Sembcorp Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sembcorp Industries Bundle

Sembcorp Industries operates within a dynamic global landscape, heavily influenced by political stability, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic decision-making.

Our comprehensive PESTLE analysis dives deep into how these factors specifically impact Sembcorp's operations, from regulatory shifts in energy markets to economic growth impacting infrastructure projects. Gain an unparalleled understanding of the opportunities and challenges ahead.

Don't get left behind by external trends. Equip yourself with the actionable intelligence needed to navigate Sembcorp's future. Download the full PESTLE analysis now and secure your competitive advantage.

Political factors

Governments globally are pushing hard for renewable energy, aiming to phase out fossil fuels. This directly shapes Sembcorp’s strategic shift towards greener power sources. For instance, the United States' Inflation Reduction Act of 2022, enacted in August 2022, provides significant tax credits for clean energy, and many countries are following suit with similar supportive policies.

These government initiatives, including subsidies, tax breaks, and mandates for renewable energy adoption, heavily influence Sembcorp's investment choices and the market opportunities available. The European Union, for example, has a target of sourcing 42.5% of its energy from renewables by 2030, a directive that encourages significant private sector investment in the sector.

Regulatory backing is absolutely vital for rolling out major renewable energy projects. By 2023, global renewable energy capacity additions reached an all-time high, with solar PV leading the charge, demonstrating the tangible impact of supportive policy frameworks on market growth.

Governments globally are increasingly implementing carbon pricing mechanisms, like carbon taxes and emissions trading schemes, directly impacting the operational costs of companies with conventional energy assets. For Sembcorp Industries, this means higher expenses for its fossil fuel-based power generation, potentially reducing profitability. For instance, in 2023, the European Union's Emissions Trading System (EU ETS) saw carbon prices averaging around €90 per tonne of CO2, a significant increase from previous years, highlighting the rising cost of carbon emissions.

Stricter emissions regulations are also compelling a strategic pivot towards lower-carbon operations. These policies mandate reduced pollution levels and encourage investments in renewable energy sources, directly influencing Sembcorp's asset portfolio. The company’s proactive strategy includes divesting carbon-intensive assets, such as its stake in the Seraya power plant in Singapore, and channeling capital into its growing renewable energy portfolio, which saw significant expansion in 2024.

The ongoing liberalization of energy markets globally presents a dynamic environment for Sembcorp Industries. As regulations ease in regions like Southeast Asia and Europe, new competitive landscapes are emerging, offering both challenges and significant growth avenues. For instance, countries such as Vietnam and the Philippines are actively reforming their power sectors to encourage private investment, potentially creating opportunities for Sembcorp to expand its renewable energy portfolio and integrated solutions.

Deregulation in these markets often translates to increased private player participation in power generation and retail. This can intensify competition, but crucially, it also allows agile companies like Sembcorp to pursue greater market share and develop innovative, integrated energy services. The company's strategic focus on renewables, evidenced by its target of 10 GW of renewable energy capacity by 2025, positions it well to capitalize on these shifts toward market-driven energy supply.

Understanding the specific market structures and regulatory frameworks within Sembcorp's key operating geographies is therefore paramount. For example, the European Union’s push for energy market integration and decarbonization, coupled with national reforms in countries like the UK, creates a complex but potentially rewarding environment for companies investing in green energy solutions and grid modernization.

International Climate Agreements

Global climate accords, such as the Paris Agreement, significantly shape national environmental policies and corporate sustainability targets. These agreements compel companies like Sembcorp to adopt decarbonization strategies, aligning their operations with global climate objectives. For instance, the Paris Agreement aims to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels, a goal that necessitates substantial shifts in energy production and consumption.

International commitments frequently manifest as domestic regulations and increased investor demand for environmentally responsible investments. This trend puts pressure on businesses to enhance their green credentials and transition towards more sustainable practices. In 2024, for example, the European Union's Carbon Border Adjustment Mechanism (CBAM) began its transitional phase, impacting carbon-intensive imports and signaling a broader shift towards pricing carbon emissions internationally.

Sembcorp's strategic emphasis on renewable energy solutions directly aids nations in fulfilling their climate change mitigation pledges. By expanding its portfolio of solar, wind, and energy storage projects, Sembcorp contributes to the global effort to reduce greenhouse gas emissions. As of early 2025, Sembcorp had a significant pipeline of renewable energy projects, aiming to substantially increase its renewable energy capacity to support these national and international goals.

Key influences stemming from international climate agreements include:

- Policy Alignment: National governments implement policies reflecting international climate targets, impacting energy sectors.

- Investor Pressure: Growing demand for ESG (Environmental, Social, and Governance) compliant investments encourages companies to prioritize sustainability.

- Technological Advancement: International focus on climate solutions drives innovation in renewable energy and carbon capture technologies.

- Market Access: Adherence to international climate standards can facilitate access to global markets and preferential trade agreements.

Geopolitical Stability and Energy Security

Geopolitical shifts significantly impact Sembcorp Industries by influencing energy supply chains and fuel costs. For instance, ongoing conflicts in Eastern Europe have continued to create volatility in global natural gas prices, a key input for Sembcorp's conventional power generation assets. This underscores the critical need for robust supply chain management and hedging strategies.

Sembcorp's strategic pivot towards renewables directly addresses national energy security concerns, a growing priority for governments worldwide. By expanding its renewable energy portfolio, Sembcorp contributes to energy independence, reducing reliance on imported fossil fuels. As of early 2025, Sembcorp has a significant pipeline of renewable projects across Asia, aiming to bolster grid stability and lower carbon emissions.

