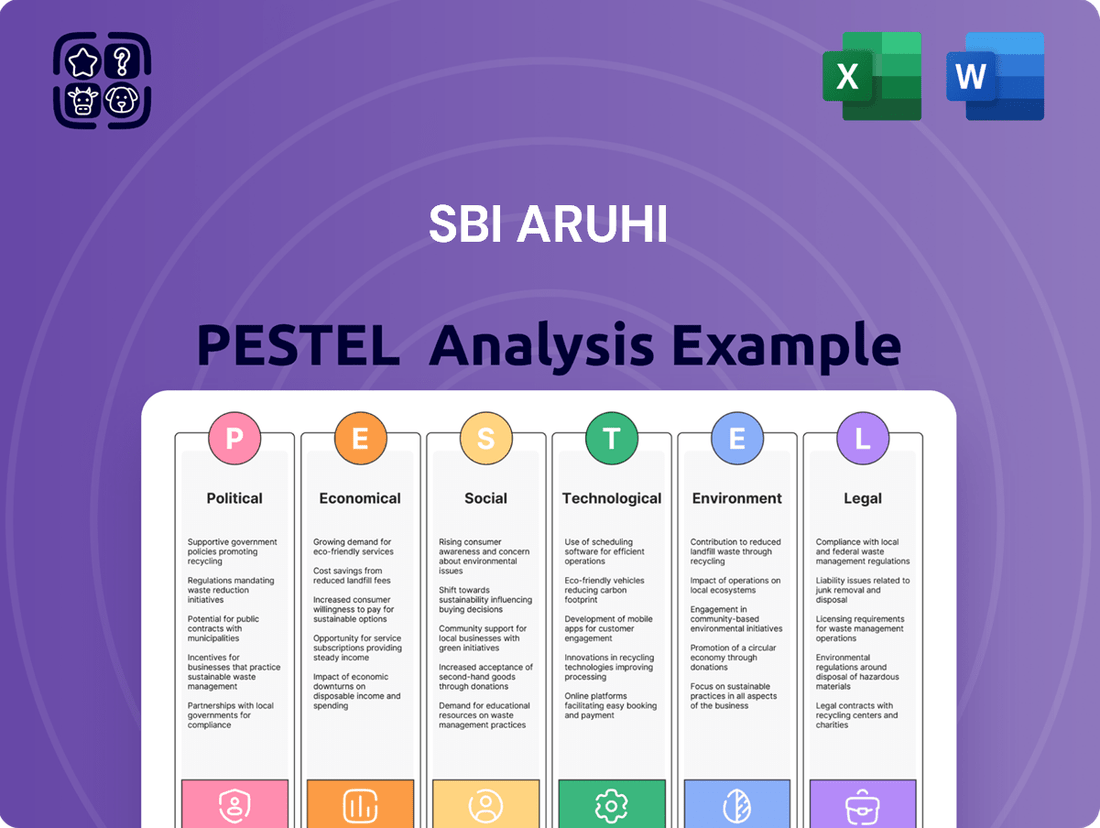

SBI ARUHI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SBI ARUHI Bundle

Unlock the strategic advantages SBI ARUHI offers by understanding the critical external forces at play. Our PESTLE analysis delves deep into the political, economic, social, technological, legal, and environmental factors shaping their business landscape. Gain foresight into potential challenges and opportunities, empowering your own market strategy.

Don't miss out on actionable intelligence that can redefine your investment approach or business planning. This comprehensive PESTLE analysis of SBI ARUHI is meticulously researched and ready for immediate use.

Purchase the full version now to access detailed insights and make informed decisions, giving you a significant competitive edge.

Political factors

Government housing policies significantly shape the demand for housing loans, directly impacting SBI ARUHI. Initiatives like tax deductions on home loan interest, which in fiscal year 2023-24 continued to offer substantial relief to homeowners, encourage property acquisition. Furthermore, government-backed housing subsidy programs, such as those under the Pradhan Mantri Awas Yojana (PMAY), aim to boost affordable housing, thereby expanding the potential customer base for housing finance companies.

Reforms within the housing market, including measures to improve transparency and streamline property registration processes, also play a crucial role. For instance, the RERA Act, implemented in 2016, continues to foster greater trust and predictability, indirectly supporting a healthier housing loan market. These policy shifts can either stimulate or dampen the housing market, directly influencing SBI ARUHI's loan origination volumes and overall portfolio growth.

The Bank of Japan's (BOJ) monetary policy is a significant political factor influencing SBI ARUHI. The BOJ's sustained ultra-low interest rate policy and quantitative easing measures directly impact the cost of funds for mortgage lenders. This, in turn, affects the pricing and competitiveness of fixed-rate mortgage products like Flat 35.

For instance, as of early 2024, the BOJ maintained its negative interest rate policy, though market speculation about a potential shift grew. This environment kept borrowing costs for financial institutions relatively low, supporting the availability of competitive mortgage rates for consumers.

