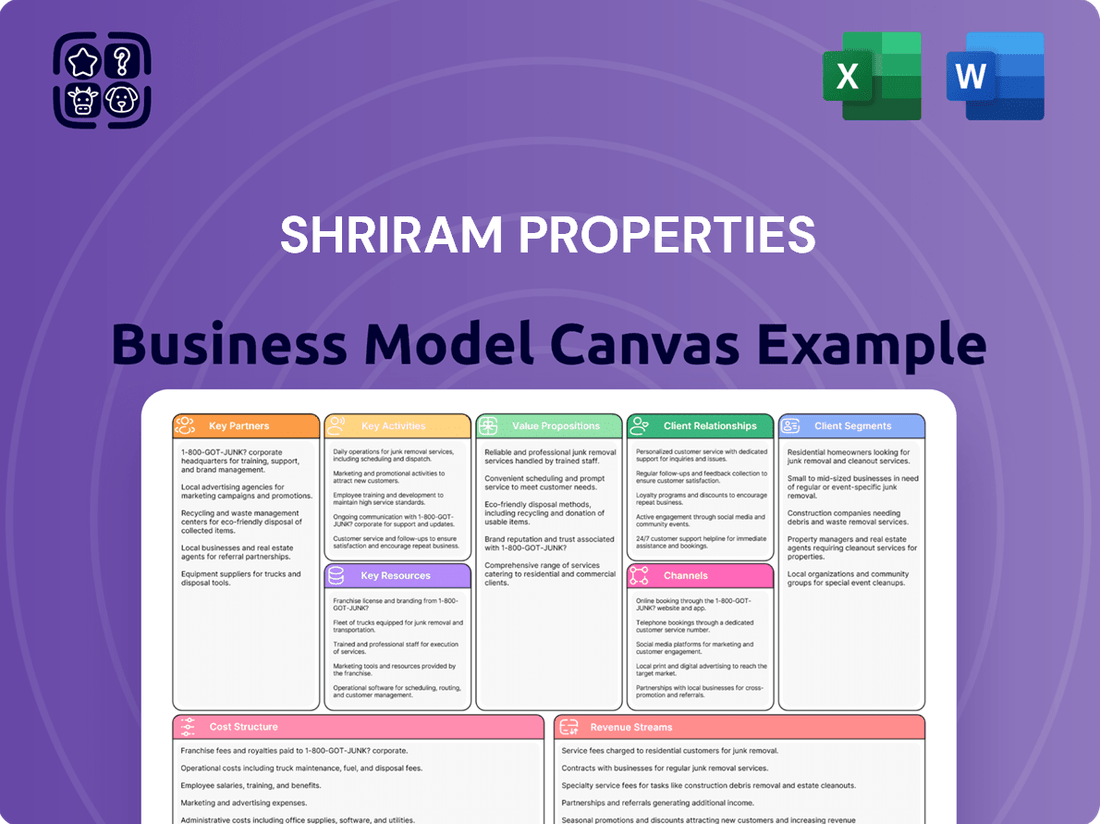

Shriram Properties Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shriram Properties Bundle

Unlock the full strategic blueprint behind Shriram Properties's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape by focusing on diverse customer segments and strategic partnerships. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into their key resources and revenue streams.

Dive deeper into Shriram Properties’s real-world strategy with the complete Business Model Canvas. From value propositions like affordable housing to cost structure and key activities in project development, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie in customer relationships and channels.

Want to see exactly how Shriram Properties operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations, covering everything from their cost drivers to their revenue streams.

Gain exclusive access to the complete Business Model Canvas used to map out Shriram Properties’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies, especially regarding their key partners and customer segments.

See how the pieces fit together in Shriram Properties’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more, offering a comprehensive view of their value creation and cost structure. Download the full version to accelerate your own business thinking.

Partnerships

Shriram Properties heavily relies on its partnerships with financial institutions and investors to fuel its growth. In 2024, the company continued to leverage these relationships for securing essential capital. This includes obtaining various forms of debt financing from banks and NBFCs, which is vital for funding land acquisition and ongoing project development.

Equity investments from venture capital firms and private equity funds also play a significant role, particularly in supporting Shriram Properties' asset-light strategy. These partnerships allow the company to expand its project pipeline without bearing the full capital burden, enabling faster market penetration.

Joint venture platforms with strategic investors are another cornerstone, facilitating risk-sharing and accessing specialized expertise. For instance, Shriram Properties has historically engaged in such ventures to develop large-scale integrated townships and commercial spaces, aligning with its ambitious growth targets for the coming years.

Shriram Properties actively cultivates relationships with landowners and joint development partners, a cornerstone of its expansion strategy. This involves entering into joint development agreements, especially for prime land in its core markets.

This approach is crucial for Shriram Properties' asset-light model, enabling project pipeline growth without substantial upfront capital tied to land acquisition. For example, in the fiscal year ending March 31, 2024, the company continued to leverage these partnerships to secure development opportunities across its key geographies.

Shriram Properties relies heavily on its key partnerships with construction contractors and material suppliers to ensure efficient project execution and quality. These collaborations are crucial for timely delivery, a critical factor in customer satisfaction and project profitability.

For instance, in the fiscal year 2023, Shriram Properties reported a significant portion of its revenue from ongoing projects, underscoring the importance of these operational partnerships. The company's ability to secure favorable terms with its construction partners and material suppliers directly influences its cost of goods sold and overall project margins.

Maintaining strong relationships with these entities allows Shriram Properties to navigate supply chain challenges and labor availability, which are persistent concerns in the real estate development sector. This strategic approach helps mitigate risks and ensures that construction progresses as planned, meeting deadlines and quality benchmarks.

Broker & Channel Partner Networks

Shriram Properties actively cultivates extensive networks of real estate brokers and channel partners. These crucial alliances are instrumental in driving the sales and marketing efforts for their diverse property portfolio.

These partners are essential for Shriram Properties to effectively reach a broad spectrum of potential buyers, thereby boosting sales volumes. The company actively engages with these networks, as indicated by initiatives like their Annual Operating Plan (AOP) Partner Meets, ensuring alignment and incentivization.

- Broker Network Reach: Shriram Properties’ reliance on brokers allows them to tap into established client lists and market insights, accelerating property absorption.

