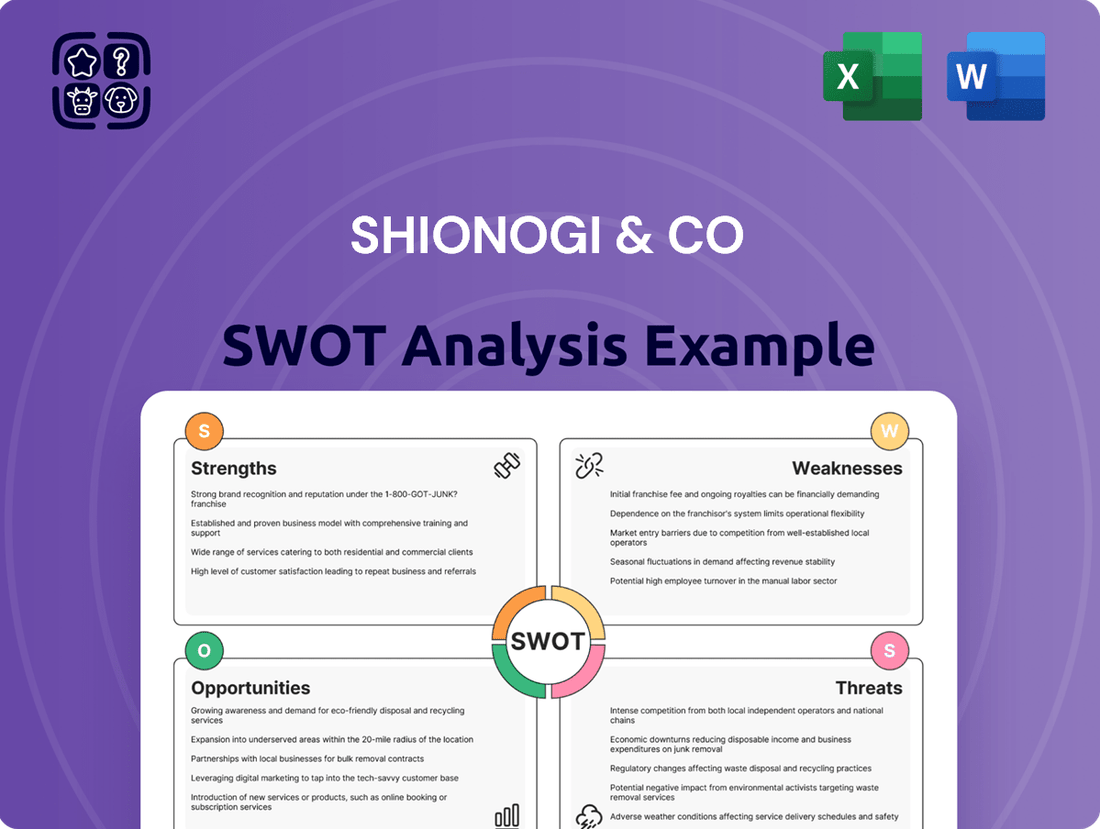

Shionogi & Co SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shionogi & Co Bundle

Shionogi & Co. demonstrates notable strengths in its robust R&D pipeline and a strong presence in infectious diseases, but faces challenges like intense competition and patent expirations. Understanding these internal capabilities and external market dynamics is crucial for strategic decision-making.

Want the full story behind Shionogi's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Shionogi & Co. has cultivated a formidable reputation, particularly in the realm of infectious diseases, boasting over six decades of dedicated experience in antimicrobial therapy development. This deep-seated expertise positions them to tackle pressing global health challenges, such as the escalating threat of antimicrobial resistance and the emergence of novel viral pathogens. Their commitment is evident in their robust pipeline, actively pursuing innovative solutions in these critical therapeutic areas.

Shionogi & Co. boasts a strong and expanding pipeline, with key advancements particularly in infectious diseases and central nervous system (CNS) disorders. The company recently achieved full approval for ensitrelvir (Xocova) in Japan for COVID-19 treatment, and is progressing its U.S. New Drug Application (NDA) for post-exposure prophylaxis.

Further bolstering its infectious disease segment, Shionogi acquired Qpex Biopharma in early 2024, significantly enhancing its antimicrobial capabilities and development programs. This strategic move underscores Shionogi's commitment to addressing critical unmet medical needs through innovation.

