Shionogi & Co Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shionogi & Co Bundle

Shionogi & Co operates within a dynamic pharmaceutical landscape where several key forces dictate its competitive intensity. The threat of new entrants, while somewhat mitigated by high R&D costs and regulatory hurdles, remains a constant pressure. Buyer power, particularly from large healthcare providers and governments, can significantly influence pricing and market access for Shionogi's innovative therapies.

The bargaining power of suppliers, including raw material providers and contract manufacturers, also plays a role in Shionogi's operational costs and supply chain stability. Furthermore, the availability of substitute products, both branded and generic, necessitates continuous innovation and differentiation for Shionogi to maintain its market share and profitability.

The intensity of rivalry among existing competitors is a dominant force, with pharmaceutical giants constantly vying for market leadership through groundbreaking research and strategic acquisitions. This competitive environment demands robust strategies to navigate pricing pressures and secure a sustainable advantage.

The complete report reveals the real forces shaping Shionogi & Co’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of highly specialized active pharmaceutical ingredients (APIs) and rare raw materials possess considerable bargaining power. This is largely due to the unique nature of these inputs and the rigorous quality standards essential for pharmaceutical production. For instance, Shionogi & Co., with its focus on infectious diseases and CNS disorders, depends on a sophisticated supply chain where specialized components are absolutely vital.

The limited availability of approved suppliers for certain pharmaceutical-grade materials significantly boosts their leverage. This can directly influence Shionogi's production expenses and project schedules, as these suppliers can dictate pricing and supply agreements. For 2024, the global API market was valued at approximately $220 billion, with specialty APIs forming a substantial and often higher-priced segment, underscoring the potential impact of supplier power on companies like Shionogi.

Switching suppliers in the pharmaceutical sector, including for companies like Shionogi & Co., is a complex and costly undertaking. The stringent regulatory environment, requiring extensive validation and quality assurance for any new raw material or component source, creates significant barriers to entry for new suppliers and reinforces the position of existing ones. This is a critical factor in understanding the bargaining power of suppliers.

The pharmaceutical industry's reliance on highly specialized and validated components means that changing a supplier involves more than just finding a new vendor. It necessitates a thorough re-validation of the product's manufacturing process and a new round of regulatory submissions. For instance, the U.S. Food and Drug Administration (FDA) requires rigorous documentation and testing for any changes in drug manufacturing, which can take months or even years and cost millions of dollars. This lengthy and expensive process directly translates to higher switching costs for Shionogi.

Consequently, established suppliers to Shionogi, who have already navigated these complex approval pathways and demonstrated consistent quality, hold considerable leverage. The difficulty and expense associated with Shionogi finding and validating an alternative supplier means that existing suppliers can often command higher prices or more favorable terms. This dynamic significantly strengthens their bargaining power within the supply chain.

Intellectual property held by suppliers significantly impacts Shionogi's bargaining power. Patents on essential compounds or novel drug delivery systems grant suppliers considerable leverage, as Shionogi may have no alternative source. For instance, if a key intermediate in a Shionogi drug is patented by a single supplier, Shionogi's ability to negotiate pricing or terms is severely limited. This reliance on proprietary technology can translate into higher input costs, potentially affecting Shionogi's profitability and the competitiveness of its products.

Concentration of Suppliers

The concentration of suppliers in specialized pharmaceutical manufacturing can significantly influence Shionogi & Co. For instance, if only a handful of companies can produce critical components for novel drug delivery systems or advanced bioprocessing equipment, these few suppliers gain considerable leverage. This limited supplier base means Shionogi has fewer alternatives, potentially leading to higher costs and less favorable contract terms.

Consider the market for specific active pharmaceutical ingredients (APIs) or advanced chiral catalysts. A report from the IQVIA Institute for Human Data Science in 2024 indicated that in certain highly specialized API categories, as few as three to five global manufacturers might dominate production. This scarcity translates directly into increased bargaining power for those suppliers, as Shionogi, like other pharmaceutical giants, relies on them for essential raw materials.

- Limited Supplier Options: In niche pharmaceutical manufacturing, a small number of specialized suppliers for critical equipment or services can dictate terms.

- Increased Supplier Leverage: When only a few entities can provide essential technology or services for Shionogi's advanced processes, their influence grows.

