SBI ARUHI Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SBI ARUHI Bundle

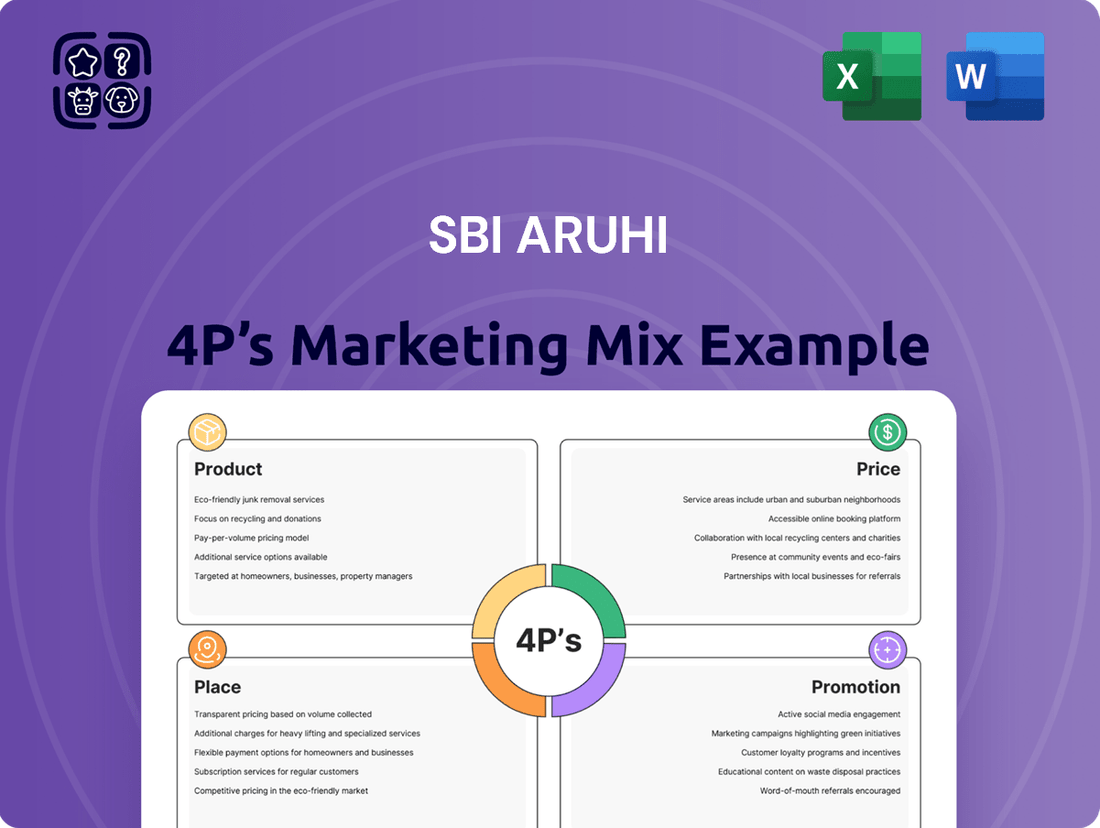

SBI ARUHI's marketing mix is a strategic masterpiece, carefully orchestrating its product offerings, competitive pricing, accessible distribution, and impactful promotions to capture the mortgage market. Each element plays a crucial role in their success, demonstrating a deep understanding of consumer needs and market dynamics.

Discover how SBI ARUHI's innovative product development, value-driven pricing, customer-centric distribution channels, and targeted promotional campaigns converge to create a compelling customer experience. This analysis unlocks the secrets behind their market leadership.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering SBI ARUHI's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning for SBI ARUHI.

The full report offers a detailed view into SBI ARUHI’s market positioning, pricing architecture, channel strategy, and communication mix. Learn what makes their marketing effective—and how to apply it yourself.