Political stability within Sembcorp's operating regions is paramount for its long-term infrastructure investments. Projects such as large-scale wind or solar farms require decades of predictable regulatory environments and secure property rights. Any political instability can deter necessary foreign direct investment and complicate project financing, potentially delaying or halting crucial energy transition initiatives.

- Energy Supply Chain Disruption: Geopolitical tensions can lead to price spikes and supply shortages for key commodities like natural gas.

- Renewable Energy as a Geopolitical Tool: Increased renewable capacity enhances national energy security and reduces dependence on volatile fossil fuel markets.

- Political Risk in Infrastructure: Long-term energy projects are highly sensitive to political stability and consistent government policy.

Government policies are a primary driver for Sembcorp's strategic direction, especially its significant investment in renewable energy. Supportive regulations, tax incentives, and carbon pricing mechanisms directly influence project viability and market opportunities. For example, the global push for net-zero emissions, reinforced by international agreements, compels nations to enact policies that favor cleaner energy sources, impacting Sembcorp's operational costs and investment decisions.

Political stability and evolving market deregulation are crucial for Sembcorp's infrastructure projects. Predictable regulatory environments and secure property rights are essential for attracting investment and ensuring the long-term success of renewable energy assets. The liberalization of energy markets in regions like Southeast Asia offers Sembcorp opportunities to expand its renewable portfolio and integrated energy services, though it also presents new competitive dynamics.

Geopolitical events can create significant volatility in energy markets, affecting fuel costs for conventional assets and underscoring the importance of energy security through renewables. Sembcorp's expansion of its renewable energy portfolio, as of early 2025, bolsters national energy independence and grid stability, aligning with government priorities to reduce reliance on imported fossil fuels.

| Factor | Impact on Sembcorp | Example/Data (2023-2025) |

|---|---|---|

| Renewable Energy Subsidies & Tax Credits | Drives investment and profitability in green energy projects. | US Inflation Reduction Act (2022) continues to incentivize clean energy development through 2025. |

| Carbon Pricing Mechanisms | Increases operational costs for fossil fuel assets; incentivizes transition. | EU ETS carbon prices averaged ~€90/tonne in 2023, rising cost of emissions. |

| Energy Market Liberalization | Creates new competitive landscapes and growth avenues in emerging markets. | Vietnam and Philippines actively reforming power sectors to encourage private investment in renewables (ongoing 2024-2025). |

| Geopolitical Tensions | Causes volatility in fossil fuel prices, influencing operational costs. | Continued instability in Eastern Europe impacting global natural gas prices (2023-2024). |

What is included in the product

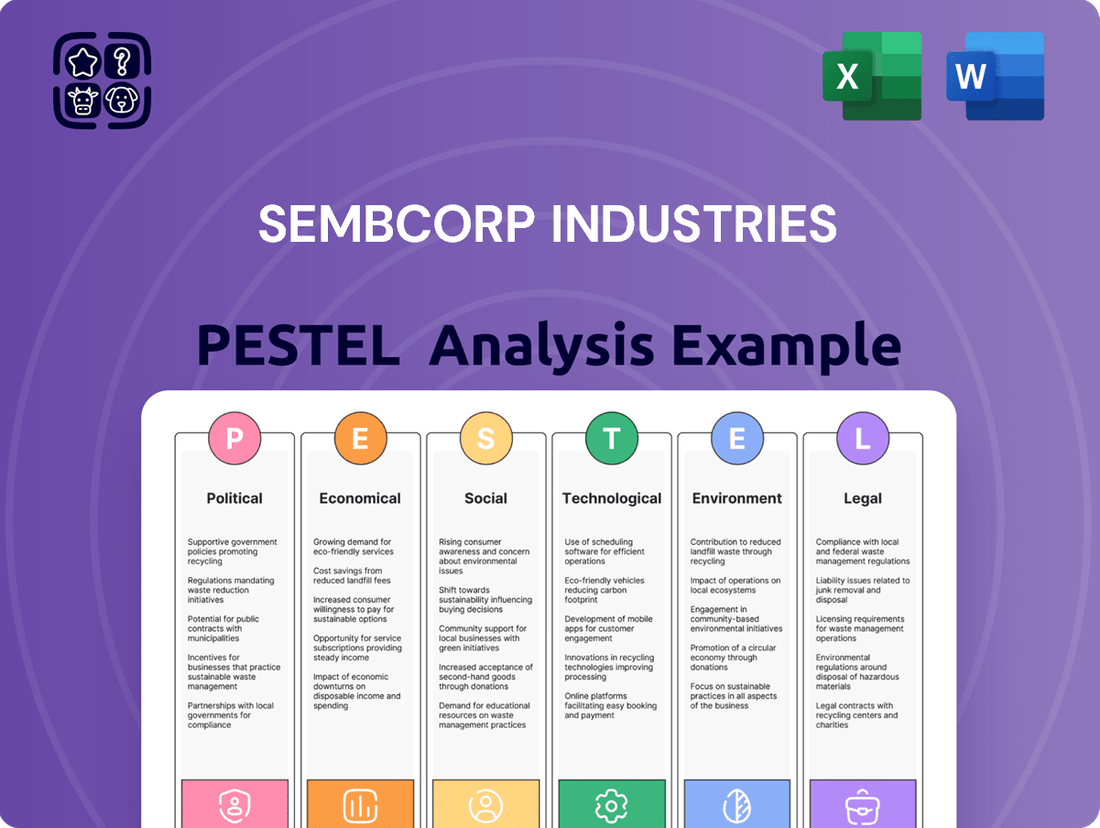

This PESTLE analysis delves into the external macro-environmental factors impacting Sembcorp Industries, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

A clear, distilled PESTLE analysis for Sembcorp Industries that succinctly highlights key external factors, acting as a readily available reference point to alleviate the burden of sifting through extensive data during strategic discussions.

