Sembcorp Industries Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sembcorp Industries Bundle

Sembcorp Industries masterfully blends its product innovation in sustainable energy and urban solutions with strategic pricing that reflects value and market positioning. Their distribution network ensures accessibility, while promotional efforts highlight their commitment to a greener future.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Sembcorp Industries' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Explore how Sembcorp Industries' product strategy, pricing decisions, distribution methods, and promotional tactics work together to drive success in the competitive energy and urban development sectors. Get the full analysis in an editable, presentation-ready format.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking for Sembcorp Industries—perfect for reports, benchmarking, or business planning.

Gain instant access to a comprehensive 4Ps analysis of Sembcorp Industries. Professionally written, editable, and formatted for both business and academic use, it offers a complete picture of their marketing approach.

The full report offers a detailed view into Sembcorp Industries’s market positioning, pricing architecture, channel strategy, and communication mix. Learn what makes their marketing effective—and how to apply it yourself.

This full 4Ps Marketing Mix Analysis gives you a deep dive into how Sembcorp Industries aligns its marketing decisions for competitive success in sustainability and urban development. Use it for learning, comparison, or business modeling.

Product

Sembcorp Industries' renewable energy solutions encompass a broad range of offerings, including solar, wind, and advanced energy storage systems. These are strategically developed to align with the accelerating global shift towards cleaner energy and to address the growing market need for sustainable power. The company’s commitment is evident in its ambitious target to significantly increase its gross installed renewables capacity.

A key driver for Sembcorp is its proactive expansion of its renewable energy portfolio, aiming for an impressive 25 gigawatts (GW) of gross installed capacity by the year 2028. This strategic objective underscores a deep dedication to fostering a predominantly green energy business, positioning Sembcorp as a significant player in the energy transition landscape.

Sembcorp Industries' conventional energy segment focuses on gas and power generation, providing essential energy security and stability. These gas-fired plants are vital for meeting growing energy demands. In 2023, Sembcorp's conventional energy portfolio contributed significantly to its overall performance, with a substantial portion of its generation capacity still rooted in gas assets, underscoring its role in current energy needs.

The company strategically manages its gas supply, often securing long-term offtake agreements. This approach ensures consistent revenue streams and operational resilience. These contracts are key to Sembcorp's strategy of supporting energy security while navigating the global shift towards a lower-carbon future, balancing immediate needs with long-term sustainability goals.

Sembcorp Industries' Integrated Urban Solutions focuses on developing and managing industrial parks, alongside its water and waste-to-resource operations. This segment provides holistic approaches to sustainable urban growth, drawing in a wide array of clients and fostering economic expansion.

The company offers ready-built facilities and essential infrastructure designed to meet the evolving needs of industrial and commercial enterprises. This strategic positioning allows Sembcorp to cater effectively to diverse market demands.

In 2023, Sembcorp's Urban Development business, a key component of this segment, secured new projects totaling approximately S$1.2 billion. This demonstrates strong market traction and continued investment in sustainable infrastructure.

The integrated nature of these solutions, encompassing utilities, logistics, and environmental services, creates significant value for businesses seeking efficient and sustainable operational bases. For instance, their Vietnam industrial parks are designed with advanced wastewater treatment facilities, aligning with stringent environmental standards.

Decarbonisation Solutions

Sembcorp Industries is actively investing in and developing a portfolio of decarbonisation solutions. This includes significant progress in building hydrogen-ready assets and advancing carbon management technologies. These initiatives are designed to offer customers reliable low-carbon energy and feedstock alternatives, aligning with evolving market demands and anticipating future commercial viability.

The company's strategic capital allocation underscores its commitment to these innovative solutions, with a clear objective to achieve its ambitious net-zero emissions targets. For instance, Sembcorp has announced plans to invest in green hydrogen production facilities, aiming to have a substantial pipeline of renewable energy projects ready for development. By 2025, Sembcorp aims to have 10 GW of renewable energy capacity, a key enabler for its decarbonisation solutions.

- Hydrogen-Ready Assets: Developing infrastructure capable of utilizing hydrogen as a fuel source, ensuring future flexibility and reduced emissions.

- Carbon Management Technologies: Investing in and deploying solutions for carbon capture, utilization, and storage (CCUS) to mitigate industrial emissions.