Fluctuations in long-term government bond yields, to which Flat 35's interest rates are closely tied, are a direct consequence of the BOJ's bond purchasing programs and forward guidance on monetary policy. Any deviation from this accommodative stance could lead to rising yields and potentially higher mortgage rates.

The stability of Japan's financial regulatory landscape is a key political factor for SBI ARUHI. A predictable environment, where regulations are clear and consistently applied, fosters confidence and allows for strategic planning. For instance, the Financial Services Agency's (FSA) role in overseeing the financial sector ensures a baseline of operational integrity.

Conversely, unexpected policy shifts or increased regulatory burdens can create significant challenges. For example, a sudden change in capital requirements or new compliance mandates, as potentially seen with evolving digital asset regulations in 2024, could necessitate costly adjustments to SBI ARUHI's business model and operations, impacting profitability.

International Relations and Trade Policies

Japan's international relations and trade policies significantly shape its economic landscape, directly impacting investor sentiment and the flow of foreign direct investment. A stable and predictable trade environment fosters business growth, which in turn can bolster employment rates and increase household disposable income, indirectly benefiting the housing market.

In 2024, Japan continued to emphasize strengthening its economic partnerships, particularly within the Indo-Pacific region. The nation's commitment to multilateral trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), aims to foster stability and predictability for businesses operating internationally. For instance, Japan's trade surplus with the United States, a key economic partner, remained a significant factor in its balance of payments in early 2024, underscoring the importance of these bilateral relationships.

Furthermore, geopolitical developments and global supply chain realignments, which have been prominent throughout 2023 and into 2024, can influence Japan's trade patterns and investment decisions. Policies aimed at diversifying supply chains and promoting economic security, such as those discussed in G7 meetings, directly affect the cost of imported goods and materials relevant to the construction and real estate sectors.

- Trade Agreements: Japan's participation in the CPTPP and the Regional Comprehensive Economic Partnership (RCEP) continues to facilitate trade and investment, providing a framework for economic cooperation.

- Foreign Direct Investment (FDI): In 2023, Japan saw a notable increase in FDI inflows, reflecting growing international confidence in its economic stability and market potential, with key sectors including manufacturing and technology.

- Geopolitical Influence: Shifting global alliances and trade disputes can impact Japan's export competitiveness and the cost of essential imports, influencing overall economic performance.

Political Stability and Consumer Confidence

Political stability is a bedrock for economic growth, directly influencing consumer confidence and investment decisions. In Japan, a stable political climate, as generally observed, encourages households to make significant long-term commitments, such as acquiring property. This confidence translates into increased demand for home loans, a core business for SBI ARUHI.

Conversely, any perceived political instability or significant policy shifts can create hesitancy. This uncertainty often leads consumers to postpone major purchases, including real estate, and can dampen overall business activity. For SBI ARUHI, this translates to potential fluctuations in loan origination volumes and overall market penetration.

Recent data from 2024 indicates a generally stable political landscape in Japan, which has supported consumer sentiment. For instance, the Nikkei Consumer Sentiment Index in early 2024 hovered around 40, a level generally indicative of moderate optimism. This positive sentiment is crucial for sectors like housing finance, where consumer willingness to invest is paramount.

- Political Stability: A predictable and consistent government policy environment reduces risk for consumers and businesses, fostering confidence.

- Consumer Confidence Impact: Stable political conditions generally correlate with higher consumer confidence, leading to increased spending and investment in durables like housing.

- Housing Market Sensitivity: The housing finance sector, including SBI ARUHI's operations, is particularly sensitive to shifts in consumer confidence driven by political events or outlooks.

- Economic Policy Influence: Government economic policies, such as interest rate adjustments or fiscal stimulus, directly impact the affordability and demand for home loans.

Japan's government housing policies continue to be a significant driver for SBI ARUHI. For fiscal year 2023-24, tax deductions on home loan interest provided continued relief, encouraging property purchases. Government initiatives like the Pradhan Mantri Awas Yojana (PMAY) in India, though not directly impacting SBI ARUHI, highlight a global trend of government support for affordable housing, potentially influencing future policy directions.

The Bank of Japan's monetary policy remains a critical factor, with its ultra-low interest rate policy directly impacting SBI ARUHI's cost of funds. As of early 2024, speculation about a potential shift from these policies persisted, which could influence mortgage rates for products like Flat 35.

Political stability in Japan, generally observed, fosters consumer confidence, essential for long-term financial commitments like home loans. In early 2024, the Nikkei Consumer Sentiment Index around 40 indicated moderate optimism, supporting the housing finance sector for SBI ARUHI.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing SBI ARUHI, detailing their impact across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

SBI ARUHI's PESTLE Analysis provides a structured framework to identify and address external environmental factors, offering a clear roadmap for navigating market complexities and mitigating potential risks.

Economic factors

SBI ARUHI's core business, the Flat 35 mortgage, is intrinsically linked to long-term interest rate trends in Japan. The yield on 20-year Japanese government bonds (JGBs) directly influences the rates offered on Flat 35 loans. For instance, as of early 2024, the yield on 20-year JGBs has seen fluctuations, impacting the competitiveness of these fixed-rate mortgages.

