Sembcorp Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sembcorp Industries Bundle

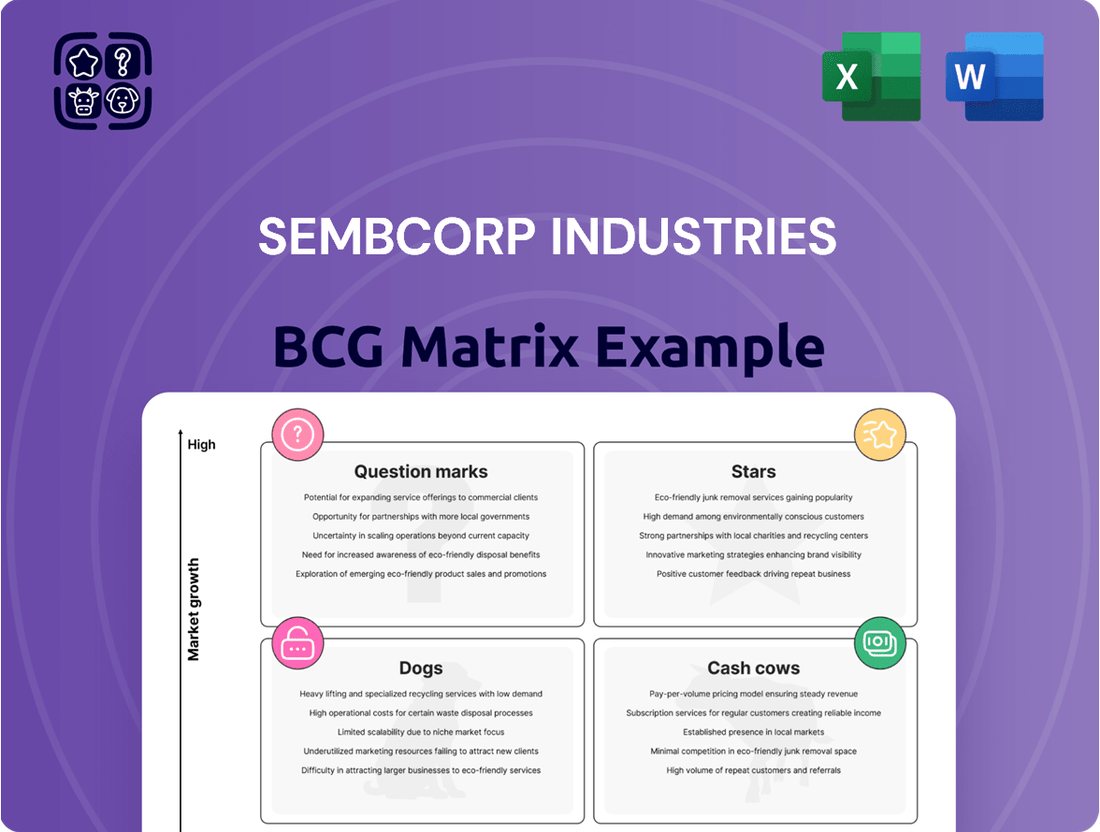

Curious about Sembcorp Industries' strategic product positioning? Our BCG Matrix preview highlights key areas, but to truly grasp their market dominance and potential, you need the full picture. Discover which segments are their Stars, Cash Cows, Dogs, and crucial Question Marks.

This glimpse is just the start of understanding Sembcorp's competitive landscape. Unlock a comprehensive breakdown of their portfolio, revealing actionable insights for investment and resource allocation.

Don't miss out on the detailed quadrant placements and data-backed recommendations that only the full BCG Matrix can provide.

Purchase the complete BCG Matrix report today and gain a strategic roadmap to navigate Sembcorp's evolving market, enabling smarter, faster, and more effective business decisions.

Stars

Sembcorp Industries is heavily investing in renewable energy, aiming to boost its gross installed capacity to 25GW by 2028, a significant jump from its 17GW at the close of 2024. This aggressive expansion strategy firmly places its renewables division as a Star within the BCG matrix. It requires substantial capital outlay but operates in a rapidly expanding market with immense growth potential.