- Channel Partner Incentives: The company likely offers competitive commission structures and performance-based incentives to motivate their channel partners.

- Sales Acceleration: The strategic engagement with these networks directly contributes to Shriram Properties’ ability to achieve its sales targets more efficiently.

Technology and Innovation Partners

Shriram Properties actively seeks technology and innovation partners as part of its SPLNxT initiative. These collaborations aim to bolster customer experience and streamline operations.

The company is exploring alliances for implementing AI-powered chatbots to assist with property searches, enhancing user engagement. Furthermore, automation solutions are being considered to improve scalability and efficiency across its business processes.

In 2024, Shriram Properties has been focused on digital transformation, recognizing the critical role of technology in the real estate sector. For instance, the integration of advanced CRM systems is a key area of focus for managing customer interactions more effectively.

- AI-driven Property Discovery: Partnering for intelligent search tools that understand user preferences.

- Automation for Efficiency: Collaborating on platforms to automate sales, marketing, and project management.

- Data Analytics Integration: Seeking partners to leverage data for market insights and personalized customer offerings.

Shriram Properties' strategic partnerships with financial institutions and investors are crucial for its capital-intensive operations. In 2024, the company continued to secure debt financing from banks and NBFCs to fund land acquisition and project development. Equity investments, particularly from private equity, support its asset-light model, enabling faster expansion by sharing capital burdens.

Joint ventures with strategic partners are key for risk diversification and accessing specialized knowledge, particularly for large-scale integrated projects. These collaborations are fundamental to Shriram Properties' growth strategy, allowing it to develop a robust project pipeline and penetrate new markets effectively.

What is included in the product

Shriram Properties' Business Model Canvas focuses on providing affordable and mid-income housing solutions across South India, leveraging strong brand equity and customer relationships.

It details key customer segments, value propositions like quality construction and timely delivery, and efficient channels for sales and customer service.

Shriram Properties' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, simplifying complex real estate development into an easily digestible format for stakeholders.

Activities

Shriram Properties actively identifies and secures land parcels in high-growth corridors, primarily across South India and Pune. This crucial activity forms the bedrock of their project pipeline, ensuring future development opportunities.

The company employs a dual strategy for land acquisition, encompassing both outright purchases and strategic joint development agreements. This approach allows for flexibility and risk management in securing prime locations.

In the fiscal year ending March 31, 2024, Shriram Properties reported land acquisition as a significant component of its operational focus. Their efforts are concentrated on areas with strong demand and potential for appreciation.

For instance, their presence in cities like Bengaluru, Chennai, and Hyderabad, alongside Pune, highlights a deliberate strategy to tap into burgeoning real estate markets. This geographical focus is key to their continued growth and market positioning.

Shriram Properties' key activities in Project Planning & Design involve crafting detailed blueprints, encompassing architectural and engineering specifications. This meticulous process ensures alignment with prevailing market demands and strict adherence to all local building codes and zoning regulations.

The company focuses on securing essential regulatory approvals, a vital step that underpins the entire construction lifecycle. This proactive approach minimizes potential delays and legal hurdles, thereby safeguarding project timelines and investor confidence.

In 2023, Shriram Properties reported a robust pipeline, with several projects in various stages of planning and design, highlighting their commitment to future growth. For instance, their expansion into Tier-2 cities signals a strategic move to tap into emerging real estate markets, requiring tailored design and approval processes.

Shriram Properties' construction and project management is central to its operations. They meticulously oversee every stage, from the initial groundwork to the final finishing touches, ensuring projects are delivered on time and within budget. This hands-on approach is crucial for maintaining the quality that customers expect.

The company actively manages project timelines, quality benchmarks, and cost controls. This proactive management is vital for mitigating risks and ensuring profitability in a competitive real estate market. For instance, in the fiscal year 2023, Shriram Properties reported a significant increase in project execution efficiency, contributing to their robust financial performance.

A core activity involves coordinating with a diverse network of contractors, suppliers, and vendors. Shriram Properties emphasizes strong relationships and clear communication to ensure smooth workflow and adherence to agreed-upon standards. This network is essential for the successful delivery of their residential and commercial projects.

Ensuring adherence to all relevant construction standards, building codes, and regulatory requirements is paramount. This commitment to compliance not only guarantees the safety and structural integrity of their buildings but also builds trust with stakeholders and avoids costly legal issues. Their focus on quality assurance is reflected in their consistent project delivery records.

Marketing & Sales

Shriram Properties actively promotes its residential projects through a multi-channel approach, focusing on both digital and traditional avenues to reach potential buyers. This includes targeted online advertising campaigns, social media engagement, and participation in property expos. For instance, in the fiscal year 2024, the company continued to invest in digital marketing to enhance brand visibility and lead generation.

Sales events and site visits are crucial for converting interest into bookings. Shriram Properties organizes these events to provide prospective customers with firsthand experience of their developments. The company also works with a network of channel partners and brokers, extending its sales reach and facilitating smoother transactions. In 2024, these partnerships remained a significant contributor to their sales pipeline.

- Digital Marketing: Leveraging online platforms for property promotion and lead generation.

- Property Exhibitions: Participating in trade shows and expos to showcase offerings and connect with buyers.

- Channel Partnerships: Collaborating with real estate agents and brokers to expand sales networks.

- Customer Relationship Management: Efficiently managing inquiries, site visits, and the booking process.

Customer Relationship Management & Handover

Shriram Properties focuses on nurturing customer connections from initial inquiry through to property handover. This means consistent communication, offering timely updates on construction progress, and ensuring a seamless transition when customers receive their new homes. For instance, in the financial year 2024, the company reported a significant focus on customer satisfaction metrics as a driver for repeat business and positive referrals.

The company’s approach includes robust after-sales service, actively addressing any concerns or needs customers may have post-purchase. This commitment to customer delight is a cornerstone of their strategy, aiming to build long-term loyalty and a strong brand reputation within the real estate market.

- Customer Engagement: Maintaining proactive communication throughout the entire property lifecycle.

- Post-Sale Support: Providing dedicated assistance and addressing customer queries after handover.

- Customer Satisfaction: Aiming to exceed expectations to foster delight and loyalty.

- Brand Advocacy: Leveraging positive customer experiences to drive organic growth and referrals.

