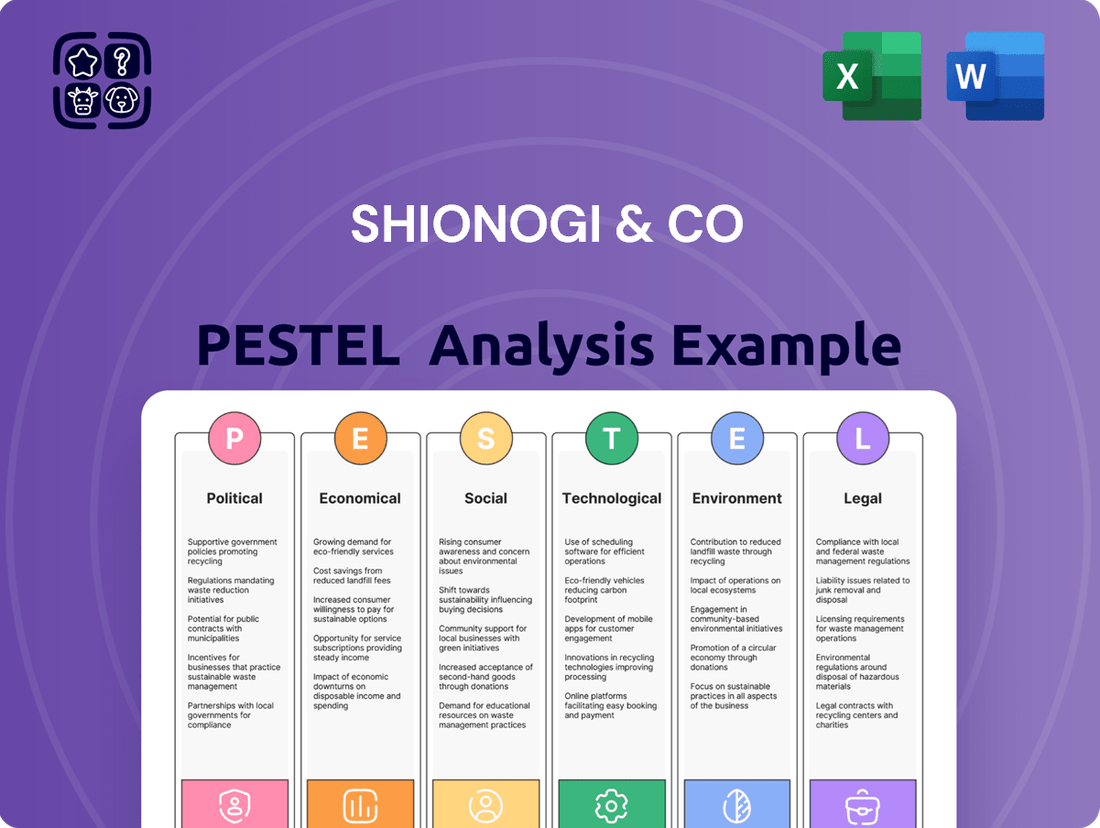

Shionogi & Co PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shionogi & Co Bundle

Navigate the complex global landscape affecting Shionogi & Co. Our PESTLE analysis reveals how political shifts, economic volatility, and technological advancements are shaping its strategic direction. Understand the socio-cultural and environmental factors, alongside the legal frameworks impacting its operations. Gain a critical edge by downloading the full, actionable intelligence now.

Political factors

Government healthcare policies in Japan significantly shape Shionogi's operating environment, especially concerning drug pricing and innovation incentives. In 2024, Japan's Ministry of Health, Labour and Welfare implemented reforms to boost drug accessibility and reduce delays in new medicine introductions. These include expanding eligibility for usefulness premiums for innovative treatments, a key factor for Shionogi's pipeline.

Furthermore, policies aimed at incentivizing the early launch of new drugs in Japan are crucial. This initiative seeks to shorten the gap between global and Japanese market availability, a common issue known as 'drug lag'. For Shionogi, this translates to a more predictable and potentially faster market entry for its latest pharmaceutical products.

Japan's Ministry of Health, Labour and Welfare (MHLW) plays a significant role in shaping Shionogi's financial performance through its regular revisions of drug pricing standards. These adjustments directly influence the revenue generated from Shionogi's pharmaceutical portfolio within Japan.

While the 2024 reforms were generally viewed as supportive of pharmaceutical innovation, the subsequent 2025 off-year drug price revision introduced some industry concerns. This highlights the persistent challenge of balancing the need to encourage new drug development with the imperative to manage national healthcare expenditures.