- Low-Carbon Feedstock: Providing customers with alternative, sustainable materials for industrial processes, reducing reliance on fossil fuels.

- Strategic Capital Allocation: Significant financial resources are earmarked for these projects to drive Sembcorp's net-zero transition.

Utilities and Environmental Services

Sembcorp Industries’ utilities and environmental services play a crucial role in its marketing mix, extending beyond its core energy and urban development offerings. These essential services, including advanced water and wastewater treatment, are vital for both industrial and municipal clients within its integrated developments and across wider markets. This integrated approach significantly boosts the value proposition of its urban solutions, demonstrating a commitment to sustainability and operational efficiency. For instance, in 2023, Sembcorp's water segment managed over 22 million cubic meters of treated wastewater, highlighting the scale of its environmental services.

The provision of these utilities and environmental services solidifies Sembcorp's position as a comprehensive solutions provider. By offering reliable water management and treatment, Sembcorp supports the operational continuity and environmental compliance of its customers. This focus on essential services creates recurring revenue streams and strengthens customer loyalty, a key aspect of its product strategy. The company's investments in advanced treatment technologies aim to meet increasingly stringent environmental regulations, further enhancing its competitive edge.

- Water Treatment Capacity: In 2023, Sembcorp managed and treated substantial volumes of water, underscoring its capacity to serve large-scale industrial and municipal needs.

- Environmental Solutions: The company actively develops and operates advanced water and wastewater treatment facilities, contributing to resource circularity and pollution control.

- Integrated Development Value: These services are strategically integrated into Sembcorp's urban developments, creating a more attractive and self-sustaining ecosystem for businesses and residents.

- Regulatory Compliance: Sembcorp's commitment to environmental services ensures clients meet evolving environmental standards, mitigating risks and promoting sustainable operations.

Sembcorp Industries' product offering is a diversified energy and urban solutions portfolio, with a strong emphasis on renewable energy. This includes solar, wind, and energy storage, targeting the global shift to cleaner power. By 2028, the company aims for 25 GW of gross installed renewables capacity.

The company's conventional energy segment provides essential power generation through gas-fired plants, ensuring energy security. In 2023, this segment remained a significant contributor, with gas assets forming a substantial part of its generation capacity.

Integrated Urban Solutions offer industrial parks and water/waste-to-resource services, promoting sustainable urban development. In 2023, the Urban Development business secured new projects valued at approximately S$1.2 billion.

Decarbonisation solutions, including hydrogen-ready assets and carbon management technologies, are a key growth area. Sembcorp plans significant investments to achieve its net-zero targets, aiming for 10 GW of renewable energy capacity by 2025 to support these initiatives.

What is included in the product

This analysis provides a comprehensive breakdown of Sembcorp Industries' marketing mix, examining its product portfolio of sustainable energy and urban development solutions, competitive pricing strategies, strategically chosen distribution channels, and targeted promotional efforts.

Simplifies Sembcorp Industries' 4Ps marketing strategy, offering a clear solution to the pain point of complex marketing analysis for stakeholders.

Provides a digestible overview of Sembcorp's 4Ps, alleviating the burden of sifting through extensive data for quick strategic understanding.

Place

Sembcorp Industries leverages a project-based delivery model globally, focusing on energy and urban solutions. This strategy is evident in their operations across Asia, the UK, and the Middle East, targeting areas with significant demand for sustainable development. For instance, in 2023, Sembcorp secured a significant contract to develop a 200 MW solar farm in the Philippines, highlighting their expansion into new, high-growth markets.

The company establishes and manages large-scale energy infrastructure and industrial parks in specific locations. This approach is crucial for meeting energy transition needs, as seen with their ongoing development of a major industrial park in Vietnam, which aims to attract significant foreign investment in green industries by 2025. Their recent entry into Oman further underscores this project-centric expansion into emerging markets.

Sembcorp Industries primarily distributes its energy and urban solutions through direct sales channels, focusing on industrial, municipal, and government clients. This approach fosters strong B2B relationships and allows for the development of highly customized solutions for large-scale projects.