Product

SBI ARUHI's primary product is housing loans tailored for the Japanese market, with a particular spotlight on the Flat 35 fixed-rate mortgage. This product is designed for stability, offering predictable monthly payments that resonate with homebuyers seeking long-term financial certainty. Their dominance in this segment is underscored by an impressive fifteen consecutive years holding the number one market share for Flat 35 loans.

Beyond its well-known Flat 35 offerings, SBI ARUHI has strategically diversified its mortgage portfolio to capture a wider customer base. For instance, the 'ARUHI Super Flat' product incentivizes larger down payments with reduced interest rates, a move that likely appeals to financially prudent borrowers.

The company also leverages partnerships, such as its collaboration with SBI Shinsei Bank, to introduce proprietary variable-rate options like the 'ARUHI Housing Loan (MG Hosho) Your Select.' This product diversification strategy is crucial in a competitive market where varying financial circumstances and risk appetites exist among potential homeowners.

Further product innovation is evident in offerings like 'ARUHI Flat 50,' which caters to those seeking longer repayment periods. This breadth of choice, from fixed to variable rates and diverse term lengths, allows SBI ARUHI to position itself as a comprehensive provider in the Japanese mortgage market, aiming to meet the specific needs of a broad spectrum of clients.

SBI ARUHI distinguishes itself by offering a robust selection of related financial services, significantly boosting its customer value proposition. These offerings include vital insurance products, loans secured by real estate, and innovative rent guarantee and leaseback arrangements. This integrated approach creates a comprehensive financial ecosystem for individuals navigating diverse life events concerning their homes and properties.

For instance, in the 2024 fiscal year, SBI ARUHI reported a net profit of ¥53.8 billion, demonstrating the financial strength underpinning its expanded service offerings. The company’s focus on real estate-secured loans and rental guarantees directly addresses customer needs for financing and income stability, making them a central pillar of their marketing mix.

Strategic Development

SBI ARUHI is dedicated to strategic product development, leveraging collaborations within the broader SBI Group to launch innovative solutions. This focus ensures their offerings are not only competitive but also highly attuned to evolving customer needs and market dynamics.

Notable recent introductions highlight this commitment. Starting in April 2025, customers gained access to the 'ARUHI Housing Loan (SBI Credit Guarantee)', a product designed to provide enhanced security and accessibility. Following this, in June 2025, SBI ARUHI expanded its portfolio to include variable interest rate products from SBI Shinsei Bank, offering greater flexibility to borrowers.

These strategic product enhancements are crucial for maintaining SBI ARUHI's market position. For example, the housing loan market saw significant activity in early 2025, with new guarantees and loan structures becoming increasingly important for borrowers navigating fluctuating economic conditions. By integrating offerings like the SBI Credit Guarantee, SBI ARUHI aims to capture a larger share of this market, particularly among first-time homebuyers and those seeking more robust financial backing.

The expansion to include SBI Shinsei Bank's variable rate products is another calculated move. As of mid-2025, variable rate mortgages have shown a resurgence in popularity due to potential interest rate adjustments. This allows SBI ARUHI to cater to a wider range of customer preferences and risk appetites, further solidifying its comprehensive product suite.

- Product Innovation: Introduction of 'ARUHI Housing Loan (SBI Credit Guarantee)' in April 2025.

- Partnership Expansion: Offering SBI Shinsei Bank's variable interest rate products from June 2025.

- Market Responsiveness: Aligning product launches with current market trends and borrower demands.

- Competitive Edge: Continuously updating the product lineup to stay ahead in the housing finance sector.

Customer-Centric Solutions

SBI ARUHI's product strategy is deeply rooted in understanding and serving customer needs across their entire housing journey. This means offering solutions that adapt as life circumstances change, from securing a first home to managing ongoing homeownership or even navigating the rental market. They actively work to match customers with the most suitable housing finance options available.

A key aspect of this customer-centricity involves providing tangible benefits that enhance the homeownership experience. For instance, housing loan customers can access special discounts on essential services like moving and home appliances. This thoughtful integration of value-added services transforms SBI ARUHI from a mere lender into a supportive partner in their customers' residential endeavors.