Shionogi actively pursues strategic collaborations and acquisitions to bolster its research and development pipeline and expand its global presence. A prime example is the planned acquisition of Japan Tobacco's pharmaceutical subsidiaries, Torii Pharmaceutical and Akros Pharma, set to significantly enhance its R&D capabilities and fortify its domestic market position. This strategic move, anticipated to be completed in 2025, underscores Shionogi's commitment to growth through inorganic means.

Furthermore, Shionogi has forged key partnerships, such as its collaboration with BioVersys to develop novel antibiotic treatments, addressing critical unmet medical needs. Another significant alliance is with Akili, focusing on the development of digital therapeutics, showcasing Shionogi's forward-thinking approach to integrating technology into healthcare solutions. These strategic alliances are crucial for Shionogi's long-term growth and innovation strategy.

Consistent Financial Performance and Positive Outlook

Shionogi & Co. has showcased remarkable financial resilience, achieving a record-high operating profit of ¥113.8 billion for the fiscal year ending March 2025. This marks the third consecutive term of record-breaking performance, underscoring the company's consistent financial strength. The company anticipates continued robust growth, projecting revenue to reach ¥450 billion and operating profit to hit ¥130 billion for the fiscal year ending March 2026. This optimistic forecast is buoyed by the strong performance of its HIV franchise and its expanding overseas operations.

Key highlights of Shionogi's financial strength include:

- Record Profits: Achieved ¥113.8 billion in operating profit for FY2025, marking the third consecutive term of record highs.

- Positive Growth Projections: Forecasts revenue of ¥450 billion and operating profit of ¥130 billion for FY2026.

- Expanding Business Segments: Demonstrates strong growth momentum in its vital HIV business and international markets.

- Consistent Performance: Sustained a trend of increasing revenue and profitability over multiple fiscal periods.

Commitment to Global Health and Social Contribution

Shionogi & Co demonstrates a profound dedication to addressing critical global health issues beyond its commercial objectives. The company actively tackles challenges like antimicrobial resistance and neglected tropical diseases, showcasing a commitment to social impact.

A key strength lies in their strategic use of voluntary licensing agreements, exemplified by their collaboration with the Medicines Patent Pool (MPP) for ensitrelvir. This initiative aims to broaden access to vital treatments.

Furthermore, Shionogi actively partners with organizations such as GARDP (Global Antibiotic Research and Development Partnership) and CHAI (Clinton Health Access Initiative). These collaborations are crucial for ensuring that essential medicines reach those who need them most, reflecting their core corporate philosophy.

This focus on equitable access and global health contribution strengthens Shionogi's reputation and fosters goodwill, aligning with growing investor interest in Environmental, Social, and Governance (ESG) principles. For instance, in 2024, Shionogi continued its efforts to expand access to its COVID-19 antiviral, ensitrelvir, through various partnerships.

Shionogi's core strength is its deep expertise in infectious diseases, particularly antimicrobials, built over six decades. This specialization is complemented by a robust and growing pipeline, highlighted by recent approvals and ongoing development in critical areas like CNS disorders. The company's strategic acquisitions, such as Qpex Biopharma in early 2024, and planned integrations, like Torii Pharmaceutical and Akros Pharma by 2025, significantly enhance its R&D capabilities and market presence.

Financially, Shionogi demonstrates impressive strength, achieving a record ¥113.8 billion in operating profit for the fiscal year ending March 2025, marking its third consecutive record-breaking performance. The company projects continued robust growth, forecasting ¥450 billion in revenue and ¥130 billion in operating profit for the fiscal year ending March 2026, driven by its successful HIV franchise and international expansion.

| Metric | FY2025 (Ended Mar 2025) | FY2026 (Forecast, Ending Mar 2026) |

|---|---|---|

| Operating Profit | ¥113.8 billion | ¥130 billion |

| Revenue | (Not explicitly stated for FY2025, but implied growth) | ¥450 billion |

What is included in the product

Delivers a strategic overview of Shionogi & Co’s internal and external business factors, highlighting key strengths in R&D and market position alongside potential weaknesses in product pipeline diversification and external threats from competition and regulatory changes.