A key aspect of this strategy is the reliance on long-term power purchase agreements (PPAs) and offtake contracts. These agreements provide Sembcorp with predictable and stable revenue streams, offering significant visibility into future earnings and project pipelines. For instance, many of Sembcorp's renewable energy projects are underpinned by such long-term contracts, ensuring consistent demand for their output.

Sembcorp Industries strategically develops and manages integrated industrial parks in high-growth regions like Vietnam, China, and Indonesia. These parks act as crucial 'places' where Sembcorp's urban solutions and utilities are directly supplied to businesses operating within them. This approach concentrates industrial and commercial activities, leveraging Sembcorp's core competencies in land development and essential infrastructure provision.

In 2023, Sembcorp's portfolio included a significant number of industrial park projects, with a focus on sustainable development and advanced infrastructure. For instance, its operations in Vietnam through the VSIP (Vietnam Singapore Industrial Park) joint venture continue to attract significant foreign direct investment, contributing to the economic development of the regions they are located in. These parks are designed to foster efficient operations for tenant companies by providing reliable utilities and streamlined services.

Partnerships and Joint Ventures

Sembcorp Industries actively leverages partnerships and joint ventures to secure and execute major projects, particularly in emerging markets. This approach is crucial for navigating complex regulatory landscapes and sharing the substantial capital investment required for large-scale energy and urban development initiatives. For instance, in 2024, Sembcorp announced a significant joint venture with a local partner in Vietnam for a renewable energy project, aiming to tap into the country's growing demand for sustainable power.

These collaborations enable Sembcorp to effectively manage project risks and enhance operational expertise by combining its global experience with local market knowledge. This strategy has been instrumental in its expansion, as evidenced by its consistent presence in key markets like India and Southeast Asia. In 2024, Sembcorp's joint ventures in India contributed significantly to its renewable energy portfolio, with several solar and wind projects reaching operational milestones.

- Market Access: Partnerships facilitate entry into new geographies and sectors by leveraging local expertise and established networks.

- Risk Mitigation: Sharing investment burdens and operational responsibilities reduces financial and execution risks for Sembcorp.

- Capability Enhancement: Collaborations allow for the integration of diverse technological and managerial skills, improving project delivery.

- Strategic Alignment: Joint ventures with state-owned enterprises or industry leaders often align with national development goals, easing regulatory approvals.

Digital Platforms for Operational Management

Sembcorp Industries utilizes digital platforms not as direct sales channels, but as crucial tools for optimizing its operational efficiency across its diverse portfolio of energy and urban development projects. These platforms are central to managing and monitoring its vast network of assets, ensuring seamless functionality and continuous improvement.

The company's investment in smart grid technologies and advanced data analytics underpins its operational excellence. For instance, Sembcorp's smart water management systems in Singapore, like the NEWater Visitor Centre's smart operations, demonstrably improve resource allocation and system reliability, contributing to sustainable urban development.

These digital investments translate into tangible benefits, such as enhanced performance and reduced operational risks. In 2024, Sembcorp reported significant progress in digitalizing its operations, aiming to achieve greater energy efficiency and predictive maintenance across its renewable energy assets, which saw a substantial increase in capacity.

The strategic deployment of these digital platforms supports Sembcorp's commitment to providing reliable and sustainable services. Key operational enhancements include:

- Smart Grid Integration: Facilitating real-time monitoring and control of distributed energy resources, improving grid stability.

- Data-Driven Performance Monitoring: Leveraging analytics to optimize asset performance and identify potential issues before they impact operations.

- Enhanced Resource Management: Implementing digital solutions for efficient water and waste management, particularly in urban development projects.

- Predictive Maintenance: Utilizing IoT sensors and AI to forecast equipment failures, reducing downtime and maintenance costs.

Sembcorp Industries' 'Place' strategy centers on developing and managing integrated industrial parks in high-growth regions. These parks serve as hubs where the company directly supplies its urban solutions and utilities to tenant businesses, concentrating industrial activity and leveraging core competencies in land and infrastructure. For example, their Vietnam Singapore Industrial Park (VSIP) ventures continue to attract significant foreign direct investment, with a strong focus on sustainable development and advanced infrastructure. This approach concentrates industrial and commercial activities, leveraging Sembcorp's core competencies in land development and essential infrastructure provision.