Economic factors

Global economic growth is a significant driver for Sembcorp Industries, directly shaping demand for its power generation and urban development services. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight uptick from 2023, suggesting a stable but not explosive environment. This level of growth generally translates to increased industrial activity and, consequently, higher energy consumption across Sembcorp's operational regions.

Conversely, economic slowdowns or recessions can dampen industrial output and lead to reduced energy demand. This can put downward pressure on electricity prices and utility service fees, impacting Sembcorp's revenue streams. The energy sector, in particular, is sensitive to economic cycles; a robust economy boosts demand for both conventional and renewable energy sources, while a contraction can lead to oversupply and price volatility.

Sembcorp's strategic diversification across different geographies and energy sources, including renewables and conventional power, as well as its urban development segment, provides a degree of resilience. This diversification helps to mitigate the impact of regional economic downturns. For example, while one market might experience slower growth, another might offer robust demand, balancing the overall portfolio performance.

In 2024, global energy demand growth was expected to moderate compared to previous years, influenced by factors like energy efficiency improvements and a shift towards renewables. Sembcorp's increasing focus on sustainable solutions aligns with this trend, positioning it to capitalize on the evolving energy landscape even amidst fluctuating economic conditions. The company reported a substantial increase in its renewable energy portfolio in 2023, a testament to this strategic adaptation.

Sembcorp Industries' growth hinges significantly on the cost of capital. For instance, in early 2024, benchmark interest rates in key markets where Sembcorp operates, such as Singapore and key Southeast Asian economies, remained elevated compared to historical lows, impacting the cost of borrowing for their extensive renewable energy and urban development projects. A rise in interest rates directly translates to higher financing expenses for Sembcorp, potentially making large-scale infrastructure investments less attractive or requiring adjustments to project profitability forecasts.

The company's ability to secure affordable financing is paramount for executing its ambitious transformation strategy, which involves substantial capital expenditure in green energy solutions. For example, if Sembcorp were to raise debt for a new solar farm project in 2024, a higher prevailing interest rate would directly increase the project's debt servicing costs, potentially reducing its internal rate of return (IRR). This cost of capital directly influences the financial viability and ultimately the pace of Sembcorp's expansion into new renewable energy markets.

Energy commodity prices, especially those for natural gas, are a major factor for Sembcorp's traditional power generation business. When these prices jump around, it directly affects how much money the company makes and its profit margins. While Sembcorp does use long-term agreements to smooth things out, big price changes can still hit their earnings.

However, Sembcorp is actively shifting its focus towards renewable energy sources like solar and wind. This strategic move is crucial because it lessens the company's reliance on the unpredictable prices of fossil fuels. For instance, in the first half of 2024, Sembcorp reported that its renewables segment saw significant growth, contributing positively to its overall performance and demonstrating the effectiveness of this diversification strategy.

Investment Incentives for Green Technologies

Government and institutional incentives are vital for driving Sembcorp's investments in green technologies. These can include direct grants, generous tax credits, and access to preferential loans, all aimed at making renewable energy and sustainable development projects more financially viable. For instance, in 2024, many governments worldwide have continued or expanded their support programs for solar, wind, and battery storage projects, directly benefiting companies like Sembcorp looking to scale up their green portfolios. These incentives are critical for reducing the upfront capital expenditure and enhancing the overall profitability of sustainable ventures, making them more competitive against traditional energy sources.

Sembcorp actively participates in securing these incentives to fuel its growth in the renewable sector. The company's strategy often involves aligning its project development pipeline with available government funding schemes. For example, the Singapore government, a key market for Sembcorp, has been actively promoting green finance and offering various grants and tax allowances for sustainable infrastructure. As of early 2025, initiatives like enhanced capital allowances for green equipment and grants for developing low-carbon solutions continue to be a significant draw. This strategic leveraging of incentives helps Sembcorp de-risk its investments and accelerate the deployment of clean energy solutions, contributing to its ambitious sustainability targets.

- Government support in 2024-2025 includes direct grants, tax credits, and preferential loans for renewable energy projects.

- These incentives reduce initial investment costs and improve the financial returns of green technologies.

- Sembcorp actively seeks to utilize these programs to expand its renewable energy and sustainable urban development business.

- For example, Singapore's continued focus on green finance and tax allowances for sustainable equipment benefits Sembcorp's local projects.

Inflationary Pressures

Inflationary pressures directly impact Sembcorp Industries by escalating the costs associated with essential inputs like raw materials, machinery, and workforce. For instance, the global rise in commodity prices, a key driver of inflation, can significantly inflate the capital expenditure required for Sembcorp's renewable energy projects and infrastructure developments.

These rising costs extend to operational expenses for existing assets, potentially squeezing profit margins if not effectively managed. In 2024, many sectors experienced heightened inflation, with many central banks maintaining higher interest rates to combat it, creating a challenging cost environment for capital-intensive businesses like Sembcorp.

Sembcorp's ability to navigate these inflationary headwinds hinges on robust cost management protocols and the implementation of strategic hedging techniques to lock in prices for key inputs.

- Increased Input Costs: Rising prices for steel, copper, and components essential for solar panels and wind turbines directly affect project budgets.

- Higher Operating Expenses: Increased energy prices and wage inflation can lift the day-to-day running costs of power plants and water treatment facilities.

- Impact on Margins: Without effective cost pass-through or hedging, higher expenses can directly reduce Sembcorp's profitability.

- Capital Expenditure Escalation: Inflationary trends can push out the timeline and increase the overall investment needed for new energy transition projects.