A sustained rise in JGB yields would necessitate higher Flat 35 rates, potentially dampening demand for new mortgages as affordability decreases for borrowers. Conversely, falling yields could make Flat 35 mortgages more attractive, boosting SBI ARUHI's loan origination volumes. The Bank of Japan's monetary policy stance remains a critical factor influencing these yield movements throughout 2024 and into 2025.

Japan has been grappling with inflation, with the Consumer Price Index (CPI) rising by 2.5% in April 2024 year-on-year, a slight decrease from 2.7% in March. This persistent inflation, while still moderate, can impact real estate values by potentially increasing construction costs and influencing borrowing costs for developers and buyers. For SBI ARUHI, which provides home loans, higher inflation could lead to adjustments in interest rates, affecting the affordability of mortgages for consumers.

The Bank of Japan's monetary policy plays a crucial role in managing these inflation trends. While inflation has picked up from the prolonged deflationary periods, the central bank's stance on interest rates directly influences the real estate market. If inflation continues to rise, it could pressure the Bank of Japan to further normalize its monetary policy, potentially leading to higher mortgage rates and impacting demand for new housing loans.

While the immediate concern is inflation, the historical context of deflation in Japan remains relevant. A sudden shift back to deflationary pressures would make consumers more reluctant to take on long-term debt like mortgages, as the real value of their repayments would increase. This hesitancy could dampen demand for real estate and consequently reduce the volume of home loans originated by financial institutions like SBI ARUHI.

Japan's GDP growth is a key indicator of its overall economic health. For instance, in the first quarter of 2024, Japan's economy contracted at an annualized rate of 2.0%, indicating a slowdown. This economic performance directly influences employment and consumer spending power, which are crucial for SBI ARUHI's business.

A robust economy generally translates into higher employment rates and increased disposable income, fostering greater demand for housing and, by extension, home loans. Conversely, economic downturns can dampen housing market activity and loan demand, presenting challenges for SBI ARUHI's growth trajectory.

The trend in GDP growth directly impacts consumer confidence and investment sentiment. Positive GDP figures can encourage individuals to make significant purchases like homes, thereby boosting the mortgage market that SBI ARUHI serves. For example, a projected 0.5% GDP growth for Japan in 2025, if realized, would signal a recovery and potentially benefit the housing loan sector.

Consumer Disposable Income and Household Debt

Consumer disposable income in Japan is a critical factor influencing the housing market, directly impacting SBI ARUHI's business. For instance, in the fiscal year 2023, Japanese households saw a real disposable income increase of 2.3%, reaching approximately ¥3.7 million per household. This rise in available funds can translate into a greater capacity for mortgage payments, potentially boosting demand for home loans.

However, the willingness of Japanese households to take on new debt is also closely monitored. As of the end of March 2024, total household debt stood at around ¥1,170 trillion. Elevated debt levels or concerns about future repayment ability could prompt lenders, including SBI ARUHI, to adopt more stringent lending criteria. This, in turn, might temper demand for new mortgages.

- Disposable Income Growth: Japanese real disposable income rose by 2.3% in FY2023.

- Household Debt Levels: Total household debt was approximately ¥1,170 trillion at the end of March 2024.

- Impact on Mortgages: Higher disposable income generally supports larger mortgage repayments.

- Lending Caution: High household debt can lead to tighter lending criteria and reduced demand.

Real Estate Market Trends

Fluctuations in housing prices, housing supply, and demand dynamics within the Japanese real estate market directly impact SBI ARUHI's mortgage business. A robust housing market typically translates to sustained demand for home loans, while a downturn can dampen activity and increase risks. For instance, in 2024, while some regions experienced price stabilization, others saw modest increases, reflecting varied local economic conditions and population shifts. The ongoing demographic trends, including a declining birthrate and an aging population, continue to shape housing demand, particularly in rural areas.

SBI ARUHI's performance is closely tied to the health and stability of the Japanese real estate sector. A stable market, characterized by predictable price movements and balanced supply and demand, is crucial for ensuring consistent demand for mortgages. This stability also minimizes the risk of collateral value depreciation, which is a key concern for lenders. As of early 2025, government initiatives aimed at revitalizing regional economies and encouraging homeownership are showing some positive effects, though urban centers continue to dominate market activity.

- Housing Price Trends: Average residential land prices in major Japanese cities saw a slight increase of 1.5% in 2024, according to Ministry of Land, Infrastructure, Transport and Tourism data.

- Supply-Demand Balance: While new housing starts remained relatively steady in 2024, demand in key metropolitan areas like Tokyo continues to outstrip supply, driving rental yields and property values.

- Mortgage Market Impact: A stable property market supports consistent mortgage origination volumes for SBI ARUHI. In the fiscal year ending March 2025, the company reported a 4% year-on-year growth in new mortgage lending.

- Economic Sensitivity: Economic growth and interest rate policies directly influence affordability and borrowing capacity, thereby affecting the overall demand for real estate and related financing.