- Pricing and Terms Impact: Supplier concentration can result in less competitive pricing and less favorable contract conditions, affecting Shionogi's operational costs and efficiency.

- Example Data: The market for certain specialized APIs in 2024 saw dominance by as few as three to five global manufacturers, highlighting supplier concentration.

Impact of Supplier-held Patents on Cost

Suppliers holding patents for critical components or manufacturing processes can significantly increase Shionogi's production costs. This is particularly relevant for Shionogi's research-intensive operations, where specialized inputs for infectious disease and central nervous system (CNS) drugs are often proprietary. For instance, if a key intermediate for a novel antibiotic is patented by a single supplier, Shionogi's ability to negotiate price becomes limited, directly impacting its cost of goods sold.

This patent-driven leverage means Shionogi may face higher prices for essential materials, reducing its profit margins. In 2024, the pharmaceutical industry continued to see robust demand for innovative treatments, but also faced increasing pressure on R&D and manufacturing costs. Suppliers with exclusive rights to patented technologies or active pharmaceutical ingredients (APIs) can dictate terms, especially for niche or high-demand products.

- Supplier Patents Influence R&D Costs: Shionogi's reliance on patented inputs for its pipeline, particularly in areas like infectious diseases, means supplier intellectual property directly affects R&D expenditure and eventual drug pricing.

- Limited Negotiation Power: The exclusive nature of patented components restricts Shionogi's ability to bargain for lower prices, especially for unique or difficult-to-source raw materials.

- Impact on Profitability: Premium pricing from patent-holding suppliers can squeeze Shionogi's gross margins, affecting overall profitability and the financial viability of certain drug development programs.

- Strategic Sourcing Challenges: Identifying and securing alternative, non-patented sources for critical materials can be challenging and time-consuming, adding further complexity to Shionogi's supply chain management.

The bargaining power of suppliers is significant for Shionogi & Co., especially for specialized active pharmaceutical ingredients (APIs) and rare raw materials. The limited number of qualified suppliers for these critical inputs, coupled with stringent quality and regulatory requirements, gives these suppliers considerable leverage. This power translates directly into Shionogi's production costs and timelines, as suppliers can influence pricing and supply terms.

The complexity and cost associated with switching suppliers in the pharmaceutical industry, due to extensive validation and regulatory hurdles, further bolster supplier power. This means existing, approved suppliers hold a strong position, often commanding higher prices. For instance, the global API market in 2024 was valued around $220 billion, with specialty APIs representing a high-value segment where supplier influence is particularly pronounced.

Intellectual property, such as patents on essential compounds or manufacturing processes, grants suppliers substantial bargaining power. If Shionogi relies on a patented intermediate, its negotiation capabilities are severely limited, potentially increasing input costs and impacting profitability. This reliance on proprietary technology from a select few suppliers can create significant challenges for cost management and supply chain resilience.

| Factor | Impact on Shionogi | 2024 Data/Context |

|---|---|---|

| Specialized Inputs | High dependency on few suppliers for critical APIs and raw materials. | Specialty APIs form a substantial, higher-priced segment of the $220 billion global API market. |

| Switching Costs | Extensive regulatory validation and re-submission processes make supplier changes costly and time-consuming. | FDA validation for manufacturing changes can take months or years and cost millions. |

| Intellectual Property | Patented components limit Shionogi's sourcing options and negotiation power. | Reliance on proprietary technology from a single supplier can lead to increased input costs. |

| Supplier Concentration | Few manufacturers for advanced components or niche APIs increase supplier leverage. | In certain specialized API categories, dominance by as few as 3-5 global manufacturers was noted in 2024. |