The cost of capital is a critical economic factor for Sembcorp Industries. In early 2024, interest rates in key markets remained elevated, increasing financing expenses for large projects. This directly impacts the financial viability of Sembcorp's ambitious green energy expansion. For instance, higher borrowing costs can reduce the internal rate of return (IRR) on new renewable energy investments, potentially slowing deployment.

| Factor | Impact on Sembcorp | 2024/2025 Relevance |

|---|---|---|

| Interest Rates | Increases financing costs for capital-intensive projects. | Elevated rates in 2024/2025 make debt financing more expensive, affecting project profitability and investment decisions. |

| Energy Commodity Prices | Affects profitability of conventional power generation. | While Sembcorp is shifting to renewables, natural gas prices remain a key factor for its remaining fossil fuel assets, impacting margins. |

| Inflation | Raises costs for raw materials, machinery, and labor. | In 2024, persistent inflation increased capital expenditure for new projects and operating expenses, squeezing profit margins if not managed. |

What You See Is What You Get

Sembcorp Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Sembcorp Industries delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. You will gain a clear understanding of the external forces shaping the company's future. The insights provided are critical for anyone seeking to understand Sembcorp's market position and potential growth avenues.

Sociological factors

Public awareness and demand for environmental sustainability are on the rise, significantly shaping how consumers and industries behave. This trend directly benefits Sembcorp Industries, as it fuels demand for their green energy projects and urban solutions. For instance, in 2023, Sembcorp expanded its renewable energy portfolio, reaching 14.2 GW of renewable capacity, a testament to this growing market preference.

A strong public perception of Sembcorp's dedication to sustainability is a major asset. It boosts the company's brand image and solidifies its social license to operate, making it easier to gain support for new ventures. This societal push towards eco-conscious practices is a key driver for investments in renewable energy and sustainable urban development.

The global shift towards a green economy necessitates specialized skills in areas like renewable energy technology, advanced battery storage, and smart grid management. Sembcorp Industries, like many in the sector, must navigate the challenge of finding and keeping individuals with these critical competencies. This means not only recruiting new talent but also upskilling their existing workforce to meet evolving industry demands.

For instance, the demand for solar and wind energy technicians saw a significant increase leading up to 2024. Sembcorp's ability to attract engineers with expertise in sustainable infrastructure and data analytics for grid optimization will be paramount. Investing in comprehensive training programs and fostering an environment that encourages continuous learning are key strategies for building a resilient and forward-thinking team.

By 2025, it's projected that the renewable energy sector will require millions of new skilled workers globally. Sembcorp's commitment to talent development, including apprenticeships and partnerships with educational institutions, will directly impact its capacity to execute its green transition strategy effectively. A strong focus on cultivating a culture of innovation ensures the company remains agile and competitive.

Rapid urbanization, especially across Asia, is fueling a significant demand for smart, sustainable urban development solutions. Sembcorp is well-positioned to meet this need, offering expertise in areas like efficient utilities, waste management, and green infrastructure crucial for rapidly growing cities. For instance, by 2050, it's projected that 68% of the world's population will live in urban areas, a substantial increase from 55% in 2018, highlighting the scale of this trend.

This shift towards more resource-efficient urban living directly plays into Sembcorp's strengths in developing sustainable urban environments. The company's focus on integrated solutions, from water treatment to renewable energy in urban settings, aligns perfectly with the growing global imperative for environmentally conscious city planning. This presents a clear pathway for considerable market expansion as cities worldwide seek to manage their growth sustainably.

Community Engagement and Social License

Sembcorp Industries, like any company undertaking large-scale infrastructure and development projects, hinges on maintaining a strong social license to operate. This means actively engaging with the communities where it operates, understanding their needs, and addressing any concerns that may arise. For instance, successful community engagement was crucial for projects like the Sembcorp Energy Singapore (SES) Jurong Island solar farm, which required local stakeholder buy-in.

Building trust through ethical conduct and transparent communication is paramount. This fosters goodwill, which is essential for securing project approvals and ensuring smooth, uninterrupted operations. Sembcorp's commitment to sustainability and community development initiatives, such as their efforts in India to provide access to clean energy, directly contributes to this social license. In 2024, Sembcorp announced plans to invest S$500 million in renewable energy projects in India, underscoring the importance of local partnerships.

- Social License to Operate: Essential for project approval and ongoing operations in energy and urban development.

- Community Engagement: Building positive relationships and addressing local concerns is a key focus for Sembcorp.

- Ethical Practices & Transparency: Vital for gaining public trust and ensuring smooth project execution.

- Contribution to Local Development: Initiatives that benefit local communities strengthen Sembcorp's social license.

Consumer Preferences for Green Products

Consumer demand for environmentally friendly products and services, particularly in renewable energy and sustainable utilities, is significantly on the rise. This trend presents a clear market opportunity for companies like Sembcorp that are committed to offering eco-conscious solutions. For instance, by 2024, projections indicated that the global market for green products would continue its upward trajectory, driven by heightened environmental awareness.

Meeting these shifting consumer preferences directly translates into a competitive edge. Companies that align with these values often experience enhanced customer loyalty and unlock avenues for new business development, especially as sustainability becomes a key purchasing criterion across various sectors. This is underscored by the fact that in 2023, a significant percentage of consumers reported being willing to pay a premium for sustainable goods.

- Growing Demand: Consumer preference for green products is a major driver in the energy sector.

- Market Advantage: Sembcorp's focus on renewable energy positions it favorably in this evolving market.

- Customer Loyalty: Aligning with sustainability values fosters stronger customer relationships.

- New Opportunities: Evolving preferences create pathways for business expansion into green solutions.