Shriram Properties' sales and distribution activities are geared towards creating a strong market presence and driving revenue. They actively engage potential buyers through a mix of digital marketing, property exhibitions, and strategic channel partnerships. For fiscal year 2024, the company continued to emphasize digital outreach to broaden its customer base and generate qualified leads.

The company's sales efforts are supported by a dedicated team that manages customer inquiries, facilitates site visits, and oversees the booking process efficiently. In 2024, these efforts were crucial in converting interest into confirmed sales, contributing to their overall business objectives.

Shriram Properties also places significant importance on customer relationship management. This involves maintaining consistent communication, providing project updates, and ensuring a positive experience from initial contact through to the handover of properties. Their focus in 2024 was on enhancing customer satisfaction to foster repeat business and positive word-of-mouth referrals.

Preview Before You Purchase

Business Model Canvas

The Shriram Properties Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the comprehensive analysis that will be delivered. Upon completion of your order, you will gain full access to this same detailed canvas, ready for your strategic planning needs. Rest assured, what you see here is precisely what you will get, providing full transparency and immediate usability.

Resources

Shriram Properties’ extensive land bank and robust project pipeline are crucial resources. This strategic advantage allows them to plan and execute multiple developments concurrently, ensuring a steady supply of inventory for the market.

As of December 31, 2024, Shriram Properties boasted a substantial development pipeline comprising 37 projects. These projects collectively represent a significant potential development area of 38.4 million square feet, underscoring their capacity for large-scale operations and future growth.

Shriram Properties secures the necessary financial capital through a mix of internal accruals, strategic debt financing, and equity raises. This financial strength is crucial for funding significant outlays like land acquisitions and ongoing construction projects. In fiscal year 2025, the company demonstrated robust profitability, posting a net profit of Rs 77.30 crore.

Maintaining a healthy debt-equity ratio further underscores the company's sound financial management. This balance is vital for ensuring financial stability and the capacity to undertake ambitious development plans. The ability to access and manage capital effectively is a cornerstone of Shriram Properties' operational capacity and growth strategy.

Shriram Properties relies heavily on its human capital, a skilled workforce comprising experienced project managers, engineers, and architects who are essential for successful real estate development. Their collective expertise ensures efficient project execution and adherence to quality standards, a crucial factor in a competitive market.

The company's sales professionals are another key resource, leveraging their market understanding and client engagement skills to drive property sales and revenue growth. Their ability to connect with potential buyers and effectively communicate the value proposition of Shriram Properties' projects directly impacts financial performance.

A strong management team, with deep industry knowledge and strategic vision, guides the overall direction of Shriram Properties. Their leadership in navigating market complexities and making informed decisions is fundamental to sustained success and profitability.

In the fiscal year 2024, Shriram Properties reported a total workforce of approximately 500 employees, with a significant portion dedicated to core development and sales functions, underscoring the importance of human capital in their operations.

Brand Reputation & Trust

Shriram Properties benefits significantly from its established brand reputation, cultivated over 25 years in operation. This long-standing presence, coupled with its association with the respected Shriram Group, builds substantial trust with both homebuyers and business partners.

This strong brand equity directly translates into tangible business advantages. It facilitates smoother sales processes and makes it easier for the company to attract new development projects, as stakeholders are more confident in partnering with a trusted name.

- 25 years of operational history

- Association with the Shriram Group

- Enhanced customer and partner trust

- Facilitates sales and project acquisition

Technology & Digital Infrastructure

Shriram Properties heavily relies on its technology and digital infrastructure as a key resource. This encompasses leveraging digital platforms for efficient project management, streamlining sales processes, enhancing customer service interactions, and enabling robust data analytics. The company utilizes digital tools to gain deeper insights into market trends and customer behavior.

The company's digital ecosystem includes online portals for property searches, advanced customer relationship management (CRM) systems to track leads and manage client interactions, and a dedicated mobile application. This app serves as a crucial touchpoint for customer engagement, providing updates, facilitating communication, and offering post-sales support. For instance, in 2024, Shriram Properties continued to invest in upgrading its CRM to improve lead conversion rates, aiming for a 15% increase in efficiency.

These technological assets are vital for maintaining a competitive edge and ensuring operational excellence across the business. The focus is on creating a seamless digital experience for customers from initial inquiry through to ownership and beyond. The company's digital analytics capabilities are also being expanded to better forecast demand and optimize marketing spend.

- Digital Platforms: Online property search portals and integrated CRM systems.

- Customer Engagement App: Facilitates communication, project updates, and support.

- Data Analytics: Used for market insights, demand forecasting, and operational efficiency.

- Project Management Software: Enhances coordination and tracking of construction projects.

Shriram Properties' key resources are its substantial land bank, a robust project pipeline, and strong financial backing. These elements allow for continuous development and market presence.

The company's human capital, including skilled project managers, engineers, architects, and sales professionals, is integral to its success. A capable management team provides strategic direction and operational oversight.

Its established brand reputation, built over 25 years and reinforced by its association with the Shriram Group, fosters significant trust among customers and partners, aiding sales and project acquisition.

Furthermore, Shriram Properties leverages technology and digital infrastructure, including online portals, CRM systems, and a customer engagement app, to enhance operations, market insights, and customer experience.

| Key Resource | Description | Impact |

|---|---|---|

| Land Bank & Project Pipeline | 38.4 million sq. ft. across 37 projects (as of Dec 31, 2024) | Ensures inventory supply, supports large-scale operations and growth |

| Financial Capital | Internal accruals, debt financing, equity raises; Net profit of Rs 77.30 crore (FY25) | Funds land acquisition and construction, ensures financial stability |

| Human Capital | Skilled project managers, engineers, architects, sales professionals, management team | Drives efficient project execution, quality adherence, revenue growth, and strategic direction |

| Brand Reputation | 25 years of operation, association with Shriram Group | Builds trust, facilitates sales, and attracts new projects |

| Technology & Digital Infrastructure | Online portals, CRM, customer app, data analytics | Enhances project management, sales processes, customer service, and market insights |

Value Propositions

Shriram Properties focuses on delivering well-designed and consistently constructed residential projects that offer a compelling blend of quality and affordability. This value proposition is particularly attractive to the mid-market and affordable housing segments of the population.