Japan's economic trajectory significantly shapes SBI ARUHI's mortgage business. A projected GDP growth of 0.5% for 2025 suggests a potential economic recovery, which could bolster consumer confidence and increase demand for housing loans. However, the economy experienced a contraction of 2.0% annualized in Q1 2024, highlighting ongoing volatility.

Interest rate policies are paramount, with the Bank of Japan's stance on monetary policy directly influencing the yield on 20-year JGBs, a key benchmark for Flat 35 mortgages. Inflation, reported at 2.5% year-on-year in April 2024, adds another layer of complexity, potentially leading to higher borrowing costs.

Consumer disposable income, which rose by 2.3% in FY2023, provides a positive backdrop for mortgage affordability. Yet, total household debt stood at approximately ¥1,170 trillion as of March 2024, signaling a need for caution regarding new debt uptake.

| Economic Factor | Data Point | Relevance to SBI ARUHI |

| GDP Growth (Projected 2025) | 0.5% | Indicates potential for increased housing demand and mortgage origination. |

| GDP Growth (Q1 2024) | -2.0% (annualized) | Highlights current economic weakness that could dampen loan demand. |

| Inflation (April 2024) | 2.5% | May lead to higher interest rates, impacting mortgage affordability. |

| Real Disposable Income (FY2023) | +2.3% | Enhances consumers' capacity to service mortgage debt. |

| Total Household Debt (March 2024) | ~¥1,170 trillion | Could lead to stricter lending standards and reduced borrowing appetite. |

Preview Before You Purchase

SBI ARUHI PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This SBI ARUHI PESTLE Analysis preview gives you a clear view of the comprehensive insights it contains. You'll find a detailed breakdown of Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting SBI ARUHI. The layout, content, and structure visible here are exactly what you’ll be able to download immediately after buying.

Sociological factors

Japan's demographic landscape is undergoing a significant transformation, with a rapidly aging population and declining birth rates. This societal shift directly impacts the housing market, potentially reducing the number of new households and shrinking the pool of younger, first-time homebuyers. For SBI ARUHI, this means a critical need to adapt its offerings and outreach to cater to an increasingly mature clientele, including those seeking home renovations or looking to borrow later in life.

As of early 2024, Japan's population is projected to continue its decline, with the proportion of those aged 65 and over already exceeding 29%. This trend highlights the growing demand for housing solutions that accommodate seniors, such as accessible renovations or retirement living options, and a potential decrease in demand for starter homes. SBI ARUHI must therefore refine its mortgage products and marketing strategies to resonate with this evolving demographic, possibly focusing on equity release schemes or loans for age-in-place modifications.

Urbanization continues to reshape demographics, with a significant concentration of people moving to major cities. This trend directly impacts the housing market, as increased demand in metropolitan areas drives up property values. SBI ARUHI needs to strategically position its physical branches and tailor its marketing to these growing urban centers to connect with a larger customer base. For instance, in India, the urban population is projected to reach 600 million by 2030, highlighting the critical importance of understanding and adapting to these regional population shifts.

In Japan, the deep-seated cultural aspiration for homeownership remains a powerful driver of mortgage demand, with a significant portion of the population viewing owning a home as a key life goal. However, evolving societal views on long-term debt are starting to shape how this aspiration translates into action, with some younger generations showing a greater willingness to consider renting or delaying home purchases due to concerns about financial commitment.

Despite this, homeownership rates in Japan, while fluctuating, have shown resilience. For instance, in 2023, the homeownership rate hovered around 61.2%, indicating that the desire to own property is still very much alive for a majority of households. This persistent aspiration directly fuels the market for housing loans, even as perceptions of debt management shift.

Consumer Behavior Towards Digital Services

Japanese consumers are increasingly embracing digital services, fundamentally altering how they engage with financial products like mortgages. This shift means many prefer the ease of online applications and digital management tools, moving away from traditional, paper-heavy processes. For SBI ARUHI, this necessitates a robust digital presence that offers seamless online experiences alongside their physical branches.

To meet these evolving demands, SBI ARUHI's strategy of a multi-channel approach, blending online convenience with the tangible support of physical locations, is crucial. The company must continuously refine its digital offerings to align with consumer expectations for quick, user-friendly interactions. For instance, in 2024, a significant portion of financial service inquiries are expected to originate online, highlighting the importance of intuitive digital platforms.

- Digital Adoption: In 2023, over 70% of Japanese consumers reported using online banking services, a figure projected to grow further in 2024.

- Preference Shift: A recent survey indicated that 65% of mortgage applicants in 2024 prefer to start their application process digitally.

- Channel Integration: SBI ARUHI's investment in its mobile app and online portal aims to capture this growing demand for digital mortgage management.

- Convenience Factor: Consumers increasingly value the ability to access and manage financial services anytime, anywhere, driving demand for 24/7 digital availability.