What is included in the product

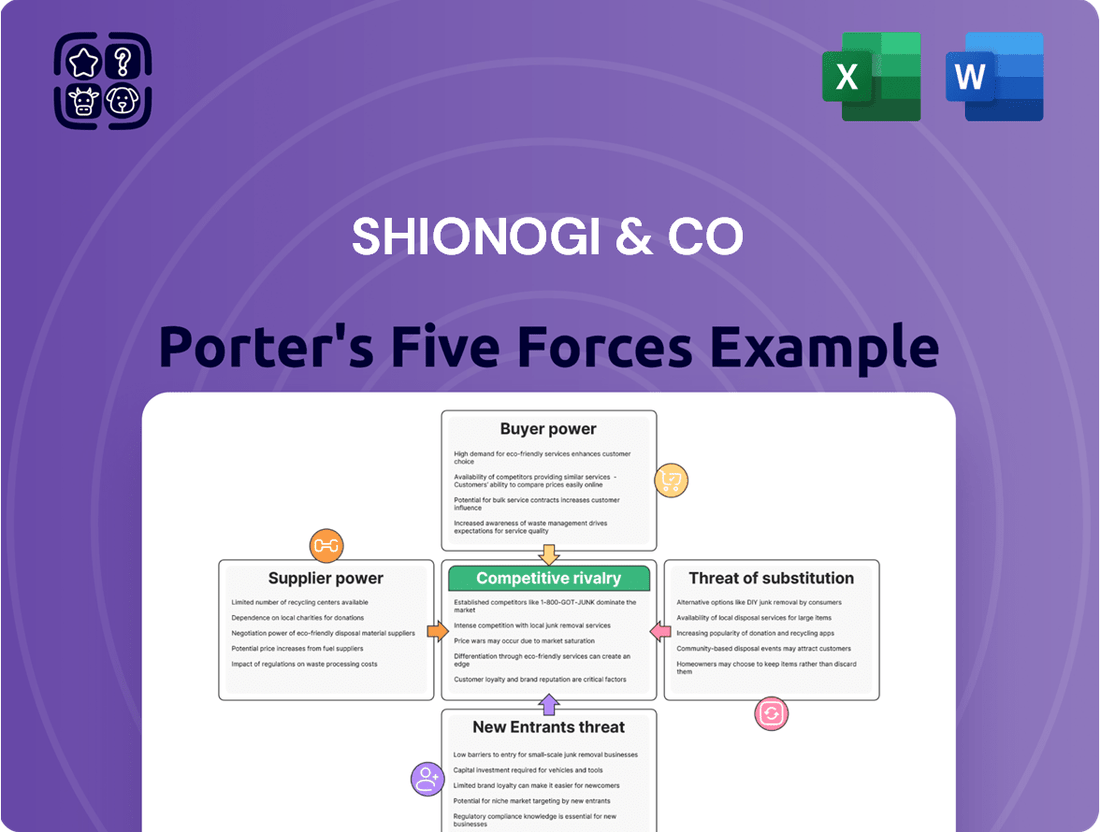

This analysis of Shionogi & Co's competitive landscape identifies the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes, all within the pharmaceutical industry.

Instantly identify competitive pressures and opportunities for Shionogi & Co with a dynamic, visual Porter's Five Forces analysis, simplifying strategic planning.

Customers Bargaining Power

Major customers for Shionogi, like governments, hospitals, and large pharmacy chains, wield considerable bargaining power. This is amplified by their bulk purchasing capabilities, particularly in regions with universal healthcare systems. For instance, in 2024, government tenders in many European countries often dictate pricing for pharmaceuticals, forcing manufacturers to compete aggressively on cost.

These large buyers can effectively negotiate for price reductions or demand enhanced product quality, directly impacting Shionogi's revenue streams and profit margins. The sheer volume they purchase gives them leverage that smaller entities lack.

The global trend of tightening healthcare budgets in 2024 further heightens the price sensitivity of these crucial customers. This pressure is especially pronounced for drugs that have lost patent protection or offer less distinct therapeutic advantages, making Shionogi vulnerable to price erosion in these segments.

The availability of generic and biosimilar alternatives significantly empowers customers, especially in the pharmaceutical sector. When a drug’s patent expires, the introduction of lower-cost generics or biosimilars directly challenges the originator's pricing power. For instance, in 2024, the U.S. market saw continued growth in biosimilar adoption, with the FDA approving multiple new biosimilars across various therapeutic areas, signaling increasing competition for established biologics.

Shionogi, like other pharmaceutical companies, faces this challenge head-on. The expiration of patents on key products can lead to a dramatic drop in revenue as cheaper alternatives enter the market. This pressure necessitates a robust pipeline of new, innovative drugs and a strong focus on lifecycle management for existing ones to mitigate the impact of generic and biosimilar erosion.