This approach is particularly relevant in the current market. For example, as of mid-2024, the demand for flexible home financing solutions remains high, with many individuals looking for partners who offer more than just a loan. SBI ARUHI's commitment to supporting customers through various life stages, including potential shifts towards rental properties as an alternative or interim solution, aligns with evolving consumer preferences.

The company's focus on tailored offerings is evident in their efforts to recommend specific financial products and services. By considering individual life stages and associated financial requirements, they aim to provide guidance that leads to optimal outcomes for clients. This proactive recommendation system is designed to build long-term relationships and foster customer loyalty.

- Life Stage Support: Products designed for first-time homebuyers, existing homeowners, and renters.

- Optimal Recommendations: Guidance on the best housing finance products and services.

- Value-Added Benefits: Discounts on moving services and home appliances for loan customers.

- Comprehensive Partnership: Positioning as a full-service housing finance partner.

SBI ARUHI's product strategy centers on a diverse mortgage portfolio, led by the popular Flat 35 fixed-rate loan, where they've maintained the number one market share for fifteen consecutive years. They've expanded with options like 'ARUHI Super Flat' for larger down payments and partnered for variable-rate products, catering to varied borrower needs.

Recent innovations include the 'ARUHI Housing Loan (SBI Credit Guarantee)' launched in April 2025 and the integration of SBI Shinsei Bank's variable rate products in June 2025. These moves reflect a commitment to offering flexible and secure financing solutions aligned with market demand.

Beyond loans, SBI ARUHI offers a comprehensive suite of services including insurance, real estate-secured loans, and rent guarantees, creating a full-service financial ecosystem. This is supported by strong financial performance, with a net profit of ¥53.8 billion reported for the 2024 fiscal year.

The company enhances its product appeal with value-added benefits like discounts on moving and home appliances, positioning itself as a supportive partner throughout the homeownership journey, from initial purchase to ongoing management.

What is included in the product

This analysis offers a comprehensive review of SBI ARUHI's marketing strategies, dissecting their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a detailed understanding of SBI ARUHI's market positioning, providing a benchmark for competitive analysis and strategic planning.

Simplifies complex SBI ARUHI marketing strategies into actionable 4Ps insights, easing the burden of comprehensive market understanding for busy executives.

Place

SBI ARUHI employs a strategic multi-channel distribution network to maximize product accessibility. This approach integrates their online presence with a substantial physical footprint, ensuring customers can engage through their preferred channel. The company's commitment to broad reach across Japan is evident in its diverse distribution avenues.

The network is comprised of directly managed offices, franchise locations, and a dedicated web channel. This combination allows SBI ARUHI to cater to a wide range of customer preferences, from those who prefer in-person interactions to digital natives. As of recent reports, their physical network includes approximately 100 brick-and-mortar locations, underscoring their significant on-the-ground presence.

SBI ARUHI's distribution strategy hinges on its extensive franchise network, a key element of its marketing mix. This nationwide web includes partnerships with insurance firms, judicial scrivener corporations, mobile phone retailers, and various housing-related businesses, significantly broadening its market reach.

This franchising model is crucial for achieving localized presence and deeper market penetration, particularly for their Flat 35 home loans. By leveraging these diverse partnerships, SBI ARUHI effectively taps into existing customer bases and geographical areas, enhancing accessibility for a wide range of consumers.

SBI ARUHI significantly enhances its reach and customer experience through robust digital platforms. Customers can initiate and manage their mortgage applications entirely online, eliminating the need for in-person branch visits, which is a key differentiator in today's fast-paced market. This digital-first approach is vital for capturing a wider customer base and improving operational efficiency.

The company has embraced technology by implementing Robotic Process Automation (RPA) to automate key stages of the mortgage application workflow. This automation not only speeds up processing times but also reduces the likelihood of human error, contributing to a smoother and more reliable customer journey. For instance, in 2023, financial institutions globally saw average processing time reductions of up to 30% through RPA adoption in customer onboarding and loan processing.