The company's operational prowess is evident as it surpassed its earlier 2025 target of 10GW of renewable capacity well ahead of schedule. This achievement underscores Sembcorp's effective execution capabilities in a dynamic and competitive sector.

Sembcorp Industries' development of large-scale solar projects, like its 150MWp floating solar PV project at Kranji Reservoir in Singapore, positions it firmly in the high-growth, high-market-share quadrant of the BCG matrix. This project alone is a significant step, showcasing Sembcorp's commitment to renewable energy expansion.

These substantial solar developments are often underpinned by long-term Power Purchase Agreements (PPAs). These agreements provide a predictable and stable revenue stream, fortifying Sembcorp's financial standing and reinforcing its leadership in the rapidly expanding renewable energy market.

Sembcorp Industries is actively pursuing strategic acquisitions in the renewable energy sector, exemplified by its entry into the Philippine solar market. This move, alongside hydroelectric acquisitions in Vietnam, underscores a clear strategy to boost its market share in rapidly expanding regions.

These acquisitions are instrumental in Sembcorp's plan to quickly grow its renewable energy capacity and solidify its position in key emerging green markets. By consolidating assets and expertise, the company aims to capture greater market influence and operational efficiencies.

In 2024, Sembcorp continued its aggressive expansion, announcing significant investments and acquisitions that are projected to further diversify its renewable energy portfolio. For instance, its Vietnam operations are a cornerstone of its Southeast Asian renewable strategy, contributing substantially to its overall green energy targets.

Hydrogen-Ready Power Plants

Sembcorp Industries is strategically investing in advanced, hydrogen-ready power plants. A prime example is their 600MW facility, scheduled to boost earnings from 2026. This move places Sembcorp at the vanguard of emerging energy technologies.

This forward-thinking approach directly addresses the escalating global demand for cleaner energy sources. By embracing hydrogen-ready infrastructure, Sembcorp is cultivating a significant competitive advantage in the rapidly shifting energy sector.

- Hydrogen-ready power plants: A 600MW plant is expected to contribute to Sembcorp's earnings starting in 2026.

- Market position: This investment positions Sembcorp to meet increasing demand for low-carbon energy solutions.

- Competitive edge: The focus on hydrogen technology provides Sembcorp with a distinct advantage in the energy transition.

Integrated Low-Carbon Industrial Parks (New Developments)

Sembcorp Industries is actively developing integrated low-carbon industrial parks, a segment likely positioned as a Star in its BCG Matrix. These innovative hubs are designed to attract and support new-economy sectors. For instance, the Tembesi Innovation District in Batam, Indonesia, is a prime example, incorporating advanced features like floating solar power and battery storage solutions. This focus on sustainability and cutting-edge infrastructure is a key differentiator.

These developments are not just about green energy; they are strategically aligned with the growth of advanced manufacturing and data centers, industries that are experiencing significant global expansion. By providing the necessary infrastructure and a sustainable framework, Sembcorp is positioning itself to capture substantial foreign direct investment. This approach demonstrates a forward-thinking strategy in urban and industrial development, emphasizing Sembcorp's commitment to innovation in sustainable solutions.

- Tembesi Innovation District, Batam: Features floating solar and battery storage, targeting advanced manufacturing and data centers.

- Foreign Direct Investment: These parks are designed to attract significant FDI due to their sustainable and advanced infrastructure.

- Growth Potential: Caters to high-growth new-economy industries, indicating strong future revenue streams.

- Innovation Focus: Showcases Sembcorp's capability in developing cutting-edge sustainable urban solutions.