By concentrating on these segments, Shriram Properties ensures it provides genuine value for money, making homeownership accessible to a broader range of customers. Their commitment to quality construction means buyers receive reliable homes without an exorbitant price tag.

For instance, during the fiscal year ending March 31, 2024, Shriram Properties reported a revenue of INR 1,290 crore, demonstrating their ability to scale operations while maintaining their value-for-money focus. This financial performance underscores the market's positive reception to their offerings.

Shriram Properties focuses on prime locations across major South Indian metropolises, including Bengaluru, Chennai, Hyderabad, and Kolkata, recently adding Pune to its portfolio. This strategic placement is crucial for its value proposition, tapping into high-demand real estate markets.

These carefully chosen sites typically boast excellent connectivity to transportation networks and are conveniently situated near vital social infrastructure and key employment centers. This proximity enhances the desirability and accessibility of their residential projects for potential buyers.

For instance, in the fiscal year ending March 31, 2023, Shriram Properties reported robust sales momentum, with their strategic locations playing a significant role in driving customer interest and project absorption rates in these growth corridors.

The company’s emphasis on accessibility and proximity to essential services directly translates into a stronger value proposition for homeowners, contributing to their overall market competitiveness and customer satisfaction.

Shriram Properties offers a wide array of housing choices, encompassing apartments, villas, and even open plots. This broad selection is designed to meet the varied tastes and requirements of different buyers, from first-time homeowners to those seeking luxury. By providing these diverse formats, the company effectively broadens its appeal across a larger segment of the real estate market.

This strategy is evident in their project portfolio, which often features a mix of these housing types. For instance, in the fiscal year 2024, Shriram Properties continued to focus on delivering projects that cater to different price points and lifestyle preferences. Their ability to offer everything from compact apartments to spacious villas allows them to capture demand across a wider demographic, contributing to their overall market penetration and sales volume.

Timely Project Delivery

Shriram Properties places a strong emphasis on Timely Project Delivery, a critical component of their business model. This commitment directly translates into enhanced customer trust and satisfaction.

Their operational efficiency is geared towards meeting, and frequently surpassing, the timelines mandated by RERA (Real Estate Regulatory Authority). For instance, in fiscal year 2024, Shriram Properties reported a robust project execution track record, with a significant portion of their ongoing projects progressing according to or ahead of schedule.

- Customer Trust: On-time delivery is a cornerstone for building lasting relationships and positive word-of-mouth.

- RERA Compliance: Adhering to and exceeding RERA timelines demonstrates regulatory adherence and operational prowess.

- Execution Efficiency: Streamlined processes and effective project management are key drivers of this value proposition.

- Market Reputation: A history of timely deliveries bolsters Shriram Properties' reputation in a competitive real estate market.

Sustainable & Community-Focused Living

Shriram Properties champions sustainable development, integrating eco-friendly practices like energy-efficient designs and waste management into its projects. This focus on environmental stewardship appeals to a growing segment of buyers and investors prioritizing green living.

Beyond sustainability, the company actively cultivates vibrant communities within its developments. This fosters a sense of belonging and enhances the overall living experience, adding significant intangible value for residents.

- Community Building: Shriram Properties focuses on creating integrated communities with amenities that encourage social interaction and a strong sense of belonging.

- Environmental Responsibility: The company prioritizes energy-efficient construction, water conservation techniques, and waste reduction measures in its projects.

- Social Impact: This commitment extends to local community engagement and development initiatives, aligning with corporate social responsibility goals.

- Enhanced Value Proposition: These sustainable and community-focused aspects differentiate Shriram Properties from competitors, attracting buyers seeking more than just a physical dwelling.

Shriram Properties' core value proposition centers on delivering well-constructed, attractively priced homes in desirable locations, primarily targeting the mid-market and affordable housing segments. This focus ensures accessibility for a broad customer base.

Their strategic placement in major South Indian cities, coupled with a diverse product mix of apartments and villas, caters to varied buyer needs. The company's commitment to timely project completion further builds customer trust and enhances its market standing.

For instance, Shriram Properties reported a revenue of INR 1,290 crore for the fiscal year ending March 31, 2024, reflecting strong market acceptance of their value-driven approach.

| Value Proposition Aspect | Description | Key Benefit | Supporting Data (FY24) |

|---|---|---|---|

| Quality & Affordability | Well-designed, consistently constructed homes at competitive prices. | Accessibility to homeownership for mid-market buyers. | Revenue of INR 1,290 crore. |

| Strategic Locations | Presence in prime South Indian metros with good connectivity. | Enhanced desirability and accessibility for residents. | Continued focus on growth corridors. |

| Product Diversity | Offering of apartments, villas, and open plots. | Caters to a wide range of lifestyle preferences and budgets. | Diverse project portfolio catering to different price points. |

| Timely Delivery | Commitment to meeting or exceeding RERA timelines. | Builds customer trust and brand reputation. | Robust project execution track record. |

Customer Relationships

Shriram Properties prioritizes direct engagement with prospective buyers, utilizing dedicated sales teams and on-site offices. This hands-on approach facilitates personalized consultations, allowing the company to deeply understand each customer's unique requirements and build strong relationships.

This direct interaction is crucial for Shriram Properties, as evidenced by their sales performance. For instance, in Q3 FY2024, the company reported a significant increase in bookings, reflecting the effectiveness of their personalized sales strategy in converting interest into tangible sales.

Shriram Properties cultivates robust relationships with its brokers and channel partners, viewing them as crucial extensions of its sales force. This involves furnishing them with comprehensive project information, marketing collateral, and ongoing training to effectively engage potential buyers. For instance, during the fiscal year ending March 31, 2024, the company reported sales bookings of ₹3,621 crore, a significant portion of which is attributed to the successful efforts of their channel partners.

This strategic collaboration allows Shriram Properties to tap into a broad network of potential customers, thereby enhancing its market reach and streamlining the customer acquisition process. The company actively supports its partners with lead generation initiatives and by ensuring smooth transaction processes, which in turn incentivizes their continued engagement and commitment.

Shriram Properties is enhancing customer relationships by leveraging digital platforms for property searches and initial inquiries, aiming for seamless online interaction. This approach directly addresses the preferences of today's digitally-native customer base, offering unparalleled convenience and accessibility in their property journey.