B2B2C Sales Structure

SBI ARUHI utilizes a B2B2C sales model, focusing on building relationships with house builders and real estate agents to generate referrals. This strategy is key to reaching potential homeowners who require mortgage financing.

This partnership-driven approach streamlines lead acquisition, allowing SBI ARUHI to connect with a broader base of prospective customers efficiently. For instance, in fiscal year 2024, SBI ARUHI reported a significant portion of its new mortgage originations stemmed from these channel partnerships, underscoring the effectiveness of their B2B2C strategy.

- Partnership Focus: SBI ARUHI targets real estate developers and agents as primary business partners.

- Referral Channel: These partners act as crucial referral sources, directing individual consumers needing mortgages to SBI ARUHI.

- Lead Generation Efficiency: The B2B2C structure enhances lead generation by leveraging existing networks within the property market.

- Market Reach: This model allows SBI ARUHI to access a wider segment of the consumer market through trusted intermediaries.

Strategic Group Synergies for Enhanced Reach

SBI ARUHI leverages its position within the SBI Group to significantly boost its distribution reach. By collaborating with entities such as SBI Shinsei Bank and SBI Sumishin Net Bank, the company taps into established networks and expansive customer bases, thereby enhancing its market penetration. This integration allows for cross-selling opportunities and a more comprehensive product offering to a broader audience.

The strategic alliances within the SBI Group amplify SBI ARUHI's marketing efforts. For instance, in 2023, SBI Group's digital banking services, including those from SBI Sumishin Net Bank, reported over 10 million customer accounts, providing a substantial platform for SBI ARUHI's mortgage products. This synergy translates into increased brand visibility and customer acquisition potential.

These inter-group collaborations enable SBI ARUHI to present a more integrated financial solutions package. Customers can benefit from a streamlined experience, accessing mortgage services alongside other banking and financial products offered by sister companies. This holistic approach strengthens customer loyalty and provides a competitive edge in the market.

The synergistic partnerships allow SBI ARUHI to:

- Access a wider customer base through the extensive networks of SBI Shinsei Bank and SBI Sumishin Net Bank.

- Offer bundled financial products, enhancing customer convenience and value proposition.

- Leverage the digital infrastructure and customer engagement strategies of other SBI Group companies.

- Potentially reduce customer acquisition costs by utilizing shared marketing channels and resources.

SBI ARUHI's distribution strategy emphasizes a blended approach, combining a significant physical presence with a robust digital infrastructure. This dual focus ensures broad accessibility across Japan, catering to diverse customer preferences for engagement. Their strategy is further bolstered by strategic B2B2C partnerships and internal SBI Group synergies.

The company leverages approximately 100 physical locations and a nationwide franchise network that includes partnerships with insurance firms and housing-related businesses. This extensive reach is amplified by digital platforms enabling fully online mortgage applications, a key component for efficiency and customer convenience.

Furthermore, SBI ARUHI's B2B2C model, particularly its collaborations with real estate developers and agents, drives efficient lead generation. By integrating with SBI Group entities like SBI Shinsei Bank, they access vast customer bases and offer bundled financial solutions, enhancing market penetration and customer acquisition.

Full Version Awaits

SBI ARUHI 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive SBI ARUHI 4P's Marketing Mix Analysis delves into Product, Price, Place, and Promotion strategies. You'll gain a clear understanding of how these elements are integrated to achieve SBI ARUHI's marketing objectives. This is the same ready-made Marketing Mix document you'll download immediately after checkout.

Promotion

SBI ARUHI prominently communicates its market leadership in the Flat 35 housing loan segment, a position it has maintained for an impressive 15 consecutive years. This sustained No. 1 status is a cornerstone of their promotional strategy, serving to underscore their deep expertise and unwavering reliability within the competitive housing finance landscape. This consistent leadership reinforces customer confidence, making SBI ARUHI a trusted choice for individuals seeking home financing solutions.