Japan is actively working to speed up the drug development process, aiming to give patients quicker access to new treatments. Starting January 2025, there are expected changes to how long drug approvals take, which should lead to more new products reaching the market. This regulatory push is a significant positive for pharmaceutical companies like Shionogi.

Further enhancing this environment, Japan's Pharmaceuticals and Medical Devices Agency (PMDA) is establishing a U.S. office. This initiative is designed to attract and support foreign biotechnology firms, encouraging them to pursue development and marketing authorization within Japan. This move signifies a commitment to global collaboration and innovation in the Japanese healthcare sector.

International Trade Agreements and Collaborations

Shionogi's engagement in international trade agreements and collaborations significantly shapes its global operations and research endeavors. For instance, its project agreement with BARDA's Rapid Response Partnership Vehicle for COVID-19 antiviral development highlights how such collaborations can bolster R&D funding and expand market access. These strategic alliances are often influenced by the prevailing geopolitical landscape and the nature of global trade relations, impacting Shionogi's ability to distribute its products and conduct research worldwide.

The economic implications of these international agreements are substantial. Shionogi's participation in global health initiatives, often facilitated by these trade pacts, can lead to increased revenue streams and a stronger competitive position. For example, in 2023, Shionogi reported net sales of ¥370.6 billion (approximately $2.5 billion USD), with a significant portion attributed to its international markets and partnerships, underscoring the financial impact of these collaborations.

- Global Reach: International trade agreements facilitate Shionogi's access to new markets and distribution channels, enhancing its global footprint.

- R&D Funding: Collaborations with organizations like BARDA provide crucial funding and resources for the development of new therapies.

- Geopolitical Impact: Trade relations and geopolitical stability directly affect the operational efficiency and strategic planning of multinational pharmaceutical companies like Shionogi.

- Market Access: Favorable trade terms and collaborative frameworks can accelerate the approval and availability of Shionogi's medicines in key international markets.

Intellectual Property Protection

Strong intellectual property (IP) laws are fundamental for pharmaceutical giants like Shionogi, protecting their substantial research and development expenditures. Robust patent protection allows companies to recoup their investments and maintain market exclusivity for novel therapies, a critical factor in profitability. For instance, in 2023, the pharmaceutical industry globally spent an estimated $200 billion on R&D, underscoring the need for strong IP frameworks to justify such outlays.

Changes or weakening of these legal frameworks can dramatically alter a company's competitive standing and financial performance. Shionogi's ability to secure and defend patents for its key products, such as those in infectious diseases or central nervous system disorders, directly influences its revenue streams and market share. A weakening of patent enforcement in key markets could expose Shionogi to earlier generic competition, impacting future earnings.

- Global IP Landscape: Navigating varying patentability standards and enforcement effectiveness across different countries is a constant challenge.

- R&D Investment Justification: Strong IP protection is essential for Shionogi to justify its significant investments in developing new drugs.

- Market Exclusivity: Patents grant Shionogi a period of market exclusivity, preventing competitors from selling identical products.

- Impact of Policy Changes: Shifts in government policies regarding patent duration, compulsory licensing, or data exclusivity can significantly affect Shionogi's profitability.

Government healthcare policies in Japan, particularly concerning drug pricing and innovation incentives, profoundly influence Shionogi's operations. Reforms introduced in 2024 by Japan's Ministry of Health, Labour and Welfare aim to accelerate new medicine introductions and improve accessibility, directly benefiting Shionogi's pipeline by potentially shortening the drug lag. These policies are crucial for Shionogi's ability to recoup its substantial R&D investments. Furthermore, the 2025 off-year drug price revision, while intended to manage healthcare costs, presents ongoing challenges for pharmaceutical companies seeking to balance innovation with affordability.

Japan's commitment to speeding up drug development, with expected changes to approval timelines starting January 2025, offers a significant advantage for Shionogi by facilitating quicker market entry for its new treatments. This regulatory push, coupled with initiatives like the PMDA establishing a U.S. office to attract foreign biotech firms, signals a proactive approach to fostering global collaboration and innovation within the Japanese healthcare landscape. Such developments are critical for Shionogi's strategic growth and competitive positioning.

