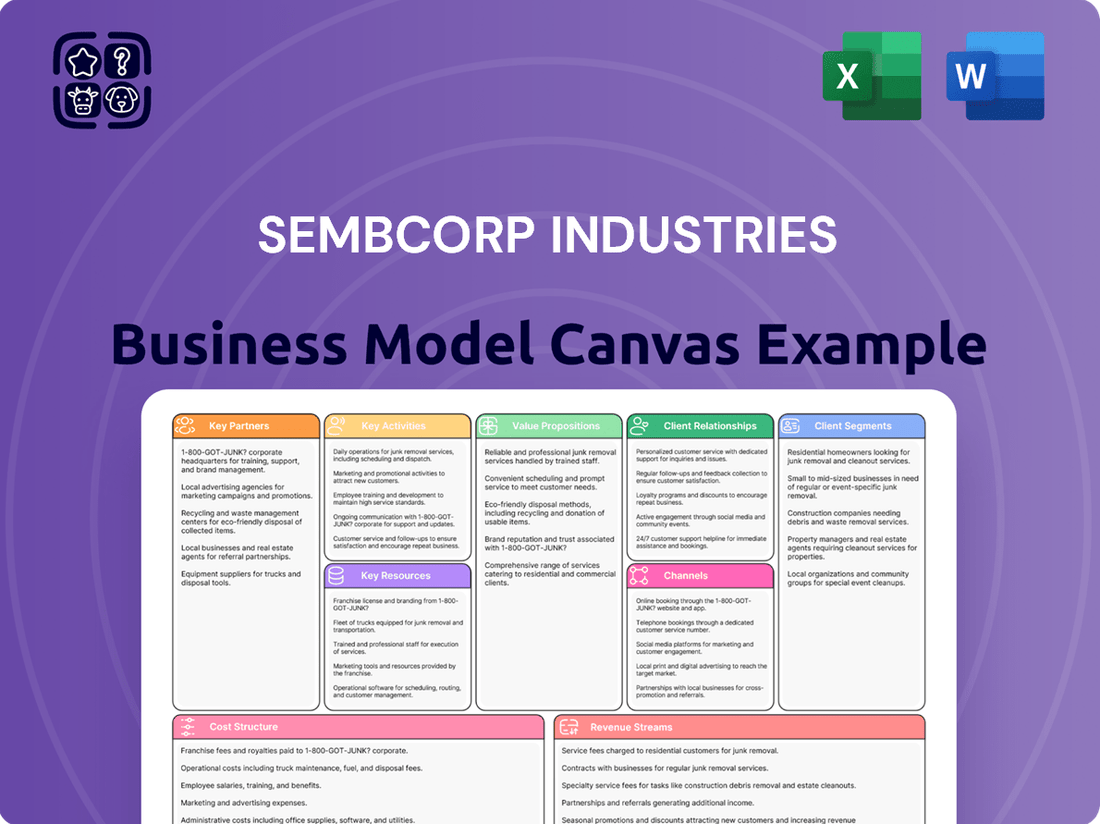

Sembcorp Industries Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sembcorp Industries Bundle

Unlock the strategic blueprint behind Sembcorp Industries's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and key resources, offering a clear view of how they operate and innovate in the energy and urban development sectors.

Discover Sembcorp's revenue streams and cost structure, revealing the financial engine that powers their sustainable growth and market leadership. This is an essential tool for anyone looking to understand their competitive advantage.

Want to see exactly how Sembcorp Industries operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Sembcorp Industries’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in Sembcorp Industries’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Sembcorp Industries actively partners with government agencies and regulators across its operating regions to navigate complex regulatory landscapes and secure necessary approvals for its extensive infrastructure projects. For instance, its collaboration with Singapore's Energy Market Authority is vital for maintaining operational compliance and obtaining licenses essential for its energy generation and urban development ventures.

These relationships are instrumental in aligning Sembcorp's strategic initiatives with national energy policies and urban planning objectives, thereby fostering a supportive environment for large-scale developments. Such partnerships are particularly crucial for advancing the energy transition, including the development of advanced assets like hydrogen-ready facilities, ensuring they meet stringent environmental and operational standards set by authorities.

In 2023, Sembcorp continued to leverage these key partnerships to advance its sustainability goals, with significant progress reported in securing permits for renewable energy projects. The company's ongoing dialogues with regulators aim to streamline processes for new energy solutions, underscoring the critical role of government collaboration in achieving ambitious decarbonization targets and fostering innovation in the energy sector.

Sembcorp Industries actively partners with technology providers and innovators to drive its renewable energy and decarbonization efforts. These collaborations are crucial for developing and deploying advanced solutions, such as cutting-edge energy storage systems, which are vital for grid stability in renewable energy integration.

Key partnerships focus on areas like green hydrogen and ammonia production technologies, positioning Sembcorp at the forefront of the transition to cleaner fuels. For instance, by mid-2024, Sembcorp has been involved in several projects exploring the viability of green ammonia as a shipping fuel, a sector heavily reliant on technological advancements.

Furthermore, Sembcorp leverages digital solutions through these partnerships to optimize the performance of its renewable assets, enhancing overall efficiency and reliability. This digital integration is fundamental to managing a complex and distributed renewable energy portfolio, aiming for maximum output and minimal waste.

These strategic alliances enable Sembcorp to stay ahead in a rapidly evolving market, ensuring they can offer the most efficient and sustainable energy solutions. By embracing innovation, Sembcorp is not only improving its operational capabilities but also contributing significantly to the global shift towards a low-carbon future.

Sembcorp Industries actively collaborates with industrial and urban developers to create sustainable projects. For instance, in its Integrated Urban Solutions segment, Sembcorp partners with entities like Panbil Group in Indonesia and Hankyu Hanshin Properties Corp. in Vietnam. These alliances are crucial for the co-development of low-carbon industrial parks and eco-friendly urban environments.

These strategic partnerships are designed to pool expertise and financial resources, enabling the undertaking of large-scale land development and the provision of essential infrastructure. Such collaborations are vital for realizing ambitious sustainability goals within the real estate sector.

Energy Offtakers and Large Corporate Clients

Sembcorp Industries forges strategic alliances with energy offtakers and large corporate clients, securing long-term Power Purchase Agreements (PPAs) and utility contracts. These vital partnerships, including those with tech giants like Meta Platforms for data center power needs and chemical manufacturers such as Aster Chemicals, are foundational to its business model. These agreements ensure consistent demand for Sembcorp's renewable energy and integrated solutions, creating predictable revenue streams.

These off-take agreements are critical for de-risking Sembcorp's renewable energy projects and providing a stable financial base. For instance, in 2023, Sembcorp announced a significant PPA with a major data center operator in Singapore, underscoring the increasing demand from this sector. Such partnerships directly contribute to the company’s ability to finance and expand its green energy portfolio.