Sembcorp Industries' renewable energy segment, with its aggressive capacity expansion to 25GW by 2028 and successful early achievement of 10GW, is a clear Star. The company’s strategic acquisitions and development of large-scale projects like the 150MWp floating solar PV project at Kranji Reservoir, often secured by long-term PPAs, solidify its high market share in a high-growth sector. Investments in hydrogen-ready plants and integrated low-carbon industrial parks further reinforce this position, targeting future energy demands and attracting foreign investment.

| Business Segment | BCG Matrix Quadrant | Key Growth Drivers | Market Share | Sembcorp's Position |

|---|---|---|---|---|

| Renewable Energy | Star | Capacity expansion (17GW end-2024 to 25GW by 2028), solar projects, acquisitions in SEA, hydrogen-ready plants | High and growing | Leading |

| Integrated Low-Carbon Industrial Parks | Star | Development of hubs like Tembesi Innovation District, attracting FDI, supporting new-economy sectors | High and growing | Emerging leader |

What is included in the product

Sembcorp Industries' BCG Matrix analysis would detail its portfolio's position in Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each business unit.

Sembcorp Industries' BCG Matrix offers a clear, one-page overview, alleviating the pain of complex portfolio analysis by placing each business unit in a quadrant.

Cash Cows

Sembcorp Industries' contracted gas and related services portfolio is a prime example of a cash cow within its business operations. The company boasts a significant gas-fired portfolio where a remarkable 98% is secured by long-term offtake agreements. This provides a strong foundation for consistent revenue generation.

Further bolstering its stability, over 60% of these gas-fired assets have contracts extending for more than five years. This long-term visibility insulates the segment from short-term market volatility, ensuring a predictable income stream for Sembcorp.

Even with occasional swings in wholesale electricity prices, this segment consistently delivers strong net profit. In the first half of 2024, for instance, Sembcorp reported a net profit attributable to shareholders of S$616 million, with the energy segment being a significant contributor.

The reliable cash flow generated from these contracted assets is crucial for Sembcorp. It provides the financial flexibility to invest in growth areas, manage debt, and distribute returns to shareholders, effectively fueling the company's overall financial health.

Sembcorp Industries' Integrated Urban Solutions, especially in established industrial parks within Vietnam, Indonesia, and China, acts as a significant cash cow. These mature operations consistently generate robust net profits.

The segment benefits from a dual revenue stream: stable land sales and reliable recurring income from services. This consistent cash flow is crucial for funding Sembcorp's other strategic ventures and investments.

For instance, in 2023, Sembcorp's Urban Development segment reported a profit before tax of S$143 million, underscoring its strong performance. This segment is a key contributor to the company's overall financial health.

Sembcorp Industries' acquisition of a 30% stake in Senoko Energy in November 2024, a move that effectively raised its ownership to 50% by June 2025, positions Senoko Energy as a significant Cash Cow within Sembcorp's portfolio.

This strategic stake enhances Sembcorp's presence in Singapore's robust and predictable power market, a sector characterized by stable demand and regulated pricing, which typically generates consistent, high cash flows.

The investment is projected to contribute substantially to Sembcorp's earnings and expand its market share within this mature yet essential utility industry, reinforcing its status as a dependable profit generator.

Existing Conventional Energy Assets

Sembcorp Industries' existing conventional energy assets, predominantly gas-fired power plants in mature markets, consistently deliver robust and stable earnings. These operations are crucial for generating the cash flow needed to support Sembcorp's aggressive expansion into renewable energy. For instance, in 2023, the company reported that its thermal power segment, which includes these conventional assets, remained a significant contributor to overall profitability.

These conventional assets are strategically positioned in established markets, ensuring a reliable demand base and predictable revenue streams. This stability allows Sembcorp to confidently invest in new, high-growth areas. The company's financial reports often highlight the resilient performance of its conventional portfolio, underscoring its role as a reliable cash generator.

- Consistent Earnings: Gas-fired power plants provide stable income.

- Funding Growth: Cash flow supports renewable energy expansion.

- Resilient Performance: Assets in established markets ensure demand.

- Strategic Importance: Foundation for Sembcorp's energy transition.

Dividend Payout and Financial Resilience

Sembcorp Industries demonstrated strong financial performance in FY2024, marked by a substantial increase in its dividend payout ratio to 40%. This elevated payout reflects the robust cash generation capabilities of its established business segments, highlighting their stability and consistent profitability.

The company’s commitment to returning value to shareholders is evident in this increased dividend, underscoring the maturity and reliable cash flows from its core operations.