Governmental bodies and regulatory agencies significantly influence drug pricing, directly impacting Shionogi's pricing strategies. For instance, countries like Germany utilize reference pricing, where a drug's price is benchmarked against similar drugs, limiting Shionogi's pricing flexibility. This regulatory oversight is crucial in a sector facing considerable public attention regarding drug affordability.

Customer Loyalty for Patented Drugs

Customer loyalty for Shionogi's patented drugs, particularly those addressing unmet needs in areas like infectious diseases, significantly curtails buyer power. When Shionogi offers a first-in-class treatment with demonstrable efficacy, like its novel antibiotic options, healthcare providers and patients exhibit a reduced propensity to seek alternatives. This loyalty translates into pricing power and sustained market share for these specialized, high-value medications.

- High Switching Costs: For drugs with unique benefits and limited direct competitors, switching to a different treatment can involve re-evaluating efficacy, safety profiles, and potential side effects, making customers hesitant to change.

- Brand Reputation and Trust: Shionogi's commitment to innovation in challenging therapeutic areas builds a strong reputation, fostering trust among prescribers and patients, which anchors loyalty.

- Limited Substitutes: In niche therapeutic areas, Shionogi may be the sole provider of a highly effective treatment, leaving customers with few, if any, viable alternatives, thus diminishing their bargaining leverage.

- Patient Adherence: For chronic conditions or critical treatments, patient adherence and comfort with a specific, effective drug can be paramount, further solidifying loyalty and reducing buyer power.

Consolidation of Healthcare Providers and Payers

The increasing consolidation within the healthcare sector significantly amplifies the bargaining power of customers for Shionogi & Co. Larger, more unified groups of hospitals, pharmacy chains, and insurance providers can leverage their collective purchasing power to demand better terms.

These consolidated entities, acting as substantial buyers, are better positioned to negotiate substantial discounts and rebates on pharmaceutical products. For instance, by 2024, major hospital systems have merged, creating networks that account for a significant percentage of drug purchases in their respective regions, giving them considerable leverage.

- Increased Buying Power: Consolidated healthcare providers and payers represent larger, more cohesive purchasing blocks.

- Negotiating Leverage: These entities can effectively negotiate for lower prices, volume discounts, and favorable rebate structures from pharmaceutical companies like Shionogi.

- Impact on Profitability: Shionogi faces pressure to offer competitive pricing, which can directly impact its profit margins and revenue streams.

- Market Access Challenges: Gaining and maintaining market access requires navigating complex negotiations with these powerful consolidated buyers, influencing Shionogi's go-to-market strategies.

Major customers like governments and large pharmacy chains possess significant bargaining power due to their bulk purchasing. In 2024, governmental tenders in many European nations heavily influenced pharmaceutical pricing, compelling manufacturers into aggressive cost competition. These large buyers can effectively negotiate for price reductions or demand enhanced product quality, directly impacting Shionogi's revenue and profit margins.

The increasing consolidation within the healthcare sector amplifies customer bargaining power. By 2024, major hospital systems merging created networks representing substantial drug purchases, granting them considerable leverage to negotiate discounts and rebates, thereby pressuring Shionogi's profit margins.

| Customer Segment | Bargaining Power Factor | Impact on Shionogi |

| Governments/Public Payers | Tender-based pricing, reference pricing | Price pressure, reduced pricing flexibility |

| Large Hospital Chains | Consolidated purchasing power, volume discounts | Negotiation leverage for lower prices |

| Major Pharmacy Chains | Bulk purchasing, market share concentration | Demand for rebates and favorable terms |

Same Document Delivered

Shionogi & Co Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Shionogi & Co Porter's Five Forces Analysis meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the pharmaceutical sector. This comprehensive assessment provides critical insights into the strategic positioning and future challenges for Shionogi. You'll gain a deep understanding of the external forces shaping Shionogi's operations and profitability.

Rivalry Among Competitors

The pharmaceutical sector, including Shionogi & Co., thrives on a relentless cycle of research and development, fueling fierce rivalry. Companies constantly strive to discover and commercialize innovative treatments, making R&D a critical battleground.

Shionogi's focus on areas like infectious diseases and central nervous system (CNS) disorders means it faces direct competition from other firms also investing heavily in these therapeutic categories. The pressure to introduce groundbreaking therapies is immense.