The company also utilizes digital platforms to optimize operations across its energy and urban development projects, rather than for direct sales. These platforms are crucial for managing and monitoring its vast network of assets, ensuring seamless functionality and continuous improvement. For instance, Sembcorp's investment in smart grid technologies and advanced data analytics, such as smart water management systems, demonstrably improves resource allocation and system reliability. In 2024, Sembcorp reported significant progress in digitalizing its operations, aiming for greater energy efficiency and predictive maintenance across its renewable energy assets.

| Key Aspect | Description | Example/Data Point |

| Physical Presence | Development of integrated industrial parks in strategic growth regions. | VSIP projects in Vietnam attracting significant FDI. |

| Service Delivery | Direct supply of urban solutions and utilities within these parks. | Providing reliable utilities to tenant companies. |

| Digital Infrastructure | Use of digital platforms for operational optimization and asset management. | Smart grid technologies and data analytics for efficiency. |

| Operational Enhancement | Focus on smart technologies for improved resource management and reliability. | Smart water management systems in Singapore improving resource allocation. |

What You See Is What You Get

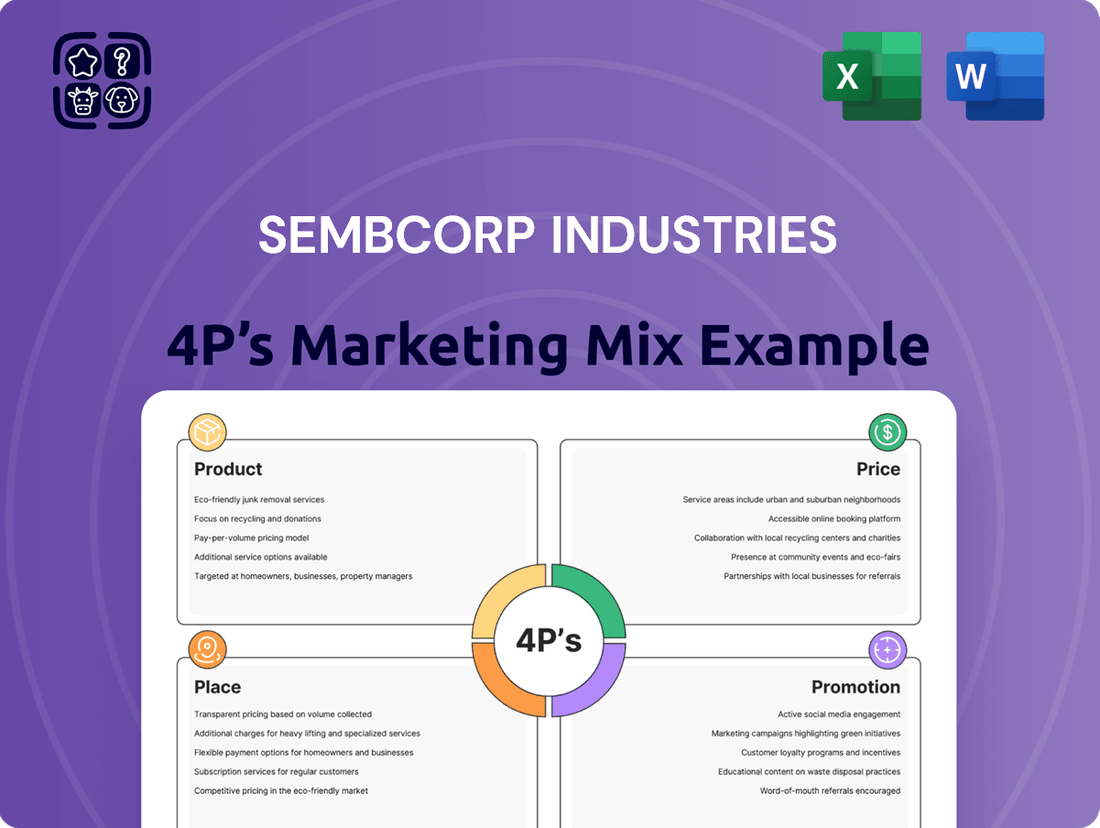

Sembcorp Industries 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Sembcorp Industries' Product, Price, Place, and Promotion strategies, offering a detailed understanding of their market approach. You'll gain insights into their diverse portfolio of sustainable energy and urban development solutions, their competitive pricing models, strategic distribution channels, and effective promotional activities designed to build brand awareness and customer loyalty. This is your direct pathway to understanding Sembcorp's marketing framework.