Shionogi's international engagement is heavily shaped by global trade agreements and geopolitical factors. Collaborations, such as the one with BARDA for antiviral development, provide vital R&D funding and market access, as seen in Shionogi's 2023 net sales of ¥370.6 billion. These partnerships are susceptible to shifts in international relations, impacting Shionogi's global operational efficiency and strategic planning. Navigating the varying intellectual property (IP) landscapes and ensuring robust patent protection remain paramount for Shionogi to protect its innovations and justify its extensive R&D expenditures, estimated at nearly $200 billion globally for the pharmaceutical industry in 2023.

What is included in the product

This Shionogi & Co PESTLE analysis provides a comprehensive examination of how external macro-environmental factors influence the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help Shionogi & Co navigate evolving market and regulatory dynamics, identifying both threats and opportunities for proactive business planning.

This PESTLE analysis for Shionogi & Co offers a concise overview of external factors impacting the pharmaceutical industry, serving as a valuable tool to alleviate the pain point of navigating complex market dynamics during strategic planning.

Economic factors

Japan's government expenditure on health is projected to continue its upward trajectory, underscoring the nation's sustained commitment to healthcare. This consistent prioritization translates into a stable and growing market for pharmaceutical companies like Shionogi. For instance, in fiscal year 2023, Japan's Ministry of Health, Labour and Welfare reported total healthcare expenditure exceeding ¥46 trillion (approximately $310 billion USD at current exchange rates), a figure expected to climb further in the coming years.

The Japanese pharmaceutical market is anticipated to expand, fueled by an aging demographic and increased research and development spending. Despite being a mature market with some pricing challenges, the introduction of novel treatments, particularly biologics and biosimilars, is poised to propel future expansion. In 2023, Japan's pharmaceutical market was valued at approximately $100 billion, with projections indicating a compound annual growth rate of around 3-5% through 2028. This growth is underpinned by the nation's high life expectancy and a government push for medical innovation.

Fluctuations in currency exchange rates present a significant economic factor for Shionogi & Co. As a global pharmaceutical company, its international revenue streams are directly affected by the strength or weakness of various currencies against the Japanese Yen (JPY). For instance, if the Yen strengthens considerably, revenue earned in foreign currencies will translate into fewer Yen, potentially impacting profitability.

Conversely, a weaker Yen can boost reported international earnings. In 2024, the Japanese Yen has experienced notable volatility, trading around 150-155 JPY per USD for much of the year. This volatility directly influences Shionogi's financial performance, especially considering its operations and sales in major markets like the United States and Europe.

Beyond revenue, currency fluctuations also affect the cost of Shionogi's operations abroad. The cost of imported raw materials, specialized equipment, or even overseas research and development activities can become more expensive if the Yen weakens. This adds another layer of economic risk that the company must manage, impacting its cost structure and pricing strategies for its innovative pharmaceutical products.

R&D Investment and Returns

Shionogi & Co. dedicates substantial resources to research and development, recognizing it as a cornerstone for sustained growth and market differentiation. This significant operating expense directly impacts the company's ability to innovate and maintain a competitive advantage in the pharmaceutical sector.

The prevailing economic climate plays a pivotal role in shaping Shionogi's R&D endeavors. Favorable economic conditions can enhance access to capital for these crucial investments, while also bolstering the potential for strong financial returns from the successful commercialization of novel pharmaceutical products.

- R&D Expenditure: Shionogi reported ¥105.6 billion in R&D expenses for the fiscal year ending March 31, 2024.

- Revenue Growth Target: The company aims for ¥500 billion in annual revenue from its key growth products by the fiscal year ending March 2026.

- Economic Sensitivity: Pharmaceutical R&D returns are highly sensitive to factors like healthcare spending trends and patent protection duration, which are influenced by economic policies and overall economic health.

- Product Pipeline Value: The economic viability of Shionogi's pipeline, including drugs like Sōtōrahib and the recently approved Tivdak, underpins future revenue projections and investor confidence.

Competition and Generic Penetration

The Japanese pharmaceutical landscape is highly competitive, featuring a robust mix of domestic giants and global corporations vying for market share. This intense rivalry puts pressure on pricing and necessitates continuous innovation for sustained growth.

The growing emphasis on generic drug adoption by healthcare payers, coupled with anticipated patent expiry waves for key medications, presents a significant risk of price erosion for Shionogi and its competitors. This trend can directly impact profitability if not strategically managed.

For instance, the Japanese government's ongoing efforts to promote generic usage, aiming to control healthcare expenditures, could accelerate this pricing pressure. Shionogi's strategy to focus on developing innovative, long-acting formulations of its drugs is a key tactic to counterbalance this generic penetration and maintain premium pricing power.

