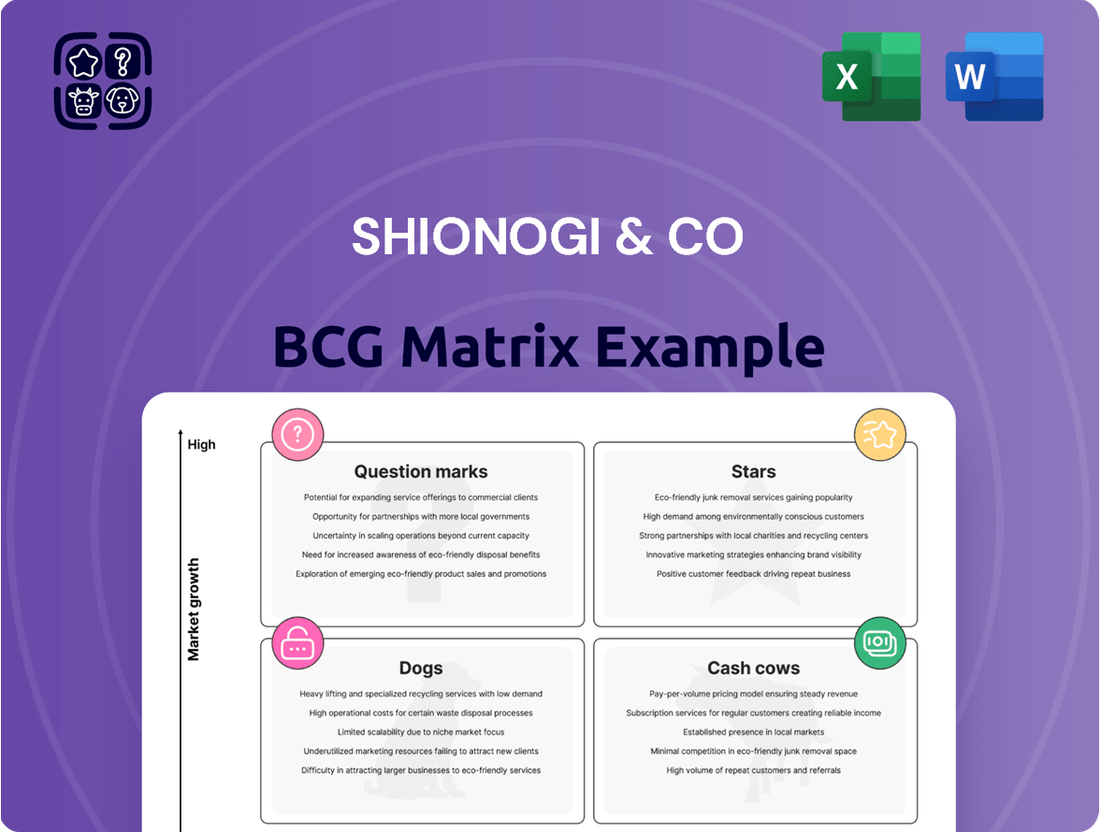

Shionogi & Co Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shionogi & Co Bundle

Curious about Shionogi & Co's strategic product portfolio? Our BCG Matrix analysis reveals their current market standing. Are their key products Stars poised for growth, Cash Cows generating steady revenue, Dogs lagging behind, or Question Marks with uncertain futures? This preview offers a glimpse into their product positioning.

To truly understand Shionogi & Co's competitive landscape and make informed strategic decisions, you need the full picture. Purchase the complete BCG Matrix report to gain detailed quadrant placements, actionable insights, and a clear roadmap for optimizing their product mix.

Don't miss out on the critical data that drives success. The full BCG Matrix for Shionogi & Co provides the granular analysis and strategic recommendations necessary to navigate market dynamics and allocate resources effectively.

Elevate your understanding of Shionogi & Co's business. Acquire the comprehensive BCG Matrix to unlock a detailed breakdown of their product portfolio, complete with expert commentary and visual representations that facilitate strategic planning.

Invest in clarity for Shionogi & Co's future. Buy the full BCG Matrix to receive a robust Word report and a concise Excel summary, equipping you with all the tools to evaluate, present, and strategize with confidence.