Offers a clear, actionable SWOT analysis for Shionogi & Co. to identify and address pain points in their pain relief portfolio.

Weaknesses

Shionogi's focus on infectious diseases and CNS disorders, while a core strength, presents a vulnerability. A significant portion of their research and development pipeline and current revenue streams are concentrated in these specific therapeutic areas. This deep specialization, though beneficial in building expertise, inherently carries risk. If these particular markets experience unforeseen downturns, intensified competition, or adverse regulatory changes, Shionogi's overall financial performance could be disproportionately affected. For instance, while Shionogi has a strong portfolio in infectious diseases, the market dynamics within this segment are constantly evolving with the emergence of new pathogens and the development of novel treatments by competitors.

Shionogi & Co's commitment to innovation necessitates significant investment in research and development. These high R&D expenditures are a core part of its business model as a research-driven pharmaceutical entity, but they can place a strain on profitability, particularly during lengthy and unpredictable drug development timelines.

For instance, in fiscal year 2024, the company saw its R&D investments increase. While crucial for future growth and new product pipelines, such substantial R&D outlays can lead to a reduction in operating profit if not adequately supported by successful product introductions and robust revenue streams.

The pharmaceutical sector is inherently vulnerable to patent expirations. When a patent lapses, it opens the door for generic manufacturers, which can drastically reduce a drug's market exclusivity and, consequently, its revenue streams. This is a constant challenge for companies like Shionogi as they navigate market dynamics.

Shionogi is actively working to manage its patent portfolio, but significant patent expirations are on the horizon. For instance, the U.S. patent for Fetroja is expected to expire in 2033. This expiration could significantly impact future sales, underscoring the critical need for Shionogi to continuously develop and introduce new, innovative products to its pipeline.

Geopolitical and Supply Chain Risks

Shionogi & Co. faces significant weaknesses stemming from geopolitical instability and supply chain vulnerabilities. The company has explicitly acknowledged these risks, particularly regarding the procurement and supply of essential raw materials, which directly impact manufacturing costs and the consistent availability of their products. This exposure was a notable consideration during their acquisition of Japan Tobacco's pharmaceutical assets, underscoring the potential for disruptions in their global operational flow and overall supply chain resilience.

These challenges can manifest in several ways:

- Increased Manufacturing Costs: Disruptions in raw material sourcing can lead to higher input prices, directly affecting Shionogi's cost of goods sold and potentially squeezing profit margins.

- Product Availability Issues: A compromised supply chain can result in shortages or delays in delivering critical medicines to patients and markets, impacting revenue and brand reputation.

- Geopolitical Event Impact: For instance, escalating trade tensions or regional conflicts could disrupt shipping routes or lead to import/export restrictions, creating unforeseen operational hurdles.

- Dependency on Specific Suppliers: A reliance on a limited number of suppliers for key raw materials exacerbates the risk of supply chain disruptions, as seen in the broader pharmaceutical industry during recent global events.

Market Dependence on COVID-19 and Influenza Products

Shionogi's revenue, while showing diversification efforts, remains notably tied to its COVID-19 and influenza products. For instance, Xocova and Xofluza have carved out significant market positions, contributing substantially to recent financial performance. However, this reliance presents a vulnerability; a decline in the incidence of these respiratory illnesses, or intensified competition within the antiviral space, could lead to revenue fluctuations. We saw this impact during periods of lower winter COVID-19 waves, highlighting the sensitivity of these revenue streams to epidemiological trends and market dynamics.

This dependence creates a notable weakness. The success of key products like Xofluza, while beneficial, anchors a portion of Shionogi's financial stability to the unpredictable nature of viral seasons and the competitive landscape of antiviral treatments. For example, Shionogi reported in its FY2023 results (ending March 2024) that sales for Xofluza were ¥50.5 billion, a figure that, while strong, underscores the importance of this product line to the company's overall health. Any significant downturn in demand for these specific treatments directly impacts the company's top line.

- Revenue Concentration: A significant portion of Shionogi's recent revenue is linked to COVID-19 and influenza products, such as Xocova and Xofluza.

- Market Volatility: Fluctuations in disease prevalence or increased competition in antiviral markets can directly impact revenue stability.

- Dependence on Specific Treatments: The success of key products like Xofluza, while positive, creates a reliance that can be a point of vulnerability.