- FY2024 Dividend Payout Ratio: 40%

- Significance: Reflects strong cash generation and profitability of established segments.

- Shareholder Returns: Demonstrates commitment to rewarding investors through consistent dividend growth.

- Financial Resilience: Indicates the stability and predictability of cash flows from mature business units.

Sembcorp Industries' contracted gas and related services, along with its Integrated Urban Solutions in established markets, are key cash cows. These segments consistently generate substantial profits, with over 60% of gas assets contracted for more than five years and Urban Development reporting S$143 million in profit before tax in 2023. The acquisition of Senoko Energy further solidifies this, enhancing stable earnings in Singapore's power market.

| Segment | Key Characteristics | FY2023/H1 2024 Data |

| Contracted Gas & Services | 98% secured by long-term offtake agreements; >60% contracts >5 years | Significant contributor to H1 2024 net profit of S$616 million |

| Integrated Urban Solutions | Mature operations in Vietnam, Indonesia, China; dual revenue stream | S$143 million profit before tax (Urban Development) in 2023 |

| Senoko Energy Stake | 50% ownership by June 2025; stable demand, regulated pricing | Projected substantial contribution to earnings |

| Conventional Energy Assets | Predominantly gas-fired power plants in mature markets | Significant contributor to overall profitability in 2023 |

What You’re Viewing Is Included

Sembcorp Industries BCG Matrix

The Sembcorp Industries BCG Matrix you are previewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, devoid of watermarks or demo content, is meticulously crafted to provide actionable strategic insights into Sembcorp's diverse business units. You can trust that the detailed breakdown of their Stars, Cash Cows, Question Marks, and Dogs is precisely what you'll download, ready for immediate integration into your business planning and strategic decision-making processes.

Dogs

Sembcorp Industries divested its waste management arm, Sembcorp Environment, in November 2024 for S$405 million. This strategic move clearly signals a shift away from this segment, positioning it as a Question Mark or perhaps a potential Divestment in the BCG Matrix context. While profitable, the divestment underscores a deliberate choice to reallocate resources and management attention toward higher-growth areas.

Sembcorp Industries' strategic shift towards renewable energy means older, less efficient conventional power plants are likely candidates for divestment. While not explicitly labeled as 'dogs' in a BCG matrix, these assets, often smaller in scale and facing declining demand, represent a legacy portfolio segment. The company's ambitious goal to transform its energy mix from brown to green directly addresses the phasing out or sale of such infrastructure.

As of 2024, Sembcorp continues to manage a portfolio that includes a portion of conventional generation. However, the company's commitment to sustainability, evidenced by significant investments in solar and wind power, signals a clear direction away from these older assets. For instance, Sembcorp aims to have 25 gigawatts of renewable energy capacity by 2025, underscoring the decreasing strategic importance of its legacy fossil fuel plants.

Non-renewable assets with high emissions intensity are likely to be Sembcorp Industries' question marks within the BCG matrix. These are the assets that are not performing well in terms of generating cash and also have a high carbon footprint, making them a concern for the company's sustainability goals.

Sembcorp Industries has a clear target to halve its emissions intensity by 2028. This aggressive goal means that assets with high emissions, particularly those lacking a defined strategy for decarbonization or efficiency upgrades, will face scrutiny and potential divestment or phase-out.

In 2024, Sembcorp reported a significant reduction in its greenhouse gas emissions intensity, achieving a rate of 0.095 kg CO2e/kWh in its energy segment. This progress underscores the company's strategic shift away from high-emission assets, signaling that those remaining that contribute disproportionately to this metric are indeed becoming liabilities.

Underperforming or Non-Strategic Urban Development Properties

These are Sembcorp Industries' urban development assets that aren't performing as expected or don't fit the company's current strategic direction. Think of them as projects that have slowed down in sales or development, or are located in areas where growth is looking pretty flat. While Sembcorp's urban solutions business is generally doing well, there might be older projects that are dragging down overall performance.

- Stalled Sales or Development: Properties experiencing significant delays in customer acquisition or project completion.