Changing Lifestyle Preferences

Evolving lifestyle preferences are significantly influencing housing demands, with a growing segment of the population seeking smaller, more manageable homes. This trend is particularly noticeable in urban centers where space is at a premium. For instance, in 2024, surveys indicated that a considerable percentage of millennials and Gen Z were prioritizing affordability and lower maintenance over larger square footage. SBI ARUHI should consider developing loan products that align with these preferences, perhaps offering specialized financing for compact urban dwellings or modular homes.

The increasing awareness of environmental issues is also driving a demand for eco-friendly housing solutions. Buyers are increasingly looking for properties with sustainable features, such as solar panels, energy-efficient appliances, and water-saving fixtures. This shift presents an opportunity for SBI ARUHI to introduce green home loan options, potentially offering preferential interest rates for properties that meet certain environmental certifications. Such a move could attract a growing demographic of environmentally conscious consumers.

Furthermore, flexible living arrangements are becoming more popular, with individuals seeking adaptable spaces that can accommodate remote work or multi-generational living. This could translate into a demand for homes with dedicated home office spaces or accessory dwelling units (ADUs). SBI ARUHI might explore financing models that support the construction or renovation of such flexible living spaces, catering to the dynamic needs of modern homeowners.

These shifting preferences necessitate that SBI ARUHI remain agile in its product development and marketing strategies. By understanding and responding to these evolving lifestyle choices, the company can better position itself to meet the diverse needs of the housing market.

- Demand for smaller homes: In 2024, urban housing markets saw a notable increase in demand for compact living spaces, driven by affordability concerns and a preference for lower maintenance.

- Eco-friendly housing: Consumer surveys in late 2024 highlighted a growing willingness to invest in homes with sustainable features, with a significant portion willing to pay a premium for green certifications.

- Flexible living arrangements: The rise of remote work has fueled interest in homes designed for dual purposes, such as incorporating dedicated office spaces or accommodating multi-generational families.

- Product adaptation: SBI ARUHI is exploring specialized loan products for eco-friendly homes and flexible living spaces to align with these emerging consumer trends.

Japan's societal fabric is characterized by a declining birth rate and an aging population, with over 29% of the population being 65 or older as of early 2024, impacting housing demand for younger demographics and increasing the need for senior-focused housing solutions.

Urbanization continues to concentrate populations in cities, driving up property values and necessitating strategic placement of SBI ARUHI's services in these growth areas, mirroring trends where urban populations are projected to reach 600 million in India by 2030.

The cultural emphasis on homeownership remains strong, though evolving views on long-term debt are influencing younger generations, even as homeownership rates stayed around 61.2% in 2023, showing continued market resilience.

Digital adoption is paramount, with over 70% of Japanese consumers using online banking in 2023 and 65% of mortgage applicants in 2024 preferring digital initiation, underscoring SBI ARUHI's need for robust online platforms.

Lifestyle shifts favor smaller, eco-friendly, and flexible living spaces, with a notable 2024 trend towards compact urban dwellings and a growing willingness to invest in green-certified homes, prompting SBI ARUHI to consider specialized loan products.

| Sociological Factor | Key Trend/Data Point | Implication for SBI ARUHI |

| Demographics | Aging population (>29% are 65+ in early 2024), declining birth rate | Adapt offerings for seniors, focus on renovations, equity release; smaller market for first-time buyers. |

| Urbanization | Concentration of population in cities | Strategic presence in urban centers to capture demand; adapt marketing for urban dwellers. |

| Cultural Values | Strong homeownership aspiration, evolving debt perception | Continue promoting homeownership while addressing concerns about financial commitment; resilience in market. |

| Digitalization | High online banking use (>70% in 2023), digital preference in mortgage applications (65% in 2024) | Enhance digital platforms for seamless user experience; invest in mobile app and online portal. |

| Lifestyle Preferences | Demand for smaller homes, eco-friendly features, flexible living spaces | Develop specialized loan products for compact homes, green certifications, and adaptable living arrangements. |

Technological factors

The digital transformation of mortgage applications is fundamentally reshaping customer interactions. SBI ARUHI must leverage online portals for faster loan processing and digital document uploads to meet evolving consumer expectations. This shift is driven by a broader trend where approximately 75% of mortgage inquiries in 2024 are initiated online, highlighting the critical need for robust digital platforms.

Ensuring a seamless and intuitive online application experience is paramount for SBI ARUHI's competitive edge. As of early 2025, customer satisfaction scores for digital mortgage services have become a key differentiator, with companies offering fully digital journeys reporting a 15% higher customer retention rate. This underscores the direct link between user experience and business success in the digital mortgage space.

SBI ARUHI can significantly improve its credit scoring and risk assessment by integrating AI and advanced data analytics. This shift allows for a more nuanced understanding of borrower profiles beyond traditional metrics, potentially leading to more accurate predictions of repayment behavior. For instance, by analyzing vast datasets, AI can identify subtle patterns indicative of creditworthiness that traditional methods might miss.

The adoption of these technologies promises more efficient loan application processing and faster approval times, a key competitive advantage in the financial services sector. In 2024, many fintech companies reported reduced processing times by up to 60% through AI-driven credit scoring. This efficiency translates directly to a better customer experience and can unlock new market segments.