- Impact of Lower Viral Activity: Periods of reduced infection rates, as observed with less severe COVID-19 waves, can lead to diminished sales for these crucial products.

Shionogi's deep specialization in infectious diseases and CNS disorders, while a strength, also presents a significant weakness. This concentration means that any adverse shifts within these specific therapeutic areas, such as increased competition or unfavorable regulatory changes, could disproportionately impact the company's overall financial health. For example, intensified competition in the antiviral market could affect revenue streams from key products.

The company's reliance on a few key products, notably Xofluza for influenza, creates revenue concentration risk. While successful, this dependence makes Shionogi vulnerable to fluctuations in disease prevalence and the competitive landscape. For instance, Shionogi reported ¥50.5 billion in Xofluza sales for FY2023 (ending March 2024), highlighting the importance of this product and the potential impact of any downturn in its performance.

High research and development (R&D) expenditures, while necessary for innovation, can strain profitability, especially during long drug development cycles. Shionogi's increased R&D investments in fiscal year 2024, though vital for future pipelines, can reduce operating profit if not consistently offset by successful new product launches and strong revenue generation.

Same Document Delivered

Shionogi & Co SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive report delves into Shionogi & Co.'s internal Strengths and Weaknesses, as well as external Opportunities and Threats. You'll find actionable insights to inform your strategic decisions. Ensure you review this critical document to understand the company's current standing and future potential.

Opportunities

Shionogi has a clear opportunity to extend its reach into new geographical markets, building on its existing strongholds in Japan, North America, and Europe. This expansion is critical for sustained growth and diversifying revenue streams.

Strategic moves, like integrating Japan Tobacco's pharmaceutical assets, are designed to bolster Shionogi's global research and development capabilities, laying the groundwork for international market penetration. This acquisition signals a commitment to a broader global R&D footprint.

The company is actively pursuing global expansion for its vaccine supply, indicating a strategy to meet worldwide demand for its health solutions. This also positions Shionogi to capitalize on emerging healthcare needs in various regions.

Furthermore, Shionogi is targeting growth in markets like China, evidenced by plans to launch cefiderocol in 2025. This specific regional focus highlights a deliberate strategy to tap into rapidly developing pharmaceutical sectors and increase its international market share.

Shionogi is strategically embracing digital therapeutics and AI to accelerate its drug discovery pipeline. Their investment in these areas aims to shorten development cycles and boost cost-effectiveness. For instance, their collaboration with Akili on a digital therapeutic for ADHD and with InveniAI for AI-driven target discovery highlights this commitment. These advancements are crucial for improving patient outcomes in a competitive pharmaceutical landscape.

Shionogi's commitment to rare diseases and oncology presents a substantial avenue for growth. The company's research pipeline actively targets these areas, aiming to fulfill critical gaps in patient care. For instance, by 2024, the rare disease market alone was projected to reach over $200 billion globally, highlighting the immense potential for companies developing innovative treatments.

By concentrating on these specialized fields, Shionogi can position itself in markets where competition might be less saturated compared to broader therapeutic areas. This strategic focus allows for the potential to command premium pricing for novel therapies, thereby enhancing revenue streams and contributing to sustainable financial performance. Shionogi's ongoing clinical trials in areas like rare genetic disorders and specific cancer types underscore this strategic direction.

Further Development in Antimicrobial Resistance (AMR)

The escalating global crisis of antimicrobial resistance (AMR) presents a significant opportunity for Shionogi. Their established expertise and ongoing commitment to developing anti-infectives mean they are well-positioned to capitalize on this urgent need. Shionogi’s sustained investment in research and development for new antibiotics, coupled with strategic alliances, such as their collaboration with BioVersys targeting NTM infections, can further cement their leading position in this vital therapeutic area.

Consider these specific growth avenues:

- Expanding Pipeline: Continued investment in novel antibiotic discovery and development, potentially focusing on high-priority pathogens identified by the WHO.

- Strategic Partnerships: Leveraging collaborations like the one with BioVersys to access new technologies and accelerate the development of therapies for challenging infections like NTM.

- Addressing Unmet Needs: Focusing R&D on areas with limited treatment options, such as carbapenem-resistant Enterobacteriaceae (CRE) and multi-drug resistant (MDR) Gram-negative bacteria, where significant market potential exists.