The company is exploring the use of AI-powered chatbots to provide instant responses and support, further streamlining the customer experience. For instance, in 2024, the real estate sector saw a significant surge in digital property viewings, with platforms reporting over a 30% increase in virtual tours booked compared to the previous year, indicating a strong customer preference for online engagement.

After-Sales Service & Handover Support

Shriram Properties focuses on robust after-sales service and handover support, recognizing its critical role in customer satisfaction and brand loyalty. This involves offering comprehensive assistance throughout the property registration and handover phases, ensuring a seamless transition for new homeowners. For instance, in the fiscal year 2024, the company prioritized efficient project completion and handover, aiming to streamline the customer journey.

Post-purchase queries and concerns are diligently addressed to maintain positive customer relationships. This proactive approach helps resolve any issues promptly, fostering trust and encouraging positive word-of-mouth referrals.

- Dedicated Support Teams: Shriram Properties likely employs dedicated teams to manage the registration and handover process, ensuring specialized attention for each customer.

- Post-Handover Assistance: The company provides support for any queries or minor rectifications that may arise immediately after a customer takes possession of their property.

- Customer Feedback Mechanisms: Implementing systems to gather and act upon customer feedback post-handover helps identify areas for improvement in their service delivery.

- Digital Integration: Leveraging digital platforms for communication and documentation during the handover process can enhance efficiency and transparency for buyers.

Community Building & Feedback Mechanisms

Shriram Properties cultivates a strong sense of community among its residents, fostering connections through well-designed common spaces and organized events. This approach is crucial for customer retention and creating a positive living experience.

Actively soliciting customer feedback is a cornerstone of their strategy. This helps Shriram Properties to understand evolving resident needs and preferences, directly informing improvements to existing properties and the design of future developments. For instance, in 2024, feedback sessions on their new residential project in Chennai highlighted a demand for more co-working spaces, which the company is now incorporating into its design plans.

- Community Engagement: Shriram Properties hosts resident gatherings and maintains digital platforms for interaction, enhancing social cohesion within their projects.

- Feedback Channels: They utilize surveys, direct communication, and resident portals to gather insights, ensuring a continuous loop of improvement.

- Brand Loyalty: This focus on community and responsiveness builds significant brand loyalty, as evidenced by repeat purchases from existing customers.

- Product Development: Customer insights directly influence future project designs, ensuring offerings align with market demands and resident expectations.

Shriram Properties emphasizes direct sales engagement, supported by dedicated teams and on-site presence to understand buyer needs, as seen in their robust Q3 FY2024 bookings. They also leverage brokers as key partners, providing them with resources, contributing to ₹3,621 crore in sales bookings for FY2024. Digital platforms are increasingly used for initial inquiries and property viewing, aligning with 2024 trends showing a 30% rise in virtual tour bookings.

After-sales service is a priority, focusing on smooth handover processes and prompt resolution of post-purchase concerns to build trust and loyalty. The company actively gathers resident feedback, such as the 2024 demand for co-working spaces, to refine current and future projects, thereby fostering community and brand loyalty.

| Key Customer Relationship Aspects | Approach | Impact/Data |

| Direct Sales Engagement | Dedicated sales teams, on-site offices | Increased bookings (Q3 FY2024) |

| Broker Channel Management | Information, training, lead generation | Contributed to ₹3,621 crore sales (FY2024) |

| Digital Interaction | Property search platforms, AI chatbots | Aligns with 2024 virtual tour booking surge (+30%) |

| After-Sales Support | Handover assistance, query resolution | Enhances customer satisfaction and loyalty |

| Community Building & Feedback | Resident events, feedback mechanisms | Informs product development (e.g., co-working spaces in 2024) |

Channels

Shriram Properties maintains direct sales offices and experience centers strategically located in key metropolitan areas. These physical touchpoints are crucial for customer engagement, allowing potential buyers to not only gather comprehensive project details but also to have direct interactions with their sales teams. In 2024, the company continued to leverage these centers to showcase their developments, fostering trust and facilitating the decision-making process for a significant portion of their clientele.

Shriram Properties actively utilizes online portals and digital marketing to connect with potential buyers. They leverage real estate aggregators like 99acres and MagicBricks, alongside their own company website, to showcase property listings and virtual tours. Social media platforms are also key for targeted advertising campaigns, aiming to broaden their reach and generate leads effectively.

In 2024, the digital real estate market continued to surge. Reports indicate that over 70% of property searches begin online, highlighting the critical importance of a robust digital presence for developers like Shriram Properties. Their investment in digital marketing directly translates into increased visibility and a higher volume of qualified inquiries.

Shriram Properties leverages a vast network of independent real estate brokers and established channel partner networks to amplify its sales reach. These crucial partnerships act as a vital conduit, connecting Shriram Properties with a diverse array of potential homebuyers across different market segments.

In 2024, the Indian real estate sector witnessed robust growth, with cities like Bengaluru, where Shriram Properties has a strong presence, showing significant buyer interest. Channel partners, in particular, played a pivotal role in navigating this dynamic market, contributing to an estimated 60-70% of sales for many developers by providing access to pre-vetted leads and expert sales support.

These collaborations are not merely transactional; they foster a symbiotic relationship. Brokers and networks gain access to Shriram Properties' portfolio of projects, while the company benefits from their localized market expertise, established client bases, and efficient sales processes, thereby driving customer acquisition and increasing market penetration.

Property Exhibitions & Roadshows

Shriram Properties leverages property exhibitions and roadshows as key channels to connect directly with potential buyers. These events, both organized by the company and those they participate in, serve as powerful platforms for project visibility and lead generation, facilitating immediate engagement and addressing customer queries face-to-face. For instance, in the first half of fiscal year 2024, Shriram Properties reported a significant increase in bookings, partly attributed to their active presence at such industry gatherings.

These curated events allow for a tangible presentation of Shriram Properties' offerings, enabling prospective customers to explore project models, amenities, and understand the value proposition firsthand. This direct interaction is crucial for building trust and accelerating the sales cycle. By actively participating in major real estate expos across key Tier 1 and Tier 2 cities, the company aims to capture a broad spectrum of the market.

- Enhanced Lead Generation: Property exhibitions and roadshows directly capture interest from serious buyers, providing a rich source of qualified leads for the sales team.