Societal expectations regarding corporate responsibility, particularly in environmental stewardship, are increasingly influencing business operations and investment decisions. Sembcorp's strategic pivot towards renewable energy and sustainable solutions directly addresses this growing public demand, enhancing its brand reputation and social license to operate.

The company's commitment to ethical practices and transparent communication is crucial for maintaining stakeholder trust and ensuring smooth project execution. Initiatives like providing access to clean energy in India, backed by a S$500 million investment in renewable projects announced in 2024, demonstrate this dedication to positive community impact.

Furthermore, the global trend of rapid urbanization, with 68% of the world's population projected to live in urban areas by 2050, creates a significant market for Sembcorp's sustainable urban development solutions. This includes efficient utilities and green infrastructure, aligning with cities' needs for resource-efficient growth.

Sembcorp's focus on talent development, particularly in specialized areas like renewable energy technology, is essential to meet the evolving demands of the green economy. By 2025, millions of new skilled workers are expected to be needed globally in this sector, highlighting the importance of Sembcorp's investment in training and partnerships.

| Sociological Factor | Impact on Sembcorp | Supporting Data/Examples |

|---|---|---|

| Public Demand for Sustainability | Drives demand for green energy and urban solutions; enhances brand image. | Reached 14.2 GW renewable capacity in 2023; consumers willing to pay a premium for sustainable goods (2023 data). |

| Skill Requirements in Green Economy | Necessitates focus on talent acquisition and development in specialized areas. | Demand for solar/wind technicians increasing; millions of new skilled workers needed globally by 2025. |

| Urbanization Trends | Creates market opportunities for sustainable urban development solutions. | 68% global urban population projected by 2050; Sembcorp offers expertise in efficient utilities and green infrastructure. |

| Social License to Operate | Crucial for project approvals and operational continuity; requires community engagement. | Community engagement vital for projects like Jurong Island solar farm; S$500 million India investment (2024) underscores local partnerships. |

Technological factors

Continuous innovation in solar photovoltaic, wind turbine, and energy storage technologies directly impacts Sembcorp's renewable energy segment. These advancements, like the increasing efficiency of solar panels which can now exceed 23% in commercially available modules and wind turbines with capacities reaching 15+ MW, improve operational efficiency and lower project costs, making renewables more competitive. Sembcorp's investment in projects like the Trafalgar Offshore Wind Farm, which will have a capacity of 1,000 MW, directly benefits from these technological leaps, allowing for larger, more reliable, and cost-effective deployments.

The ongoing development of smart grid technologies, coupled with advancements in artificial intelligence and data analytics, is significantly transforming energy management and operational efficiency for Sembcorp Industries. These digital solutions enable better monitoring of energy flows, predictive maintenance of assets, and more effective demand-side management, all contributing to a more resilient and efficient energy infrastructure.

By integrating these technologies, Sembcorp can optimize grid stability and improve overall operational performance in both its energy and urban solutions segments. For instance, AI-powered analytics can forecast energy demand with greater accuracy, allowing for more efficient resource allocation and reduced waste. This digital transformation is not merely an option but a necessity for staying competitive and sustainable in the modern energy landscape.

Technological advancements in waste treatment, such as advanced sorting and processing, are crucial for Sembcorp's integrated urban solutions. Innovations in waste-to-energy conversion, like improved gasification and pyrolysis techniques, are enhancing efficiency and enabling Sembcorp to generate more power from waste streams. For instance, the global waste-to-energy market was valued at approximately USD 35 billion in 2023 and is projected to grow significantly, offering substantial revenue potential.

Resource recovery technologies, including the extraction of valuable materials from waste, are central to Sembcorp's circular economy strategy. These innovations not only reduce landfill reliance but also create new income sources through the sale of recovered materials. As of early 2024, Sembcorp continues to invest in R&D for these technologies, aiming to boost the economic viability of waste management services and support sustainable urban development goals.

Carbon Capture, Utilization, and Storage (CCUS)

Technological advancements in Carbon Capture, Utilization, and Storage (CCUS) present a significant opportunity for Sembcorp Industries to decarbonize its conventional energy assets, particularly its gas-fired power plants. CCUS technologies are evolving rapidly, offering a viable route to mitigate emissions in sectors where a complete shift to renewables faces immediate challenges. For instance, the International Energy Agency reported in 2024 that global CCUS capacity is projected to reach over 250 million tonnes per annum by 2030, indicating substantial growth potential. Sembcorp's engagement with CCUS research and potential investments aligns with a forward-looking decarbonization strategy, ensuring adaptability as these technologies mature and become more commercially viable.

CCUS can serve as a crucial transitional technology, bridging the gap until renewable energy sources can fully meet energy demands. This approach is particularly relevant for hard-to-abate industries and existing infrastructure like Sembcorp's gas power fleet. The global CCUS market is expected to grow substantially, with projections suggesting it could reach tens of billions of dollars by the early 2030s, driven by policy support and technological innovation. Therefore, monitoring and potentially participating in CCUS development is a strategic imperative for Sembcorp’s long-term sustainability and competitive positioning.

Key technological factors impacting Sembcorp regarding CCUS include:

- Advancements in capture efficiency: New solvent and membrane technologies are improving the cost-effectiveness and energy penalty of CO2 capture.

- Utilization pathways: Developing viable uses for captured CO2, such as in concrete production or synthetic fuels, enhances the economic attractiveness of CCUS projects.

- Storage infrastructure development: Progress in identifying and developing secure geological storage sites is critical for widespread CCUS deployment.

- Integration with existing assets: The ability to retrofit CCUS technology onto existing gas-fired power plants without significant operational disruption is a key consideration for Sembcorp.