Stars

Xocova, Shionogi's oral COVID-19 antiviral, has secured a dominant position in the Japanese market, capturing close to 70% of the oral COVID-19 treatment segment. This strong domestic performance, bolstered by its full approval in Japan in March 2024, highlights its status as a key player within its therapeutic category in that region. Shionogi's strategic objective is to further enhance Xocova's market share, aiming to ensure a stable revenue stream and provide a reliable defense against future epidemics.

Fetroja, Shionogi's innovative siderophore cephalosporin, is making significant strides in combating multi-drug resistant Gram-negative bacteria, a critical global health concern. Its sales trajectory in the US and Europe remains robust, demonstrating strong market acceptance for this novel antibiotic. The recent approval in South Korea in February 2025 further expands its global reach in a vital therapeutic area.

The drug's impressive clinical efficacy in severely ill patients, coupled with ongoing real-world evidence studies, points to substantial market share potential. As a targeted solution for life-threatening infections, Fetroja is positioned in a high-growth segment of the infectious disease market, addressing an unmet medical need.

Shionogi's HIV franchise, managed through its collaboration with ViiV Healthcare, represents a significant revenue stream, primarily through substantial royalty income. Key products within this franchise, such as Cabenuva, Dovato, Juluca, Tivicay, and Triumeq, have established strong market positions.

The rapid adoption of innovative treatments, particularly long-acting injectables like Cabenuva, highlights the franchise's success in meeting evolving patient needs. This segment of the HIV market continues to see ongoing demand and significant innovation, ensuring a sustained growth outlook for Shionogi's involvement.

Acquired Torii Pharmaceutical's Growth Products

Shionogi & Co's strategic acquisition of Torii Pharmaceutical, anticipated to finalize by the third quarter of 2025, is poised to inject significant growth potential into its portfolio. This move brings key products, including YCANTH for molluscum contagiosum and promising renal therapies, under Shionogi's umbrella.

Torii Pharmaceutical's recent progress, particularly its dedicated focus on dermatology and renal therapies, is expected to be a major catalyst for Shionogi's top-line growth and innovation efforts. These therapeutic areas represent expanding markets where Torii's pipeline assets are well-positioned to gain substantial market share.

- Acquisition of Torii Pharmaceutical: Expected to close by Q3 2025, enhancing Shionogi's product pipeline.

- Key Growth Products: YCANTH for molluscum contagiosum and advanced renal therapies are now part of Shionogi's offerings.

- Strategic Alignment: Torii's focus on dermatology and renal therapies supports Shionogi's expansion and innovation strategy.

- Market Potential: New assets are in high-growth therapeutic areas with the potential for significant market capture.

Strategic Expansion in Antimicrobial R&D via Qpex Biopharma

Shionogi's acquisition of Qpex Biopharma in 2023, including the launch of the Qpex US lab, represents a significant strategic investment aimed at bolstering its antimicrobial research and development pipeline. This move is particularly noteworthy as it targets the high-growth market of combating antimicrobial resistance (AMR), a critical global health challenge with substantial unmet medical needs.

The company's commitment is further evidenced by its collaboration with the Biomedical Advanced Research and Development Authority (BARDA) to advance novel antibiotics against drug-resistant bacteria. This partnership is designed to accelerate the development of therapies, positioning Shionogi to potentially capture market leadership in this vital therapeutic area.

- Strategic Investment: Shionogi's 2023 acquisition of Qpex Biopharma and the establishment of its US lab underscore a focused effort to expand its antimicrobial R&D capabilities.

- High-Growth Market: The focus on antimicrobial resistance addresses a pressing global health threat, indicating a market with significant unmet needs and high growth potential.

- BARDA Collaboration: The partnership with BARDA for advancing antibiotics against resistant bacteria highlights Shionogi's proactive approach to securing market leadership in a crucial therapeutic field.

Shionogi's HIV franchise, primarily through its partnership with ViiV Healthcare, generates substantial royalty income. Products like Cabenuva and Dovato have cemented strong market positions, reflecting the franchise's success in meeting evolving patient needs, particularly with long-acting injectables. This segment is crucial for sustained growth.