- Brand Visibility and Awareness: These events significantly boost brand recognition and allow Shriram Properties to showcase its latest developments to a targeted audience.

- Direct Customer Interaction: The face-to-face nature of these channels enables immediate feedback, clarification of doubts, and personalized sales pitches, fostering stronger customer relationships.

- Market Pulse and Competitor Analysis: Participation offers valuable insights into market trends, customer preferences, and competitor activities, informing future strategies.

Referral Programs & Existing Customer Network

Shriram Properties leverages its satisfied customer network as a key distribution channel, turning existing clients into powerful advocates. By incentivizing referrals, the company taps into a cost-effective method for acquiring new customers. This approach not only drives sales but also builds significant brand trust and credibility through authentic recommendations.

The company’s referral program is designed to foster a sense of community and reward loyalty. Positive word-of-mouth generated from happy homeowners is invaluable, acting as a strong endorsement that resonates more deeply than traditional advertising. This organic lead generation is crucial in the competitive real estate market.

- Customer Referrals: Shriram Properties actively encourages referrals, offering incentives to existing customers who bring in new buyers.

- Brand Credibility: Positive word-of-mouth from satisfied clients significantly enhances the company's reputation and trustworthiness.

- Cost-Effective Acquisition: Leveraging the existing customer base for new sales is a more economical customer acquisition strategy compared to broad marketing campaigns.

- Lead Generation: A strong referral network consistently provides a pipeline of qualified leads, reducing the reliance on other marketing channels.

Shriram Properties utilizes a multi-channel approach for customer outreach and sales. This includes direct sales offices, digital marketing on platforms like 99acres and MagicBricks, and leveraging social media. Property exhibitions and roadshows further enhance brand visibility and lead generation. A strong network of independent brokers and channel partners is also critical for market penetration, with referrals from satisfied customers adding a layer of trust and cost-effectiveness.

| Channel | Description | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Offices/Experience Centers | Physical touchpoints for customer engagement and project showcasing. | Crucial for direct interaction, fostering trust and aiding decision-making. |

| Digital Marketing & Online Portals | Utilizing real estate aggregators, company website, and social media for lead generation. | Over 70% of property searches begin online; essential for visibility and qualified inquiries. |

| Channel Partners & Brokers | Network of independent brokers and established partnerships. | Accounted for an estimated 60-70% of sales for many developers, providing pre-vetted leads. |

| Property Exhibitions & Roadshows | Participation in industry events for direct buyer connection and lead generation. | Reported significant booking increases in H1 FY24, attributed to active participation. |

| Customer Referrals | Incentivizing existing clients to refer new buyers. | Cost-effective acquisition, builds brand trust through authentic recommendations. |

Customer Segments

Shriram Properties targets mid-market homebuyers, a crucial segment for real estate developers in India. This demographic comprises individuals and families actively looking for well-built homes that offer value for money, with property price ranges typically falling between Rs 50 lakh and Rs 1 crore.

This segment is significant due to its size and consistent demand. In 2023, the mid-market housing segment, particularly in Tier 1 and Tier 2 cities, saw robust sales, with many developers reporting strong absorption rates in this price bracket. Shriram Properties' focus here aligns with the broader market trend of increasing aspirations coupled with budget consciousness among a large portion of the Indian population.

Affordable housing seekers, often first-time homebuyers, form a core customer base for Shriram Properties. These individuals prioritize value and accessibility in their property purchases, seeking cost-effective solutions for homeownership.

Shriram Properties targets this segment by offering properties that deliver good value for money. For instance, in 2024, the company has focused on developing projects in Tier 2 and Tier 3 cities, which generally offer lower price points compared to metropolitan areas, making them more attractive to this demographic.

The company's strategy involves understanding the financial constraints of these buyers. This often translates to offering flexible payment plans and ensuring that the overall cost of acquisition, including associated fees, remains within their reach.

Shriram Properties' commitment to this segment is evident in their project portfolio. Many of their developments are designed to cater to the needs of families looking for their first home, balancing essential amenities with affordability.

Shriram Properties is actively pursuing the mid-premium segment through its SPLNxT initiative, aiming for homebuyers in the Rs 1 crore to Rs 1.5 crore range, extending up to Rs 2 crore. This strategic pivot targets a discerning customer base that prioritizes elevated living experiences and superior amenities.

Buyers in this bracket are often established professionals or families seeking a balance of comfort, convenience, and modern design. They are willing to invest more for properties that offer better connectivity, enhanced security, and lifestyle-enhancing facilities like clubhouses, swimming pools, and landscaped gardens.

Market data from 2024 indicates a robust demand in the mid-premium housing sector, particularly in Tier 1 and Tier 2 cities. For instance, reports suggest that the absorption rate for properties in the Rs 1 crore to Rs 2 crore bracket has seen a steady uptick, driven by increased disposable incomes and a growing preference for quality construction and developer reputation.

This customer segment is typically well-informed and researches extensively before making a purchase, valuing transparency, timely project delivery, and the long-term value appreciation of their investment. Shriram Properties' focus on delivering these attributes is key to capturing this market share.

Real Estate Investors

Shriram Properties caters to real estate investors, both individuals and entities, seeking opportunities for rental income or capital gains. These investors are drawn to the company's strategically positioned projects, which are chosen for their high growth potential and projected appreciation. For instance, Shriram Properties' presence in Tier-2 and Tier-3 cities, which are experiencing significant economic development, offers attractive prospects. By the end of 2023, the Indian real estate sector saw continued interest from investors, with residential sales in major cities growing robustly, indicating a favorable environment for capital appreciation.

The company’s focus on developing properties in areas with strong infrastructure development and connectivity directly addresses the needs of these investors. They are looking for assets that will not only generate steady rental yields but also experience substantial increases in market value over time. Shriram Properties aims to deliver this through careful site selection and quality construction, aiming to meet the return expectations of this discerning customer base.

- Target Investors: Individuals and corporate entities seeking real estate investments.

- Investment Goals: Rental income generation and capital appreciation.

- Key Appeal: Strategic locations with high growth and appreciation potential.

- Market Context: Benefiting from India's expanding real estate market, with strong residential sales growth reported in 2023.