- Limited Market Growth: Assets situated in urban areas with low projected economic or population expansion.

- Legacy Projects: Older developments that may no longer align with current market demands or company strategy.

- Potential Divestment: Such assets might be candidates for sale or restructuring to optimize the portfolio.

Non-Renewable Projects in Highly Competitive or Saturated Markets

Sembcorp Industries might classify its conventional energy projects in saturated or rapidly transitioning markets as Dogs. These are segments where growth is minimal due to intense competition or a clear shift away from fossil fuels. Without strong, pre-existing contracts, these ventures could struggle to generate significant returns.

For instance, Sembcorp's exposure to thermal power generation in regions with aggressive decarbonization targets, where they haven't secured long-term power purchase agreements, could fit this category. The company's strategy to proactively secure contracts helps to de-risk these assets, aiming to ensure a stable, albeit potentially low, cash flow.

- Market Saturation: Conventional energy markets often face oversupply, leading to price pressures.

- Energy Transition: The global shift towards renewables diminishes the long-term viability of fossil fuel assets.

- Contractual Risk: Lack of secured, long-term contracts exposes projects to market volatility.

- Sembcorp's Mitigation: Proactive contracting aims to lock in revenue streams for these types of assets.

Sembcorp Industries' conventional energy projects in saturated or rapidly transitioning markets, especially those lacking long-term contracts, are likely candidates for the Dogs category in a BCG Matrix. These segments face minimal growth due to intense competition or the global shift away from fossil fuels, potentially struggling to generate significant returns. For example, thermal power generation in regions with aggressive decarbonization targets without secured power purchase agreements exemplify these challenged assets.

These "dog" assets, typically characterized by low market share and low growth, require careful management to minimize losses or facilitate divestment. Sembcorp's strategy of securing contracts for these assets aims to provide stable, albeit potentially low, cash flow and de-risk them from market volatility. By focusing on these aspects, the company can optimize its portfolio and allocate resources more effectively to its growth areas.

The company's commitment to achieving 25 gigawatts of renewable energy capacity by 2025 highlights the diminishing strategic importance of its legacy fossil fuel plants. These older, less efficient conventional power plants, facing declining demand and regulatory pressures, represent assets that are likely becoming dogs within Sembcorp's portfolio. Their continued operation, if any, is likely to be on a declining trajectory as the company prioritizes its green energy transition.

These urban development assets, characterized by stalled sales or development and limited market growth, represent Sembcorp Industries' potential dogs in that segment. Older projects that no longer align with current market demands or the company's strategic direction may be candidates for sale or restructuring to optimize the overall portfolio performance.

Question Marks

Sembcorp Industries is strategically investing in emerging hydrogen and decarbonization solutions, recognizing their substantial long-term growth potential. These areas, while currently representing a small fraction of Sembcorp's overall business, are crucial for future energy transitions. For instance, in 2023, Sembcorp announced a partnership to develop a green hydrogen project in India, aiming to produce 5,000 tonnes per annum of green hydrogen.

These nascent technologies are characterized by high capital expenditure requirements and ongoing research and development. The path to widespread adoption and significant revenue generation for hydrogen and broader decarbonization solutions is still in its early stages. Sembcorp's commitment to these areas positions them to capture future market share as these technologies mature and become more economically viable.

Sembcorp Industries' expansion into the Philippines renewable energy sector, marked by recent acquisitions and project developments, firmly places it in the Question Mark category of the BCG Matrix. The Philippines presents a compelling growth opportunity within renewables, aligning with Sembcorp's strategic pivot towards sustainable energy solutions.

In 2023, Sembcorp secured a significant 150 MW solar PV project in the Philippines, further solidifying its commitment to this burgeoning market. This move reflects a strategy to build market share in a region with high demand for clean energy, though it requires substantial investment to establish a strong foothold.

The Philippines' renewable energy market is projected for robust expansion, driven by government targets and increasing investor interest. Sembcorp’s presence here is indicative of a high-growth potential market where the company is still in the early stages of establishing its competitive position and brand recognition.