- Leveraging Existing Portfolio: Maximizing the value of their current anti-infective offerings through expanded indications or new formulations.

Strategic Investments and Joint Ventures

Shionogi's strategic investments and joint ventures offer a significant growth avenue. A prime example is the Shionogi-Apnimed Sleep Science (SASS) collaboration, targeting the lucrative sleep disorder market. This partnership, initiated in 2023, aims to leverage Apnimed's innovative treatments and Shionogi's global reach.

Further bolstering this strategy, Shionogi has actively invested in early-stage startups focused on neurology and infectious diseases. These investments, totaling several hundred million USD in the 2023-2024 period, provide access to novel technologies and accelerate the development of its R&D pipeline. By fostering external innovation, Shionogi can quickly bring cutting-edge therapies to market.

- Strategic Alliance: The SASS joint venture with Apnimed exemplifies Shionogi's proactive approach to market expansion in sleep disorders.

- R&D Acceleration: Investments in neurology and infectious disease startups provide Shionogi with access to novel technologies, speeding up drug development.

- Pipeline Diversification: These external collaborations help diversify Shionogi's product pipeline, reducing reliance on existing revenue streams.

- Market Entry: By partnering with specialized firms, Shionogi can gain expertise and expedite market entry for new treatments.

Shionogi can capitalize on the growing demand for advanced therapies in oncology and rare diseases, areas where unmet medical needs remain high. By 2025, the global rare disease market is projected to exceed $250 billion, offering substantial revenue potential for innovative treatments.

The company's focus on antimicrobial resistance (AMR) is particularly timely, with the WHO identifying it as a major global health threat. Shionogi's established expertise in anti-infectives, supported by ongoing R&D and partnerships like the one with BioVersys, positions it to lead in developing solutions for multidrug-resistant infections.

Expanding its global presence, especially into markets like China with planned launches such as cefiderocol in 2025, presents a significant growth opportunity. This geographical diversification is crucial for revenue stability and market penetration, especially as China's pharmaceutical market continues its rapid expansion.

Shionogi's strategic embrace of digital therapeutics and AI, evidenced by collaborations for ADHD treatments and AI-driven target discovery, promises to accelerate drug development and improve cost-effectiveness. These technological advancements are key to staying competitive and enhancing patient outcomes.

Strategic collaborations and investments, such as the Shionogi-Apnimed Sleep Science (SASS) venture, provide access to novel technologies and lucrative new markets like sleep disorders. These partnerships, along with investments in neurology and infectious disease startups totaling hundreds of millions USD in 2023-2024, are vital for pipeline diversification and accelerated market entry.

| Opportunity Area | Market Potential (2025 est.) | Key Shionogi Strategy | Supporting Fact/Data |

|---|---|---|---|

| Oncology & Rare Diseases | Rare Disease Market: >$250 Billion | Focus R&D on unmet needs | High demand for novel therapies |

| Antimicrobial Resistance (AMR) | Global Health Threat | Develop new anti-infectives | WHO priority area, BioVersys partnership |

| Global Market Expansion | China Market Growth | Launch cefiderocol in China | Planned 2025 launch |

| Digital Therapeutics & AI | Accelerated Drug Discovery | Invest in AI and digital health | Collaborations for ADHD and target discovery |

| Strategic Partnerships | New Market Entry (e.g., Sleep) | Joint ventures and startup investments | SASS venture, investments in neurology/infectious diseases |

Threats

Shionogi operates in a fiercely competitive pharmaceutical landscape. Globally, numerous large and agile companies are constantly innovating and marketing products in Shionogi's key therapeutic areas, such as infectious diseases and pain management. This intense rivalry often translates into significant pricing pressures, forcing companies to be more aggressive with their pricing strategies to secure market share.

The need to stand out in such a crowded market also drives up marketing and sales expenses. Shionogi, like its peers, must invest heavily to promote its products and educate healthcare providers. This increased expenditure can eat into profit margins, especially when facing established blockbuster drugs or new entrants with similar efficacy.

Gaining and maintaining market access for new therapies is another major hurdle. Regulatory hurdles, payer negotiations, and physician prescribing habits are all influenced by the competitive environment. For instance, in the United States, the average time for a new drug to achieve formulary acceptance in 2024 was reported to be around 12-18 months, a period that can be extended by strong competition from existing treatments.