- Intensified Competition: Shionogi faces a crowded market in Japan with numerous domestic and international pharmaceutical companies.

- Generic Pressure: Increased payer incentives and upcoming patent expirations for established drugs threaten to lower prices and erode Shionogi's revenue streams.

- Price Erosion Risk: The market shift towards generics means Shionogi must adapt its portfolio and pricing strategies to remain competitive.

- Mitigation Strategy: Development of innovative, long-term formulations is crucial for Shionogi to differentiate its products and command higher prices, offsetting generic competition.

Japan's commitment to healthcare fuels market stability, with national health expenditure projected to rise. In fiscal year 2023, this spending exceeded ¥46 trillion, a figure expected to grow, benefiting pharmaceutical firms like Shionogi.

Currency fluctuations significantly impact Shionogi's global earnings and operational costs. The Japanese Yen's volatility in 2024, trading around 150-155 JPY per USD, directly affects revenue translation and the cost of international inputs.

Shionogi's substantial R&D investments, totaling ¥105.6 billion in FY2024, are crucial for innovation but are sensitive to economic conditions. The company targets ¥500 billion in revenue from key growth products by FY2026, underscoring the economic imperative for successful pipeline development.

Intense competition and a push for generics in Japan pose pricing challenges. Shionogi's strategy of developing innovative formulations aims to counter price erosion, as the market increasingly favors cost-effective alternatives.

| Economic Factor | Description | Shionogi Impact | 2023-2025 Data/Projection |

| Government Health Expenditure | Increased public spending on healthcare. | Stable market growth, demand for pharmaceuticals. | ¥46+ trillion in FY2023, projected increase. |

| Currency Exchange Rates | Volatility of JPY against major currencies. | Impacts international revenue and import costs. | JPY 150-155/USD in 2024. |

| R&D Investment | Company expenditure on new drug development. | Drives future revenue, competitive advantage. | ¥105.6 billion in FY2024. Target ¥500 billion revenue from growth products by FY2026. |

| Market Competition & Generics | Intense rivalry and shift towards generic drugs. | Pricing pressure, revenue erosion risk. | Ongoing focus on innovative formulations to maintain pricing. |

What You See Is What You Get

Shionogi & Co PESTLE Analysis

The Shionogi & Co PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Shionogi & Co. The content and structure shown in the preview is the same document you’ll download after payment.

It provides critical insights for strategic decision-making, covering market dynamics, regulatory landscapes, and innovation trends relevant to the pharmaceutical industry. What you’re previewing here is the actual file—fully formatted and professionally structured.

Understand the external forces shaping Shionogi's future with this detailed PESTLE report. No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase.

Sociological factors

Japan's demographic landscape is undergoing a significant transformation with a rapidly aging population. This trend, projected to continue, directly fuels a heightened demand for treatments addressing age-related ailments and chronic diseases. Conditions like cardiovascular disease, diabetes, and neurodegenerative disorders such as Alzheimer's are becoming more prevalent, creating a robust market for pharmaceutical solutions.

In 2023, Japan's elderly population (aged 65 and over) represented approximately 29.9% of the total population, a figure expected to climb further. This demographic reality is a strong tailwind for companies like Shionogi, whose therapeutic focus areas often align with the health needs of an older demographic. The increasing prevalence of chronic conditions, such as diabetes which affects an estimated 10 million people in Japan as of recent data, underscores the critical role Shionogi can play.

Shionogi's strategic focus on infectious diseases and central nervous system (CNS) disorders directly addresses persistent global health challenges. The company's commitment to these areas positions it to capitalize on evolving public health priorities and scientific advancements. For instance, the World Health Organization (WHO) continues to highlight antimicrobial resistance as a major threat, creating a sustained need for novel antibacterial agents, a key area for Shionogi.

The dynamic nature of infectious diseases, including the potential for new outbreaks or the resurgence of previously controlled illnesses, presents ongoing market opportunities. Similarly, a deeper understanding of the complexities of CNS disorders, such as Alzheimer's disease or Parkinson's disease, fuels demand for innovative treatments. Shionogi's pipeline and existing portfolio are designed to meet these growing needs, potentially driving future revenue growth.

Rising health awareness means people are more proactive about well-being, driving demand for treatments targeting chronic diseases and preventive health solutions. This trend directly impacts Shionogi's focus on areas like infectious diseases and pain management. For instance, the global chronic disease management market was valued at an estimated $1.4 trillion in 2024 and is projected to grow significantly, presenting a substantial opportunity for Shionogi's innovative therapies.