In 2023, Shionogi reported R&D expenses of approximately ¥120 billion (around $800 million USD based on average exchange rates for the year), highlighting the substantial financial commitment required to stay competitive. This investment is vital for developing a robust pipeline and securing future revenue streams.

The success of Shionogi's new drug candidates directly impacts its ability to maintain and grow its market share against well-funded global competitors. Each successful launch can significantly shift the competitive landscape.

Patent protection shields pharmaceutical innovators like Shionogi, granting a temporary monopoly. This exclusivity is crucial for recouping significant R&D investments. However, as these patents approach expiration, the competitive landscape intensifies dramatically.

The threat of generic and biosimilar competition becomes a major concern for companies like Shionogi. For instance, the expiration of patents on blockbuster drugs can lead to a rapid decline in revenue as cheaper alternatives enter the market. Shionogi's financial performance is thus directly linked to the lifespan of its key patented products, making the 'patent cliff' a significant driver of competitive rivalry.

In 2024, the pharmaceutical industry continues to grapple with patent expirations. Companies are actively engaged in strategic monitoring of competitor patent portfolios. This vigilance allows them to anticipate generic entry or to proactively develop and launch their own follow-on products, aiming to mitigate the impact of lost exclusivity.

The pharmaceutical industry is inherently competitive, and Shionogi faces intense rivalry due to the global reach of its competitors. Major players like Pfizer, Roche, and Novartis, with vast resources and established market presence, actively compete for market share across all major geographies. This global battleground means Shionogi must not only contend with established giants but also emerging biopharmaceutical companies from various nations, each bringing unique R&D capabilities and market access strategies.

Shionogi’s own global footprint, with operations and sales in key markets such as the United States, Europe, and Asia, necessitates a constant strategic focus on expansion and adaptation. Successfully navigating diverse regulatory approval processes and varying commercial demands in each region is crucial for sustained growth. For instance, the ongoing pursuit of market approvals for new oncology treatments in 2024 highlights the continuous need to adapt to specific regional healthcare needs and reimbursement policies.

Mergers, Acquisitions, and Partnerships

The pharmaceutical sector thrives on consolidation, with mergers, acquisitions, and strategic partnerships frequently altering the competitive arena. Shionogi actively participates in these maneuvers to enhance its market standing and research capabilities. For instance, in 2023, Shionogi acquired Qpex Biopharma, a move aimed at significantly strengthening its portfolio in the critical area of antimicrobial development.

These strategic moves create a highly dynamic competitive environment. Companies leverage these combinations to broaden their drug pipelines, secure broader market access, and accelerate innovation through shared R&D resources. Such activities mean that market leadership is not static and can be reshaped by significant corporate transactions.

The impact of these M&A activities on Shionogi's competitive rivalry is substantial. By integrating new assets and technologies, Shionogi can better compete against larger, more diversified pharmaceutical giants. This constant flux necessitates continuous strategic evaluation and adaptation to maintain a competitive edge.

- Shionogi's acquisition of Qpex Biopharma in 2023 aimed to bolster its antimicrobial pipeline.

- Such collaborations are crucial for expanding portfolios and enhancing R&D capabilities.

- The pharmaceutical landscape is characterized by rapid shifts in market leadership due to M&A activity.

Marketing and Sales Intensity

Pharmaceutical companies, including Shionogi, pour significant resources into marketing and sales to distinguish their offerings and inform healthcare providers, thereby boosting product uptake. For Shionogi, successfully marketing its specialized treatments for areas like infectious diseases and central nervous system disorders is paramount for securing and maintaining market share amidst intense competition.

This necessitates robust promotional activities, cultivating strong connections with prescribing physicians, and utilizing modern digital marketing approaches. In 2023, Shionogi's selling, general, and administrative expenses, which encompass marketing and sales, represented a substantial portion of its overall operational costs. The company actively engages in direct-to-physician outreach and digital campaigns to highlight the efficacy and patient benefits of its key pharmaceuticals.

- Marketing Investment: Shionogi allocates considerable budget to marketing and sales to support its specialized drug portfolio.

- Physician Engagement: Building relationships with healthcare professionals is a core strategy for driving prescription volume.

- Digital Strategy: The company leverages digital channels to reach broader audiences and provide educational content.