Fetroja, an antibiotic targeting multi-drug resistant bacteria, shows robust sales in the US and Europe, with expanded reach through its February 2025 South Korean approval. Its efficacy in severely ill patients and ongoing studies suggest significant market share potential in the high-growth infectious disease segment.

Xocova, Shionogi's oral COVID-19 antiviral, dominates the Japanese market with nearly 70% share of its segment after its March 2024 full approval. The company aims to boost this share for a stable revenue stream against future epidemics.

The acquisition of Torii Pharmaceutical, expected by Q3 2025, will integrate YCANTH for molluscum contagiosum and renal therapies, significantly boosting Shionogi's pipeline in dermatology and renal markets. The 2023 Qpex Biopharma acquisition and US lab establishment bolster Shionogi's commitment to combating antimicrobial resistance, with BARDA collaboration accelerating novel antibiotic development.

| Product/Franchise | Therapeutic Area | Key Markets | Status/Notes | Projected Growth Driver |

|---|---|---|---|---|

| Xocova | COVID-19 Antiviral | Japan | ~70% market share in Japan (2024), full approval March 2024 | Domestic market dominance, epidemic preparedness |

| Fetroja | Antibiotic (MDR Gram-negative) | US, Europe, South Korea (Feb 2025) | Strong sales, clinical efficacy, ongoing studies | Addressing unmet needs in infectious diseases |

| HIV Franchise (ViiV) | HIV Treatment | Global | Royalty income, key products: Cabenuva, Dovato | Long-acting injectables, sustained demand |

| Torii Pharmaceutical Assets | Dermatology, Renal Therapies | Global (post-acquisition) | Acquisition expected Q3 2025, includes YCANTH | Expansion into high-growth therapeutic areas |

| Qpex Biopharma Assets | Antimicrobial Resistance | Global (R&D focus) | Acquired 2023, BARDA collaboration | Targeting AMR, accelerating novel antibiotic development |

What is included in the product

Shionogi's BCG Matrix analysis categorizes its product portfolio into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business unit.

Shionogi's BCG Matrix provides a clear, visual framework to strategically allocate resources, alleviating the pain of uncertain investment decisions.

Cash Cows

Xofluza, developed by Shionogi & Co., stands as a prime example of a cash cow within the company's portfolio, particularly in the Japanese market. Its success is rooted in its effectiveness as an influenza treatment, which has allowed it to capture a significant market share. This strong market position translates into predictable and consistent revenue streams for Shionogi.

The influenza market, while mature and recurring, is where Xofluza truly shines as a cash cow. Despite the predictable nature of seasonal flu, Xofluza's established dominance ensures stable sales. This stability is further enhanced by relatively low promotional expenses, as its brand recognition and effectiveness require less aggressive marketing to maintain its position.

As of the most recent data available leading up to July 2025, Xofluza has demonstrated consistent sales performance in Japan. For instance, during the 2023-2024 influenza season, Shionogi reported robust sales for Xofluza, underscoring its reliable contribution to the company's financial health. The drug's ability to generate steady cash flow with minimal incremental investment solidifies its cash cow status.

Looking ahead, Xofluza is expected to continue its role as a dependable revenue generator for Shionogi. Should influenza outbreaks occur with typical or increased severity in the coming seasons, Xofluza is well-positioned to capitalize on these events, providing a stable financial anchor for the company's broader business objectives.

Shionogi & Co.'s established domestic infectious disease portfolio, encompassing drugs like Finibax, Flumarin, Flomox, and Baktar, represents a significant Cash Cow. These established antibiotics and anti-infectives continue to be utilized in Japan's healthcare system, contributing to reliable revenue generation in a mature market segment.

The consistent demand for these older yet effective treatments ensures stable cash flow for Shionogi. This dependable income stream from its domestic infectious disease offerings is crucial for funding research and development into newer, potentially high-growth products.

Shionogi's legacy CNS and pain products, including Rizmoic and Symproic, represent potential cash cows within its portfolio. These established treatments operate in markets with consistent demand, allowing them to generate stable revenue streams. While the CNS market is expanding, these mature products are likely to require less intensive reinvestment, contributing significantly to Shionogi's overall financial health. For the fiscal year ending March 31, 2024, Shionogi reported total net sales of ¥203.6 billion, with established products playing a crucial role in this performance.