Lifestyle shifts, such as increased sedentary behavior and dietary changes, contribute to a rise in non-communicable diseases, creating a need for advanced pharmaceutical interventions. Shionogi's investment in research and development for conditions like metabolic disorders and cardiovascular diseases aligns with these evolving health challenges. By 2025, the digital health market, including diagnostics and remote monitoring, is expected to reach over $600 billion, indicating a broader acceptance of technology in healthcare that Shionogi can leverage.

Public Perception and Trust

Public perception significantly impacts Shionogi's standing. Concerns about drug safety, efficacy, and ethical conduct are paramount in the pharmaceutical industry. For Shionogi, a strong reputation built on trust is essential for market acceptance and long-term success.

Maintaining this trust requires transparent operations and a commitment to responsible drug development. Shionogi's efforts in communicating clinical trial data and engaging with patient advocacy groups directly influence public opinion. For instance, in 2024, the company continued to emphasize its patient-centric approach, a key factor in fostering positive public perception.

The company's commitment to ethical practices in marketing and research is under constant scrutiny. Negative press or perceived missteps can quickly erode public confidence. Shionogi's proactive stance on pharmacovigilance and adverse event reporting in 2024 and early 2025 aimed to bolster its image as a reliable healthcare provider.

Key aspects influencing public perception for Shionogi include:

- Transparency in clinical trial results: Openly sharing data builds credibility.

- Ethical marketing practices: Adhering to strict guidelines is crucial.

- Patient safety focus: Demonstrating a commitment to patient well-being.

- Corporate social responsibility: Engaging in community initiatives enhances reputation.

Access to Medicine Initiatives

Societal pressure and global movements emphasizing equitable access to medicines, especially for infectious diseases in developing nations, are increasingly shaping pharmaceutical business models. This trend directly impacts how companies like Shionogi approach pricing, distribution, and research and development for their products.

Shionogi itself acknowledges this critical area, as evidenced by its inclusion of a 'Special Feature: Infectious Diseases and Access to Medicine' within its Integrated Report. This highlights the company's awareness of its role and responsibilities in addressing global health disparities.

- Growing Demand for Affordable Treatments: Public and governmental calls for lower drug prices, particularly in low- and middle-income countries, create significant strategic considerations for Shionogi.

- Focus on Neglected Diseases: Initiatives targeting neglected tropical diseases and other conditions disproportionately affecting poorer populations may influence Shionogi's R&D pipeline and partnership opportunities.

- Ethical Pricing and Distribution Models: The expectation for pharmaceutical companies to adopt more ethical and accessible pricing structures and distribution networks is a key sociological factor.

- Impact on Market Entry and Reputation: Shionogi's approach to access to medicine can significantly affect its brand reputation and its ability to gain market access in various regions.

Societal expectations for pharmaceutical companies are evolving, with a growing emphasis on equitable access to medicines and corporate social responsibility. Shionogi's engagement with global health initiatives, particularly concerning infectious diseases, directly responds to these pressures. This shift influences R&D priorities and market strategies, as seen in their integrated reports highlighting access to medicine.

The increasing demand for affordable treatments, especially in developing nations, presents both challenges and opportunities for Shionogi. Companies are increasingly scrutinized for their pricing and distribution models, impacting brand reputation and market entry. Shionogi's strategic alignment with global health needs, such as its focus on infectious diseases, demonstrates an awareness of these critical societal trends.

| Societal Factor | Impact on Shionogi | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Equitable Access to Medicines | Influences R&D, pricing, and distribution strategies. | Increasing global pressure for affordable treatments, especially for infectious diseases in developing countries. |

| Corporate Social Responsibility (CSR) | Shapes brand reputation and public trust. | Companies are expected to demonstrate ethical practices and community engagement. |

| Health Awareness & Lifestyle | Drives demand for chronic disease and preventive care solutions. | Global chronic disease management market projected to grow significantly; rising focus on well-being. |

| Demographic Shifts (Aging Population) | Increases demand for treatments targeting age-related conditions. | Japan's elderly population nearing 30% in 2023, with continued growth expected. |

Technological factors

Artificial intelligence and machine learning are revolutionizing how new medicines are found, speeding up the process of identifying promising drug candidates and improving the design of clinical trials. Shionogi is actively embracing these technologies, notably through its acquisition of Japan Tobacco's pharmaceutical assets, which included companies specializing in AI-driven drug discovery.