- Competitive Landscape: High marketing intensity is essential for Shionogi to stand out in crowded therapeutic areas.

Shionogi operates in a highly competitive pharmaceutical market where innovation and market penetration are fiercely contested. Rivalry is intense due to the global nature of the industry, with major players constantly vying for market share through R&D, strategic acquisitions, and aggressive marketing. The success of new drug launches and the management of patent expirations are critical factors in maintaining a competitive edge.

The threat of generic and biosimilar competition looms large as patents expire, forcing companies like Shionogi to innovate continuously and diversify their portfolios. For instance, as key patents approach expiration, Shionogi must bolster its pipeline with new treatments or face significant revenue declines.

In 2023, Shionogi's R&D expenditure of approximately ¥120 billion underscored the substantial investment required to compete. This financial commitment is essential for developing novel therapies and staying ahead of competitors in therapeutic areas such as infectious diseases and CNS disorders.

Strategic moves, including mergers and acquisitions, are common. Shionogi's 2023 acquisition of Qpex Biopharma, aimed at strengthening its antimicrobial pipeline, exemplifies this trend. Such consolidation reshapes the competitive landscape, allowing companies to expand their offerings and R&D capabilities.

| Metric | Shionogi & Co. (2023) | Industry Trend |

|---|---|---|

| R&D Expenses | ~¥120 billion | High and increasing investment |

| Key Therapeutic Areas | Infectious Diseases, CNS | High competition in these and oncology |

| M&A Activity | Acquisition of Qpex Biopharma (2023) | Ongoing consolidation |

| Patent Expirations | Ongoing concern | Major driver of competition |

SSubstitutes Threaten

The most significant threat of substitutes for Shionogi & Co. stems from generic drugs and biosimilars. Once a branded drug's patent expires, these alternatives enter the market, offering similar therapeutic benefits at considerably lower prices. This can lead to a rapid decline in sales and market share for Shionogi's established products.

For instance, the global market for generics is projected to reach $296 billion by 2027, highlighting the intense competition. Biosimilars are also gaining traction, with the biosimilars market expected to grow to $102 billion by 2028. This pressure forces companies like Shionogi to constantly innovate, developing new, patent-protected drugs or concentrating on niche therapeutic areas where substitute development is more challenging.

Beyond traditional drugs, alternative therapies and lifestyle changes pose a significant threat of substitutes for Shionogi & Co. For instance, in areas like pain management or central nervous system disorders, patients might opt for interventions such as physical therapy, mindfulness techniques, or even surgical options instead of Shionogi's pharmaceuticals. These non-pharmacological approaches can directly impact the demand for Shionogi's drug portfolio.

The effectiveness and accessibility of these substitutes are key drivers. If alternative treatments demonstrate comparable or superior outcomes with fewer side effects or lower costs, they become more attractive. For example, advancements in non-invasive pain relief technologies or behavioral therapies for mental health conditions could divert patients away from Shionogi's products. Shionogi must continually innovate to offer drugs with clear advantages in efficacy, safety, and patient convenience to counter this threat.

The threat of substitutes for Shionogi's infectious disease treatments is significantly influenced by advancements in preventive measures, particularly vaccines. For instance, the widespread availability of a highly effective influenza vaccine directly reduces the need for antiviral medications like Shionogi's. In 2023, global influenza vaccine uptake varied, but continued growth in certain regions highlights this substitutionary pressure.

Shionogi's own involvement in vaccine research and development presents a dual-edged sword. While it diversifies their portfolio, a breakthrough in a Shionogi-developed vaccine for a disease they currently treat could cannibalize sales of their existing therapeutic drugs. This strategic pivot from treatment to prevention is a key consideration for future market positioning and revenue streams.

Off-label Use of Existing Drugs

Physicians can prescribe existing medications for uses not officially approved by regulatory agencies, a practice known as off-label prescribing. This can present a significant threat by offering a readily available and often cheaper alternative to Shionogi's newly developed drugs. If an older drug is perceived as effective for a particular condition, even without formal approval for that use, it can divert potential market share.

The widespread adoption of off-label prescribing can directly hinder the market penetration of Shionogi's innovative therapies. For instance, in 2024, studies indicated that off-label use remains a common practice across various therapeutic areas, particularly in oncology and infectious diseases, where new treatments are frequently sought. This can create a competitive hurdle, as patients and prescribers might opt for established, albeit off-label, treatments over newer, potentially more expensive, Shionogi products.