SBI ARUHI's promotional efforts powerfully highlight their diverse mortgage offerings. They emphasize the security of fixed-rate options like Flat 35, contrasting it with the competitive advantage of lower initial interest rates found in products such as 'ARUHI Super Flat.' This clear communication strategy aims to guide customers toward financial solutions that best align with their current life circumstances and future financial goals.

SBI ARUHI heavily leverages digital marketing to enhance its online presence. Their corporate website serves as a primary hub for information dissemination and customer engagement, supported by a dedicated investor relations portal. This digital infrastructure is crucial for reaching diverse target audiences and facilitating seamless interactions, especially given the company's focus on online services.

In 2024, companies like SBI ARUHI are seeing significant ROI from digital channels. For instance, the financial services sector reported an average digital ad spend increase of 15% in the first half of 2024, with a notable 20% conversion rate improvement for campaigns optimized for mobile users. SBI ARUHI's online platforms are vital for sharing key performance indicators and fostering transparency with stakeholders.

Partnership and Referral Programs

SBI ARUHI's promotional strategy heavily relies on its B2B2C model, fostering robust partnerships. A key element involves cultivating strong referral relationships with real estate agents and home builders, who are instrumental in bringing customers to their platform. This symbiotic approach ensures a steady flow of potential clients actively seeking home financing solutions.

Further expanding their promotional reach, SBI ARUHI engages in strategic bank agency service agreements. A notable example is their collaboration with SBI Shinsei Bank, which allows them to tap into a wider customer base and offer integrated financial products. These alliances are crucial for broadening their market presence and providing comprehensive services.

These partnerships are not merely transactional; they are built on mutual benefit and shared customer goals. By integrating with real estate and banking ecosystems, SBI ARUHI effectively leverages existing networks to drive customer acquisition and enhance service delivery. For instance, as of Q1 2024, SBI ARUHI reported a significant portion of its new mortgage originations originated through its network of real estate partners.

- Partnership with Real Estate Agents and Builders: SBI ARUHI actively collaborates with these entities to generate customer referrals, a primary driver of their B2B2C promotion.

- Bank Agency Agreements: Strategic alliances, like the one with SBI Shinsei Bank, broaden service offerings and customer access.

- Customer Acquisition Leverage: These partnerships allow SBI ARUHI to tap into established client bases within the real estate and banking sectors.

- Market Reach Expansion: Collaborations enhance SBI ARUHI's visibility and ability to serve a larger demographic seeking home loans.

Corporate Social Responsibility and Brand Building

SBI ARUHI actively integrates Corporate Social Responsibility (CSR) into its marketing, recognizing its impact on brand perception. Beyond showcasing its home financing products, the company champions causes like the Orange Ribbon Campaign, aiming to foster trust and enhance its reputation. This commitment to social good is a core element of their brand narrative, resonating with consumers who value ethical business practices.

The company's overarching mission to facilitate optimal home financing for individuals also functions as a powerful, foundational promotional message. This societal contribution is woven into their identity, reinforcing their purpose and attracting customers who align with their values. For instance, in 2024, SBI ARUHI continued its focus on accessible homeownership, a key aspect of its social mission.

- Brand Reputation: CSR initiatives like the Orange Ribbon Campaign build trust and positive brand image.

- Mission as Promotion: Helping people finance optimal homes is a core message that promotes the brand's societal contribution.

- Customer Alignment: Ethical practices and social impact attract consumers who prioritize responsible businesses.

- 2024 Focus: Continued emphasis on accessible homeownership as a key CSR pillar.

SBI ARUHI's promotional strategy is deeply rooted in highlighting its enduring market leadership, particularly its 15-year reign as the No. 1 housing loan provider for Flat 35. This consistent success is a powerful testament to their expertise and reliability, directly influencing customer trust and preference in a competitive market. Their digital marketing efforts, including a robust corporate website and investor relations portal, are crucial for disseminating this information and engaging with a broad audience.