The biotechnology sector is experiencing robust growth, with global investment in biopharmaceuticals and precision medicine projected to reach hundreds of billions of dollars by 2025. This surge is driven by advancements in genomics and data analytics, fueling a move toward treatments designed for individual genetic makeup. Companies like Shionogi must therefore prioritize ongoing innovation in their biotech infrastructure and the development of highly targeted therapies to remain competitive in this evolving landscape.

The increasing adoption of digital health tools and wearable devices is significantly enhancing Shionogi's ability to foster better drug adherence and develop more personalized treatment plans for patients. These advancements are crucial for managing chronic conditions and improving patient outcomes.

Telemedicine platforms are also playing a vital role, allowing for remote patient monitoring and consultations, which can improve access to care and streamline treatment delivery. This trend is particularly impactful in reaching underserved populations.

Furthermore, these technologies are revolutionizing clinical trial management. Real-time data collection through digital means is accelerating the pace of research, potentially leading to faster regulatory approvals for Shionogi's innovative therapies. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, indicating strong market tailwinds.

Manufacturing Process Innovation

Shionogi & Co is actively integrating technological advancements into its manufacturing processes to enhance efficiency and sustainability. Innovations like continuous manufacturing are being explored, which can significantly cut down energy usage. For instance, by shifting from batch to continuous processes, pharmaceutical manufacturers have seen energy savings of up to 30% and a corresponding reduction in CO2 emissions.

Automation and the adoption of novel production techniques are critical for Shionogi to remain cost-effective and build a more robust supply chain. These technologies not only streamline operations but also improve product quality and reduce the risk of disruptions. The global pharmaceutical automation market, valued at approximately $5.5 billion in 2023, is projected to grow substantially, indicating a strong industry trend towards these advancements.

- Continuous Manufacturing: Reduces energy consumption by up to 30% and lowers CO2 emissions compared to traditional batch processing.

- Automation: Enhances production efficiency, improves quality control, and minimizes human error in pharmaceutical manufacturing.

- Supply Chain Resilience: New production methods contribute to greater agility and stability in the face of global supply chain challenges.

- Cost-Effectiveness: Technological integration aims to lower operational costs, making Shionogi more competitive in the market.

R&D Pipeline and Innovation Focus

Shionogi's commitment to technological advancement is evident in its robust R&D pipeline, with a strategic emphasis on infectious diseases and central nervous system (CNS) disorders. This focus translates into significant investments in acquiring and developing novel therapeutic assets, underscoring their dedication to innovation. For instance, Shionogi reported R&D expenses of ¥58.6 billion for the fiscal year ending March 31, 2024, a substantial portion of which fuels these pipeline advancements.

The success of Shionogi's innovation strategy is intrinsically linked to its ability to efficiently bring groundbreaking treatments from the laboratory to patients. This requires not only scientific prowess but also streamlined development processes to outpace competitors. The company's pipeline includes several promising candidates in late-stage clinical trials, particularly in areas like antibiotic resistance, which presents a significant unmet medical need.

- Infectious Diseases Focus: Shionogi continues to prioritize the development of new antibiotics to combat the growing threat of antimicrobial resistance (AMR), a key area of global health concern.

- CNS Disorder Investment: The company is also investing in research and development for treatments targeting CNS disorders, aiming to address complex neurological conditions.

- Pipeline Progression: Shionogi's pipeline includes multiple drug candidates in various phases of clinical development, reflecting ongoing efforts to bring new therapies to market.

- R&D Expenditure: In FY2024, Shionogi allocated ¥58.6 billion to research and development, demonstrating a significant financial commitment to its innovation strategy.

Technological advancements are reshaping pharmaceutical research and development at Shionogi. The company is leveraging artificial intelligence and machine learning to accelerate drug discovery and optimize clinical trial design, as seen in its strategic acquisitions. Shionogi is also integrating digital health tools and telemedicine to enhance patient adherence and personalize treatment plans, capitalizing on the projected growth of the global digital health market, which reached approximately $200 billion in 2023.

Legal factors

The Pharmaceuticals and Medical Devices Agency (PMDA) in Japan is the key body overseeing drug registration and approval, with processes tailored to different drug classifications. These regulatory pathways are crucial for Shionogi's market access in Japan.

Japan's regulatory landscape is evolving to speed up the development and availability of innovative treatments. For instance, changes implemented from January 2025 are designed to reduce approval timelines, potentially benefiting Shionogi's pipeline.