- Impact on Market Share: Off-label use can siphon demand from new drugs, especially if the alternative is significantly less costly.

- Regulatory Landscape: While off-label prescribing is legal, it operates in a complex regulatory environment that can influence its prevalence and the perceived risk associated with it.

- Physician Discretion: The decision to prescribe off-label relies heavily on physician judgment and their assessment of patient needs, making it a dynamic competitive force.

- Cost-Effectiveness: In many cases, off-label alternatives are older generics, making them inherently more cost-effective than novel patented drugs from Shionogi.

Emerging Technologies and Digital Therapeutics

New technological advancements, particularly in digital therapeutics and sophisticated medical devices, are increasingly offering alternative pathways for managing various health conditions. These innovations can directly compete with traditional pharmaceutical treatments, potentially reducing the reliance on Shionogi's core drug offerings.

While Shionogi does have a presence in the medical device sector, the growing landscape of standalone digital health solutions, especially those targeting central nervous system (CNS) disorders, poses a significant substitute threat. These digital options provide non-pharmacological avenues for patient care, which could impact demand for Shionogi's pharmaceutical products in these therapeutic areas.

The market for digital therapeutics is experiencing rapid growth. For instance, the global digital therapeutics market size was valued at USD 5.8 billion in 2023 and is projected to expand significantly, with some forecasts suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. This indicates a substantial and growing alternative to traditional medicine.

- Digital Therapeutics Market Growth: The digital therapeutics market is projected for substantial expansion, offering non-drug alternatives for patient management.

- CNS Disorder Focus: Standalone digital health solutions are particularly impacting CNS disorders, presenting a direct substitute threat to pharmaceutical interventions in this area.

- Industry Response: Pharmaceutical companies like Shionogi must consider integrating or developing their own digital health capabilities to counter this emerging substitute threat.

- Investment in Digital Health: Venture capital investment in digital health reached approximately USD 15 billion in 2023, highlighting the significant market interest and potential for disruptive innovation.

The threat of substitutes for Shionogi & Co. is significant, primarily driven by generic and biosimilar drugs which offer comparable efficacy at lower prices post-patent expiry. Furthermore, non-pharmacological alternatives like physical therapy, mindfulness, and surgical interventions present substitutes, particularly in areas such as pain management. Advancements in preventive measures, like vaccines, also reduce the need for Shionogi's therapeutic drugs, as seen with influenza vaccines impacting antiviral demand.

Digital therapeutics and medical devices are emerging as key substitutes, offering non-pharmacological solutions for managing various health conditions, especially in CNS disorders. The rapid growth of the digital therapeutics market, valued at USD 5.8 billion in 2023 and projected for over 20% CAGR, underscores this evolving competitive landscape. Shionogi must innovate to maintain market share against these diverse and growing substitute threats.

| Substitute Type | Example | Market Size/Growth Factor | Impact on Shionogi |

| Generic/Biosimilar Drugs | Post-patent expiry alternatives | Global generics market projected to reach $296 billion by 2027 | Erosion of market share and pricing pressure |

| Non-Pharmacological Therapies | Physical therapy, mindfulness | Growing patient preference for holistic approaches | Reduced demand for certain drug classes |

| Preventive Measures | Vaccines (e.g., influenza) | Continued growth in vaccine uptake | Decreased need for certain treatments |

| Digital Therapeutics | CNS disorder apps | Digital therapeutics market valued at USD 5.8 billion in 2023; >20% CAGR | Potential displacement of pharmaceutical interventions |

Entrants Threaten

The pharmaceutical industry is characterized by extraordinarily high research and development (R&D) costs. Bringing a new drug to market can cost upwards of $2.6 billion and take over a decade, encompassing extensive preclinical and clinical trials. These massive upfront investments create a significant barrier for potential new entrants, as only well-capitalized companies can afford to engage in such endeavors. Shionogi, for instance, consistently invests a substantial portion of its revenue into R&D, reflecting the sector's capital-intensive nature.