- Secured long-term PPAs with major industrial clients, including data centers and chemical companies.

- Partnerships with entities like Meta Platforms and Aster Chemicals ensure stable demand for energy and integrated solutions.

- These agreements provide predictable revenue streams, supporting project financing and expansion.

- In 2023, Sembcorp highlighted its growing PPA pipeline, with a significant portion attributed to the burgeoning data center sector.

Financial Institutions and Investors

Sembcorp Industries actively collaborates with financial institutions and investors to fuel its growth, particularly in capital-intensive sectors like renewable energy and urban development. These relationships are crucial for securing the necessary capital for large-scale projects and advancing its decarbonization strategy.

Key partnerships with entities such as the Japan Bank for International Cooperation (JBIC) are instrumental. JBIC, for instance, has been a significant partner in financing Sembcorp’s renewable energy ventures, demonstrating a shared commitment to sustainable development.

- Project Financing: Securing substantial loans and credit facilities from banks and financial institutions to fund the construction and development of renewable energy assets.

- Green Financing: Engaging with institutions offering green bonds and sustainability-linked loans to align funding with environmental, social, and governance (ESG) objectives.

- Investor Relations: Maintaining strong ties with institutional investors, including pension funds and asset managers, to attract equity investment for strategic initiatives and expansions.

- Strategic Capital: Collaborating with development finance institutions and sovereign wealth funds for co-investment opportunities in emerging markets and new energy technologies.

Sembcorp Industries actively partners with financial institutions and investors to secure capital for its energy transition and urban development projects. These alliances are critical for funding its ambitious growth plans and decarbonization targets. For example, in 2023, Sembcorp successfully issued sustainability-linked bonds, attracting significant interest from ESG-focused investors.

These partnerships are vital for accessing diverse funding sources, including green financing and project-specific debt. By mid-2024, the company has reported a robust pipeline of green financing initiatives, reflecting its commitment to sustainable growth and attracting capital aligned with its strategic objectives.

Sembcorp's collaborations with entities like the Japan Bank for International Cooperation (JBIC) underscore its ability to secure substantial funding for large-scale renewable energy projects, demonstrating a shared vision for sustainable infrastructure development.

What is included in the product

A detailed Sembcorp Industries Business Model Canvas outlining its integrated approach to energy and urban solutions, focusing on sustainable energy generation, urban development, and water management.

It comprehensively covers key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams.

Sembcorp Industries' Business Model Canvas offers a clear, structured approach to understanding their energy and urban development strategies, effectively addressing the pain point of complex, multi-faceted operations by providing a digestible, one-page snapshot.

Activities

Sembcorp Industries' key activities in developing and constructing energy infrastructure are central to its business. This includes the entire lifecycle of power generation assets, from initial planning and sophisticated engineering to procuring materials and overseeing the actual construction. They are actively involved in building diverse power sources, encompassing traditional gas-fired plants alongside a significant push into renewables like solar, wind, and hydropower.

A crucial part of this is the development of energy storage systems, which are vital for grid stability and integrating intermittent renewable sources. For instance, Sembcorp has been a leader in deploying battery energy storage systems (BESS). As of early 2024, they had a significant portfolio of renewable energy projects under development and construction globally, aiming to rapidly expand their green energy capacity.

Their expertise extends to managing complex, large-scale projects, ensuring they are delivered on time and within budget. This involves meticulous procurement strategies and robust construction management to bring new, efficient energy assets online. Sembcorp’s commitment to this area is reflected in their substantial investments in green energy development, with ambitious targets set for their renewable energy portfolio by 2025 and beyond.

Sembcorp Industries actively manages and maintains its extensive network of energy and water infrastructure. This involves ensuring the consistent and efficient delivery of essential services like electricity, gas, steam, and water to a broad customer base, encompassing both industrial and municipal sectors. For instance, as of early 2024, Sembcorp's portfolio includes a significant global presence in renewable energy and conventional power generation, requiring robust operational and maintenance protocols.

The company's key activities in this area focus on the day-to-day running of its power plants and water treatment facilities. This includes implementing rigorous planned maintenance schedules to prevent disruptions and proactively optimizing asset performance to maximize efficiency and output. Sembcorp's commitment to reliable operations is crucial for its customers' business continuity and for meeting energy and water demands across its operational regions.

Sembcorp Industries actively designs and builds industrial parks, focusing on creating sustainable environments with integrated utilities and smart solutions. This involves master planning and land development to offer ready-built factories and essential infrastructure for businesses. For instance, Sembcorp's development in Vietnam's VSIP projects has been a significant undertaking, with ongoing expansion and upgrades to meet evolving industrial needs.

The company's commitment extends to developing eco-friendly and technologically advanced industrial zones. This includes providing robust utility services, such as reliable power and water, alongside digital connectivity to support modern manufacturing and logistics. Their strategy aims to attract foreign direct investment by offering complete, ready-to-operate industrial solutions.

Sembcorp’s Urban Solutions segment plays a crucial role in facilitating economic growth by creating well-equipped industrial estates. These parks are designed to be efficient and attractive to a wide range of industries, from manufacturing to technology. The development pipeline includes new projects and expansions, reflecting continued investment in this area.

Strategic Investments and Acquisitions

Sembcorp Industries actively engages in strategic investments and acquisitions to bolster its renewable energy and urban solutions segments. A prime example is its acquisition of a 25% stake in Senoko Energy, a significant move within the energy sector. This aligns with Sembcorp's ambition to become a leading energy player in the region, focusing on sustainable growth.

Further demonstrating this commitment, Sembcorp has secured renewable energy assets in the Philippines and Vietnam, expanding its operational footprint. These moves are critical for achieving its ambitious growth targets and driving its green transformation strategy forward. The company aims to significantly increase its renewable energy capacity.

- Acquisition of 25% stake in Senoko Energy: Broadens Sembcorp's energy portfolio and regional presence.

- Expansion into Philippines and Vietnam: Secures new renewable energy assets, enhancing its green energy capacity.

- Focus on Growth and Green Transformation: These activities are central to achieving Sembcorp's strategic objectives for sustainable development.

Research and Development in Decarbonization Solutions

Sembcorp Industries actively invests in and explores cutting-edge technologies crucial for decarbonization. This includes pioneering advancements in green hydrogen and ammonia production, alongside the development of sophisticated carbon management solutions. These efforts are central to their strategy of leading Asia's energy transition.

Their commitment is evident in their focus on developing and deploying low-carbon energy solutions. For instance, Sembcorp has been actively involved in projects aimed at advancing the hydrogen economy, a key component of future decarbonization efforts.

- Investing in R&D for Green Hydrogen: Sembcorp is a participant in initiatives exploring the production and application of green hydrogen, a vital element in reducing industrial emissions.