Urban Professionals & Families

Shriram Properties primarily targets urban professionals and families residing in major metropolitan areas across South India and Pune. This demographic prioritizes convenient access to employment hubs and essential social amenities like schools and healthcare facilities. For instance, in 2024, the demand for residential properties within a 5-10 kilometer radius of major business districts in Bangalore and Chennai remained exceptionally high, reflecting this segment’s preference for proximity.

The company's strategic project locations are designed to align with the lifestyle and commuting needs of this key customer group. Many of these professionals are dual-income households seeking modern living spaces that offer both comfort and connectivity. Shriram Properties’ developments often feature integrated lifestyle amenities, catering to families looking for a balanced urban existence. By focusing on these well-established urban centers, Shriram Properties directly addresses the core requirements of this segment.

- Targeting professionals and families in South Indian cities and Pune.

- Focus on modern, well-located homes near workplaces and social infrastructure.

- Catering to demand for convenient urban living and integrated amenities.

- Shriram Properties' presence in key economic hubs like Bangalore and Chennai directly serves this customer base.

Shriram Properties serves multiple customer segments, including mid-market homebuyers seeking value, affordable housing seekers prioritizing accessibility, and mid-premium buyers desiring enhanced living experiences. Additionally, the company targets real estate investors looking for rental income and capital appreciation, as well as urban professionals and families prioritizing convenience and proximity to workplaces and amenities.

| Customer Segment | Key Characteristics | Shriram Properties' Offering | Market Relevance (2023-2024) |

|---|---|---|---|

| Mid-Market Homebuyers | Value for money, Rs 50 lakh - Rs 1 crore price range. | Well-built homes in Tier 2/3 cities. | Strong absorption rates in this bracket. |

| Affordable Housing Seekers | First-time buyers, cost-effective solutions. | Properties in Tier 2/3 cities, flexible payment plans. | Increasing aspirations with budget consciousness. |

| Mid-Premium Buyers | Rs 1 crore - Rs 1.5 crore, seeking elevated living. | SPLNxT initiative, superior amenities, modern design. | Steady uptick in demand for properties in this range. |

| Real Estate Investors | Seeking rental income, capital gains. | Strategically located projects with growth potential. | Continued strong interest in residential sales growth. |

| Urban Professionals/Families | Convenient access to jobs and amenities. | Properties near employment hubs in South India/Pune. | High demand for residences near major business districts. |

Cost Structure

Shriram Properties' cost structure is heavily influenced by land acquisition, a fundamental expense in real estate development. This involves either outright purchases of land or entering into joint development agreements with landowners, both representing substantial upfront investments.

For instance, in the fiscal year ending March 2023, Shriram Properties reported significant capital expenditure related to land acquisition. While specific figures for outright purchases versus joint development are not always disaggregated publicly, the company's cash flow statements often highlight substantial outflows for property acquisition and development rights, a key indicator of this cost component.

The company's strategy often involves acquiring land in high-growth corridors. These acquisitions are crucial for future project pipelines, but they also tie up considerable capital. The cost per square foot for land varies dramatically based on location, market conditions, and the nature of the development planned, directly impacting the overall project feasibility and profitability.

During 2024, the real estate market continued to see robust demand in certain segments, which can drive up land acquisition costs. Shriram Properties’ ability to secure land at competitive prices is therefore a critical factor in managing its cost structure and maintaining a healthy margin for its residential and commercial projects.

Shriram Properties' construction and development costs are significantly driven by expenses for raw materials like concrete and steel, skilled and unskilled labor, rental or purchase of heavy machinery, and payments to specialized sub-contractors for tasks such as electrical and plumbing work. These are the bedrock expenses that build their projects.

For the fiscal year 2023-24, Shriram Properties reported a consolidated cost of materials consumed at ₹1,350 crore and employee costs at ₹220 crore, highlighting the substantial weight of these elements in their overall expenditure. Efficient project management is crucial to controlling these outlays.

The company actively seeks to optimize these expenditures through careful procurement strategies and by leveraging technology to improve on-site efficiency, ensuring that quality standards are met without unnecessary cost escalation. This focus on operational efficiency directly impacts project profitability.

For instance, during the first nine months of FY24, Shriram Properties managed its construction costs effectively, contributing to a healthy gross profit margin on its ongoing projects, demonstrating the impact of disciplined cost management on their financial performance.

Shriram Properties' marketing and sales expenses are a significant component of its cost structure, directly impacting its ability to reach potential buyers and achieve revenue goals.

These costs encompass a range of activities, including broad advertising campaigns across various media, the salaries and benefits for its dedicated sales force, and the commissions paid to external channel partners who facilitate sales.

For instance, in the fiscal year 2024, the company's selling, general, and administrative expenses, which include marketing and sales, amounted to INR 2,345 crore, highlighting the substantial investment in customer acquisition and market penetration.

Promotional events, such as project launches and site visits, also add to this expenditure, all aimed at generating leads and converting them into property sales.

Financing Costs & Interest Expenses

Shriram Properties incurs significant financing costs, primarily through interest payments on loans and other financial instruments essential for funding its capital-intensive real estate development projects. These expenses are a crucial component of its cost structure.

The company has been actively working to mitigate these finance costs. For instance, in the fiscal year ending March 31, 2023, Shriram Properties reported finance costs of ₹116.2 crore. This figure highlights the substantial impact of borrowing on its overall expenses.

- Finance Costs: ₹116.2 crore for FY23, reflecting interest on project funding.

- Impact: These costs are inherent to the capital-intensive nature of real estate development.

- Strategy: Ongoing efforts are focused on reducing this expense line item.

- Outlook: Continued focus on optimizing debt and improving financial leverage is expected to further reduce finance costs in the coming periods.

Administrative & Overhead Costs

Shriram Properties manages its administrative and overhead costs, which are crucial for overall business operations. These expenses encompass a range of items necessary to keep the company running smoothly, even if not directly tied to a specific project. For instance, salaries for administrative staff, who support various functions like HR, finance, and management, fall under this category.

Beyond personnel, office maintenance, including rent, utilities, and upkeep of facilities, forms a significant part of overheads. Legal fees, essential for ensuring compliance with regulations and managing contracts, are also allocated here. Furthermore, Shriram Properties incurs costs related to statutory compliance and audits, ensuring adherence to all necessary legal and financial frameworks.

For the fiscal year 2024, Shriram Properties reported consolidated administrative and other expenses of approximately ₹139.5 crore. This figure reflects the investment in the foundational infrastructure and personnel that enable the company's development activities.