Leveraging AI also empowers SBI ARUHI to offer highly personalized financial products and services. By understanding individual customer needs and financial habits through data analytics, the company can tailor loan terms, interest rates, and advisory services, thereby increasing customer loyalty and reducing churn. This personalized approach is crucial in a market where customer expectations are continually rising.

Ultimately, enhanced credit scoring through AI and data analytics can lead to a tangible reduction in default rates. For example, in 2025, leading banks employing sophisticated AI models saw their non-performing loan ratios decrease by an average of 1.5% compared to those relying on conventional methods. This financial prudence strengthens SBI ARUHI's overall risk management framework and profitability.

Cybersecurity and data privacy are critical for SBI ARUHI, given its growing digital footprint and the sensitive nature of customer information. A significant data breach in 2024, affecting millions of users across various financial institutions, highlighted the escalating threats and the severe reputational and financial damage they can cause. Ensuring robust protection against cyberattacks and adhering to stringent data privacy laws, such as evolving GDPR-like regulations in key markets, is not just a legal necessity but a cornerstone of customer trust and business continuity.

Blockchain for Property Records and Securitization

Blockchain technology is starting to show promise in revolutionizing property record management and securitization, even though its adoption is still in its early stages. By providing a secure, transparent, and immutable ledger, blockchain can significantly simplify title transfers and reduce the complexities and costs associated with traditional property transactions. This innovation could lead to a more efficient and trustworthy system for managing real estate assets.

The potential for blockchain to streamline mortgage securitization is particularly noteworthy. Imagine a future where the entire process, from loan origination to the creation and trading of mortgage-backed securities, is recorded on a blockchain. This could enhance transparency, reduce counterparty risk, and potentially lower the cost of capital for lenders. For instance, projects exploring tokenized real estate assets are gaining traction, with some estimates suggesting the global tokenized real estate market could reach trillions of dollars by 2030, indicating significant future potential for such applications.

Monitoring these technological advancements is crucial for companies like SBI ARUHI to maintain a competitive edge. Early exploration and potential integration of blockchain solutions could lead to significant operational efficiencies and new business models.

- Streamlined Property Records: Blockchain offers a tamper-proof system for property titles, reducing fraud and administrative overhead.

- Efficient Securitization: Potential to simplify the complex process of mortgage-backed securities, improving liquidity and transparency.

- Cost Reduction: Automation and disintermediation through blockchain could significantly cut transaction costs in real estate finance.

- Emerging Market Growth: The global tokenized real estate market is projected to expand rapidly, presenting new opportunities for innovation.

Integration of Fintech Solutions

SBI ARUHI is actively integrating a range of FinTech solutions to broaden its service offerings and customer value. Beyond streamlining the application process, the company is exploring partnerships with digital payment systems, personal finance management tools, and PropTech platforms. For example, as of late 2024, the FinTech sector saw significant growth, with global investment reaching over $200 billion, indicating a strong market for such integrations.

These strategic integrations aim to create a more comprehensive financial ecosystem for SBI ARUHI's customers. By offering access to diverse FinTech services, the company can enhance user experience and potentially capture a larger market share. In 2024, the adoption rate of digital payment solutions in Japan increased by 15%, highlighting the growing consumer preference for seamless digital transactions.

- Digital Payments: Enhancing transaction speed and convenience for mortgage-related payments.

- Personal Finance Management: Providing tools for customers to better manage their finances alongside their mortgage obligations.

- PropTech Integration: Connecting property technology platforms to offer a more holistic home-buying and ownership experience.

- Data Analytics: Leveraging FinTech data to personalize customer offerings and improve risk assessment.

Technological advancements are fundamentally reshaping how SBI ARUHI interacts with customers and manages its operations. The increasing reliance on digital platforms for mortgage applications, with an estimated 75% of inquiries initiated online in 2024, necessitates a superior user experience to drive customer satisfaction and retention, as companies with fully digital journeys see a 15% higher retention rate.

AI and advanced data analytics are becoming crucial for more accurate credit scoring and risk assessment, potentially reducing default rates by up to 1.5% in 2025 for institutions employing sophisticated models. Furthermore, integrating FinTech solutions, with a global sector investment exceeding $200 billion in late 2024, allows SBI ARUHI to expand its services and capture market share by offering digital payments and personal finance management tools.

Cybersecurity is paramount, especially after significant data breaches in 2024, underscoring the need for robust protection of sensitive customer data. Emerging technologies like blockchain, while still in early adoption, offer potential for secure property record management and efficient mortgage securitization, with the tokenized real estate market projected for significant growth.

Legal factors

SBI ARUHI, as a financial services provider in Japan, must adhere to a robust regulatory landscape. Key among these are the Financial Services Agency's (FSA) requirements for licensing, capital adequacy, and consumer protection. For instance, Japan's banking sector, which heavily influences mortgage lending, saw its average capital adequacy ratio stand at a strong 13.07% as of March 2024, demonstrating a commitment to financial stability.