- Developing Carbon Capture Technologies: The company is also researching and implementing carbon management solutions, including carbon capture, utilization, and storage (CCUS) to mitigate CO2 emissions.

- Driving Asia's Energy Transition: Sembcorp's research and development activities are strategically aligned with their goal of positioning themselves as a leader in Asia's shift towards sustainable energy sources.

- Expanding Low-Carbon Portfolio: Through continuous innovation in R&D, Sembcorp aims to broaden its portfolio of low-carbon energy and urban solutions.

Sembcorp Industries' key activities revolve around developing, constructing, and maintaining energy and water infrastructure. This includes a strong focus on renewable energy sources like solar and wind, alongside traditional power generation and energy storage solutions. They are also involved in building and managing industrial parks, offering integrated utilities and smart solutions to businesses. Furthermore, strategic investments and acquisitions, along with a commitment to research and development in areas like green hydrogen and carbon capture, are crucial for their growth and decarbonization efforts.

| Key Activity Area | Description | Key 2024/2025 Focus | Impact |

|---|---|---|---|

| Energy Infrastructure Development & Construction | Building diverse power generation assets, including renewables and storage. | Expanding global renewable energy portfolio; deploying battery energy storage systems (BESS). | Increases clean energy capacity; enhances grid stability. |

| Operations & Maintenance | Ensuring efficient and reliable delivery of energy and water services. | Optimizing performance of power plants and water treatment facilities. | Guarantees customer business continuity; meets energy/water demands. |

| Urban Solutions (Industrial Parks) | Designing and developing sustainable industrial zones with integrated utilities. | Expanding VSIP projects; offering ready-to-operate industrial solutions. | Facilitates economic growth; attracts foreign direct investment. |

| Strategic Investments & Acquisitions | Bolstering renewable energy and urban solutions segments through strategic moves. | Acquisition of 25% stake in Senoko Energy; securing renewable assets in Philippines and Vietnam. | Expands regional presence and green energy capacity. |

| Technology & Decarbonization R&D | Investing in and exploring cutting-edge technologies for decarbonization. | Pioneering advancements in green hydrogen, ammonia, and carbon management solutions. | Positions Sembcorp as a leader in Asia's energy transition. |

What You See Is What You Get

Business Model Canvas

The document you're previewing on this page is the real deal. It’s not a mockup or a sample—it's a direct snapshot from the actual file you’ll receive after purchase. When you complete your order, you’ll get full access to this same professional, ready-to-use Sembcorp Industries Business Model Canvas.

Resources

Sembcorp Industries boasts a substantial collection of physical assets crucial to its operations. This includes a diverse range of power generation facilities, encompassing both traditional and renewable energy sources, alongside vital water treatment infrastructure.

These operational power plants, energy storage systems, and water treatment facilities are strategically located across Asia and other international markets. The company's commitment to sustainability is evident in its growing renewable energy capacity, which reached 13.9 GW as of the first half of 2024, with a target of 25 GW by 2025.

Furthermore, Sembcorp manages well-established industrial parks, providing essential infrastructure for businesses. This extensive network of tangible assets serves as the fundamental basis for delivering its integrated energy and urban solutions to a broad customer base.

Sembcorp Industries relies heavily on a highly skilled workforce, encompassing engineers, project managers, and operations specialists. This expertise is fundamental to the successful development, operation, and maintenance of its complex energy and urban infrastructure projects.

The company's competitive advantage is significantly bolstered by its team's deep knowledge in critical areas such as the energy transition, sustainable urban development, and emerging digital technologies. This specialized know-how enables Sembcorp to navigate and lead in these evolving sectors.

In 2023, Sembcorp reported a substantial increase in its renewable energy portfolio, reaching 12.1 GW of gross installed capacity. This growth is directly attributable to the technical expertise of its workforce in managing and expanding these advanced energy solutions.

Furthermore, Sembcorp's commitment to innovation, evidenced by its investment in digital solutions for its urban developments, underscores the importance of its technically proficient employees. Their ability to integrate smart technologies ensures efficient and sustainable urban environments.

Sembcorp Industries commands substantial financial capital, a critical resource for its ambitious renewable energy and infrastructure ventures. This capital is bolstered by robust cash flow generation, evident in its consistent operational performance.

Access to sustainable financing frameworks is equally vital, enabling Sembcorp to fund its large-scale investments. For instance, in 2023, the company secured a significant green loan facility, underscoring its commitment to environmentally sound financial practices.

This financial strength directly fuels Sembcorp's strategic growth and transformation objectives. The company's ability to raise capital efficiently is a key enabler for expanding its renewable portfolio and developing critical infrastructure projects globally.

Intellectual Property and Proprietary Technologies

Sembcorp Industries leverages its proprietary technologies, operational know-how, and intellectual property to create unique value. These assets are crucial in areas like advanced energy solutions, waste-to-resource management, and smart urban infrastructure. This expertise allows Sembcorp to deliver innovative and highly efficient solutions to its clients.

The company's commitment to innovation is evident in its digital platforms for carbon management, which are a key component of its intellectual property portfolio. For instance, Sembcorp's focus on sustainable solutions is a direct result of its investment in proprietary technologies.

- Proprietary Technologies: Sembcorp develops and utilizes advanced technologies in renewable energy generation, energy storage, and waste-to-energy processes.

- Operational Know-how: Decades of experience in managing complex energy and environmental projects globally provide a significant competitive advantage.

- Intellectual Property: This includes patents, trademarks, and trade secrets related to their core business areas, such as advanced cooling systems and digital energy management platforms.

- Digital Platforms: Investments in digital solutions, including sophisticated carbon management tools, enhance efficiency and offer new service opportunities.

Strategic Land Bank and Development Rights

Sembcorp Industries leverages its strategic land bank and development rights as a core asset for its Integrated Urban Solutions business. This includes significant holdings in growth markets such as Vietnam, Indonesia, and China.

These land banks, coupled with the essential development rights, are fundamental to the continuous expansion of the company's low-carbon industrial parks. For instance, as of their 2023 reporting, Sembcorp continued to actively develop and expand its industrial park offerings, focusing on sustainable infrastructure to attract global investments.

The ability to secure and develop these land parcels is a key enabler for Sembcorp’s strategy to provide integrated solutions, including utilities, logistics, and environmental services, within these parks. Their commitment to developing sustainable urban solutions is underscored by their ongoing investments in renewable energy and green facilities within these strategic locations.

Key aspects of this resource include:

- Extensive Land Holdings: Sembcorp maintains a substantial and growing portfolio of land in strategically important Southeast Asian and Chinese markets.

- Development Rights: Crucial permits and approvals are secured, allowing for the planned development and expansion of industrial park facilities.

- Low-Carbon Focus: The land bank is utilized to build and expand industrial parks designed with sustainability and low-carbon principles at their core.