Promotion

Sembcorp Industries actively communicates its dedication to sustainability and the energy transition through detailed annual and sustainability reports. These publications are crucial for demonstrating its commitment to environmental, social, and governance (ESG) principles. For instance, Sembcorp's 2023 Sustainability Report detailed significant progress, including a 20% reduction in its Scope 1 and 2 emissions intensity compared to its 2020 baseline, and a 4.6 GW increase in its renewable energy portfolio, reaching a total of 13.9 GW by the end of 2023.

This transparent reporting showcases Sembcorp's advancements in achieving its decarbonisation goals and expanding its renewable energy capacity. By highlighting metrics like the percentage of revenue from sustainable solutions, which stood at over 70% in 2023, Sembcorp provides tangible evidence of its strategic shift. This approach is designed to attract and reassure investors, meet regulatory expectations, and appeal to stakeholders who prioritize environmental responsibility.

Sembcorp Industries actively cultivates industry engagement and thought leadership through participation in key forums and conferences, solidifying its position in the energy and urban solutions space. For instance, events like the Sembcorp Energy Insights series convene industry and government leaders to deliberate on critical topics such as sustainable energy transitions. This strategic engagement showcases the company's deep expertise and significant influence within the sector.

Sembcorp Industries actively cultivates a strong digital footprint, primarily through its official website and professional social media channels, notably LinkedIn. This strategy ensures the consistent dissemination of crucial information, including company news, project milestones, and valuable industry insights, reaching stakeholders worldwide.

The company’s digital communication strategy is further bolstered by regular media releases and a dedicated investor relations section on its website. This commitment to transparency is vital for maintaining trust and providing timely updates to a global audience of investors and partners.

As of the first half of 2024, Sembcorp reported a significant increase in its renewable energy portfolio, highlighting its digital platforms' role in communicating these strategic growth areas to the market.

This robust digital presence facilitates engagement and information sharing, reinforcing Sembcorp's commitment to clear and accessible communication across all its marketing efforts.

Public Relations and Media Relations

Sembcorp Industries actively manages its public relations and media relations to showcase its progress in sustainable energy and urban solutions. This proactive approach includes sharing news about significant project achievements, such as the recent completion of a major solar farm in India, and detailing strategic acquisitions that bolster its renewable energy portfolio.

The company regularly communicates with financial and industry-specific media outlets. This engagement is crucial for shaping public perception, reinforcing its brand as a leader in the energy transition, and ensuring stakeholders are well-informed about Sembcorp's strategic direction and its commitment to environmental, social, and governance (ESG) principles. For example, Sembcorp's 2024 interim report highlighted a significant increase in its renewable energy capacity, a key talking point in its media outreach.

- Project Milestones: Sembcorp consistently announces the successful commissioning of renewable energy projects, such as its offshore wind farm in Taiwan, demonstrating tangible progress in its growth strategy.

- Strategic Acquisitions: The company communicates its strategic moves, like the acquisition of a distributed solar business in Australia, to underscore its expansion and market positioning.

- Sustainable Development Contributions: Sembcorp leverages PR to highlight its role in advancing sustainable development, including its contributions to decarbonization efforts and the circular economy.

- Media Engagement: Proactive engagement with financial and industry media ensures accurate reporting and positive brand association for Sembcorp's energy and urban solutions offerings.

Strategic Investor Communications

Sembcorp Industries actively engages its investor community through a multi-faceted communication strategy. This includes hosting regular investor days and presenting at industry conferences, providing a platform for direct dialogue and insight sharing. These events are crucial for conveying Sembcorp's strategic direction, with a notable emphasis on its transition towards renewable energy and sustainable growth, a key area of interest for 2024 and 2025 financial planning.

The company ensures transparency by delivering comprehensive financial reports and updates, enabling financially literate decision-makers to assess performance and potential. For instance, Sembcorp's commitment to decarbonization, targeting 20 gigawatts of renewable energy capacity by 2025, is a recurring theme in these communications. This clear articulation of targets and progress is vital for building investor confidence.

Key communication elements include:

- Investor Days: Scheduled events to provide in-depth updates on strategy, performance, and outlook.