These competitive pressures directly impact Shionogi's revenue potential and overall profitability. The constant need to innovate, differentiate, and efficiently market its products is critical for survival and growth in this dynamic sector.

Shionogi faces significant threats from ongoing global discussions and policy shifts aimed at reducing drug prices, especially in key markets like the United States. This intensified scrutiny could directly impact Shionogi's revenue potential for its innovative therapies.

The pharmaceutical landscape is also characterized by complex and often lengthy regulatory approval pathways worldwide. For instance, the timeline for Shionogi's ensitrelvir New Drug Application (NDA) in the U.S. highlights how these stringent processes can create substantial hurdles and potentially delay crucial market entry, affecting revenue projections.

The pharmaceutical industry faces significant hurdles, with a substantial percentage of drugs failing during clinical trials. For Shionogi, a late-stage failure in its key pipeline candidates, such as those in oncology or infectious diseases, could mean millions in lost R&D investment and a setback in projected revenue streams, potentially impacting its market valuation and investor sentiment.

Emergence of New Pathogens and Disease Shifts

The emergence of new pathogens and shifts in existing diseases present a significant threat to Shionogi. Despite its expertise in infectious diseases, the company faces the inherent unpredictability of novel viral strains and bacterial mutations. For instance, the ongoing evolution of SARS-CoV-2, leading to new variants, underscores the challenge of maintaining the efficacy of existing treatments and the need for continuous adaptation.

Rapid changes in disease prevalence or the development of antimicrobial resistance (AMR) can quickly diminish the market value of Shionogi's current portfolio and necessitate costly, accelerated research and development pivots. The World Health Organization (WHO) estimates that by 2050, AMR could cause 10 million deaths annually, a stark reminder of the evolving threat landscape that Shionogi must navigate.

- Unforeseen Pathogen Emergence: The constant threat of novel infectious agents, such as a new influenza strain or a previously unknown virus, could require Shionogi to rapidly reallocate resources and R&D focus.

- Antimicrobial Resistance (AMR) Escalation: The growing challenge of AMR, where existing antibiotics become ineffective, directly impacts Shionogi's core business and requires ongoing investment in developing new therapeutic approaches.

- Evolving Viral Strains: The continuous mutation of viruses, exemplified by COVID-19 variants, can reduce the effectiveness of vaccines and treatments, demanding swift development of updated or alternative solutions.

Intellectual Property Infringement and Legal Challenges

Protecting intellectual property (IP) is paramount in the pharmaceutical industry, and Shionogi is not immune to challenges in this area. The company faces the ongoing threat of its drug patents being infringed upon by generic manufacturers, particularly as patents approach expiry. For instance, in early 2024, Shionogi was involved in litigation concerning its HIV treatment, Tivicay, which is co-marketed with ViiV Healthcare, highlighting the constant need for IP defense.

These legal battles can be costly and resource-intensive, diverting funds that could otherwise be invested in research and development. The potential for litigation, alongside the need to actively defend its patents, poses a significant risk to Shionogi's long-term revenue streams and market exclusivity. In 2023, pharmaceutical companies globally saw a substantial increase in patent litigation, with the costs often running into millions of dollars per case.

- Patent Expiry: Shionogi's key drug patents are subject to expiration, opening the door for generic competition.

- Litigation Costs: Defending IP can lead to substantial legal expenses, impacting profitability.

- Market Exclusivity Erosion: Infringement can dilute market share and reduce revenue during critical patent-protected periods.

- R&D Resource Diversion: Legal defense can pull resources away from innovation and new drug development.

Shionogi faces considerable threats from increasing global drug price controls and intense competition in its therapeutic areas. Regulatory hurdles and lengthy approval processes, such as the extended timeline for ensitrelvir's U.S. NDA in 2024, can delay market entry and impact revenue. Furthermore, the constant risk of late-stage R&D failures, with a high percentage of drugs not making it to market, could lead to substantial financial losses and damage investor confidence.

SWOT Analysis Data Sources

This analysis draws from comprehensive data, including Shionogi's official financial reports, robust market research, and expert industry commentary to provide a well-rounded perspective.