Battery Storage and Grid Modernization

Advancements in battery storage technology are pivotal for effectively integrating variable renewable energy sources like solar and wind into the power grid, thereby enhancing energy reliability. As the cost of battery storage continues its downward trend and storage capacity expands, Sembcorp Industries is strategically positioned to deploy more hybrid renewable energy projects, combining solar or wind with battery storage. This allows them to also participate in crucial grid ancillary services, helping to balance supply and demand. For instance, by mid-2024, the global energy storage market was valued at over $100 billion, with projections indicating significant growth driven by renewable integration needs.

These technological improvements are fundamental to constructing a robust and sustainable energy infrastructure capable of supporting the energy transition. Sembcorp's investment in and deployment of these solutions directly address the intermittency challenge inherent in renewables. By 2025, it's anticipated that battery storage capacity will reach hundreds of gigawatt-hours globally, a substantial increase from previous years, underscoring the rapid development and adoption of this technology.

- Battery Cost Reduction: Lithium-ion battery pack prices have fallen by over 90% in the last decade, making storage more economically viable for grid-scale applications.

- Capacity Growth: Global energy storage capacity is projected to grow at a compound annual growth rate of over 30% through 2030.

- Hybrid Project Viability: Enhanced storage allows Sembcorp to offer more consistent power output from its renewable assets, increasing their market competitiveness.

- Ancillary Services Revenue: Improved storage capabilities enable Sembcorp to provide grid stability services, creating new revenue streams.

Technological advancements are reshaping Sembcorp's operational landscape, particularly in renewable energy and urban solutions. Innovations in solar and wind technologies, with solar panel efficiencies exceeding 23% and wind turbines reaching 15+ MW capacities, are driving down costs and improving efficiency for projects like the 1,000 MW Trafalgar Offshore Wind Farm. Simultaneously, smart grid technologies, AI, and data analytics are enhancing energy management, enabling predictive maintenance and optimizing resource allocation across Sembcorp's diverse operations.

Furthermore, Sembcorp benefits from technological progress in waste-to-energy conversion, with advanced gasification and pyrolysis techniques improving efficiency and revenue potential, as the global waste-to-energy market reached approximately USD 35 billion in 2023. Resource recovery technologies are also central to their circular economy strategy, creating new income streams from waste. As of early 2024, Sembcorp continues its R&D investment in these critical areas.

The company is strategically positioned to leverage advancements in battery storage, with global capacity projected to reach hundreds of gigawatt-hours by 2025, enabling hybrid renewable projects and participation in grid ancillary services. Battery costs have seen a significant decline, falling by over 90% in the last decade, making storage more economically viable. This trend, coupled with a projected over 30% CAGR in energy storage capacity growth through 2030, underpins Sembcorp's competitive edge in offering consistent power and new revenue streams.

Carbon Capture, Utilization, and Storage (CCUS) technologies represent another key area of technological evolution, with global CCUS capacity projected to exceed 250 million tonnes per annum by 2030, according to the International Energy Agency in 2024. Sembcorp's engagement with CCUS research is vital for decarbonizing its conventional assets, bridging the gap to full renewable energy reliance and tapping into a market expected to reach tens of billions of dollars by the early 2030s.

Legal factors

Sembcorp Industries operates under a stringent environmental regulatory framework that significantly influences its project development. For instance, in 2023, Singapore, a key market, continued to emphasize ambitious climate targets, aiming for net-zero emissions by 2050, which translates to tighter controls on industrial emissions and waste management for Sembcorp's energy facilities.

The process of securing environmental permits for new energy and urban development projects can be intricate and time-consuming. In 2024, Sembcorp's ongoing development of renewable energy projects, such as solar farms and offshore wind initiatives, necessitates navigating various local and international environmental impact assessments and licensing procedures.

Compliance with these environmental laws is not just a legal obligation but a critical factor for Sembcorp's operational sustainability and financial performance. Non-compliance can lead to substantial fines, project delays, and reputational damage, impacting investor confidence and the company's ability to secure future financing for its green initiatives.

Energy market regulations, including power purchase agreements, grid access rules, and electricity pricing, directly influence Sembcorp's revenue and operational planning. For instance, in Singapore, the Energy Market Authority (EMA) oversees these regulations, impacting how Sembcorp sells power and manages its grid connections. Changes in tariff structures or competitive bidding processes can alter the profitability of existing energy assets.

Evolving regulatory landscapes, such as the push towards carbon pricing mechanisms or renewable energy mandates in various operating regions, necessitate strategic adaptation for Sembcorp. These shifts can redefine market competition and the economic viability of different energy sources. Sembcorp’s ability to navigate these complex frameworks, like adhering to national renewable energy targets, is crucial for maintaining its competitive edge and ensuring the long-term profitability of its energy portfolio.

Land use and zoning regulations are pivotal for Sembcorp Industries, shaping the feasibility and deployment of both its renewable energy ventures, like solar farms, and urban development projects. These laws determine permissible locations and construction methods, directly impacting project timelines and overall costs. For instance, securing permits for a large-scale solar farm in a region with strict agricultural zoning can add significant delays and expenses.

Navigating the intricate web of diverse local and national land use regulations is a critical component of Sembcorp's project planning and execution. In 2024, the Singapore government continued to emphasize sustainable land use, with policies like the Urban Redevelopment Authority's (URA) Master Plan guiding development intensity and land allocation, which directly affects Sembcorp's ability to expand its urban solutions portfolio.

The cost implications of these regulations can be substantial; in 2024, the average permitting time for major infrastructure projects in Southeast Asia, including those Sembcorp undertakes, could range from 6 to 18 months, with associated fees and compliance costs often adding 5-10% to initial project budgets. Understanding and proactively addressing these legal frameworks is essential for Sembcorp to ensure project success and mitigate risks.