- Financial Reports: Detailed quarterly and annual reports outlining financial health and operational achievements.

- Presentations: Participation in industry forums and analyst calls to disseminate information.

- Sustainability Disclosures: Clear communication on Environmental, Social, and Governance (ESG) performance, particularly renewable energy targets.

Sembcorp Industries' promotion strategy centers on transparent communication of its sustainability leadership and growth in renewable energy. This is achieved through detailed reports, digital channels, and active media engagement, all aimed at building trust and showcasing its transition to a leading energy and urban solutions provider.

Key promotional activities focus on highlighting project milestones, strategic acquisitions, and contributions to sustainable development, reinforced by consistent media outreach. The company's 2024 interim report, for instance, underscored a substantial increase in renewable energy capacity, a core message in its market communications.

Investor relations are actively managed through events like investor days and participation in conferences, alongside comprehensive financial reporting. Sembcorp's clear communication of its 2025 renewable energy target of 20 gigawatts is crucial for investor confidence and strategic planning.

| Key Promotional Focus | 2023 Data/Milestone | 2024 Outlook/Target | Supporting Channels |

| Sustainability & ESG | 70%+ revenue from sustainable solutions | Continued growth in sustainable revenue | Sustainability Reports, Website |

| Renewable Energy Growth | 13.9 GW renewable energy portfolio | Targeting 20 GW by 2025 | Investor Days, Media Releases, LinkedIn |

| Decarbonisation | 20% reduction in Scope 1 & 2 emissions intensity (vs. 2020) | Ongoing emissions reduction efforts | Annual Reports, ESG Disclosures |

Price

Sembcorp Industries' pricing strategy for its energy solutions, especially conventional gas-fired power and renewable energy, is fundamentally built upon long-term offtake contracts and power purchase agreements (PPAs). These agreements are crucial for securing predictable revenue streams.

These long-term contracts, often spanning 15 to 25 years, offer significant insulation from the often-volatile short-term energy market prices. This stability is key to Sembcorp's financial planning and ensures a consistent earnings profile over extended durations, a critical factor for investors seeking reliable returns.

For instance, Sembcorp has secured several significant PPAs in recent years. In 2023, the company announced a 15-year PPA with a major industrial customer for its Vietnam operations, underpinning future revenue. Similarly, its renewable energy projects in India are often supported by long-term PPAs with state utilities, with tariffs fixed for the contract period.

This reliance on long-term contracts allows Sembcorp to manage its capital investments effectively, knowing that the output from its power generation assets will be sold at pre-determined prices. This strategic approach is vital for maintaining profitability and supporting its growth in both conventional and renewable energy sectors.

Sembcorp Industries often employs project-specific pricing for its large-scale energy and urban solutions. This approach acknowledges the unique requirements and complexities of each undertaking, moving beyond a one-size-fits-all model.

The company engages in competitive bidding for many of its projects, ensuring that its pricing is aligned with market expectations and the value delivered. This process is crucial for securing significant contracts in sectors like renewable energy and sustainable infrastructure.

Value-based pricing is a cornerstone of Sembcorp's strategy, as it quantifies the long-term advantages for clients. These benefits include enhanced energy security, improved sustainability metrics, and greater operational efficiency, all of which contribute to a strong return on investment for customers.

For instance, in 2024, Sembcorp secured a significant contract to develop a large-scale solar project in India, with pricing structured to reflect the project's contribution to the region's renewable energy targets and the long-term savings for the off-taker. Similarly, its urban solutions projects often incorporate pricing that accounts for the lifecycle benefits of sustainable water management and waste-to-energy systems.

Sembcorp Industries actively engages in competitive bidding processes for new renewable energy projects, a key strategy for market penetration and revenue generation. These tenders typically involve offering specific tariffs or power purchase prices, ensuring Sembcorp's projects are cost-competitive.

For instance, Sembcorp secured a significant 1.1 GW solar project in India through a competitive auction, with tariffs reflecting market dynamics. This approach allows the company to lock in contracted revenue streams, providing financial stability over the long-term operational life of the renewable assets.

The company’s success in these bids, such as winning a 150 MW solar project in the Philippines in 2024 at a competitive rate, underscores its ability to navigate complex tender landscapes and secure profitable ventures. These secured tariffs are crucial for financial planning and investor confidence.