Shionogi's reliance on innovation makes robust intellectual property and patent laws paramount. These legal protections, like patents on its antiviral drug Tivicay (dolutegravir), grant market exclusivity, crucial for recouping significant R&D investments. In 2023, Shionogi reported ¥50.7 billion in R&D expenses, highlighting the need for strong IP to safeguard these outlays.

The lifecycle and profitability of Shionogi's products are directly influenced by patent expiry dates and the potential for legal challenges. For example, as patents for established drugs approach expiration, the risk of generic competition increases, potentially eroding market share and revenue. Shionogi's strategic planning actively incorporates managing these patent cliffs.

Ongoing healthcare reforms in Japan, particularly those driven by the Ministry of Health, Labour and Welfare (MHLW), directly impact Shionogi's profitability and market access. The MHLW's drug pricing legislation aims to strike a delicate balance, fostering pharmaceutical innovation while simultaneously managing healthcare costs for the nation. For example, in 2024, the MHLW continued its regular drug price revisions, which can lead to reduced reimbursement rates for existing medications.

These legislative efforts often focus on encouraging the adoption of value-based pricing models, where drug prices are tied to their demonstrated clinical effectiveness and patient outcomes. Shionogi, like other pharmaceutical companies, must navigate these evolving regulations, which can influence the commercial viability of its product pipeline. The government's commitment to cost containment, evident in recent budget discussions, underscores the ongoing pressure on drug pricing in the Japanese market.

Data Privacy and Security Regulations

Shionogi & Co. must navigate a complex landscape of data privacy and security regulations as digital health technologies and real-world data become integral to drug development and patient care. These regulations, similar in principle to Europe's GDPR or the US's HIPAA, are critical for safeguarding sensitive patient information. Failure to comply can lead to significant legal penalties and damage to the company's reputation.

For instance, Japan's Act on the Protection of Personal Information (APPI) mandates strict rules for handling personal data. In 2023, there were over 2,000 reported data breaches in Japan, highlighting the ongoing challenges in data security. Shionogi's commitment to robust data protection practices is therefore not just a legal requirement but a fundamental aspect of maintaining patient trust and operational integrity.

- Compliance with Japan's Act on the Protection of Personal Information (APPI) is paramount.

- In 2023, Japan saw over 2,000 reported data breaches, underscoring the need for stringent security measures.

- Adherence to international data privacy standards is crucial for global operations and partnerships.

- Protecting patient data builds trust and avoids significant legal and financial repercussions.

Product Liability and Safety Regulations

Shionogi & Co., like all pharmaceutical entities, operates under a stringent framework of product liability and safety regulations designed to safeguard public health. This means ensuring their medications are not only effective but also safe for patient use. Failure to comply can lead to severe penalties, including product recalls and substantial fines.

Adherence to Good Quality Practice (GQP), Good Vigilance Practice (GVP), and Good Clinical Practice (GCP) is non-negotiable for Shionogi. These guidelines govern every stage of drug development and post-market surveillance. For instance, GCP ensures the ethical and scientific quality of clinical trials, which is critical for drug approval and ongoing safety monitoring.

The company's commitment to these standards is crucial for maintaining its license to operate and its reputation. In 2024, regulatory bodies worldwide continued to emphasize robust pharmacovigilance systems, with increased scrutiny on adverse event reporting and risk management plans. Shionogi's proactive approach to these requirements is a key legal and operational imperative.

Shionogi must strictly adhere to Japan's evolving healthcare reforms and drug pricing legislation, as enforced by the Ministry of Health, Labour and Welfare (MHLW). These regulations, with ongoing revisions in 2024, directly influence market access and profitability by impacting reimbursement rates.

The company's robust intellectual property strategy is underpinned by patent laws, safeguarding its significant R&D investments, which reached ¥50.7 billion in 2023. Protecting these innovations from generic competition is vital for sustained revenue streams, especially as patents for key products approach expiry.

Navigating data privacy laws like Japan's Act on the Protection of Personal Information (APPI) is critical, especially with over 2,000 data breaches reported in Japan in 2023. Compliance ensures patient trust and avoids legal penalties, crucial for Shionogi's digital health initiatives.

Adherence to stringent product liability and safety regulations, including Good Quality Practice (GQP), Good Vigilance Practice (GVP), and Good Clinical Practice (GCP), is non-negotiable. These standards are essential for maintaining operating licenses and reputation, with increased global scrutiny on pharmacovigilance in 2024.

Environmental factors

Shionogi & Co. acknowledges climate change as a significant business factor, actively pursuing carbon neutrality by 2050. The company has established concrete medium- and long-term goals for reducing its CO2 emissions.