- Integrated Solutions Hubs: These developed parks serve as integrated hubs, offering a comprehensive suite of services to tenants, thereby enhancing their value proposition.

Sembcorp Industries' Key Resources are multifaceted, encompassing tangible assets like power plants and water treatment facilities, alongside intangible assets such as proprietary technologies and intellectual property. The company's human capital, comprised of skilled engineers and project managers, is vital for its complex operations and innovation. Furthermore, substantial financial capital and strategic land holdings are instrumental in driving its growth, particularly in renewable energy and integrated urban solutions.

| Resource Category | Key Components | Relevance to Sembcorp's Business Model | Supporting Data/Facts (as of H1 2024 or recent) |

| Physical Assets | Power Generation Facilities (Renewable & Conventional) | Core for energy solutions; drives revenue and market presence. | 13.9 GW renewable energy capacity; significant conventional capacity. |

| Physical Assets | Water Treatment Infrastructure | Essential for integrated urban solutions and industrial park offerings. | Operates water treatment plants across key markets. |

| Human Capital | Skilled Workforce (Engineers, Operations Specialists) | Enables development, operation, and maintenance of complex infrastructure; drives innovation. | Expertise in energy transition and digital technologies. |

| Financial Capital | Operating Cash Flow, Access to Financing | Funds large-scale investments in renewables and infrastructure development. | Secured green loan facilities; robust cash flow generation. |

| Intellectual Property & Technology | Proprietary Technologies, Digital Platforms | Differentiates offerings in energy efficiency, carbon management, and smart urban solutions. | Investment in digital platforms for carbon management; advanced energy solutions. |

| Strategic Land Bank | Land Holdings and Development Rights | Foundation for expanding low-carbon industrial parks and integrated urban solutions. | Significant holdings in growth markets like Vietnam and Indonesia. |

Value Propositions

Sembcorp Industries guarantees a dependable and robust energy provision, a key value proposition for its diverse clientele. This is achieved through a strategically diversified energy generation mix, encompassing both conventional gas-fired power plants and an expanding portfolio of renewable energy sources like solar and wind.

A significant portion of Sembcorp's energy output is secured by long-term contracts, offering customers a predictable and stable energy supply. For instance, as of early 2024, Sembcorp maintained a substantial percentage of its generation capacity under such agreements, underpinning its commitment to reliability.

This balanced approach to energy generation and the emphasis on contractual security translate directly into enhanced energy security and operational certainty for Sembcorp's customers. Businesses can rely on consistent utility provision, minimizing the risk of disruptions that could impact their operations and profitability.

In 2023, Sembcorp continued its strategic pivot, with renewable energy assets forming an increasingly larger share of its operational capacity, aiming for 25 gigawatts of gross renewable energy capacity by 2030. This ongoing transition further strengthens the resilience of its energy supply, even as it leverages existing gas assets for stability.

Sembcorp Industries champions sustainable and low-carbon solutions, a core value proposition directly addressing clients' urgent decarbonization needs. This commitment is demonstrated through significant investments in renewable energy, aiming to expand its green energy portfolio substantially. By 2025, Sembcorp targets having at least 10 gigawatts (GW) of renewable energy capacity.

A crucial aspect of this offering involves developing future-ready energy infrastructure, such as hydrogen-ready assets, to facilitate the transition to cleaner fuel sources. Furthermore, Sembcorp is actively developing low-carbon industrial parks, creating environments that inherently reduce environmental impact for businesses operating within them.

This focus on sustainability not only aligns with global environmental goals but also provides a tangible competitive advantage for clients seeking to improve their own environmental, social, and governance (ESG) profiles. For instance, Sembcorp's integrated urban solutions often incorporate advanced water treatment and waste management technologies, further contributing to a circular economy model.

Sembcorp Industries delivers integrated urban development, transforming undeveloped land into fully functional, sustainable industrial parks. This includes providing essential utilities like power and water, along with ready-built factories and smart infrastructure, creating a streamlined environment for businesses to thrive.

In 2023, Sembcorp reported significant growth in its Urban business, with revenue reaching S$1.4 billion, highlighting the demand for its comprehensive development solutions. This integrated approach reduces setup time and operational complexities for clients.

The company's commitment to sustainability is a core value proposition, with a focus on green solutions and smart city technologies within these developments. This attracts businesses looking to enhance their environmental, social, and governance credentials.

By offering a complete package from land development to operational utilities, Sembcorp provides a one-stop solution that enhances efficiency and reduces risk for its customers. This integrated model is a key differentiator in the competitive urban development market.

Cost Efficiency and Optimized Resource Management

Sembcorp Industries drives cost efficiency for its customers by leveraging advanced technologies and integrated solutions. This approach helps businesses optimize their energy and resource consumption, leading to significant economic value creation alongside environmental benefits. For example, their waste-to-resource initiatives can transform waste streams into valuable inputs, reducing raw material costs and disposal expenses.

In 2024, Sembcorp's focus on operational excellence and digital transformation enabled clients to achieve substantial savings. Their integrated energy solutions, which combine renewable energy sources with smart grid technologies, allow for more predictable and lower energy bills. This strategic advantage is crucial for businesses looking to maintain competitiveness in a fluctuating market.

- Optimized Resource Consumption: Sembcorp's solutions help customers reduce their reliance on finite resources, leading to lower procurement costs.

- Waste-to-Value Creation: By converting waste into energy or materials, Sembcorp offers a dual benefit of cost reduction and new revenue streams for clients.

- Energy Cost Predictability: The integration of renewable energy and smart management systems provides clients with more stable and often lower energy expenditures.

- Operational Efficiency Gains: Through advanced technologies and streamlined processes, Sembcorp enhances the overall operational efficiency of its partners.

Global Expertise with Localized Execution

Sembcorp Industries leverages over three decades of global experience to deliver top-tier projects. Their approach is rooted in a deep understanding of international best practices, refined over years of operation across diverse markets.

This extensive global footprint allows Sembcorp to adapt its strategies effectively to local market conditions, including specific regulatory frameworks and cultural nuances. This flexibility is crucial for successful project development in varied environments.

The company's value proposition centers on providing high-quality project execution. For instance, in 2024, Sembcorp continued to secure significant renewable energy projects globally, demonstrating their capability in diverse geographies.

- Global Experience: Over 30 years in project development and execution.

- Localized Approach: Adapting to specific market conditions and regulations.

- Quality Execution: Delivering best-in-class projects worldwide.

- Tailored Solutions: Creating solutions that fit unique geographical needs.

Sembcorp Industries offers reliable and stable energy supply through a diversified generation mix, including renewables and gas, often secured by long-term contracts. This ensures energy security and operational certainty for clients, minimizing disruption risks.

The company champions sustainable, low-carbon solutions by investing heavily in renewables and developing future-ready infrastructure like hydrogen-ready assets and low-carbon industrial parks. This helps clients improve their ESG profiles.