Corporate Governance and Compliance Standards

Sembcorp Industries, as a global, publicly traded company, is subject to a complex web of legal and regulatory requirements. This includes adherence to stringent corporate governance principles, anti-corruption legislation, and rigorous financial reporting standards across every nation it operates within. Maintaining compliance is paramount for fostering investor trust and preventing costly legal entanglements.

For instance, in Singapore, where Sembcorp is headquartered, the Securities and Futures Act and the Companies Act mandate specific disclosure and governance practices. Globally, Sembcorp must navigate regulations like the UK Bribery Act and the US Foreign Corrupt Practices Act, which carry significant penalties for non-compliance. These legal frameworks are not merely hurdles but foundational elements for sustainable business operations and reputation management.

- Corporate Governance: Sembcorp's board structure and practices must align with recommendations from the Code of Corporate Governance Singapore, aiming for transparency and accountability.

- Anti-Corruption: Strict policies and training programs are in place to prevent bribery and corruption, aligning with international standards and local laws in countries like the UK and USA.

- Financial Reporting: Adherence to International Financial Reporting Standards (IFRS) ensures consistent and comparable financial statements, crucial for investor confidence and regulatory scrutiny.

- Legal Compliance: Ongoing monitoring and adaptation to evolving legal landscapes in its operating regions, including environmental regulations and labor laws, are essential for risk mitigation.

International Trade and Investment Treaties

International trade and investment treaties significantly shape Sembcorp Industries' ability to undertake projects and safeguard its assets across different countries. These agreements establish the rules for cross-border commerce and investment, directly affecting how Sembcorp finances its operations and manages its international portfolio. For instance, the World Trade Organization (WTO) agreements, to which many of Sembcorp's operating regions are signatories, set standards for trade in services, including energy, which is a core sector for the company.

The presence of bilateral investment treaties (BITs) and free trade agreements (FTAs) can provide Sembcorp with crucial legal protections. These treaties often include provisions for fair and equitable treatment of investors, protection against unlawful expropriation, and mechanisms for investor-state dispute settlement. As of early 2025, there are over 3,000 BITs globally, offering a complex but potentially beneficial legal landscape for multinational corporations like Sembcorp engaging in foreign direct investment. For example, treaties may reduce tariffs or non-tariff barriers on equipment imported for renewable energy projects, thereby lowering capital costs.

Understanding the specifics of these treaties is vital for Sembcorp's global strategy. Agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) or regional pacts like ASEAN agreements can create favorable conditions for investment in infrastructure and renewable energy projects. Conversely, the absence or weak enforcement of such treaties in certain markets can heighten investment risks, potentially deterring Sembcorp from expanding its presence or requiring more robust risk mitigation strategies.

Key implications for Sembcorp include:

- Facilitation of Cross-Border Projects: Trade agreements can streamline customs procedures and reduce barriers for importing necessary equipment and technology for Sembcorp's energy and urban development projects.

- Investment Protection: Bilateral investment treaties offer legal recourse against government actions that could harm Sembcorp's investments, such as unfair nationalization or discriminatory practices.

- Dispute Resolution: Treaties provide established frameworks for resolving commercial disputes with host governments or other investors, offering a more predictable and less costly process than ad-hoc litigation.

- Market Access: FTAs can improve Sembcorp's access to new markets by reducing tariffs and other trade impediments on its services and products, such as renewable energy solutions.

Sembcorp Industries must navigate a complex legal landscape, from environmental compliance to corporate governance. In 2024, Singapore's continued focus on net-zero emissions by 2050 means stricter environmental regulations for Sembcorp's energy projects, impacting permits and operational standards.

The company's global operations are subject to diverse legal frameworks, including anti-corruption laws like the UK Bribery Act and US FCPA, with non-compliance carrying severe penalties. Financial reporting adheres to IFRS, ensuring transparency for investors and regulators, a crucial aspect for a publicly traded entity like Sembcorp.

International trade and investment treaties are vital for Sembcorp's cross-border activities. These agreements, such as those under the WTO or regional pacts like ASEAN, can reduce barriers for importing equipment and offer investment protections, influencing the economic viability of projects in 2024 and beyond.

Sembcorp's adherence to corporate governance principles, as recommended by Singapore's Code of Corporate Governance, is essential for maintaining investor confidence and operational integrity. This includes robust anti-corruption policies and transparent financial reporting, critical for risk mitigation.

Environmental factors

The global push to address climate change is intensifying the need for Sembcorp to speed up its decarbonization and move away from assets that produce a lot of carbon. For instance, in 2023, Sembcorp announced it would invest S$20 billion in sustainable solutions by 2030, with a significant portion aimed at green energy and decarbonization projects.

Furthermore, the tangible effects of a changing climate, like more frequent and severe weather, present direct operational challenges to Sembcorp's existing infrastructure. This could lead to disruptions in energy supply or damage to assets, impacting service reliability and potentially increasing maintenance costs.

Sembcorp's strategic direction is clearly focused on backing the global energy transition and actively lowering its own carbon emissions. The company has set a target to significantly reduce its carbon intensity, aiming for a substantial decrease by 2030 compared to its 2020 baseline.

Increasing scarcity of vital resources like water and land presents a significant challenge for Sembcorp Industries. This scarcity directly impacts operations, especially in water-intensive sectors such as conventional energy generation and urban solutions development. For instance, regions where Sembcorp operates are increasingly facing water stress, with projections indicating a worsening situation in many parts of Asia by 2030.