These regulations directly impact SBI ARUHI's operational boundaries, shaping its lending practices and risk management strategies. Non-compliance can lead to severe penalties, including fines and operational restrictions, underscoring the critical importance of diligent adherence to all legal mandates governing financial institutions in the country.

SBI ARUHI, as a key participant in the Flat 35 mortgage program, must adhere to the Japan Housing Finance Agency's (JHFA) detailed regulations. These rules govern everything from who can qualify for a loan to the specific conditions and how these loans are packaged for sale to investors. For instance, the JHFA's ongoing efforts to maintain housing market stability, as evidenced by their loan origination guidelines for 2024, directly shape SBI ARUHI's lending practices.

Changes in the Flat 35 scheme's eligibility criteria, such as adjustments to income requirements or property types, necessitate swift adaptation by SBI ARUHI to remain compliant. Similarly, modifications to loan terms, like interest rate caps or repayment periods, directly influence the product offerings and risk assessment models employed by the company. The JHFA's securitization requirements, which dictate how mortgages are bundled and sold, also impose operational constraints and opportunities for SBI ARUHI.

Japan's Act on the Protection of Personal Information (APPI) is a cornerstone of data protection, imposing strict requirements on how companies like SBI ARUHI handle sensitive customer data. Compliance is paramount, as violations can lead to significant fines, with penalties for individuals reaching up to ¥1 million and for corporations up to ¥300 million, as per recent amendments. This necessitates robust internal policies for data collection, consent management, and secure storage, particularly given SBI ARUHI's reliance on digital platforms for customer interactions and transactions.

Anti-Money Laundering (AML) and KYC Compliance

SBI ARUHI, like all financial entities, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These legal frameworks are crucial for preventing financial crimes and ensuring the integrity of the financial system. For SBI ARUHI, this means implementing robust customer due diligence processes and transaction monitoring systems to identify and report suspicious activities, a commitment reinforced by global standards and national legislation. In 2023, global AML enforcement actions reached record levels, with significant fines levied against institutions for compliance failures, underscoring the critical importance of meticulous adherence.

The legal landscape mandates that SBI ARUHI must have comprehensive policies and procedures in place. These include verifying the identity of all customers, understanding the nature and purpose of customer relationships, and maintaining records for a specified period. Failure to comply can result in severe penalties, reputational damage, and operational disruptions.

- Customer Identification: Verifying identity through reliable, independent source documents, data, or information.

- Transaction Monitoring: Implementing systems to detect and report unusual or suspicious transaction patterns.

- Record Keeping: Maintaining detailed records of customer identification and transaction data for regulatory review.

- Regulatory Reporting: Promptly reporting suspicious activities to the relevant financial intelligence units.

Property Law and Land Registration

Changes in property law and land registration processes directly affect SBI ARUHI's ability to secure collateral for its mortgage products. For instance, recent amendments to India's property laws, enacted in late 2023 and continuing into 2024, have streamlined the e-registration of property documents, potentially speeding up the mortgage origination cycle. These legal shifts can impact the efficiency and legal validity of mortgage agreements, making it vital for SBI ARUHI to maintain vigilance.

The efficiency of land registration systems is a critical factor; a backlog or outdated system can delay the confirmation of clear title, a fundamental requirement for mortgage approval. As of early 2024, many Indian states are actively working to digitize land records, with some reporting significant progress in reducing registration times. Staying updated on these evolving legal aspects is therefore crucial for ensuring smooth operations and the secure establishment of collateral for SBI ARUHI.

- Property Law Amendments: Ongoing legal reforms aim to enhance transparency and efficiency in property transactions, impacting mortgage validity.

- Land Registration Digitization: Efforts to digitize land records are underway across India, potentially reducing processing times for property ownership verification.

- Regulatory Compliance: Adherence to evolving real estate transaction regulations is paramount for SBI ARUHI's operational integrity and risk management.

- Collateral Security: Clear and legally sound property titles, facilitated by efficient registration, are essential for securing mortgage lending.

SBI ARUHI operates within Japan's strict legal framework, governed by entities like the Financial Services Agency (FSA) and the Japan Housing Finance Agency (JHFA). These bodies set requirements for capital adequacy, consumer protection, and participation in programs like Flat 35, directly influencing SBI ARUHI's lending and product offerings. For instance, Japan's average capital adequacy ratio for banks was 13.07% in March 2024, indicating a healthy financial system that SBI ARUHI must align with.

Environmental factors

Japan's vulnerability to natural disasters, amplified by climate change, presents significant risks for SBI ARUHI's housing collateral. The increasing frequency and intensity of events like typhoons and heavy rainfall, as seen in the record rainfall across Japan in July 2024, directly impact property values and the ability of borrowers to repay loans. This necessitates a robust assessment of properties in disaster-prone regions.

SBI ARUHI must proactively incorporate climate change risk into its lending frameworks. This could involve adjusting loan-to-value ratios for properties in high-risk zones or mandating enhanced disaster insurance coverage. For instance, the estimated economic losses from natural disasters in Japan for 2023 alone exceeded ¥2 trillion, underscoring the financial implications of these events.

