatory filings. We supplement this with insights from reputable real estate industry publications and market research reports to capture a comprehensive view of the competitive landscape.