Consequently, efficient resource management is paramount for Sembcorp's ongoing sustainability and cost control. This includes implementing advanced water recycling technologies and optimizing land utilization across its projects. Sembcorp's commitment to sustainable design principles is evident in its urban developments, aiming to minimize environmental footprints and enhance resource efficiency.

Sembcorp Industries faces significant environmental considerations regarding biodiversity and ecosystem protection, directly impacting its site selection and project design. The company must meticulously plan to minimize ecological disruption during the development of its renewable energy and urban development projects.

Adherence to strict biodiversity conservation guidelines is paramount for securing regulatory approvals and bolstering Sembcorp's environmental reputation. For instance, projects in sensitive areas often require detailed environmental impact assessments (EIAs) to identify and mitigate potential harm to local flora and fauna.

In 2023, Sembcorp completed several EIAs for new solar and wind farm projects, with a focus on protecting critical habitats. The company's commitment to sustainability includes investing in biodiversity offsetting programs, aiming to achieve a net positive impact on ecosystems where feasible.

Waste Management and Circular Economy

The increasing global focus on waste management is a significant environmental factor shaping Sembcorp Industries' operations. This presents both a challenge and a strategic opportunity for the company. Sembcorp's integrated urban solutions often incorporate advanced waste-to-resource facilities, playing a key role in fostering a circular economy. These facilities not only recover valuable materials but also generate energy from waste streams, addressing pressing environmental concerns while simultaneously opening up new revenue streams and business avenues.

Sembcorp's commitment to waste management aligns with broader global sustainability goals. For instance, in 2023, Sembcorp's waste management segment processed a substantial volume of waste, contributing to resource recovery.

- Circular Economy Initiatives: Sembcorp actively develops and operates waste-to-resource facilities that transform waste into valuable commodities and energy.

- Resource Recovery: These facilities focus on recovering materials like metals, plastics, and other recyclables, reducing reliance on virgin resources.

- Energy Generation: Waste-to-energy processes contribute to a cleaner energy mix by utilizing non-recyclable waste as a fuel source.

- Regulatory Alignment: Sembcorp's waste management solutions help clients comply with increasingly stringent environmental regulations regarding waste disposal and resource utilization.

Pollution Control and Emissions Reduction

Sembcorp Industries faces increasing pressure from stringent pollution control regulations, necessitating significant investments in advanced abatement technologies and comprehensive environmental management systems across its diverse operations. These standards cover air, water, and soil quality, impacting everything from its power generation facilities to its water treatment plants.

A major focus for Sembcorp is the reduction of emissions, particularly greenhouse gases and other pollutants emanating from its conventional power generation assets. This aligns with global and national efforts to combat climate change and improve air quality. For example, in 2023, Sembcorp continued its strategic pivot towards renewable energy, which inherently reduces emissions compared to its legacy fossil fuel assets.

The company's commitment to continuous improvement in environmental performance is a core strategic pillar. This translates into ongoing efforts to enhance operational efficiency, adopt cleaner technologies, and minimize its environmental footprint. Sembcorp's sustainability targets often include specific, measurable goals for emissions reduction and waste management.

- Investment in Renewables: Sembcorp's ongoing divestment from thermal assets and substantial investment in renewable energy projects, such as solar and wind farms, directly addresses emissions reduction. By 2023, the company had a significant portfolio of renewable energy capacity, contributing to a lower carbon intensity in its energy generation mix.

- Technological Upgrades: Facilities still operating with fossil fuels are subject to upgrades to meet stricter emission standards, often involving flue gas desulfurization and selective catalytic reduction technologies.

- Environmental Management Systems: Sembcorp maintains ISO 14001 certifications for its environmental management systems, demonstrating a structured approach to controlling its environmental impact and ensuring compliance.

- Reporting and Transparency: The company actively reports on its environmental performance, including emissions data and progress towards sustainability goals, in its annual sustainability reports, providing transparency to stakeholders.

Sembcorp's aggressive transition to renewable energy, backed by a S$20 billion investment by 2030, directly tackles climate change pressures and carbon intensity reduction targets. However, the increasing scarcity of resources like water necessitates efficient management, impacting operations, particularly in water-intensive sectors.

Biodiversity and ecosystem protection are critical for Sembcorp's project planning and regulatory approvals, with a focus on minimizing ecological disruption. The company's waste management initiatives, including waste-to-resource facilities, contribute to the circular economy and offer new revenue streams.

Stringent pollution control regulations require Sembcorp to invest in advanced abatement technologies and robust environmental management systems to reduce emissions from its operations. These environmental factors are shaping Sembcorp's strategic direction and operational focus for sustainable growth.

| Environmental Factor | Sembcorp's Response/Impact | Key Data/Initiative |

| Climate Change & Decarbonization | Accelerated transition to renewables, divestment from thermal assets. | S$20 billion investment in sustainable solutions by 2030; aiming for significant carbon intensity reduction by 2030 (vs. 2020 baseline). |

| Resource Scarcity (Water, Land) | Focus on efficient resource management, advanced water recycling. | Impact on water-intensive operations; increasing water stress in Asian operating regions. |

| Biodiversity & Ecosystem Protection | Meticulous planning, Environmental Impact Assessments (EIAs). | Completed EIAs for new renewable projects in 2023, focusing on habitat protection; investment in biodiversity offsetting programs. |

| Waste Management | Development of waste-to-resource facilities, circular economy focus. | Substantial waste processed in 2023; contributing to resource recovery and energy generation from waste. |

| Pollution Control Regulations | Investment in abatement technologies, enhanced environmental management. | ISO 14001 certified environmental management systems; continuous improvement in operational efficiency and cleaner technologies. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Sembcorp Industries synthesizes data from government publications, international financial institutions, and reputable industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.