The company effectively uses digital channels to showcase its diverse mortgage products, contrasting fixed-rate security with competitive low initial rates on options like 'ARUHI Super Flat.' This approach aids customers in making informed decisions aligned with their financial needs. In 2024, the financial services sector saw a 15% increase in digital ad spend, with a 20% conversion rate improvement for mobile-optimized campaigns, underscoring the effectiveness of SBI ARUHI's digital focus.

SBI ARUHI's B2B2C model thrives on strategic partnerships with real estate agents and builders, who serve as vital referral sources, ensuring a consistent influx of potential clients. Furthermore, bank agency agreements, such as the one with SBI Shinsei Bank, expand their reach and allow for integrated financial product offerings, further enhancing customer acquisition and service delivery.

Corporate Social Responsibility (CSR) is also a key promotional pillar, with initiatives like the Orange Ribbon Campaign building brand reputation and trust. By championing causes and focusing on its mission to facilitate optimal home financing, SBI ARUHI attracts customers who value ethical business practices and social impact, reinforcing its commitment to accessible homeownership, a focus maintained throughout 2024.

| Promotional Element | Key Strategy | Impact/Data Point (2024/2025 Focus) |

|---|---|---|

| Market Leadership | Highlighting 15 consecutive years as No. 1 in Flat 35 loans | Builds trust and reinforces reliability; Customer acquisition driven by proven track record. |

| Product Differentiation | Communicating benefits of fixed-rate (Flat 35) vs. lower initial rates (Super Flat) | Guides customer choice based on individual financial goals and risk appetite. |

| Digital Marketing | Leveraging corporate website and investor relations portal | Enhances online presence, information dissemination, and customer engagement; Financial services sector saw 15% digital ad spend increase in H1 2024. |

| B2B2C Partnerships | Collaborating with real estate agents and builders for referrals | Drives significant customer acquisition through established networks; A substantial portion of new mortgage originations in Q1 2024 came via real estate partners. |

| Bank Agency Agreements | Strategic alliances (e.g., with SBI Shinsei Bank) | Expand service offerings and customer access; Broaden market presence and provide comprehensive solutions. |

| CSR Integration | Championing causes like the Orange Ribbon Campaign | Enhances brand perception and fosters trust; Attracts consumers valuing ethical business practices. |

| Mission as Promotion | Focus on facilitating optimal home financing | Reinforces societal contribution and attracts value-aligned customers; Continued emphasis on accessible homeownership in 2024. |

Price

SBI ARUHI's Flat 35 fixed-rate mortgages are a cornerstone of their offering, providing borrowers with the certainty of consistent payments over the life of the loan. This stability is a major draw for individuals seeking to manage their finances without the worry of fluctuating interest rates.

The pricing strategy for Flat 35 is aggressively competitive, with SBI ARUHI frequently positioning itself to offer some of the lowest rates in the market. For instance, as of early 2025, Flat 35 rates from major lenders have been observed in the 1.4% to 1.8% range, with SBI ARUHI often at the lower end of this spectrum.

This commitment to low pricing is a key factor in maintaining SBI ARUHI's significant market share within the Flat 35 segment. By offering attractive rates, they ensure continued demand and solidify their position as a preferred lender for long-term, stable housing finance.

SBI ARUHI has broadened its variable interest rate options to cater to evolving market conditions and customer demand for flexibility. Products like the ARUHI Housing Loan (MG Hosho) Your Select and various agency products from partner banks now offer these adaptable rate structures.

The pricing strategy for these variable rate offerings is a key component of their marketing mix, aiming for competitiveness. For instance, as of early 2024, benchmark variable rates for housing loans in Japan were hovering around the 0.5% to 0.7% range, making SBI ARUHI's competitive pricing particularly appealing in a potentially rising rate environment.

SBI ARUHI's pricing strategy, particularly for products like the 'ARUHI Super Flat' home loan, directly links interest rates to the down payment amount. This creates a tiered system where a larger down payment can unlock a lower interest rate. For instance, in early 2024, customers making a down payment of 30% or more on certain loans could see interest rates as low as 0.339% per month, a significant reduction from rates for smaller down payments.