Government initiatives promoting green building standards and energy-efficient homes are increasingly shaping the housing market. For instance, the Indian government’s push for sustainable urban development, coupled with incentives for green construction, could directly influence housing demand and create opportunities for specialized financial products. SBI ARUHI might consider developing specific mortgage offerings for eco-friendly properties, aligning with these policy directions and potentially attracting a growing segment of environmentally conscious buyers.

Consumer demand for eco-friendly homes is on the rise, driven by increasing awareness of climate change and a desire for healthier living spaces. This trend presents a significant opportunity for mortgage providers like SBI ARUHI. In 2024, reports indicated a substantial percentage of homebuyers, potentially over 60% in developed markets, expressed interest in sustainable features, influencing their purchasing decisions.

SBI ARUHI can leverage this by developing specialized mortgage products that offer incentives for energy-efficient homes. This could include lower interest rates or extended loan terms for properties with green certifications or features such as solar panels, high-performance insulation, and water-saving fixtures. Such offerings align with the growing consumer preference for environmentally conscious choices.

ESG Considerations for Financial Institutions

Environmental factors are critical for financial institutions like SBI ARUHI, especially concerning their role in financing projects with ecological impacts. The increasing focus on Environmental, Social, and Governance (ESG) criteria means investors and stakeholders are scrutinizing financial institutions' contributions to sustainability. SBI ARUHI's proactive approach to environmental stewardship, extending beyond loan origination to its own operational footprint, is vital for building trust and attracting capital from responsible investors.

A strong environmental strategy can significantly bolster SBI ARUHI's corporate image. For instance, as of early 2025, global sustainable investment funds are projected to exceed $50 trillion, a substantial portion of which is allocated to companies demonstrating robust environmental commitments. By integrating green financing options and minimizing its own carbon emissions, SBI ARUHI can tap into this growing market. This alignment with global best practices not only mitigates regulatory risks associated with climate change but also positions the company as a leader in responsible finance.

- Climate Risk Management: Implementing robust frameworks to assess and manage climate-related financial risks in lending portfolios.

- Green Financing Growth: Expanding offerings in green bonds and sustainable loans, aligning with the global surge in demand for environmentally friendly investments.

- Operational Efficiency: Reducing the company's own environmental footprint through energy efficiency measures and waste reduction programs.

- Disclosure and Transparency: Enhancing reporting on environmental performance and climate-related impacts to meet stakeholder expectations and regulatory requirements.

Availability of Land and Environmental Impact Assessments

Environmental regulations significantly shape the availability of land for housing development, directly impacting the supply side of the housing market. For instance, stringent land use zoning and conservation mandates can restrict the developable area, leading to increased competition for available plots. In 2024, many regions continued to strengthen environmental protection laws, requiring more thorough environmental impact assessments (EIAs) before approving new construction projects. This process, while crucial for sustainability, can add considerable time and cost to development, potentially slowing down housing supply and influencing property values.

These assessments are not just bureaucratic hurdles; they are designed to mitigate potential harm to ecosystems, water sources, and biodiversity. For example, a proposed development might be delayed or even halted if its EIA reveals a significant negative impact on a protected species or a critical wetland area. This directly affects developers' ability to bring new housing units to market, indirectly influencing the demand for housing loans as fewer new properties become available.

The cost of complying with these environmental standards is also a factor. Developers may need to invest in more sustainable building materials, waste management systems, or even land remediation, all of which increase the overall cost of a project. These higher development costs can translate into higher property prices, potentially making homeownership less accessible and altering the landscape of the mortgage market. For instance, in 2025, a number of urban regeneration projects faced scrutiny over their carbon footprint and waste disposal plans, leading to revised timelines and increased budgets.

- Land Availability: Stricter zoning and conservation laws in 2024-2025 have reduced the supply of developable land in many prime urban and suburban areas.

- Development Costs: Environmental impact assessments and compliance measures can add 5-15% to project development costs, affecting housing affordability.

- Project Timelines: The EIA process can extend project timelines by 6-18 months, impacting the pace of new housing delivery.

- Housing Loan Market: Reduced housing supply and increased property prices due to environmental compliance can indirectly affect mortgage demand and loan origination volumes.

Japan's exposure to natural disasters, exacerbated by climate change, poses significant risks to SBI ARUHI's housing collateral, with events like record rainfall in July 2024 impacting property values and loan repayment capabilities. Proactive integration of climate risk into lending, perhaps through adjusted loan-to-value ratios or mandatory enhanced insurance, is crucial, especially given that estimated economic losses from natural disasters in Japan exceeded ¥2 trillion in 2023.

PESTLE Analysis Data Sources

Our SBI ARUHI PESTLE Analysis is built on a robust foundation of data from government agencies, financial institutions, and industry-specific research. We draw insights from economic reports, regulatory updates, and technological advancements to ensure comprehensive coverage.