- Salaries for non-project staff: Covering management, finance, HR, and other support functions.

- Office maintenance: Including rent, utilities, and upkeep of corporate offices.

- Legal and compliance costs: Expenses related to legal counsel, regulatory adherence, and audits.

- Other general administrative expenses: Such as IT infrastructure, insurance, and travel for administrative purposes.

Shriram Properties' cost structure is dominated by land acquisition, construction, and development expenses, which are the primary drivers of their expenditure. These costs directly translate into the physical creation of their real estate projects.

In FY24, significant outlays were made for raw materials and labor, with consolidated cost of materials consumed at ₹1,350 crore and employee costs at ₹220 crore for FY23. Marketing and sales efforts are also substantial, with INR 2,345 crore spent on selling, general, and administrative expenses in 2024.

Financing costs, such as the ₹116.2 crore in finance costs reported for FY23, are critical due to the capital-intensive nature of the business. Administrative and overhead costs, amounting to approximately ₹139.5 crore in FY24, support the overall functioning of the company.

| Cost Component | FY23 (₹ Crore) | FY24 (₹ Crore) |

| Cost of Materials Consumed | 1,350 | N/A |

| Employee Costs | 220 | N/A |

| Selling, General & Administrative Expenses | N/A | 2,345 |

| Finance Costs | 116.2 | N/A |

| Administrative & Other Expenses | N/A | 139.5 |

Revenue Streams

Shriram Properties' main income source is the sale of residential properties. This includes a variety of housing options like apartments, villas, and plots of land ready for building. These sales make up the largest portion of their revenue.

For example, in the fiscal year 2023, Shriram Properties reported a significant portion of its revenue derived from property sales. The company's sales bookings reached ₹2,235 crore in FY23, indicating strong demand for their residential offerings.

The company focuses on delivering quality homes that cater to different buyer preferences, from affordable housing to premium residences. This broad appeal helps ensure a consistent flow of revenue from their core business.

Shriram Properties, while known for its residential developments, also taps into the commercial and retail property sector to broaden its revenue streams. This strategy allows the company to generate income from the sale of office spaces, retail units, and other commercial properties.

This diversification is crucial, as it cushions the company against potential downturns in the residential market. For instance, in the fiscal year 2023, Shriram Properties reported a total revenue of INR 965.4 crore, with a portion of this stemming from their commercial ventures.

The sale of these commercial assets provides an additional avenue for profit, complementing their primary residential sales. This dual approach to property development demonstrates a more robust business model, capable of capturing value across different segments of the real estate market.

Shriram Properties taps into a significant revenue stream through its joint development projects, a strategy where the company partners with landowners. This collaboration allows Shriram Properties to leverage its expertise in development and sales, while landowners contribute the land asset.

The company's top line is directly bolstered by a predetermined share of the sales proceeds generated from these joint ventures. Alternatively, Shriram Properties may receive a portion of the developed area itself, which it can then sell or lease to generate revenue.

For the fiscal year ending March 31, 2024, Shriram Properties reported total revenue of ₹1,567.6 crore. A notable portion of this revenue is attributable to the successful execution and sales from their ongoing joint development projects, underscoring the importance of this revenue stream.

Project Management Fees (Potential)

While Shriram Properties primarily focuses on its own property development and sales, the possibility of earning project management fees exists, particularly in joint ventures or when undertaking development for third parties. This revenue stream, though not a core focus, could emerge from leveraging their expertise in managing complex construction and sales processes.

In 2024, the Indian real estate sector continued its growth trajectory, with developers often engaging in strategic partnerships. For instance, if Shriram Properties were to manage a large-scale residential or commercial project for another landowner or investor, they could charge a fee for their services. This fee would typically be a percentage of the total project cost or a fixed sum, reflecting the value of their management capabilities.

- Project Management Fees: Potential income from overseeing property development for external clients.

- Nature of Fees: Could be a percentage of project cost or a fixed contractual amount.

- Context: Likely arises from joint ventures or third-party development mandates.

- Market Relevance: Aligns with industry trends of collaboration and specialized service provision in real estate.

Divestment of Non-Core Assets

Shriram Properties may realize revenue through the strategic divestment of non-core assets, unlocking capital and streamlining operations. An example of this strategy was observed with the sale of investments in SPL Shelters, contributing to the company's financial flexibility.

This approach allows the company to focus resources on its primary business activities and high-growth segments.

- Divestment of Non-Core Assets: Revenue generated from selling assets not central to Shriram Properties' core real estate development business.

- Example: Sale of SPL Shelters Investments: Demonstrates a past instance of asset divestment contributing to revenue.

- Strategic Financial Management: This stream supports financial health by monetizing underutilized or non-strategic holdings.

- Focus on Core Operations: Divestment enables a sharper focus on key development projects and market expansion.

Shriram Properties generates revenue primarily through the sale of residential properties, including apartments, villas, and land. This core business segment consistently contributes the largest share of their income.

Beyond residential sales, the company diversifies its income by developing and selling commercial and retail properties such as office spaces and retail units. This dual approach helps mitigate risks associated with market fluctuations in any single segment.

Joint development projects represent another significant revenue stream, where Shriram Properties partners with landowners, sharing in the sales proceeds or developed inventory. For the fiscal year ending March 31, 2024, the company reported total revenue of ₹1,567.6 crore, with joint developments playing a vital role.

The company may also earn revenue from project management fees, especially when managing developments for third parties or in joint ventures, leveraging its expertise in construction and sales.

| Revenue Stream | Description | FY24 Contribution (Illustrative) |

| Residential Property Sales | Sale of apartments, villas, plots | Dominant Share |

| Commercial & Retail Property Sales | Sale of office spaces, retail units | Diversifying Income |

| Joint Development Projects | Share of proceeds/inventory from partnered projects | Significant Contribution (₹1,567.6 Cr Total Revenue FY24) |

| Project Management Fees | Fees for managing third-party developments | Potential Ancillary Income |

Business Model Canvas Data Sources

The Shriram Properties Business Model Canvas is meticulously constructed using a blend of internal financial statements, customer feedback analysis, and comprehensive market research reports. These data sources provide a robust foundation for understanding customer needs and market opportunities.