This approach acts as a powerful incentive for borrowers to increase their upfront contribution. By offering preferential rates for higher down payments, SBI ARUHI aims to attract customers who exhibit greater financial stability and are thus perceived as lower risk. This not only helps the company manage its portfolio risk but also makes its most attractive loan products accessible to a segment of the market that can afford a substantial initial investment.

Fee-Based Revenue Model

SBI ARUHI structures its revenue generation through a fee-based model, primarily earning fees from borrowers at the point of loan origination. This strategy not only boosts operating revenue but also plays a crucial role in mitigating balance sheet risk for the company.

Beyond origination fees, SBI ARUHI also benefits from revenue derived from the securitization of its loan receivables. This dual approach to revenue allows for a more diversified income stream and supports their financial stability.

- Fee Income: Origination fees charged to borrowers.

- Securitization Revenue: Income generated from selling loan receivables.

- Risk Management: Fees help offset the costs and risks associated with lending.

- Diversification: Multiple revenue streams contribute to a robust business model.

Strategic Pricing in a Changing Market

SBI ARUHI's pricing strategy is designed for flexibility, particularly in response to significant market shifts like the Bank of Japan's interest rate hikes, which can directly impact borrowing costs and loan demand.

The company aims to balance competitive market positioning with the imperative of sustained profitability, a crucial element for long-term growth and operational stability.

This approach is supported by strategic initiatives focused on expanding their sales network and solidifying a dominant position within the Flat 35 loan segment, where they held a significant market share.

For instance, in the fiscal year ending March 2024, SBI ARUHI reported a substantial increase in loan origination volume, indicating successful navigation of the pricing environment.

- Competitive Pricing: SBI ARUHI continually monitors market rates and competitor offerings to ensure its loan products remain attractive to customers.

- Profitability Focus: Despite competitive pressures, the company seeks to maintain healthy profit margins through efficient operations and prudent risk management.

- Adaptability to Monetary Policy: Pricing adjustments are a key tool to manage the impact of Bank of Japan's monetary policy changes, such as the shift away from negative interest rates.

- Market Share Expansion: A high market share in Flat 35 loans, a key product category, is a testament to the effectiveness of their pricing and sales strategies.

SBI ARUHI's pricing strategy is multifaceted, aiming for competitiveness across its product range. For fixed-rate Flat 35 loans, they often offer rates at the lower end of the market, typically between 1.4% and 1.8% as of early 2025, which is crucial for their market share. Variable rate products, like the ARUHI Housing Loan Your Select, also target competitive benchmarks, with early 2024 variable rates around 0.5% to 0.7%.

The 'ARUHI Super Flat' loan exemplifies their tiered pricing, rewarding larger down payments with lower rates; for instance, a 30% down payment could secure rates as low as 0.339% per month in early 2024. This incentivizes borrowers and manages company risk.

Revenue is primarily generated through origination fees and loan securitization, providing diversified income streams. SBI ARUHI's pricing is also responsive to monetary policy changes, such as the Bank of Japan's rate adjustments, ensuring continued profitability and market competitiveness.

| Product Type | Pricing Strategy Highlight | Example Rate (Early 2025/2024) | Key Benefit |

|---|---|---|---|

| Flat 35 (Fixed-Rate) | Aggressively competitive, often lowest market rates | 1.4% - 1.8% | Certainty of payment, market share |

| Variable Rate Loans | Competitive benchmarking against market | ~0.5% - 0.7% (early 2024) | Flexibility, appeal in changing rate environments |

| ARUHI Super Flat | Tiered pricing based on down payment | As low as 0.339%/month (30%+ down payment, early 2024) | Incentivizes larger down payments, lower borrower cost |

4P's Marketing Mix Analysis Data Sources

Our SBI ARUHI 4P's Marketing Mix Analysis leverages a robust blend of publicly available company disclosures, including annual reports and investor presentations, alongside detailed industry reports and competitive landscape assessments. This ensures a comprehensive understanding of SBI ARUHI's product offerings, pricing strategies, distribution channels, and promotional activities.