Sembcorp provides integrated urban development, creating sustainable industrial parks with essential utilities and smart infrastructure, streamlining business setup and operations while enhancing efficiency and reducing risk.

Cost efficiency is driven by advanced technologies and integrated solutions, optimizing resource consumption and creating value from waste, leading to lower operational costs and enhanced competitiveness for clients.

Leveraging over 30 years of global experience, Sembcorp delivers high-quality project execution, adapting to local market conditions with tailored solutions for diverse geographical needs.

| Value Proposition | Description | Key Metrics/Facts |

| Dependable Energy Provision | Guaranteed reliable energy through diverse generation and long-term contracts. | Strategic pivot towards renewables: targeting 25 GW gross renewable capacity by 2030. |

| Sustainable & Low-Carbon Solutions | Focus on green energy and future-ready infrastructure for decarbonization. | Targeting at least 10 GW of renewable energy capacity by 2025. |

| Integrated Urban Development | End-to-end solutions for sustainable industrial parks. | Urban business revenue reached S$1.4 billion in 2023. |

| Cost Efficiency | Optimizing resource use and waste-to-value for reduced client costs. | Focus on operational excellence and digital transformation in 2024 for client savings. |

| Global Project Expertise | High-quality project delivery with over 30 years of international experience. | Continued securing of significant global renewable energy projects in 2024. |

Customer Relationships

Sembcorp Industries cultivates enduring customer relationships primarily through long-term contractual engagements, especially within its gas and power segments. A substantial portion of its energy portfolio benefits from multi-year offtake agreements, offering both Sembcorp and its clients a foundation of stability and predictable revenue streams. For instance, in 2024, such contracts continued to form the bedrock of its recurring income, ensuring consistent demand for its energy output and fostering deep-seated partnerships built on reliability and mutual commitment.

Sembcorp Industries prioritizes strong customer relationships, especially with its large industrial and municipal clients, through dedicated account management and specialized technical support teams. This proactive approach ensures that each client receives tailored solutions designed to meet their unique operational requirements and challenges.

These dedicated teams are crucial for efficiently resolving any issues that arise, fostering a sense of reliability and trust. For instance, in 2024, Sembcorp’s commitment to service excellence was reflected in its high client retention rates across its utility and urban development segments, underscoring the value placed on these support structures.

The focus on continuous optimization of utility services and urban infrastructure means Sembcorp's support extends beyond initial setup. They actively work with clients to enhance performance, improve sustainability, and adapt to evolving needs, a strategy that proved particularly effective in managing complex energy transition projects for industrial partners throughout the year.

In its Integrated Urban Solutions segment, Sembcorp Industries frequently cultivates customer relationships that blossom into genuine collaborative partnerships. This approach goes beyond a simple transactional exchange, focusing instead on jointly developing sustainable industrial environments. For instance, Sembcorp actively engages with clients to understand their evolving long-term growth strategies, a crucial element in tailoring and integrating effective green solutions.

This deep level of engagement allows Sembcorp to act as a strategic partner, not just a service provider. By co-creating these sustainable ecosystems, Sembcorp helps clients achieve their environmental, social, and governance (ESG) goals while simultaneously enhancing operational efficiency. This model proved particularly valuable in 2024, as many industrial clients sought to bolster their sustainability credentials and secure long-term resource management strategies.

Sustainability Advisory and Solutions Provision

Sembcorp Industries actively partners with its clients to navigate their sustainability goals, offering expert advisory services and implementing tailored low-carbon energy solutions. This collaborative approach solidifies Sembcorp's role as a crucial ally in their clients' decarbonization efforts.

- Advisory Services: Sembcorp provides guidance on achieving specific environmental, social, and governance (ESG) targets.

- Bespoke Solutions: They deploy customized low-carbon energy and solutions to meet individual client needs.

- Strategic Partnership: This positions Sembcorp as a key facilitator in their customers' transition to a lower-carbon future.

- Customer Success: The focus is on enabling clients to meet their sustainability objectives, fostering long-term relationships.

Investor Relations and Shareholder Engagement

Sembcorp Industries prioritizes robust investor relations and shareholder engagement. This includes maintaining transparent and proactive communication with a diverse investor base, encompassing both individual investors and sophisticated financial professionals. The company’s approach is built on regular financial reporting, detailed analyst briefings, and a clear commitment to delivering sustainable returns and enhancing shareholder value through increased dividends, underscoring confidence in Sembcorp's future performance trajectory.

Key aspects of their engagement strategy include:

- Transparent Financial Reporting: Providing timely and accurate financial statements and performance updates.

- Proactive Communication: Engaging with investors through regular briefings, investor calls, and participation in industry conferences.

- Commitment to Returns: Demonstrating a focus on sustainable financial performance, leading to potential increases in dividends.

- Shareholder Value Focus: Aligning corporate strategy with the goal of maximizing long-term shareholder value.

Sembcorp Industries fosters collaborative partnerships within its urban development sector, working alongside clients to co-create sustainable industrial environments and achieve shared ESG objectives. This deep engagement strategy, which saw significant traction in 2024 as companies prioritized sustainability, positions Sembcorp as a strategic ally in their clients' decarbonization journeys.

Channels

Sembcorp Industries primarily connects with its industrial and municipal clientele through dedicated direct sales teams. This approach allows for personalized engagement and the development of tailored solutions that precisely meet customer needs for energy and urban infrastructure projects.

The company actively participates in competitive project tenders, a crucial channel for securing large-scale energy and urban development contracts. In 2023, Sembcorp secured over 2GW of new renewable energy projects, many of which were awarded through these tender processes, demonstrating the effectiveness of this channel in expanding their project pipeline.

Sembcorp Industries frequently utilizes strategic joint ventures and partnerships to bring its large-scale projects to fruition, especially when entering new territories or undertaking complex developments. These collaborations are crucial for market access, risk mitigation, and capitalizing on shared expertise, as seen in their renewable energy ventures.

For instance, in 2023, Sembcorp announced a significant joint venture with a leading developer to build a large-scale solar power plant in India, a market with substantial growth potential but also unique regulatory landscapes. This partnership allowed Sembcorp to leverage local market knowledge and share the substantial capital investment required.

These alliances are not just about sharing costs; they are about pooling technical capabilities and operational experience. By partnering, Sembcorp can accelerate project timelines and enhance the overall execution quality, thereby strengthening its competitive position in the global energy transition market.

Sembcorp utilizes online platforms extensively for real-time operational monitoring and sophisticated asset management across its diverse energy portfolio. This digital backbone is crucial for optimizing performance and ensuring reliability. For instance, their digital services enable predictive maintenance, reducing downtime and operational costs.