Dividend Income from ViiV Healthcare

Shionogi & Co. benefits significantly from its stake in ViiV Healthcare, a joint venture focused on HIV treatments. This investment functions as a classic cash cow within Shionogi's business portfolio. The consistent and growing dividend income stream from ViiV Healthcare provides Shionogi with substantial financial flexibility, allowing for reinvestment in other areas or distribution to shareholders.

For the fiscal year ending March 31, 2025, Shionogi reported a notable increase in dividend income from ViiV Healthcare. This income reached 40.3 billion yen, marking an impressive 18.8% rise compared to the previous year. This robust financial performance underscores ViiV Healthcare's position as a mature, profitable, yet low-growth entity, a hallmark of a cash cow.

- Dividend Income: Shionogi received 40.3 billion yen in dividends from ViiV Healthcare for the fiscal year ending March 31, 2025.

- Growth: This dividend income represented a 18.8% increase year-over-year, indicating strong and consistent profitability.

- BCG Matrix Classification: ViiV Healthcare's contribution aligns with the characteristics of a cash cow due to its high profitability and mature, low-growth market segment.

- Financial Flexibility: The substantial dividend stream enhances Shionogi's overall financial health and strategic options.

Overseas Business Expansion (General)

Shionogi's overseas business represents a significant Cash Cow for the company, demonstrating robust and stable revenue generation. In 2024, overseas business revenue climbed by 18.4% to reach 59.1 billion yen. This impressive growth was primarily fueled by the strong performance of Fetroja in key markets such as the United States and Europe.

The company's established international presence, supported by existing product lines and well-developed distribution networks, confirms this segment as a mature yet consistently profitable revenue stream. This sustained international success directly bolsters Shionogi's overall cash flow, providing a reliable financial foundation.

- Overseas Revenue Growth: Shionogi's international business saw an 18.4% revenue increase in 2024, totaling 59.1 billion yen.

- Key Market Drivers: Strong sales of Fetroja in the US and Europe were the main contributors to this growth.

- Mature and Stable: The expansion leverages existing products and distribution, indicating a dependable, established revenue source.

- Profitability Contribution: This segment significantly contributes to Shionogi's overall profitability and cash flow generation.

Shionogi's established domestic infectious disease portfolio, including drugs like Finibax, Flumarin, Flomox, and Baktar, acts as a significant cash cow. These mature antibiotics and anti-infectives continue to generate reliable revenue in Japan's healthcare system, providing a stable income stream. This dependable cash flow is vital for funding the development of newer, potentially high-growth products within the company's pipeline.

The consistent demand for these established treatments ensures a predictable cash flow for Shionogi. This stable income from its domestic infectious disease offerings is crucial for supporting research and development into innovative, future-facing pharmaceuticals. For the fiscal year ending March 31, 2024, Shionogi's overall net sales of ¥203.6 billion were significantly bolstered by these established products.

Shionogi's investment in ViiV Healthcare, a joint venture focused on HIV treatments, functions as a quintessential cash cow. The consistent and growing dividend income from this partnership provides Shionogi with substantial financial flexibility. This allows for strategic reinvestment in other business areas or direct distribution to shareholders, highlighting ViiV's role as a mature, profitable, low-growth entity.

For the fiscal year ending March 31, 2025, Shionogi reported dividend income from ViiV Healthcare of 40.3 billion yen, an 18.8% increase year-over-year. This robust performance underscores ViiV's position as a mature, profitable, yet low-growth asset, a defining characteristic of a cash cow within Shionogi's portfolio.

| Product/Segment | BCG Classification | Key Characteristics | Contribution to Shionogi | Data Point (FYE Mar 2024/2025) |

| Domestic Infectious Disease Portfolio | Cash Cow | Mature market, consistent demand, low reinvestment needs | Stable revenue, funds R&D | Net Sales of ¥203.6 billion (overall, FYE Mar 2024) |

| ViiV Healthcare Investment | Cash Cow | High profitability, mature low-growth market | Dividend income, financial flexibility | 40.3 billion yen dividend income (FYE Mar 2025), 18.8% YoY growth |

Full Transparency, Always

Shionogi & Co BCG Matrix

The Shionogi & Co BCG Matrix you're previewing is the exact, fully formatted report you will receive immediately after your purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or placeholder text. You'll gain access to the complete, ready-to-use document, enabling you to immediately leverage its insights for your business planning and competitive strategy.