Regulatory and Market Influence

Sembcorp Industries' pricing is significantly shaped by the regulatory landscape and prevailing market forces. Government policies on energy, including subsidies for renewables and carbon pricing mechanisms, directly impact the cost of generation and, consequently, the prices offered to customers. For instance, the evolving energy transition policies in key markets like Singapore and the UK create both opportunities and pricing challenges.

The competitive nature of the energy sector means wholesale electricity prices are a critical determinant. Sembcorp's ability to secure competitive fuel sources and manage its generation portfolio effectively influences its pricing strategies. Economic conditions, such as inflation and interest rates, also play a role, affecting operational costs and the demand for energy services.

Key influences on Sembcorp's pricing include:

- Government Regulations: Policies on renewable energy mandates, feed-in tariffs, and emissions standards directly affect operational costs and revenue potential. For example, Singapore's target to import 100% of its electricity needs by 2025 from low-carbon sources influences Sembcorp's investment and pricing decisions.

- Energy Market Policies: The structure of electricity markets, including price caps, capacity mechanisms, and transmission charges, dictates the revenue Sembcorp can achieve.

- Wholesale Electricity Prices: Fluctuations in spot and forward electricity prices in markets like the UK and Singapore directly impact Sembcorp's profitability and pricing flexibility.

- Subsidies and Incentives: Government support for renewable energy projects, such as tax credits or grants, can lower the effective cost of Sembcorp's green energy offerings, allowing for more competitive pricing.

Capital Allocation and Return on Equity Targets

Sembcorp Industries' capital allocation strategy directly influences its investment decisions and return expectations, with a clear focus on expanding its renewables portfolio. The company has set ambitious return on equity (ROE) targets, guiding its investment choices across its energy and urban development segments.

The financial model employed by Sembcorp is designed to assess and balance the returns from its existing conventional energy assets against the significant growth prospects offered by its sustainable solutions. This approach ensures that capital is deployed where it is expected to generate the most value.

- Renewables Growth Focus: Sembcorp aims to significantly increase its renewable energy capacity, a key driver for capital allocation.

- ROE Targets: The company targets a sustainable ROE, influencing the types of projects and investments it pursues.

- Portfolio Balancing: Sembcorp strategically balances the profitability of its established conventional assets with the long-term potential of its green portfolio.

- FY2023 Performance: For the full year 2023, Sembcorp reported a net profit after tax of S$1,007 million, demonstrating strong financial performance which supports its capital allocation strategy.

Sembcorp Industries' pricing for its energy solutions is largely dictated by long-term Power Purchase Agreements (PPAs) and competitive bidding for projects. These contracts, often 15-25 years in duration, provide price stability and predictable revenue streams, insulating the company from market volatility.

Value-based pricing is also key, with Sembcorp quantifying long-term client benefits like energy security and sustainability. For instance, winning a 1.1 GW solar project in India in 2024 through a competitive auction, with tariffs reflecting market dynamics, highlights this approach.

The company's pricing is also influenced by regulatory environments and market forces, with government policies and wholesale electricity prices playing significant roles. Sembcorp's FY2023 performance, including a net profit after tax of S$1,007 million, underpins its ability to secure competitive pricing for its growing renewables portfolio.

| Key Pricing Influences | Impact on Sembcorp | Example Data |

|---|---|---|

| Long-term PPAs | Revenue stability, price insulation | 15-year PPA with Vietnam industrial customer (2023) |

| Competitive Bidding | Market-aligned pricing, revenue certainty | 1.1 GW solar project in India (2024) via auction |

| Regulatory Environment | Cost of generation, revenue potential | Singapore's 2025 low-carbon electricity import target |

| Financial Performance | Ability to offer competitive pricing | FY2023 Net Profit After Tax: S$1,007 million |

4P's Marketing Mix Analysis Data Sources

Our Sembcorp Industries 4P's Marketing Mix Analysis is built on a foundation of robust data, drawing from official company disclosures like annual reports and investor presentations, alongside comprehensive industry analyses and market research reports. We also incorporate data from Sembcorp's corporate website, news releases, and publicly available information on their project developments and partnerships to ensure a holistic view of their strategies.