The company is also actively expanding its digital offerings to provide decarbonization solutions, most notably through its GoNetZero™ suite. This platform aims to help customers track, manage, and reduce their carbon emissions, showcasing a strategic shift towards digitally-enabled sustainability services. By offering these solutions online, Sembcorp broadens its market reach and creates new revenue streams.

These digital channels are instrumental in fostering enhanced customer engagement and delivering services more efficiently. Sembcorp is leveraging these platforms to build stronger relationships with clients and provide them with data-driven insights into their energy consumption and environmental impact.

Industry Events and Thought Leadership Forums

Sembcorp Industries actively participates in key industry conferences and exhibitions, using these platforms to highlight its advancements in renewable energy and sustainable solutions. For instance, in 2024, Sembcorp's presence at major energy summits allowed for direct engagement with potential clients and investors, showcasing their expanding portfolio of solar and wind projects. This strategic engagement is crucial for building brand visibility and fostering new business relationships.

Hosting proprietary thought leadership forums, such as Sembcorp Energy Insights, further solidifies their position as an industry leader. These events bring together experts, policymakers, and business leaders to discuss critical trends and challenges in the energy sector. For example, a 2024 forum might have focused on the integration of battery storage solutions, attracting significant attention from utility companies and government agencies.

- Showcasing Capabilities: Sembcorp leverages industry events to present its latest technological innovations and project successes, particularly in the renewable energy space.

- Stakeholder Engagement: Participation in conferences and forums facilitates direct interaction with customers, partners, and investors, fostering dialogue and collaboration.

- Brand Awareness: These channels are vital for building and reinforcing Sembcorp's brand as a leader in sustainable energy solutions and a reliable partner for green transitions.

- Market Insights: Hosting thought leadership events allows Sembcorp to shape industry discourse and gain valuable insights into market needs and future trends.

Corporate Website and Investor Relations Portals

Sembcorp Industries leverages its corporate website and dedicated investor relations (IR) portals as primary channels to communicate its offerings, financial health, and future strategies. These platforms are crucial for reaching a wide audience, from individual investors to institutional shareholders, as well as media outlets and potential business partners.

These digital touchpoints are essential for transparency and engagement, providing detailed insights into Sembcorp's operations, including its growing renewable energy portfolio and sustainable solutions. For instance, in its 2024 financial reporting, the company highlighted significant growth in its urban development and energy segments, which is readily accessible through these channels.

- Information Dissemination: Provides comprehensive details on Sembcorp's energy (including renewables), urban development, and related services.

- Financial Transparency: Offers access to annual reports, quarterly results, and investor presentations, crucial for valuation and decision-making.

- Strategic Communication: Outlines the company's strategic direction, including its commitment to sustainability and its transition towards a greener energy future.

- Stakeholder Engagement: Serves as a direct line of communication for investors, analysts, media, and other stakeholders seeking timely and accurate information.

Sembcorp Industries also leverages industry conferences and its own thought leadership events to connect with stakeholders. These platforms are vital for showcasing their renewable energy advancements and engaging directly with potential clients and investors. For example, participation in major energy summits in 2024 allowed Sembcorp to highlight its expanding solar and wind project portfolio.

Customer Segments

Sembcorp Industries serves a critical customer segment comprising industrial and commercial clients. This includes major players like large industrial manufacturers, chemical companies, and increasingly, data centers, all of which depend on robust and integrated energy, water, and waste-to-resource solutions. These businesses operate within Sembcorp's managed industrial parks or require Sembcorp’s services at their own sites.

These clients typically seek long-term, stable utility provisions to ensure uninterrupted operations and predictable costs. For instance, in 2024, Sembcorp continued to secure significant contracts with industrial park developers and large manufacturers, focusing on providing sustainable energy and water solutions essential for their production processes. The demand from data centers, a rapidly growing sector, is particularly notable, requiring substantial and reliable power and cooling infrastructure.

Sembcorp Industries is a key partner for government and municipal authorities, especially within its urban solutions division. They focus on developing and managing integrated industrial parks and providing essential utilities, crucial for urban growth and economic zones. These collaborations frequently take the form of public-private partnerships, fostering infrastructure development.

Sembcorp Industries serves a critical customer segment: renewable energy buyers, primarily comprised of utility companies and large corporations worldwide. These entities are actively seeking to secure clean energy through Power Purchase Agreements (PPAs) to achieve ambitious sustainability goals and significantly lower their carbon emissions.

This segment includes forward-thinking organizations like Meta Platforms, which has publicly committed to 100% renewable energy sourcing. In 2023, Meta reported sourcing approximately 9.9 gigawatts of renewable energy, demonstrating the substantial demand from major corporate players for sustainable power solutions.

The drive for decarbonization is a major catalyst, with many corporations setting net-zero targets. For instance, a significant percentage of Fortune 500 companies have established science-based targets, creating a robust market for renewable energy procurement. Sembcorp's ability to offer reliable, long-term PPAs directly addresses this growing need.

Sembcorp’s renewable energy portfolio, which reached over 13 gigawatts in gross installed capacity by the end of 2024, is strategically positioned to meet the diverse energy requirements of these global buyers. This scale allows them to cater to the substantial energy demands of large industrial and technology firms.

Real Estate Developers and Investors

Sembcorp Industries' urban solutions segment actively engages with real estate developers and investors. These customers seek well-established, sustainable industrial parks to house their own development projects or investment portfolios.

This customer segment values Sembcorp's ability to provide strategic land parcels within integrated, green industrial estates. For instance, Sembcorp’s operations in Vietnam, a key growth market, have seen significant interest from property developers looking for well-serviced land. In 2024, the demand for sustainable industrial real estate in Southeast Asia continued to rise, driven by foreign direct investment and reshoring trends.

- Strategic Land Access: Developers gain access to prime locations within Sembcorp’s developed industrial parks, reducing upfront development hurdles.

- Sustainability Focus: Investors and developers increasingly prioritize green certifications and sustainable infrastructure, which Sembcorp offers.

- Integrated Infrastructure: These customers benefit from ready access to utilities, logistics, and amenities, enhancing the attractiveness of their own projects.

- Market Growth: The demand for such integrated solutions is bolstered by continued economic growth and industrial expansion in key Asian markets.

Emerging Market Governments and Enterprises

Sembcorp Industries strategically focuses on emerging economies across Asia, recognizing their robust demand for enhanced energy infrastructure and sustainable urban development. Countries like Vietnam, Indonesia, India, and the Philippines are experiencing rapid industrialization and urbanization, creating substantial investment opportunities. For instance, Vietnam's renewable energy sector saw significant growth, with solar and wind power capacity increasing substantially in recent years, driven by government targets and international investment. Similarly, Indonesia's push for industrial expansion requires reliable and cleaner energy sources.