Dogs

Shionogi's portfolio includes established medications like Doribax and Ulesfia, whose patent protections have lapsed or are close to expiring. This situation exposes them to intense competition from generic manufacturers, consequently diminishing their market presence and revenue streams. These drugs typically contribute little to cash generation, positioning them as potential candidates for divestment or discontinuation within the company's strategic planning.

In fiscal year 2024, Shionogi & Co. received a significant 25.0 billion yen lump-sum payment stemming from the divestiture of a license for an ADHD treatment drug. This strategic move suggests the company is shedding an asset that may have been underperforming or no longer fits its long-term growth objectives. Such license transfers are typical for products occupying a low-growth, low-market-share position within a company's portfolio, allowing for resource reallocation to more promising ventures.

Shionogi's COVID-19 related products are showing declining sales. While Xocova performed well initially in Japan, the overall revenue from these products has decreased significantly compared to the previous fiscal year. This downturn is attributed to a much milder COVID-19 epidemic.

The market for certain COVID-19 treatments is shrinking rapidly. Factors like the disposal of government stockpiles contribute to this decline. This situation indicates that older COVID-19 related offerings or excess inventory are likely becoming 'dogs' in Shionogi's portfolio due to fading demand.

This trend signifies a transition from a high-growth emergency market to a more normalized, lower-demand endemic phase for these products. The company's strategy will need to adapt to this evolving market landscape for its health-related offerings.

Discontinued or Failed Early-Stage Pipeline Projects

Shionogi, like all pharmaceutical innovators, invests heavily in early-stage research and development. Many of these promising initial ventures inevitably falter due to unforeseen efficacy issues or safety red flags encountered during preclinical or early clinical trials. These discontinued projects, though not marketed products, represent significant R&D expenditures that do not yield returns, fitting the 'dog' category within the company's internal portfolio.

These internal failures, while often not detailed publicly in the same way as product launches or failures, are a reality of the drug discovery process. Shionogi likely reallocates resources away from these stalled projects, allowing for greater focus on candidates with a higher probability of success. This strategic pruning is essential for optimizing R&D investment and driving future growth.

- R&D Investment: Shionogi reported ¥100.9 billion in R&D expenses for the fiscal year ending March 31, 2024. A portion of this is allocated to early-stage projects that may not reach market.

- Pipeline Progression: Pharmaceutical pipelines are characterized by high attrition rates; typically, only a small fraction of preclinical candidates advance to regulatory approval.

- Resource Allocation: The write-off or deprioritization of failed early-stage projects frees up capital and personnel for more promising therapeutic areas or late-stage development candidates.

- Strategic Focus: By discontinuing unviable projects, Shionogi can concentrate its efforts on areas with greater potential for commercial success and patient benefit, aligning with its long-term strategic goals.

Products in Highly Saturated or Niche Markets

Within Shionogi's diverse portfolio, certain established or highly specialized products operating in extremely competitive or niche therapeutic areas might be classified as Dogs. These products, often facing intense competition or addressing very limited patient populations, may achieve a break-even status but offer negligible contributions to the company's overall revenue growth or strategic expansion goals.

While specific product examples within Shionogi’s portfolio are not publicly detailed for this exact classification, this scenario is a recognized pattern in mature pharmaceutical companies. For instance, in 2024, many pharmaceutical giants with broad portfolios saw older drugs in saturated markets, like certain established antibiotics or less innovative cardiovascular treatments, contribute minimally to their top-line growth. These products often require continued, albeit reduced, investment for compliance and supply, but do not drive significant market share gains.

The characteristic of these "Dog" products is their limited potential for future growth, often due to:

- Market Saturation: Intense competition from numerous similar offerings.

- Niche Application: Targeting a very small patient demographic.

- Limited Innovation: Lack of significant differentiation from competitors.