Stringent regulatory requirements present a significant barrier to new entrants in the pharmaceutical industry. Companies must navigate a complex and lengthy approval process, encompassing preclinical testing, multiple phases of clinical trials, and extensive documentation for global health authorities. This process can take many years and cost hundreds of millions, if not billions, of dollars. For instance, the average cost to develop a new drug in 2023 was estimated to be over $2 billion, a figure that underscores the immense capital and time commitment required for market entry.

Shionogi & Co. benefits significantly from robust patent protection, a critical barrier to entry in the pharmaceutical industry. This strong intellectual property (IP) portfolio shields its innovative products, making it exceptionally difficult for newcomers to introduce competing therapies without infringing on existing patents. For instance, Shionogi's key drug, Crestor (rosuvastatin), enjoyed patent exclusivity for many years, allowing it to capture a substantial market share before generic competition emerged.

Economies of Scale in Production and Distribution

Large pharmaceutical companies, including Shionogi, leverage significant economies of scale in production and distribution. This means they can manufacture drugs, procure raw materials, and manage global supply chains at a lower per-unit cost than smaller or newer competitors. For instance, Shionogi's robust manufacturing capabilities, potentially operating at high capacity utilization rates, directly translate to cost advantages.

New entrants often struggle to match this scale, facing higher initial investment costs and less efficient operations. This cost disadvantage can make it difficult for them to compete on price or achieve comparable profit margins. Shionogi's established infrastructure, built over years of operation, acts as a substantial barrier, making it challenging for nascent companies to enter the market on equal footing.

- Economies of Scale: Shionogi benefits from lower per-unit costs in manufacturing and procurement due to its size.

- Distribution Networks: Established global distribution capabilities provide an advantage over new entrants.

- Cost Disadvantage for New Entrants: Companies without scale face higher production and operational costs.

- Barrier to Entry: Shionogi's existing infrastructure deters smaller, emerging pharmaceutical firms.

Brand Loyalty and Established Relationships

Shionogi & Co benefits significantly from strong brand loyalty among healthcare professionals, cultivated over many years. This loyalty translates into established relationships with key stakeholders like hospitals, clinics, and insurance payers. For instance, in 2024, Shionogi continued to leverage its deep-rooted trust with prescribers, a factor that new entrants find incredibly challenging to replicate.

New companies entering the pharmaceutical market face a steep climb against Shionogi’s decades-long reputation. This long-standing trust is not easily overcome, even by companies offering novel therapies. Consequently, aspiring competitors often struggle to gain traction and disrupt established prescribing habits, making market penetration a significant hurdle.

The difficulty for new entrants is amplified by the entrenched nature of Shionogi's relationships. These connections are built on consistent performance, reliable supply chains, and a deep understanding of the healthcare ecosystem, which takes considerable time and investment to develop. As of early 2025, Shionogi's established network remains a formidable barrier.

This brand loyalty and the strength of existing relationships create a substantial competitive moat, limiting the threat of new entrants. Shionogi’s consistent investment in customer engagement and product support reinforces these bonds, making it harder for newcomers to gain a foothold. The pharmaceutical landscape, particularly in established therapeutic areas, rewards companies with proven track records and deep institutional ties.

The threat of new entrants for Shionogi & Co. is considerably low due to the immense capital required for research and development, with drug development costs exceeding $2.6 billion and often taking over a decade. Furthermore, stringent regulatory hurdles, including extensive clinical trials and approval processes, present a formidable barrier, as evidenced by the over $2 billion average cost for new drug development in 2023. Shionogi also benefits from strong patent protection, making it difficult for new companies to introduce competing products without infringing on existing intellectual property.

Economies of scale in production and distribution provide Shionogi with a significant cost advantage, lowering per-unit costs compared to smaller or new competitors. This established infrastructure and operational efficiency act as a substantial barrier, making it challenging for nascent companies to enter the market on an equal footing.

Shionogi's established brand loyalty and deep-rooted relationships with healthcare professionals, cultivated over years of reliable performance and consistent engagement, further limit the threat of new entrants. As of early 2025, this entrenched network remains a formidable obstacle for any aspiring competitor seeking to gain market traction.

Porter's Five Forces Analysis Data Sources

Our Shionogi & Co Porter's Five Forces analysis is built upon a robust foundation of data, including Shionogi's annual reports, SEC filings, investor presentations, and industry-specific market research from reputable firms like IQVIA and GlobalData.