These emerging markets represent a significant growth trajectory for Sembcorp. The increasing need for power generation, particularly renewable energy to meet climate goals and growing demand, positions Sembcorp to provide essential services. For example, in 2024, India continued its aggressive renewable energy expansion, aiming to reach 500 GW of non-fossil fuel energy capacity by 2030. This ambition translates directly into opportunities for companies like Sembcorp to develop and operate solar, wind, and other sustainable energy projects.

Sembcorp's engagement with emerging market governments and enterprises is crucial for its business model. They partner with these entities to develop large-scale infrastructure projects, often involving long-term concessions and power purchase agreements. This approach allows Sembcorp to secure stable revenue streams while contributing to the critical development needs of these nations.

Key aspects of Sembcorp's customer segments in emerging markets include:

- Governments: Seeking to secure reliable and sustainable energy supplies to power economic growth and meet climate commitments.

- State-Owned Enterprises: Requiring new energy generation capacity and infrastructure upgrades to support industrial development.

- Private Sector Developers: Collaborating on integrated urban development projects that include sustainable energy solutions.

- International Development Agencies: Partnering on projects that promote green energy transition and sustainable infrastructure in developing economies.

Sembcorp Industries caters to a diverse clientele, including industrial and commercial businesses, government entities, and renewable energy buyers globally. These customers seek reliable utility provisions, sustainable energy solutions, and integrated urban development services.

Key customer segments include major industrial manufacturers, chemical companies, and data centers requiring robust energy and water infrastructure. In 2024, Sembcorp saw continued demand from these sectors, particularly for sustainable power and cooling solutions for data centers.

Furthermore, Sembcorp partners with governments and municipal authorities on urban solutions, developing integrated industrial parks and essential utilities, often through public-private partnerships. They also serve utility companies and large corporations worldwide looking to secure clean energy through Power Purchase Agreements (PPAs) to meet sustainability targets.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

| Industrial & Commercial Clients | Reliable utilities, integrated solutions, sustainable operations | Secured contracts with industrial park developers and large manufacturers for sustainable energy and water solutions. |

| Renewable Energy Buyers (Utilities, Corporations) | Clean energy procurement, PPA agreements, carbon emission reduction | Sembcorp's renewable energy portfolio reached over 13 GW gross installed capacity by end of 2024. |

| Urban Solutions Clients (Developers, Investors) | Sustainable industrial parks, integrated infrastructure, strategic land access | Demand for sustainable industrial real estate in Southeast Asia continued to rise in 2024. |

| Emerging Market Governments & Enterprises | Energy infrastructure development, renewable energy expansion, urban development | India's renewable energy expansion aims for 500 GW non-fossil fuel capacity by 2030, presenting significant opportunities. |

Cost Structure

Sembcorp Industries allocates a considerable amount to capital expenditure for building new infrastructure. This includes significant investments in renewable energy projects like solar and wind farms, alongside conventional power generation facilities.

The company also invests heavily in developing energy storage solutions and integrated urban infrastructure projects. These expenditures cover the costs of acquiring land, purchasing specialized equipment, and the actual construction and development phases.

In 2023, Sembcorp's capital expenditure reached S$2.4 billion, a substantial increase from S$1.7 billion in 2022, reflecting its aggressive expansion in the renewable energy sector.

Operational and maintenance costs are a significant component for Sembcorp Industries. These ongoing expenses cover the upkeep and running of their diverse energy and urban development assets.

This includes substantial fuel costs for their gas-fired power plants, which are essential for reliable energy generation. For instance, in 2024, Sembcorp continued to manage fuel procurement and plant efficiency to mitigate price volatility.

Maintenance of their growing renewable energy portfolio, such as solar farms and wind turbines, also falls under this category. Ensuring these assets operate at peak performance is crucial for their sustainability goals.

Furthermore, operational expenses for their industrial parks and water treatment facilities represent another key cost area. These involve managing infrastructure, utilities, and environmental compliance to serve their clients effectively.

Personnel and human capital costs represent a significant portion of Sembcorp Industries' expenses. These include the salaries, benefits, and ongoing development for their substantial and highly skilled workforce, which is crucial for their operations in energy and urban solutions.

In 2023, Sembcorp Industries reported employee benefits expenses of S$300 million. This figure underscores the investment in attracting, retaining, and upskilling the specialized talent needed to manage complex projects and maintain technological advancements in their sectors.

The company's commitment to training and recruitment, especially for roles requiring expertise in renewable energy and sustainable urban development, contributes to this cost base. These investments are vital for maintaining a competitive edge and driving innovation within the business.

Financing and Interest Costs

Sembcorp Industries, operating in capital-intensive sectors like energy and urban development, faces substantial financing and interest costs. These expenses are critical to its business model, stemming from the significant debt used to fund its extensive projects and acquisitions. For instance, Sembcorp's financial reports often detail interest expenses related to its various borrowings.

The company actively manages its debt portfolio to optimize these costs. This involves strategic refinancing and careful consideration of interest rate fluctuations.

- Financing Costs: Interest paid on loans and bonds forms a core expense.

- Debt Management: Ongoing efforts to maintain a healthy debt-to-equity ratio and secure favorable borrowing terms are crucial.

- Impact on Profitability: High interest expenses directly reduce net profit, making efficient financing a key strategic imperative.

- 2024 Data: While specific 2024 interest expense figures will be fully available in year-end reports, the trend of managing significant debt for growth initiatives continues to define this cost center.

Research, Development, and Decarbonization Investments

Sembcorp Industries dedicates significant resources to research, development, and decarbonization initiatives. These are crucial for future-proofing its energy portfolio and meeting sustainability goals. For instance, in 2024, the company continued its strategic investments in areas like green hydrogen production technologies and carbon capture, utilization, and storage (CCUS) solutions. These are not just operational costs but long-term strategic investments designed to drive innovation and create new revenue streams in the evolving energy landscape.

The financial commitment to these forward-looking projects reflects Sembcorp's strategy to transition towards a sustainable energy future. These investments are essential for developing and scaling up new, cleaner energy technologies.

- Research and Development: Costs associated with exploring and developing advanced technologies for renewable energy, energy storage, and smart grids.

- Decarbonization Solutions: Investments in projects aimed at reducing the carbon footprint of existing operations and developing new low-carbon energy solutions.

- Strategic Long-Term Investments: Significant capital allocation towards hydrogen, CCUS, and other emerging sustainable technologies, anticipating future market demand and regulatory shifts.

- Innovation and Sustainability Focus: These expenditures underscore Sembcorp's commitment to innovation and its role in driving the energy transition, aligning with global decarbonization efforts.

Sembcorp Industries' cost structure is dominated by significant capital expenditures for infrastructure development, particularly in renewables, and ongoing operational and maintenance expenses for its diverse asset portfolio. Personnel costs are also substantial, reflecting investment in a skilled workforce essential for complex energy and urban solutions.