Sembcorp Industries' integration of Battery Energy Storage Systems (BESS) with its renewable projects, particularly in emerging markets like Indonesia and India, positions it in a high-growth segment of the energy sector. These BESS solutions are vital for ensuring grid stability when relying on intermittent renewable sources. As of early 2024, the global BESS market is experiencing rapid expansion, driven by the need for grid modernization and increased renewable penetration, with projections indicating continued strong growth throughout the decade.

The substantial capital investment required for BESS deployment, coupled with the ongoing development of supportive market frameworks and regulations, presents both challenges and opportunities. Sembcorp's strategic focus on these integrated solutions reflects a forward-looking approach to the evolving energy landscape, aiming to capture value in a market segment that is becoming increasingly critical for the reliable integration of renewables.

Early-Stage Industrial Parks in Nascent Markets

Early-stage industrial parks in nascent markets represent a potential Question Mark for Sembcorp Industries. These ventures demand substantial initial investment and a considerable runway to cultivate tenant interest and establish market presence, even with their inherent high growth prospects.

While Sembcorp's urban solutions portfolio is robust, these emerging industrial parks carry a higher risk profile due to market immaturity. For instance, Sembcorp's focus on sustainable urban development in regions like India, while promising, involves navigating evolving regulatory landscapes and infrastructure readiness, impacting the pace of tenant acquisition.

- High Capital Outlay: Development and infrastructure costs for new industrial parks are significant.

- Longer Payback Periods: Attracting anchor tenants and achieving operational efficiency takes time, delaying returns.

- Market Uncertainty: Nascent markets may have unpredictable demand and competitive dynamics.

- Strategic Importance: These parks are crucial for Sembcorp's long-term growth strategy in new territories.

Exploration of Green Hydrogen Production Facilities

Sembcorp Industries' exploration into green hydrogen production facilities, exemplified by its Memoranda of Understanding (MOUs) in regions like Odisha, India, positions these ventures squarely in the question mark category of the BCG matrix. These initiatives represent a significant investment in a high-growth, emerging market, with the potential to capture substantial future market share. However, the technology and market for green hydrogen are still in nascent stages, meaning these projects are capital-intensive, requiring significant outlay for feasibility studies, technology development, and securing partnerships. As of early 2024, the global green hydrogen market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by 2030, indicating Sembcorp's strategic foresight.

The exploratory nature of these green hydrogen projects means they currently consume capital without generating significant revenue or established market share. Sembcorp is investing in the future, betting on the eventual widespread adoption and economic viability of green hydrogen as a clean energy source. This commitment is substantial, as the infrastructure and technological advancements required are considerable. For instance, the cost of electrolyzers, a key component in green hydrogen production, has been decreasing, but remains a significant capital expense.

- High Growth Potential: The global green hydrogen market is anticipated to expand rapidly in the coming years, driven by decarbonization efforts and government support.

- Capital Intensive: Significant upfront investment is required for research, development, pilot projects, and infrastructure build-out.

- Uncertain Market Share: As the market is still developing, Sembcorp's future market share in green hydrogen production is yet to be determined.

- Strategic Importance: These ventures align with global energy transition trends and Sembcorp's broader sustainability goals.

Sembcorp Industries' ventures into emerging markets like the Philippines renewable energy sector and its investments in Battery Energy Storage Systems (BESS) fit the Question Mark category. These areas represent high growth potential but require substantial capital and are in early stages of market development. For example, Sembcorp secured a 150 MW solar PV project in the Philippines in 2023, a move demanding significant investment to establish market presence.

The company's focus on green hydrogen production, with projects like the one in Odisha, India, also falls into this category. While the global green hydrogen market is projected for significant expansion, estimated to reach hundreds of billions of dollars by 2030, these projects are capital-intensive and their future market share is yet to be solidified.

| Business Segment | Market Growth Rate | Relative Market Share | BCG Category |

|---|---|---|---|

| Philippines Renewables | High | Low | Question Mark |

| Battery Energy Storage Systems (BESS) | High | Low | Question Mark |

| Green Hydrogen Production | Very High | Very Low | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining Sembcorp Industries' financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.