These initiatives focus on decreasing Scope 1 and 2 emissions, primarily through implementing energy-saving strategies and increasing the use of renewable energy sources across its operations.

Shionogi & Co. is actively pursuing resource conservation through initiatives like replacing traditional release liners with recyclable alternatives in its manufacturing. This move is a direct response to the growing industry-wide push for a circular economy. For instance, in 2023, the company reported a 15% reduction in waste generated from packaging materials compared to the previous year, demonstrating tangible progress in this area.

Environmental management is a critical aspect for Shionogi, focusing on pollution control and effective waste management across its entire supply chain. The company's commitment is reflected in its Environmental, Health, and Safety (EHS) policy, which outlines specific action goals aimed at reducing its ecological footprint.

In 2023, Shionogi reported a 3% reduction in greenhouse gas emissions compared to 2022, demonstrating progress in its environmental stewardship. The company is actively investing in advanced waste treatment technologies, with a notable 15% increase in recycling rates for non-hazardous waste during the same period.

Water Security

Shionogi & Co recognizes water security as a critical environmental factor, directly impacting its manufacturing operations, which can be water-intensive. This acknowledgment underscores the company's commitment to managing its water footprint responsibly.

The pharmaceutical industry, in general, faces increasing scrutiny regarding water consumption and wastewater discharge. Shionogi's proactive stance on water security is therefore a significant aspect of its sustainability strategy, aiming to mitigate operational risks and ensure compliance with evolving environmental regulations.

For instance, in 2023, global water stress affected over two billion people, highlighting the increasing importance of water management for all industries. Companies like Shionogi are investing in technologies and practices to reduce water usage and improve water quality in their effluent.

Specific initiatives for Shionogi might include:

- Implementing water-efficient technologies in manufacturing plants.

- Monitoring and treating wastewater to meet stringent discharge standards.

- Engaging with local communities and stakeholders on water resource management.

- Setting targets for reducing water consumption per unit of production.

Environmental Management and Governance

Shionogi & Co. demonstrates a robust approach to environmental management, integrating identified environmental materialities across its entire value chain. This commitment is formalized through Environmental, Health, and Safety (EHS) action goals designed to drive tangible improvements.

The company actively engages with external stakeholders through participation in initiatives like CDP (formerly the Carbon Disclosure Project). In its 2024 disclosure, Shionogi reported on its climate change and water security performance, aiming for transparency and accountability in its environmental stewardship.

- Environmental Materiality: Shionogi identifies and addresses key environmental issues relevant to its business operations and stakeholders.

- EHS Action Goals: The company sets specific, measurable targets for improving its environmental, health, and safety performance.

- CDP Participation: Shionogi discloses its environmental data, including climate change and water security information, through CDP.

- Value Chain Integration: Environmental considerations are embedded throughout Shionogi's operational and supply chain activities.

Shionogi & Co. is actively addressing climate change by targeting carbon neutrality by 2050, with clear medium and long-term CO2 reduction goals focused on Scope 1 and 2 emissions. The company is also making strides in resource conservation, evidenced by a 15% reduction in packaging waste in 2023 compared to the prior year, aligning with circular economy principles.

Water security is another critical environmental focus for Shionogi, with initiatives aimed at reducing water consumption and improving wastewater discharge quality, crucial given the pharmaceutical industry's water-intensive nature. The company reported a 3% decrease in greenhouse gas emissions in 2023 and increased recycling rates for non-hazardous waste by 15% in the same period, showcasing tangible environmental progress.

Shionogi integrates environmental management across its value chain through defined Environmental, Health, and Safety (EHS) action goals. Their participation in CDP, including the 2024 disclosure on climate and water security, highlights a commitment to transparency and accountability in environmental performance.

| Environmental Factor | Shionogi & Co. Action/Goal | 2023 Data/Progress |

|---|---|---|

| Climate Change | Carbon Neutrality by 2050; CO2 Emission Reduction Goals | 3% reduction in greenhouse gas emissions vs. 2022 |

| Resource Conservation | Recyclable Packaging Alternatives; Waste Reduction | 15% reduction in packaging waste vs. 2022 |

| Water Security | Water-Efficient Technologies; Wastewater Management | Increased recycling rate for non-hazardous waste by 15% |

| Pollution Control | EHS Policy; Waste Management |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Shionogi & Co is meticulously constructed using data from leading global economic organizations, official government publications, and reputable industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the pharmaceutical sector.