Financing costs are a critical component due to the debt financing of its capital-intensive projects, while R&D and decarbonization initiatives represent strategic long-term investments to secure future growth in sustainable technologies.

| Cost Category | Description | 2023 Impact (S$) | 2024 Focus |

|---|---|---|---|

| Capital Expenditure | Infrastructure for renewables, storage, urban development | 2.4 billion | Continued aggressive expansion in renewables |

| Operational & Maintenance | Fuel, upkeep of power plants (gas, renewables), industrial parks | Significant ongoing costs | Managing fuel costs, ensuring renewable asset performance |

| Personnel Costs | Salaries, benefits for skilled workforce | 300 million (employee benefits) | Attracting, retaining talent for new energy technologies |

| Financing Costs | Interest on debt for project funding | Material expense impacting profitability | Debt portfolio management, optimizing borrowing terms |

| R&D / Decarbonization | Green hydrogen, CCUS, new sustainable technologies | Strategic long-term investments | Scaling up new, cleaner energy solutions |

Revenue Streams

Sembcorp Industries' core revenue driver is the sale of energy, encompassing electricity, steam, and gas. This income is primarily generated from its diverse portfolio of power plants, which includes both conventional gas-fired facilities and increasingly, renewable energy sources. The company also supplies steam and gas directly to industrial clients, further diversifying its energy sales income.

A significant portion of these energy sales are underpinned by long-term contracts. These agreements provide a stable and predictable revenue stream, offering a degree of insulation from short-term market volatility. For instance, in the first half of 2024, Sembcorp reported that its energy segment contributed substantially to its overall financial performance, with a strong emphasis on its growing renewables capacity.

Sembcorp Industries generates significant revenue from its urban development segment, primarily through the sale of land within its industrial parks. This is complemented by fees earned from providing comprehensive urban solutions, which include ready-built factories and warehouses designed to meet specific client needs.

The company has seen robust growth in this area, reflecting strong demand for its integrated offerings. For example, in 2023, Sembcorp's urban development segment contributed to its overall performance, with ongoing projects and new land sales bolstering its financial results.

Sembcorp Industries generates revenue through fees charged for its comprehensive water and wastewater treatment services. These services cater to both industrial clients requiring specialized solutions and municipal entities managing public water systems.

In 2024, Sembcorp's Urban Development segment, which includes its utilities and water businesses, reported a significant contribution to the group's overall performance. For instance, its water treatment operations across various countries are a steady source of recurring income, reflecting the essential nature of water management services.

The company leverages its extensive expertise in water resource management, advanced treatment technologies, and operational efficiency to secure and retain long-term contracts. This focus on delivering reliable and sustainable water solutions underpins the consistent revenue stream from these services.

Renewable Energy Credits and Incentives

Sembcorp Industries generates revenue through the sale of Renewable Energy Certificates (RECs), which represent the environmental attributes of renewable energy. These credits are valuable to companies seeking to meet their sustainability goals or comply with regulations. This stream also includes income from various government incentives and favorable tariffs specifically implemented to encourage and support renewable energy projects in the regions where Sembcorp operates.

For instance, in 2024, the global market for RECs continued to show strong demand, with prices varying by region and certification type. Sembcorp's participation in these markets allows them to monetize the green attributes of their solar and wind power generation. Government support mechanisms, such as feed-in tariffs or renewable portfolio standards, provide a stable and often premium price for the electricity generated, further bolstering this revenue stream.

- REC Sales: Direct revenue from selling the environmental benefits of renewable energy.

- Government Incentives: Financial support and subsidies provided by governments to promote renewable energy adoption.

- Favorable Tariffs: Guaranteed purchase prices for renewable electricity, often above market rates, ensuring predictable revenue.

- Market Demand: Increasing corporate and regulatory demand for renewable energy and its associated credits.

Asset Management and Advisory Services

Sembcorp Industries is increasingly leveraging its deep expertise in renewable energy and sustainable urban development to generate revenue through asset management and advisory services. This segment offers a compelling avenue for growth as global demand for decarbonization solutions intensifies.

The company's strategy includes managing energy and urban infrastructure assets, providing specialized operational expertise for renewable energy projects. Furthermore, Sembcorp is poised to offer valuable advisory services, guiding businesses and governments through complex sustainability transitions and decarbonization pathways.

For instance, Sembcorp's significant presence in the renewable energy sector, with a growing portfolio of solar and wind assets, directly translates into potential asset management fees. In 2024, Sembcorp announced plans to develop a substantial pipeline of green energy projects, underscoring the tangible growth in assets under its purview.

- Asset Management Fees: Revenue generated from managing Sembcorp's own and potentially third-party renewable energy and urban infrastructure assets.

- Advisory Services: Income derived from consulting on sustainability strategies, decarbonization roadmaps, and green project development.

- Operational Expertise: Fees for providing specialized operational and maintenance services for energy infrastructure, ensuring optimal performance and efficiency.

- Project Development Support: Revenue from assisting clients in the planning, financing, and execution of sustainable infrastructure projects.

Sembcorp Industries' revenue streams are primarily derived from the sale of energy, including electricity and steam, often secured through long-term contracts for stability. The company also generates income from its urban development segment, mainly through land sales within industrial parks and fees for providing integrated urban solutions like ready-built factories.

Furthermore, Sembcorp earns revenue from comprehensive water and wastewater treatment services for both industrial clients and municipalities. In 2024, its renewables segment showed strong growth, supported by the sale of Renewable Energy Certificates (RECs) and government incentives like feed-in tariffs, which provide premium prices for green energy.

The company is also expanding into asset management and advisory services, leveraging its expertise in renewables and sustainable urban development to earn fees. For instance, Sembcorp's growing portfolio of solar and wind assets in 2024 directly translates into potential asset management revenue.

| Revenue Stream | Primary Income Source | 2024 Data/Trends |

| Energy Sales | Electricity, steam, gas from power plants and direct supply to industrial clients | Strong performance in H1 2024, with increasing renewable capacity |

| Urban Development | Land sales in industrial parks, fees for urban solutions (factories, warehouses) | Robust growth in 2023, reflecting high demand for integrated offerings |

| Water & Wastewater Services | Fees for water treatment and management for industrial and municipal clients | Steady recurring income from essential water management services |

| Renewable Energy Certificates & Incentives | Sale of RECs, government incentives, favorable tariffs | Strong global REC demand in 2024; government support ensures premium pricing |

| Asset Management & Advisory | Fees for managing renewable energy/urban infrastructure assets and sustainability consulting | Growth potential driven by decarbonization demand; pipeline of green projects expanding |

Business Model Canvas Data Sources

The Sembcorp Industries Business Model Canvas is built upon a foundation of robust financial statements, comprehensive market research reports, and internal strategic planning documents. These data sources ensure that each element of the canvas, from value propositions to cost structures, is accurately and strategically represented.