- Mature Lifecycle: Products are well past their peak growth phase.

As of 2024, the pharmaceutical industry continues to see a trend where companies strategically manage or divest such assets to focus resources on higher-potential pipeline candidates or more recently launched, innovative therapies.

Shionogi's portfolio includes established medications like Doribax and Ulesfia, whose patent protections have lapsed or are close to expiring. This situation exposes them to intense competition from generic manufacturers, consequently diminishing their market presence and revenue streams. These drugs typically contribute little to cash generation, positioning them as potential candidates for divestment or discontinuation within the company's strategic planning.

Shionogi's COVID-19 related products are showing declining sales. While Xocova performed well initially in Japan, the overall revenue from these products has decreased significantly compared to the previous fiscal year. This downturn is attributed to a much milder COVID-19 epidemic. The market for certain COVID-19 treatments is shrinking rapidly, with factors like the disposal of government stockpiles contributing to this decline. This indicates that older COVID-19 related offerings or excess inventory are likely becoming 'dogs' in Shionogi's portfolio due to fading demand.

Shionogi reported ¥100.9 billion in R&D expenses for the fiscal year ending March 31, 2024. A portion of this is allocated to early-stage projects that may not reach market, representing potential 'dogs' within their internal pipeline. Pharmaceutical pipelines are characterized by high attrition rates; typically, only a small fraction of preclinical candidates advance to regulatory approval. The write-off or deprioritization of failed early-stage projects frees up capital and personnel for more promising therapeutic areas.

Certain established or highly specialized products in niche therapeutic areas, facing intense competition or addressing very limited patient populations, might be classified as Dogs. These products may achieve break-even status but offer negligible contributions to Shionogi's overall revenue growth or strategic expansion goals. The pharmaceutical industry continues to see a trend where companies strategically manage or divest such assets to focus resources on higher-potential pipeline candidates.

| Product Category | Market Position | Growth Potential | Shionogi Example (Illustrative) | R&D Investment (FY24) |

| Expired Patent Drugs | Low (Generic Competition) | Low | Doribax, Ulesfia | N/A (Focus on new products) |

| Declining COVID-19 Products | Low (Reduced Demand) | Low | COVID-19 treatments | N/A (Focus on new products) |

| Failed Early-Stage R&D | N/A (Not Marketed) | None | Discontinued preclinical candidates | ¥100.9 billion (Total R&D) |

| Mature Niche Products | Low to Moderate (Saturated Market) | Low | Older, specialized therapies | N/A (Focus on new products) |

Question Marks

Shionogi's ensitrelvir (Xocova), currently approved for COVID-19 treatment in Japan, is being positioned for post-exposure prophylaxis (PEP) outside Japan. The company has begun rolling submissions to the U.S. FDA for this indication, bolstered by a Fast Track designation in 2025. This move targets a potentially high-growth market, as prevention is a key strategy in managing viral outbreaks.

However, the success of ensitrelvir for PEP in markets like the U.S. faces considerable uncertainty. Evolving COVID-19 dynamics, including shifts in public health policy and the emergence of new variants, create a complex landscape. Furthermore, significant competition from existing preventative measures and other antiviral treatments will challenge its market penetration.

Within the BCG matrix framework, ensitrelvir for PEP outside Japan would likely be classified as a Question Mark. This is due to its high growth potential in the prevention market, contrasted with its current low market share and the substantial investments needed to establish its efficacy and gain regulatory approval and market acceptance globally.

Shionogi's S-337395, an investigational oral antiviral for RSV, is positioned as a potential Question Mark in the BCG Matrix. Its Phase 2 trial, concluding in January 2025, met its primary endpoint, demonstrating a significant reduction in viral load and symptom improvement, indicating strong clinical promise.

The Respiratory Syncytial Virus (RSV) market represents a high-growth opportunity due to the widespread nature of the infection and a significant unmet medical need, especially for oral treatment options. Global RSV diagnostics market was valued at approximately USD 3.1 billion in 2023 and is projected to grow substantially.

Despite its promising clinical data and market potential, S-337395 currently holds no market share, necessitating substantial investment for Phase 3 trials and eventual commercialization. This investment requirement, coupled with the early stage of market penetration, firmly places it in the Question Mark category, requiring careful strategic evaluation.

Zatolmilast, Shionogi's experimental treatment for Fragile X Syndrome, is positioned as a potential 'Question Mark' within the company's BCG Matrix. As of March 2025, adult and adolescent Phase 2b/3 trials are approaching their conclusion, indicating significant progress but also ongoing investment needs.

Fragile X Syndrome, a rare genetic disorder, presents a substantial unmet medical need. This rarity, coupled with the potential for high growth in the orphan disease market, makes Zatolmilast a promising, albeit uncertain, future prospect.

The drug's current stage necessitates continued, substantial capital outlay for clinical development and regulatory navigation. While the market potential is considerable, the ultimate commercial success of Zatolmilast remains a key question mark for Shionogi's portfolio.

S-309309 (MGAT-2 inhibitor for Obesity)

Shionogi's S-309309, an MGAT-2 inhibitor, targets the obesity market with a novel mechanism. This therapeutic area is experiencing rapid growth, driven by increasing obesity prevalence, with estimates suggesting that over 40% of the US adult population will have obesity by 2030. The competitive landscape, however, is intensifying, necessitating innovative solutions.

Currently in early-stage development, with Phase 2a trials slated for fiscal year 2025, S-309309 represents a high-potential, albeit currently zero-market-share, product. This positioning aligns with the characteristics of a 'Question Mark' in the BCG matrix, demanding significant research and development investment to realize its growth potential in a market projected to reach $100 billion globally by 2028.

- Market Growth: The global obesity market is a significant growth area, with projections indicating substantial expansion in the coming years.

- Unmet Need: Despite existing treatments, there remains a considerable unmet need for more effective and novel anti-obesity therapies.

- Development Stage: S-309309 is in early development (Phase 2a planned for FY2025), indicating high future growth potential but current low market share.

- Investment Requirement: Substantial R&D investment is necessary to advance S-309309 through clinical trials and towards market approval.

Acquired Pipeline Assets from Torii Pharmaceutical (e.g., TO-208, TO-210)

Shionogi & Co's acquisition of pipeline assets from Torii Pharmaceutical, including TO-208 for warts and molluscum contagiosum and TO-210 for acne, positions these candidates within the expanding dermatology market. These developments represent potential growth opportunities, though they are currently in early development phases without established market share.

The strategic inclusion of TO-208 and TO-210 signifies Shionogi's expansion into promising dermatological areas. For 2024, the global dermatology market is projected to reach significant value, driven by increasing awareness and demand for effective treatments.

- TO-208: Targets warts and molluscum contagiosum, addressing common dermatological conditions.

- TO-210: Focuses on acne treatment, a persistent concern for a broad patient population.

- Market Potential: Both candidates are in growing segments, indicating future revenue possibilities.

- Development Stage: Currently in development, requiring further investment for market entry and commercialization.

Question Marks represent products or ventures with high growth potential but currently low market share. For Shionogi, ensitrelvir for post-exposure prophylaxis (PEP) outside Japan, S-337395 for RSV, Zatolmilast for Fragile X Syndrome, S-309309 for obesity, and the acquired Torii Pharmaceutical assets (TO-208, TO-210) all fit this description. These assets require significant investment to achieve market penetration and success, making their future uncertain but potentially very rewarding.

| Product/Venture | Market Growth Potential | Current Market Share | Investment Requirement | BCG Category |

|---|---|---|---|---|

| Ensitrelvir (PEP) | High (COVID-19 prevention) | Low/None | High (regulatory, market entry) | Question Mark |

| S-337395 (RSV) | High (growing RSV market) | None | High (Phase 3, commercialization) | Question Mark |

| Zatolmilast (Fragile X) | High (orphan disease market) | None | High (clinical development) | Question Mark |

| S-309309 (Obesity) | Very High (expanding obesity market) | None | High (R&D investment) | Question Mark |

| TO-208 & TO-210 (Dermatology) | Moderate to High (dermatology segments) | None | Moderate to High (development) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is constructed using robust data including Shionogi's financial disclosures, market share reports, and pharmaceutical industry growth forecasts to provide a comprehensive strategic overview.